Category: Trade Ideas

-

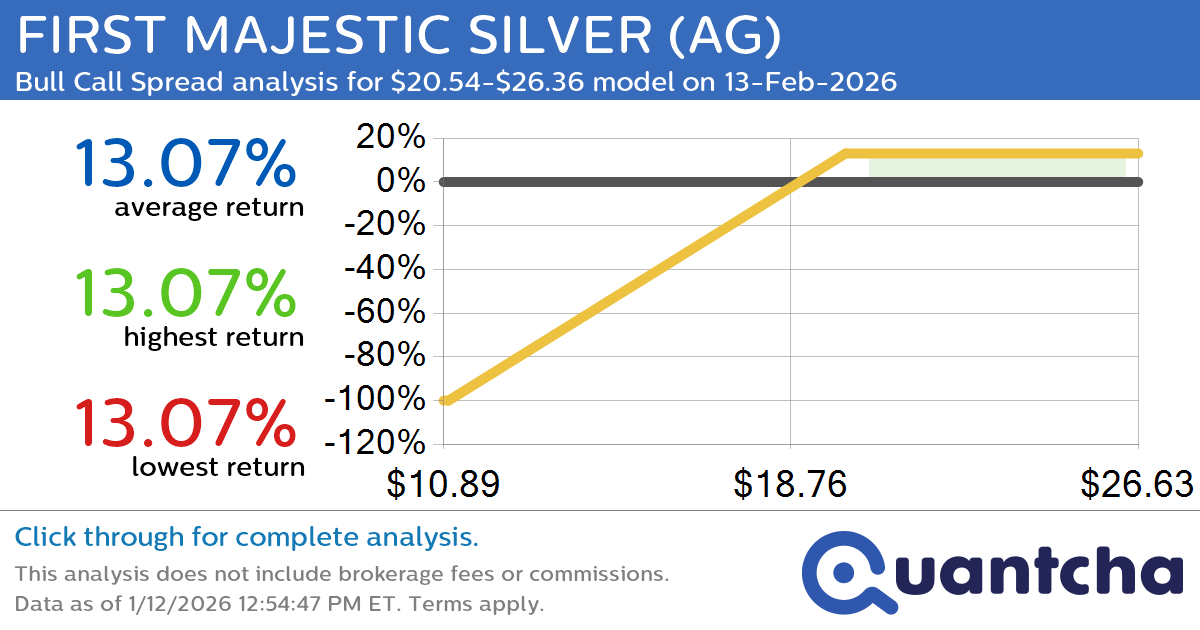

Big Gainer Alert: Trading today’s 8.2% move in FIRST MAJESTIC SILVER $AG

Quantchabot has detected a new Bull Call Spread trade opportunity for FIRST MAJESTIC SILVER (AG) for the 13-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. AG was recently trading at $20.47 and has an implied volatility of 83.35% for this period. Based on an analysis of…

-

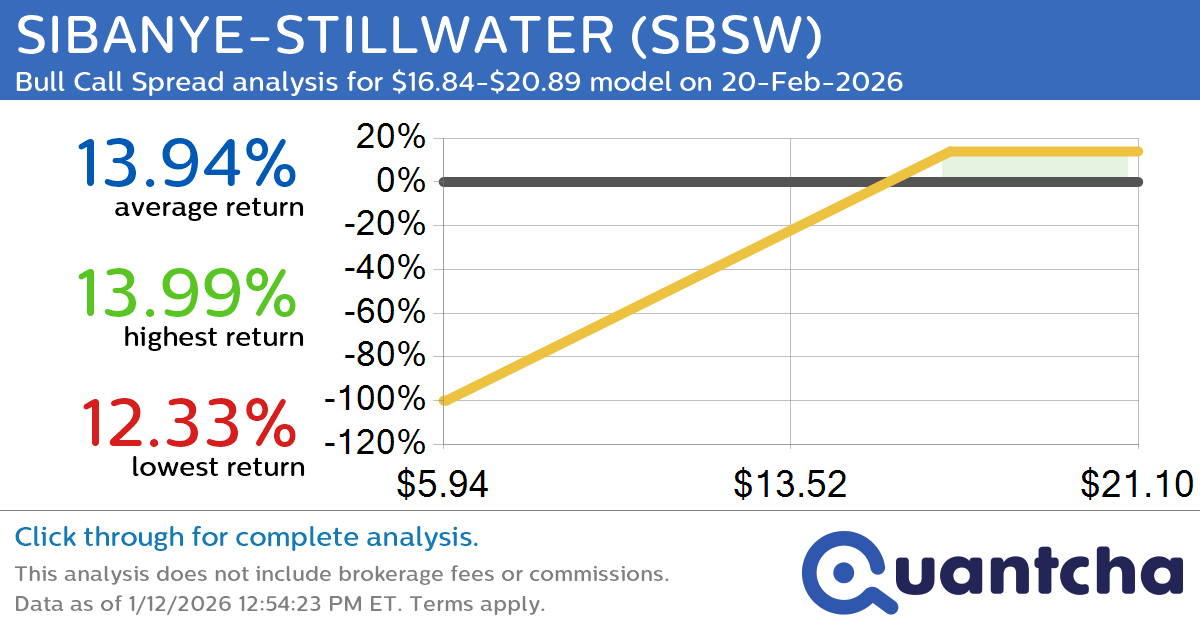

Big Gainer Alert: Trading today’s 7.2% move in SIBANYE-STILLWATER $SBSW

Quantchabot has detected a new Bull Call Spread trade opportunity for SIBANYE-STILLWATER (SBSW) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SBSW was recently trading at $16.77 and has an implied volatility of 65.42% for this period. Based on an analysis of the options…

-

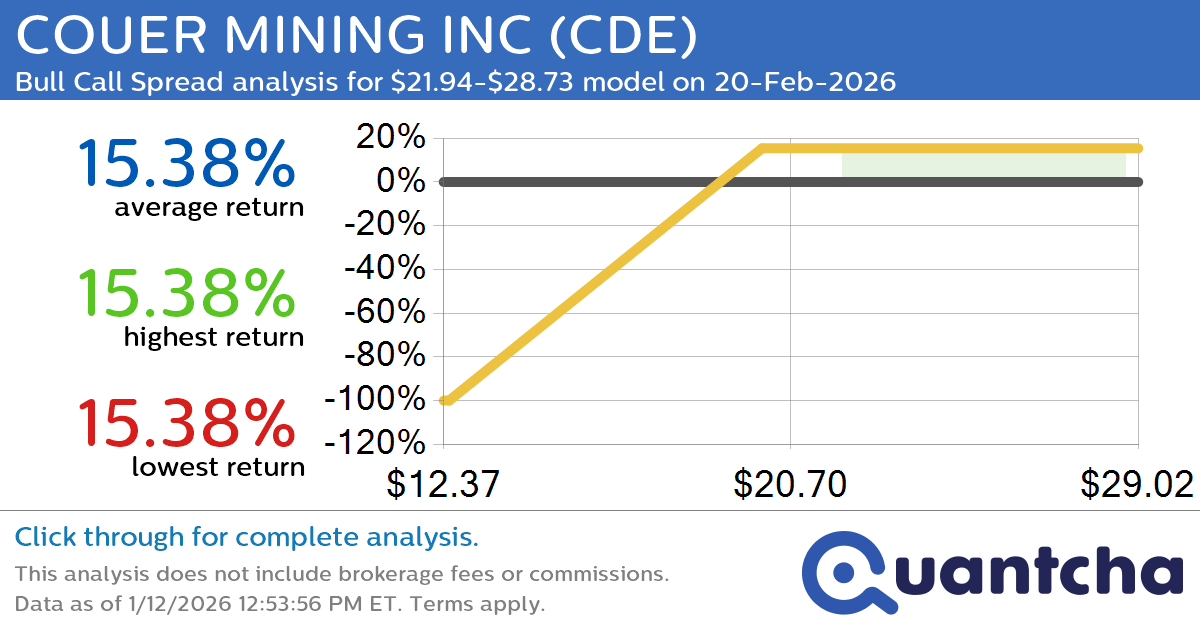

Big Gainer Alert: Trading today’s 7.1% move in COUER MINING INC $CDE

Quantchabot has detected a new Bull Call Spread trade opportunity for COUER MINING INC (CDE) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CDE was recently trading at $21.86 and has an implied volatility of 81.72% for this period. Based on an analysis of…

-

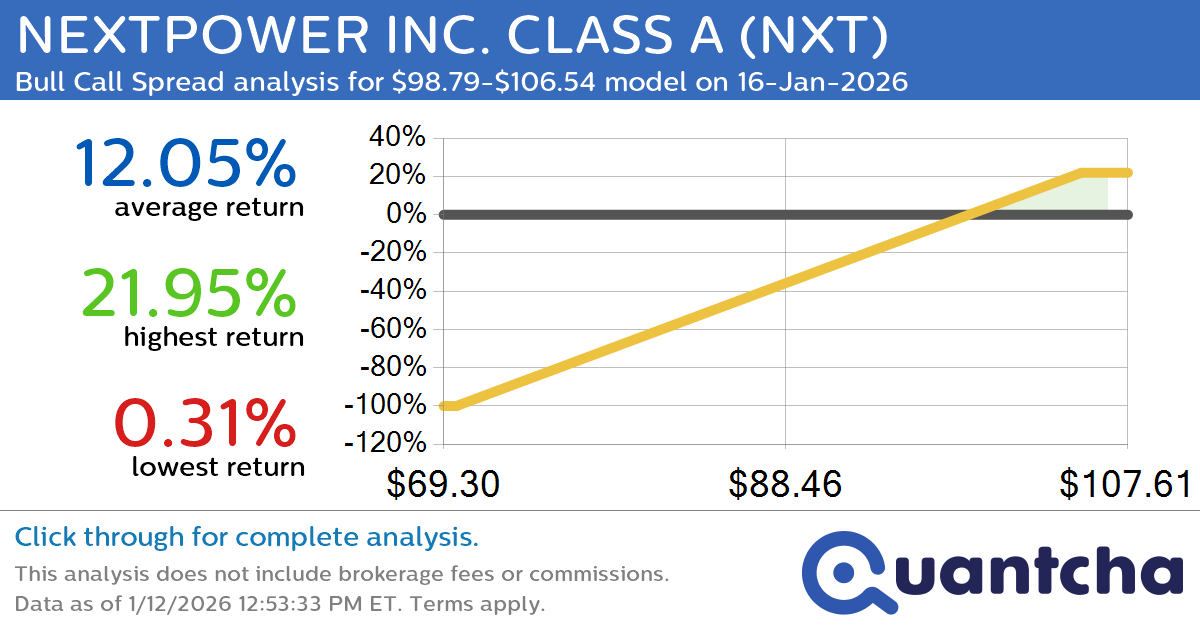

Big Gainer Alert: Trading today’s 8.3% move in NEXTPOWER INC. CLASS A $NXT

Quantchabot has detected a new Bull Call Spread trade opportunity for NEXTPOWER INC. CLASS A (NXT) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. NXT was recently trading at $98.74 and has an implied volatility of 66.79% for this period. Based on an analysis…

-

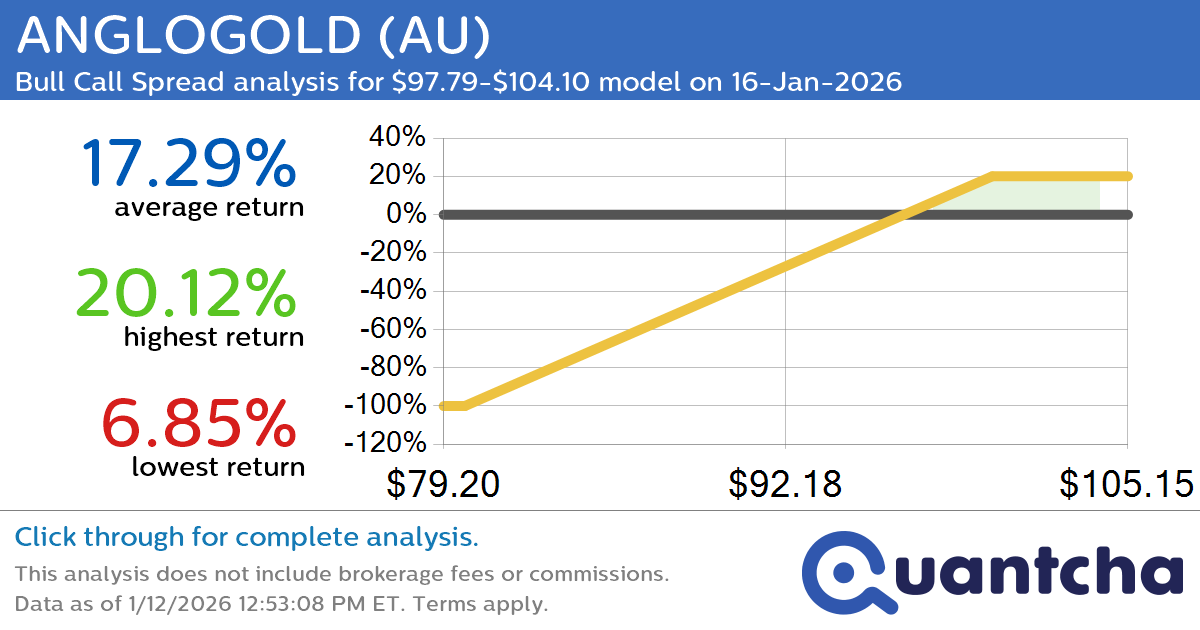

52-Week High Alert: Trading today’s movement in ANGLOGOLD $AU

Quantchabot has detected a new Bull Call Spread trade opportunity for ANGLOGOLD (AU) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. AU was recently trading at $97.74 and has an implied volatility of 55.27% for this period. Based on an analysis of the options…

-

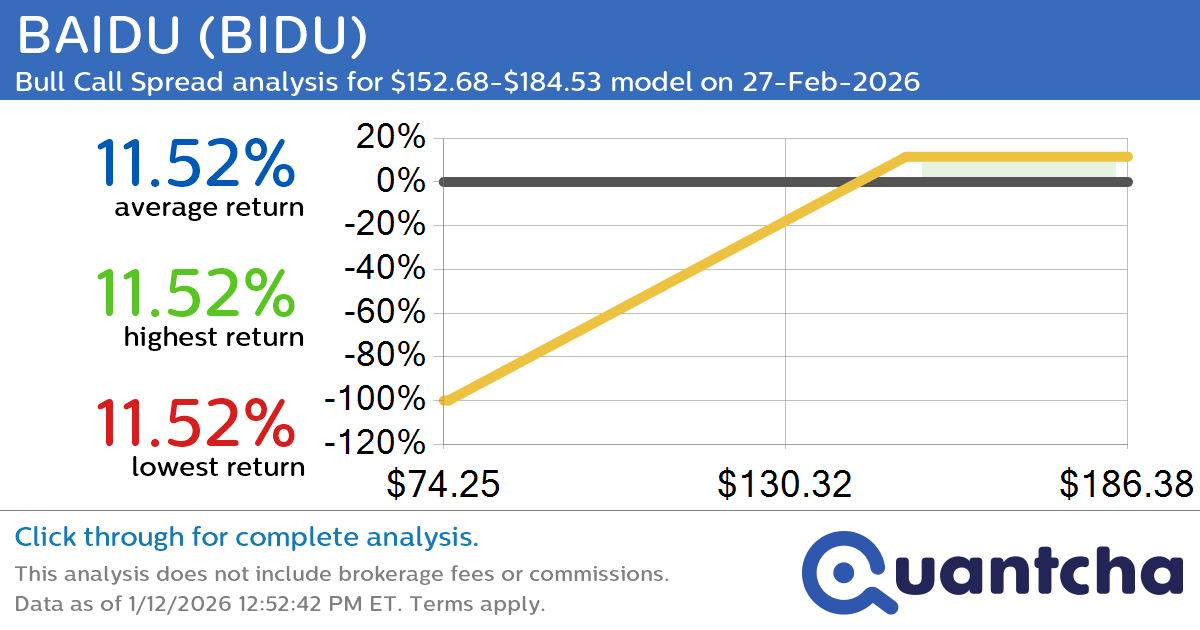

52-Week High Alert: Trading today’s movement in BAIDU $BIDU

Quantchabot has detected a new Bull Call Spread trade opportunity for BAIDU (BIDU) for the 27-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. BIDU was recently trading at $151.95 and has an implied volatility of 52.97% for this period. Based on an analysis of the options…

-

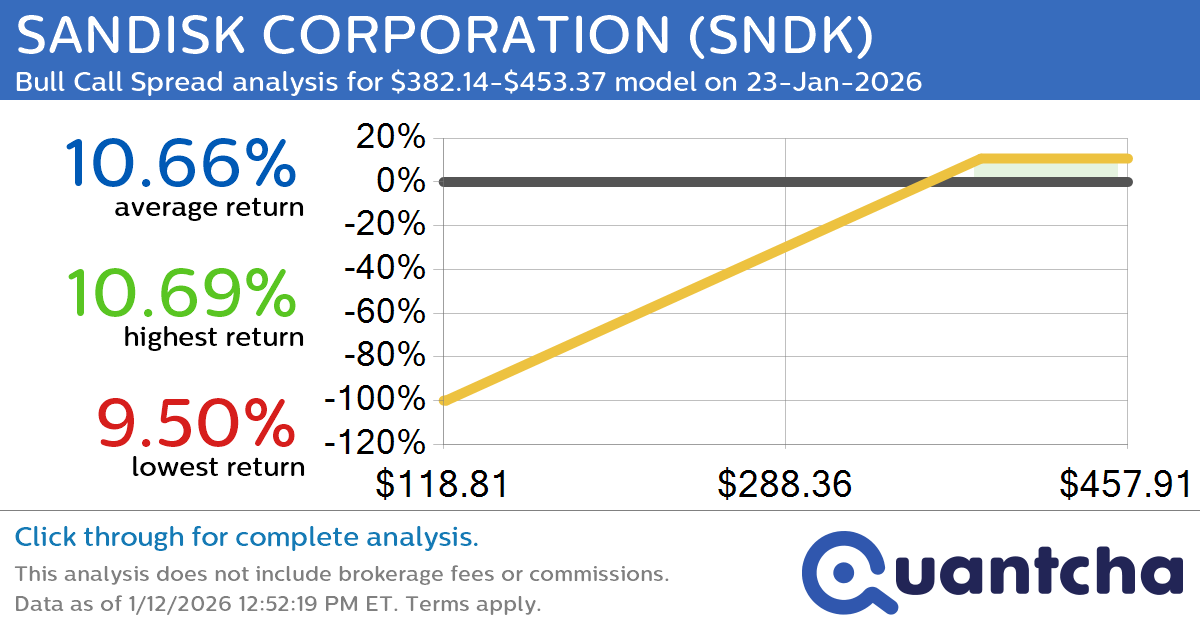

52-Week High Alert: Trading today’s movement in SANDISK CORPORATION $SNDK

Quantchabot has detected a new Bull Call Spread trade opportunity for SANDISK CORPORATION (SNDK) for the 23-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SNDK was recently trading at $381.68 and has an implied volatility of 95.57% for this period. Based on an analysis of the…

-

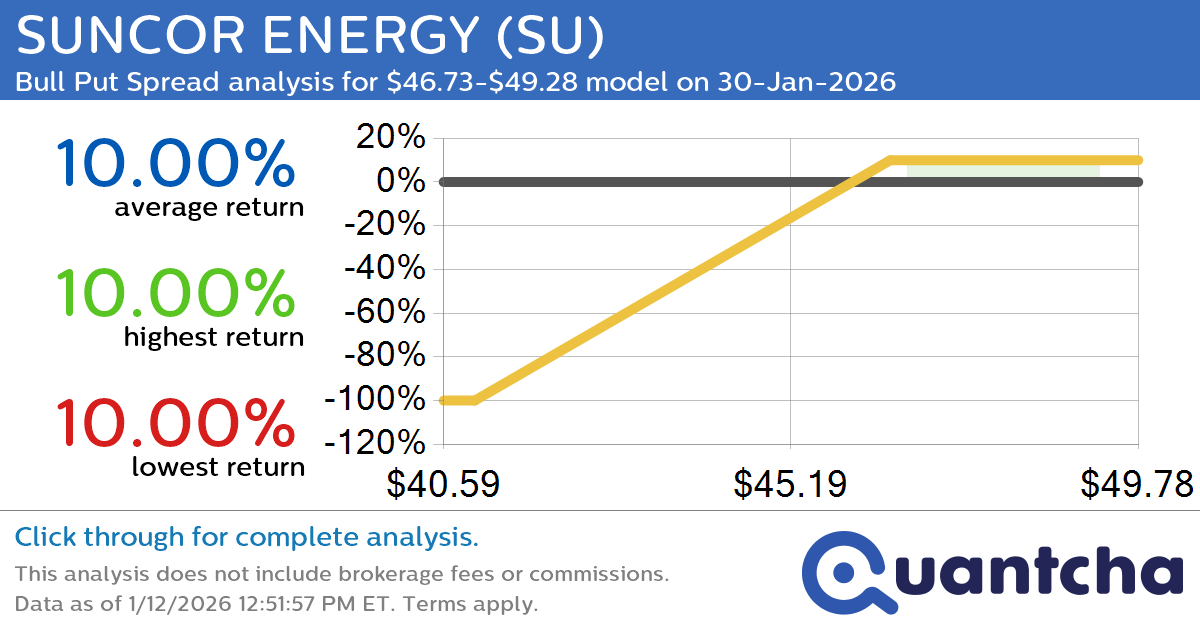

52-Week High Alert: Trading today’s movement in SUNCOR ENERGY $SU

Quantchabot has detected a new Bull Put Spread trade opportunity for SUNCOR ENERGY (SU) for the 30-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SU was recently trading at $46.64 and has an implied volatility of 23.47% for this period. Based on an analysis of the…

-

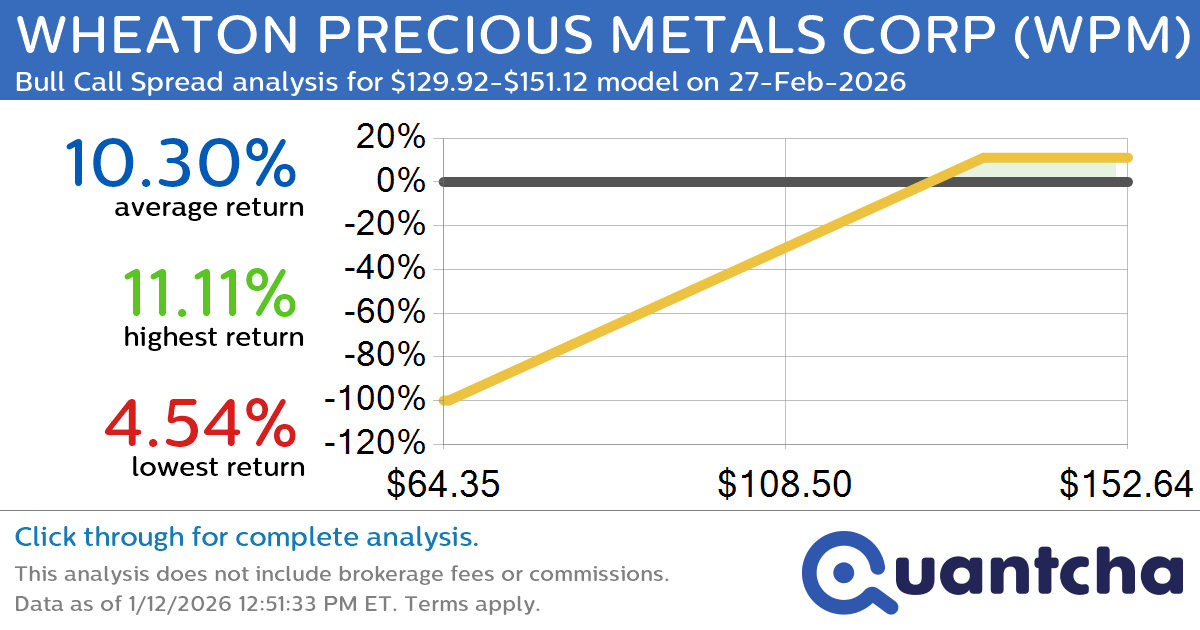

52-Week High Alert: Trading today’s movement in WHEATON PRECIOUS METALS CORP $WPM

Quantchabot has detected a new Bull Call Spread trade opportunity for WHEATON PRECIOUS METALS CORP (WPM) for the 27-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. WPM was recently trading at $129.30 and has an implied volatility of 42.25% for this period. Based on an analysis…

-

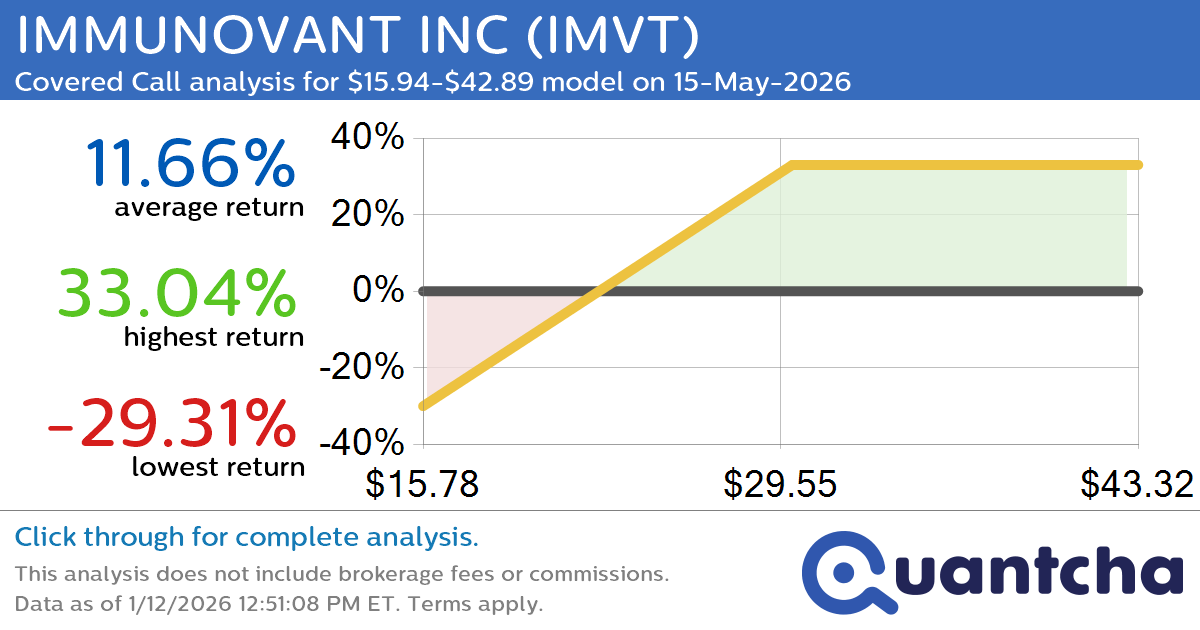

Covered Call Alert: IMMUNOVANT INC $IMVT returning up to 32.57% through 15-May-2026

Quantchabot has detected a new Covered Call trade opportunity for IMMUNOVANT INC (IMVT) for the 15-May-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. IMVT was recently trading at $25.82 and has an implied volatility of 85.00% for this period. Based on an analysis of the options…