Category: Trade Ideas

-

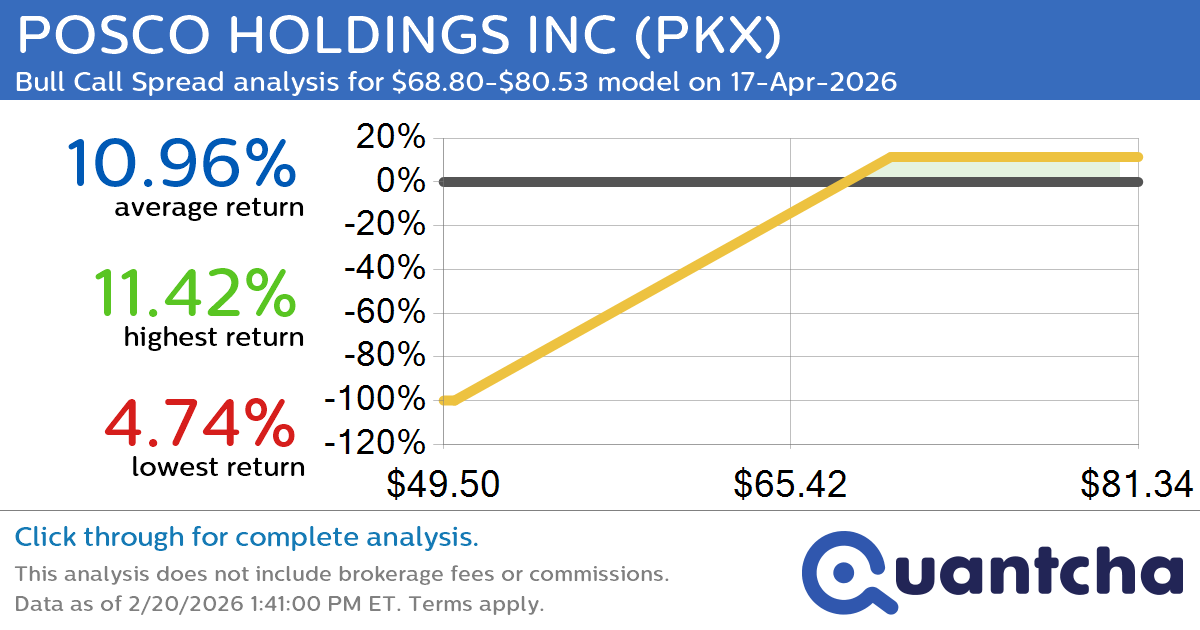

52-Week High Alert: Trading today’s movement in POSCO HOLDINGS INC $PKX

Quantchabot has detected a new Bull Call Spread trade opportunity for POSCO HOLDINGS INC (PKX) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. PKX was recently trading at $68.39 and has an implied volatility of 39.96% for this period. Based on an analysis of…

-

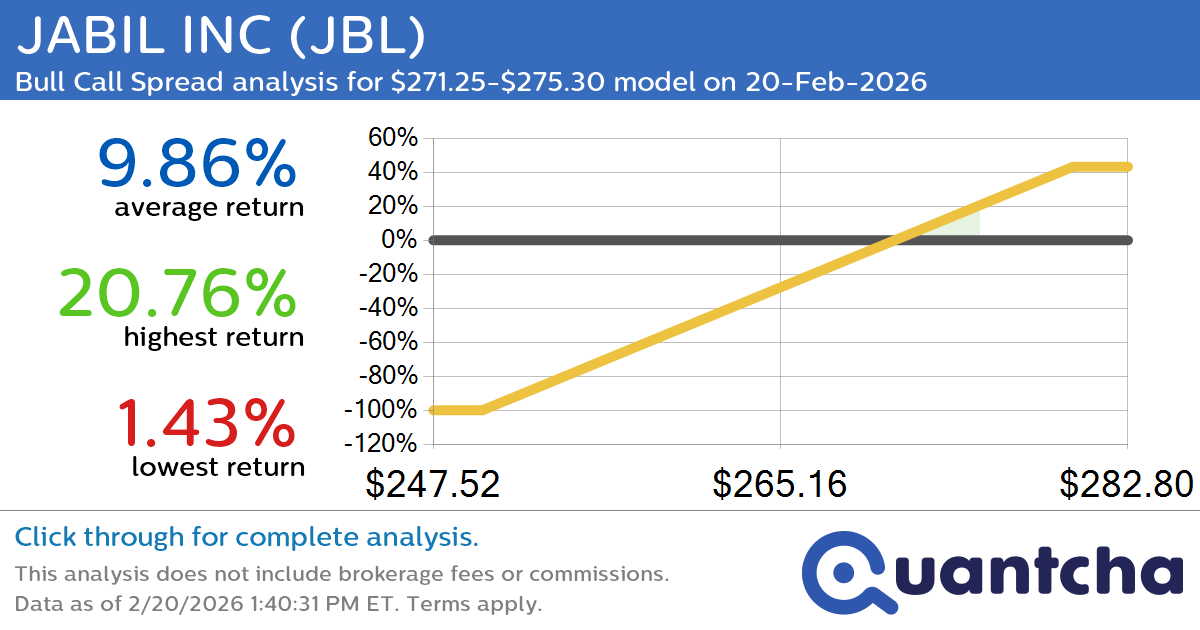

52-Week High Alert: Trading today’s movement in JABIL INC $JBL

Quantchabot has detected a new Bull Call Spread trade opportunity for JABIL INC (JBL) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. JBL was recently trading at $271.23 and has an implied volatility of 35.38% for this period. Based on an analysis of the…

-

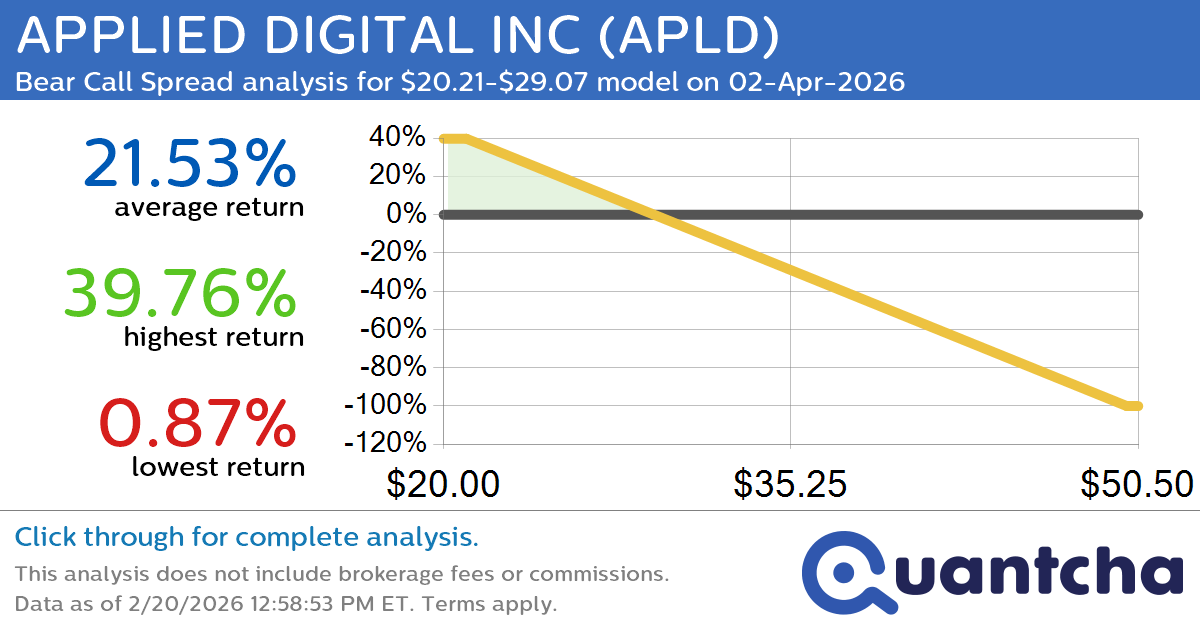

Big Loser Alert: Trading today’s -8.2% move in APPLIED DIGITAL INC $APLD

Quantchabot has detected a new Bear Call Spread trade opportunity for APPLIED DIGITAL INC (APLD) for the 2-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. APLD was recently trading at $28.94 and has an implied volatility of 107.51% for this period. Based on an analysis of…

-

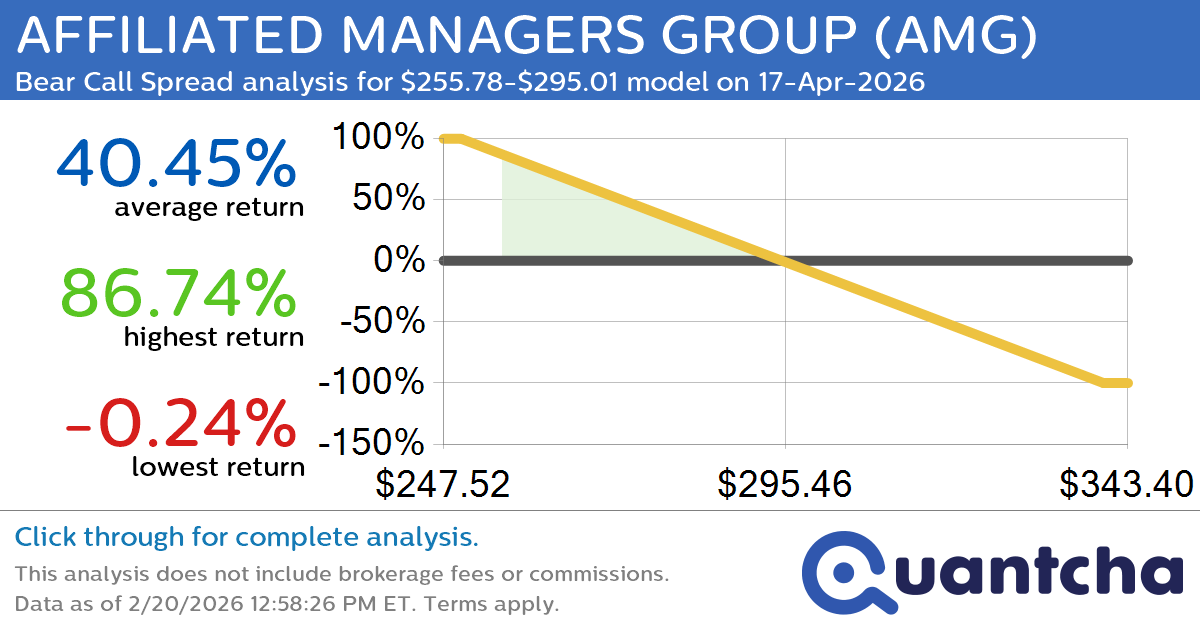

Big Loser Alert: Trading today’s -9.0% move in AFFILIATED MANAGERS GROUP $AMG

Quantchabot has detected a new Bear Call Spread trade opportunity for AFFILIATED MANAGERS GROUP (AMG) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. AMG was recently trading at $293.29 and has an implied volatility of 36.21% for this period. Based on an analysis of…

-

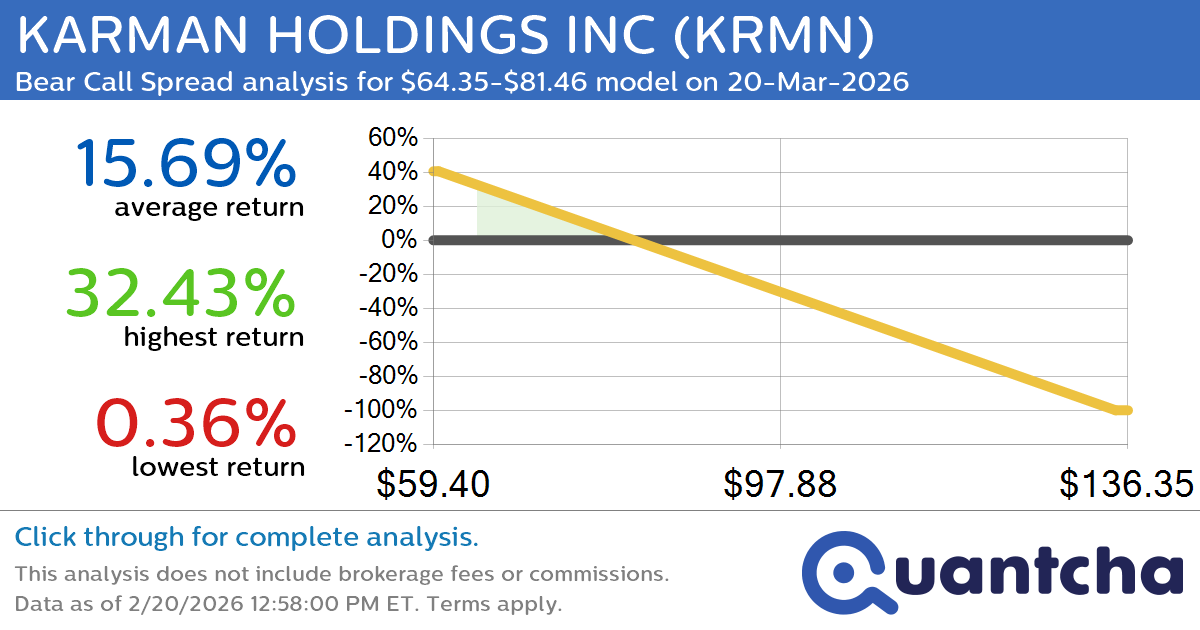

Big Loser Alert: Trading today’s -8.2% move in KARMAN HOLDINGS INC $KRMN

Quantchabot has detected a new Bear Call Spread trade opportunity for KARMAN HOLDINGS INC (KRMN) for the 20-Mar-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. KRMN was recently trading at $81.22 and has an implied volatility of 84.11% for this period. Based on an analysis of…

-

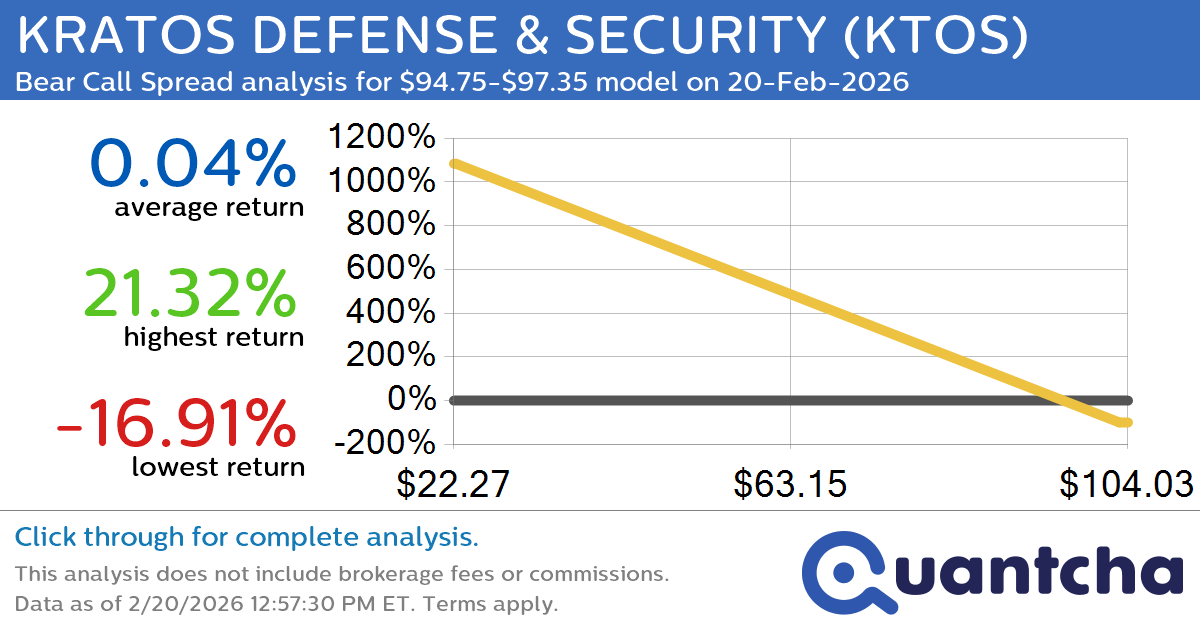

Big Loser Alert: Trading today’s -7.9% move in KRATOS DEFENSE & SECURITY $KTOS

Quantchabot has detected a new Bear Call Spread trade opportunity for KRATOS DEFENSE & SECURITY (KTOS) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. KTOS was recently trading at $97.34 and has an implied volatility of 62.89% for this period. Based on an analysis…

-

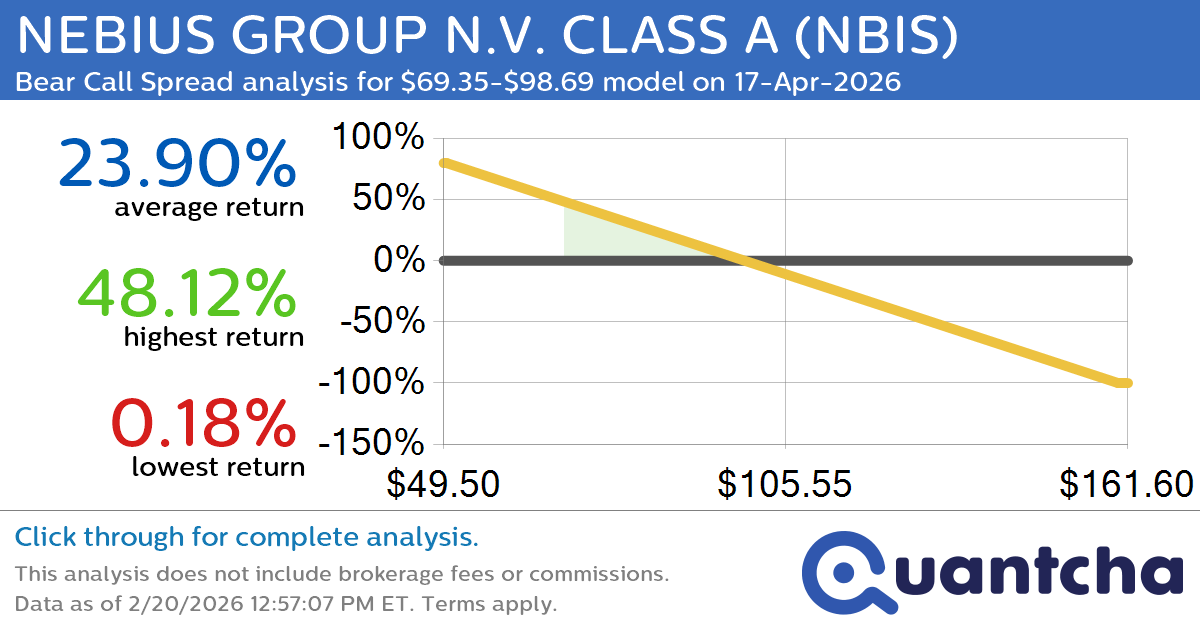

Big Loser Alert: Trading today’s -8.8% move in NEBIUS GROUP N.V. CLASS A $NBIS

Quantchabot has detected a new Bear Call Spread trade opportunity for NEBIUS GROUP N.V. CLASS A (NBIS) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. NBIS was recently trading at $98.11 and has an implied volatility of 89.54% for this period. Based on an…

-

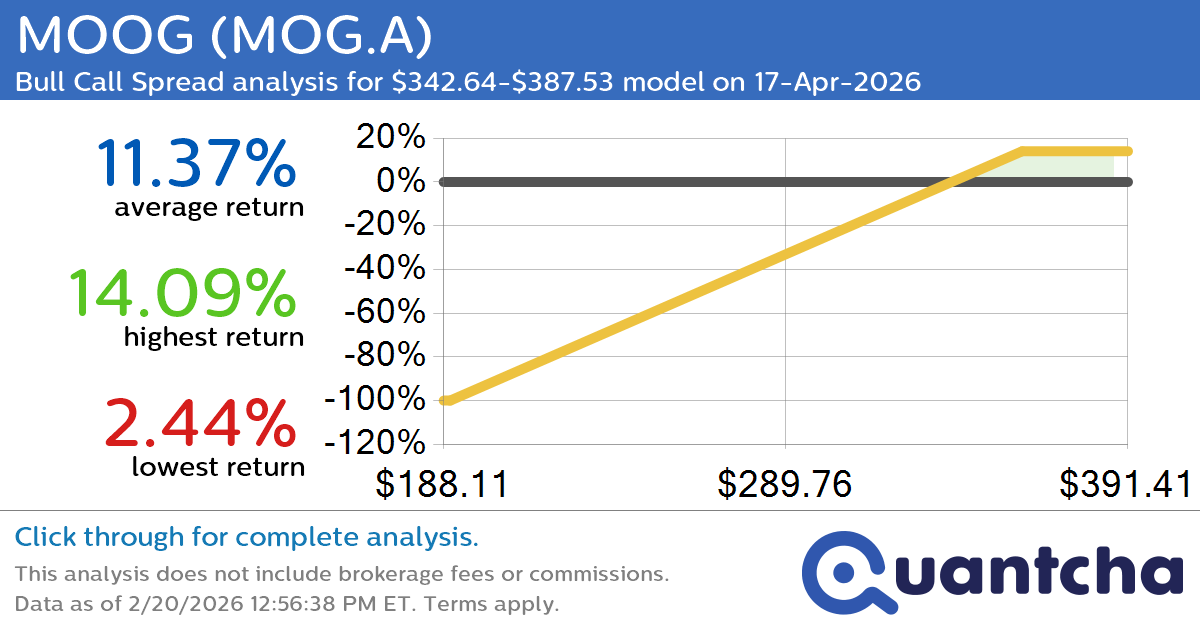

52-Week High Alert: Trading today’s movement in MOOG $MOG.A

Quantchabot has detected a new Bull Call Spread trade opportunity for MOOG (MOG.A) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. MOG.A was recently trading at $340.63 and has an implied volatility of 31.24% for this period. Based on an analysis of the options…

-

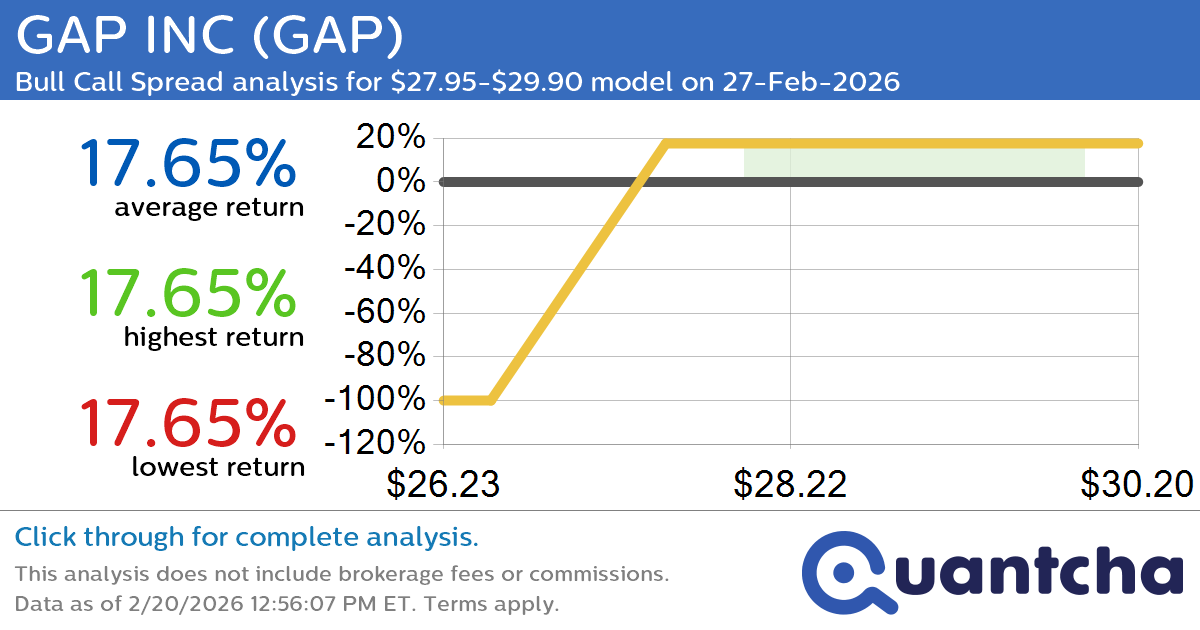

52-Week High Alert: Trading today’s movement in GAP INC $GAP

Quantchabot has detected a new Bull Call Spread trade opportunity for GAP INC (GAP) for the 27-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. GAP was recently trading at $27.93 and has an implied volatility of 46.55% for this period. Based on an analysis of the…

-

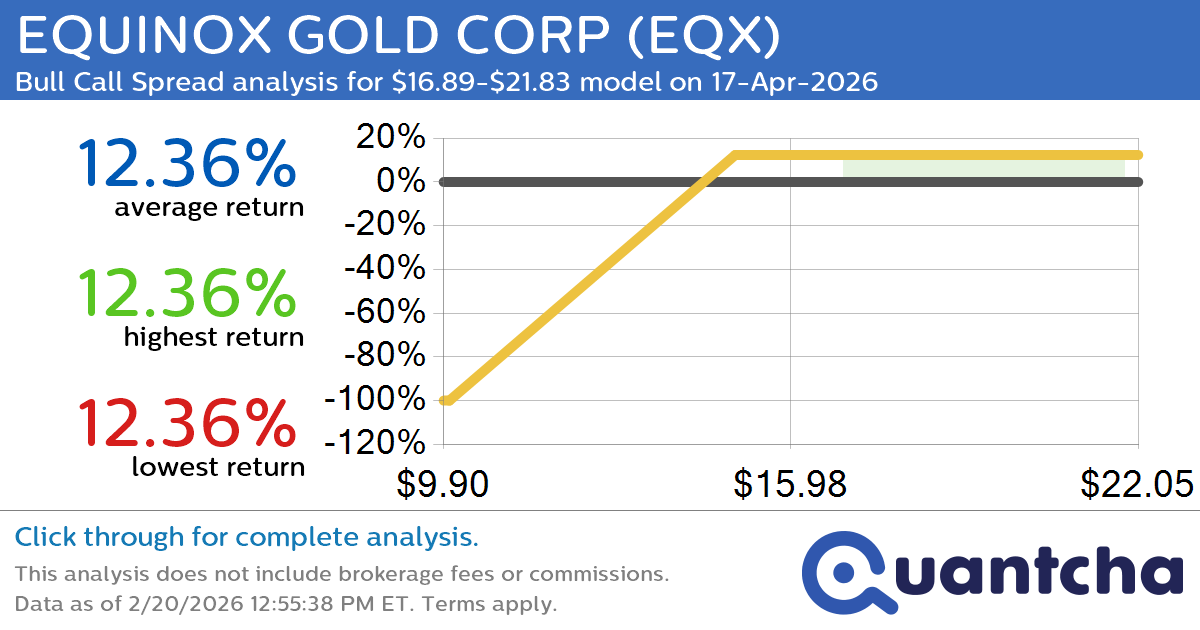

52-Week High Alert: Trading today’s movement in EQUINOX GOLD CORP $EQX

Quantchabot has detected a new Bull Call Spread trade opportunity for EQUINOX GOLD CORP (EQX) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. EQX was recently trading at $16.81 and has an implied volatility of 65.12% for this period. Based on an analysis of…