Category: Trade Ideas

-

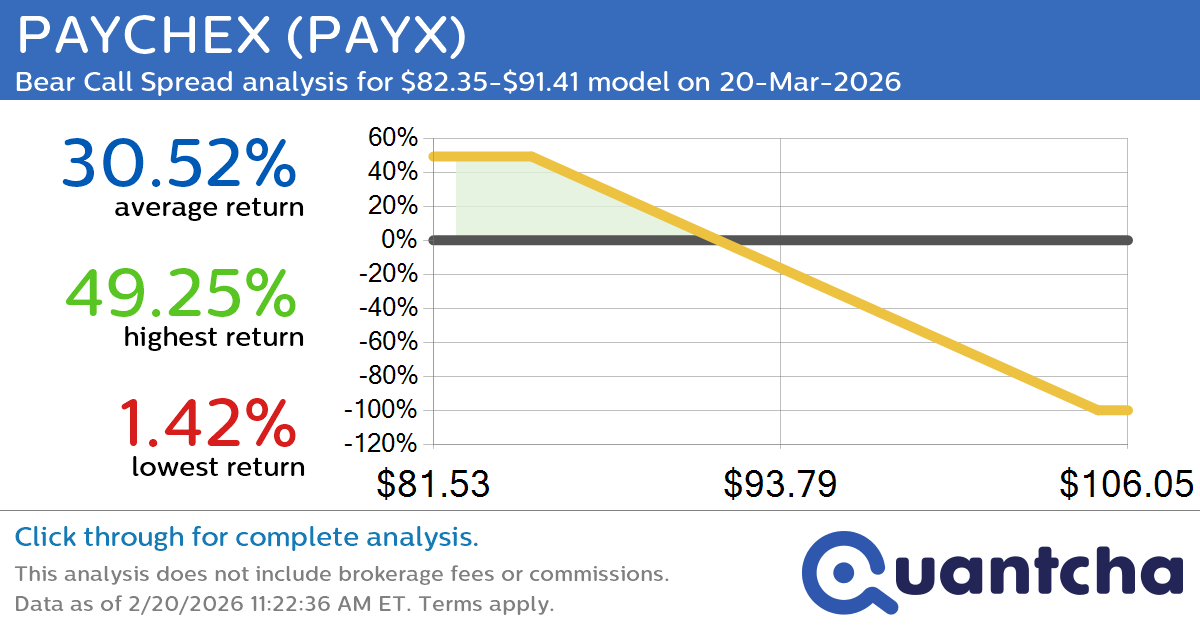

52-Week Low Alert: Trading today’s movement in PAYCHEX $PAYX

Quantchabot has detected a new Bear Call Spread trade opportunity for PAYCHEX (PAYX) for the 20-Mar-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. PAYX was recently trading at $91.14 and has an implied volatility of 37.18% for this period. Based on an analysis of the options…

-

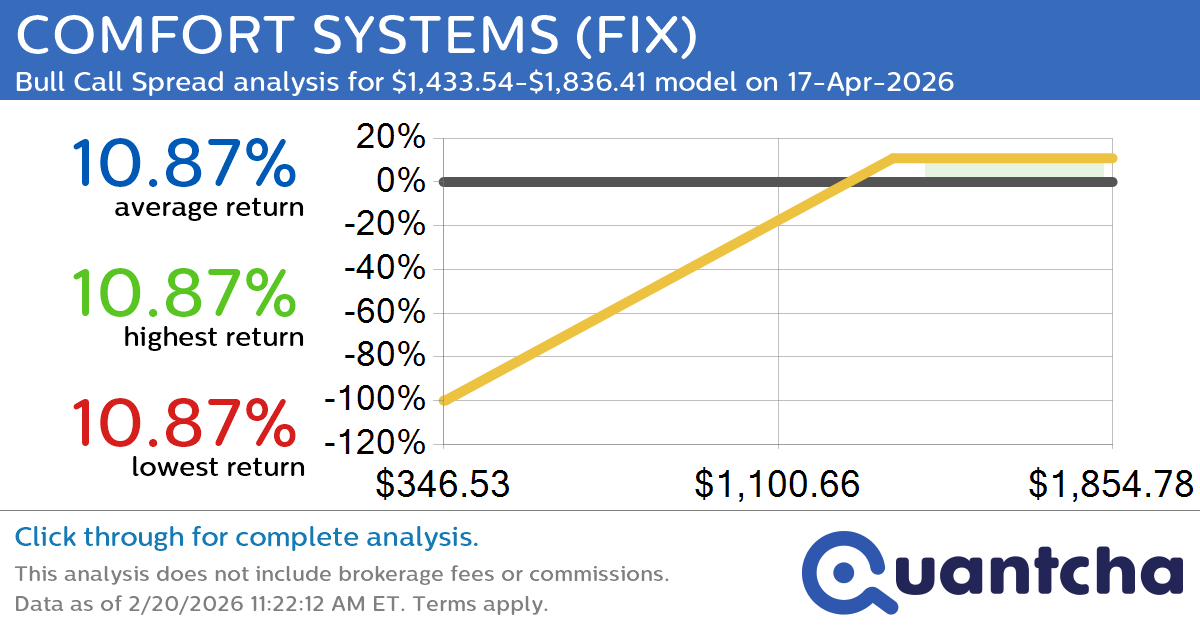

52-Week High Alert: Trading today’s movement in COMFORT SYSTEMS $FIX

Quantchabot has detected a new Bull Call Spread trade opportunity for COMFORT SYSTEMS (FIX) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. FIX was recently trading at $1,425.82 and has an implied volatility of 62.82% for this period. Based on an analysis of the…

-

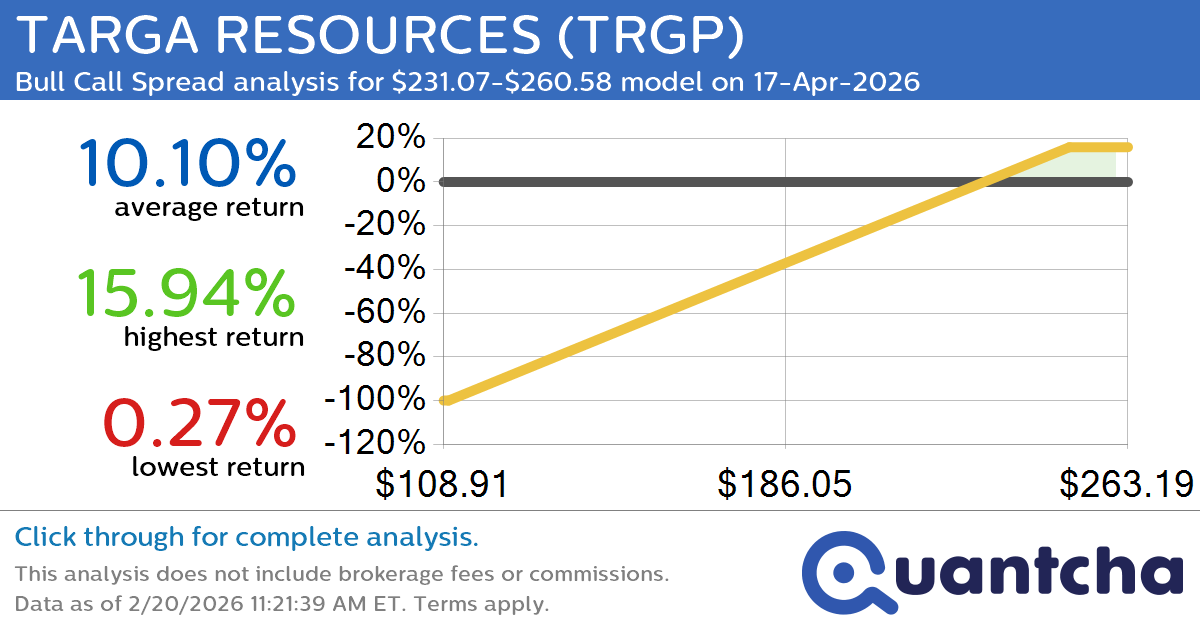

52-Week High Alert: Trading today’s movement in TARGA RESOURCES $TRGP

Quantchabot has detected a new Bull Call Spread trade opportunity for TARGA RESOURCES (TRGP) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TRGP was recently trading at $229.71 and has an implied volatility of 30.49% for this period. Based on an analysis of the…

-

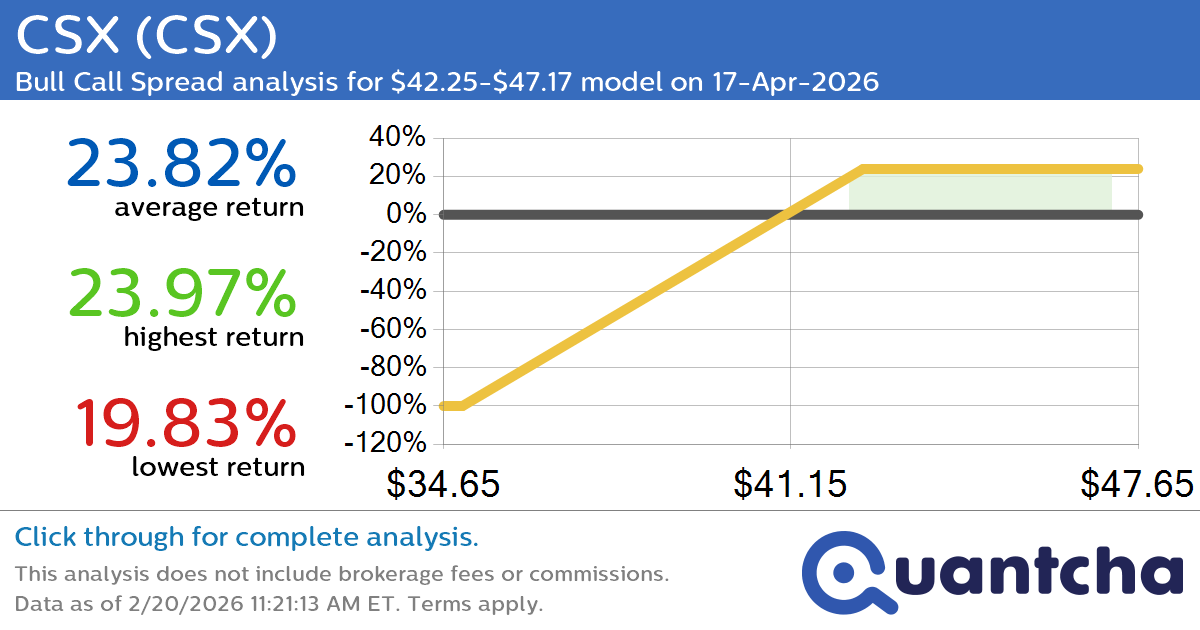

52-Week High Alert: Trading today’s movement in CSX $CSX

Quantchabot has detected a new Bull Call Spread trade opportunity for CSX (CSX) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CSX was recently trading at $42.01 and has an implied volatility of 27.89% for this period. Based on an analysis of the options…

-

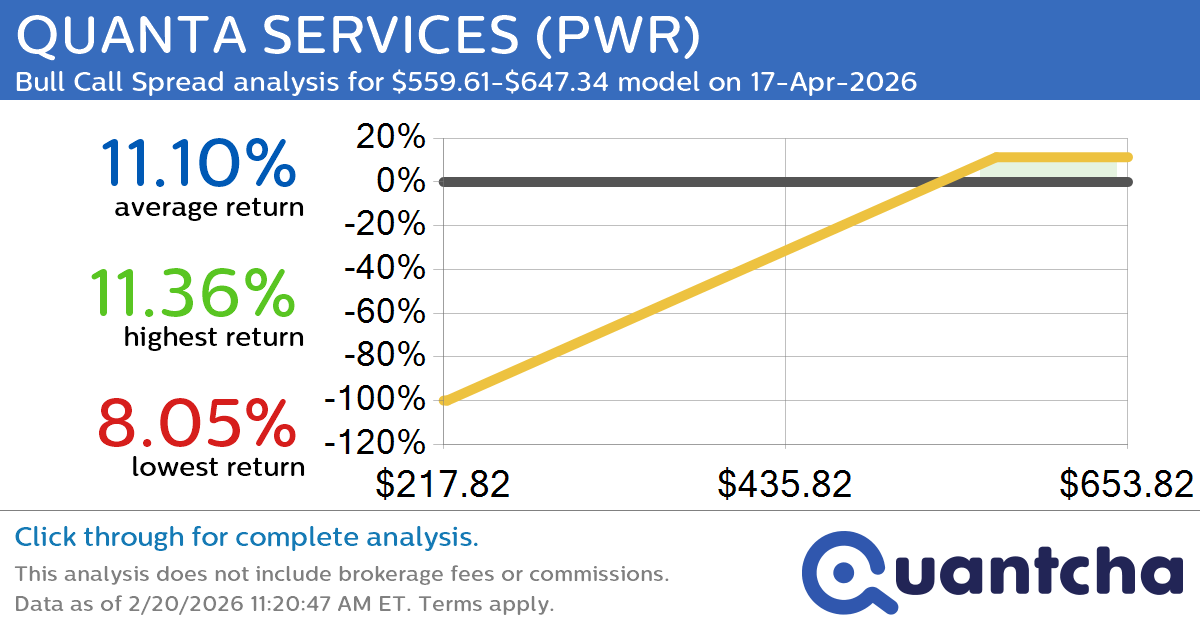

52-Week High Alert: Trading today’s movement in QUANTA SERVICES $PWR

Quantchabot has detected a new Bull Call Spread trade opportunity for QUANTA SERVICES (PWR) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. PWR was recently trading at $556.32 and has an implied volatility of 36.94% for this period. Based on an analysis of the…

-

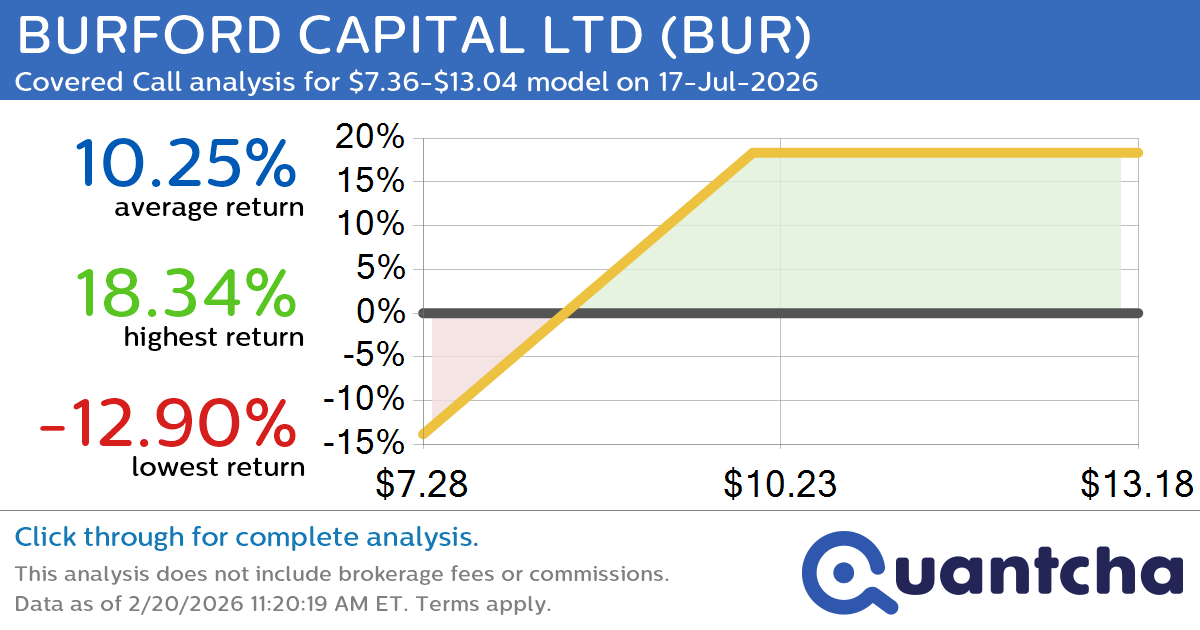

Covered Call Alert: BURFORD CAPITAL LTD $BUR returning up to 18.34% through 17-Jul-2026

Quantchabot has detected a new Covered Call trade opportunity for BURFORD CAPITAL LTD (BUR) for the 17-Jul-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. BUR was recently trading at $9.65 and has an implied volatility of 44.91% for this period. Based on an analysis of the…

-

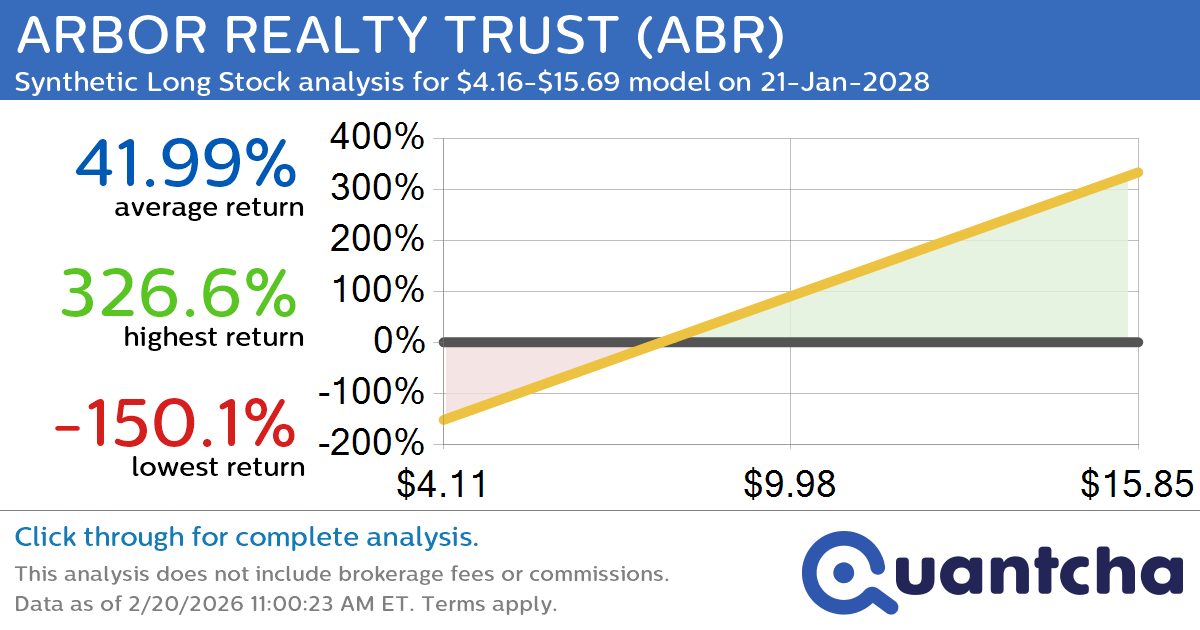

Synthetic Long Discount Alert: ARBOR REALTY TRUST $ABR trading at a 15.44% discount for the 21-Jan-2028 expiration

Quantchabot has detected a new Synthetic Long Stock trade opportunity for ARBOR REALTY TRUST (ABR) for the 21-Jan-2028 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ABR was recently trading at $7.54 and has an implied volatility of 47.89% for this period. Based on an analysis of…

-

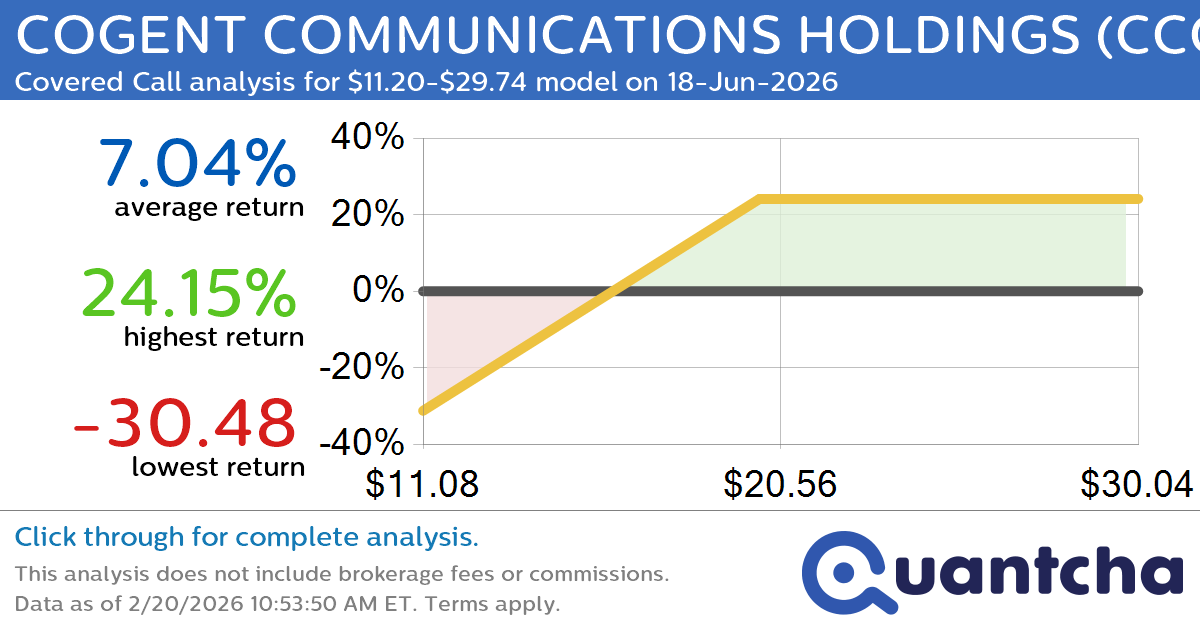

Covered Call Alert: COGENT COMMUNICATIONS HOLDINGS $CCOI returning up to 31.49% through 18-Jun-2026

Quantchabot has detected a new Covered Call trade opportunity for COGENT COMMUNICATIONS HOLDINGS (CCOI) for the 18-Jun-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CCOI was recently trading at $18.03 and has an implied volatility of 85.58% for this period. Based on an analysis of the…

-

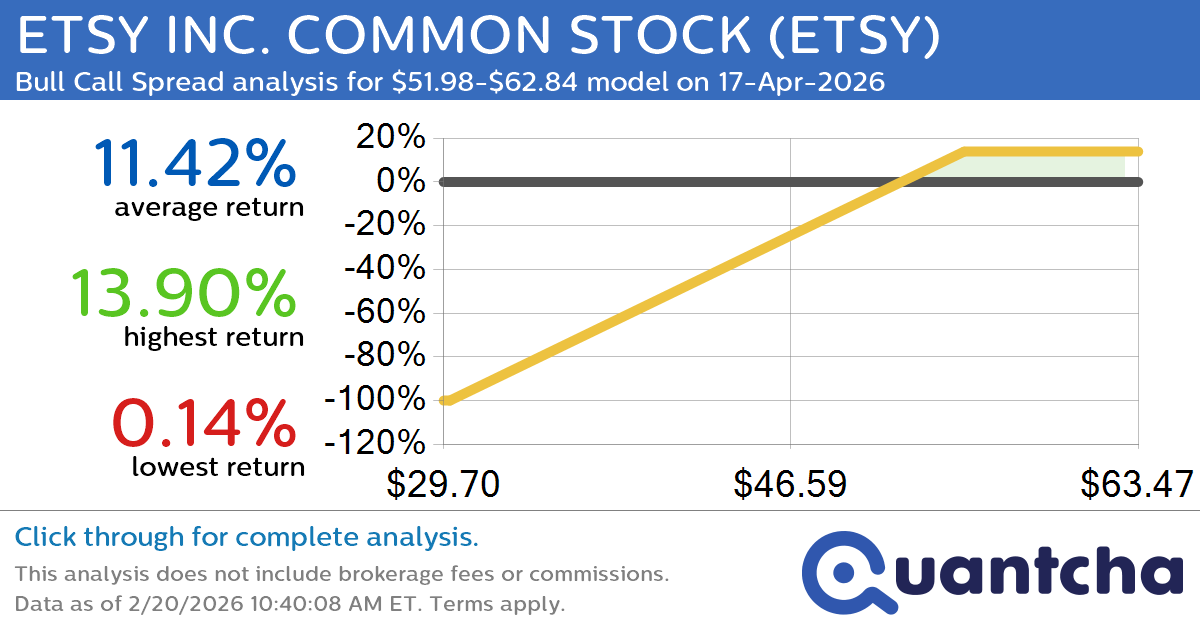

Big Gainer Alert: Trading today’s 7.3% move in ETSY INC. COMMON STOCK $ETSY

Quantchabot has detected a new Bull Call Spread trade opportunity for ETSY INC. COMMON STOCK (ETSY) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ETSY was recently trading at $51.67 and has an implied volatility of 48.09% for this period. Based on an analysis…

-

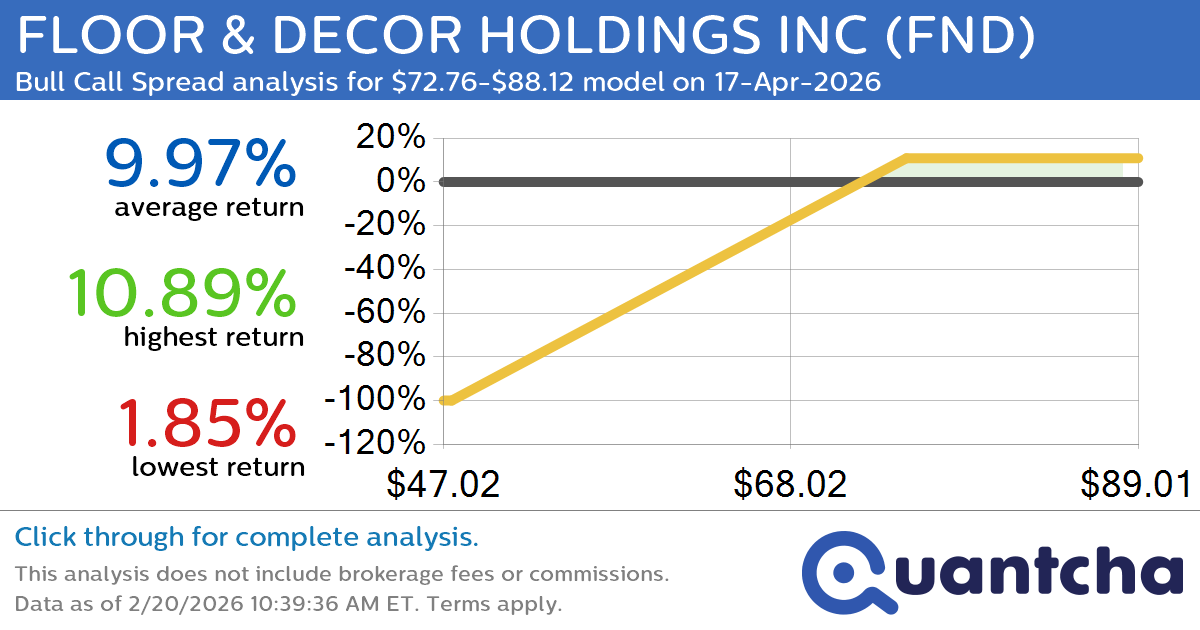

Big Gainer Alert: Trading today’s 9.4% move in FLOOR & DECOR HOLDINGS INC $FND

Quantchabot has detected a new Bull Call Spread trade opportunity for FLOOR & DECOR HOLDINGS INC (FND) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. FND was recently trading at $72.33 and has an implied volatility of 48.57% for this period. Based on an…