Category: Trade Ideas

-

52-Week Low Alert: Trading today’s movement in AMBARELLA INC $AMBA

Quantchabot has detected a new Bear Call Spread trade opportunity for AMBARELLA INC (AMBA) for the 24-May-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. AMBA was recently trading at $42.95 and has an implied volatility of 43.94% for this period. Based on an analysis of the…

-

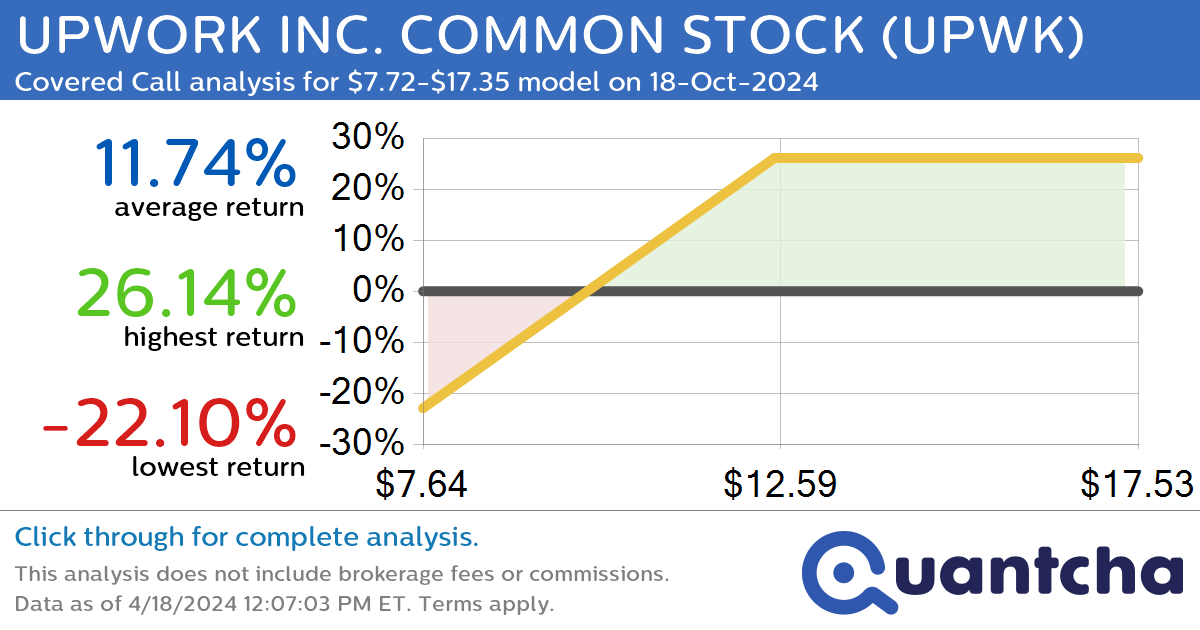

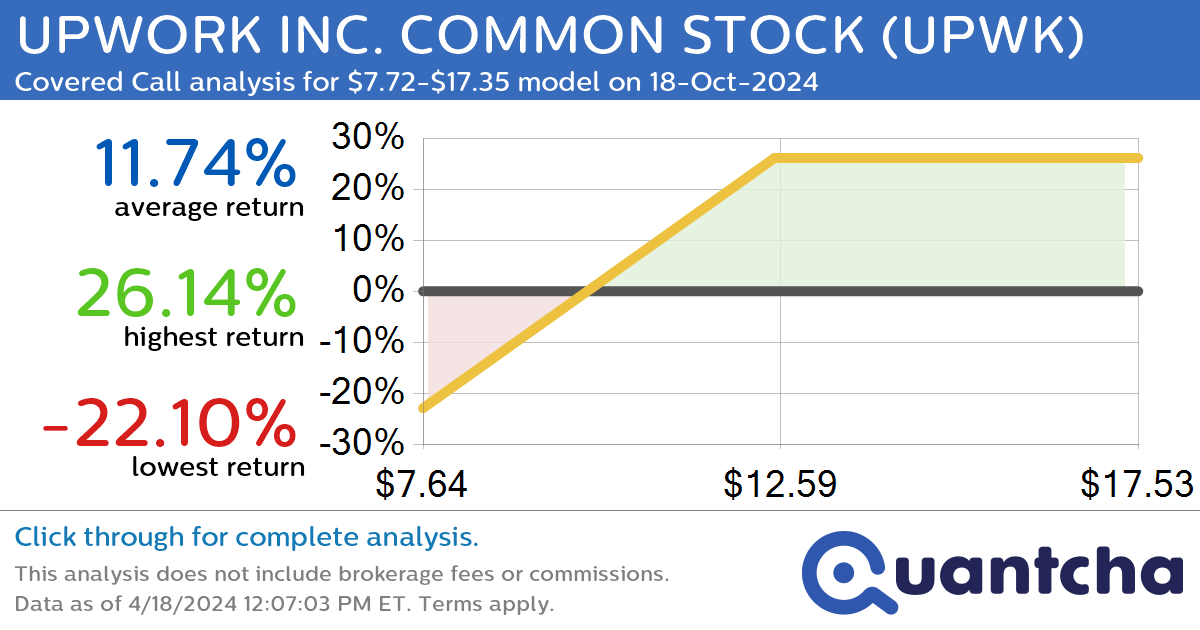

Covered Call Alert: UPWORK INC. COMMON STOCK $UPWK returning up to 26.14% through 18-Oct-2024

Quantchabot has detected a new Covered Call trade opportunity for UPWORK INC. COMMON STOCK (UPWK) for the 18-Oct-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. UPWK was recently trading at $11.26 and has an implied volatility of 57.09% for this period. Based on an analysis of…

-

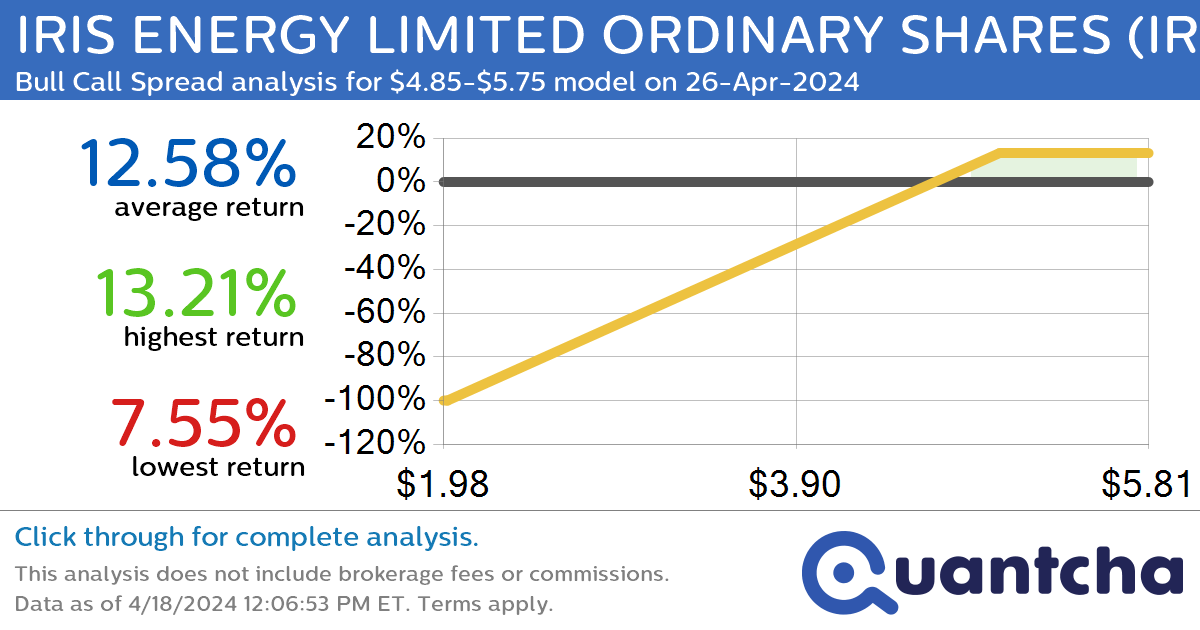

Big Gainer Alert: Trading today’s 7.6% move in IRIS ENERGY LIMITED ORDINARY SHARES $IREN

Quantchabot has detected a new Bull Call Spread trade opportunity for IRIS ENERGY LIMITED ORDINARY SHARES (IREN) for the 26-Apr-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. IREN was recently trading at $4.84 and has an implied volatility of 111.33% for this period. Based on an…

-

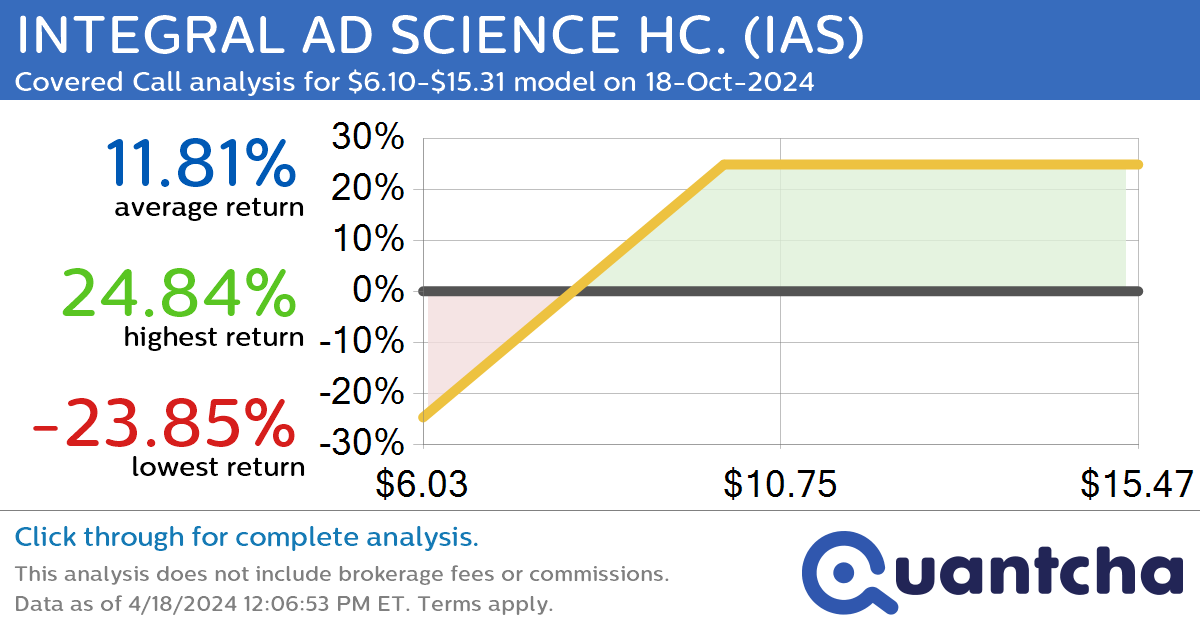

Covered Call Alert: INTEGRAL AD SCIENCE HC. $IAS returning up to 24.84% through 18-Oct-2024

Quantchabot has detected a new Covered Call trade opportunity for INTEGRAL AD SCIENCE HC. (IAS) for the 18-Oct-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. IAS was recently trading at $9.40 and has an implied volatility of 64.82% for this period. Based on an analysis of…

-

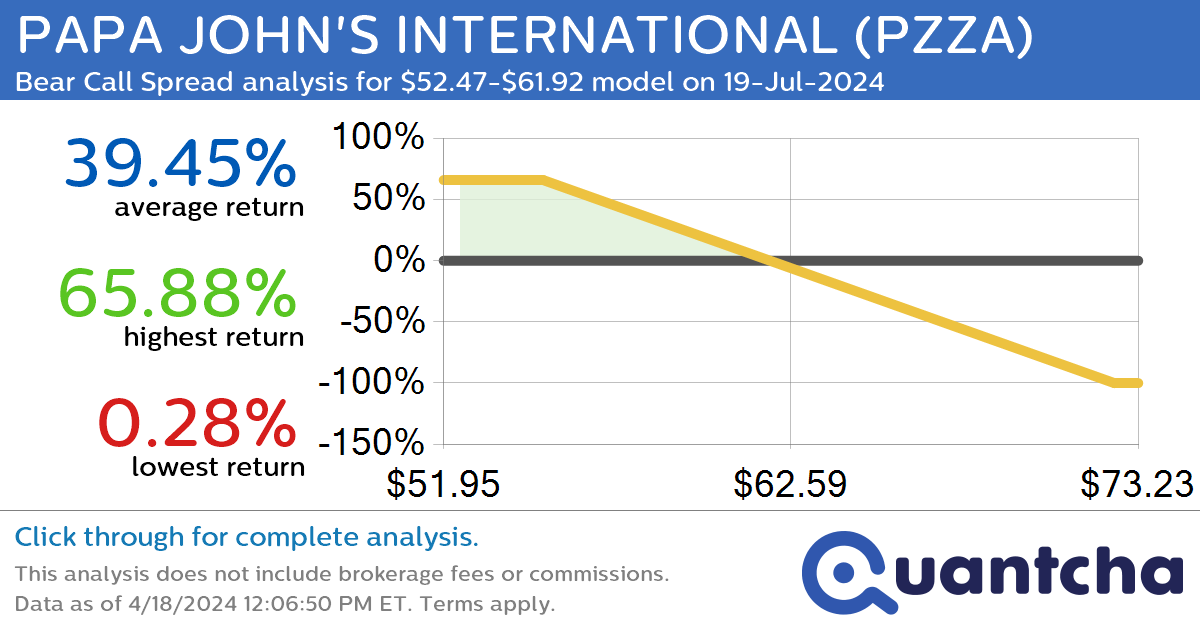

52-Week Low Alert: Trading today’s movement in PAPA JOHN’S INTERNATIONAL $PZZA

Quantchabot has detected a new Bear Call Spread trade opportunity for PAPA JOHN’S INTERNATIONAL (PZZA) for the 19-Jul-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. PZZA was recently trading at $61.05 and has an implied volatility of 32.89% for this period. Based on an analysis of…

-

52-Week Low Alert: Trading today’s movement in RIOT BLOCKCHAIN INC. COMMON STOCK $RIOT

Quantchabot has detected a new Bear Call Spread trade opportunity for RIOT BLOCKCHAIN INC. COMMON STOCK (RIOT) for the 3-May-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. RIOT was recently trading at $8.32 and has an implied volatility of 97.59% for this period. Based on an…

-

Big Gainer Alert: Trading today’s 7.3% move in HUT 8 MINING CORP. COMMON SHARES $HUT

Quantchabot has detected a new Bull Call Spread trade opportunity for HUT 8 MINING CORP. COMMON SHARES (HUT) for the 3-May-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. HUT was recently trading at $7.98 and has an implied volatility of 113.44% for this period. Based on…

-

Covered Call Alert: GLOBAL-E ONLINE LTD. $GLBE returning up to 30.04% through 18-Oct-2024

Quantchabot has detected a new Covered Call trade opportunity for GLOBAL-E ONLINE LTD. (GLBE) for the 18-Oct-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. GLBE was recently trading at $34.15 and has an implied volatility of 55.39% for this period. Based on an analysis of the…

-

Covered Call Alert: DIREXION DAILY S&P500 BEAR 3X $SPXS returning up to 32.45% through 18-Oct-2024

Quantchabot has detected a new Covered Call trade opportunity for DIREXION DAILY S&P500 BEAR 3X (SPXS) for the 18-Oct-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SPXS was recently trading at $9.89 and has an implied volatility of 48.59% for this period. Based on an analysis…

-

Big Gainer Alert: Trading today’s 7.4% move in GIGACLOUD TECHNOLOGY INC CLASS A $GCT

Quantchabot has detected a new Bull Call Spread trade opportunity for GIGACLOUD TECHNOLOGY INC CLASS A (GCT) for the 17-May-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. GCT was recently trading at $37.54 and has an implied volatility of 105.88% for this period. Based on an…