Category: Trade Ideas

-

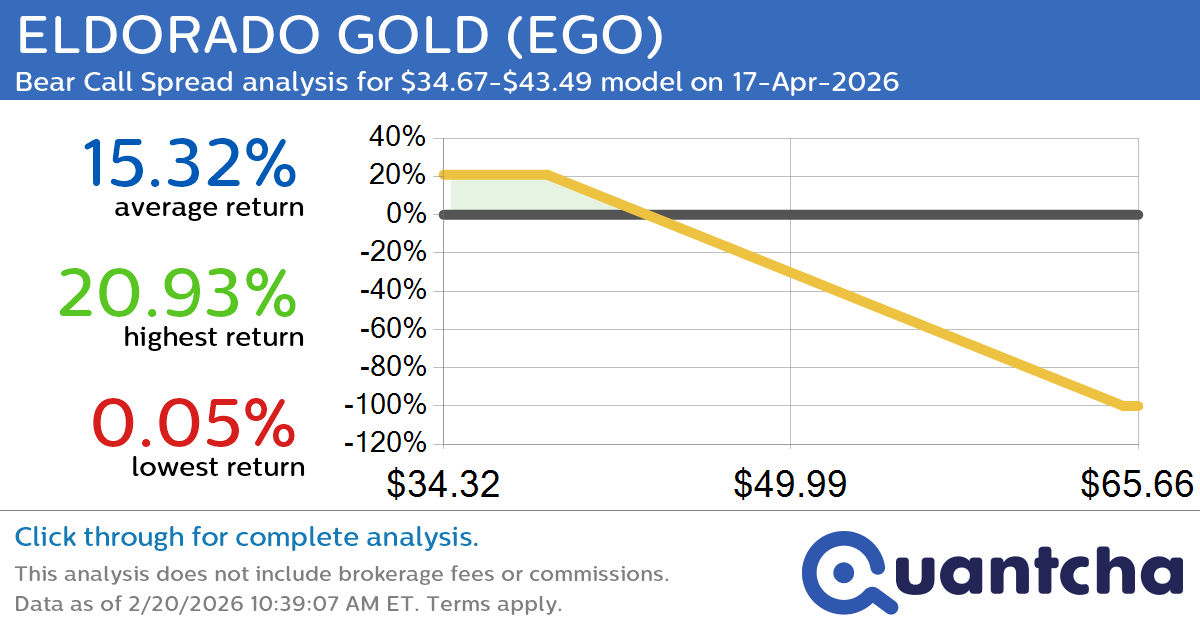

Big Loser Alert: Trading today’s -9.1% move in ELDORADO GOLD $EGO

Quantchabot has detected a new Bear Call Spread trade opportunity for ELDORADO GOLD (EGO) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. EGO was recently trading at $43.31 and has an implied volatility of 57.47% for this period. Based on an analysis of the…

-

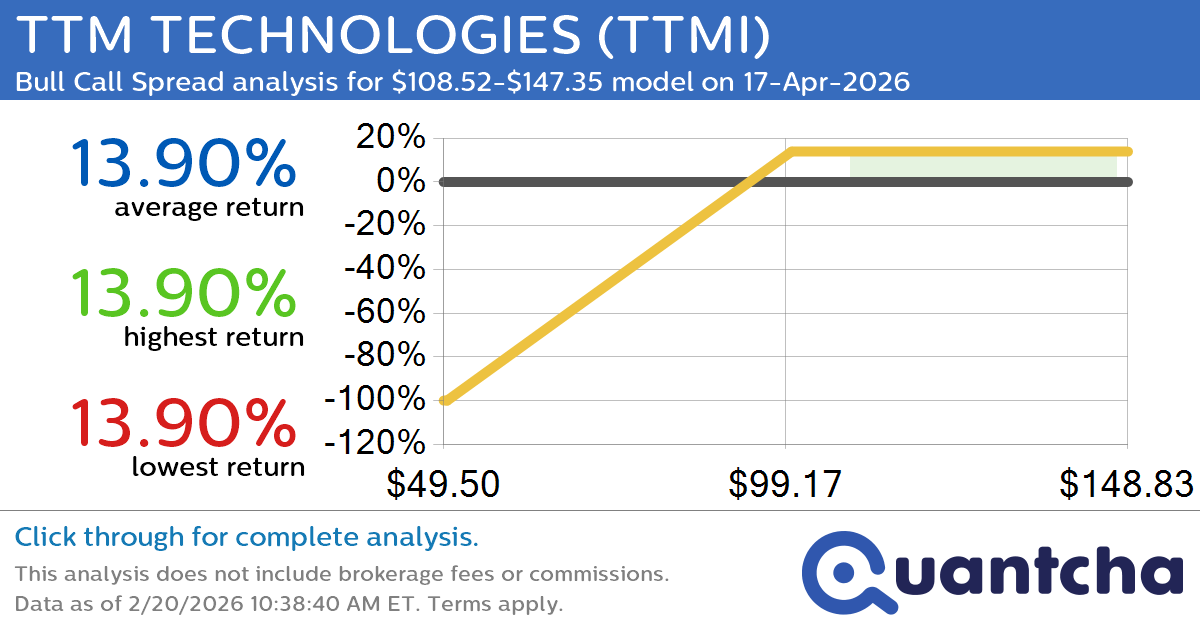

Big Gainer Alert: Trading today’s 7.5% move in TTM TECHNOLOGIES $TTMI

Quantchabot has detected a new Bull Call Spread trade opportunity for TTM TECHNOLOGIES (TTMI) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TTMI was recently trading at $107.89 and has an implied volatility of 77.56% for this period. Based on an analysis of the…

-

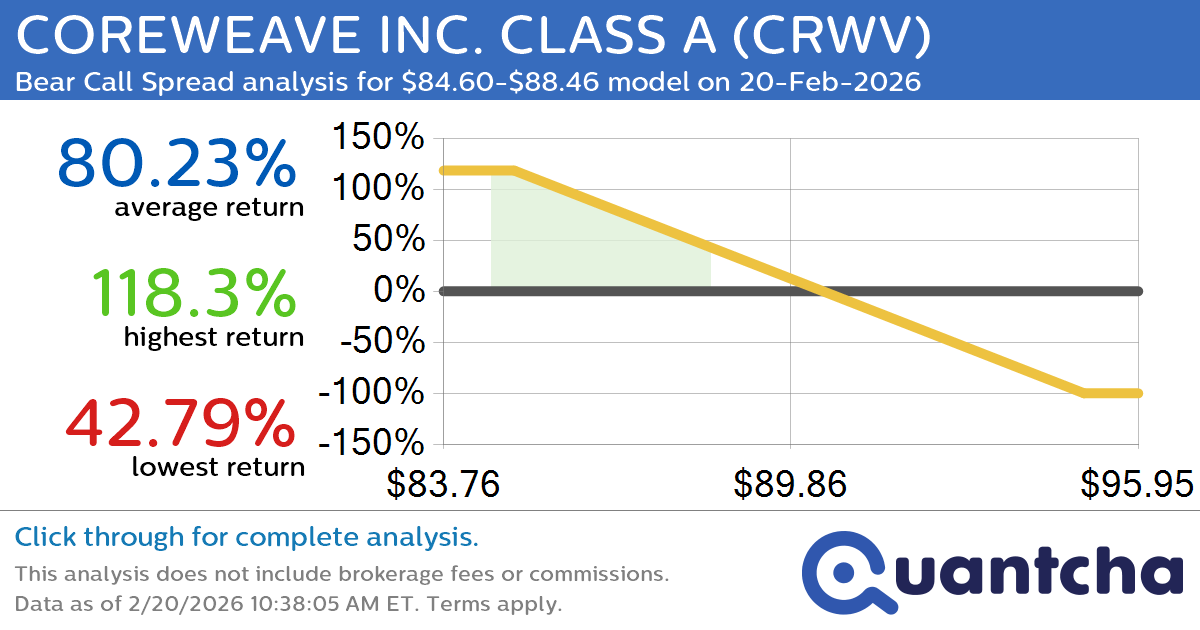

Big Loser Alert: Trading today’s -8.9% move in COREWEAVE INC. CLASS A $CRWV

Quantchabot has detected a new Bear Call Spread trade opportunity for COREWEAVE INC. CLASS A (CRWV) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CRWV was recently trading at $88.45 and has an implied volatility of 97.12% for this period. Based on an analysis…

-

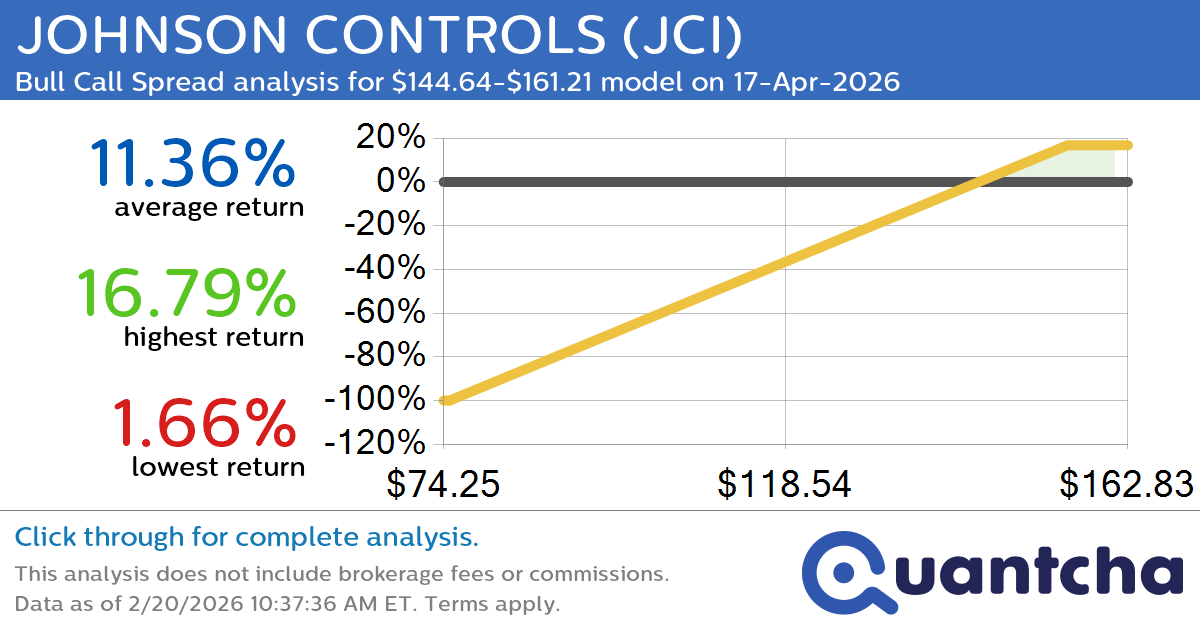

52-Week High Alert: Trading today’s movement in JOHNSON CONTROLS $JCI

Quantchabot has detected a new Bull Call Spread trade opportunity for JOHNSON CONTROLS (JCI) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. JCI was recently trading at $143.79 and has an implied volatility of 27.50% for this period. Based on an analysis of the…

-

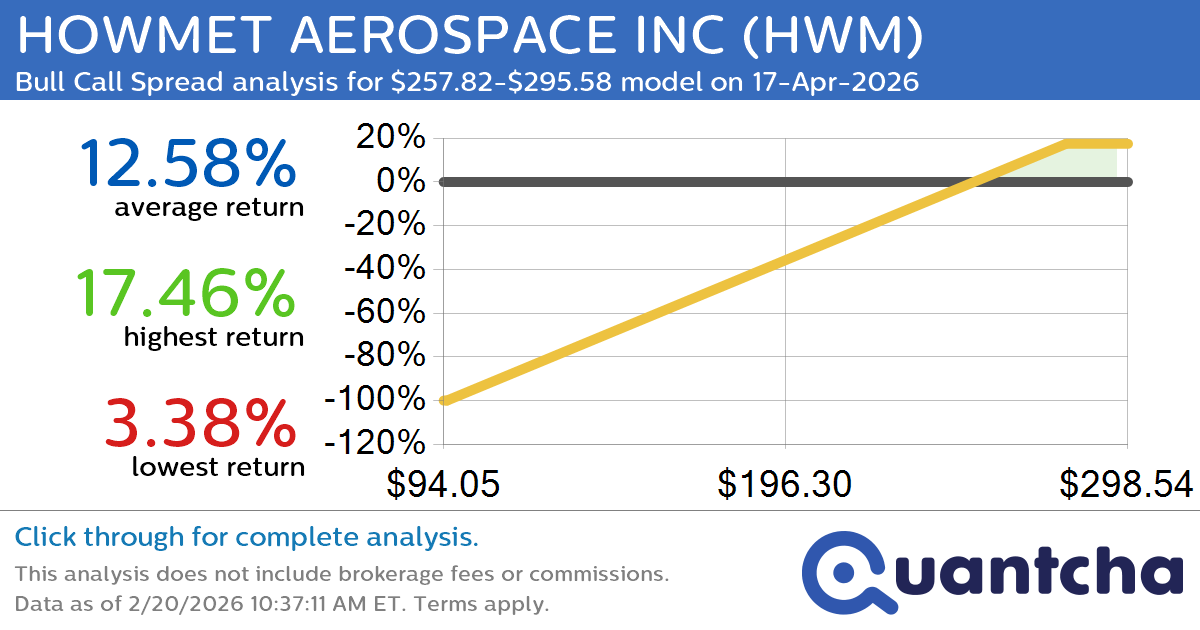

52-Week High Alert: Trading today’s movement in HOWMET AEROSPACE INC $HWM

Quantchabot has detected a new Bull Call Spread trade opportunity for HOWMET AEROSPACE INC (HWM) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. HWM was recently trading at $256.30 and has an implied volatility of 34.66% for this period. Based on an analysis of…

-

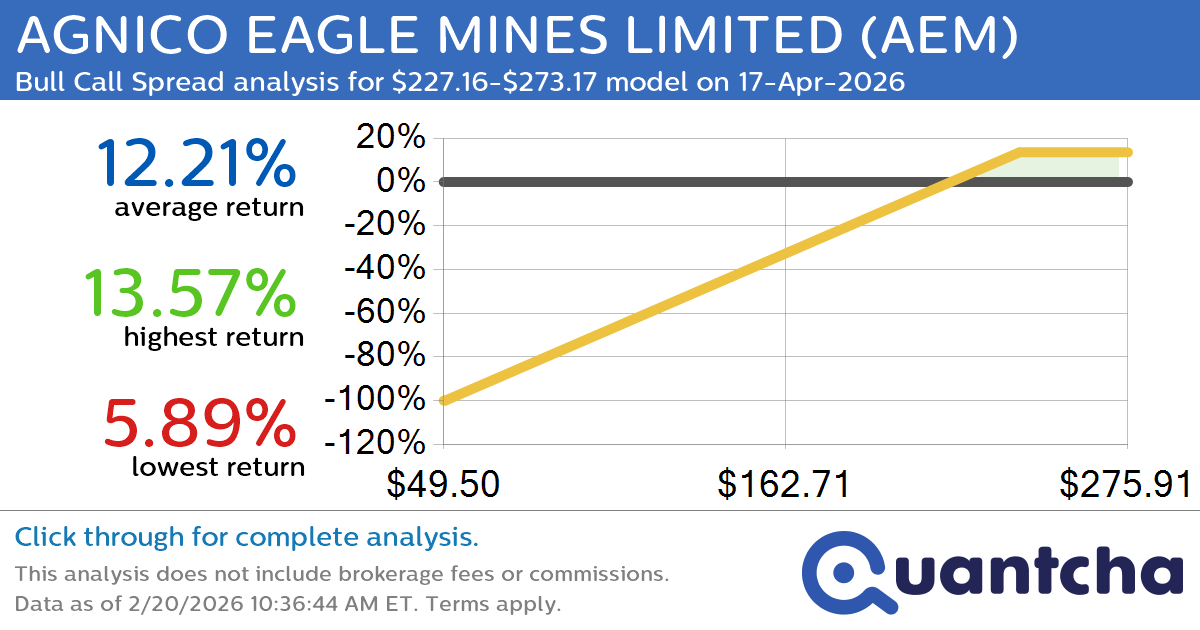

52-Week High Alert: Trading today’s movement in AGNICO EAGLE MINES LIMITED $AEM

Quantchabot has detected a new Bull Call Spread trade opportunity for AGNICO EAGLE MINES LIMITED (AEM) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. AEM was recently trading at $226.27 and has an implied volatility of 46.77% for this period. Based on an analysis…

-

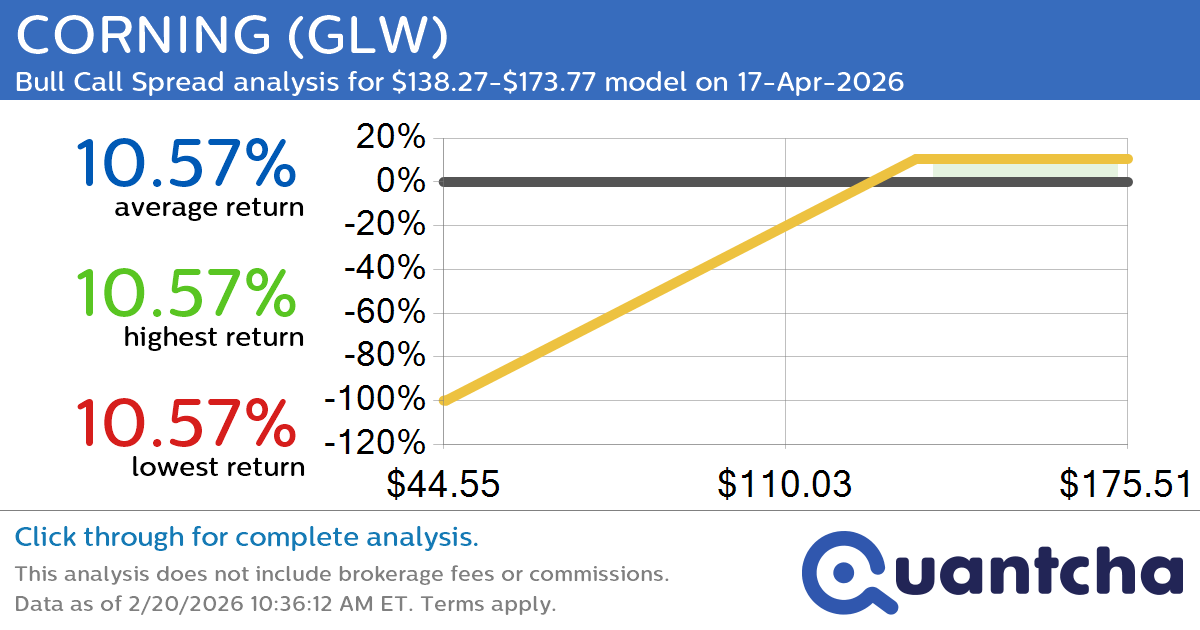

52-Week High Alert: Trading today’s movement in CORNING $GLW

Quantchabot has detected a new Bull Call Spread trade opportunity for CORNING (GLW) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. GLW was recently trading at $137.74 and has an implied volatility of 57.94% for this period. Based on an analysis of the options…

-

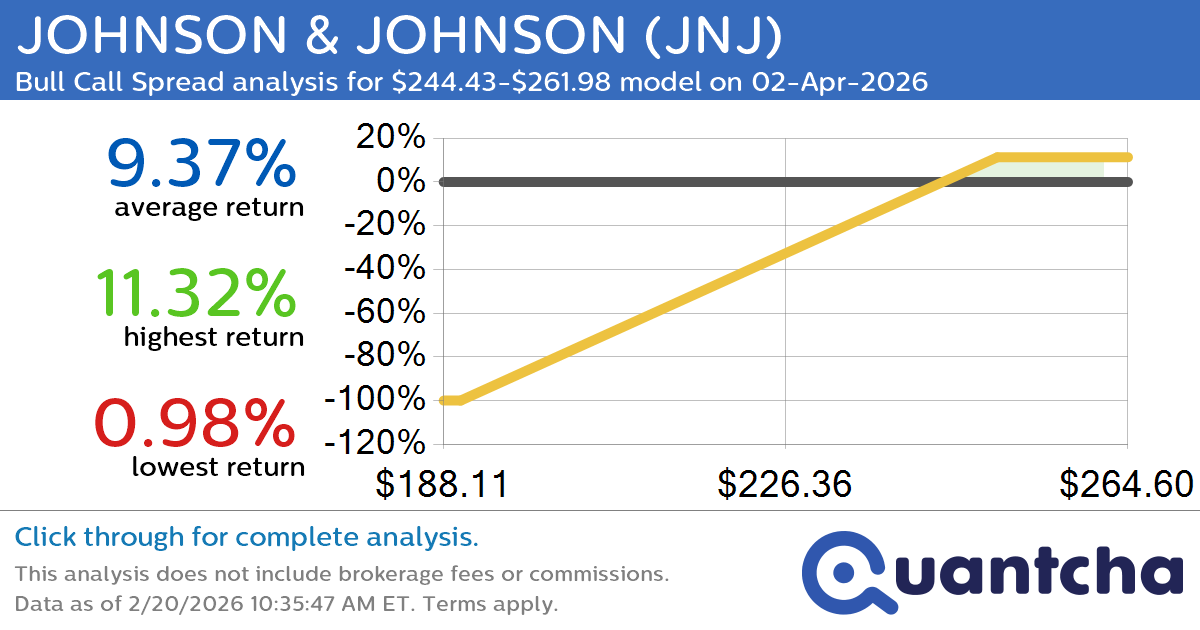

52-Week High Alert: Trading today’s movement in JOHNSON & JOHNSON $JNJ

Quantchabot has detected a new Bull Call Spread trade opportunity for JOHNSON & JOHNSON (JNJ) for the 2-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. JNJ was recently trading at $244.67 and has an implied volatility of 20.50% for this period. Based on an analysis of…

-

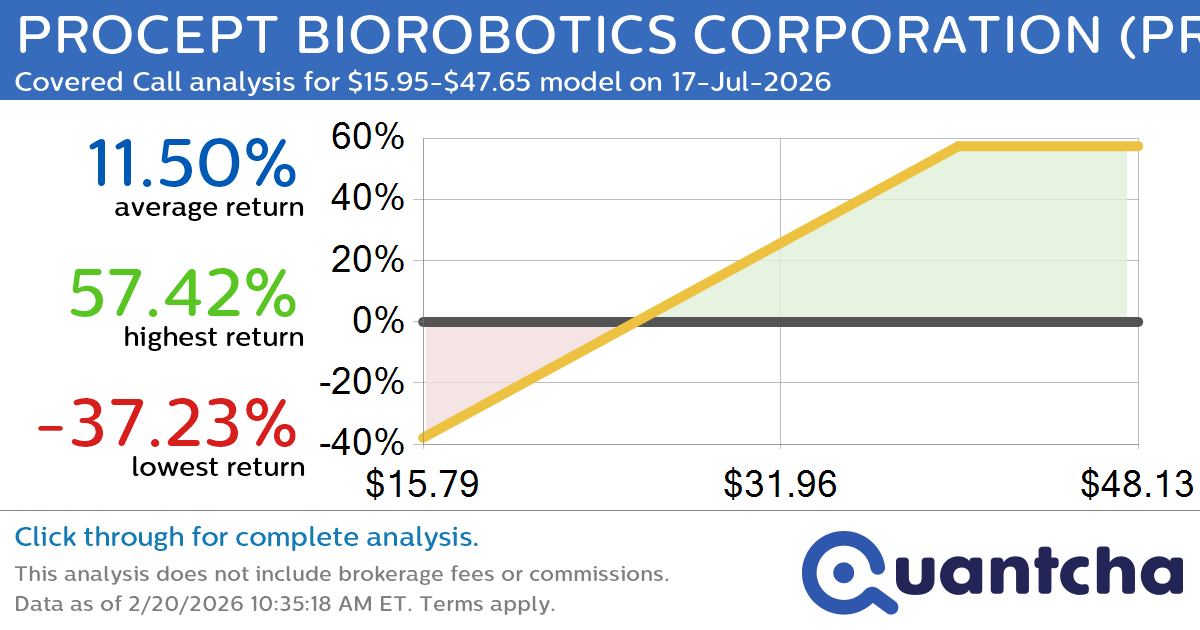

Covered Call Alert: PROCEPT BIOROBOTICS CORPORATION $PRCT returning up to 56.19% through 17-Jul-2026

Quantchabot has detected a new Covered Call trade opportunity for PROCEPT BIOROBOTICS CORPORATION (PRCT) for the 17-Jul-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. PRCT was recently trading at $27.15 and has an implied volatility of 86.02% for this period. Based on an analysis of the…

-

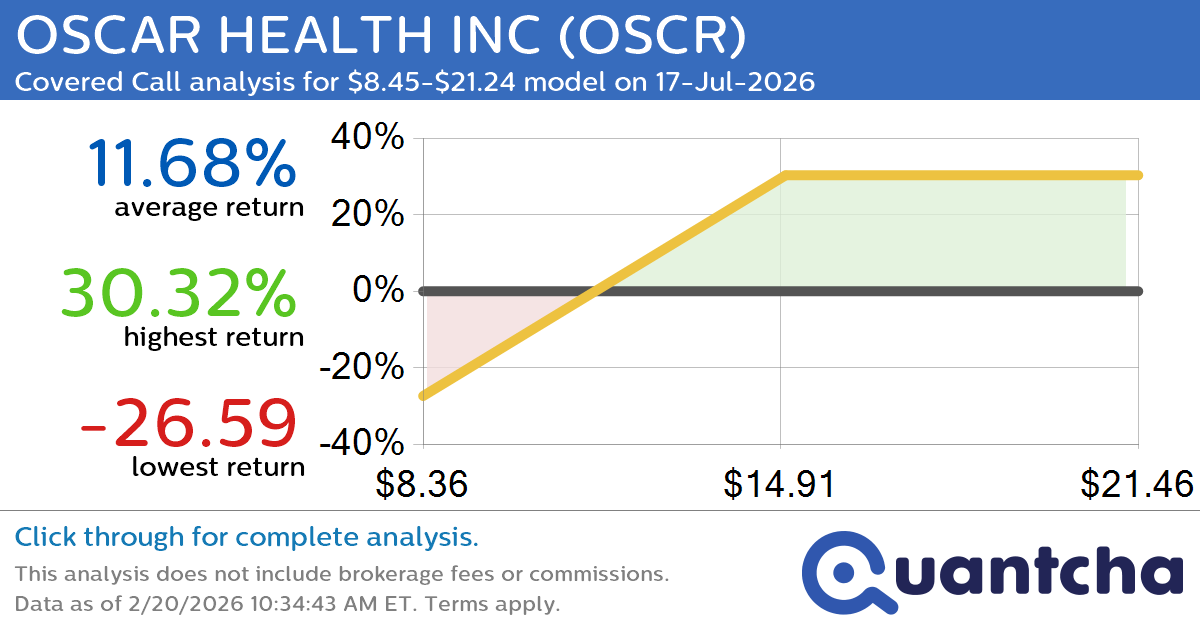

Covered Call Alert: OSCAR HEALTH INC $OSCR returning up to 30.21% through 17-Jul-2026

Quantchabot has detected a new Covered Call trade opportunity for OSCAR HEALTH INC (OSCR) for the 17-Jul-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. OSCR was recently trading at $13.20 and has an implied volatility of 72.40% for this period. Based on an analysis of the…