Category: Trade Ideas

-

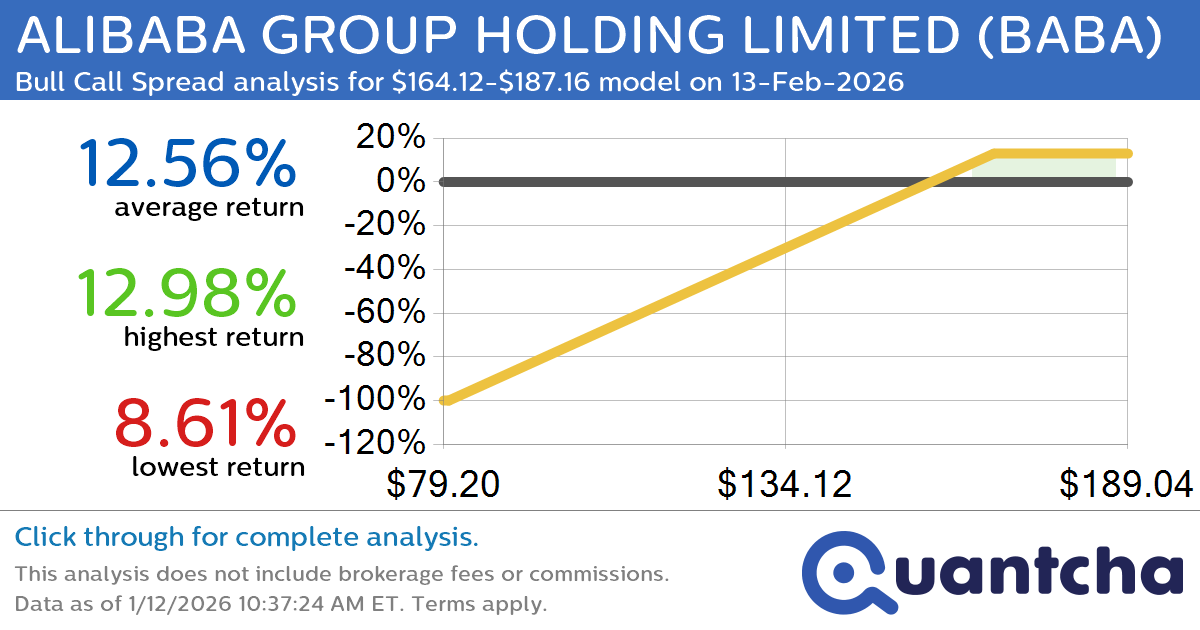

Big Gainer Alert: Trading today’s 8.3% move in ALIBABA GROUP HOLDING LIMITED $BABA

Quantchabot has detected a new Bull Call Spread trade opportunity for ALIBABA GROUP HOLDING LIMITED (BABA) for the 13-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. BABA was recently trading at $163.56 and has an implied volatility of 43.84% for this period. Based on an analysis…

-

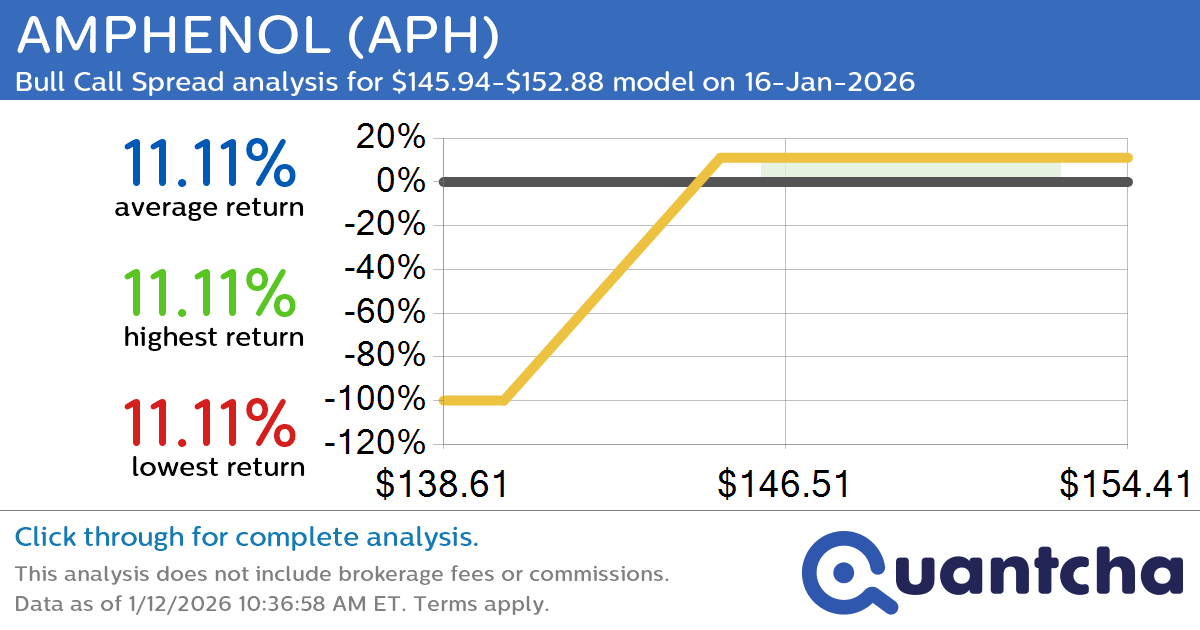

52-Week High Alert: Trading today’s movement in AMPHENOL $APH

Quantchabot has detected a new Bull Call Spread trade opportunity for AMPHENOL (APH) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. APH was recently trading at $145.87 and has an implied volatility of 40.65% for this period. Based on an analysis of the options…

-

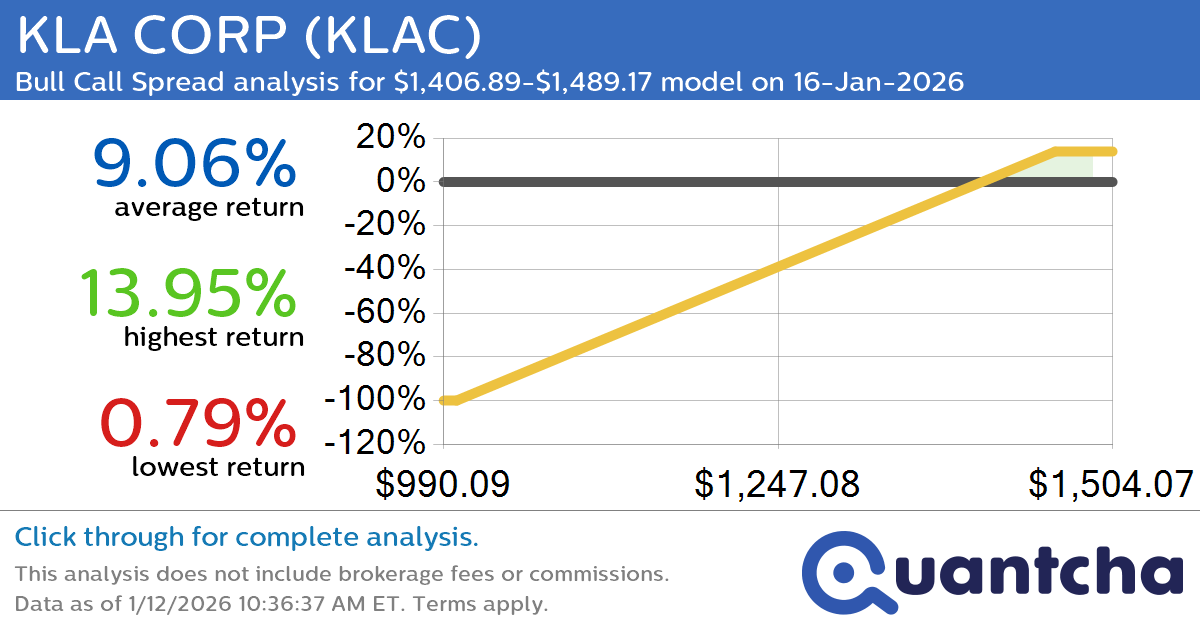

52-Week High Alert: Trading today’s movement in KLA CORP $KLAC

Quantchabot has detected a new Bull Call Spread trade opportunity for KLA CORP (KLAC) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. KLAC was recently trading at $1,406.20 and has an implied volatility of 49.71% for this period. Based on an analysis of the…

-

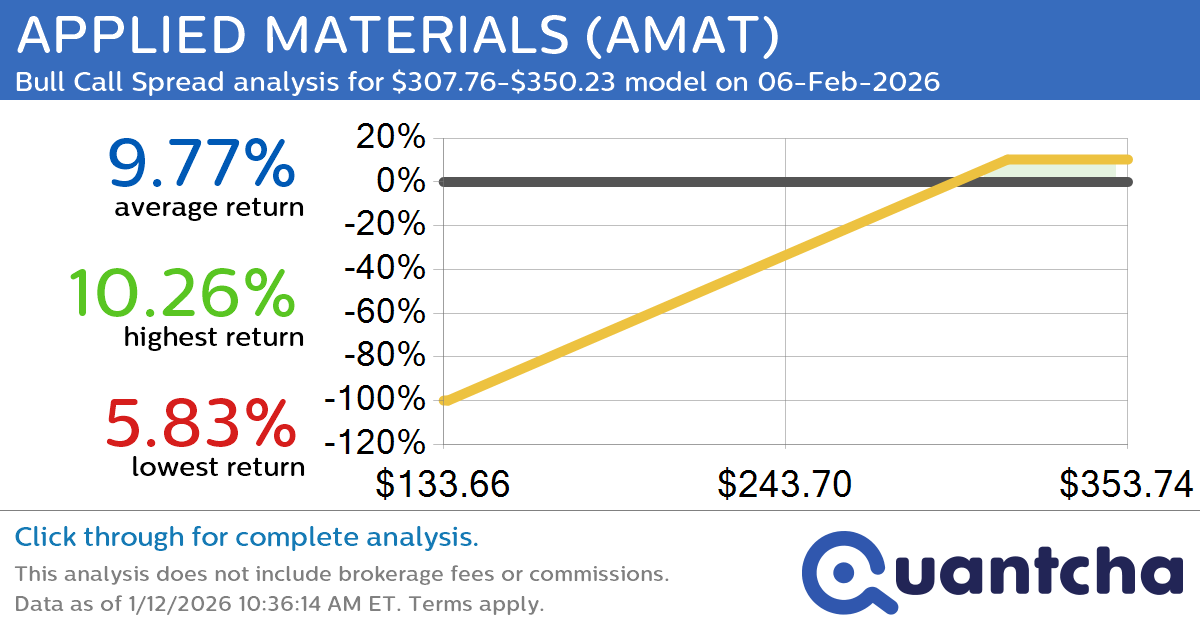

52-Week High Alert: Trading today’s movement in APPLIED MATERIALS $AMAT

Quantchabot has detected a new Bull Call Spread trade opportunity for APPLIED MATERIALS (AMAT) for the 6-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. AMAT was recently trading at $306.94 and has an implied volatility of 48.66% for this period. Based on an analysis of the…

-

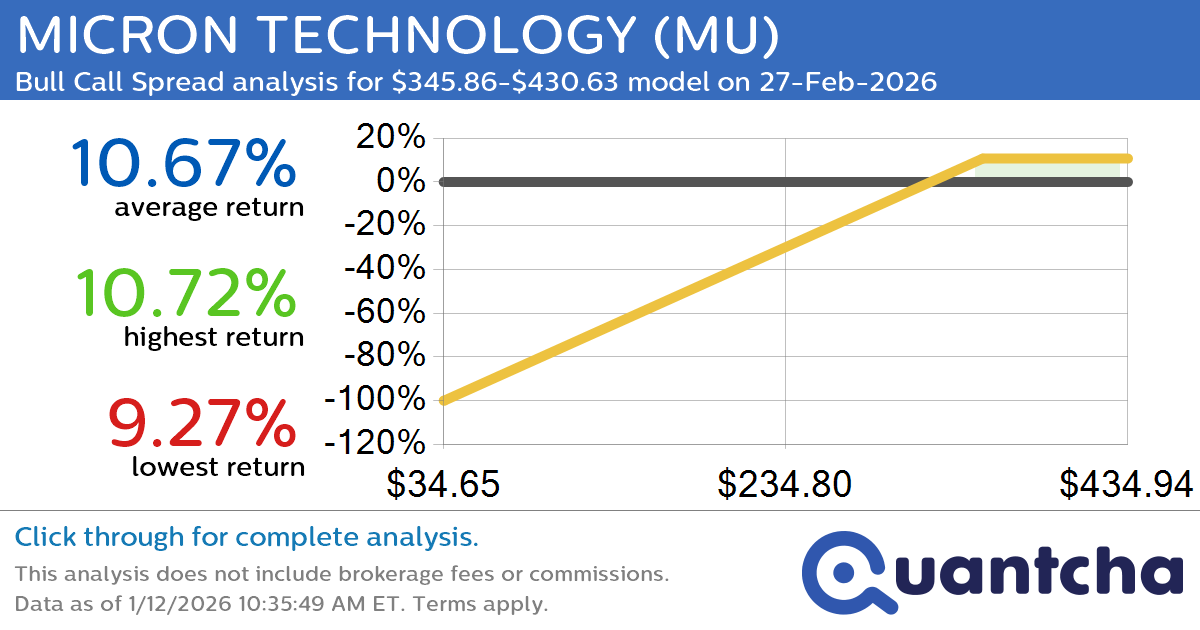

52-Week High Alert: Trading today’s movement in MICRON TECHNOLOGY $MU

Quantchabot has detected a new Bull Call Spread trade opportunity for MICRON TECHNOLOGY (MU) for the 27-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. MU was recently trading at $344.19 and has an implied volatility of 61.24% for this period. Based on an analysis of the…

-

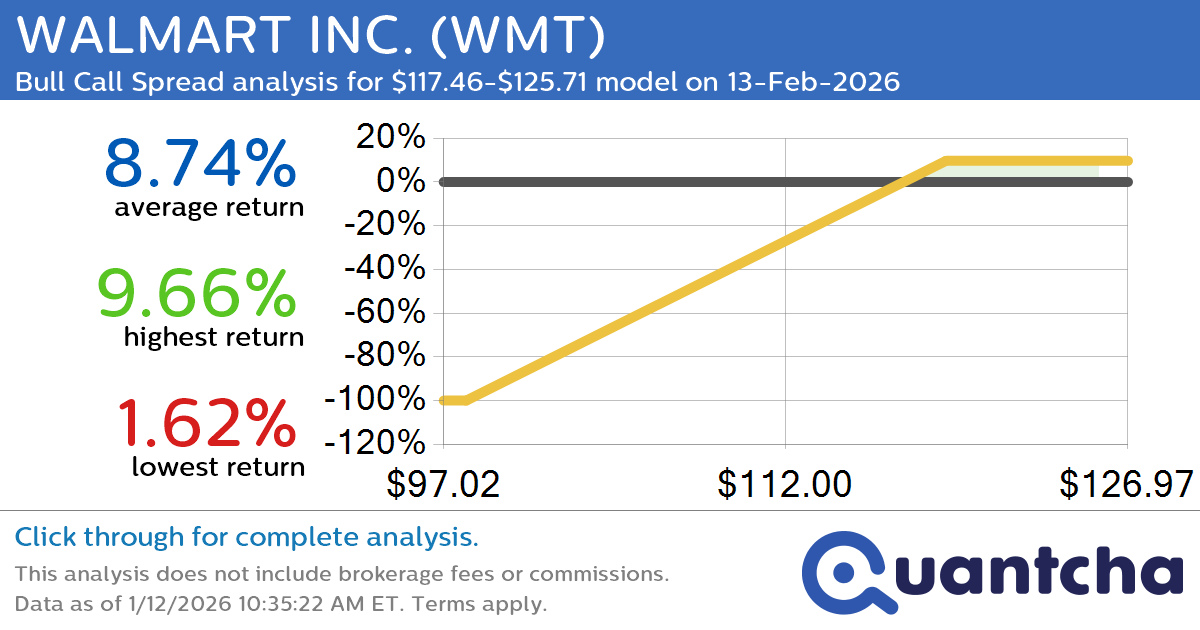

52-Week High Alert: Trading today’s movement in WALMART INC. $WMT

Quantchabot has detected a new Bull Call Spread trade opportunity for WALMART INC. (WMT) for the 13-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. WMT was recently trading at $117.06 and has an implied volatility of 22.67% for this period. Based on an analysis of the…

-

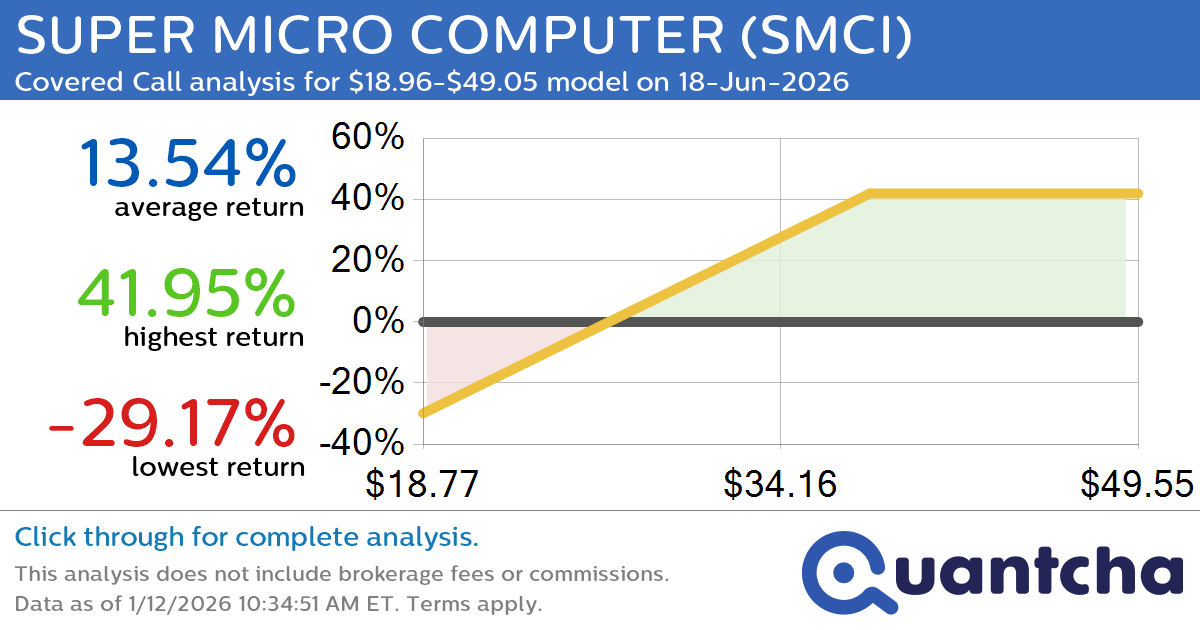

Covered Call Alert: SUPER MICRO COMPUTER $SMCI returning up to 41.95% through 18-Jun-2026

Quantchabot has detected a new Covered Call trade opportunity for SUPER MICRO COMPUTER (SMCI) for the 18-Jun-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SMCI was recently trading at $30.02 and has an implied volatility of 72.29% for this period. Based on an analysis of the…

-

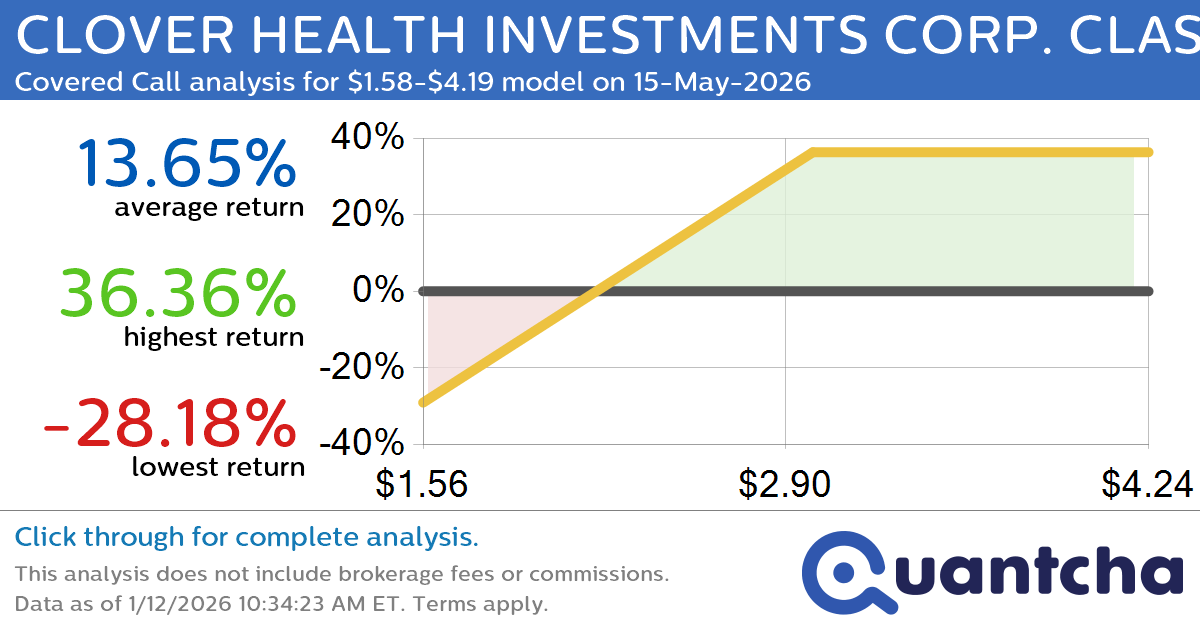

Covered Call Alert: CLOVER HEALTH INVESTMENTS CORP. CLASS A $CLOV returning up to 36.36% through 15-May-2026

Quantchabot has detected a new Covered Call trade opportunity for CLOVER HEALTH INVESTMENTS CORP. CLASS A (CLOV) for the 15-May-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CLOV was recently trading at $2.54 and has an implied volatility of 83.53% for this period. Based on an…

-

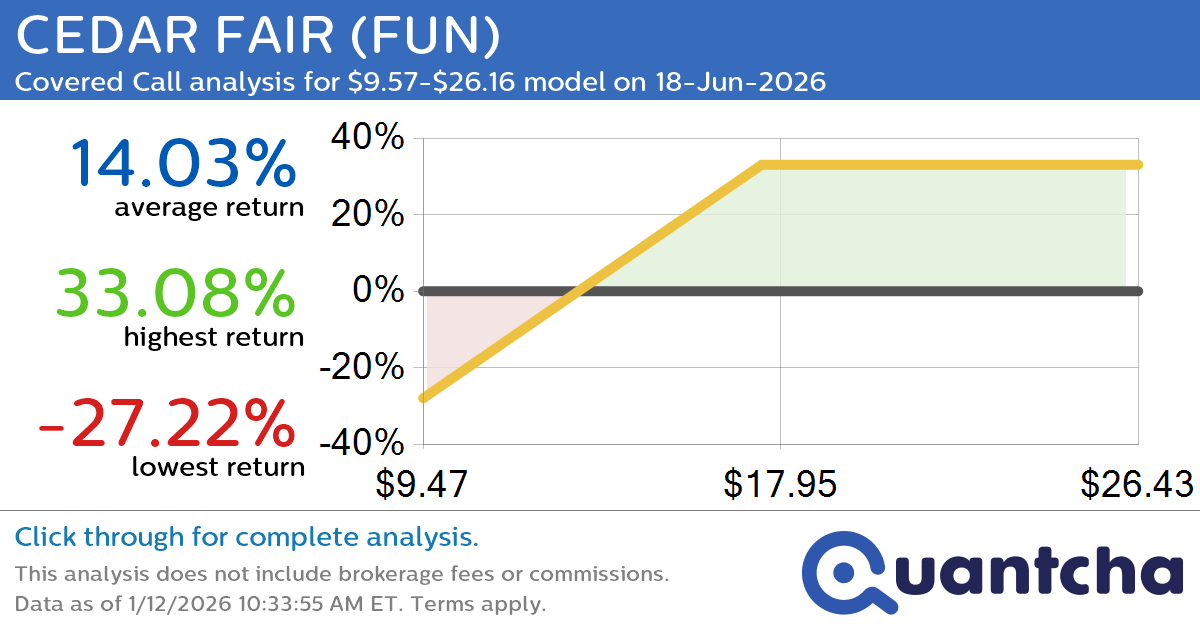

Covered Call Alert: CEDAR FAIR $FUN returning up to 33.08% through 18-Jun-2026

Quantchabot has detected a new Covered Call trade opportunity for CEDAR FAIR (FUN) for the 18-Jun-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. FUN was recently trading at $15.57 and has an implied volatility of 76.52% for this period. Based on an analysis of the options…

-

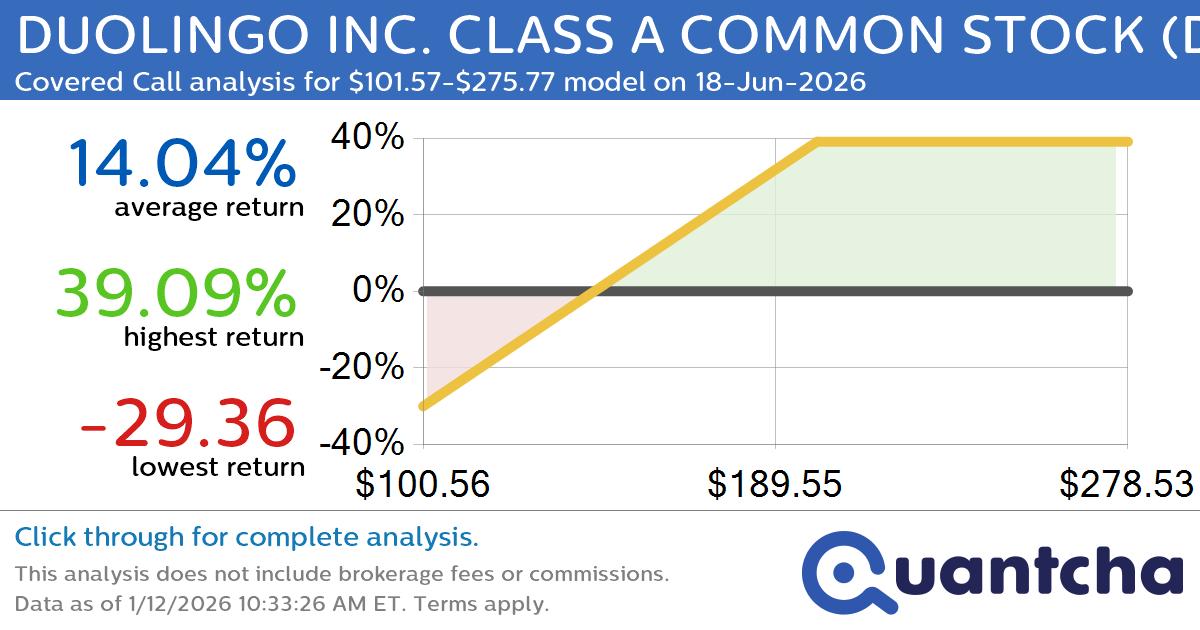

Covered Call Alert: DUOLINGO INC. CLASS A COMMON STOCK $DUOL returning up to 39.09% through 18-Jun-2026

Quantchabot has detected a new Covered Call trade opportunity for DUOLINGO INC. CLASS A COMMON STOCK (DUOL) for the 18-Jun-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. DUOL was recently trading at $164.72 and has an implied volatility of 75.96% for this period. Based on an…