Category: Trade Ideas

-

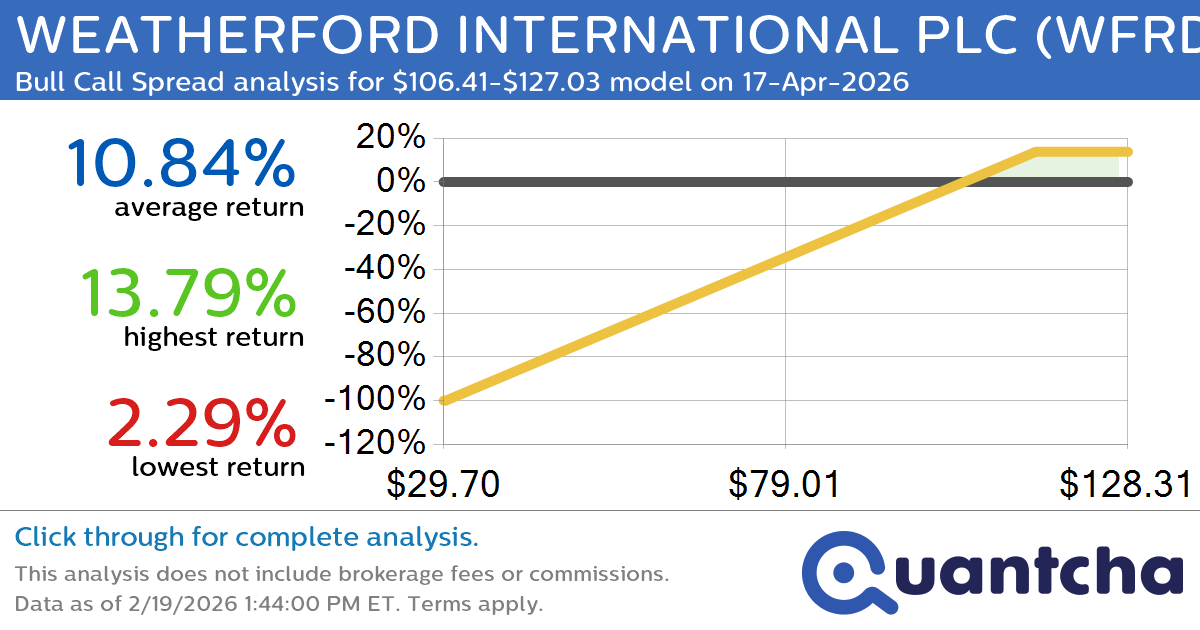

52-Week High Alert: Trading today’s movement in WEATHERFORD INTERNATIONAL PLC $WFRD

Quantchabot has detected a new Bull Call Spread trade opportunity for WEATHERFORD INTERNATIONAL PLC (WFRD) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. WFRD was recently trading at $105.78 and has an implied volatility of 44.56% for this period. Based on an analysis of…

-

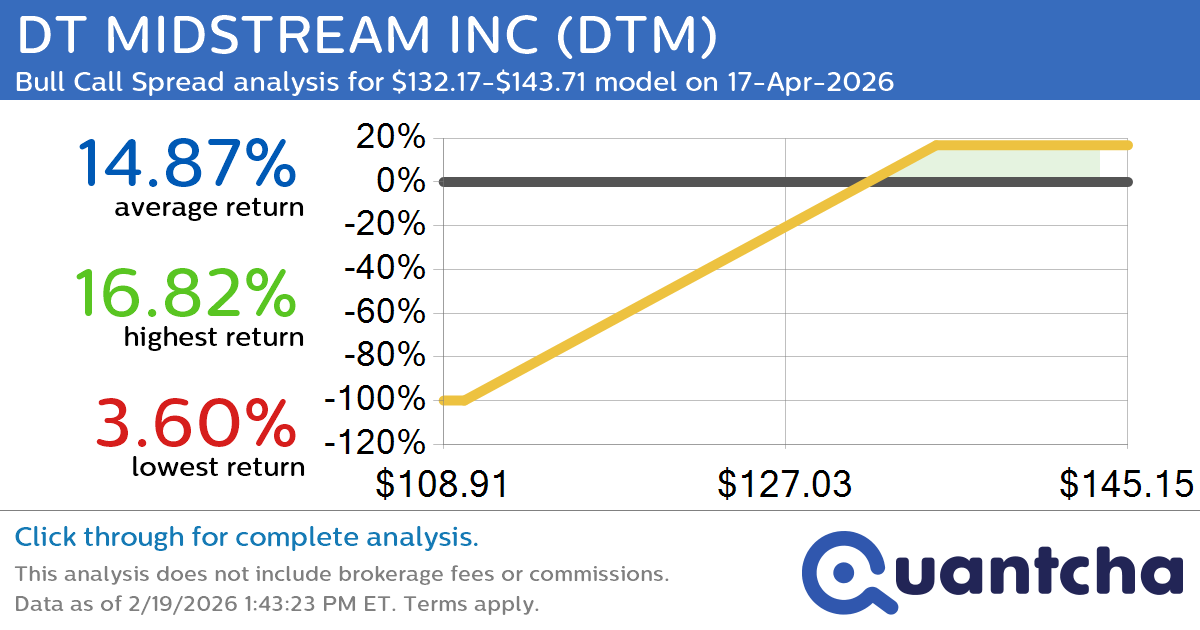

52-Week High Alert: Trading today’s movement in DT MIDSTREAM INC $DTM

Quantchabot has detected a new Bull Call Spread trade opportunity for DT MIDSTREAM INC (DTM) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. DTM was recently trading at $132.26 and has an implied volatility of 21.06% for this period. Based on an analysis of…

-

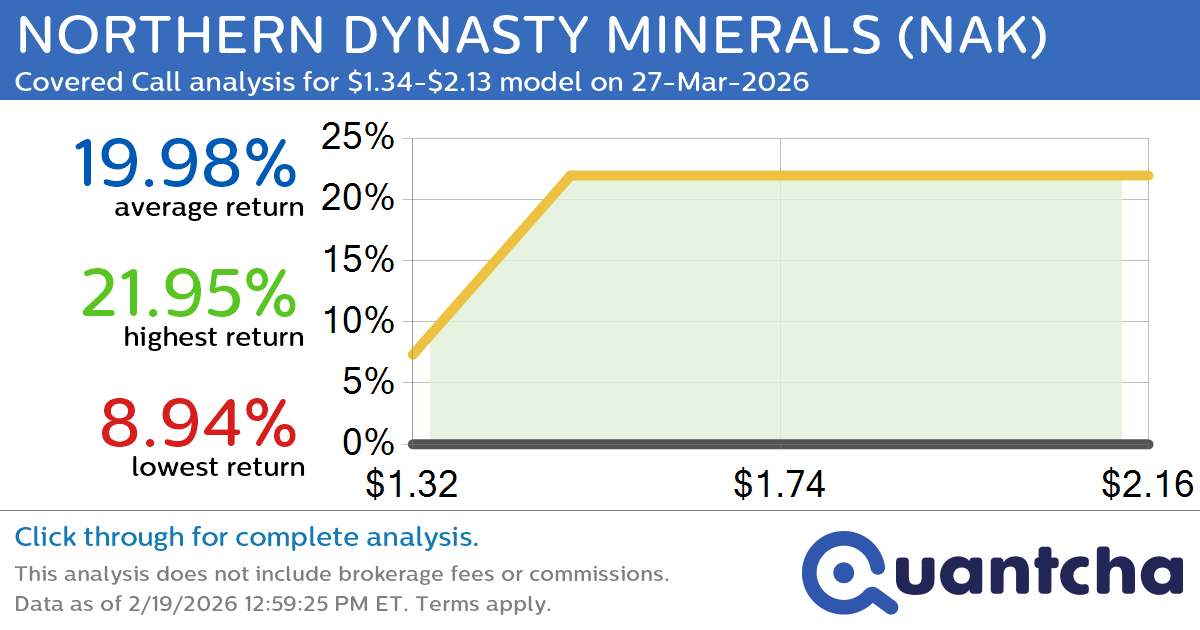

Big Gainer Alert: Trading today’s 8.1% move in NORTHERN DYNASTY MINERALS $NAK

Quantchabot has detected a new Covered Call trade opportunity for NORTHERN DYNASTY MINERALS (NAK) for the 27-Mar-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. NAK was recently trading at $1.33 and has an implied volatility of 147.54% for this period. Based on an analysis of the…

-

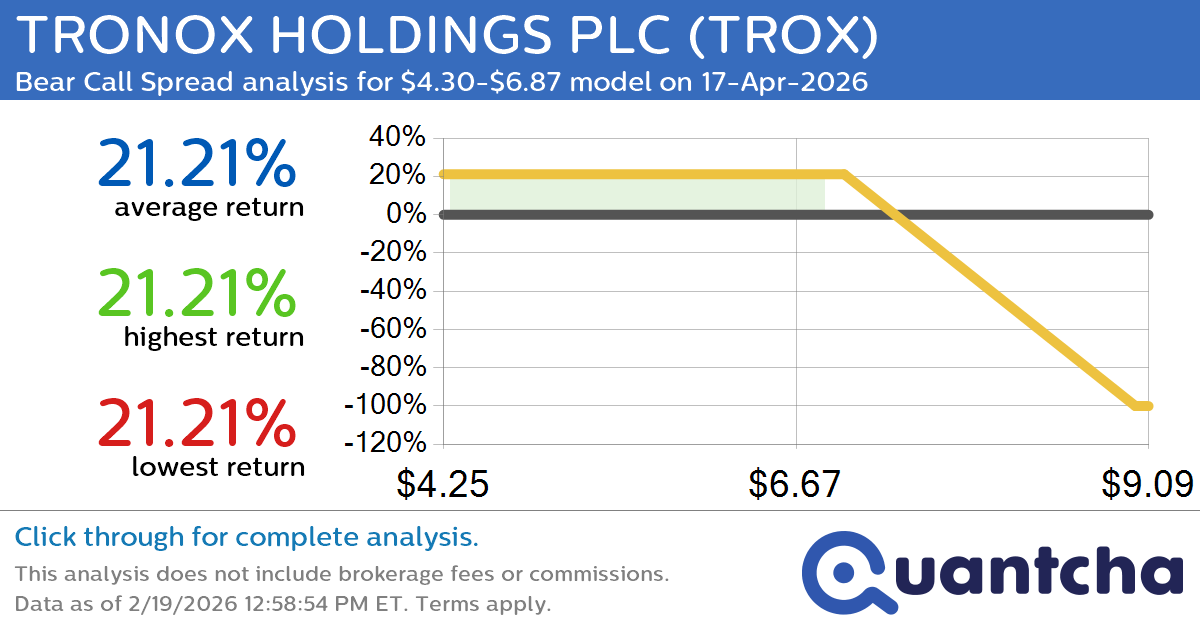

Big Loser Alert: Trading today’s -11.3% move in TRONOX HOLDINGS PLC $TROX

Quantchabot has detected a new Bear Call Spread trade opportunity for TRONOX HOLDINGS PLC (TROX) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TROX was recently trading at $6.88 and has an implied volatility of 117.47% for this period. Based on an analysis of…

-

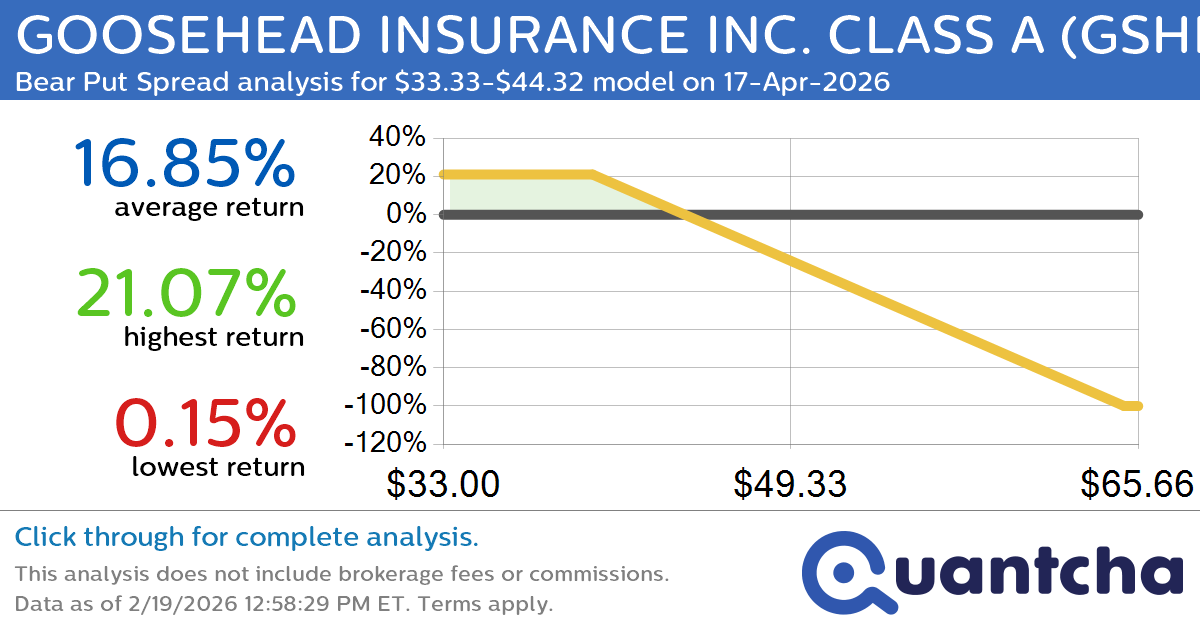

Big Loser Alert: Trading today’s -7.0% move in GOOSEHEAD INSURANCE INC. CLASS A $GSHD

Quantchabot has detected a new Bear Put Spread trade opportunity for GOOSEHEAD INSURANCE INC. CLASS A (GSHD) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. GSHD was recently trading at $44.06 and has an implied volatility of 71.71% for this period. Based on an…

-

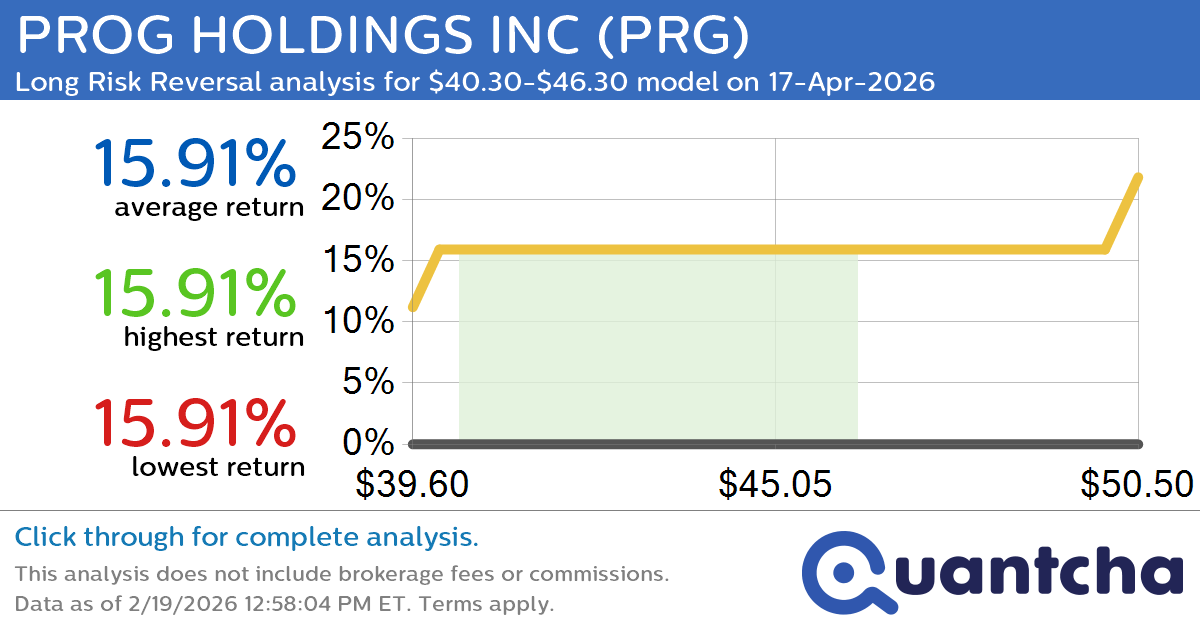

Big Gainer Alert: Trading today’s 10.9% move in PROG HOLDINGS INC $PRG

Quantchabot has detected a new Long Risk Reversal trade opportunity for PROG HOLDINGS INC (PRG) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. PRG was recently trading at $40.06 and has an implied volatility of 34.90% for this period. Based on an analysis of…

-

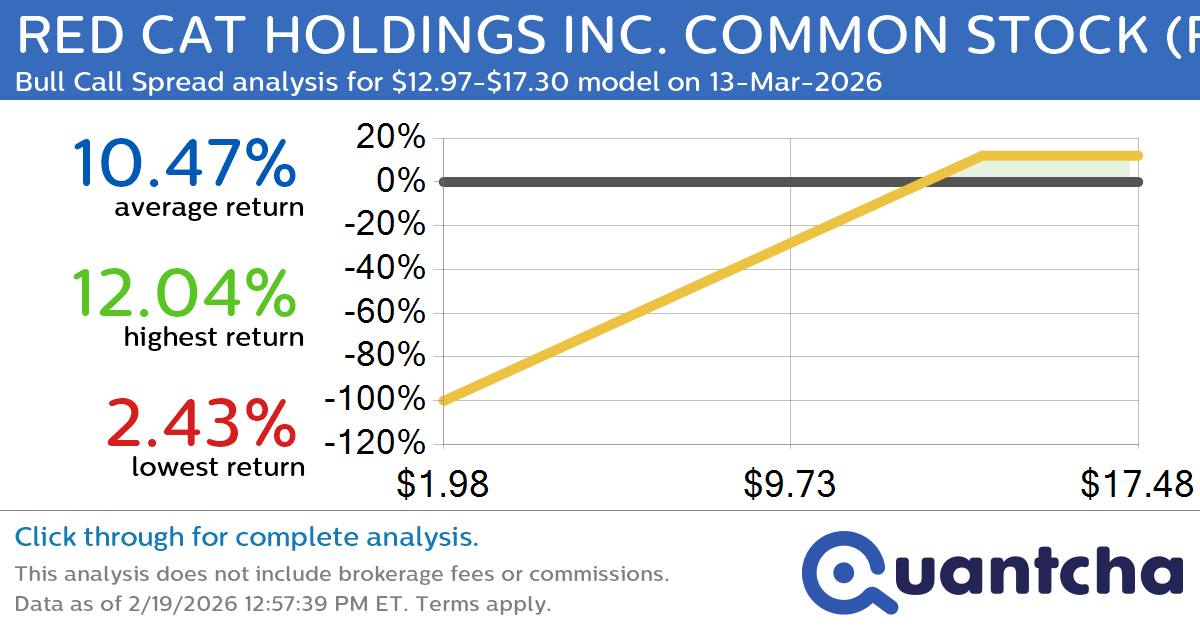

Big Gainer Alert: Trading today’s 7.1% move in RED CAT HOLDINGS INC. COMMON STOCK $RCAT

Quantchabot has detected a new Bull Call Spread trade opportunity for RED CAT HOLDINGS INC. COMMON STOCK (RCAT) for the 13-Mar-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. RCAT was recently trading at $12.94 and has an implied volatility of 115.60% for this period. Based on…

-

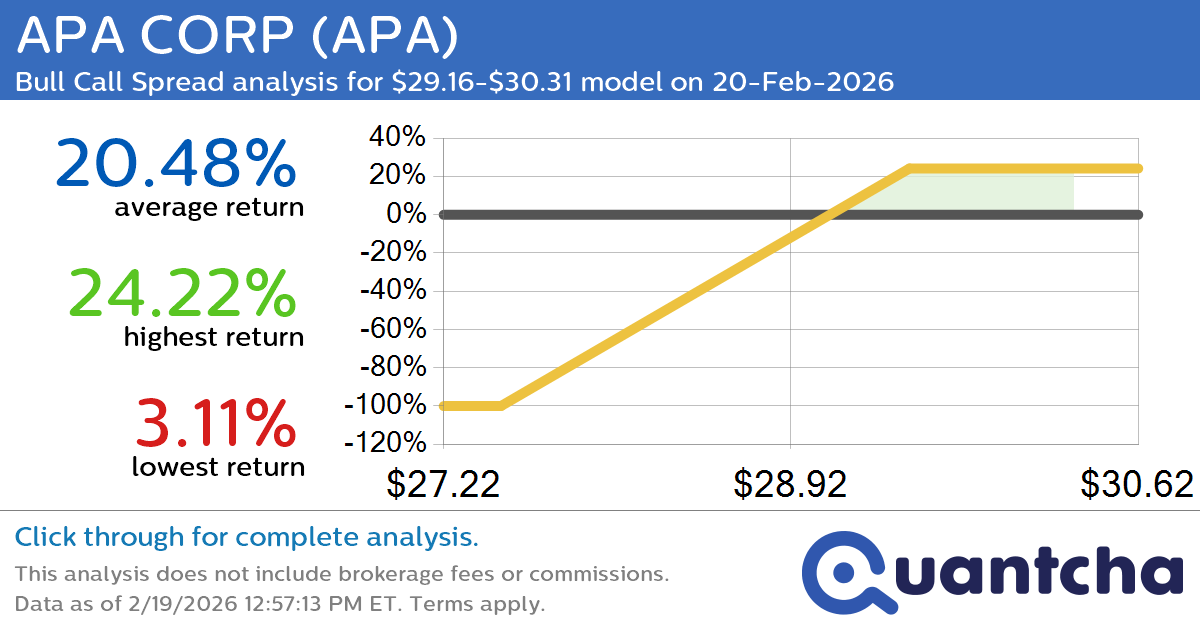

52-Week High Alert: Trading today’s movement in APA CORP $APA

Quantchabot has detected a new Bull Call Spread trade opportunity for APA CORP (APA) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. APA was recently trading at $29.15 and has an implied volatility of 57.40% for this period. Based on an analysis of the…

-

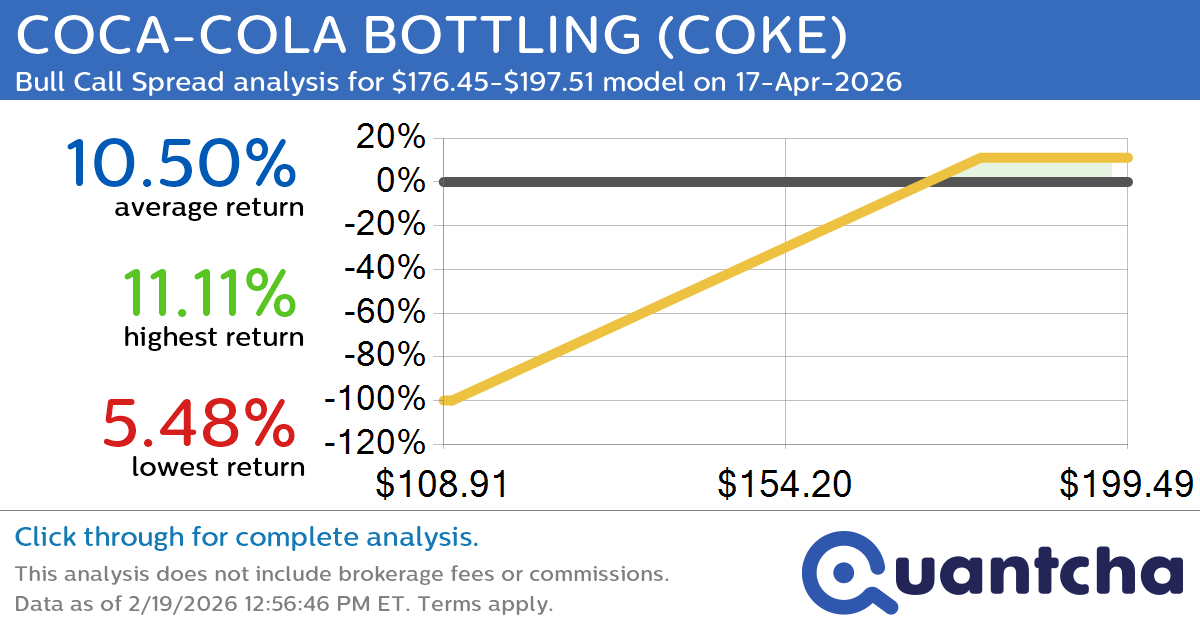

52-Week High Alert: Trading today’s movement in COCA-COLA BOTTLING $COKE

Quantchabot has detected a new Bull Call Spread trade opportunity for COCA-COLA BOTTLING (COKE) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. COKE was recently trading at $175.40 and has an implied volatility of 28.36% for this period. Based on an analysis of the…

-

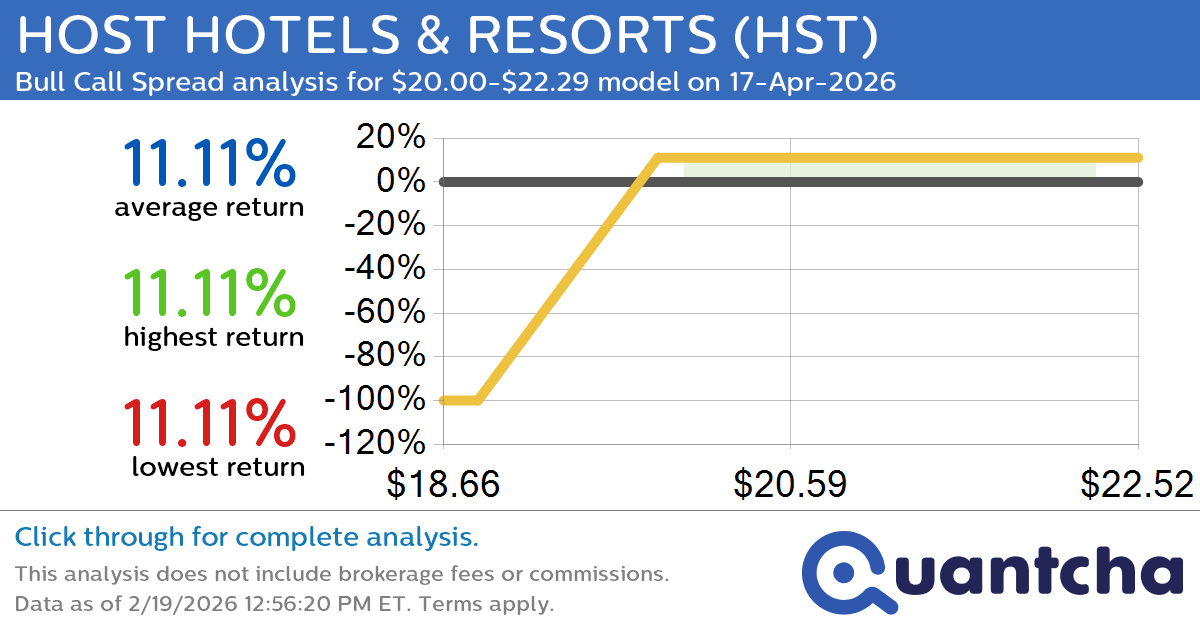

52-Week High Alert: Trading today’s movement in HOST HOTELS & RESORTS $HST

Quantchabot has detected a new Bull Call Spread trade opportunity for HOST HOTELS & RESORTS (HST) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. HST was recently trading at $20.09 and has an implied volatility of 27.17% for this period. Based on an analysis…