Category: Trade Ideas

-

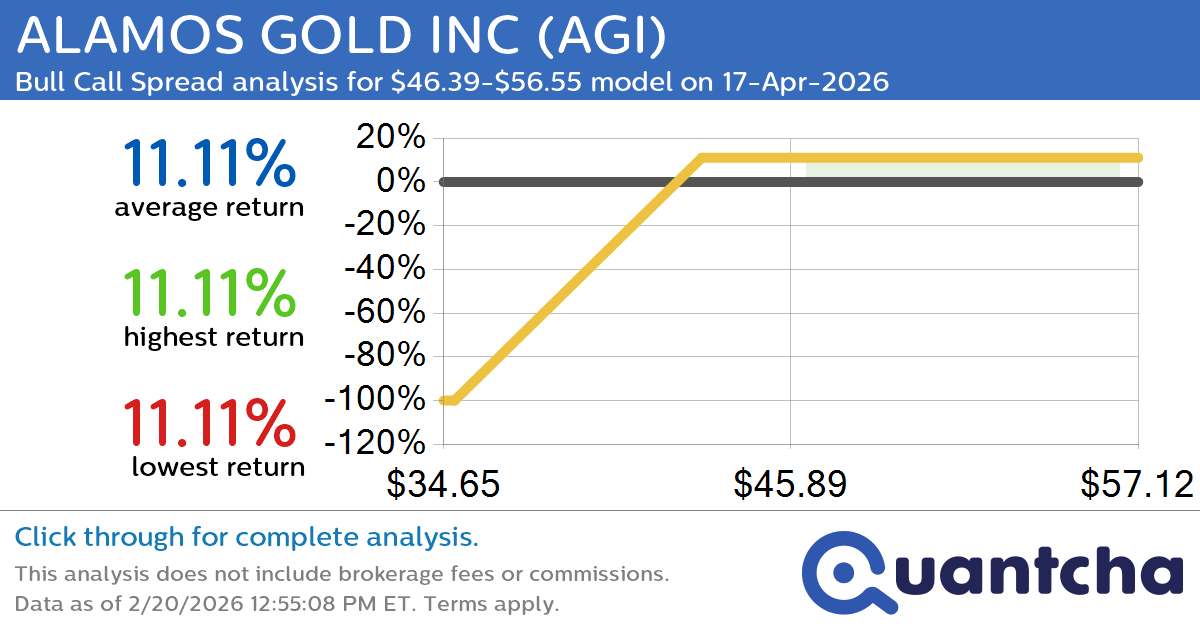

52-Week High Alert: Trading today’s movement in ALAMOS GOLD INC $AGI

Quantchabot has detected a new Bull Call Spread trade opportunity for ALAMOS GOLD INC (AGI) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. AGI was recently trading at $46.16 and has an implied volatility of 50.25% for this period. Based on an analysis of…

-

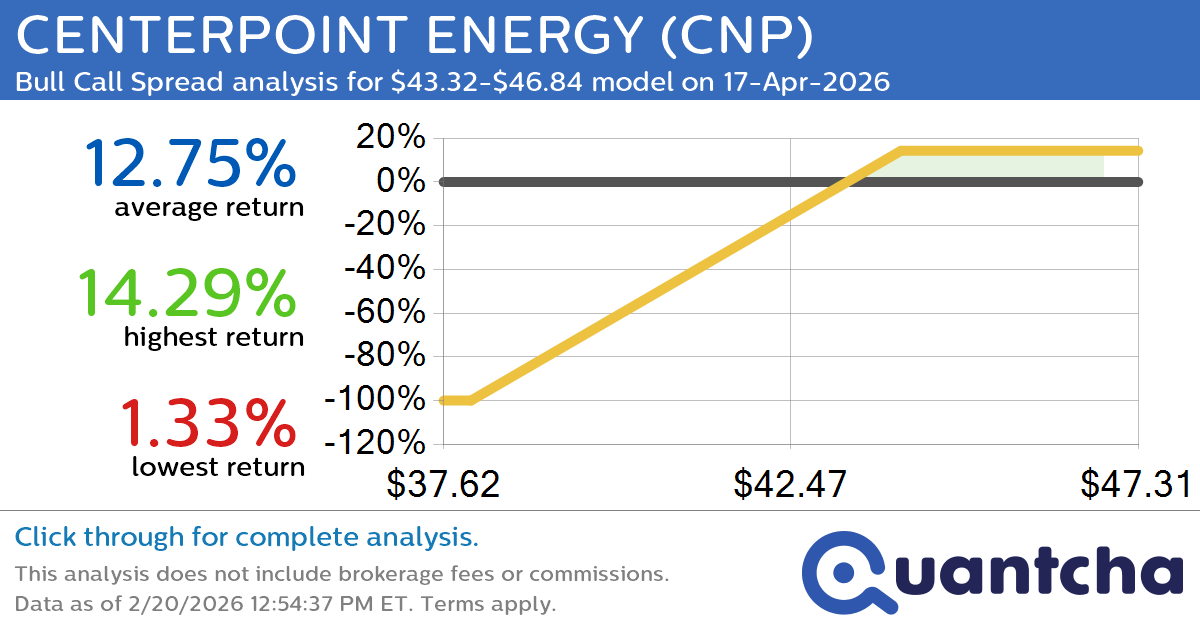

52-Week High Alert: Trading today’s movement in CENTERPOINT ENERGY $CNP

Quantchabot has detected a new Bull Call Spread trade opportunity for CENTERPOINT ENERGY (CNP) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CNP was recently trading at $43.07 and has an implied volatility of 19.82% for this period. Based on an analysis of the…

-

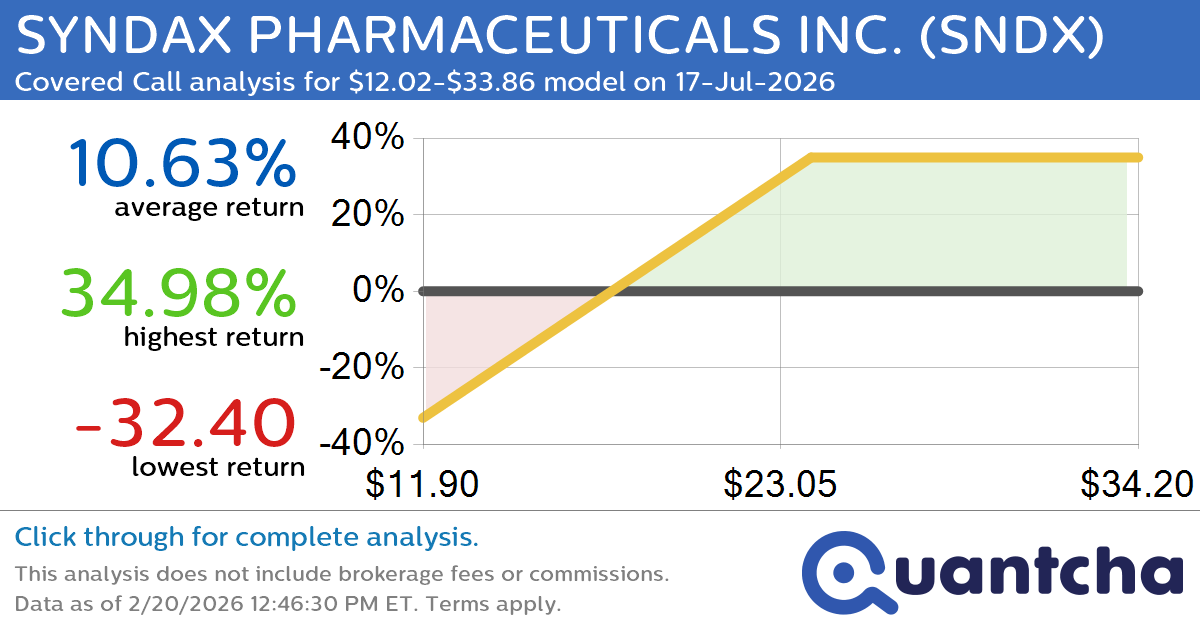

Covered Call Alert: SYNDAX PHARMACEUTICALS INC. $SNDX returning up to 34.98% through 17-Jul-2026

Quantchabot has detected a new Covered Call trade opportunity for SYNDAX PHARMACEUTICALS INC. (SNDX) for the 17-Jul-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SNDX was recently trading at $19.87 and has an implied volatility of 81.39% for this period. Based on an analysis of the…

-

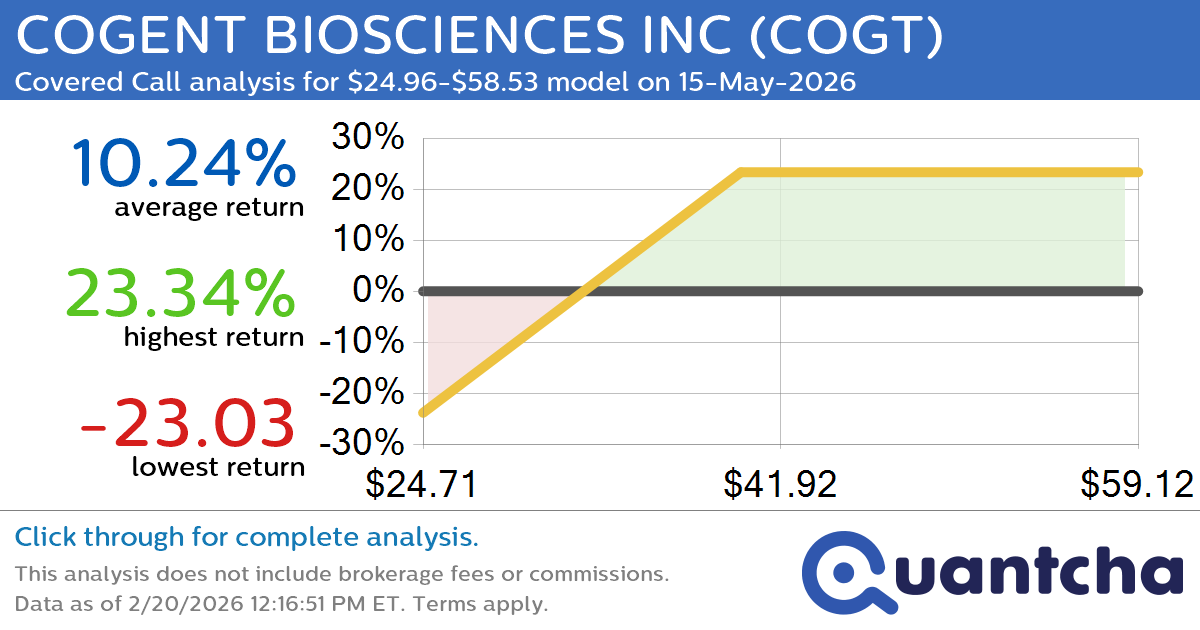

Covered Call Alert: COGENT BIOSCIENCES INC $COGT returning up to 23.34% through 15-May-2026

Quantchabot has detected a new Covered Call trade opportunity for COGENT BIOSCIENCES INC (COGT) for the 15-May-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. COGT was recently trading at $37.89 and has an implied volatility of 88.45% for this period. Based on an analysis of the…

-

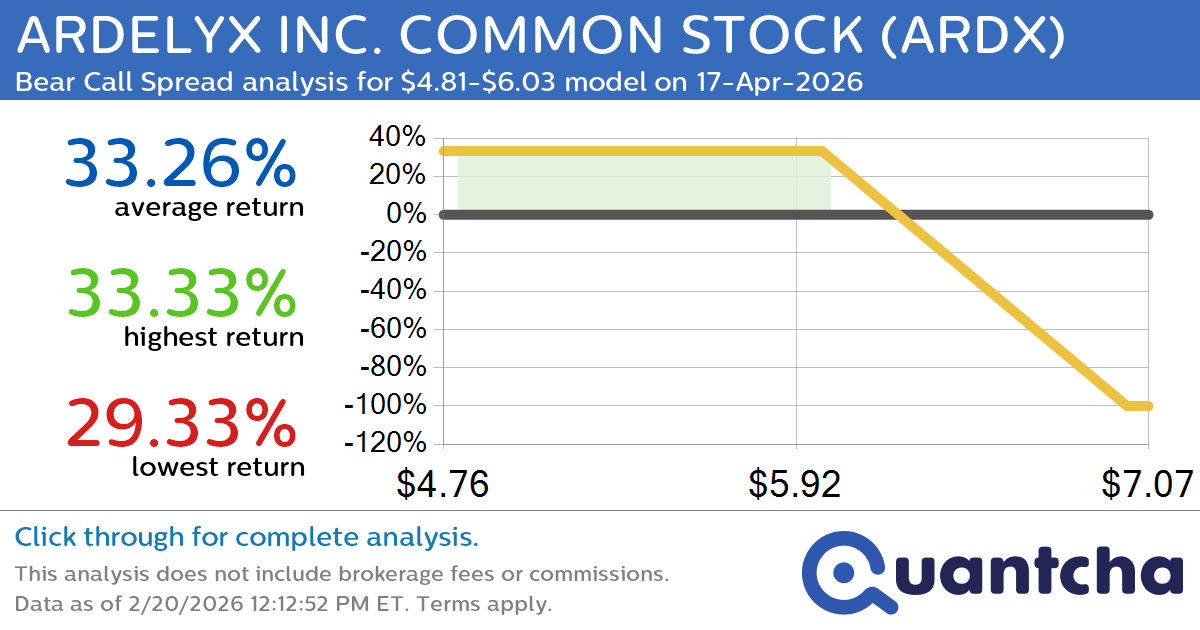

Big Loser Alert: Trading today’s -11.1% move in ARDELYX INC. COMMON STOCK $ARDX

Quantchabot has detected a new Bear Call Spread trade opportunity for ARDELYX INC. COMMON STOCK (ARDX) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ARDX was recently trading at $6.00 and has an implied volatility of 57.17% for this period. Based on an analysis…

-

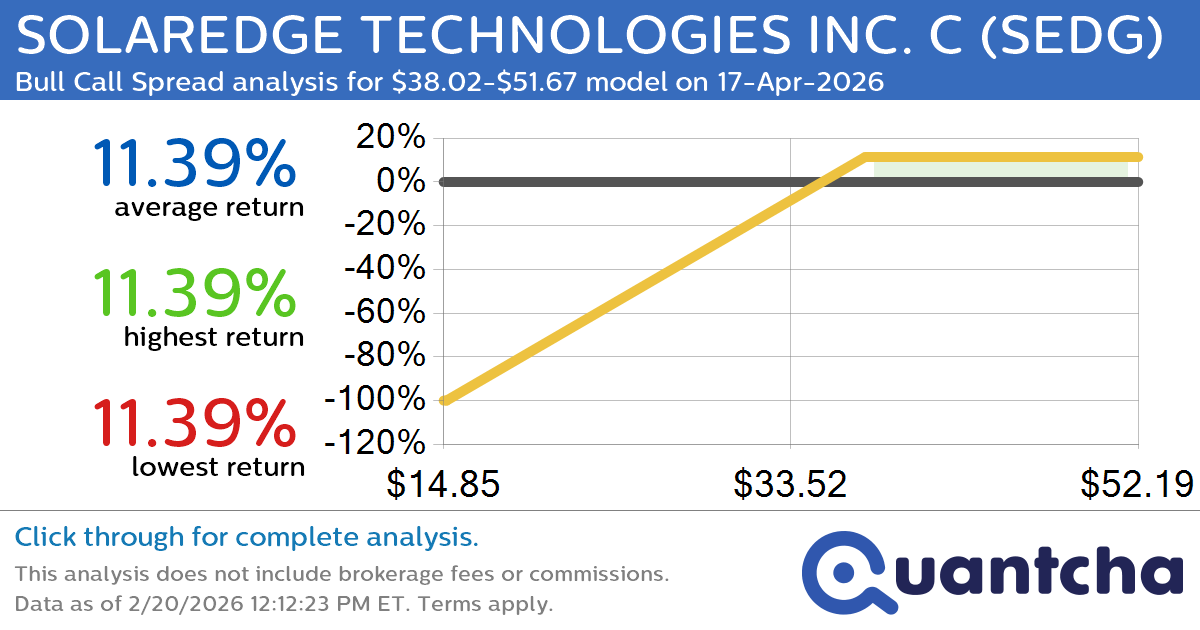

Big Gainer Alert: Trading today’s 8.1% move in SOLAREDGE TECHNOLOGIES INC. C $SEDG

Quantchabot has detected a new Bull Call Spread trade opportunity for SOLAREDGE TECHNOLOGIES INC. C (SEDG) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SEDG was recently trading at $37.80 and has an implied volatility of 77.81% for this period. Based on an analysis…

-

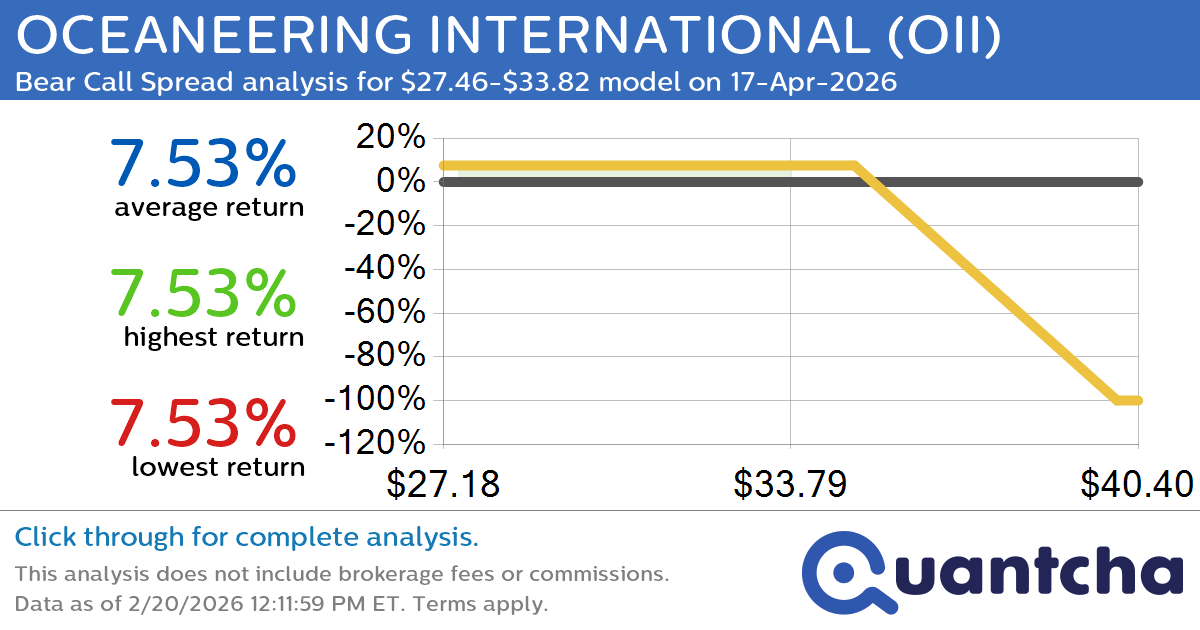

Big Loser Alert: Trading today’s -7.1% move in OCEANEERING INTERNATIONAL $OII

Quantchabot has detected a new Bear Call Spread trade opportunity for OCEANEERING INTERNATIONAL (OII) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. OII was recently trading at $33.62 and has an implied volatility of 52.86% for this period. Based on an analysis of the…

-

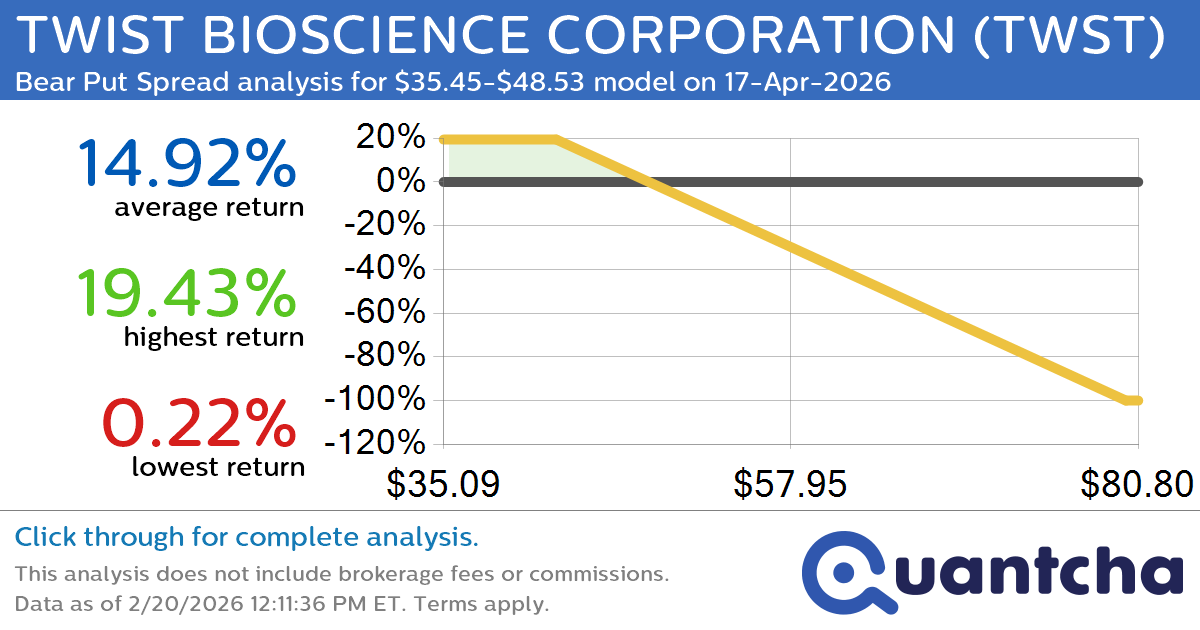

Big Loser Alert: Trading today’s -8.1% move in TWIST BIOSCIENCE CORPORATION $TWST

Quantchabot has detected a new Bear Put Spread trade opportunity for TWIST BIOSCIENCE CORPORATION (TWST) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TWST was recently trading at $48.25 and has an implied volatility of 79.70% for this period. Based on an analysis of…

-

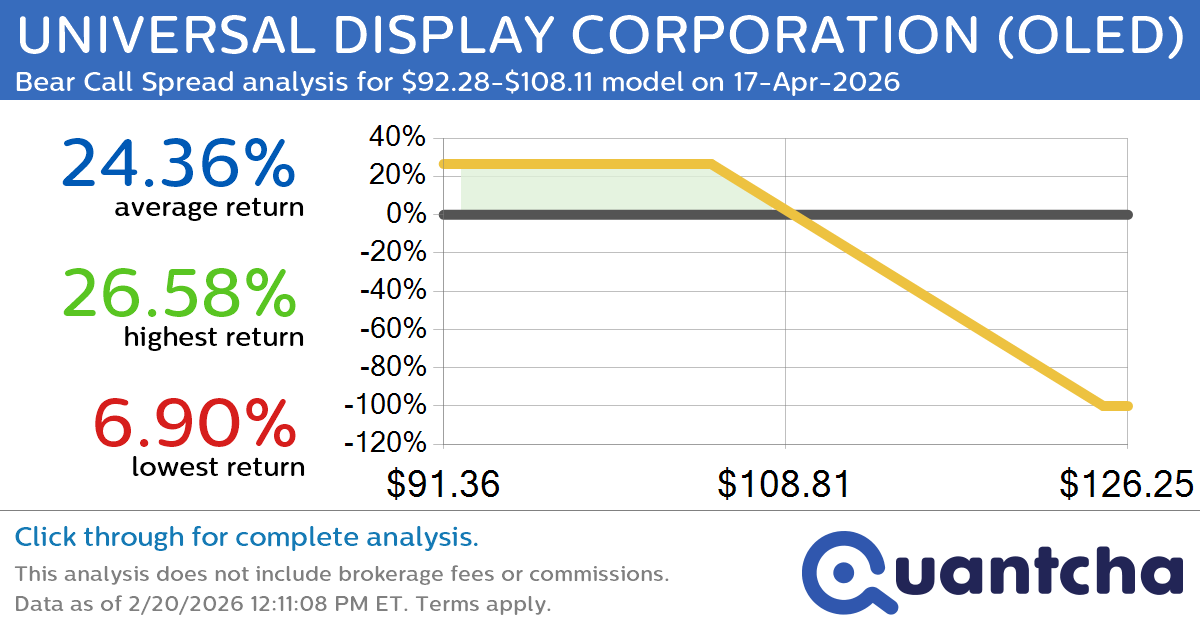

Big Loser Alert: Trading today’s -7.8% move in UNIVERSAL DISPLAY CORPORATION $OLED

Quantchabot has detected a new Bear Call Spread trade opportunity for UNIVERSAL DISPLAY CORPORATION (OLED) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. OLED was recently trading at $107.98 and has an implied volatility of 40.19% for this period. Based on an analysis of…

-

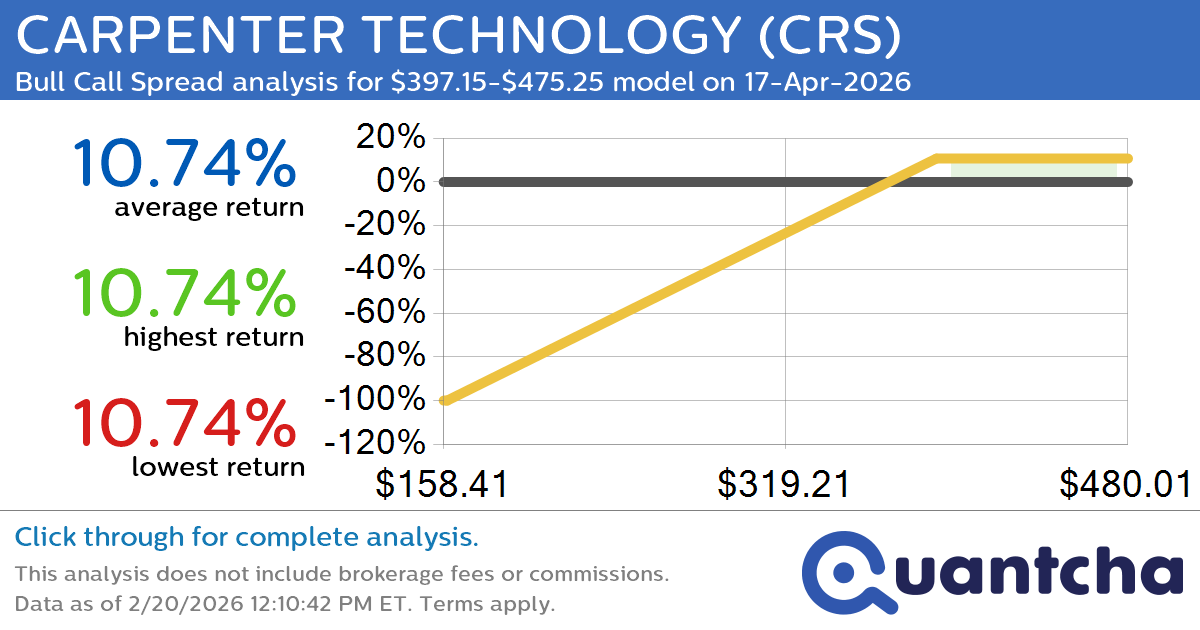

52-Week High Alert: Trading today’s movement in CARPENTER TECHNOLOGY $CRS

Quantchabot has detected a new Bull Call Spread trade opportunity for CARPENTER TECHNOLOGY (CRS) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CRS was recently trading at $394.82 and has an implied volatility of 45.55% for this period. Based on an analysis of the…