Category: Trade Ideas

-

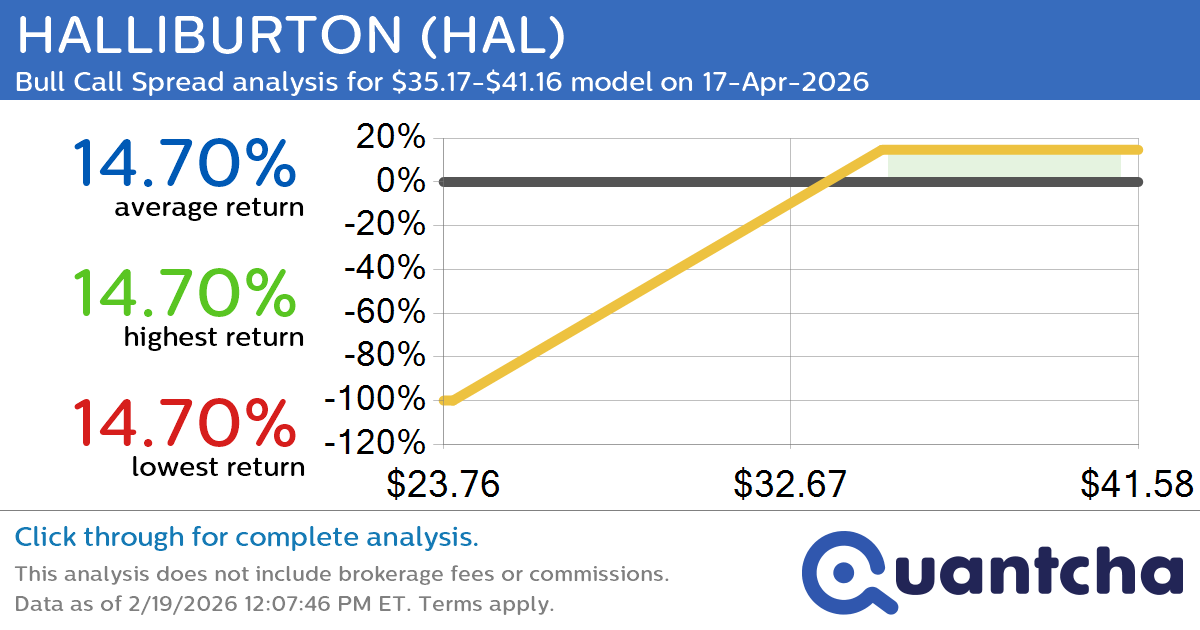

52-Week High Alert: Trading today’s movement in HALLIBURTON $HAL

Quantchabot has detected a new Bull Call Spread trade opportunity for HALLIBURTON (HAL) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. HAL was recently trading at $35.13 and has an implied volatility of 39.58% for this period. Based on an analysis of the options…

-

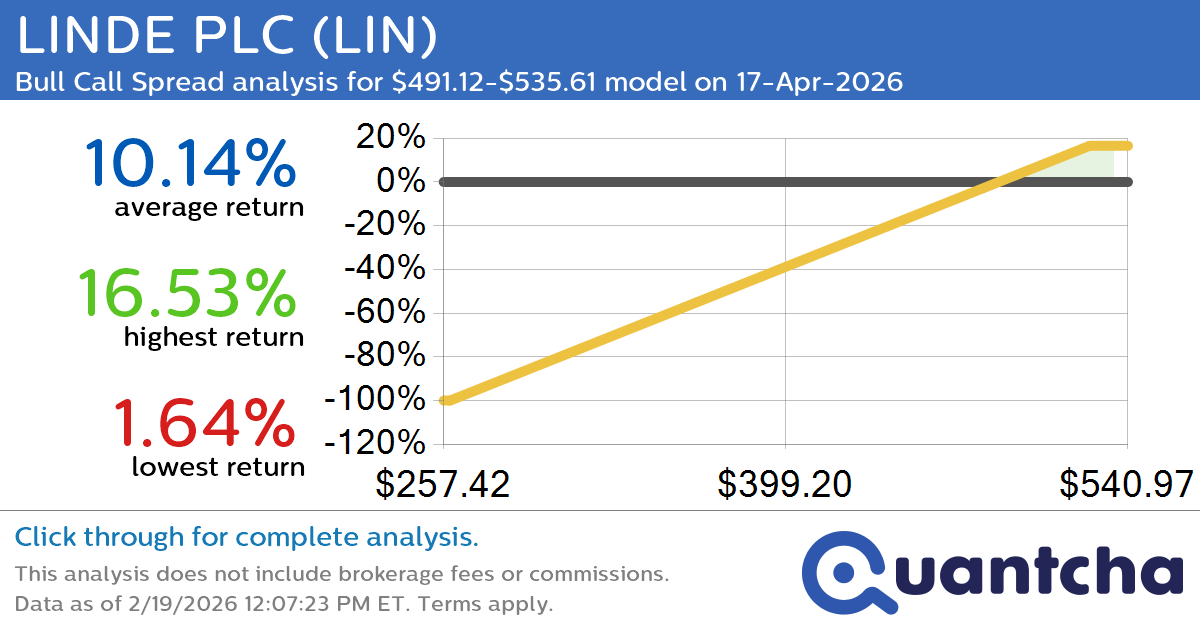

52-Week High Alert: Trading today’s movement in LINDE PLC $LIN

Quantchabot has detected a new Bull Call Spread trade opportunity for LINDE PLC (LIN) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. LIN was recently trading at $488.19 and has an implied volatility of 21.81% for this period. Based on an analysis of the…

-

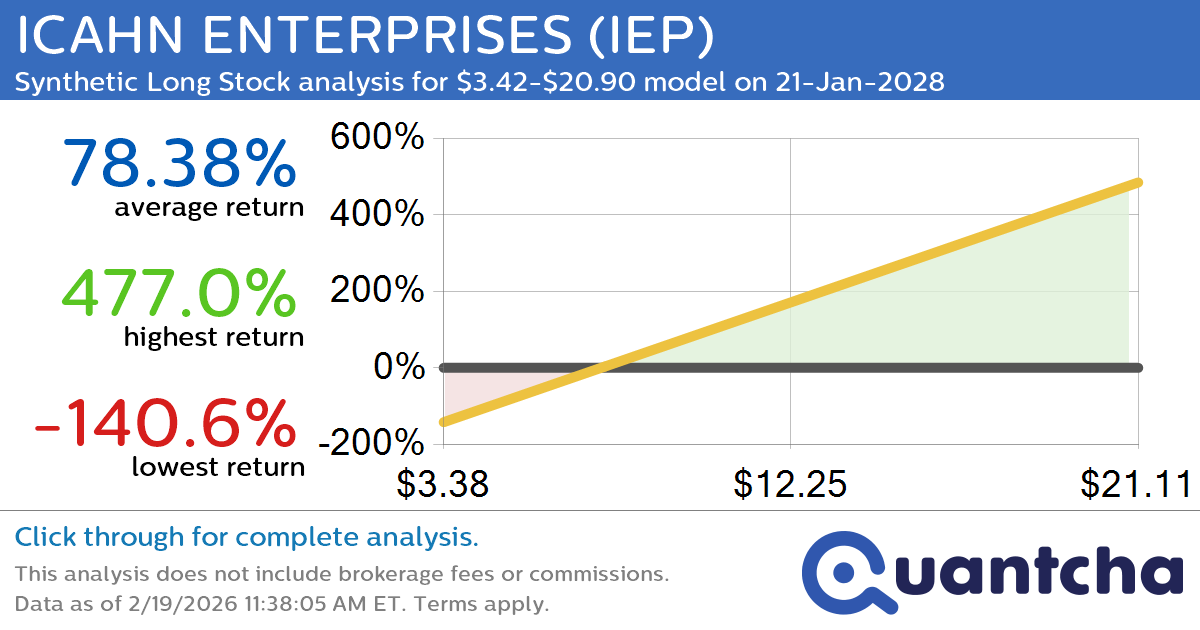

Synthetic Long Discount Alert: ICAHN ENTERPRISES $IEP trading at a 20.89% discount for the 21-Jan-2028 expiration

Quantchabot has detected a new Synthetic Long Stock trade opportunity for ICAHN ENTERPRISES (IEP) for the 21-Jan-2028 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. IEP was recently trading at $7.90 and has an implied volatility of 65.23% for this period. Based on an analysis of the…

-

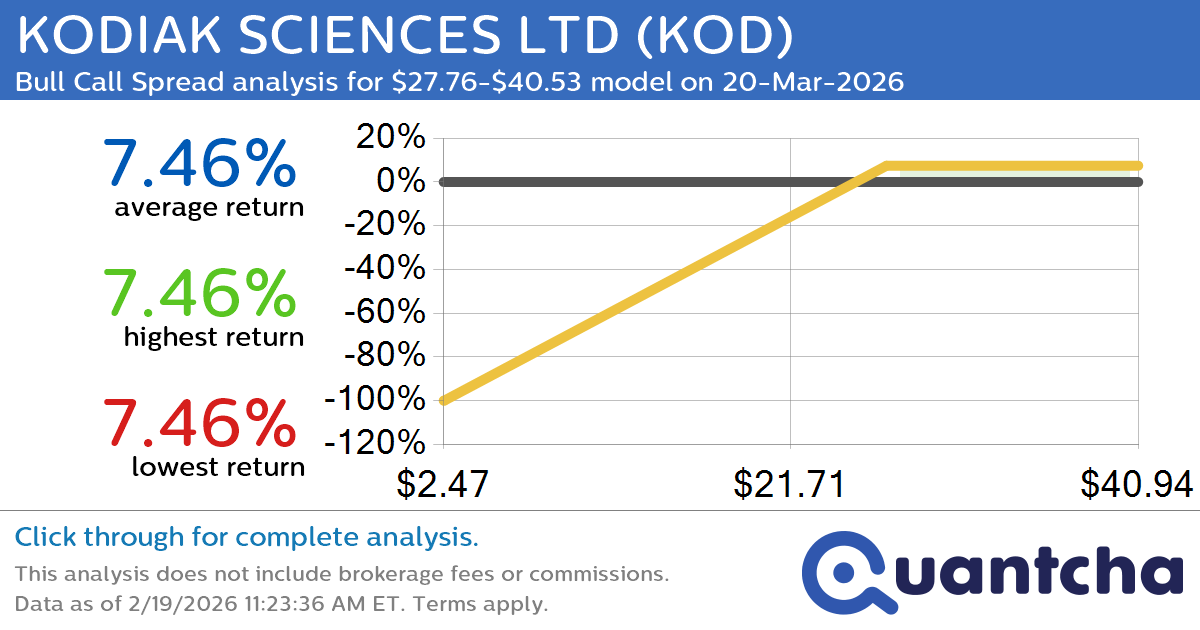

Big Gainer Alert: Trading today’s 12.6% move in KODIAK SCIENCES LTD $KOD

Quantchabot has detected a new Bull Call Spread trade opportunity for KODIAK SCIENCES LTD (KOD) for the 20-Mar-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. KOD was recently trading at $27.67 and has an implied volatility of 132.67% for this period. Based on an analysis of…

-

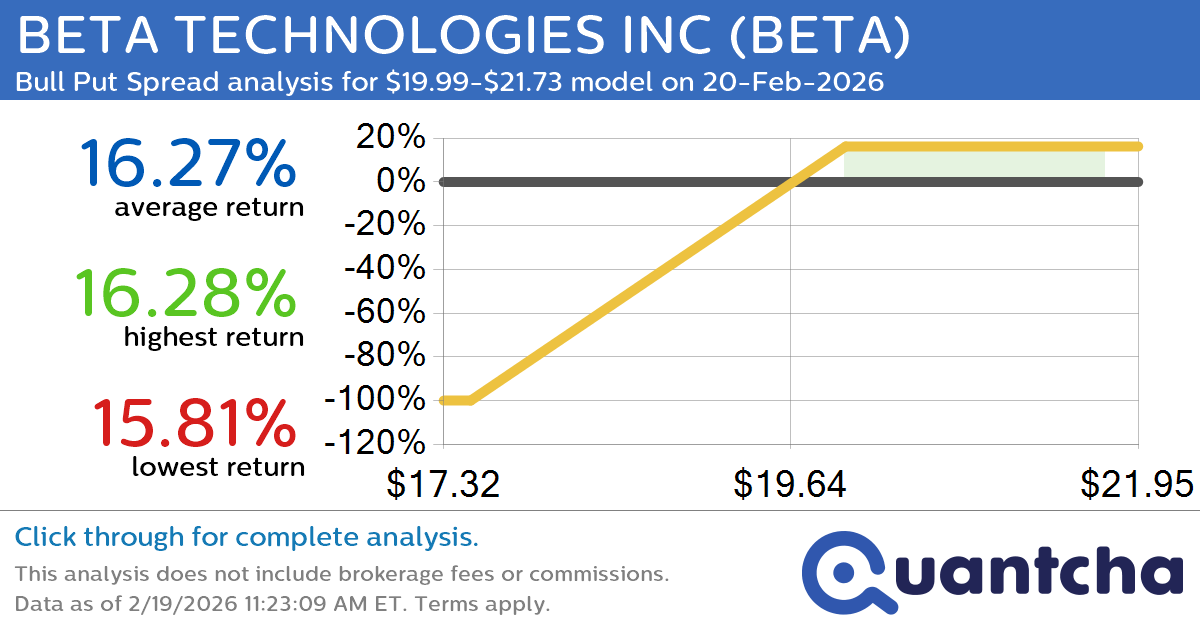

Big Gainer Alert: Trading today’s 7.4% move in BETA TECHNOLOGIES INC $BETA

Quantchabot has detected a new Bull Put Spread trade opportunity for BETA TECHNOLOGIES INC (BETA) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. BETA was recently trading at $19.99 and has an implied volatility of 120.71% for this period. Based on an analysis of…

-

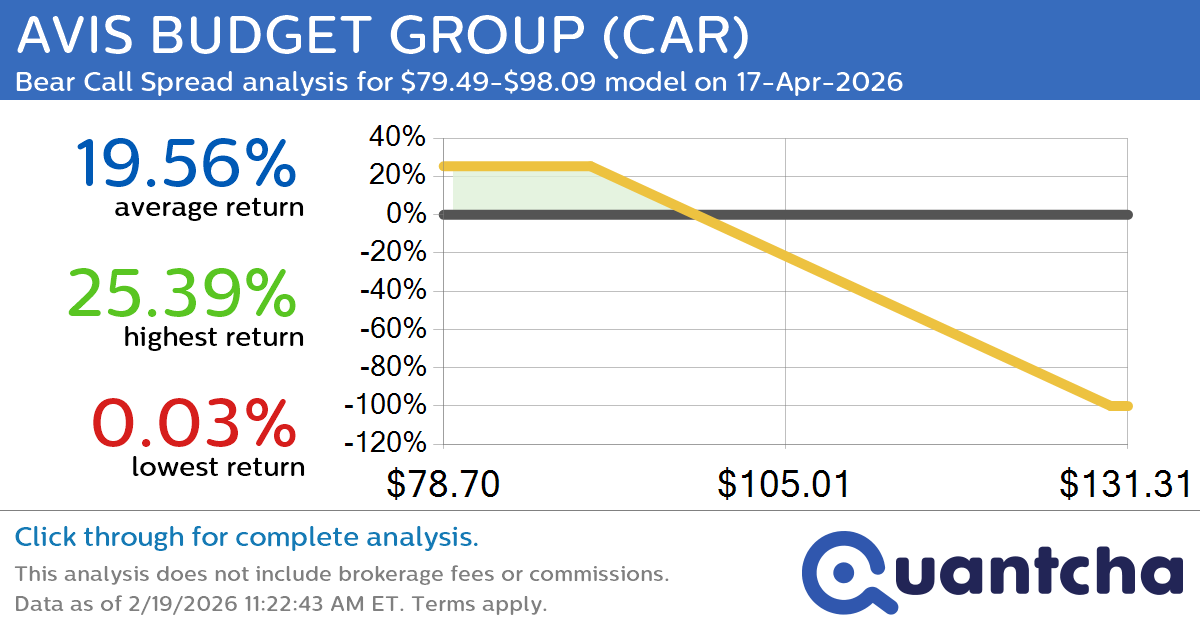

Big Loser Alert: Trading today’s -20.9% move in AVIS BUDGET GROUP $CAR

Quantchabot has detected a new Bear Call Spread trade opportunity for AVIS BUDGET GROUP (CAR) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CAR was recently trading at $97.51 and has an implied volatility of 52.87% for this period. Based on an analysis of…

-

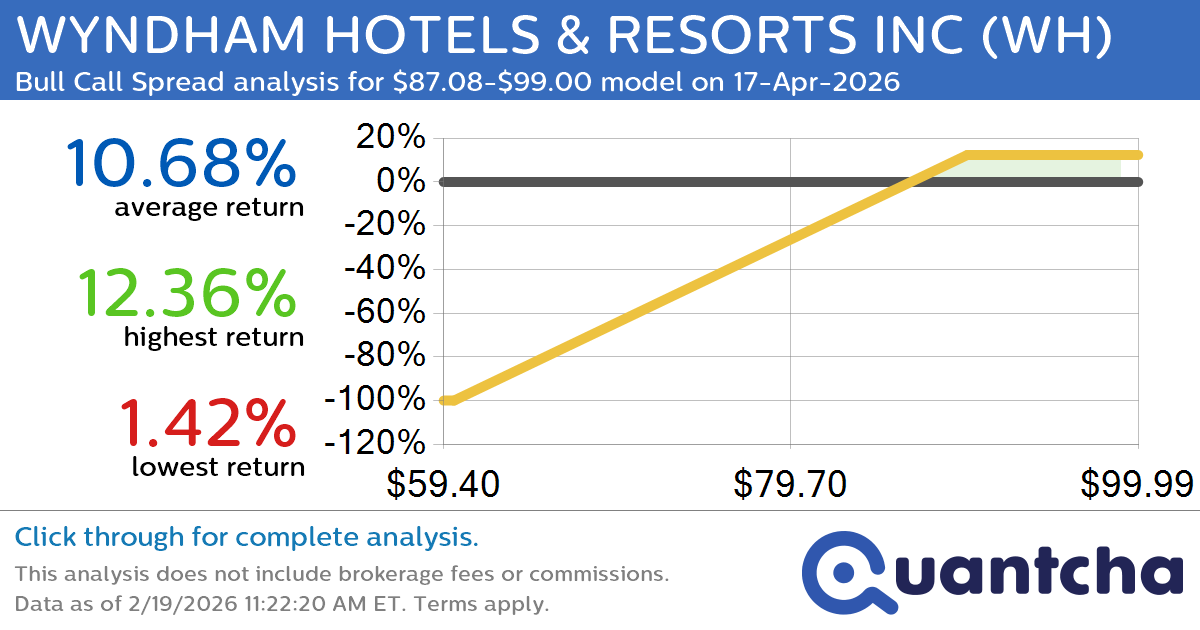

Big Gainer Alert: Trading today’s 7.9% move in WYNDHAM HOTELS & RESORTS INC $WH

Quantchabot has detected a new Bull Call Spread trade opportunity for WYNDHAM HOTELS & RESORTS INC (WH) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. WH was recently trading at $86.56 and has an implied volatility of 32.27% for this period. Based on an…

-

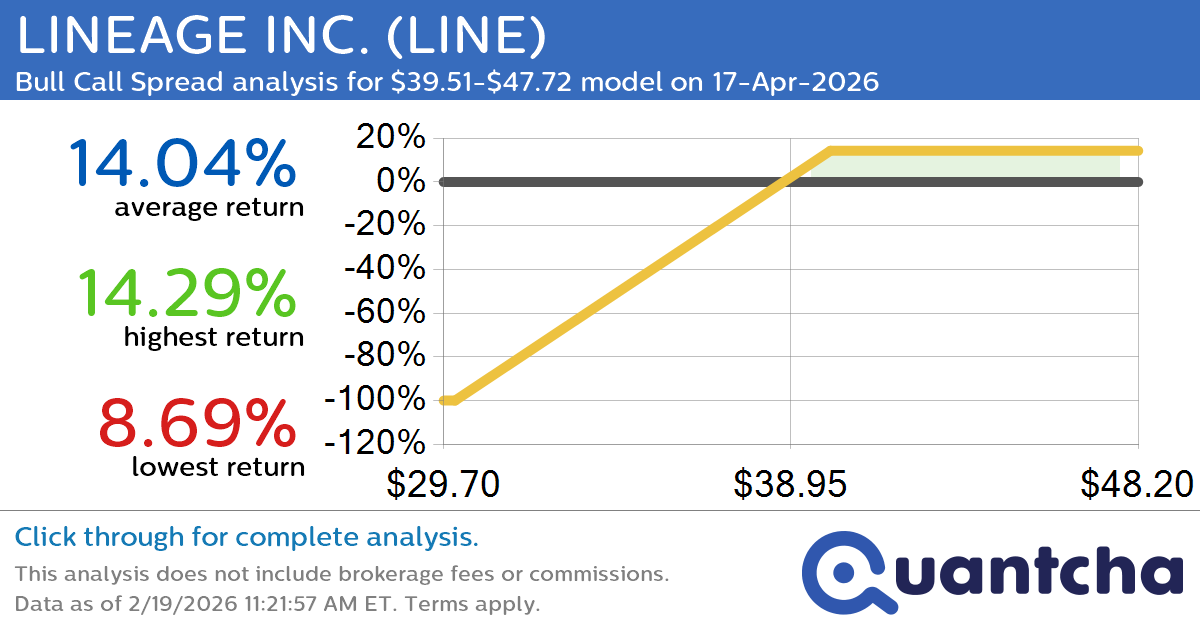

Big Gainer Alert: Trading today’s 7.3% move in LINEAGE INC. $LINE

Quantchabot has detected a new Bull Call Spread trade opportunity for LINEAGE INC. (LINE) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. LINE was recently trading at $39.27 and has an implied volatility of 47.47% for this period. Based on an analysis of the…

-

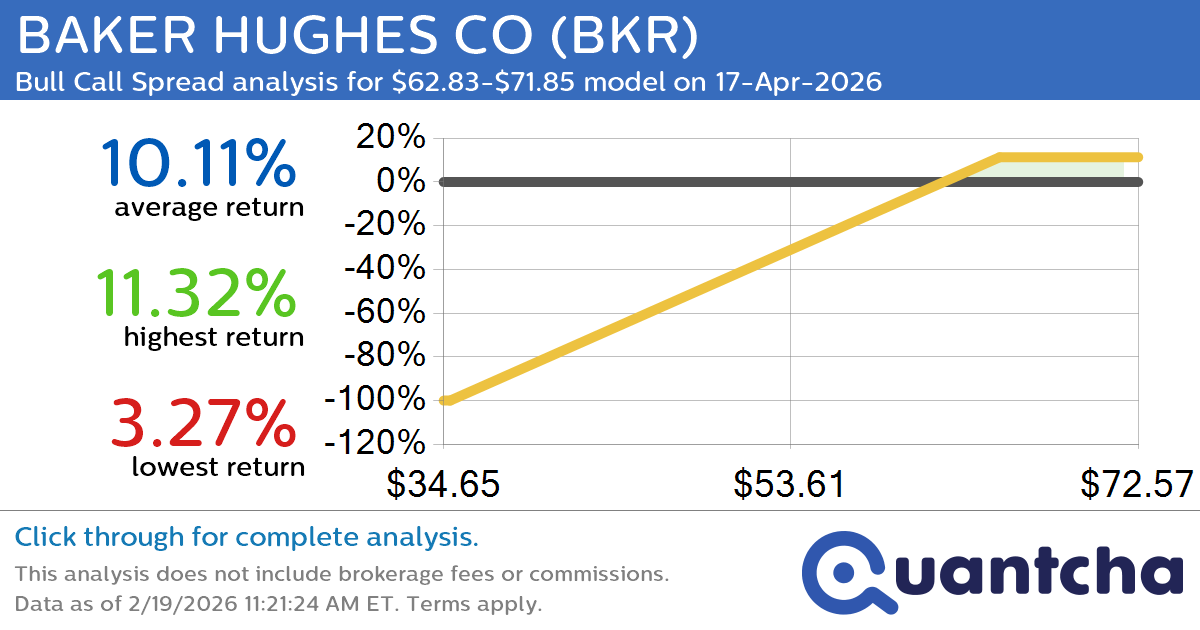

52-Week High Alert: Trading today’s movement in BAKER HUGHES CO $BKR

Quantchabot has detected a new Bull Call Spread trade opportunity for BAKER HUGHES CO (BKR) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. BKR was recently trading at $62.46 and has an implied volatility of 33.72% for this period. Based on an analysis of…

-

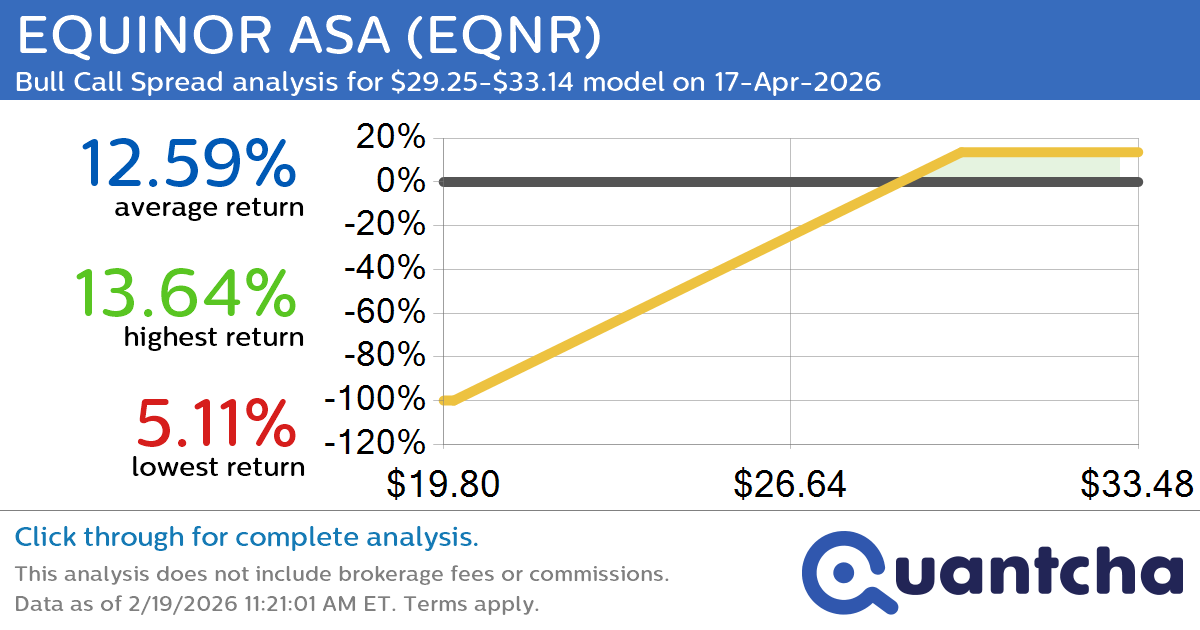

52-Week High Alert: Trading today’s movement in EQUINOR ASA $EQNR

Quantchabot has detected a new Bull Call Spread trade opportunity for EQUINOR ASA (EQNR) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. EQNR was recently trading at $29.07 and has an implied volatility of 31.40% for this period. Based on an analysis of the…