Category: Trade Ideas

-

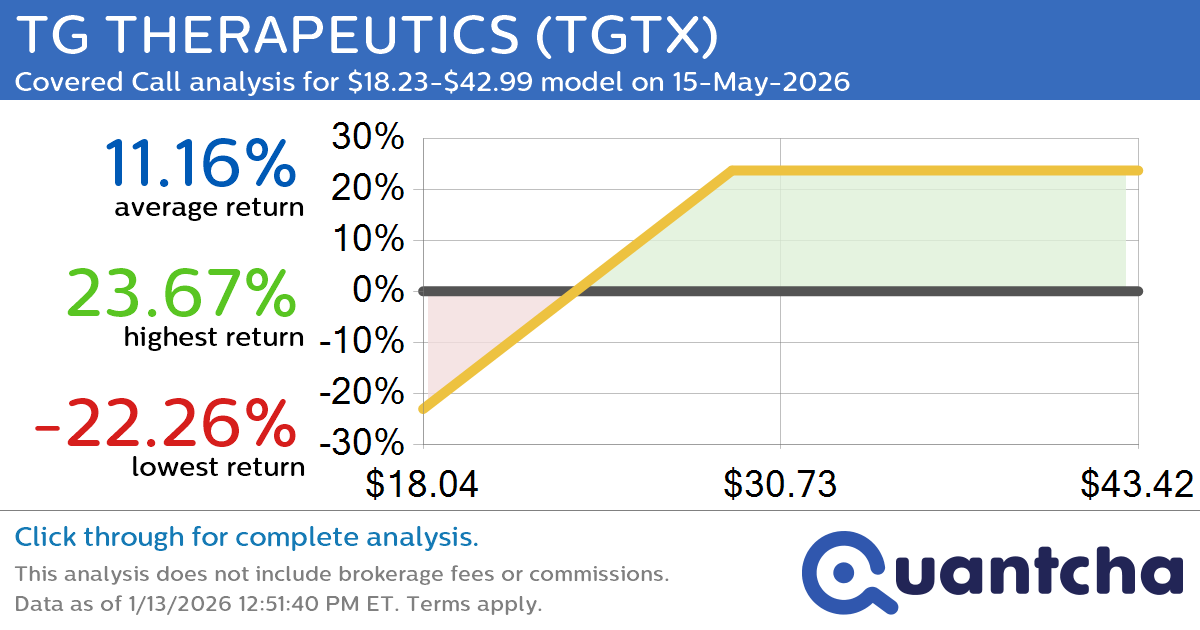

Covered Call Alert: TG THERAPEUTICS $TGTX returning up to 23.67% through 15-May-2026

Quantchabot has detected a new Covered Call trade opportunity for TG THERAPEUTICS (TGTX) for the 15-May-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TGTX was recently trading at $27.64 and has an implied volatility of 73.99% for this period. Based on an analysis of the options…

-

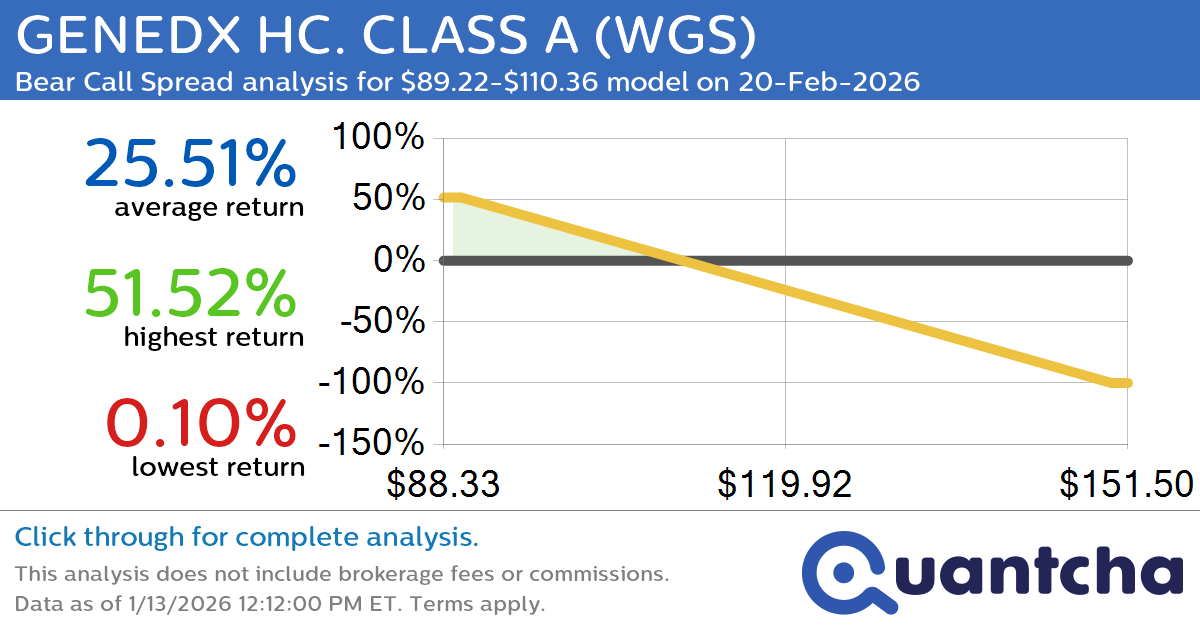

Big Loser Alert: Trading today’s -7.8% move in GENEDX HC. CLASS A $WGS

Quantchabot has detected a new Bear Call Spread trade opportunity for GENEDX HC. CLASS A (WGS) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. WGS was recently trading at $109.92 and has an implied volatility of 65.30% for this period. Based on an analysis…

-

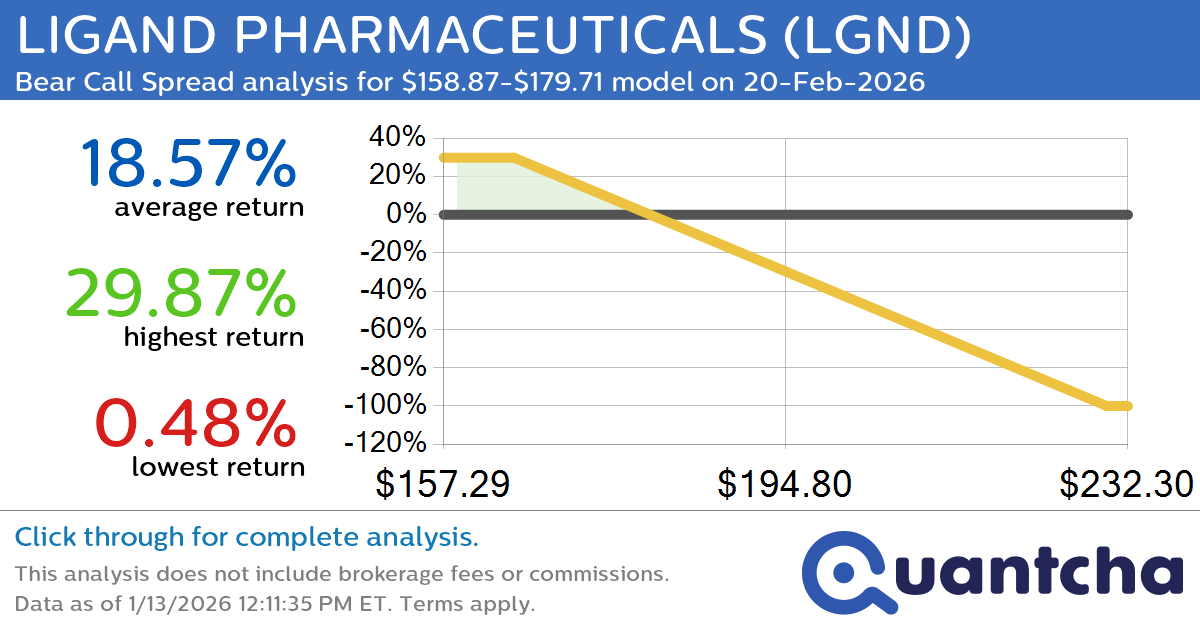

Big Loser Alert: Trading today’s -13.4% move in LIGAND PHARMACEUTICALS $LGND

Quantchabot has detected a new Bear Call Spread trade opportunity for LIGAND PHARMACEUTICALS (LGND) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. LGND was recently trading at $179.00 and has an implied volatility of 37.85% for this period. Based on an analysis of the…

-

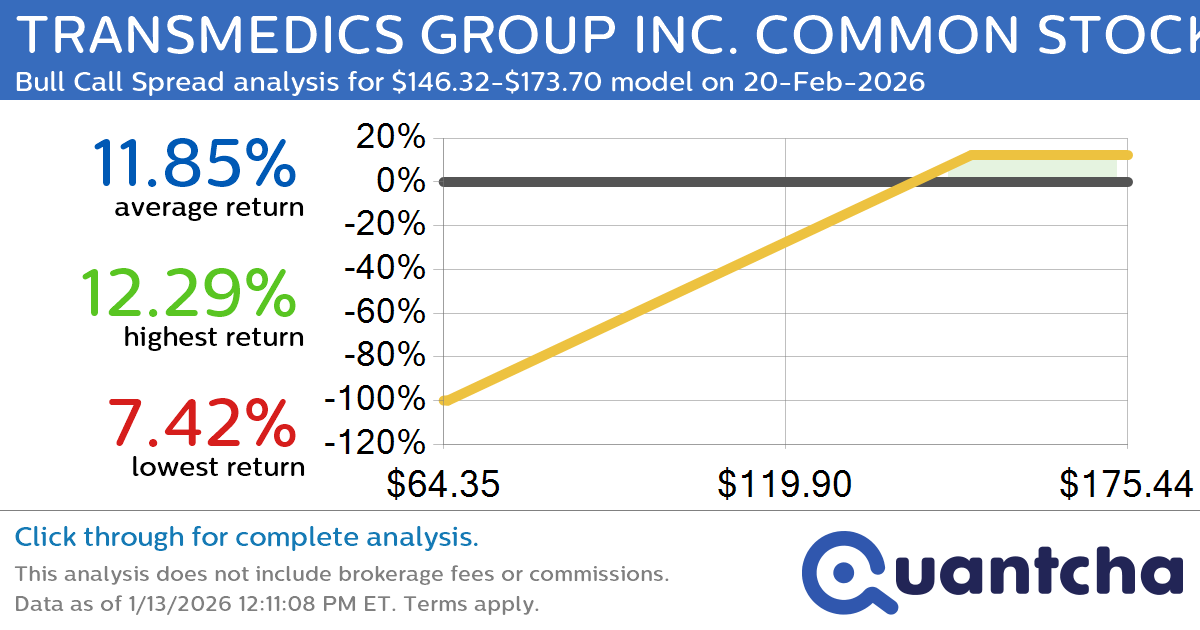

Big Gainer Alert: Trading today’s 8.2% move in TRANSMEDICS GROUP INC. COMMON STOCK $TMDX

Quantchabot has detected a new Bull Call Spread trade opportunity for TRANSMEDICS GROUP INC. COMMON STOCK (TMDX) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TMDX was recently trading at $145.74 and has an implied volatility of 52.67% for this period. Based on an…

-

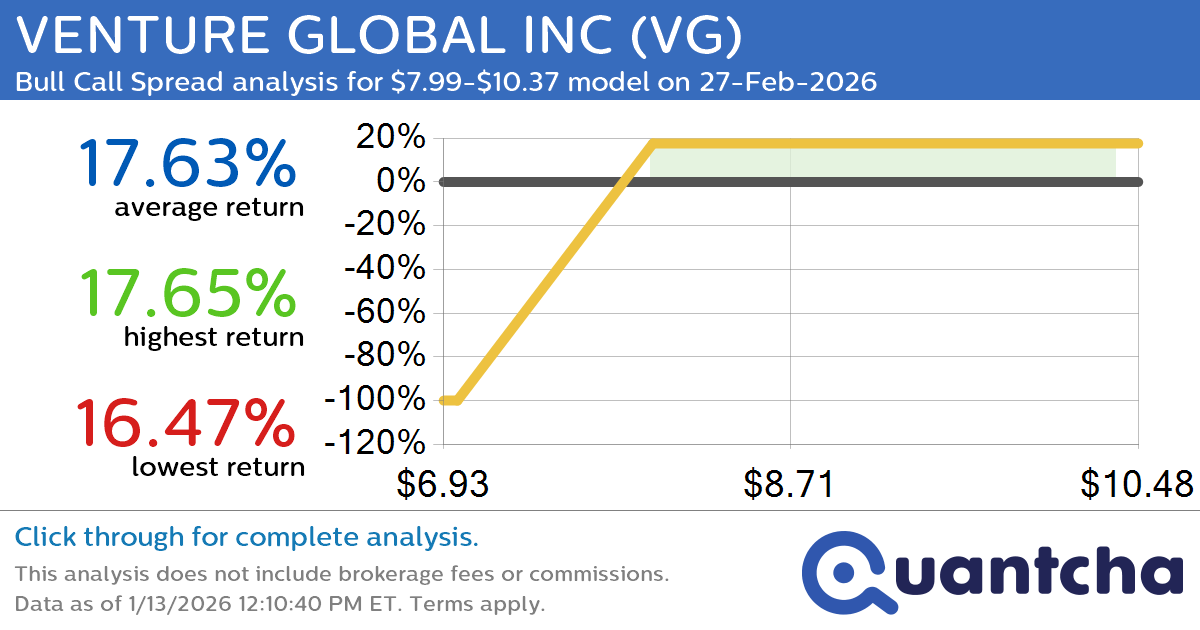

Big Gainer Alert: Trading today’s 7.8% move in VENTURE GLOBAL INC $VG

Quantchabot has detected a new Bull Call Spread trade opportunity for VENTURE GLOBAL INC (VG) for the 27-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. VG was recently trading at $7.96 and has an implied volatility of 73.63% for this period. Based on an analysis of…

-

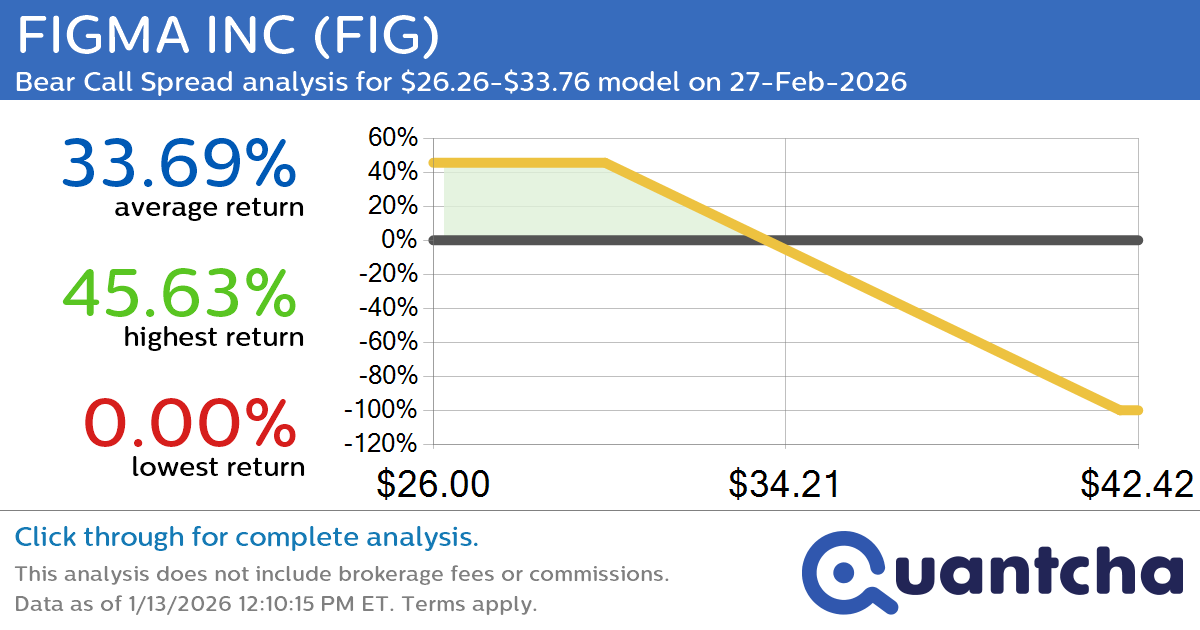

Big Loser Alert: Trading today’s -7.7% move in FIGMA INC $FIG

Quantchabot has detected a new Bear Call Spread trade opportunity for FIGMA INC (FIG) for the 27-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. FIG was recently trading at $33.60 and has an implied volatility of 70.94% for this period. Based on an analysis of the…

-

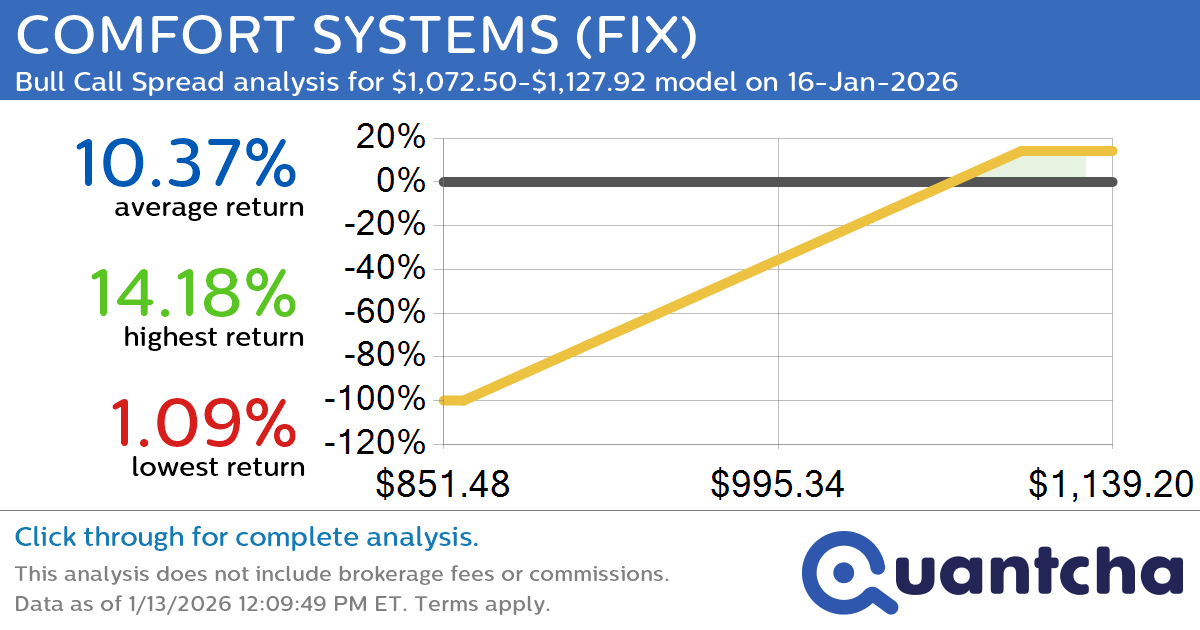

52-Week High Alert: Trading today’s movement in COMFORT SYSTEMS $FIX

Quantchabot has detected a new Bull Call Spread trade opportunity for COMFORT SYSTEMS (FIX) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. FIX was recently trading at $1,072.09 and has an implied volatility of 50.00% for this period. Based on an analysis of the…

-

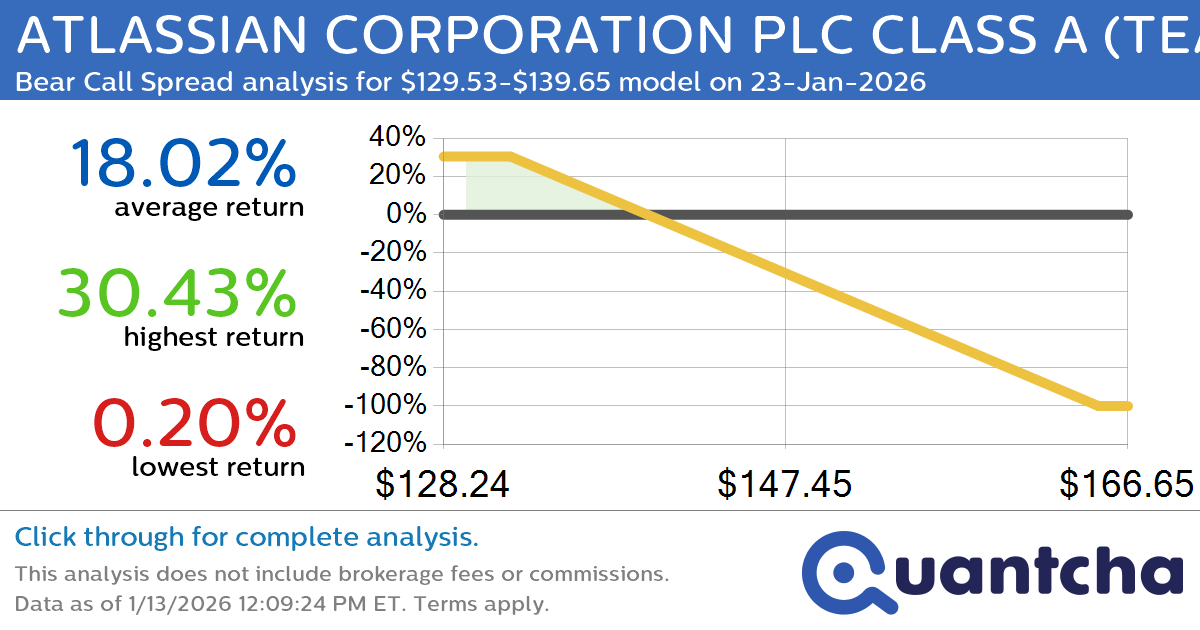

52-Week Low Alert: Trading today’s movement in ATLASSIAN CORPORATION PLC CLASS A $TEAM

Quantchabot has detected a new Bear Call Spread trade opportunity for ATLASSIAN CORPORATION PLC CLASS A (TEAM) for the 23-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TEAM was recently trading at $139.50 and has an implied volatility of 43.97% for this period. Based on an…

-

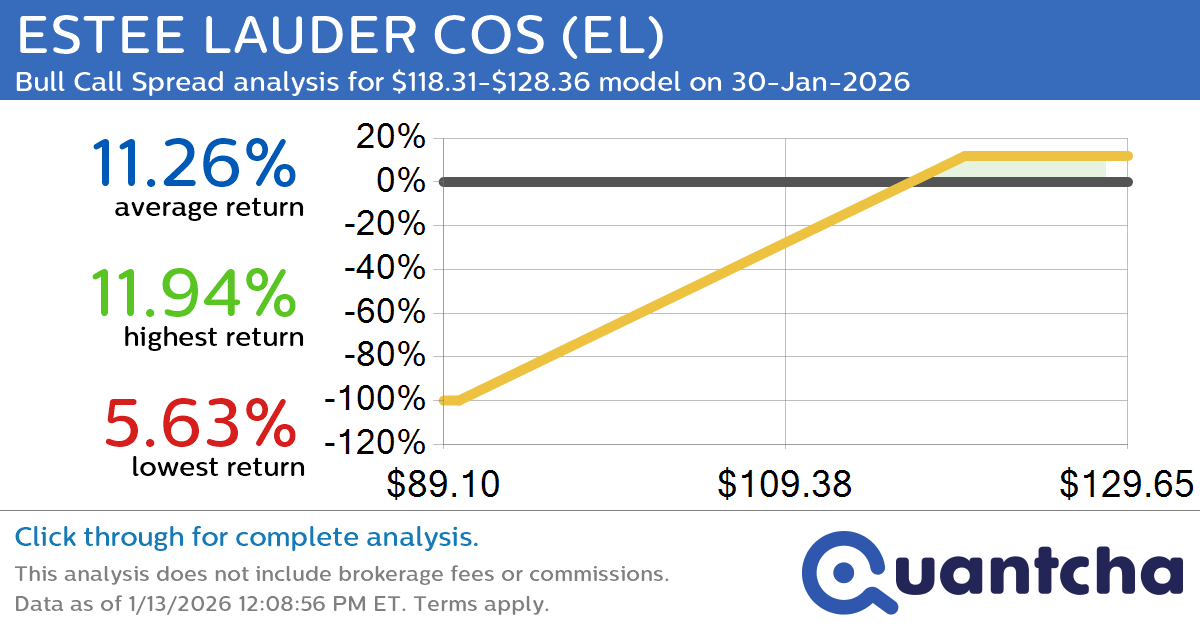

52-Week High Alert: Trading today’s movement in ESTEE LAUDER COS $EL

Quantchabot has detected a new Bull Call Spread trade opportunity for ESTEE LAUDER COS (EL) for the 30-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. EL was recently trading at $118.09 and has an implied volatility of 37.04% for this period. Based on an analysis of…

-

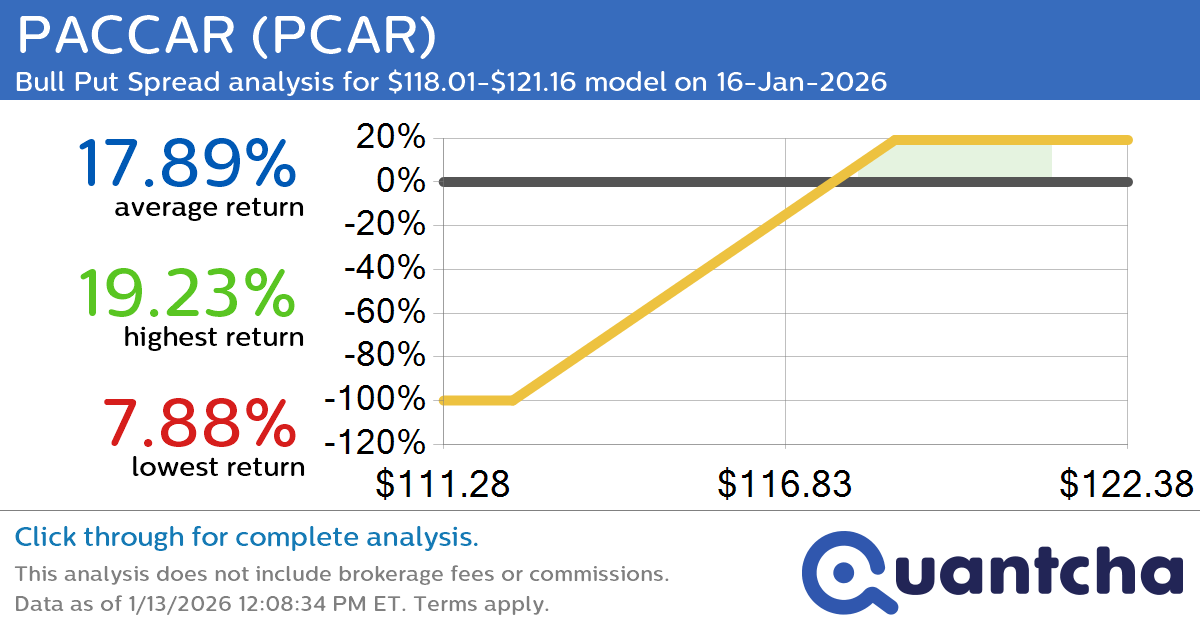

52-Week High Alert: Trading today’s movement in PACCAR $PCAR

Quantchabot has detected a new Bull Put Spread trade opportunity for PACCAR (PCAR) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. PCAR was recently trading at $117.96 and has an implied volatility of 26.22% for this period. Based on an analysis of the options…