Category: Trade Ideas

-

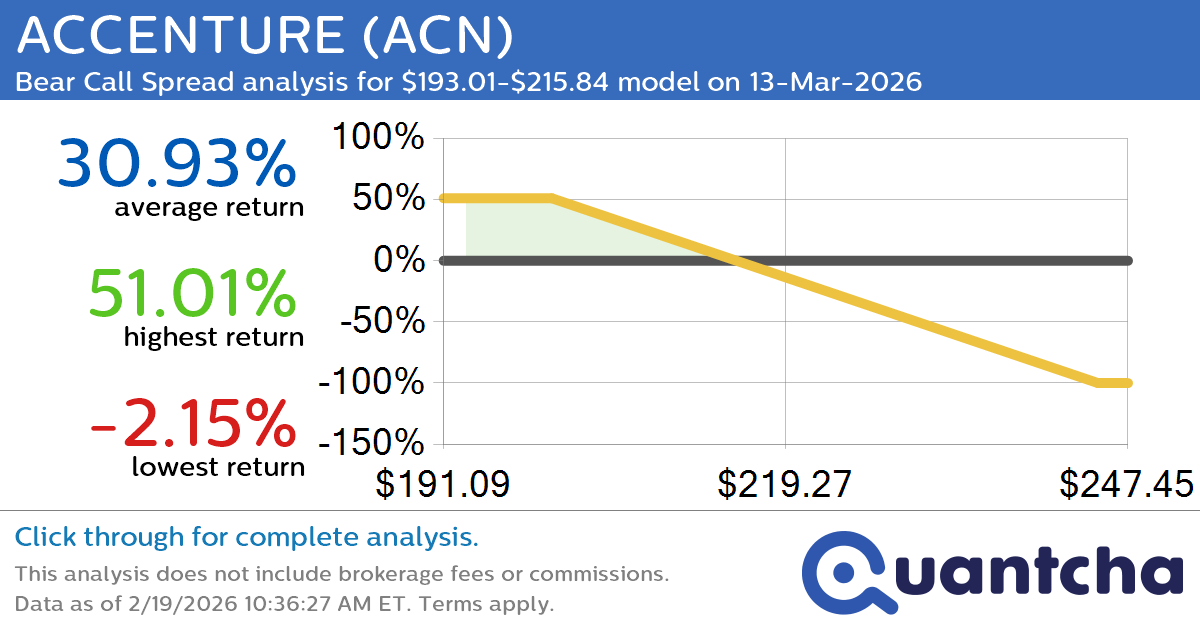

52-Week Low Alert: Trading today’s movement in ACCENTURE $ACN

Quantchabot has detected a new Bear Call Spread trade opportunity for ACCENTURE (ACN) for the 13-Mar-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ACN was recently trading at $215.34 and has an implied volatility of 44.77% for this period. Based on an analysis of the options…

-

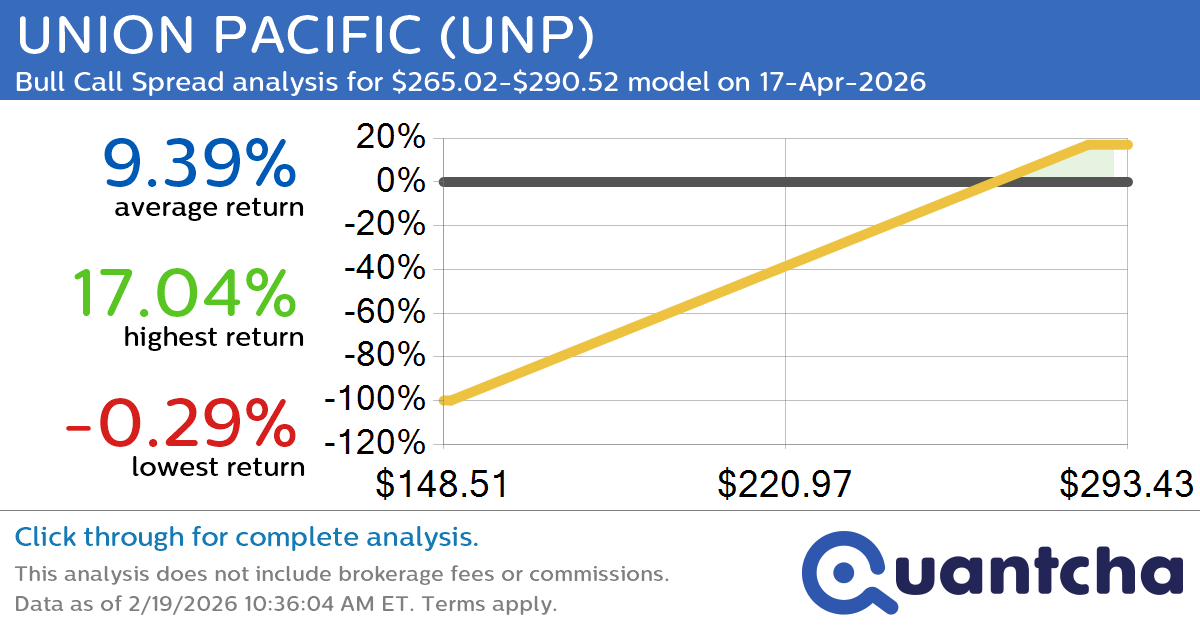

52-Week High Alert: Trading today’s movement in UNION PACIFIC $UNP

Quantchabot has detected a new Bull Call Spread trade opportunity for UNION PACIFIC (UNP) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. UNP was recently trading at $264.81 and has an implied volatility of 23.09% for this period. Based on an analysis of the…

-

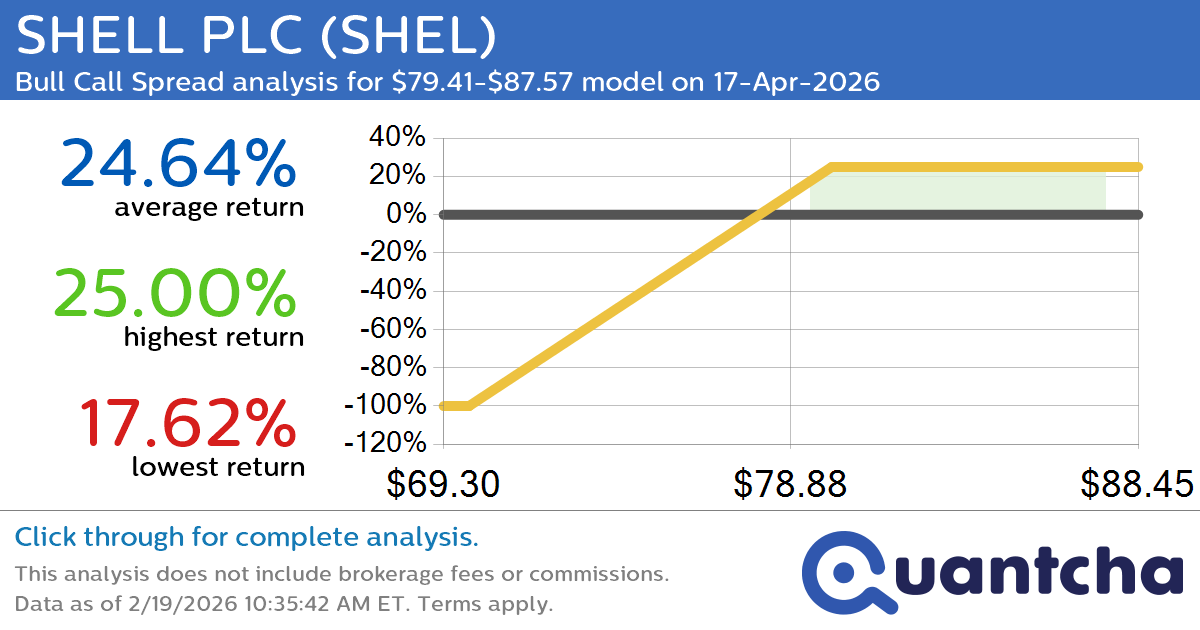

52-Week High Alert: Trading today’s movement in SHELL PLC $SHEL

Quantchabot has detected a new Bull Call Spread trade opportunity for SHELL PLC (SHEL) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SHEL was recently trading at $79.68 and has an implied volatility of 24.59% for this period. Based on an analysis of the…

-

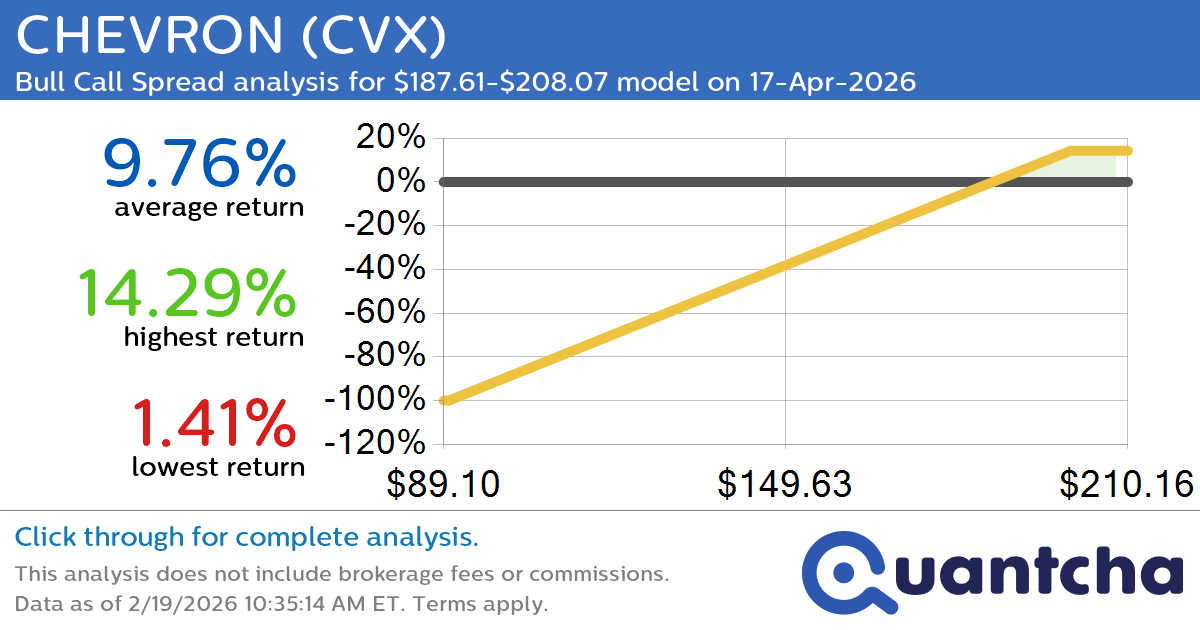

52-Week High Alert: Trading today’s movement in CHEVRON $CVX

Quantchabot has detected a new Bull Call Spread trade opportunity for CHEVRON (CVX) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CVX was recently trading at $186.49 and has an implied volatility of 26.02% for this period. Based on an analysis of the options…

-

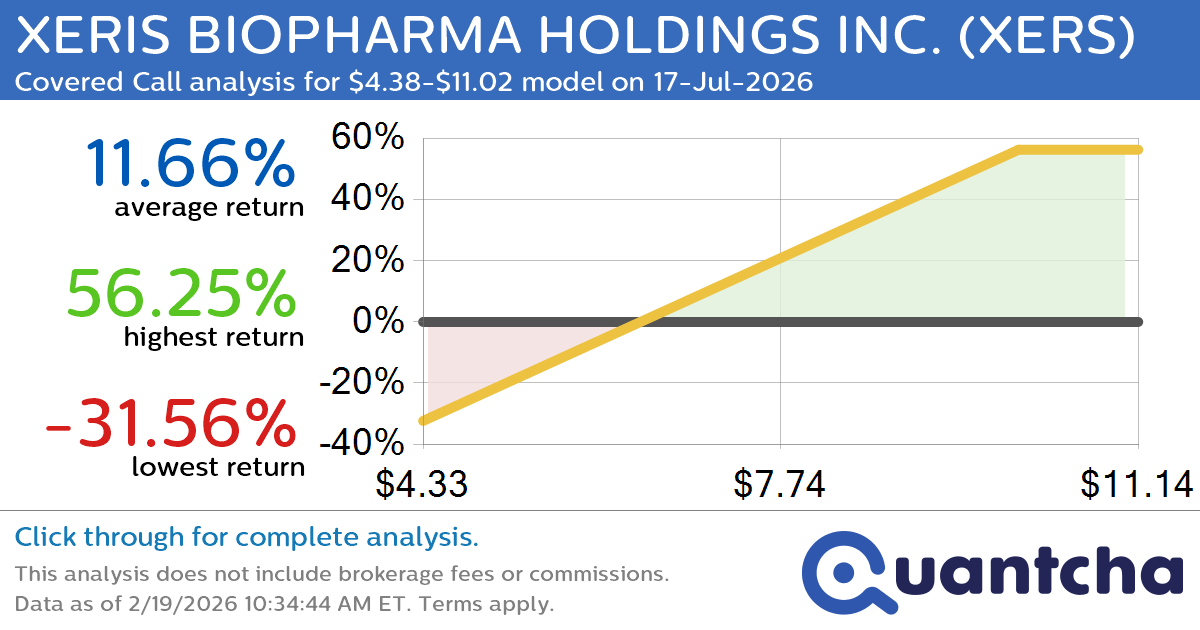

Covered Call Alert: XERIS BIOPHARMA HOLDINGS INC. $XERS returning up to 56.25% through 17-Jul-2026

Quantchabot has detected a new Covered Call trade opportunity for XERIS BIOPHARMA HOLDINGS INC. (XERS) for the 17-Jul-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. XERS was recently trading at $6.84 and has an implied volatility of 72.31% for this period. Based on an analysis of…

-

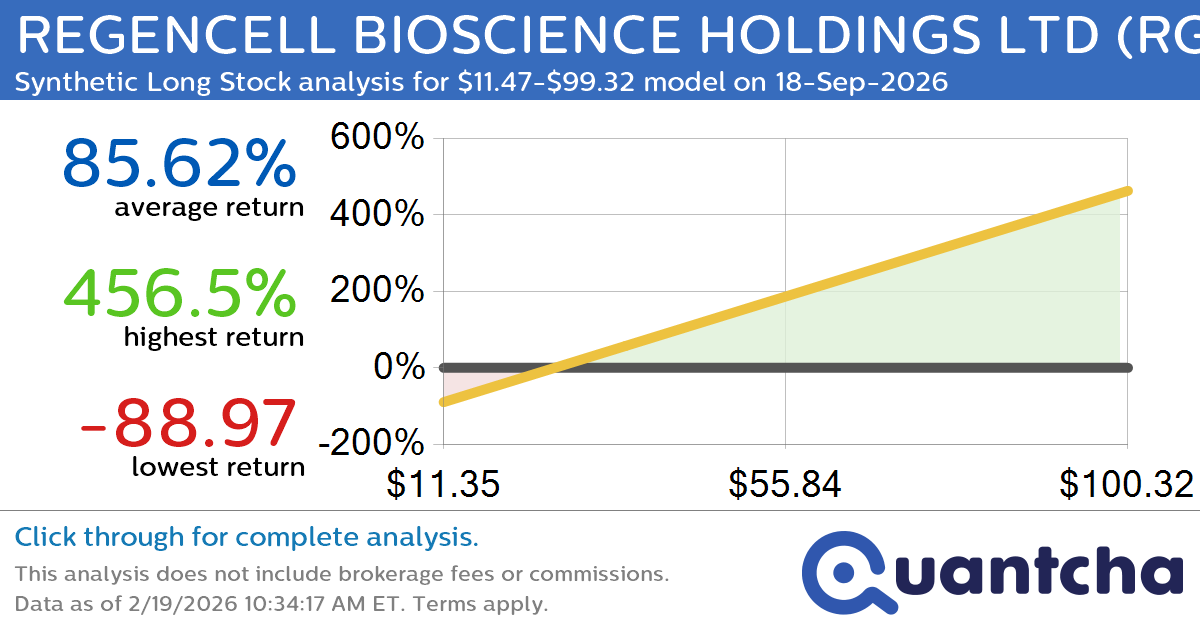

Synthetic Long Discount Alert: REGENCELL BIOSCIENCE HOLDINGS LTD $RGC trading at a 21.90% discount for the 18-Sep-2026 expiration

Quantchabot has detected a new Synthetic Long Stock trade opportunity for REGENCELL BIOSCIENCE HOLDINGS LTD (RGC) for the 18-Sep-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. RGC was recently trading at $33.03 and has an implied volatility of 141.72% for this period. Based on an analysis…

-

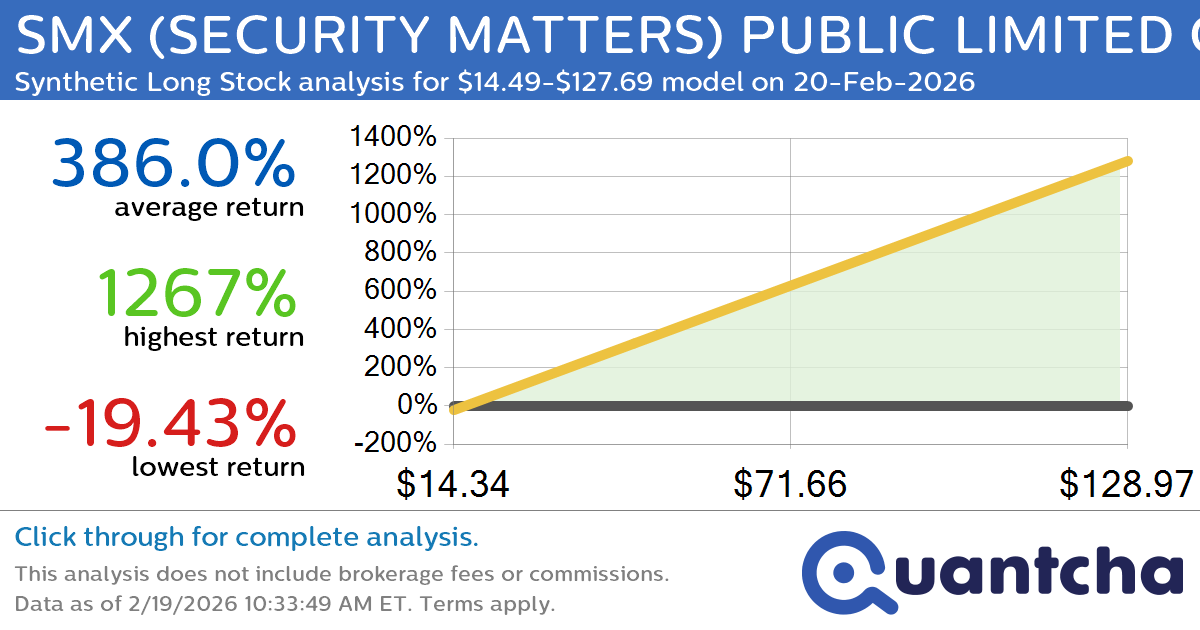

Synthetic Long Discount Alert: SMX (SECURITY MATTERS) PUBLIC LIMITED COMPANY $SMX trading at a 62.33% discount for the 20-Feb-2026 expiration

Quantchabot has detected a new Synthetic Long Stock trade opportunity for SMX (SECURITY MATTERS) PUBLIC LIMITED COMPANY (SMX) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SMX was recently trading at $43.00 and has an implied volatility of 1562.60% for this period. Based on…