Category: Trade Ideas

-

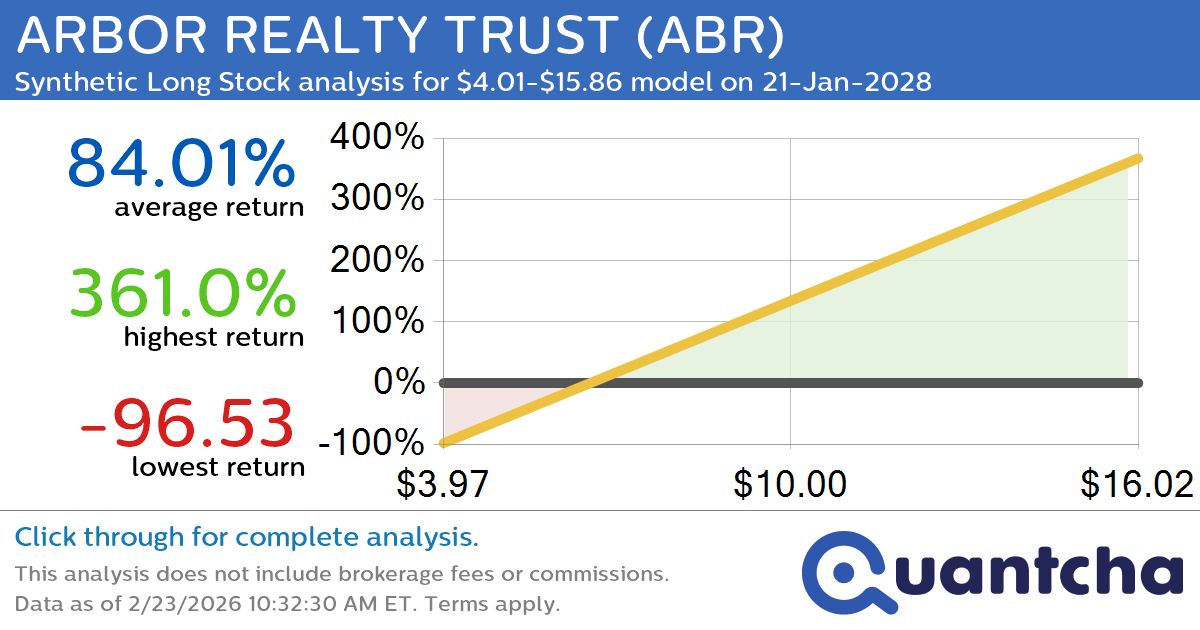

Synthetic Long Discount Alert: ARBOR REALTY TRUST $ABR trading at a 12.62% discount for the 21-Jan-2028 expiration

Quantchabot has detected a new Synthetic Long Stock trade opportunity for ARBOR REALTY TRUST (ABR) for the 21-Jan-2028 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ABR was recently trading at $7.45 and has an implied volatility of 49.72% for this period. Based on an analysis of…

-

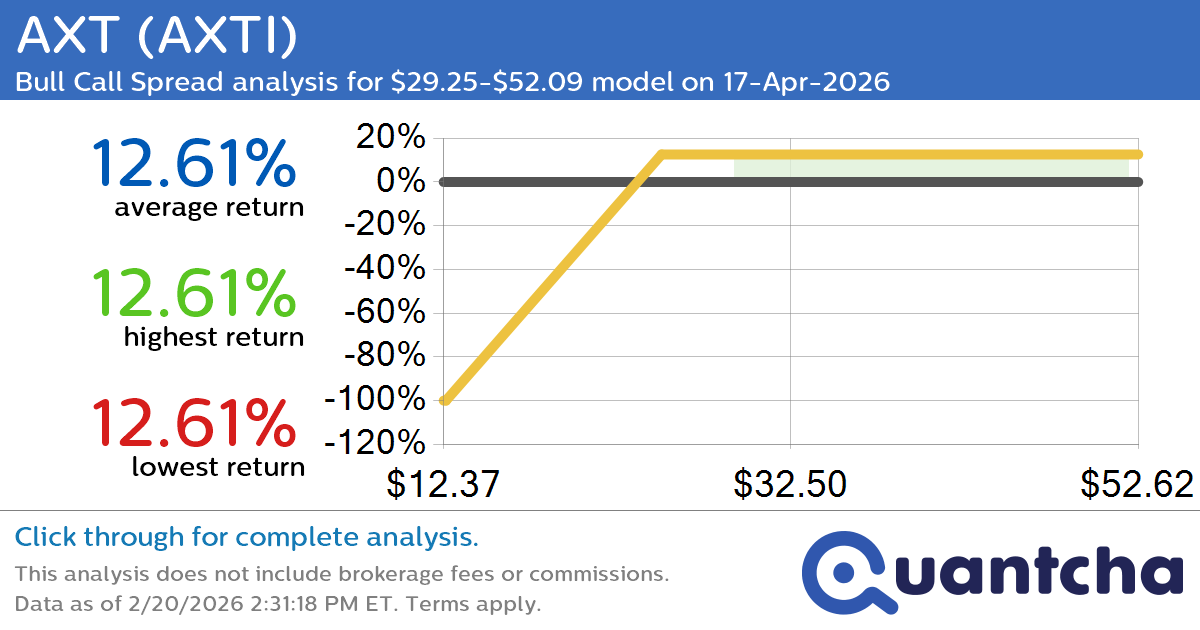

Big Gainer Alert: Trading today’s 22.1% move in AXT $AXTI

Quantchabot has detected a new Bull Call Spread trade opportunity for AXT (AXTI) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. AXTI was recently trading at $29.07 and has an implied volatility of 146.56% for this period. Based on an analysis of the options…

-

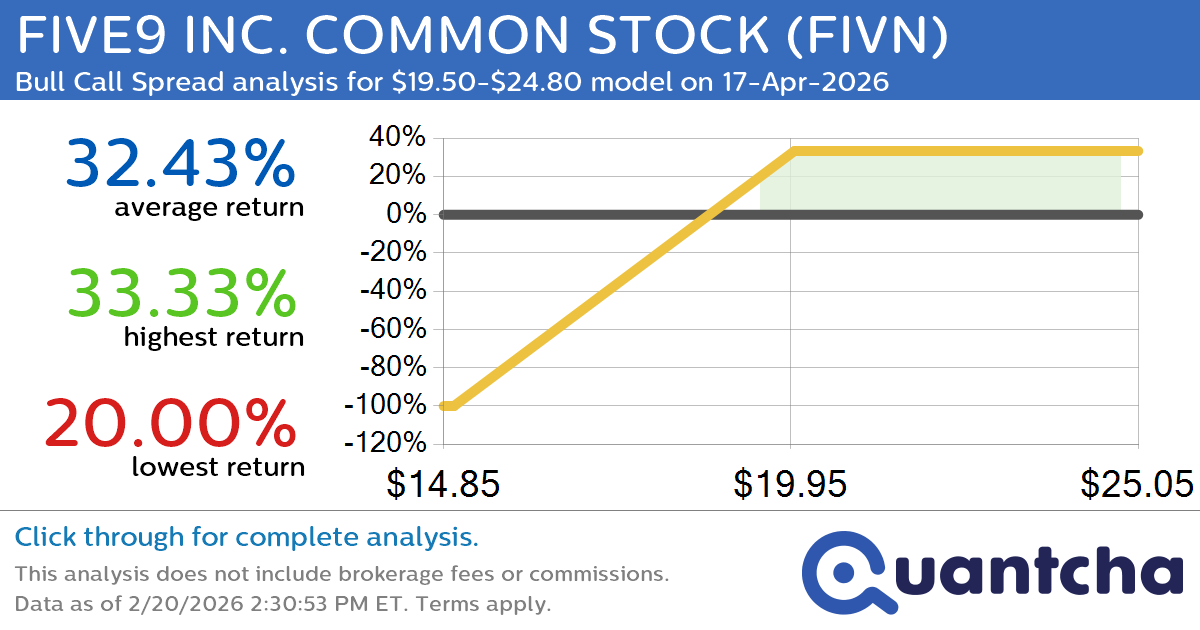

Big Gainer Alert: Trading today’s 12.9% move in FIVE9 INC. COMMON STOCK $FIVN

Quantchabot has detected a new Bull Call Spread trade opportunity for FIVE9 INC. COMMON STOCK (FIVN) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. FIVN was recently trading at $19.39 and has an implied volatility of 60.98% for this period. Based on an analysis…

-

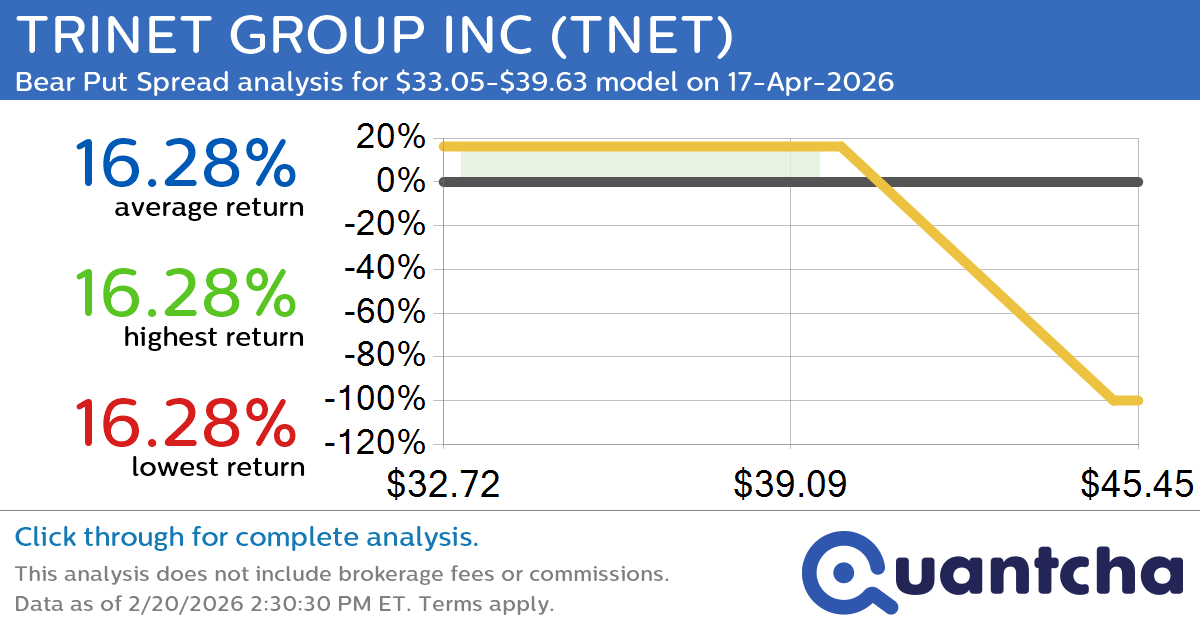

Big Loser Alert: Trading today’s -7.7% move in TRINET GROUP INC $TNET

Quantchabot has detected a new Bear Put Spread trade opportunity for TRINET GROUP INC (TNET) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TNET was recently trading at $39.40 and has an implied volatility of 46.11% for this period. Based on an analysis of…

-

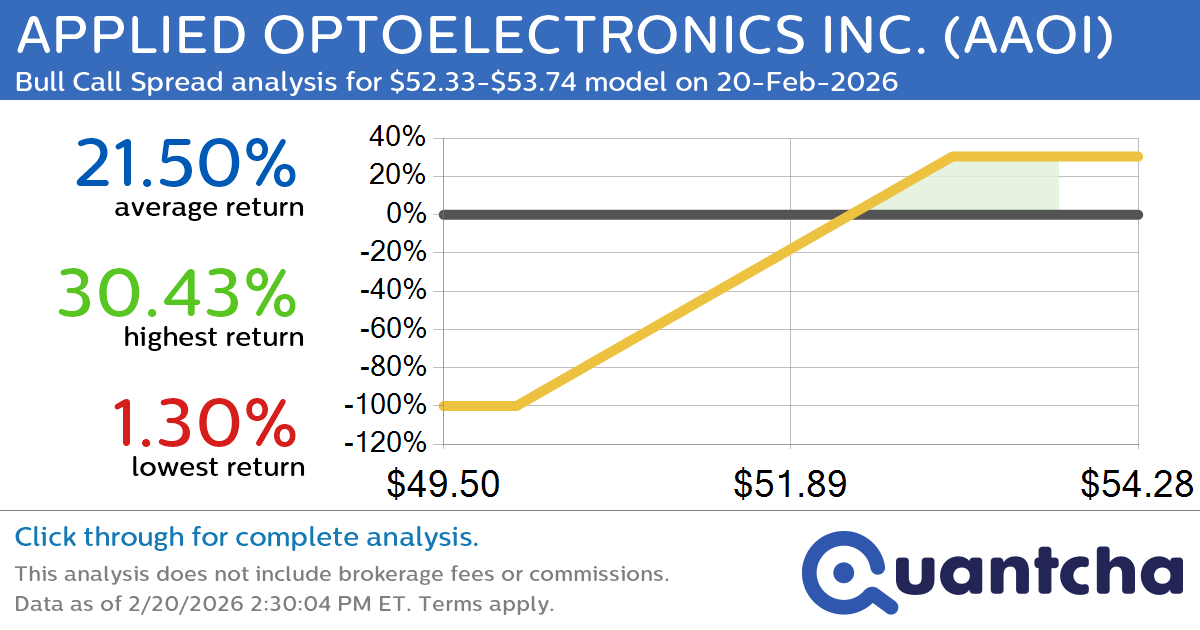

Big Gainer Alert: Trading today’s 11.4% move in APPLIED OPTOELECTRONICS INC. $AAOI

Quantchabot has detected a new Bull Call Spread trade opportunity for APPLIED OPTOELECTRONICS INC. (AAOI) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. AAOI was recently trading at $52.33 and has an implied volatility of 65.02% for this period. Based on an analysis of…

-

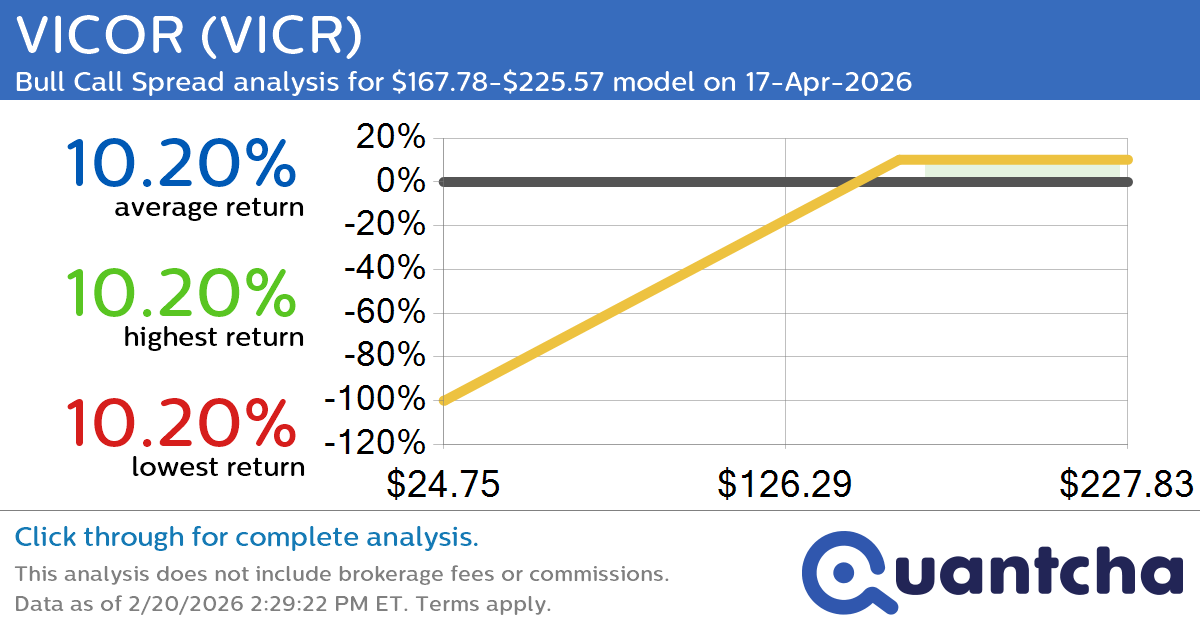

Big Gainer Alert: Trading today’s 9.1% move in VICOR $VICR

Quantchabot has detected a new Bull Call Spread trade opportunity for VICOR (VICR) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. VICR was recently trading at $166.80 and has an implied volatility of 75.15% for this period. Based on an analysis of the options…

-

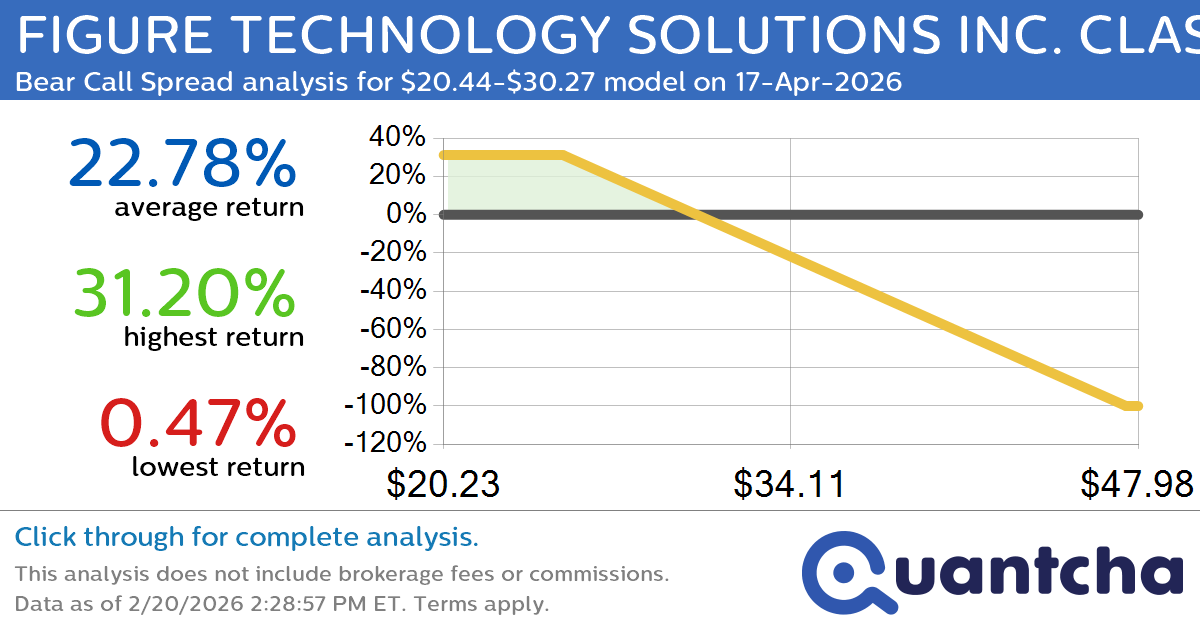

52-Week Low Alert: Trading today’s movement in FIGURE TECHNOLOGY SOLUTIONS INC. CLASS A $FIGR

Quantchabot has detected a new Bear Call Spread trade opportunity for FIGURE TECHNOLOGY SOLUTIONS INC. CLASS A (FIGR) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. FIGR was recently trading at $30.09 and has an implied volatility of 99.74% for this period. Based on…

-

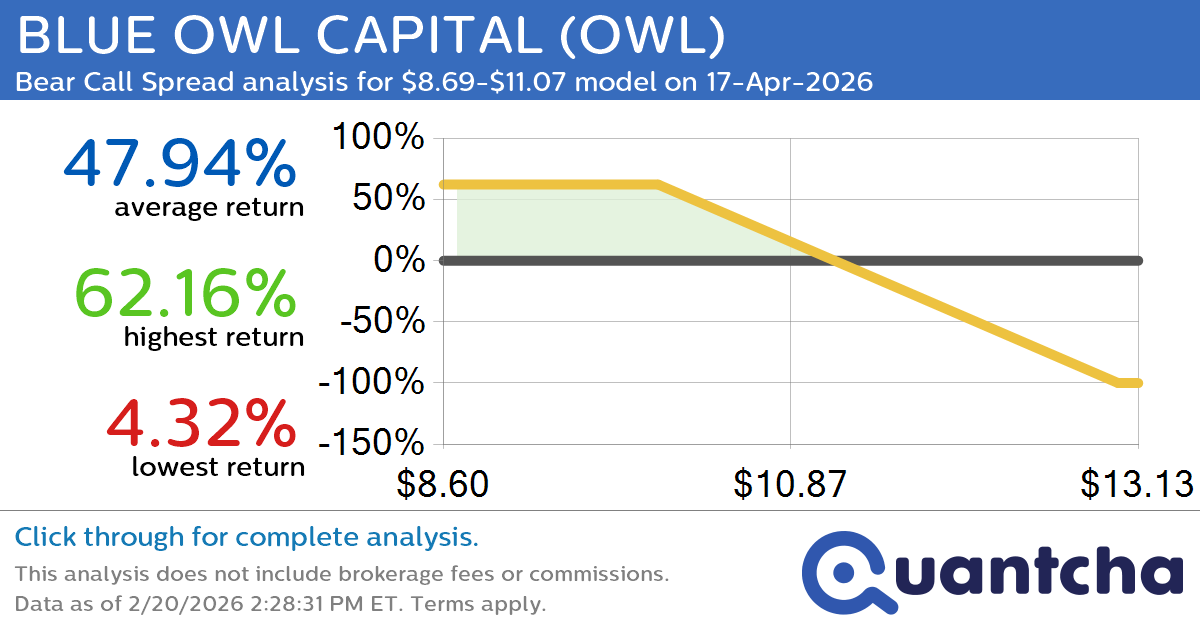

52-Week Low Alert: Trading today’s movement in BLUE OWL CAPITAL $OWL

Quantchabot has detected a new Bear Call Spread trade opportunity for BLUE OWL CAPITAL (OWL) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. OWL was recently trading at $11.01 and has an implied volatility of 61.55% for this period. Based on an analysis of…

-

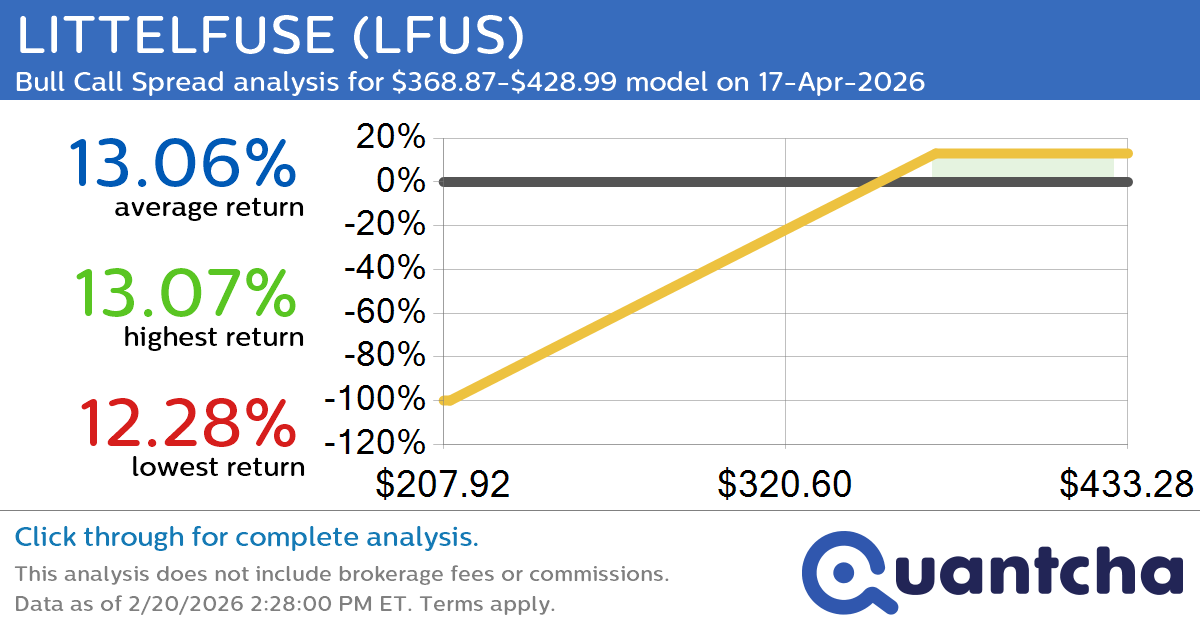

52-Week High Alert: Trading today’s movement in LITTELFUSE $LFUS

Quantchabot has detected a new Bull Call Spread trade opportunity for LITTELFUSE (LFUS) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. LFUS was recently trading at $366.70 and has an implied volatility of 38.34% for this period. Based on an analysis of the options…

-

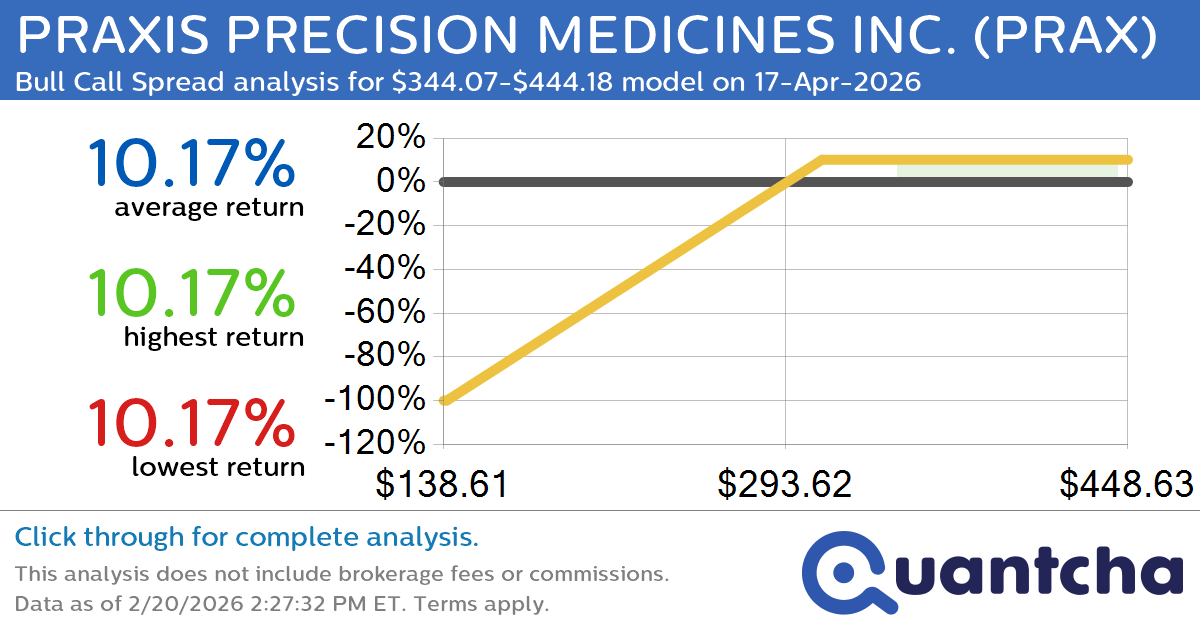

52-Week High Alert: Trading today’s movement in PRAXIS PRECISION MEDICINES INC. $PRAX

Quantchabot has detected a new Bull Call Spread trade opportunity for PRAXIS PRECISION MEDICINES INC. (PRAX) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. PRAX was recently trading at $342.05 and has an implied volatility of 64.85% for this period. Based on an analysis…