Category: Trade Ideas

-

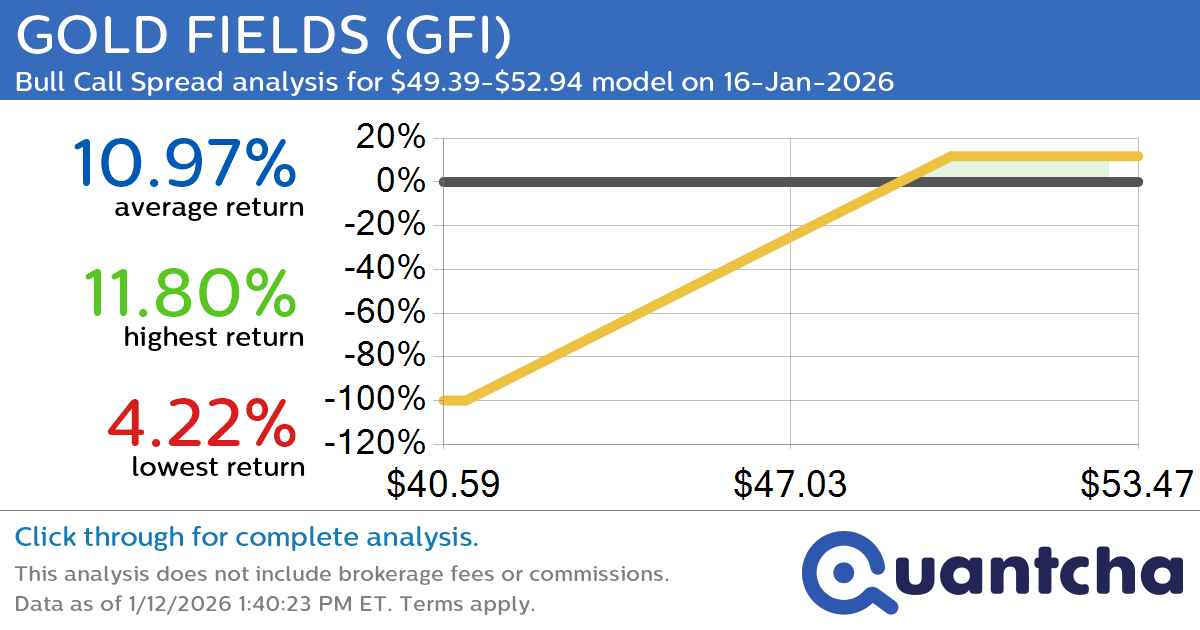

52-Week High Alert: Trading today’s movement in GOLD FIELDS $GFI

Quantchabot has detected a new Bull Call Spread trade opportunity for GOLD FIELDS (GFI) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. GFI was recently trading at $49.37 and has an implied volatility of 61.51% for this period. Based on an analysis of the…

-

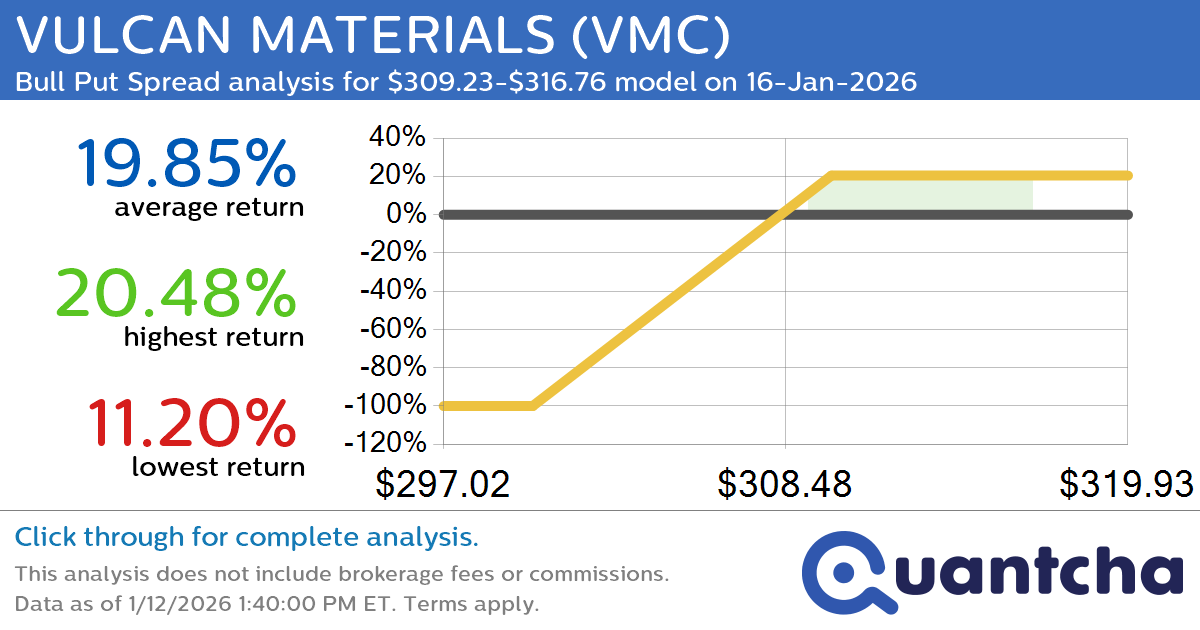

52-Week High Alert: Trading today’s movement in VULCAN MATERIALS $VMC

Quantchabot has detected a new Bull Put Spread trade opportunity for VULCAN MATERIALS (VMC) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. VMC was recently trading at $309.08 and has an implied volatility of 21.34% for this period. Based on an analysis of the…

-

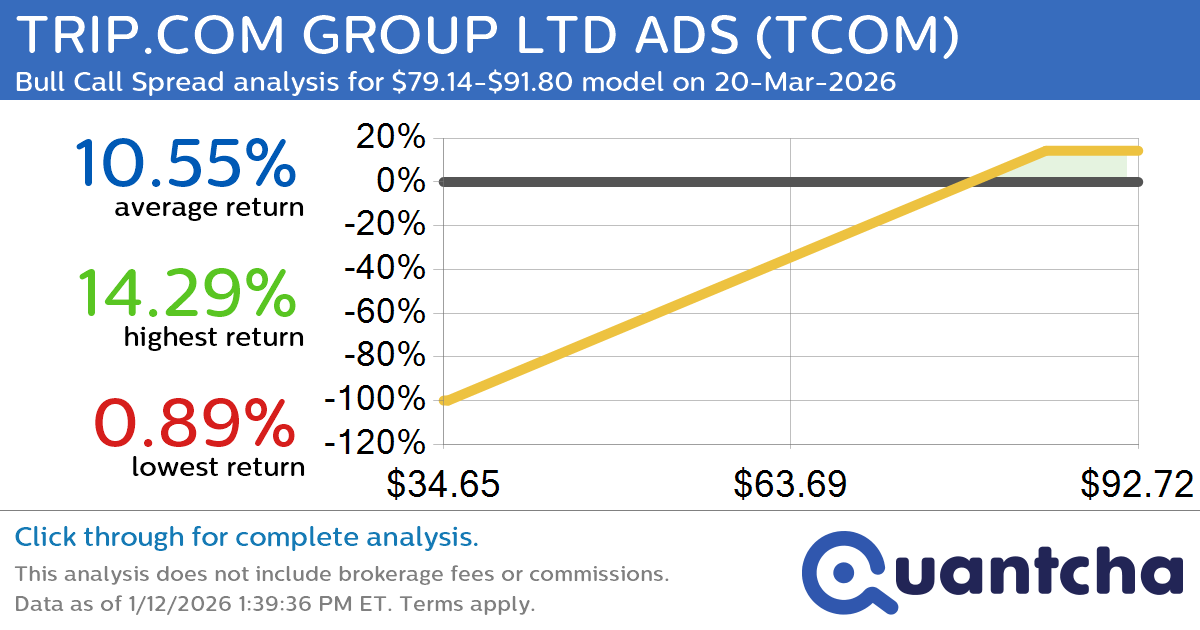

52-Week High Alert: Trading today’s movement in TRIP.COM GROUP LTD ADS $TCOM

Quantchabot has detected a new Bull Call Spread trade opportunity for TRIP.COM GROUP LTD ADS (TCOM) for the 20-Mar-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TCOM was recently trading at $78.59 and has an implied volatility of 34.46% for this period. Based on an analysis…

-

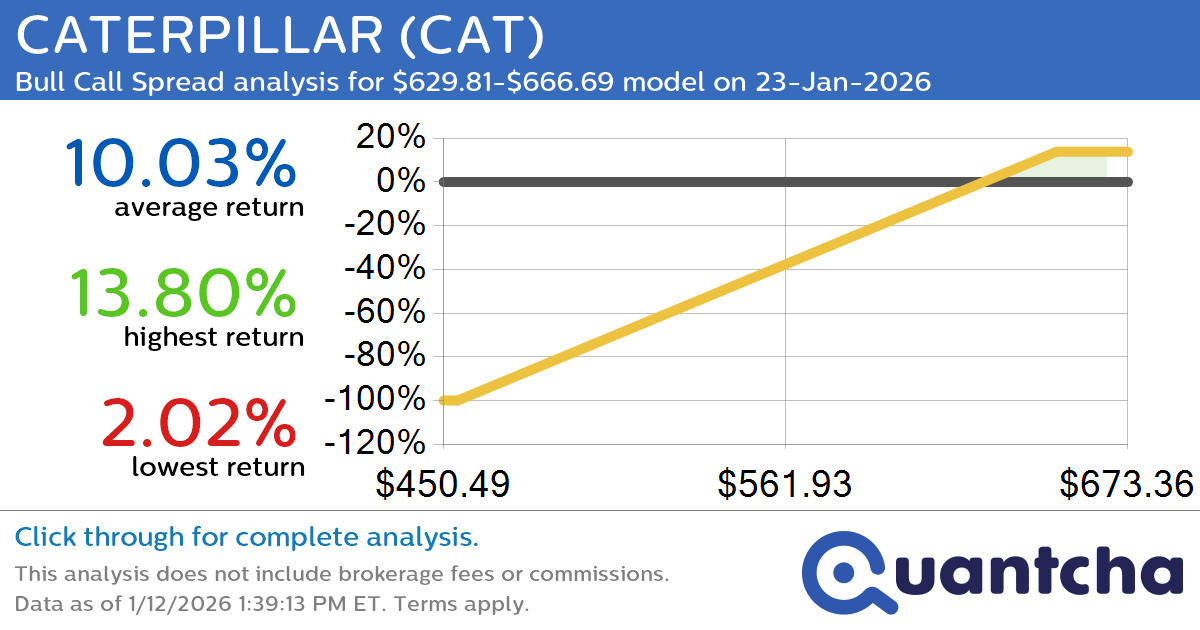

52-Week High Alert: Trading today’s movement in CATERPILLAR $CAT

Quantchabot has detected a new Bull Call Spread trade opportunity for CATERPILLAR (CAT) for the 23-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CAT was recently trading at $630.57 and has an implied volatility of 31.86% for this period. Based on an analysis of the options…

-

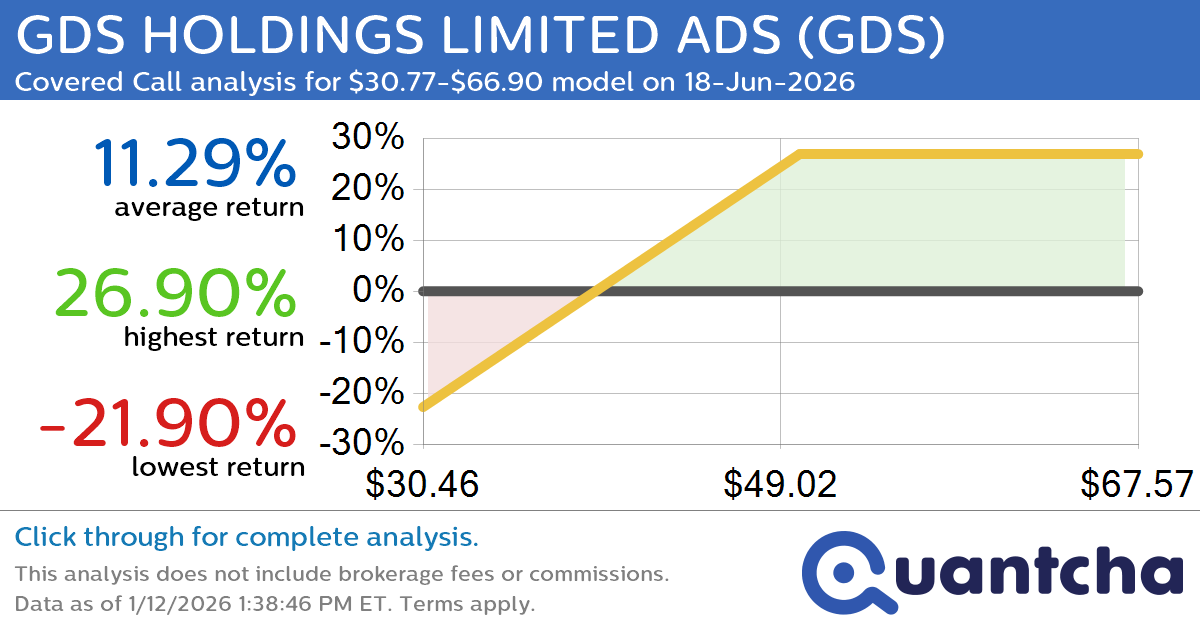

Covered Call Alert: GDS HOLDINGS LIMITED ADS $GDS returning up to 27.36% through 18-Jun-2026

Quantchabot has detected a new Covered Call trade opportunity for GDS HOLDINGS LIMITED ADS (GDS) for the 18-Jun-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. GDS was recently trading at $44.66 and has an implied volatility of 59.09% for this period. Based on an analysis of…

-

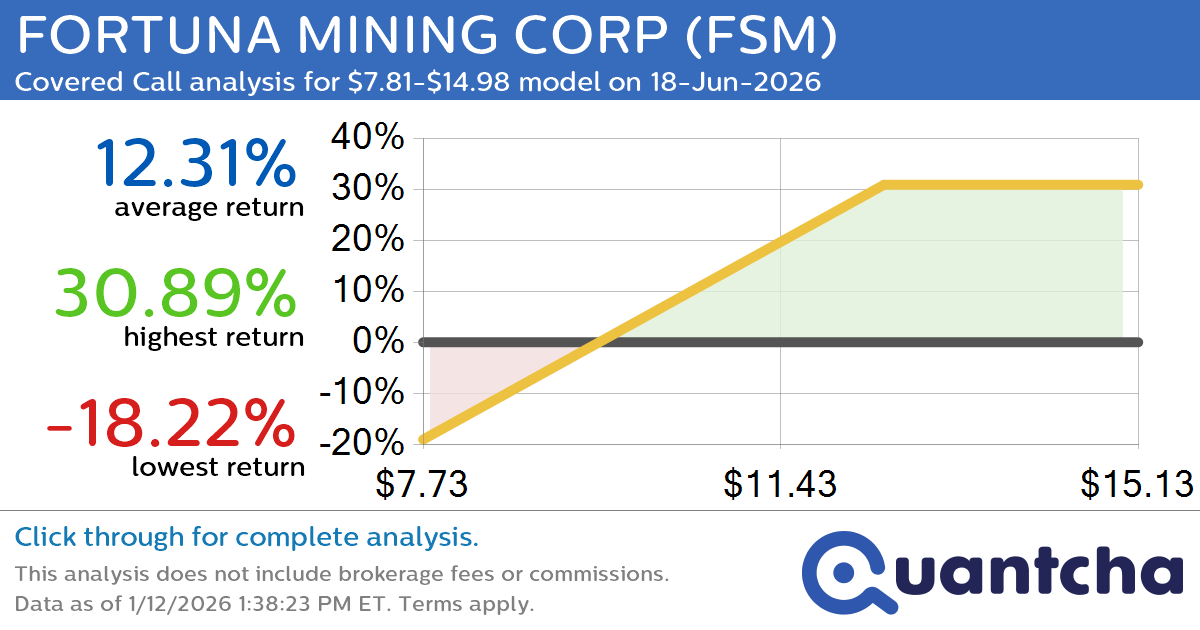

Covered Call Alert: FORTUNA MINING CORP $FSM returning up to 30.21% through 18-Jun-2026

Quantchabot has detected a new Covered Call trade opportunity for FORTUNA MINING CORP (FSM) for the 18-Jun-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. FSM was recently trading at $10.65 and has an implied volatility of 49.54% for this period. Based on an analysis of the…

-

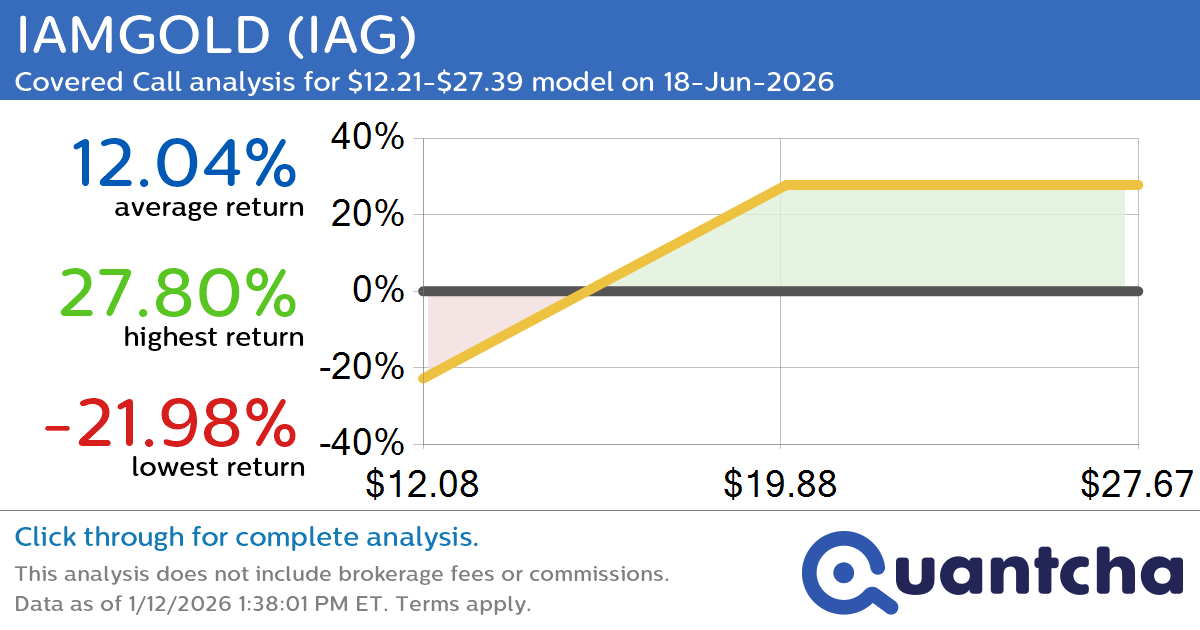

Covered Call Alert: IAMGOLD $IAG returning up to 27.39% through 18-Jun-2026

Quantchabot has detected a new Covered Call trade opportunity for IAMGOLD (IAG) for the 18-Jun-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. IAG was recently trading at $18.00 and has an implied volatility of 61.44% for this period. Based on an analysis of the options available…

-

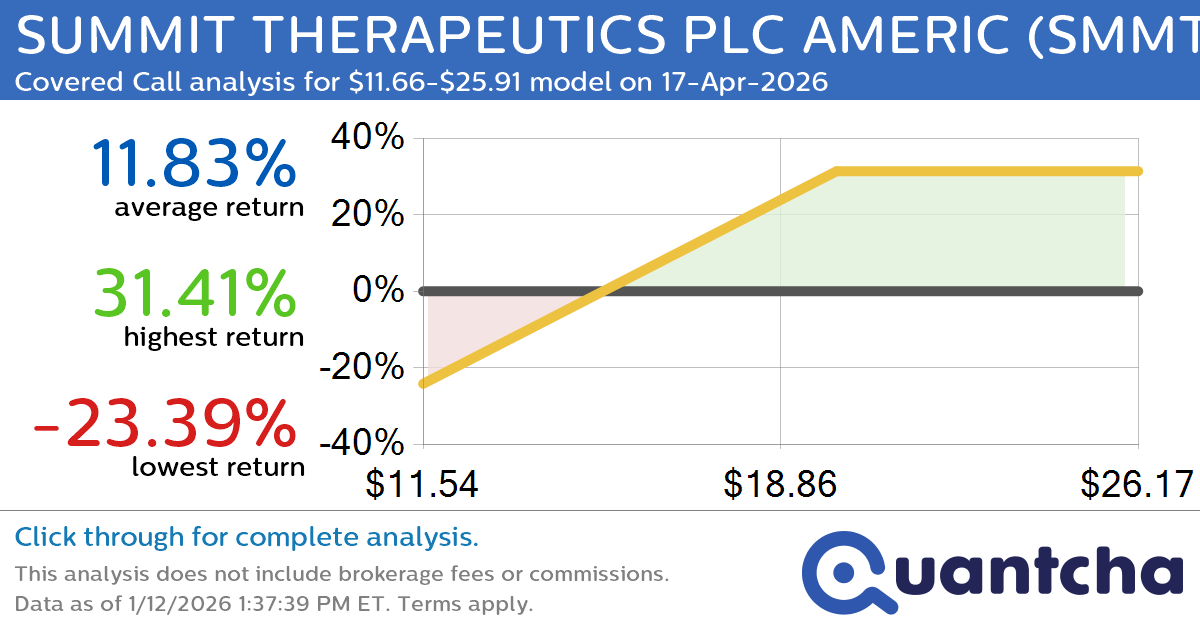

Covered Call Alert: SUMMIT THERAPEUTICS PLC AMERIC $SMMT returning up to 31.41% through 17-Apr-2026

Quantchabot has detected a new Covered Call trade opportunity for SUMMIT THERAPEUTICS PLC AMERIC (SMMT) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SMMT was recently trading at $17.21 and has an implied volatility of 77.96% for this period. Based on an analysis of…

-

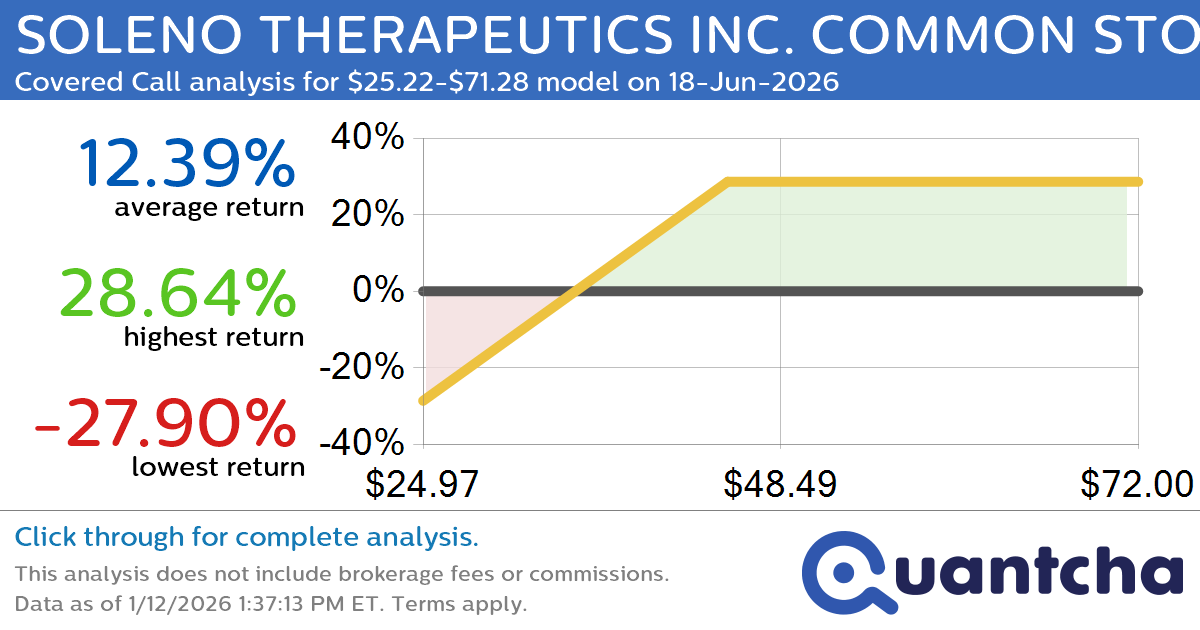

Covered Call Alert: SOLENO THERAPEUTICS INC. COMMON STOCK $SLNO returning up to 28.64% through 18-Jun-2026

Quantchabot has detected a new Covered Call trade opportunity for SOLENO THERAPEUTICS INC. COMMON STOCK (SLNO) for the 18-Jun-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SLNO was recently trading at $41.73 and has an implied volatility of 79.05% for this period. Based on an analysis…

-

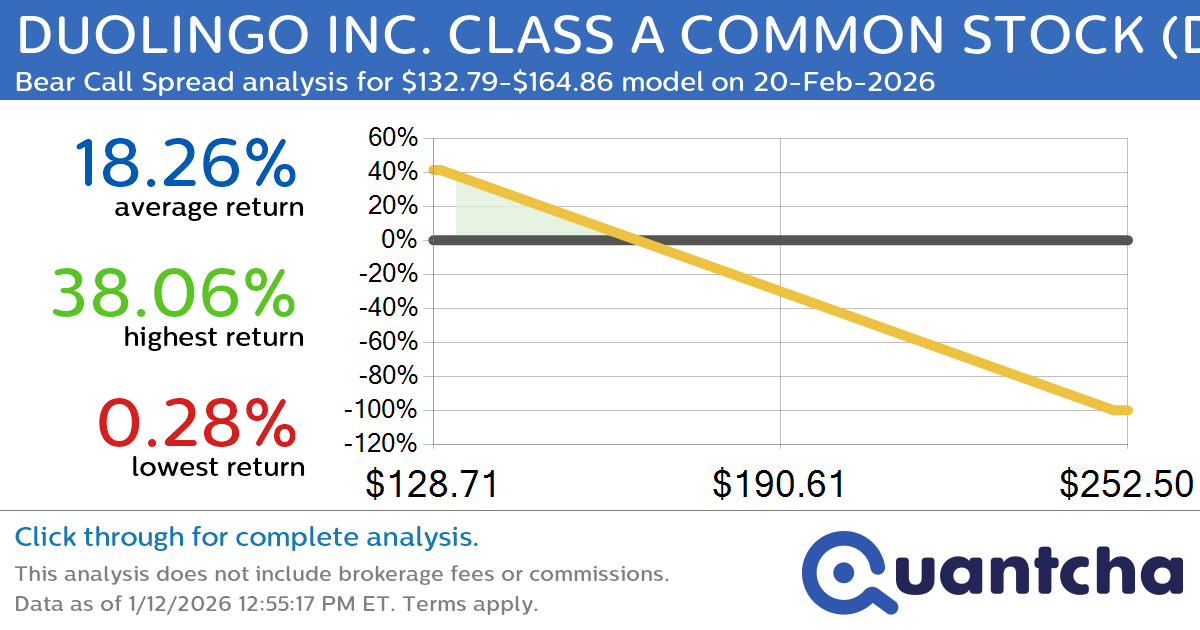

Big Loser Alert: Trading today’s -7.1% move in DUOLINGO INC. CLASS A COMMON STOCK $DUOL

Quantchabot has detected a new Bear Call Spread trade opportunity for DUOLINGO INC. CLASS A COMMON STOCK (DUOL) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. DUOL was recently trading at $164.19 and has an implied volatility of 65.63% for this period. Based on…