Category: Trade Ideas

-

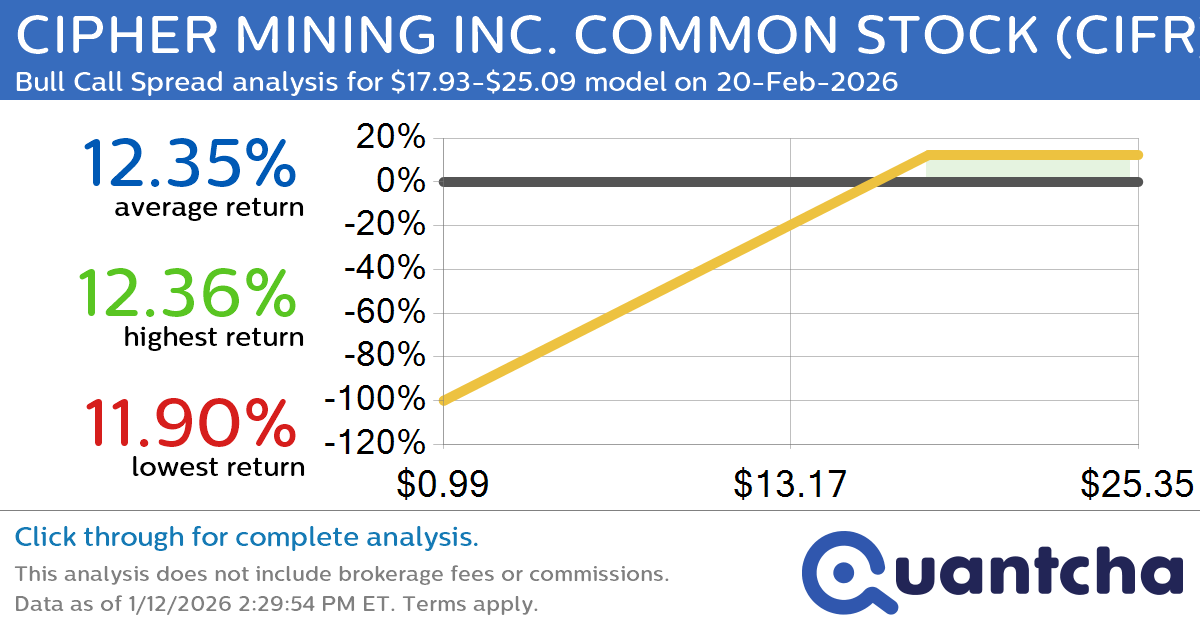

Big Gainer Alert: Trading today’s 7.4% move in CIPHER MINING INC. COMMON STOCK $CIFR

Quantchabot has detected a new Bull Call Spread trade opportunity for CIPHER MINING INC. COMMON STOCK (CIFR) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CIFR was recently trading at $17.86 and has an implied volatility of 102.08% for this period. Based on an…

-

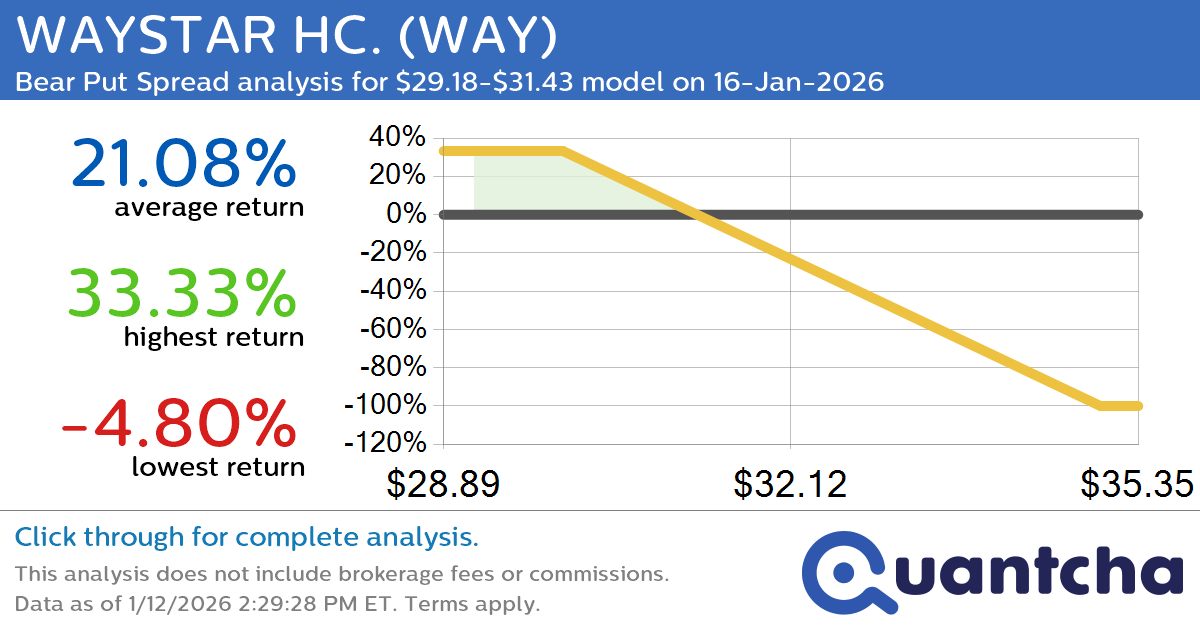

Big Loser Alert: Trading today’s -8.9% move in WAYSTAR HC. $WAY

Quantchabot has detected a new Bear Put Spread trade opportunity for WAYSTAR HC. (WAY) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. WAY was recently trading at $31.42 and has an implied volatility of 66.23% for this period. Based on an analysis of the…

-

Big Gainer Alert: Trading today’s 10.4% move in PLANET LABS PBC $PL

Quantchabot has detected a new Bull Call Spread trade opportunity for PLANET LABS PBC (PL) for the 27-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. PL was recently trading at $25.08 and has an implied volatility of 81.05% for this period. Based on an analysis of…

-

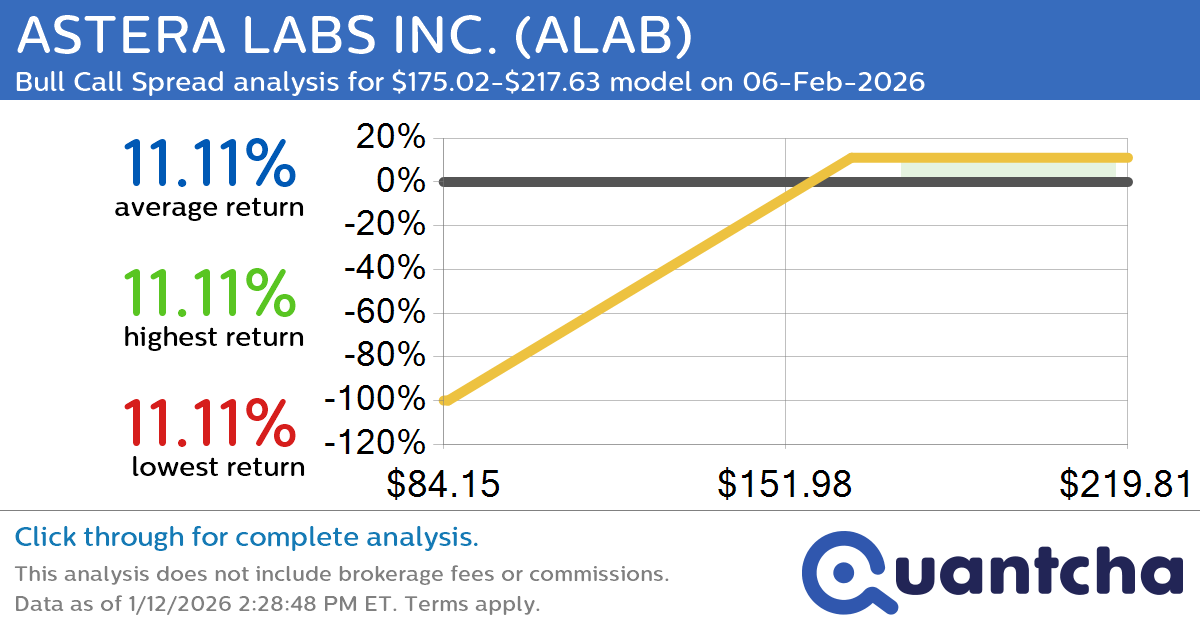

Big Gainer Alert: Trading today’s 7.3% move in ASTERA LABS INC. $ALAB

Quantchabot has detected a new Bull Call Spread trade opportunity for ASTERA LABS INC. (ALAB) for the 6-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ALAB was recently trading at $174.56 and has an implied volatility of 82.25% for this period. Based on an analysis of…

-

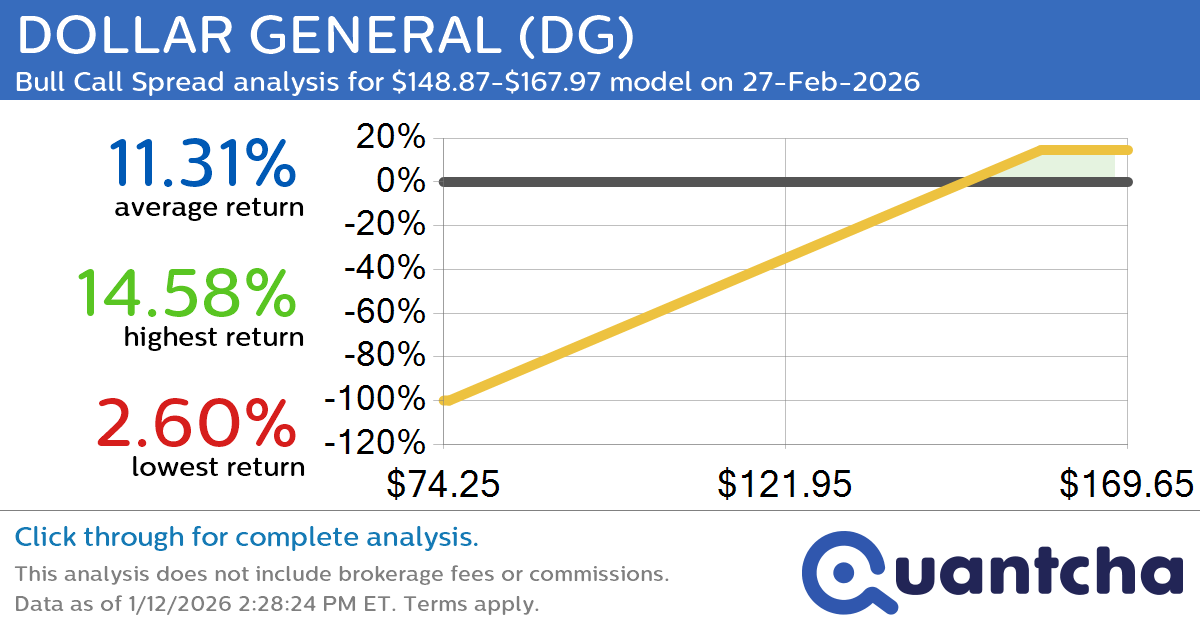

52-Week High Alert: Trading today’s movement in DOLLAR GENERAL $DG

Quantchabot has detected a new Bull Call Spread trade opportunity for DOLLAR GENERAL (DG) for the 27-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. DG was recently trading at $148.16 and has an implied volatility of 33.77% for this period. Based on an analysis of the…

-

52-Week High Alert: Trading today’s movement in ECHOSTAR $SATS

Quantchabot has detected a new Bull Call Spread trade opportunity for ECHOSTAR (SATS) for the 13-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SATS was recently trading at $125.22 and has an implied volatility of 55.76% for this period. Based on an analysis of the options…

-

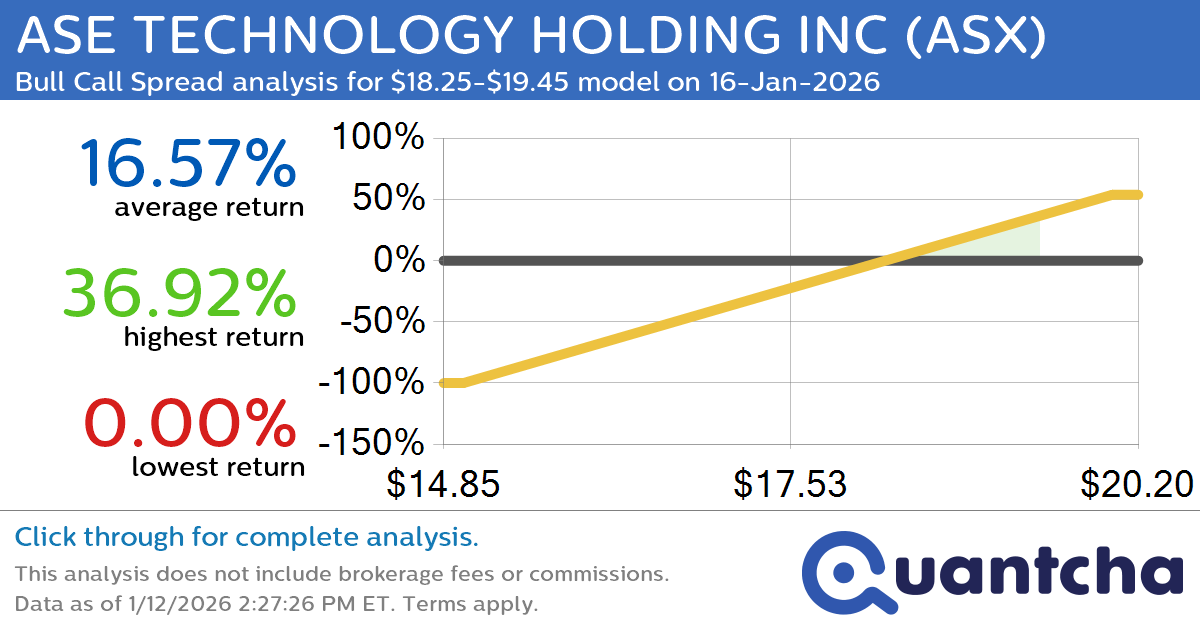

52-Week High Alert: Trading today’s movement in ASE TECHNOLOGY HOLDING INC $ASX

Quantchabot has detected a new Bull Call Spread trade opportunity for ASE TECHNOLOGY HOLDING INC (ASX) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ASX was recently trading at $18.25 and has an implied volatility of 56.58% for this period. Based on an analysis…

-

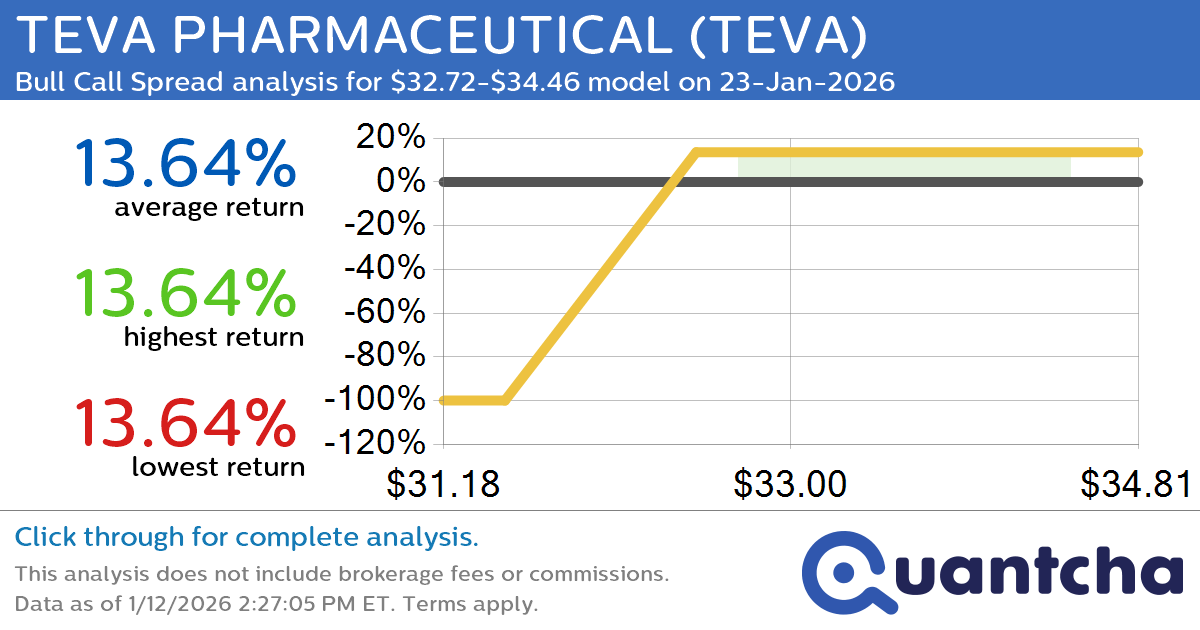

52-Week High Alert: Trading today’s movement in TEVA PHARMACEUTICAL $TEVA

Quantchabot has detected a new Bull Call Spread trade opportunity for TEVA PHARMACEUTICAL (TEVA) for the 23-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TEVA was recently trading at $32.69 and has an implied volatility of 29.06% for this period. Based on an analysis of the…

-

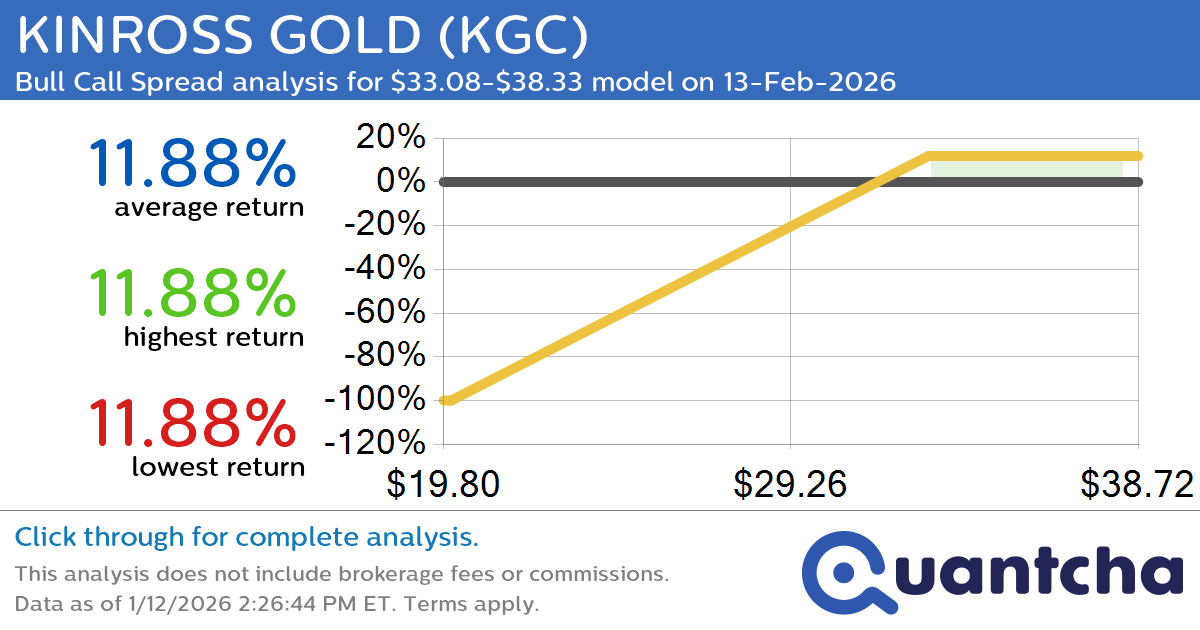

52-Week High Alert: Trading today’s movement in KINROSS GOLD $KGC

Quantchabot has detected a new Bull Call Spread trade opportunity for KINROSS GOLD (KGC) for the 13-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. KGC was recently trading at $32.97 and has an implied volatility of 49.34% for this period. Based on an analysis of the…

-

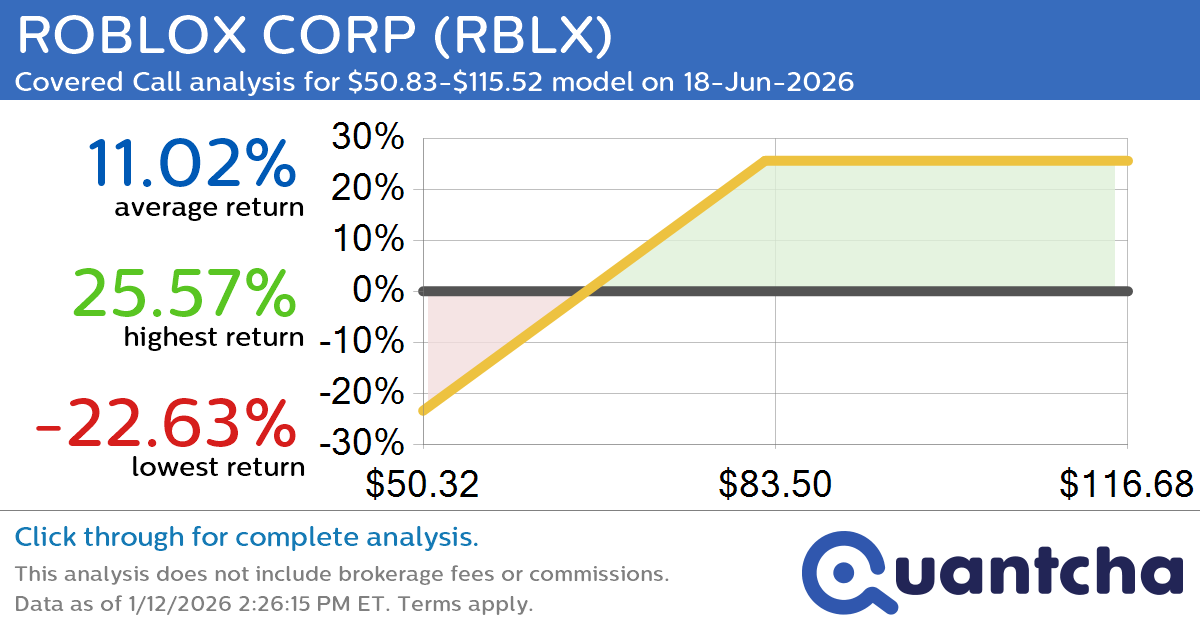

Covered Call Alert: ROBLOX CORP $RBLX returning up to 25.57% through 18-Jun-2026

Quantchabot has detected a new Covered Call trade opportunity for ROBLOX CORP (RBLX) for the 18-Jun-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. RBLX was recently trading at $75.42 and has an implied volatility of 62.47% for this period. Based on an analysis of the options…