Category: Trade Ideas

-

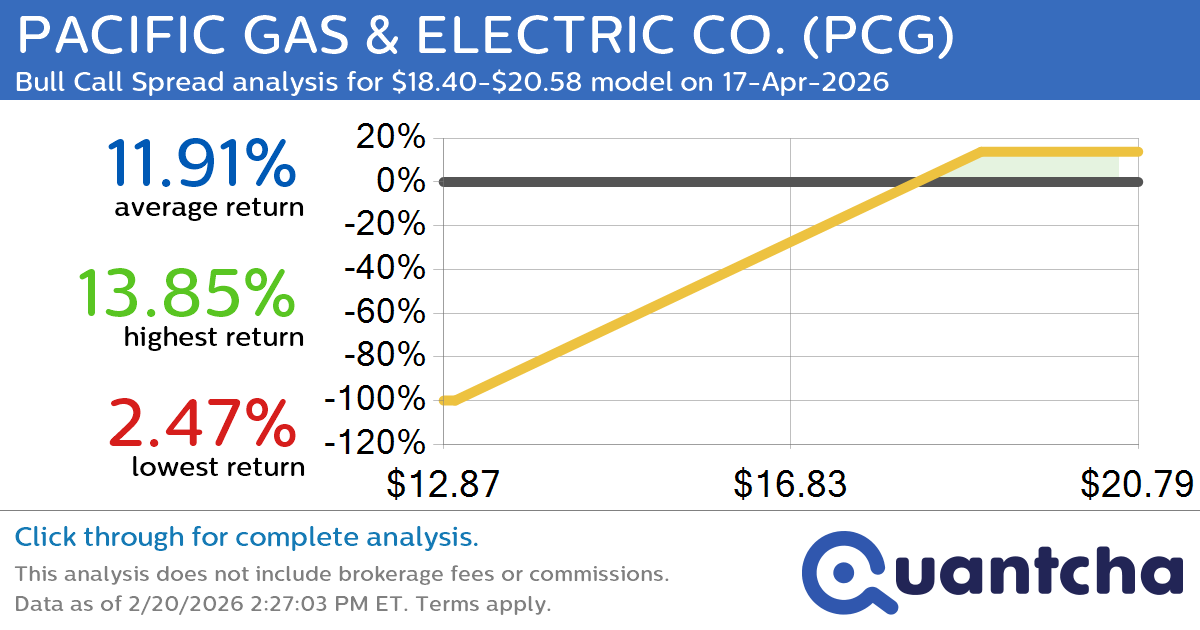

52-Week High Alert: Trading today’s movement in PACIFIC GAS & ELECTRIC CO. $PCG

Quantchabot has detected a new Bull Call Spread trade opportunity for PACIFIC GAS & ELECTRIC CO. (PCG) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. PCG was recently trading at $18.34 and has an implied volatility of 28.38% for this period. Based on an…

-

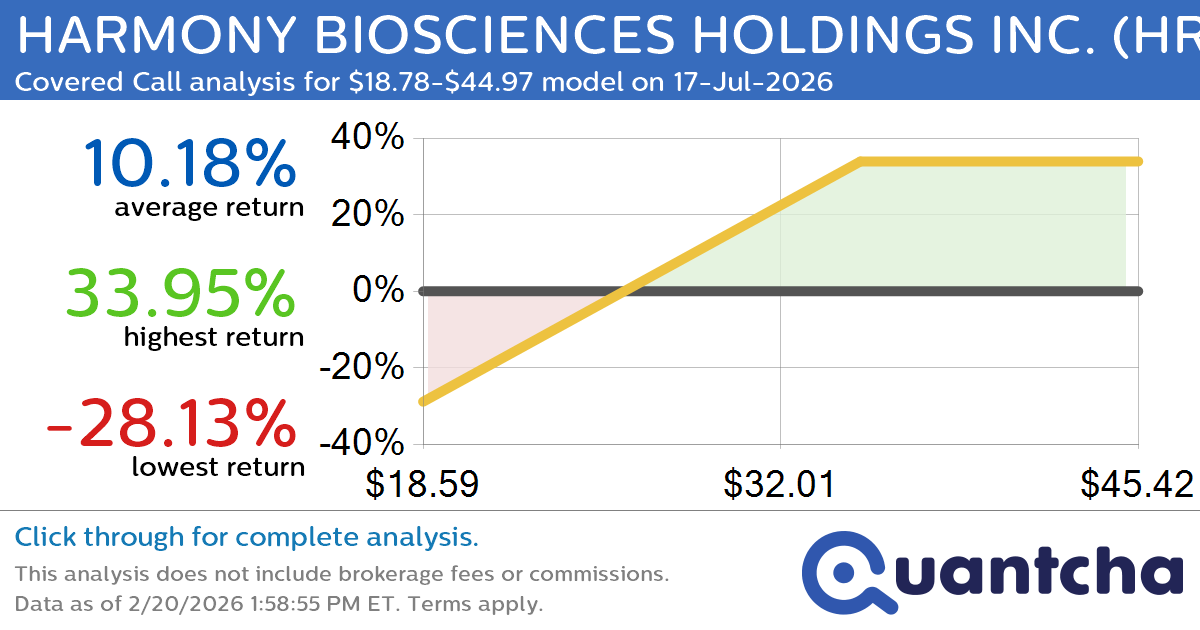

Covered Call Alert: HARMONY BIOSCIENCES HOLDINGS INC. $HRMY returning up to 33.95% through 17-Jul-2026

Quantchabot has detected a new Covered Call trade opportunity for HARMONY BIOSCIENCES HOLDINGS INC. (HRMY) for the 17-Jul-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. HRMY was recently trading at $28.62 and has an implied volatility of 68.65% for this period. Based on an analysis of…

-

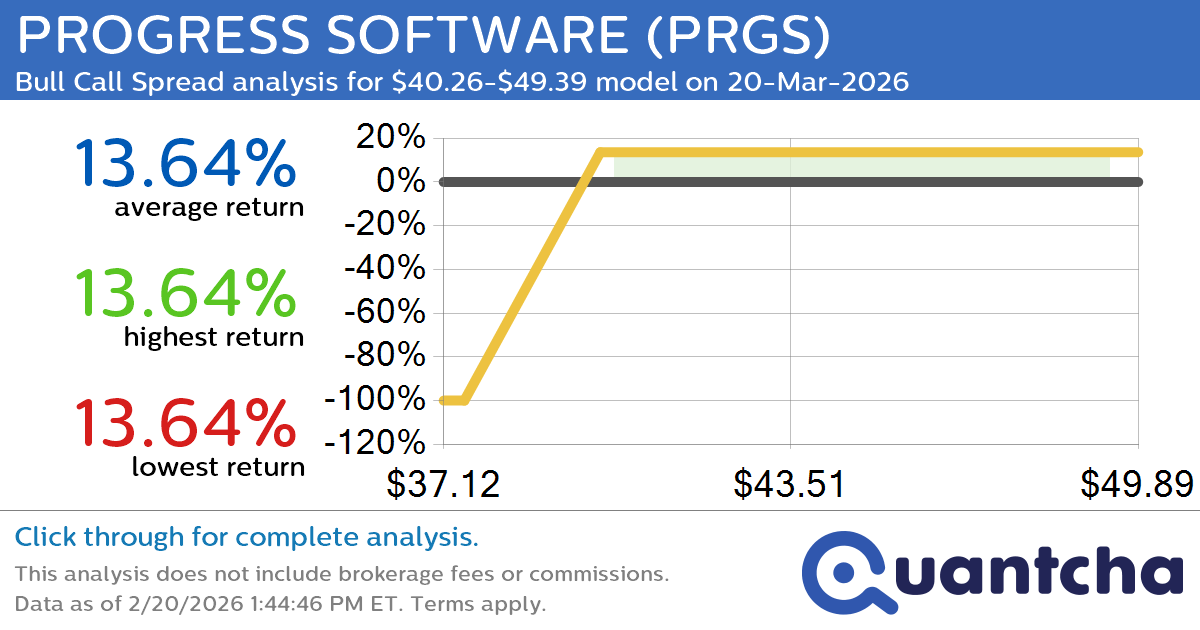

Big Gainer Alert: Trading today’s 10.2% move in PROGRESS SOFTWARE $PRGS

Quantchabot has detected a new Bull Call Spread trade opportunity for PROGRESS SOFTWARE (PRGS) for the 20-Mar-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. PRGS was recently trading at $40.14 and has an implied volatility of 72.99% for this period. Based on an analysis of the…

-

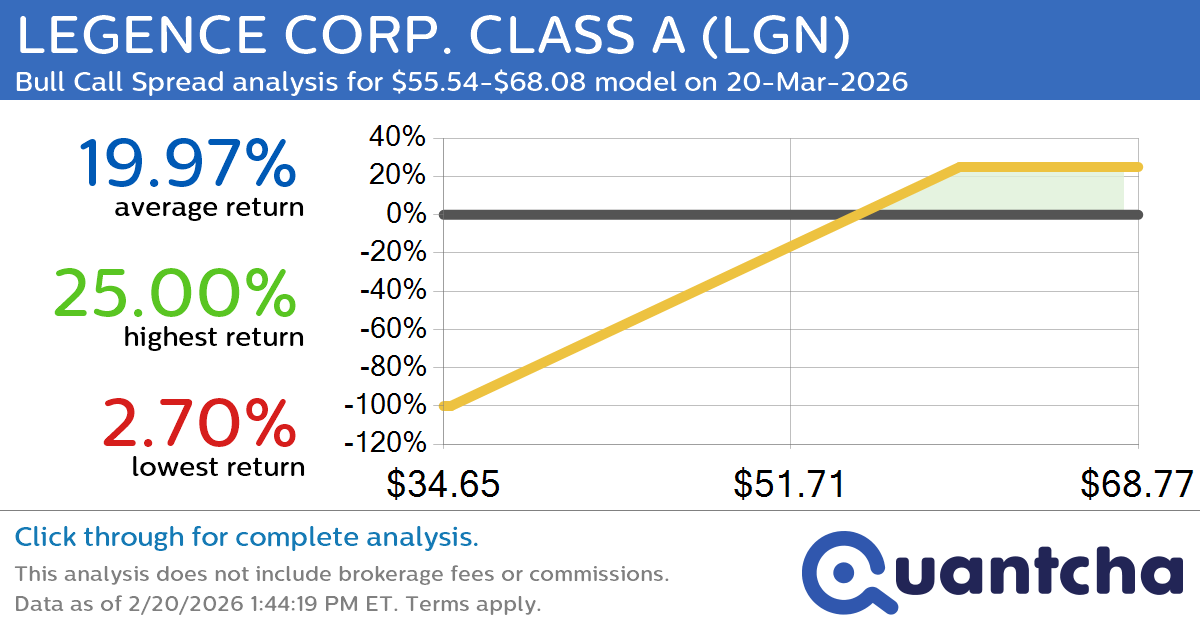

Big Gainer Alert: Trading today’s 17.1% move in LEGENCE CORP. CLASS A $LGN

Quantchabot has detected a new Bull Call Spread trade opportunity for LEGENCE CORP. CLASS A (LGN) for the 20-Mar-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. LGN was recently trading at $55.38 and has an implied volatility of 72.65% for this period. Based on an analysis…

-

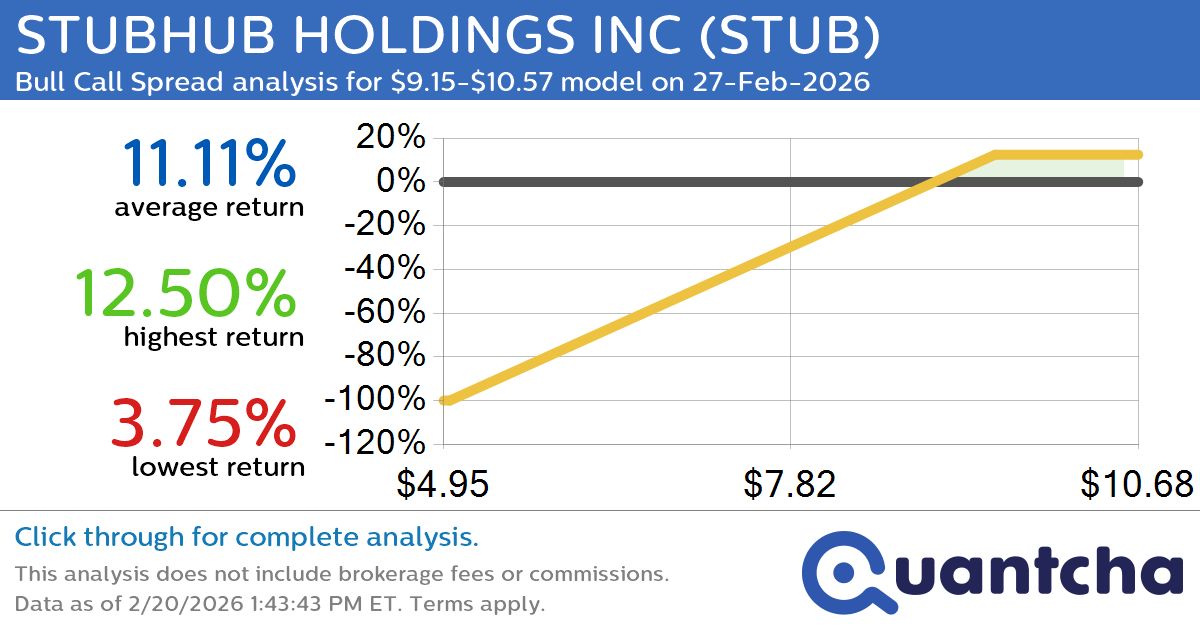

Big Gainer Alert: Trading today’s 7.3% move in STUBHUB HOLDINGS INC $STUB

Quantchabot has detected a new Bull Call Spread trade opportunity for STUBHUB HOLDINGS INC (STUB) for the 27-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. STUB was recently trading at $9.14 and has an implied volatility of 99.83% for this period. Based on an analysis of…

-

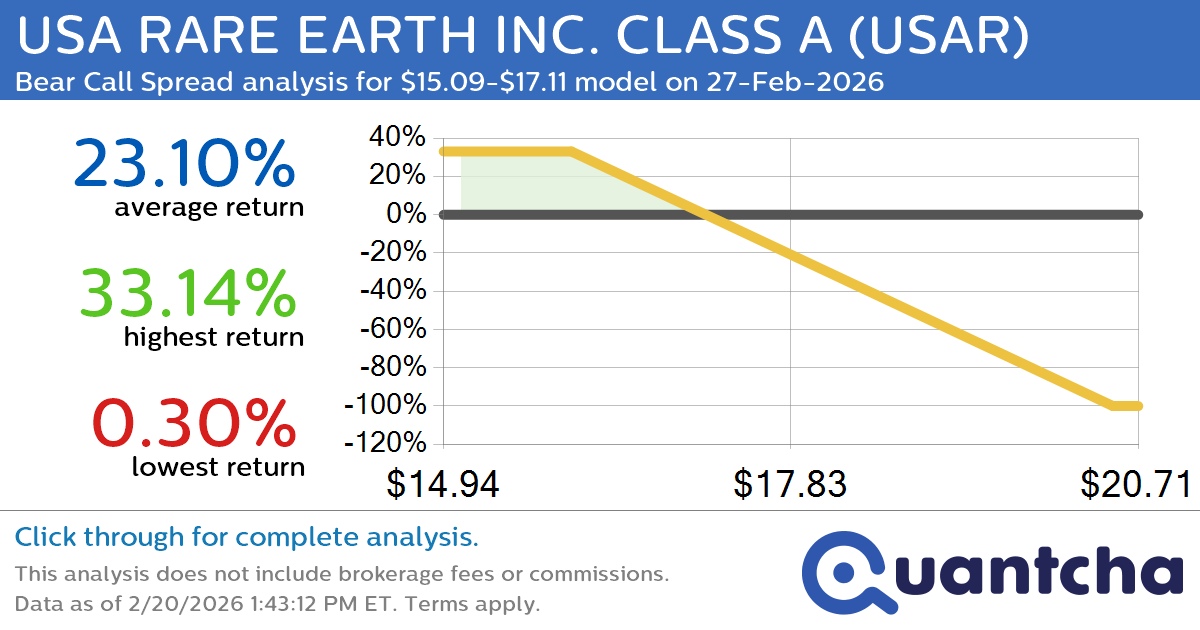

Big Loser Alert: Trading today’s -7.0% move in USA RARE EARTH INC. CLASS A $USAR

Quantchabot has detected a new Bear Call Spread trade opportunity for USA RARE EARTH INC. CLASS A (USAR) for the 27-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. USAR was recently trading at $17.09 and has an implied volatility of 86.91% for this period. Based on…

-

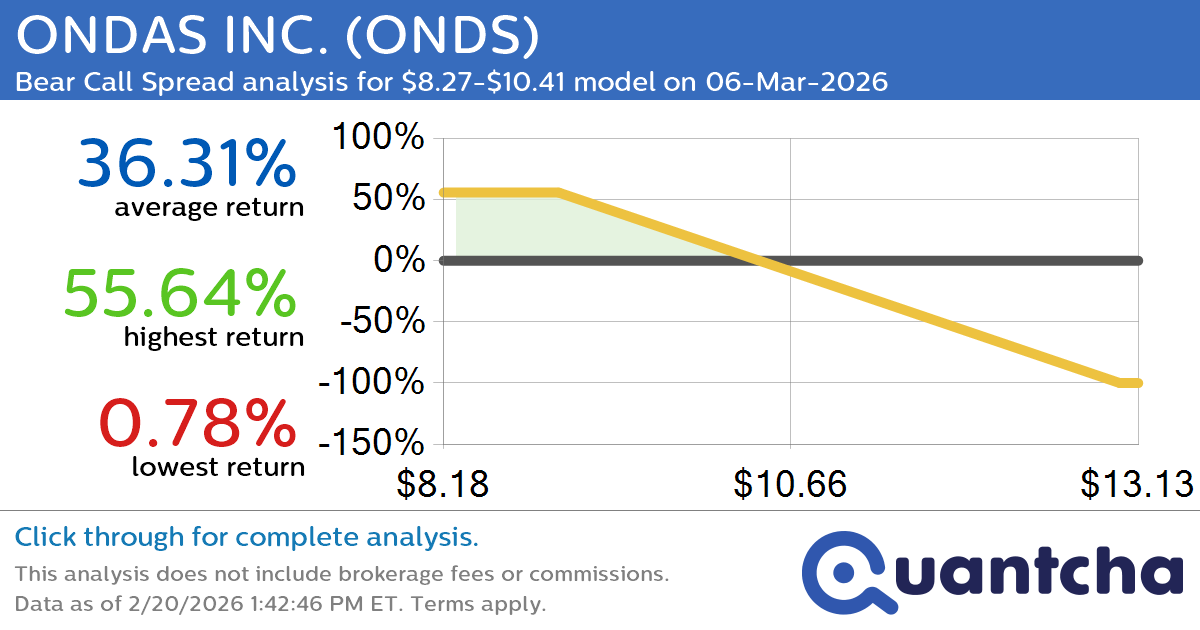

Big Loser Alert: Trading today’s -8.8% move in ONDAS INC. $ONDS

Quantchabot has detected a new Bear Call Spread trade opportunity for ONDAS INC. (ONDS) for the 6-Mar-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ONDS was recently trading at $10.39 and has an implied volatility of 114.88% for this period. Based on an analysis of the…

-

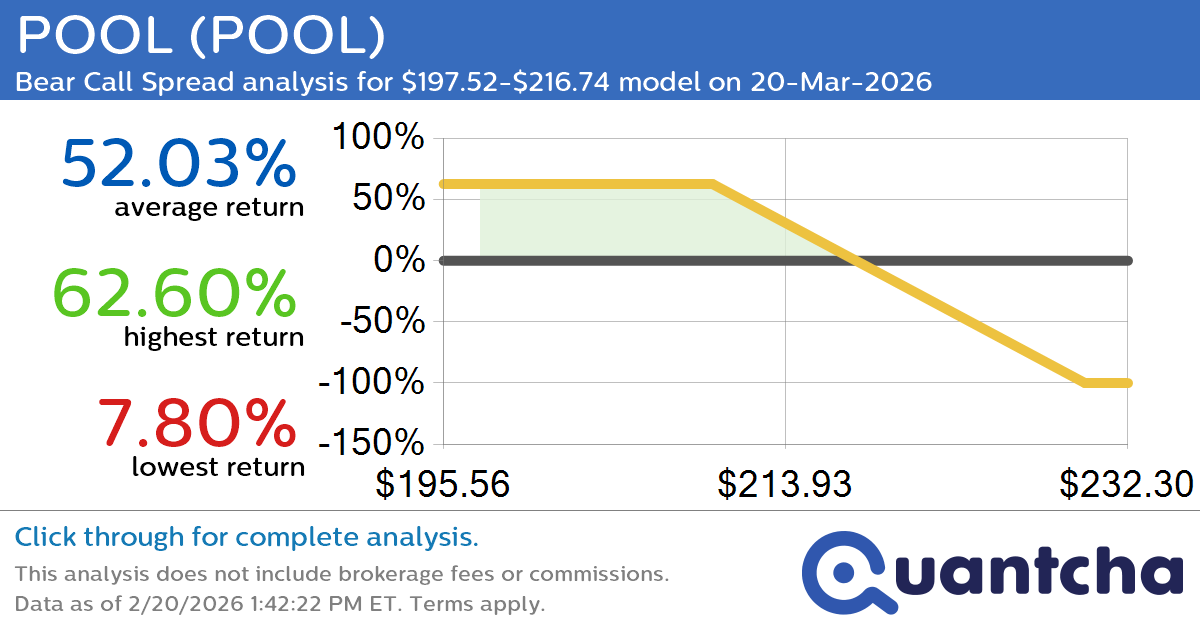

52-Week Low Alert: Trading today’s movement in POOL $POOL

Quantchabot has detected a new Bear Call Spread trade opportunity for POOL (POOL) for the 20-Mar-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. POOL was recently trading at $216.10 and has an implied volatility of 33.16% for this period. Based on an analysis of the options…

-

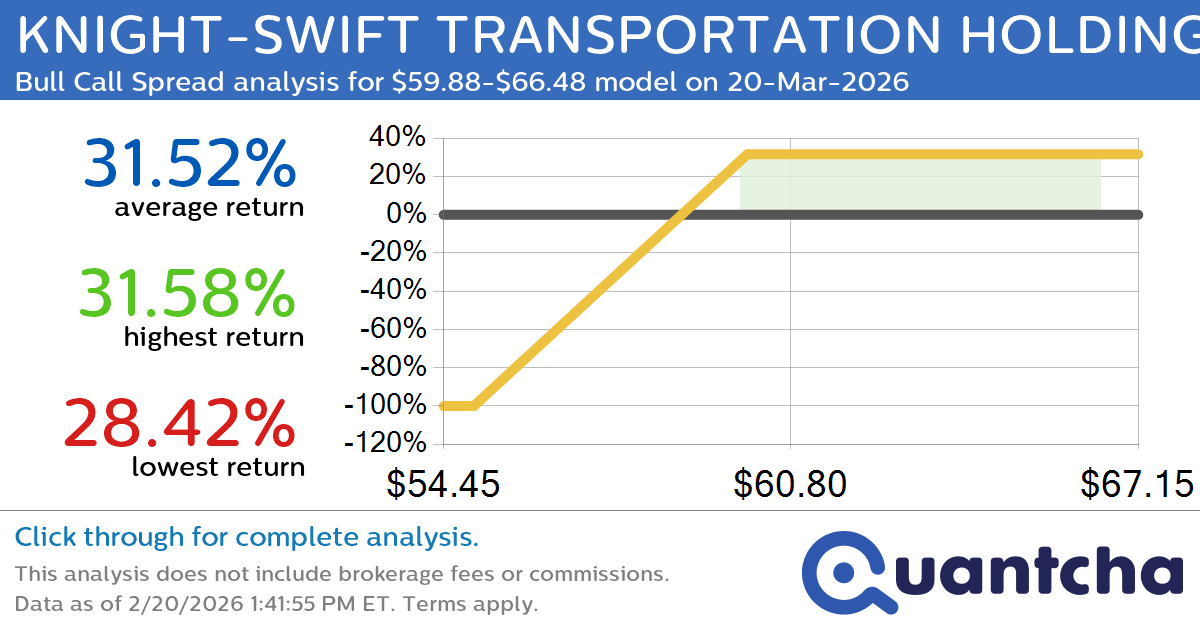

52-Week High Alert: Trading today’s movement in KNIGHT-SWIFT TRANSPORTATION HOLDINGS INC $KNX

Quantchabot has detected a new Bull Call Spread trade opportunity for KNIGHT-SWIFT TRANSPORTATION HOLDINGS INC (KNX) for the 20-Mar-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. KNX was recently trading at $59.91 and has an implied volatility of 37.33% for this period. Based on an analysis…

-

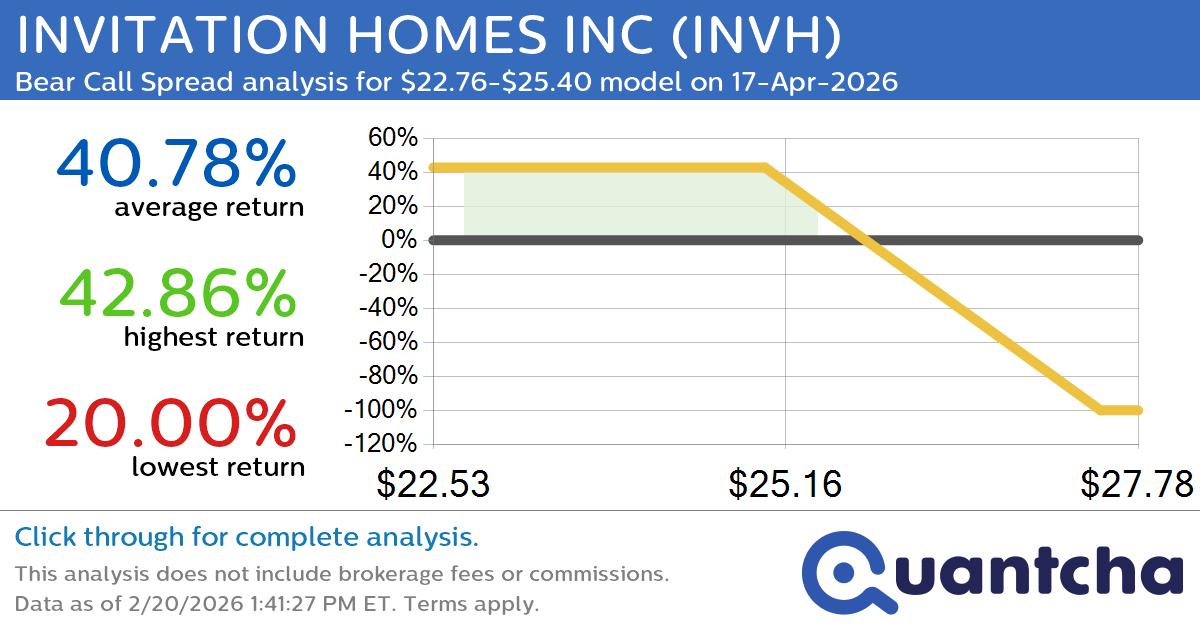

52-Week Low Alert: Trading today’s movement in INVITATION HOMES INC $INVH

Quantchabot has detected a new Bear Call Spread trade opportunity for INVITATION HOMES INC (INVH) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. INVH was recently trading at $25.25 and has an implied volatility of 27.86% for this period. Based on an analysis of…