Category: Trade Ideas

-

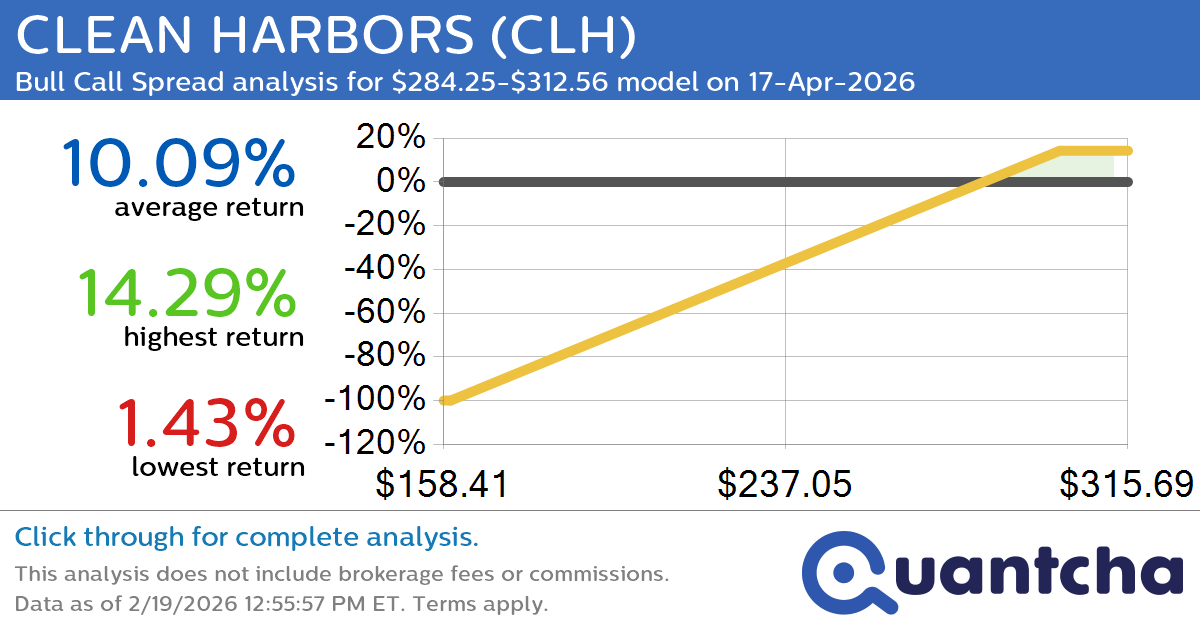

52-Week High Alert: Trading today’s movement in CLEAN HARBORS $CLH

Quantchabot has detected a new Bull Call Spread trade opportunity for CLEAN HARBORS (CLH) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CLH was recently trading at $282.56 and has an implied volatility of 23.88% for this period. Based on an analysis of the…

-

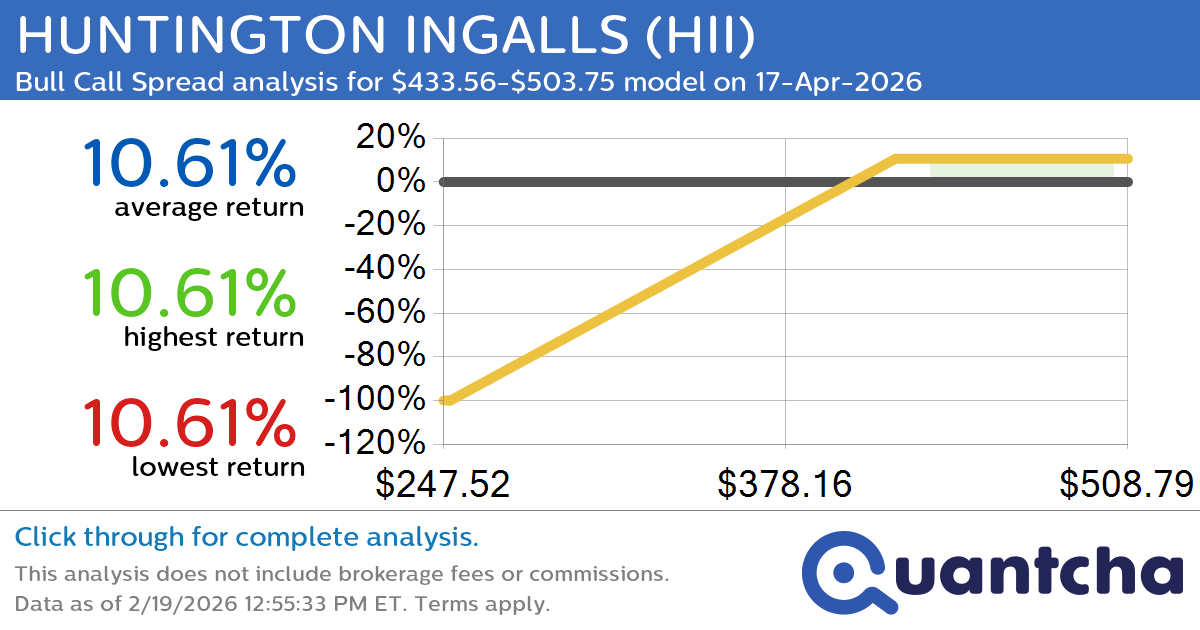

52-Week High Alert: Trading today’s movement in HUNTINGTON INGALLS $HII

Quantchabot has detected a new Bull Call Spread trade opportunity for HUNTINGTON INGALLS (HII) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. HII was recently trading at $432.36 and has an implied volatility of 37.75% for this period. Based on an analysis of the…

-

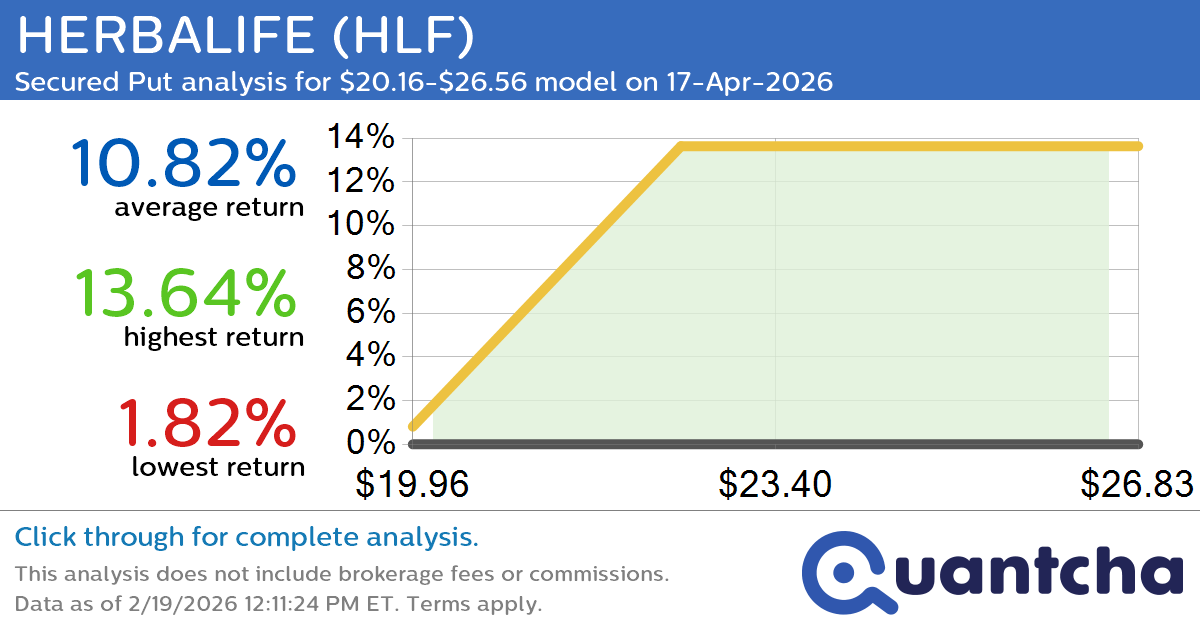

Big Gainer Alert: Trading today’s 21.1% move in HERBALIFE $HLF

Quantchabot has detected a new Secured Put trade opportunity for HERBALIFE (HLF) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. HLF was recently trading at $20.04 and has an implied volatility of 69.39% for this period. Based on an analysis of the options available…

-

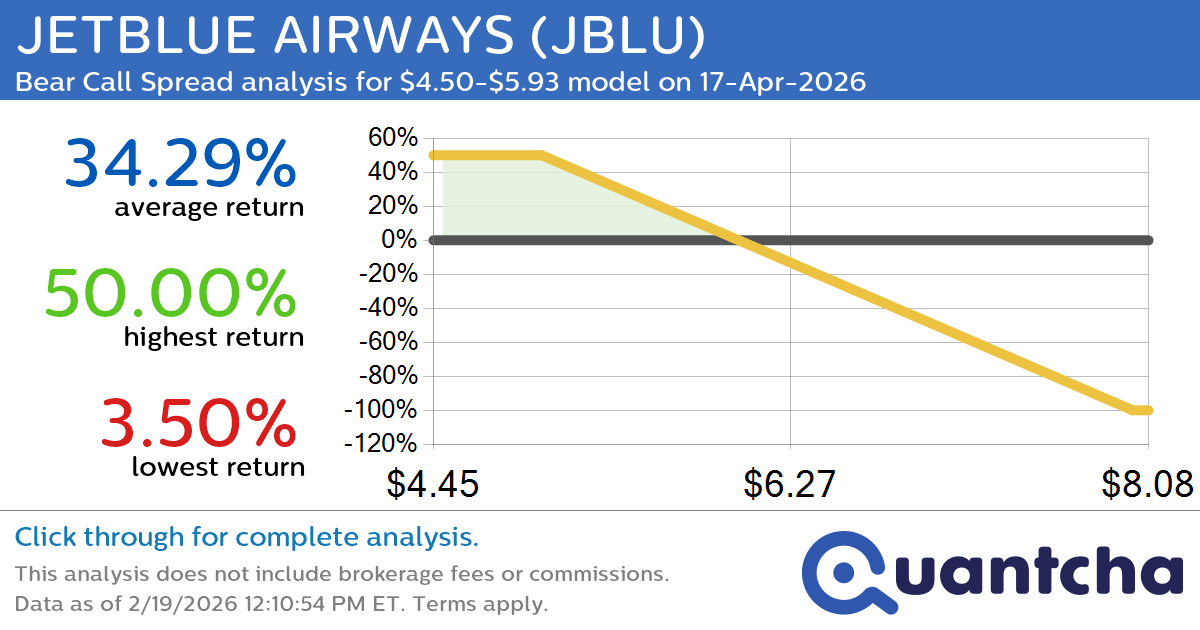

Big Loser Alert: Trading today’s -8.8% move in JETBLUE AIRWAYS $JBLU

Quantchabot has detected a new Bear Call Spread trade opportunity for JETBLUE AIRWAYS (JBLU) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. JBLU was recently trading at $5.89 and has an implied volatility of 69.08% for this period. Based on an analysis of the…

-

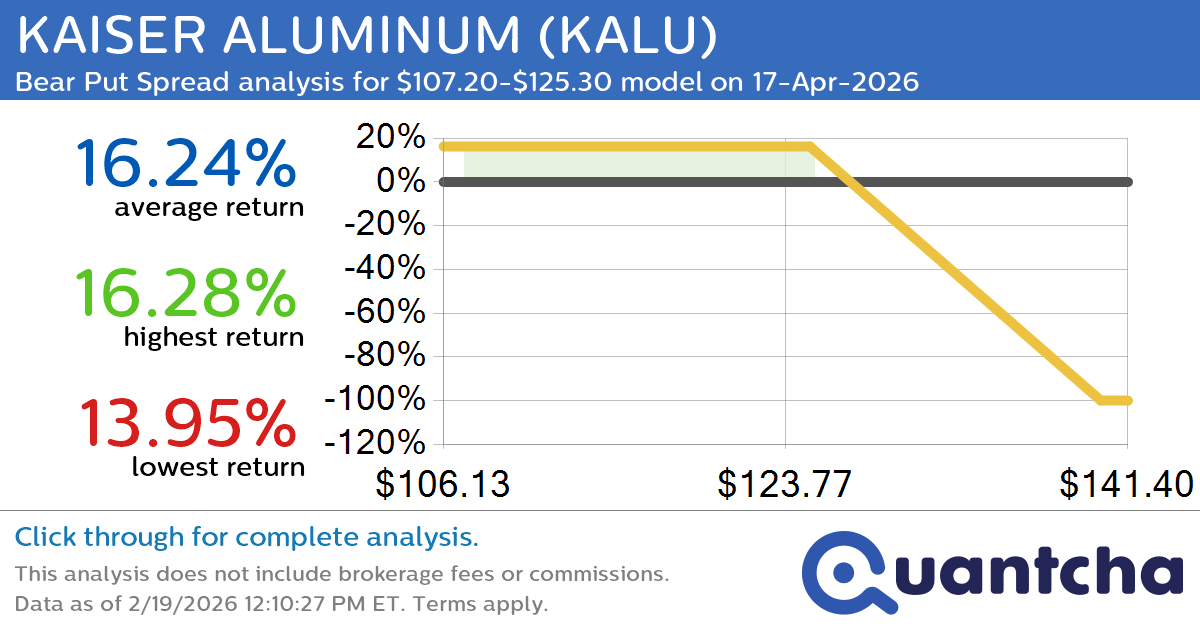

Big Loser Alert: Trading today’s -10.6% move in KAISER ALUMINUM $KALU

Quantchabot has detected a new Bear Put Spread trade opportunity for KAISER ALUMINUM (KALU) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. KALU was recently trading at $124.56 and has an implied volatility of 39.24% for this period. Based on an analysis of the…

-

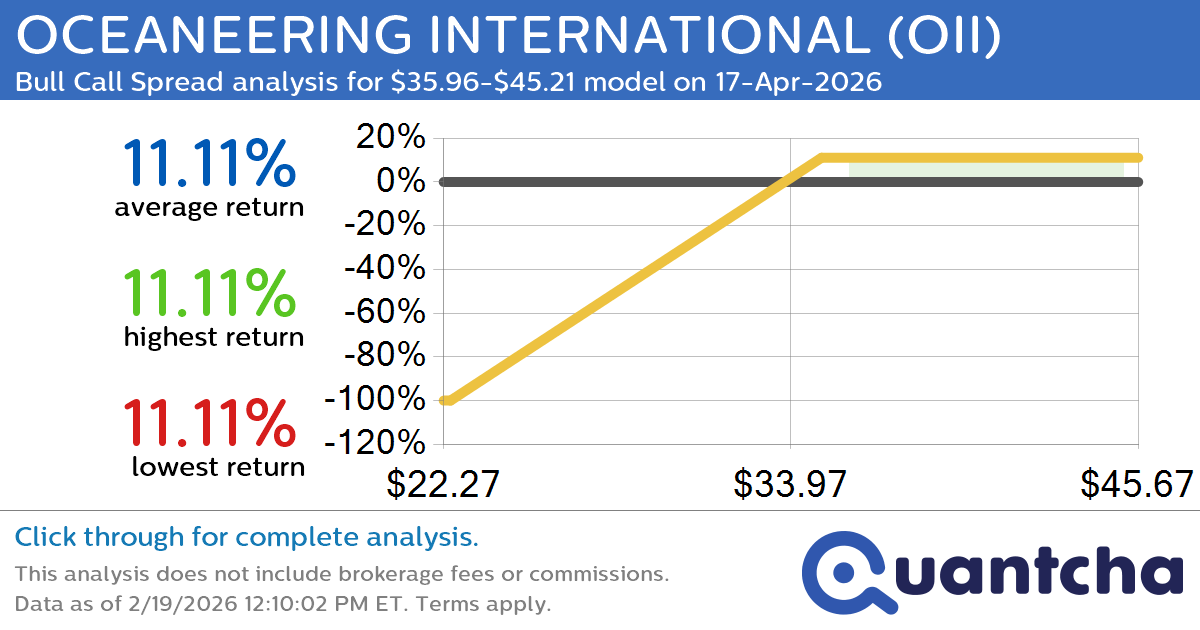

Big Gainer Alert: Trading today’s 8.0% move in OCEANEERING INTERNATIONAL $OII

Quantchabot has detected a new Bull Call Spread trade opportunity for OCEANEERING INTERNATIONAL (OII) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. OII was recently trading at $35.74 and has an implied volatility of 57.63% for this period. Based on an analysis of the…

-

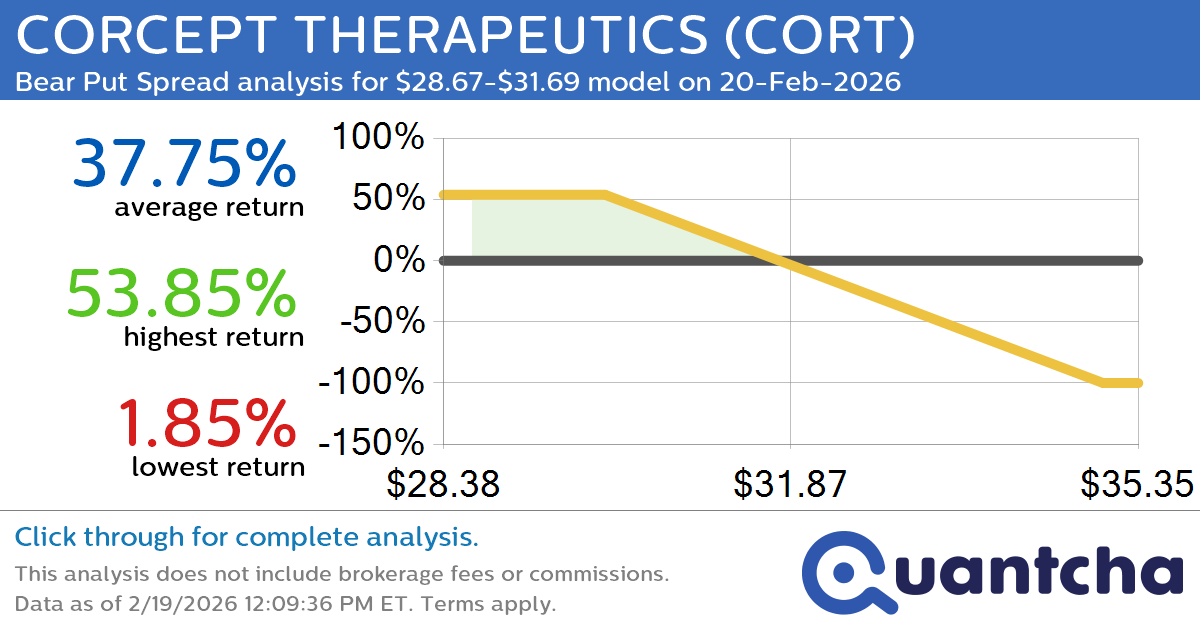

Big Loser Alert: Trading today’s -20.4% move in CORCEPT THERAPEUTICS $CORT

Quantchabot has detected a new Bear Put Spread trade opportunity for CORCEPT THERAPEUTICS (CORT) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CORT was recently trading at $31.68 and has an implied volatility of 146.50% for this period. Based on an analysis of the…

-

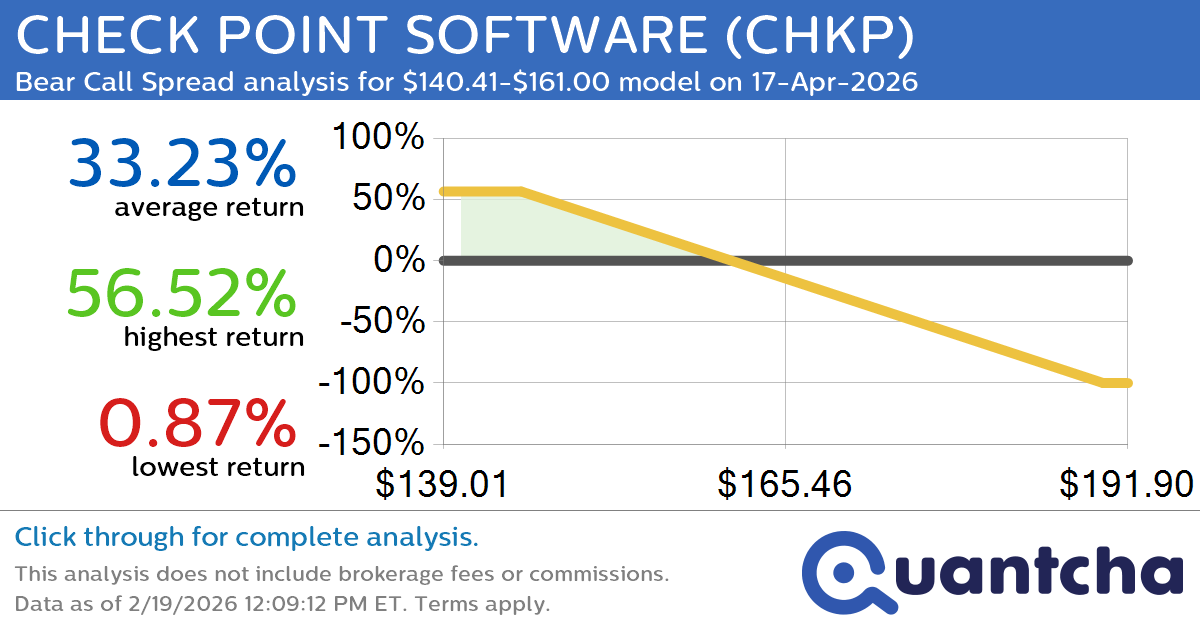

52-Week Low Alert: Trading today’s movement in CHECK POINT SOFTWARE $CHKP

Quantchabot has detected a new Bear Call Spread trade opportunity for CHECK POINT SOFTWARE (CHKP) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CHKP was recently trading at $160.04 and has an implied volatility of 34.41% for this period. Based on an analysis of…

-

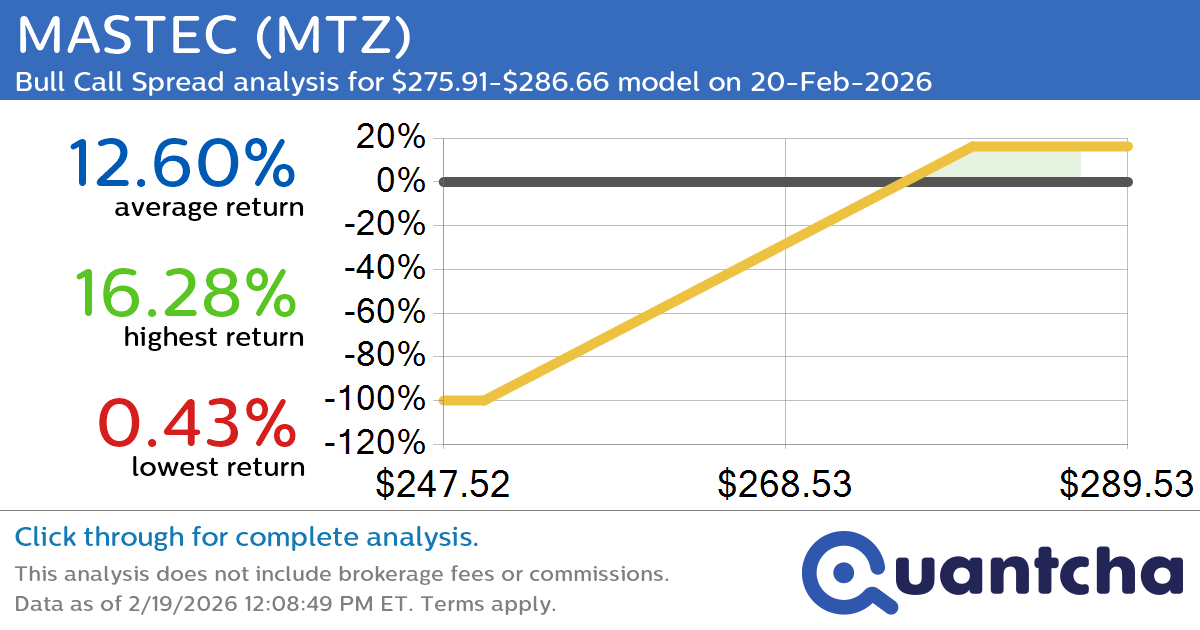

52-Week High Alert: Trading today’s movement in MASTEC $MTZ

Quantchabot has detected a new Bull Call Spread trade opportunity for MASTEC (MTZ) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. MTZ was recently trading at $275.86 and has an implied volatility of 55.91% for this period. Based on an analysis of the options…

-

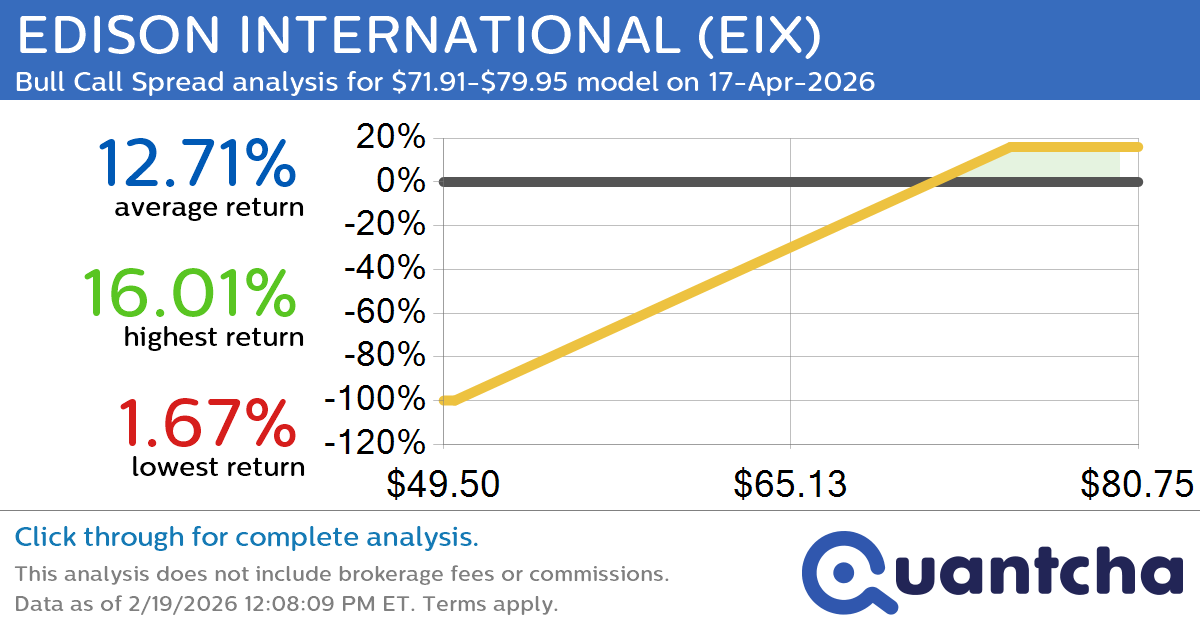

52-Week High Alert: Trading today’s movement in EDISON INTERNATIONAL $EIX

Quantchabot has detected a new Bull Call Spread trade opportunity for EDISON INTERNATIONAL (EIX) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. EIX was recently trading at $72.36 and has an implied volatility of 26.65% for this period. Based on an analysis of the…