Category: Trade Ideas

-

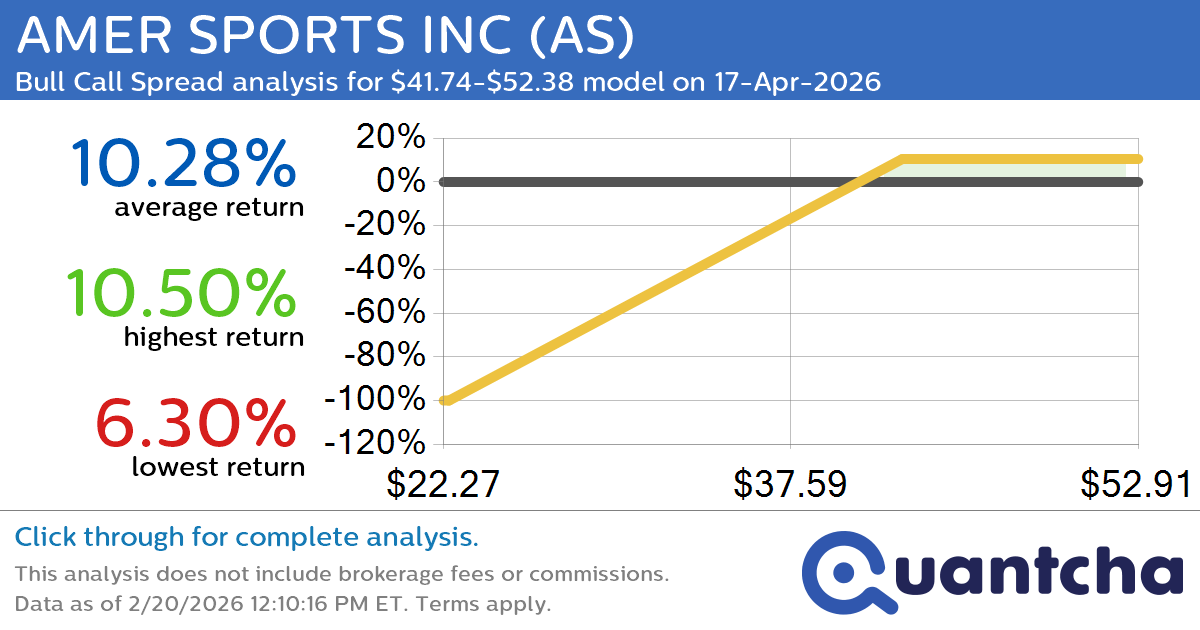

52-Week High Alert: Trading today’s movement in AMER SPORTS INC $AS

Quantchabot has detected a new Bull Call Spread trade opportunity for AMER SPORTS INC (AS) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. AS was recently trading at $41.49 and has an implied volatility of 57.58% for this period. Based on an analysis of…

-

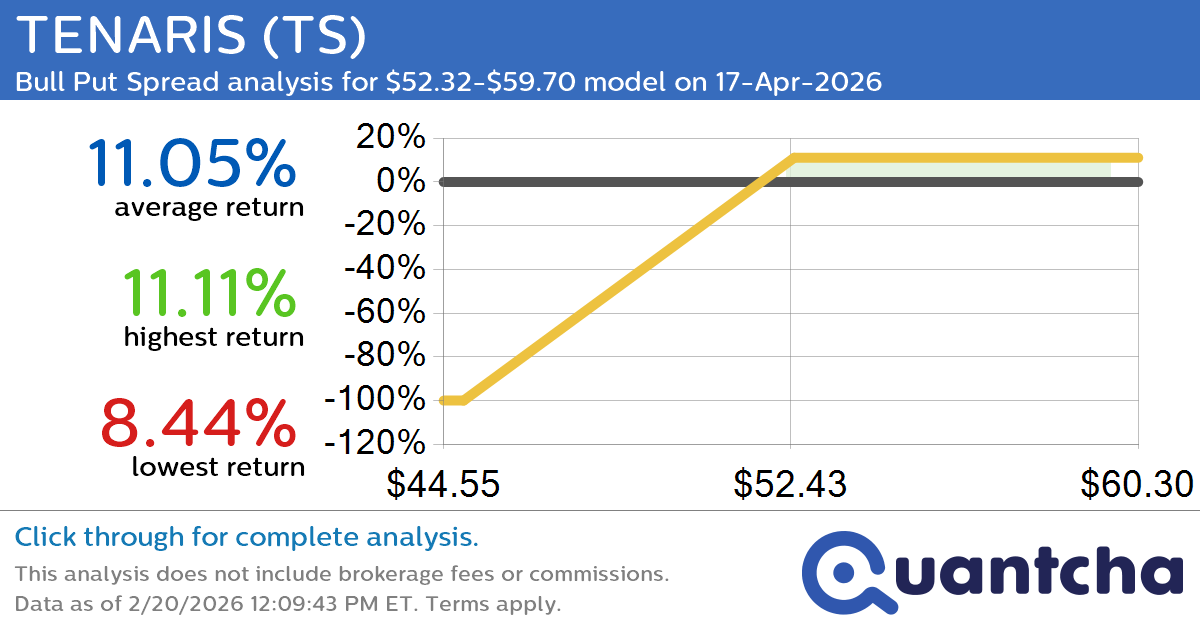

52-Week High Alert: Trading today’s movement in TENARIS $TS

Quantchabot has detected a new Bull Put Spread trade opportunity for TENARIS (TS) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TS was recently trading at $52.02 and has an implied volatility of 33.45% for this period. Based on an analysis of the options…

-

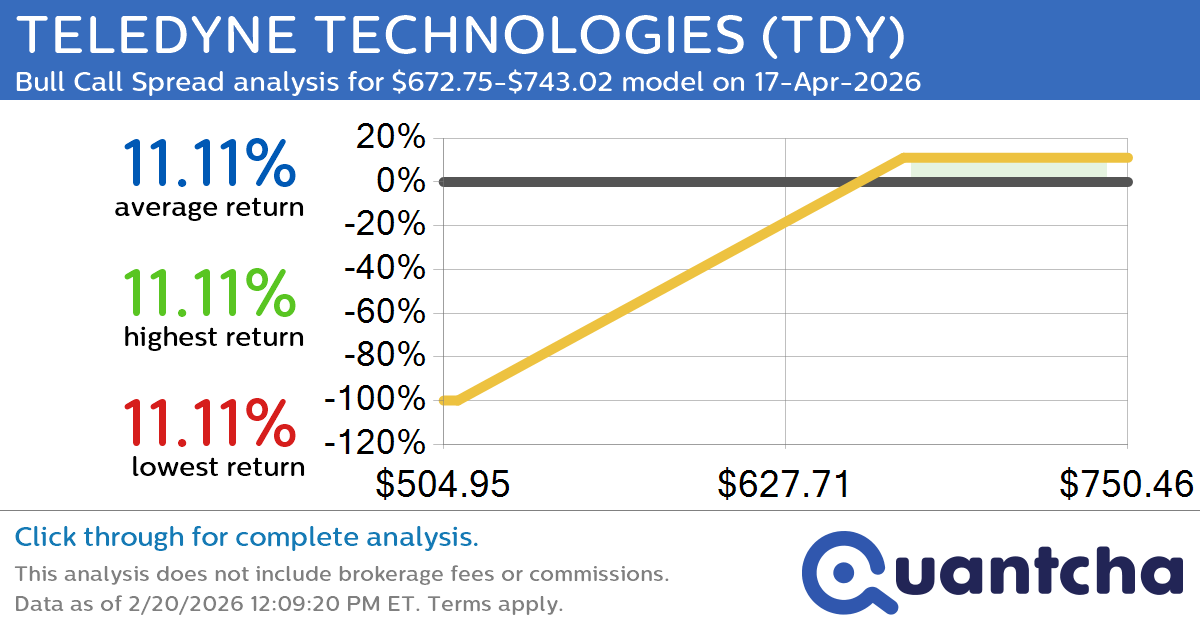

52-Week High Alert: Trading today’s movement in TELEDYNE TECHNOLOGIES $TDY

Quantchabot has detected a new Bull Call Spread trade opportunity for TELEDYNE TECHNOLOGIES (TDY) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TDY was recently trading at $668.80 and has an implied volatility of 25.21% for this period. Based on an analysis of the…

-

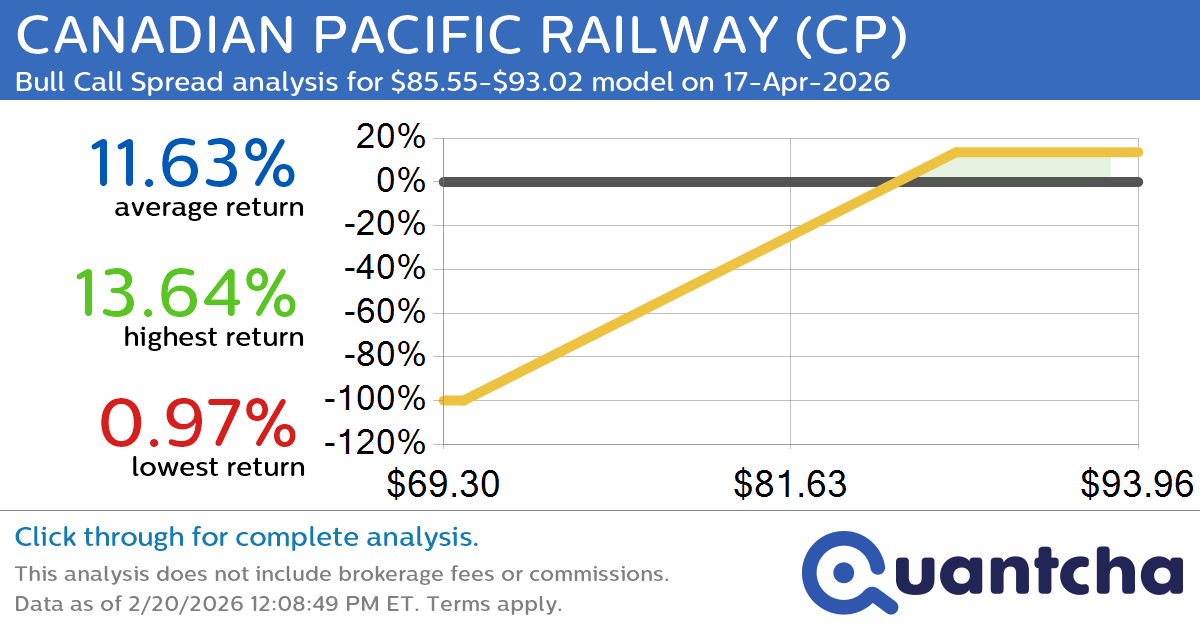

52-Week High Alert: Trading today’s movement in CANADIAN PACIFIC RAILWAY $CP

Quantchabot has detected a new Bull Call Spread trade opportunity for CANADIAN PACIFIC RAILWAY (CP) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CP was recently trading at $85.22 and has an implied volatility of 21.22% for this period. Based on an analysis of…

-

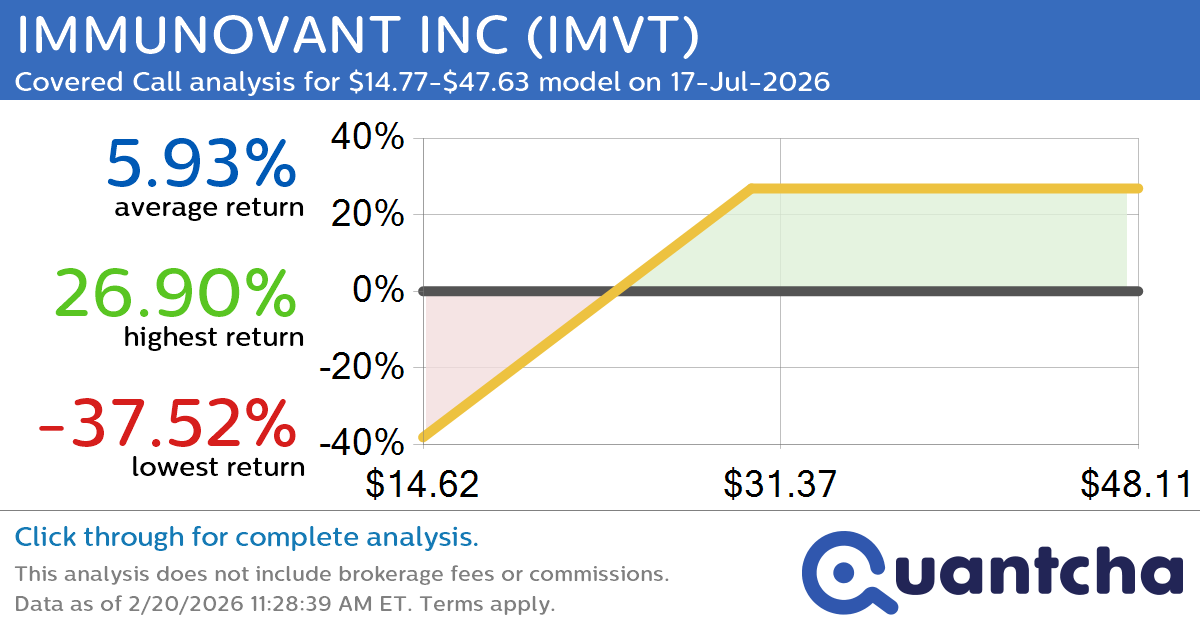

Covered Call Alert: IMMUNOVANT INC $IMVT returning up to 32.22% through 17-Jul-2026

Quantchabot has detected a new Covered Call trade opportunity for IMMUNOVANT INC (IMVT) for the 17-Jul-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. IMVT was recently trading at $26.12 and has an implied volatility of 92.00% for this period. Based on an analysis of the options…

-

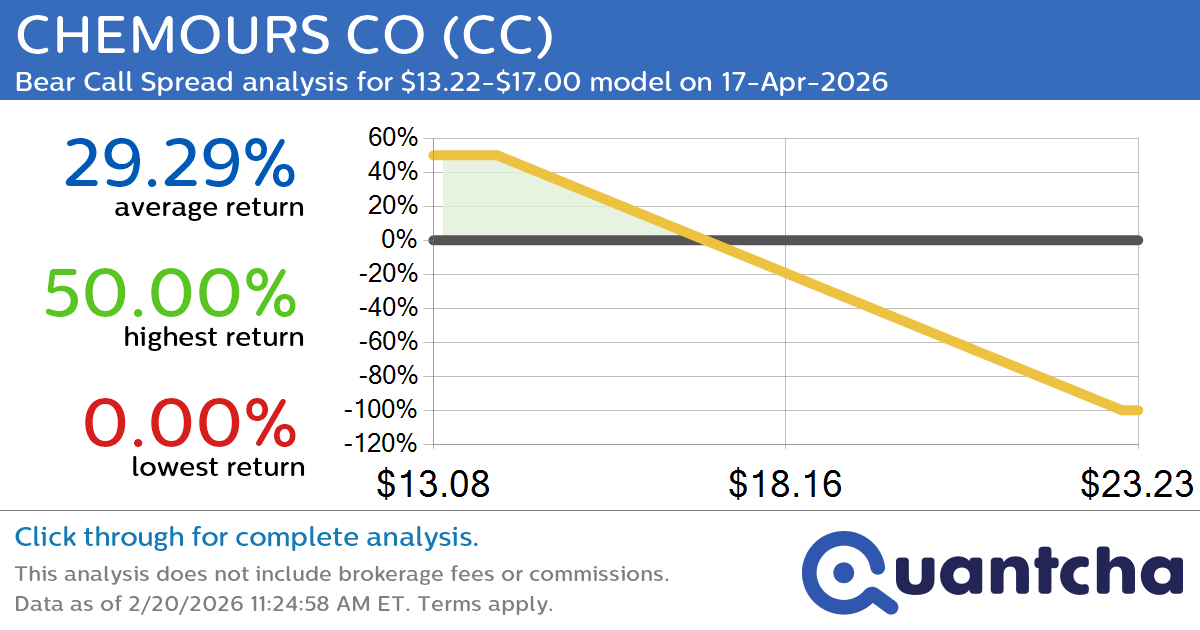

Big Loser Alert: Trading today’s -16.8% move in CHEMOURS CO $CC

Quantchabot has detected a new Bear Call Spread trade opportunity for CHEMOURS CO (CC) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CC was recently trading at $16.98 and has an implied volatility of 63.68% for this period. Based on an analysis of the…

-

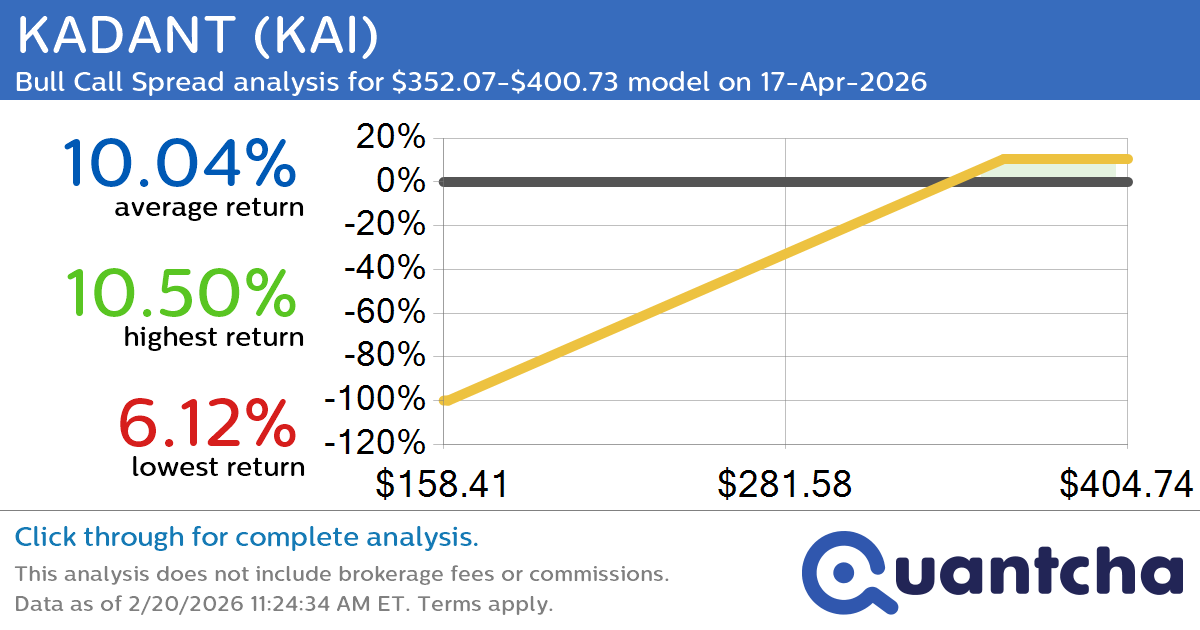

Big Gainer Alert: Trading today’s 7.0% move in KADANT $KAI

Quantchabot has detected a new Bull Call Spread trade opportunity for KADANT (KAI) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. KAI was recently trading at $350.00 and has an implied volatility of 32.84% for this period. Based on an analysis of the options…

-

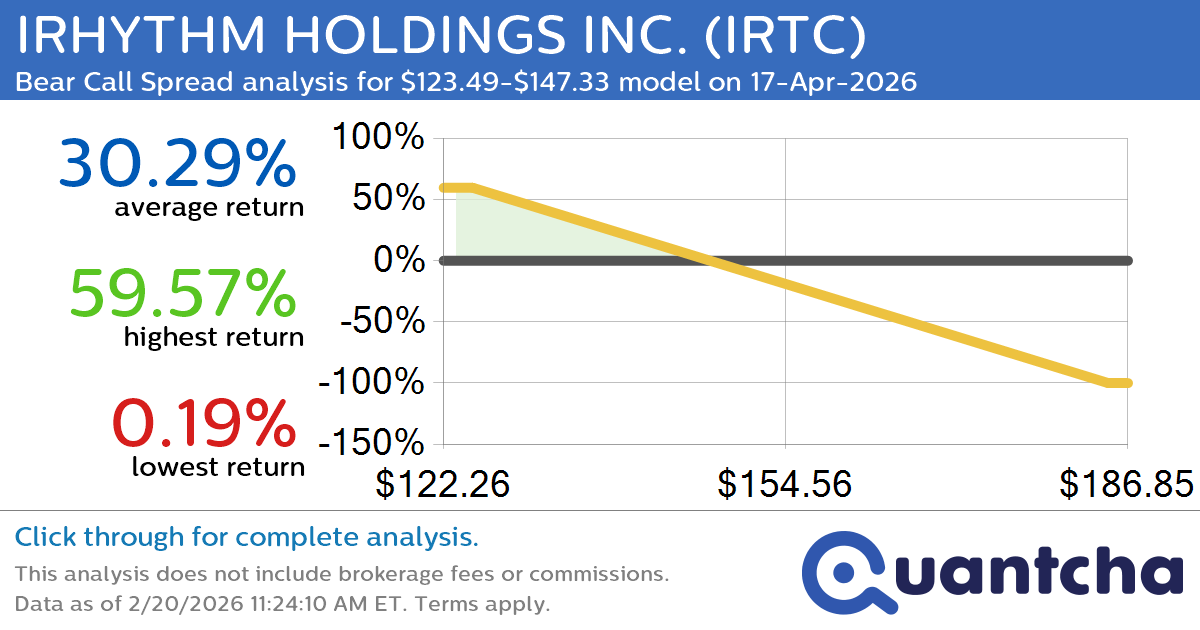

Big Loser Alert: Trading today’s -7.8% move in IRHYTHM HOLDINGS INC. $IRTC

Quantchabot has detected a new Bear Call Spread trade opportunity for IRHYTHM HOLDINGS INC. (IRTC) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. IRTC was recently trading at $146.46 and has an implied volatility of 44.77% for this period. Based on an analysis of…

-

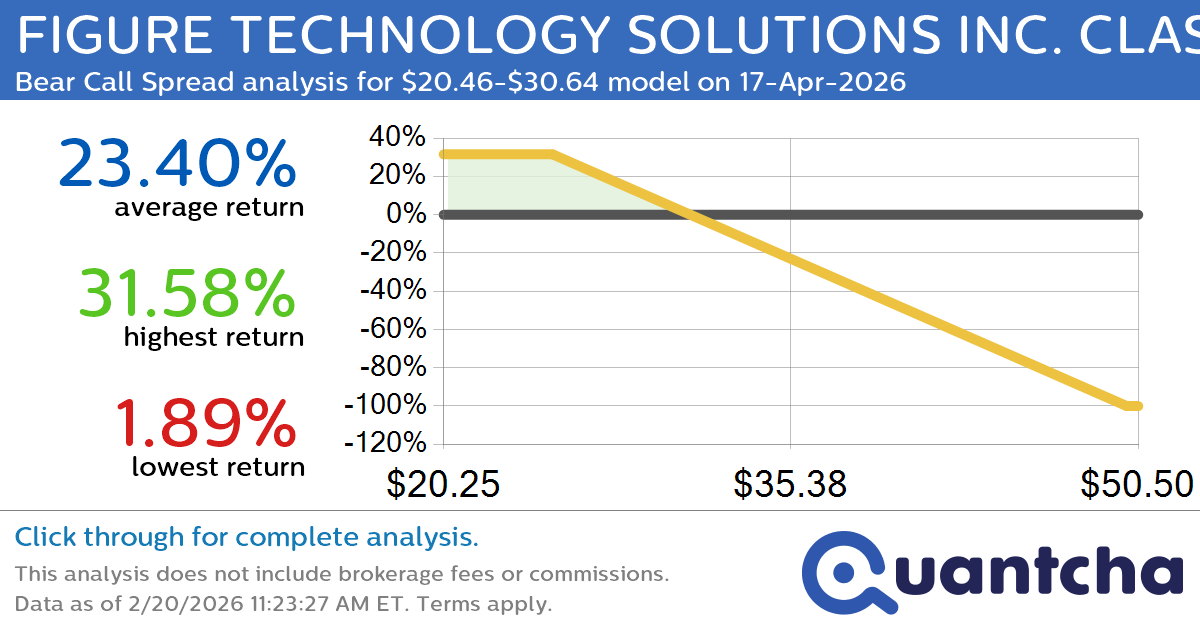

Big Loser Alert: Trading today’s -7.5% move in FIGURE TECHNOLOGY SOLUTIONS INC. CLASS A $FIGR

Quantchabot has detected a new Bear Call Spread trade opportunity for FIGURE TECHNOLOGY SOLUTIONS INC. CLASS A (FIGR) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. FIGR was recently trading at $30.46 and has an implied volatility of 102.41% for this period. Based on…

-

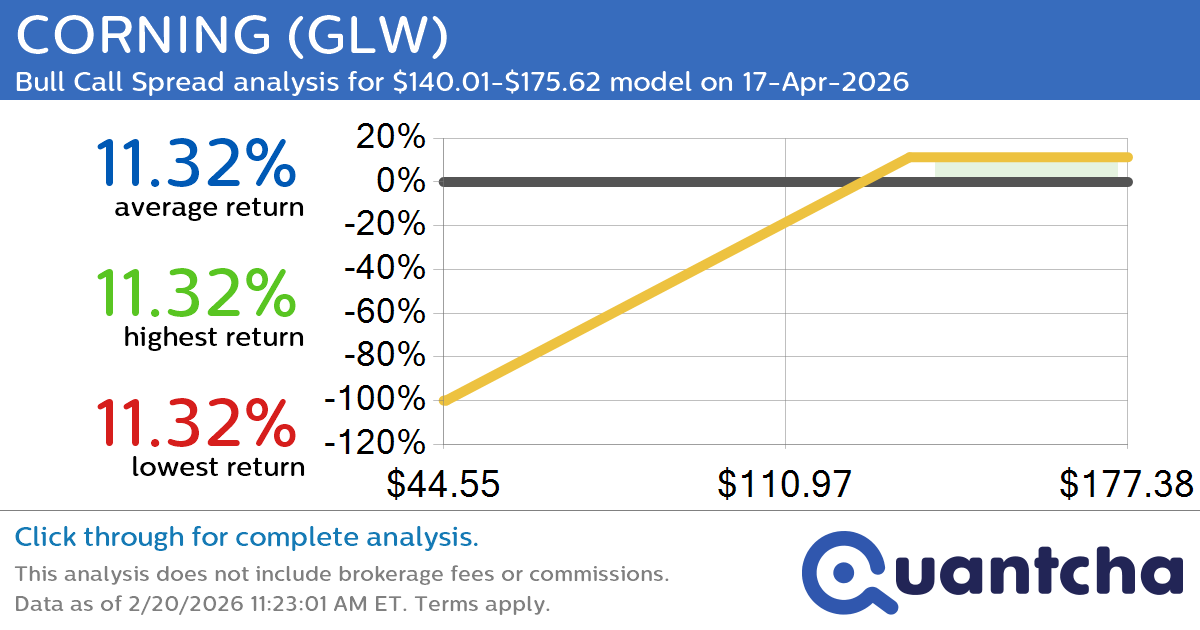

Big Gainer Alert: Trading today’s 7.3% move in CORNING $GLW

Quantchabot has detected a new Bull Call Spread trade opportunity for CORNING (GLW) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. GLW was recently trading at $139.47 and has an implied volatility of 57.47% for this period. Based on an analysis of the options…