Category: Trade Ideas

-

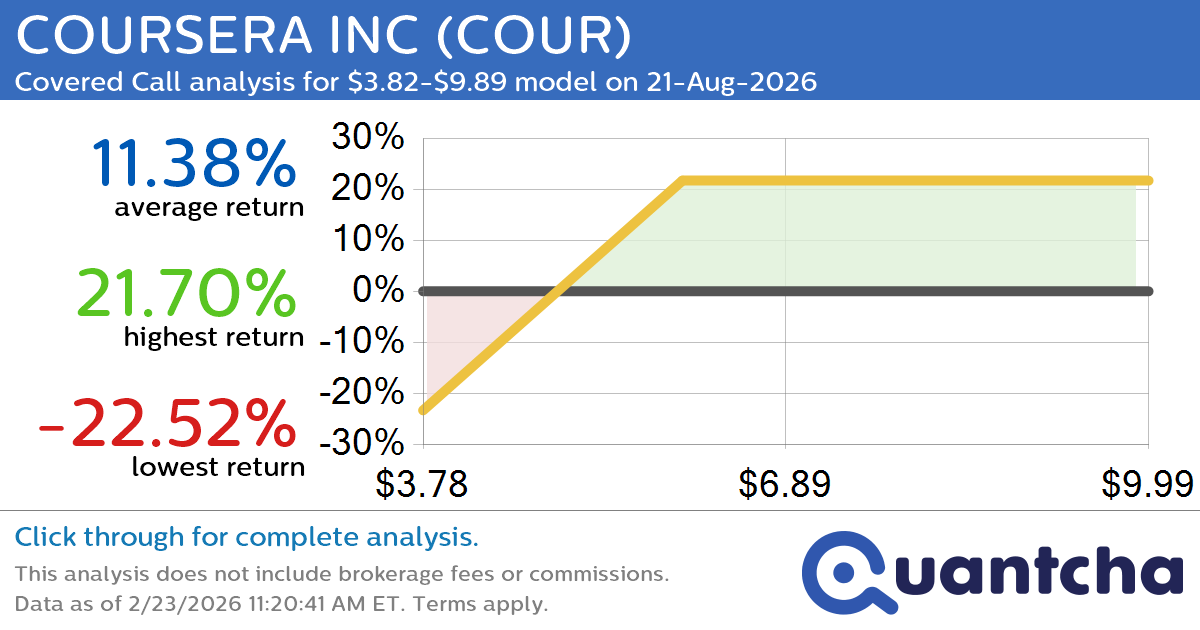

Covered Call Alert: COURSERA INC $COUR returning up to 21.70% through 21-Aug-2026

Quantchabot has detected a new Covered Call trade opportunity for COURSERA INC (COUR) for the 21-Aug-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. COUR was recently trading at $6.03 and has an implied volatility of 67.86% for this period. Based on an analysis of the options…

-

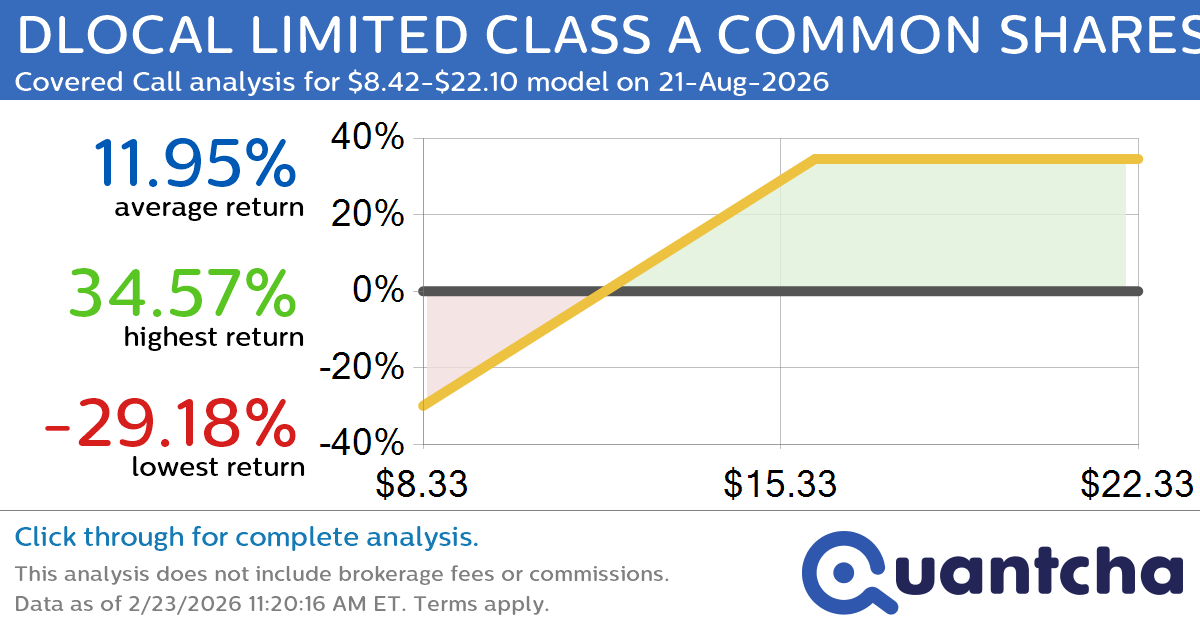

Covered Call Alert: DLOCAL LIMITED CLASS A COMMON SHARES $DLO returning up to 34.57% through 21-Aug-2026

Quantchabot has detected a new Covered Call trade opportunity for DLOCAL LIMITED CLASS A COMMON SHARES (DLO) for the 21-Aug-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. DLO was recently trading at $13.39 and has an implied volatility of 68.76% for this period. Based on an…

-

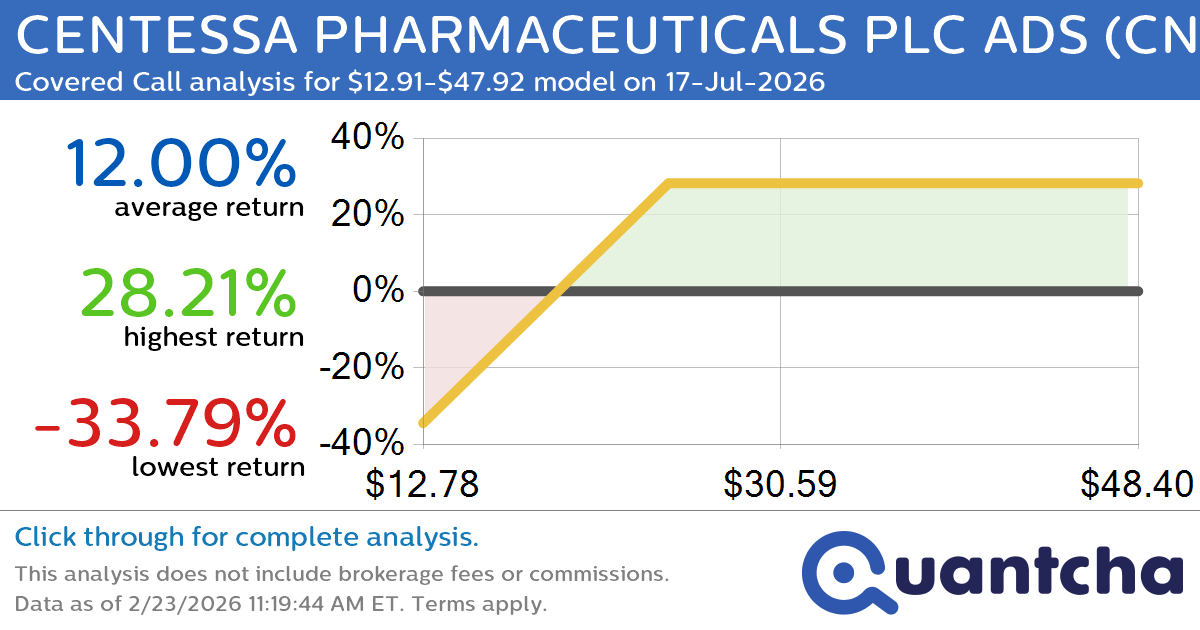

Covered Call Alert: CENTESSA PHARMACEUTICALS PLC ADS $CNTA returning up to 28.21% through 17-Jul-2026

Quantchabot has detected a new Covered Call trade opportunity for CENTESSA PHARMACEUTICALS PLC ADS (CNTA) for the 17-Jul-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CNTA was recently trading at $24.50 and has an implied volatility of 104.16% for this period. Based on an analysis of…

-

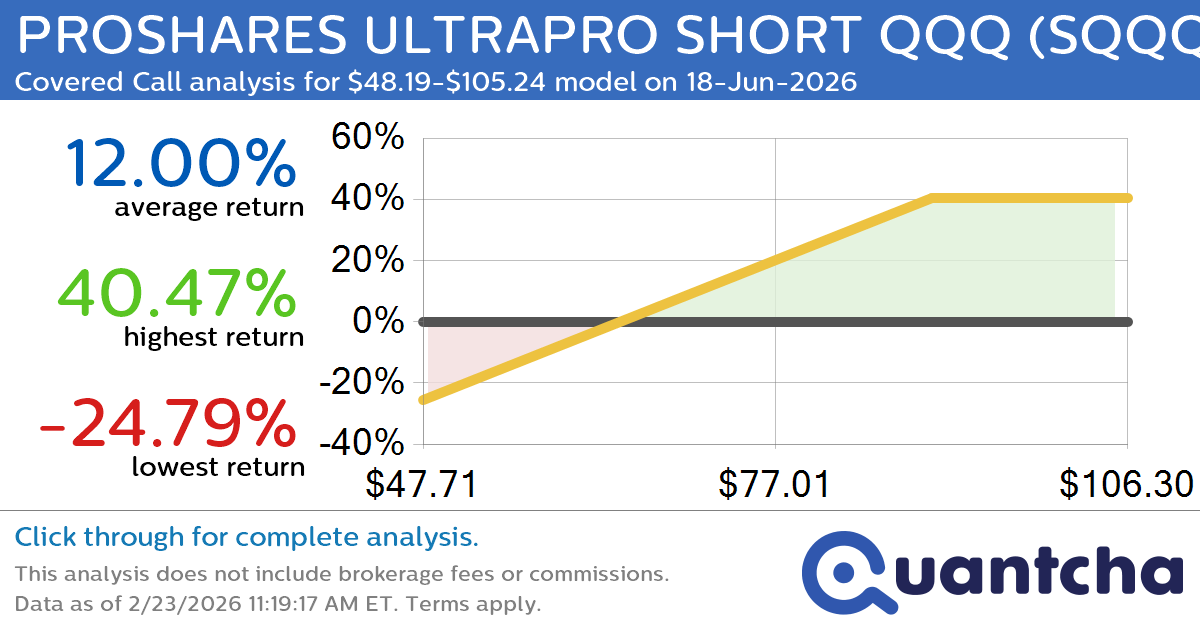

Covered Call Alert: PROSHARES ULTRAPRO SHORT QQQ $SQQQ returning up to 40.47% through 18-Jun-2026

Quantchabot has detected a new Covered Call trade opportunity for PROSHARES ULTRAPRO SHORT QQQ (SQQQ) for the 18-Jun-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SQQQ was recently trading at $70.37 and has an implied volatility of 69.36% for this period. Based on an analysis of…

-

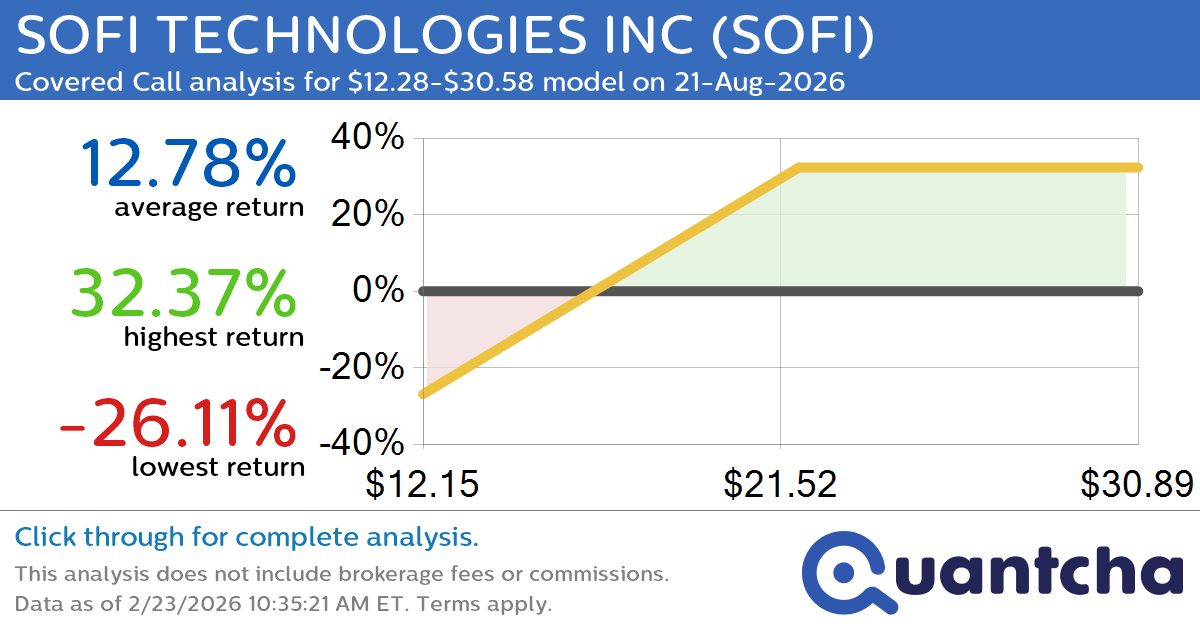

Covered Call Alert: SOFI TECHNOLOGIES INC $SOFI returning up to 32.37% through 21-Aug-2026

Quantchabot has detected a new Covered Call trade opportunity for SOFI TECHNOLOGIES INC (SOFI) for the 21-Aug-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SOFI was recently trading at $19.02 and has an implied volatility of 65.00% for this period. Based on an analysis of the…

-

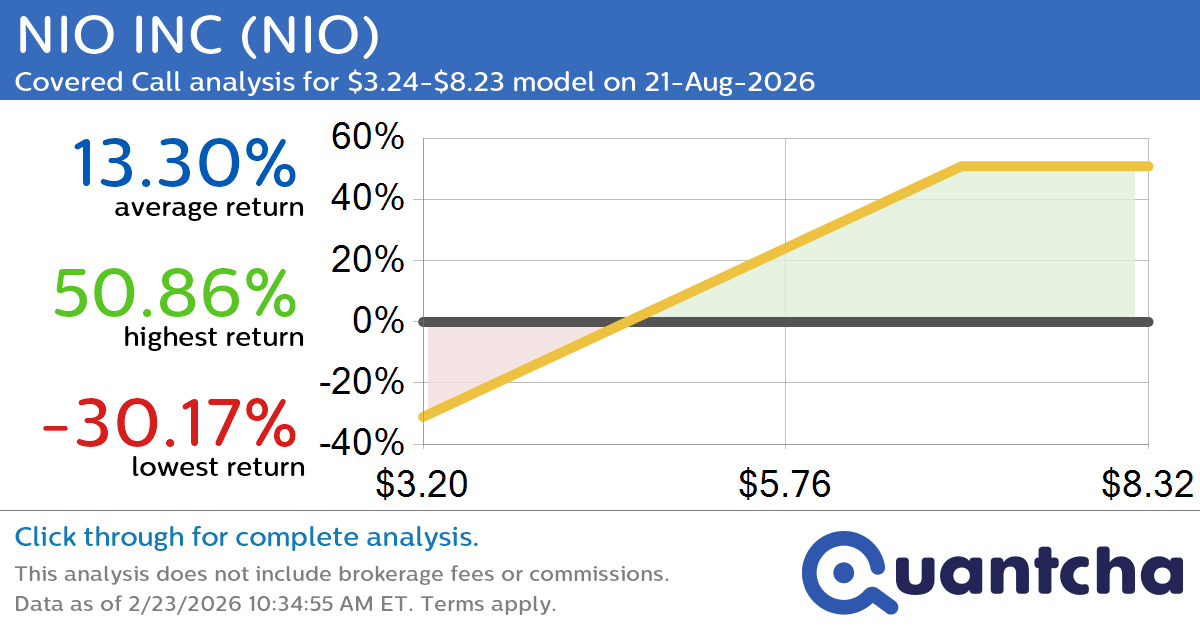

Covered Call Alert: NIO INC $NIO returning up to 50.86% through 21-Aug-2026

Quantchabot has detected a new Covered Call trade opportunity for NIO INC (NIO) for the 21-Aug-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. NIO was recently trading at $5.07 and has an implied volatility of 66.37% for this period. Based on an analysis of the options…

-

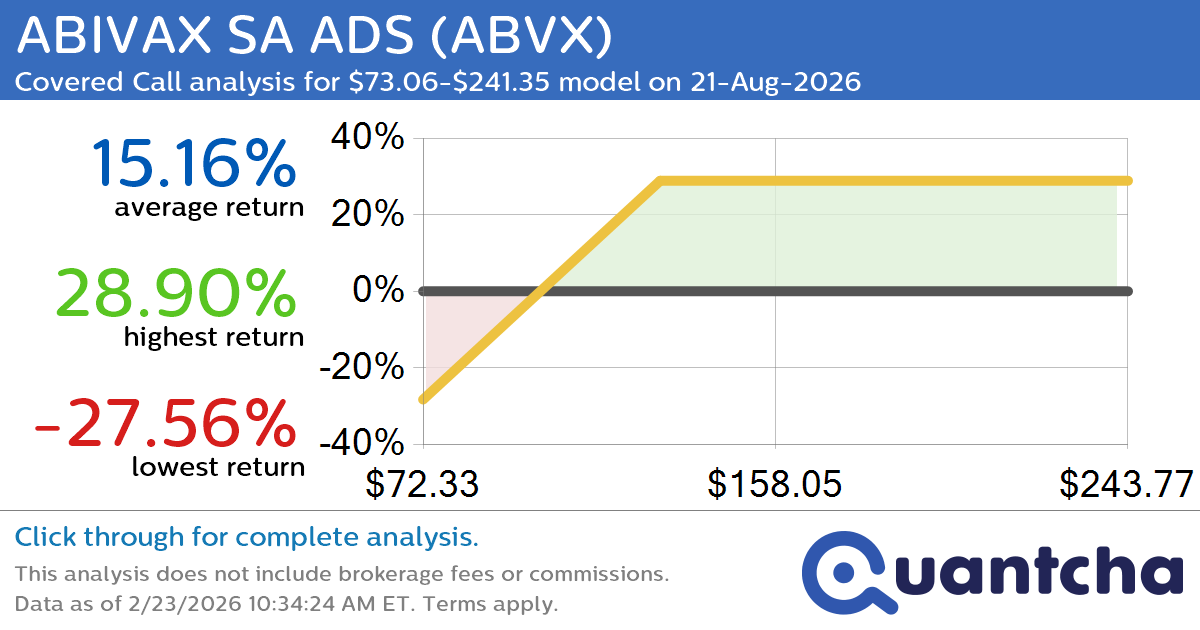

Covered Call Alert: ABIVAX SA ADS $ABVX returning up to 28.90% through 21-Aug-2026

Quantchabot has detected a new Covered Call trade opportunity for ABIVAX SA ADS (ABVX) for the 21-Aug-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ABVX was recently trading at $130.35 and has an implied volatility of 85.14% for this period. Based on an analysis of the…

-

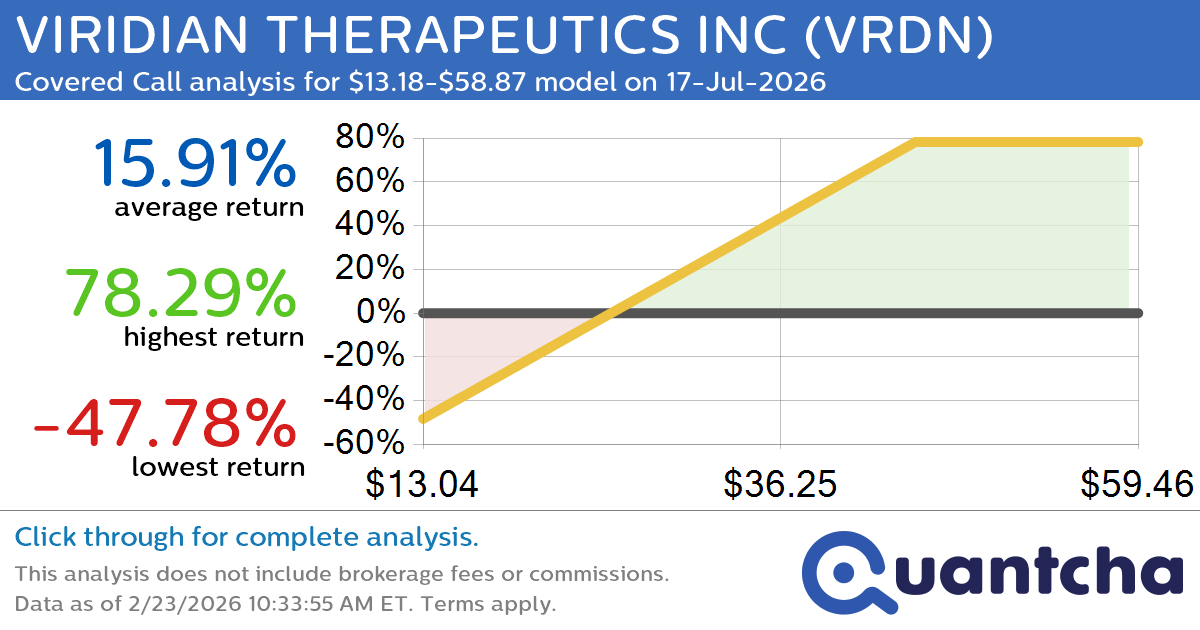

Covered Call Alert: VIRIDIAN THERAPEUTICS INC $VRDN returning up to 78.29% through 17-Jul-2026

Quantchabot has detected a new Covered Call trade opportunity for VIRIDIAN THERAPEUTICS INC (VRDN) for the 17-Jul-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. VRDN was recently trading at $27.44 and has an implied volatility of 118.85% for this period. Based on an analysis of the…

-

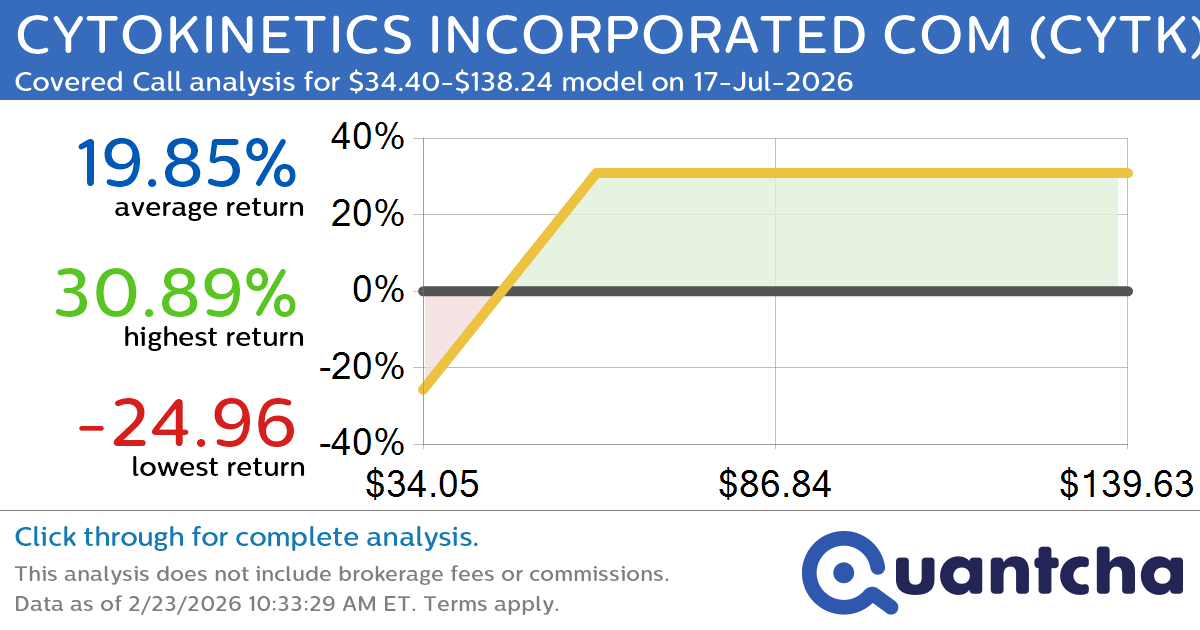

Covered Call Alert: CYTOKINETICS INCORPORATED COM $CYTK returning up to 30.89% through 17-Jul-2026

Quantchabot has detected a new Covered Call trade opportunity for CYTOKINETICS INCORPORATED COM (CYTK) for the 17-Jul-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CYTK was recently trading at $67.94 and has an implied volatility of 110.43% for this period. Based on an analysis of the…

-

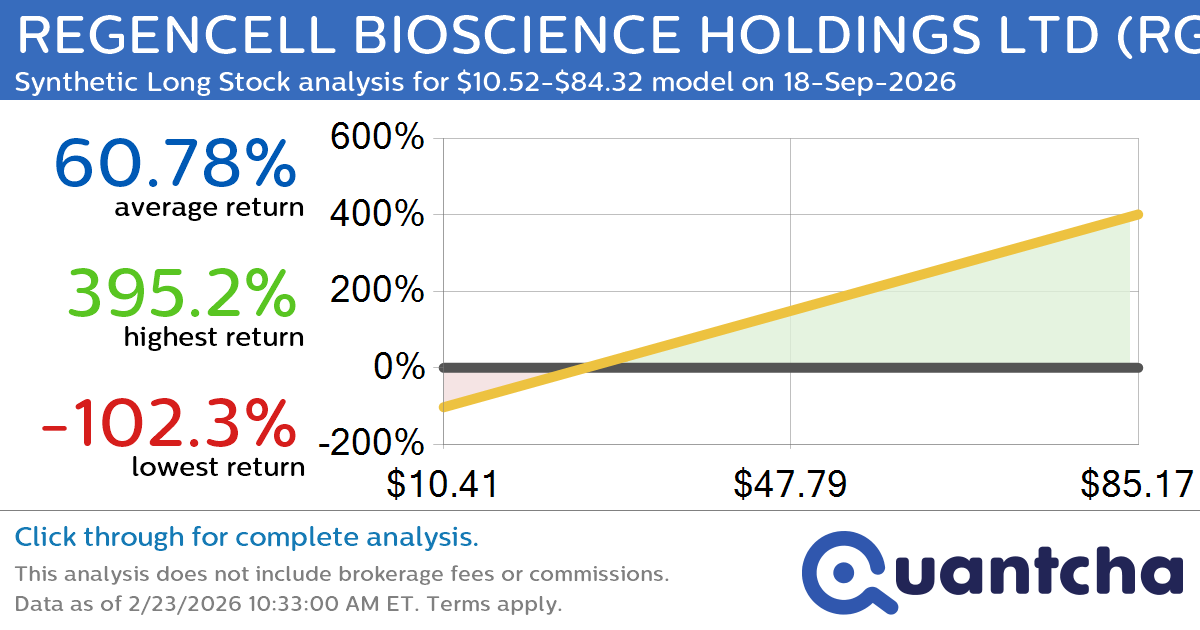

Synthetic Long Discount Alert: REGENCELL BIOSCIENCE HOLDINGS LTD $RGC trading at a 11.90% discount for the 18-Sep-2026 expiration

Quantchabot has detected a new Synthetic Long Stock trade opportunity for REGENCELL BIOSCIENCE HOLDINGS LTD (RGC) for the 18-Sep-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. RGC was recently trading at $29.17 and has an implied volatility of 137.92% for this period. Based on an analysis…