Category: Trade Ideas

-

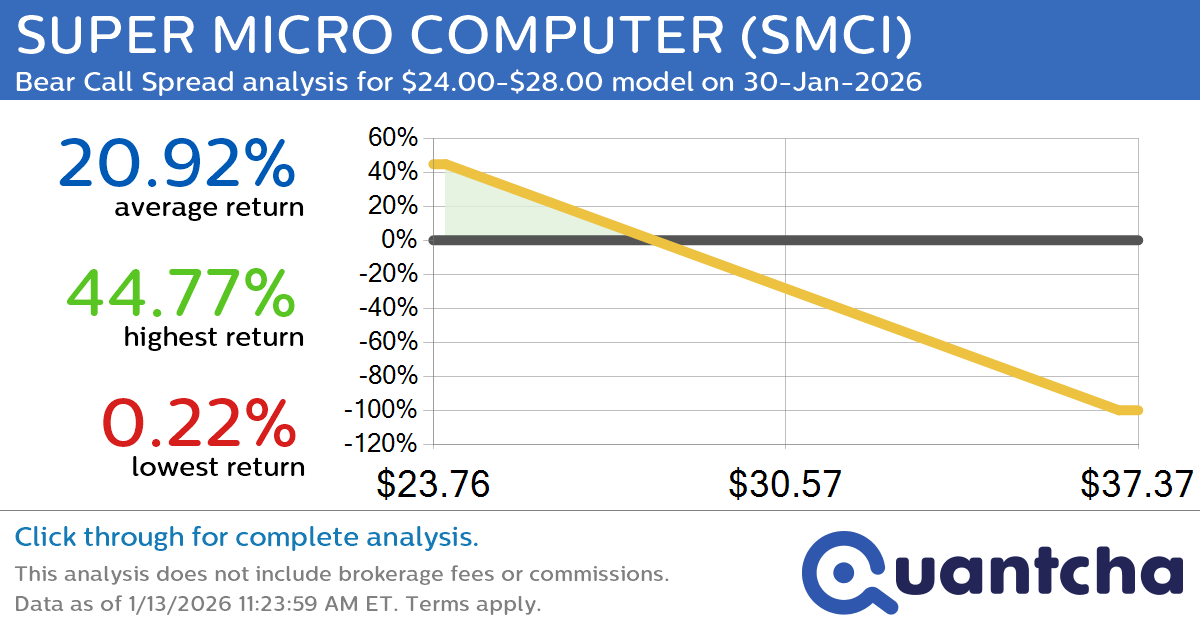

Big Loser Alert: Trading today’s -7.2% move in SUPER MICRO COMPUTER $SMCI

Quantchabot has detected a new Bear Call Spread trade opportunity for SUPER MICRO COMPUTER (SMCI) for the 30-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SMCI was recently trading at $27.95 and has an implied volatility of 69.96% for this period. Based on an analysis of…

-

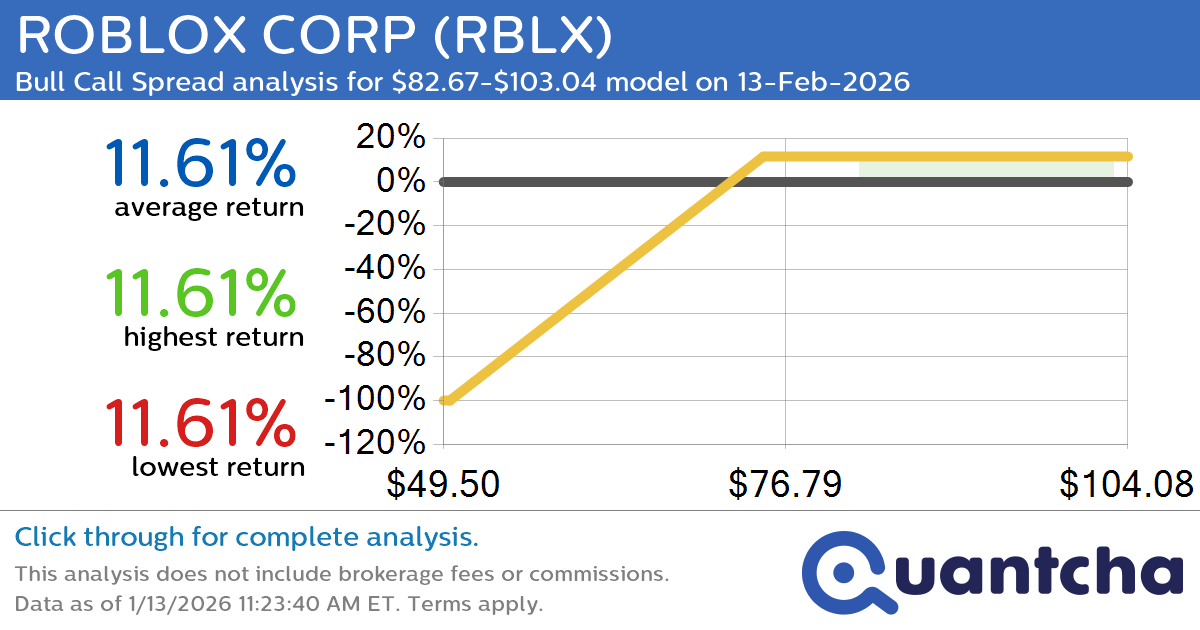

Big Gainer Alert: Trading today’s 7.4% move in ROBLOX CORP $RBLX

Quantchabot has detected a new Bull Call Spread trade opportunity for ROBLOX CORP (RBLX) for the 13-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. RBLX was recently trading at $82.40 and has an implied volatility of 74.68% for this period. Based on an analysis of the…

-

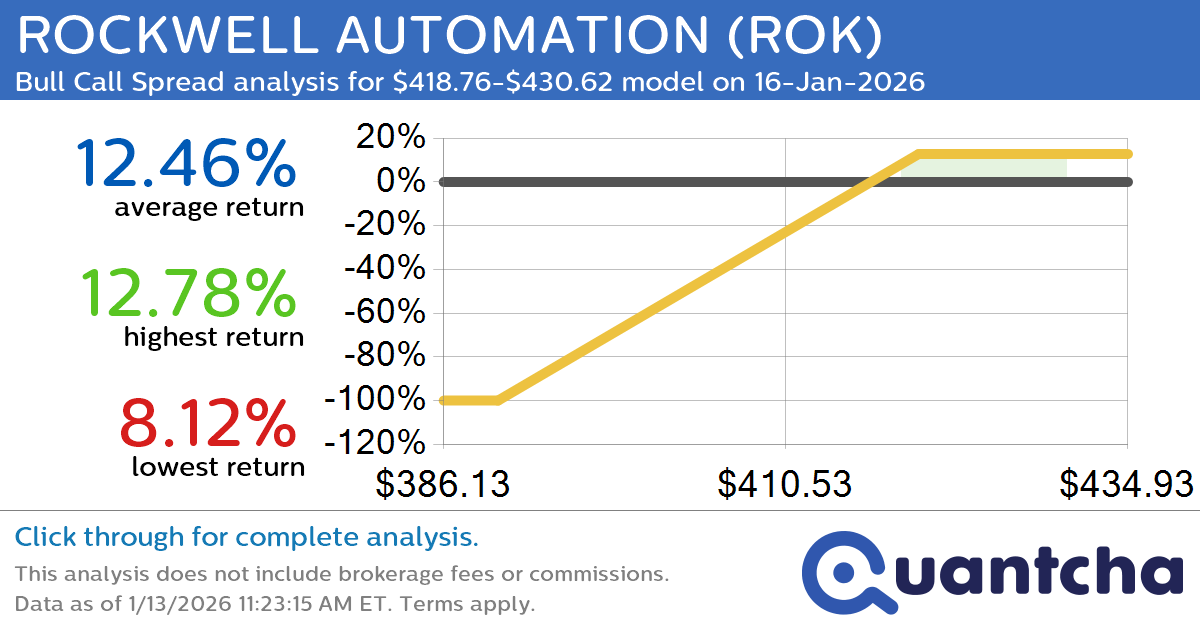

52-Week High Alert: Trading today’s movement in ROCKWELL AUTOMATION $ROK

Quantchabot has detected a new Bull Call Spread trade opportunity for ROCKWELL AUTOMATION (ROK) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ROK was recently trading at $418.60 and has an implied volatility of 27.58% for this period. Based on an analysis of the…

-

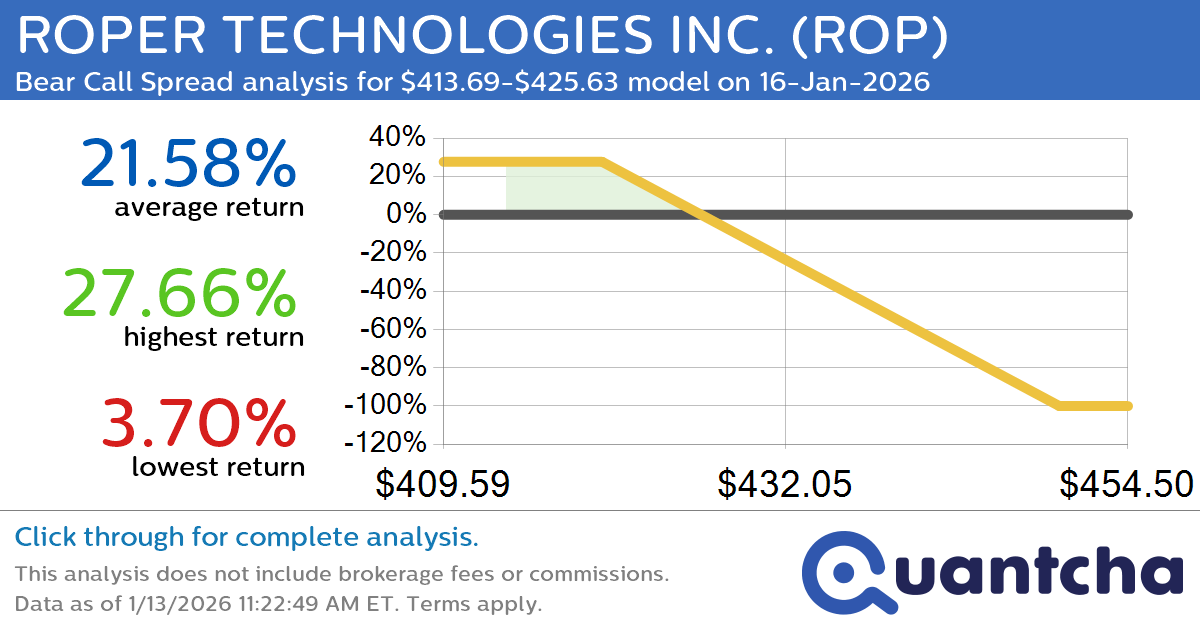

52-Week Low Alert: Trading today’s movement in ROPER TECHNOLOGIES INC. $ROP

Quantchabot has detected a new Bear Call Spread trade opportunity for ROPER TECHNOLOGIES INC. (ROP) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ROP was recently trading at $425.46 and has an implied volatility of 28.11% for this period. Based on an analysis of…

-

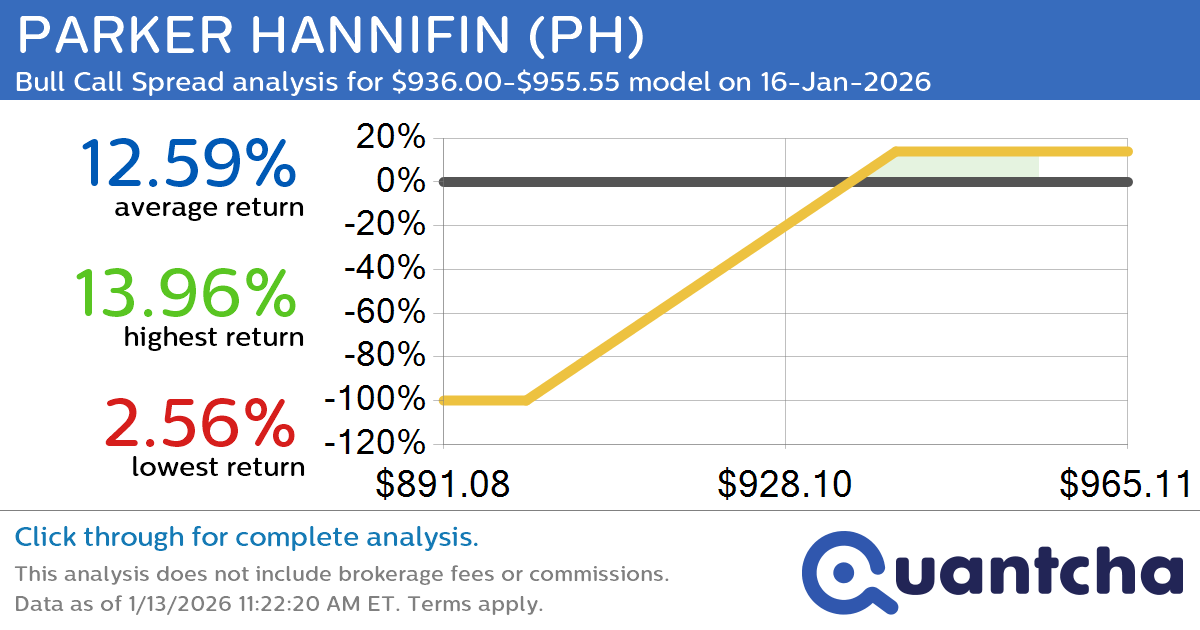

52-Week High Alert: Trading today’s movement in PARKER HANNIFIN $PH

Quantchabot has detected a new Bull Call Spread trade opportunity for PARKER HANNIFIN (PH) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. PH was recently trading at $935.63 and has an implied volatility of 20.43% for this period. Based on an analysis of the…

-

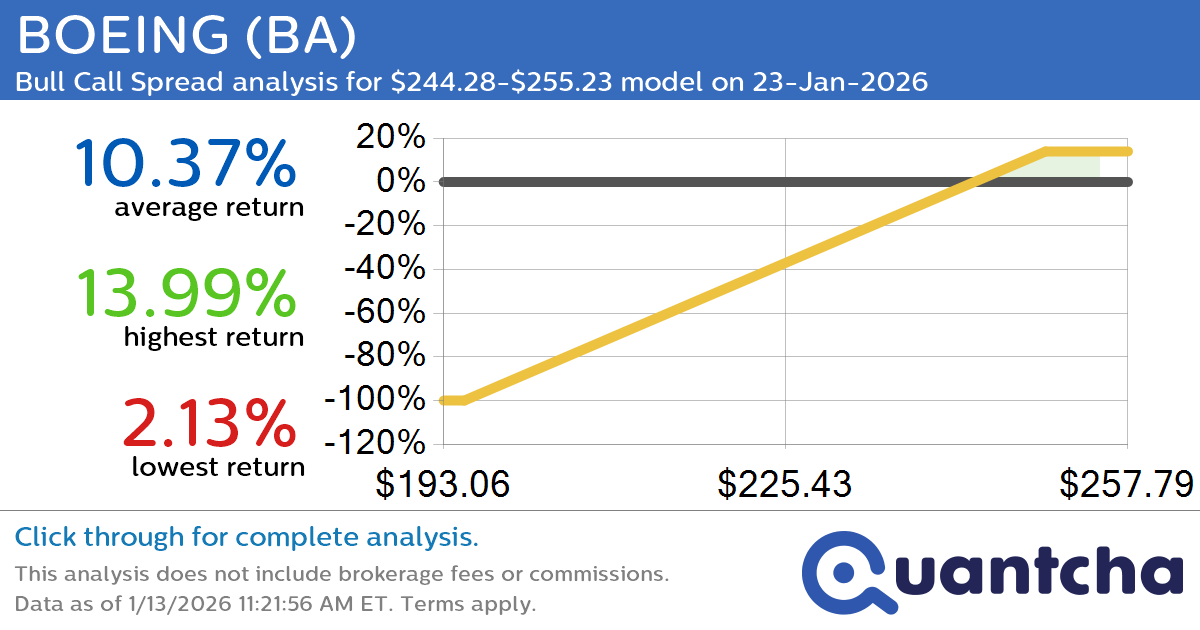

52-Week High Alert: Trading today’s movement in BOEING $BA

Quantchabot has detected a new Bull Call Spread trade opportunity for BOEING (BA) for the 23-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. BA was recently trading at $244.01 and has an implied volatility of 25.57% for this period. Based on an analysis of the options…

-

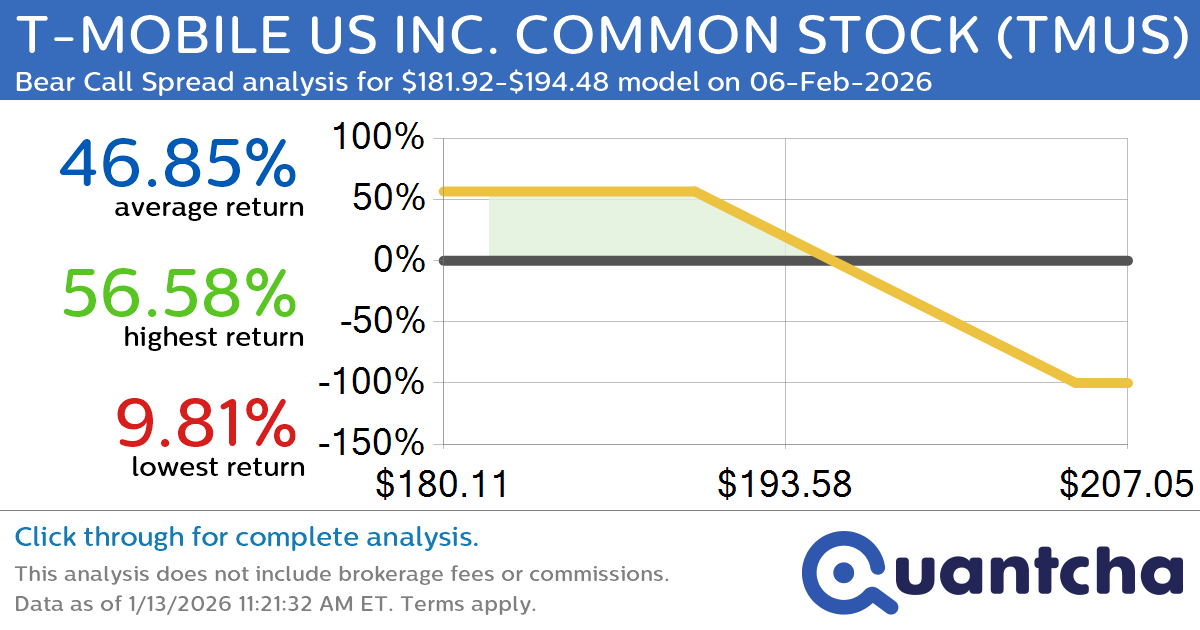

52-Week Low Alert: Trading today’s movement in T-MOBILE US INC. COMMON STOCK $TMUS

Quantchabot has detected a new Bear Call Spread trade opportunity for T-MOBILE US INC. COMMON STOCK (TMUS) for the 6-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TMUS was recently trading at $193.98 and has an implied volatility of 25.65% for this period. Based on an…

-

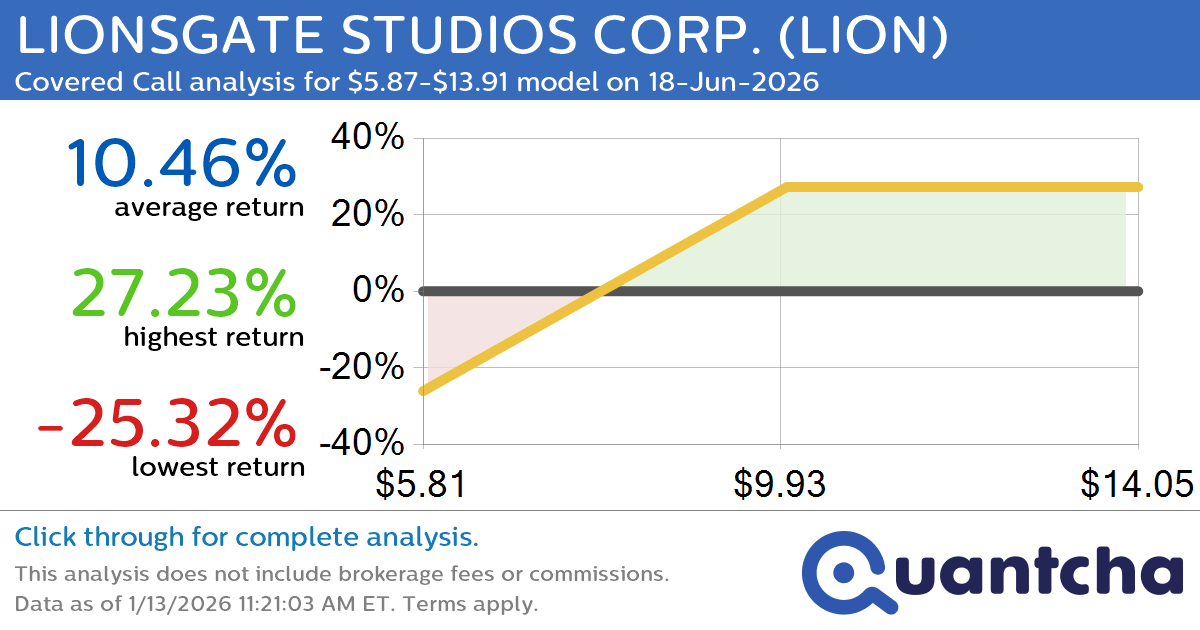

Covered Call Alert: LIONSGATE STUDIOS CORP. $LION returning up to 27.55% through 18-Jun-2026

Quantchabot has detected a new Covered Call trade opportunity for LIONSGATE STUDIOS CORP. (LION) for the 18-Jun-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. LION was recently trading at $8.89 and has an implied volatility of 65.86% for this period. Based on an analysis of the…

-

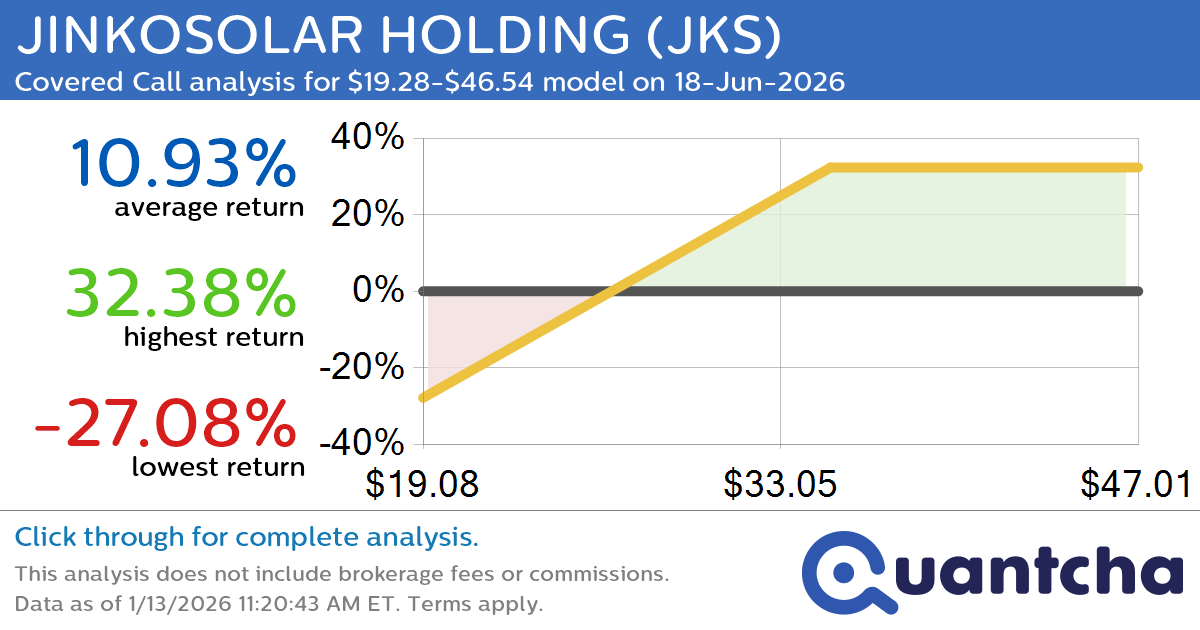

Covered Call Alert: JINKOSOLAR HOLDING $JKS returning up to 31.93% through 18-Jun-2026

Quantchabot has detected a new Covered Call trade opportunity for JINKOSOLAR HOLDING (JKS) for the 18-Jun-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. JKS was recently trading at $29.48 and has an implied volatility of 67.22% for this period. Based on an analysis of the options…

-

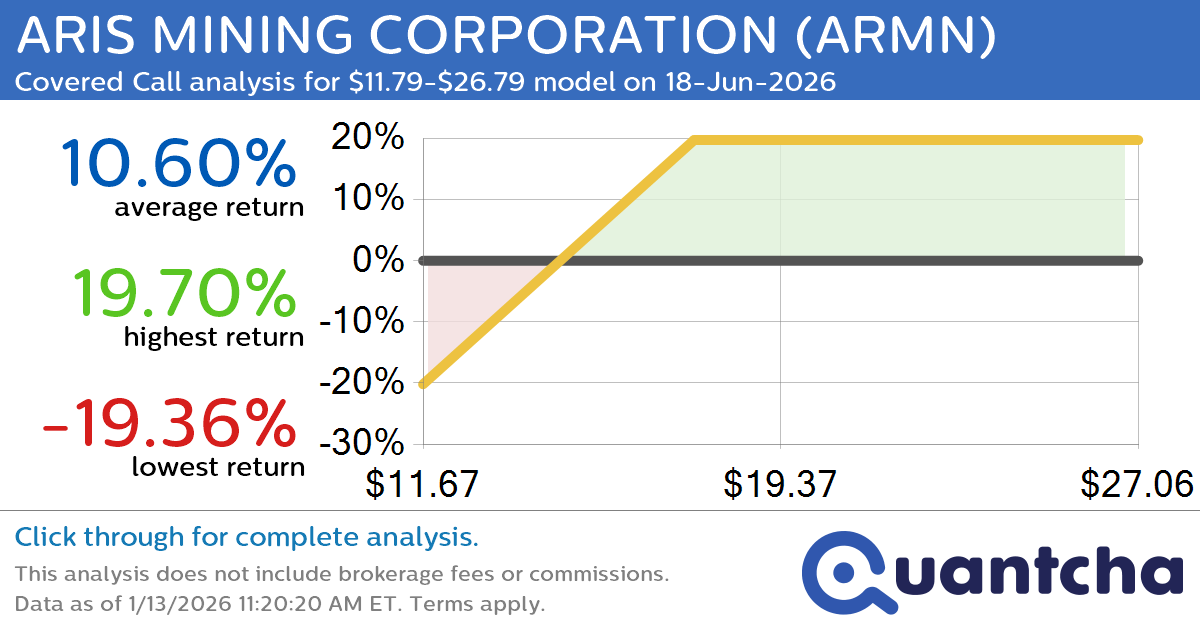

Covered Call Alert: ARIS MINING CORPORATION $ARMN returning up to 19.86% through 18-Jun-2026

Quantchabot has detected a new Covered Call trade opportunity for ARIS MINING CORPORATION (ARMN) for the 18-Jun-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ARMN was recently trading at $17.49 and has an implied volatility of 62.62% for this period. Based on an analysis of the…