Quantcha Ideas: Turn a good idea about a stock into a great options trade

-

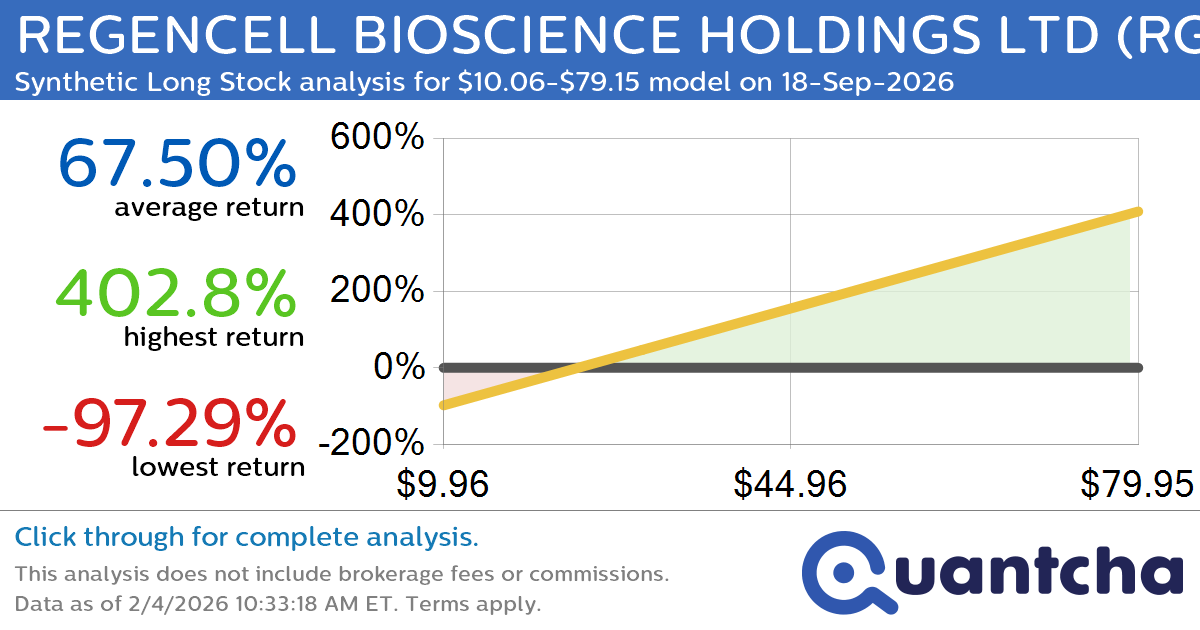

Synthetic Long Discount Alert: REGENCELL BIOSCIENCE HOLDINGS LTD $RGC trading at a 14.78% discount for the 18-Sep-2026 expiration

Quantchabot has detected a new Synthetic Long Stock trade opportunity for REGENCELL BIOSCIENCE HOLDINGS LTD (RGC) for the 18-Sep-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. RGC was recently trading at $27.57 and has an implied volatility of 130.87% for this period. Based on an analysis…

-

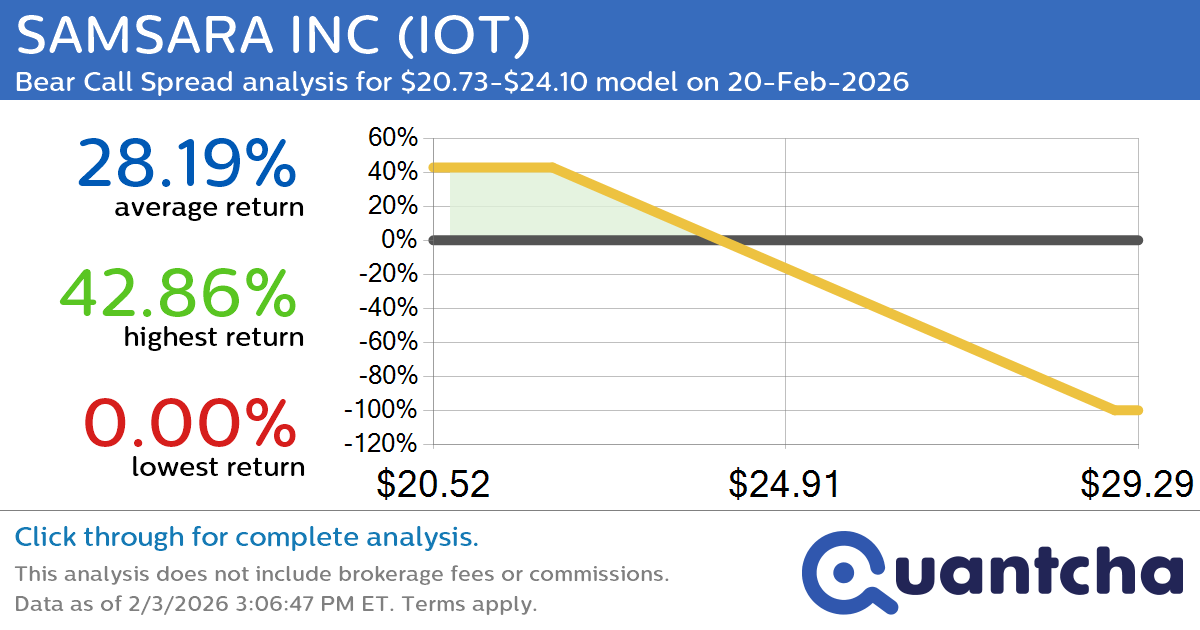

Big Loser Alert: Trading today’s -8.9% move in SAMSARA INC $IOT

Quantchabot has detected a new Bear Call Spread trade opportunity for SAMSARA INC (IOT) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. IOT was recently trading at $24.05 and has an implied volatility of 68.71% for this period. Based on an analysis of the…

-

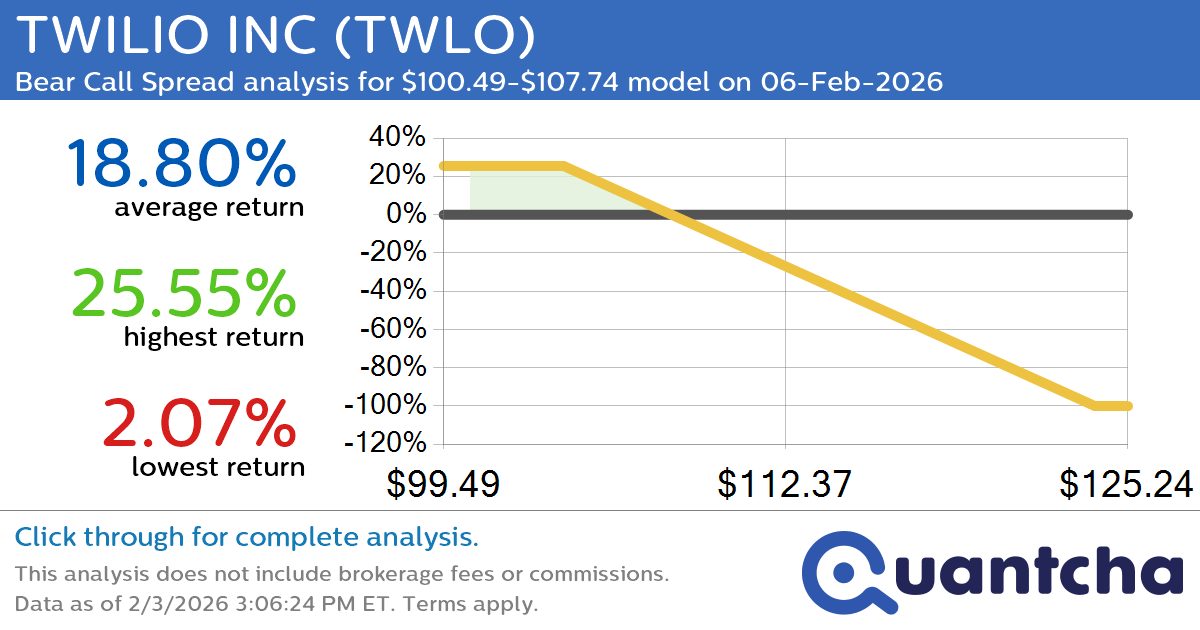

Big Loser Alert: Trading today’s -10.3% move in TWILIO INC $TWLO

Quantchabot has detected a new Bear Call Spread trade opportunity for TWILIO INC (TWLO) for the 6-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TWLO was recently trading at $107.70 and has an implied volatility of 70.34% for this period. Based on an analysis of the…

-

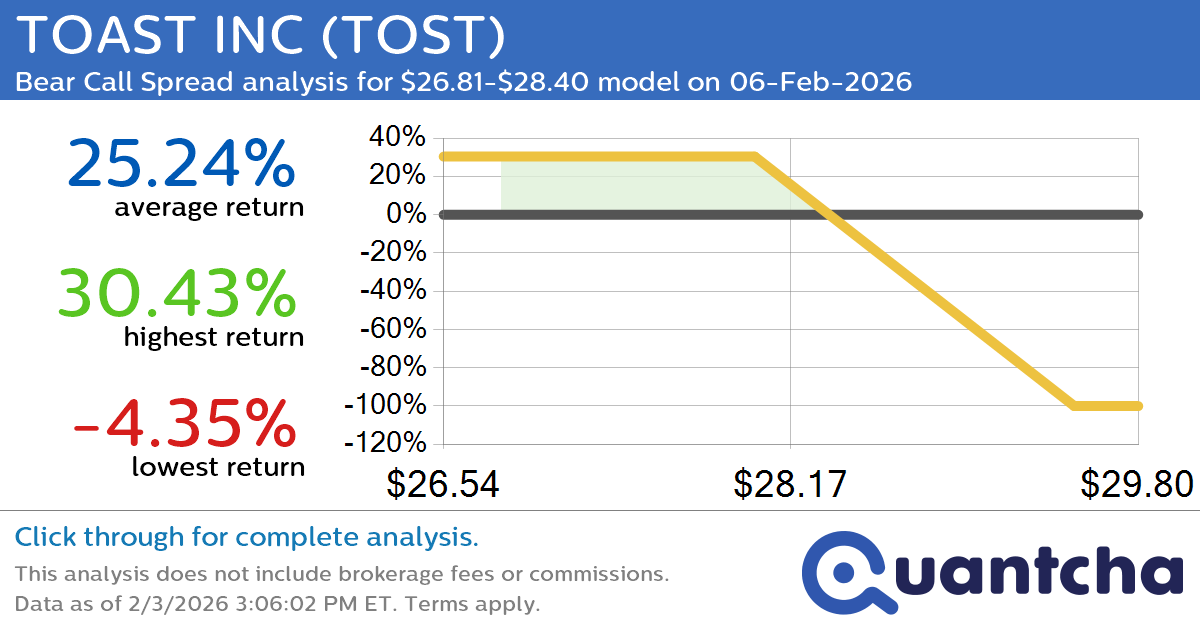

Big Loser Alert: Trading today’s -9.9% move in TOAST INC $TOST

Quantchabot has detected a new Bear Call Spread trade opportunity for TOAST INC (TOST) for the 6-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TOST was recently trading at $28.39 and has an implied volatility of 57.98% for this period. Based on an analysis of the…

-

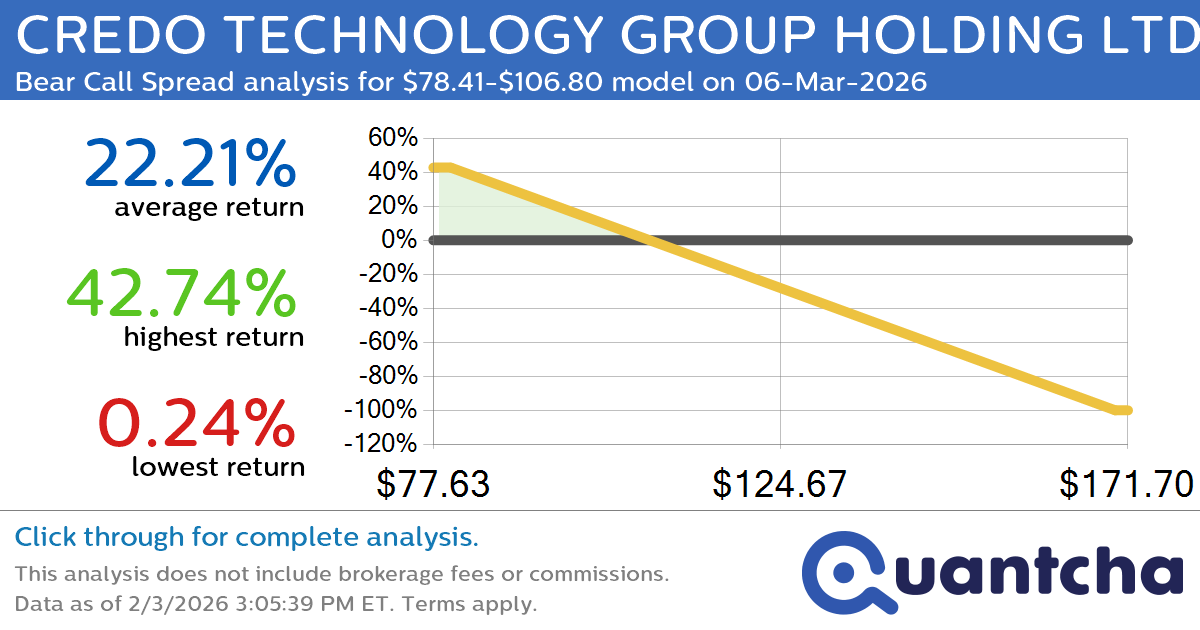

Big Loser Alert: Trading today’s -11.3% move in CREDO TECHNOLOGY GROUP HOLDING LTD $CRDO

Quantchabot has detected a new Bear Call Spread trade opportunity for CREDO TECHNOLOGY GROUP HOLDING LTD (CRDO) for the 6-Mar-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CRDO was recently trading at $106.45 and has an implied volatility of 105.05% for this period. Based on an…

-

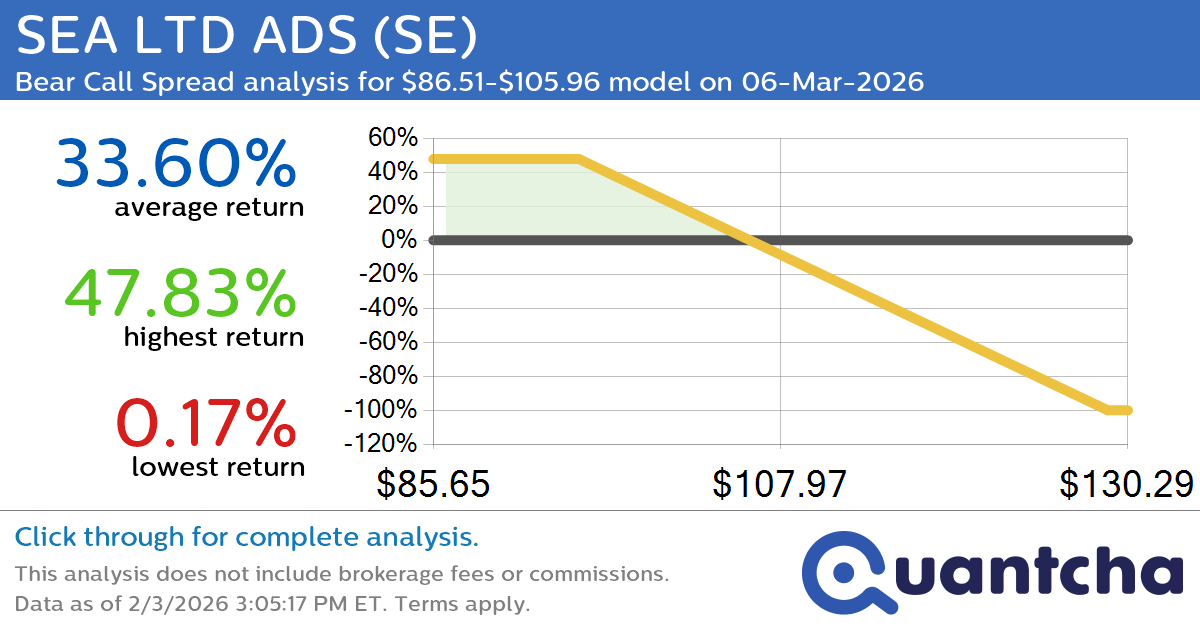

Big Loser Alert: Trading today’s -7.0% move in SEA LTD ADS $SE

Quantchabot has detected a new Bear Call Spread trade opportunity for SEA LTD ADS (SE) for the 6-Mar-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SE was recently trading at $105.61 and has an implied volatility of 68.95% for this period. Based on an analysis of…

-

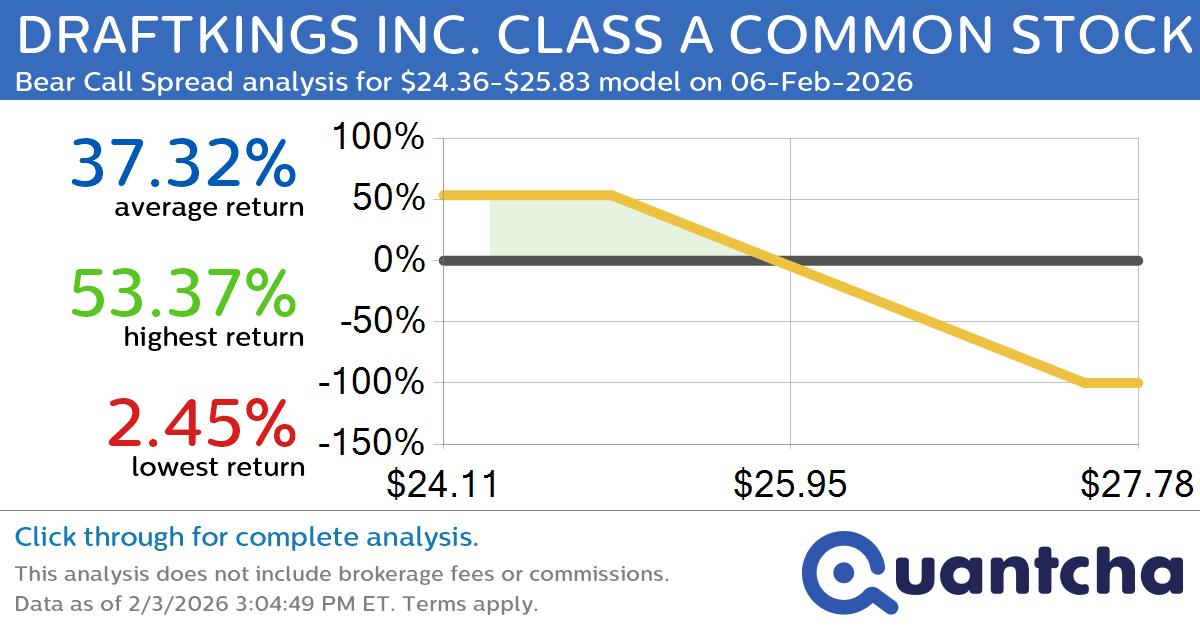

52-Week Low Alert: Trading today’s movement in DRAFTKINGS INC. CLASS A COMMON STOCK $DKNG

Quantchabot has detected a new Bear Call Spread trade opportunity for DRAFTKINGS INC. CLASS A COMMON STOCK (DKNG) for the 6-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. DKNG was recently trading at $25.82 and has an implied volatility of 59.41% for this period. Based on…

-

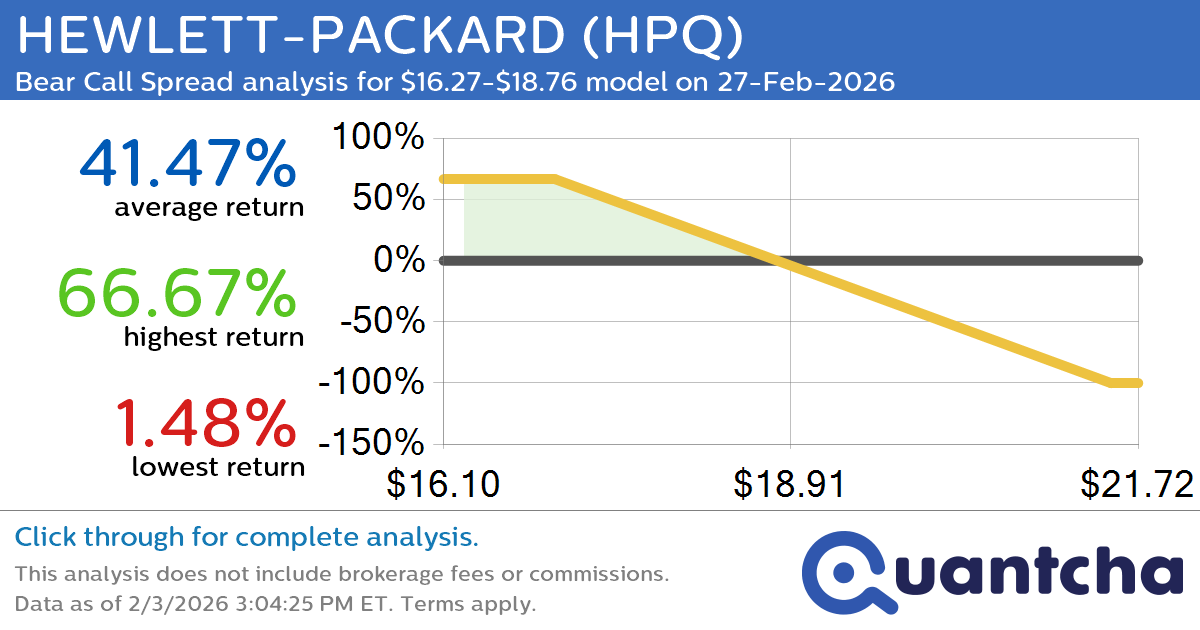

52-Week Low Alert: Trading today’s movement in HEWLETT-PACKARD $HPQ

Quantchabot has detected a new Bear Call Spread trade opportunity for HEWLETT-PACKARD (HPQ) for the 27-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. HPQ was recently trading at $18.71 and has an implied volatility of 54.96% for this period. Based on an analysis of the options…

-

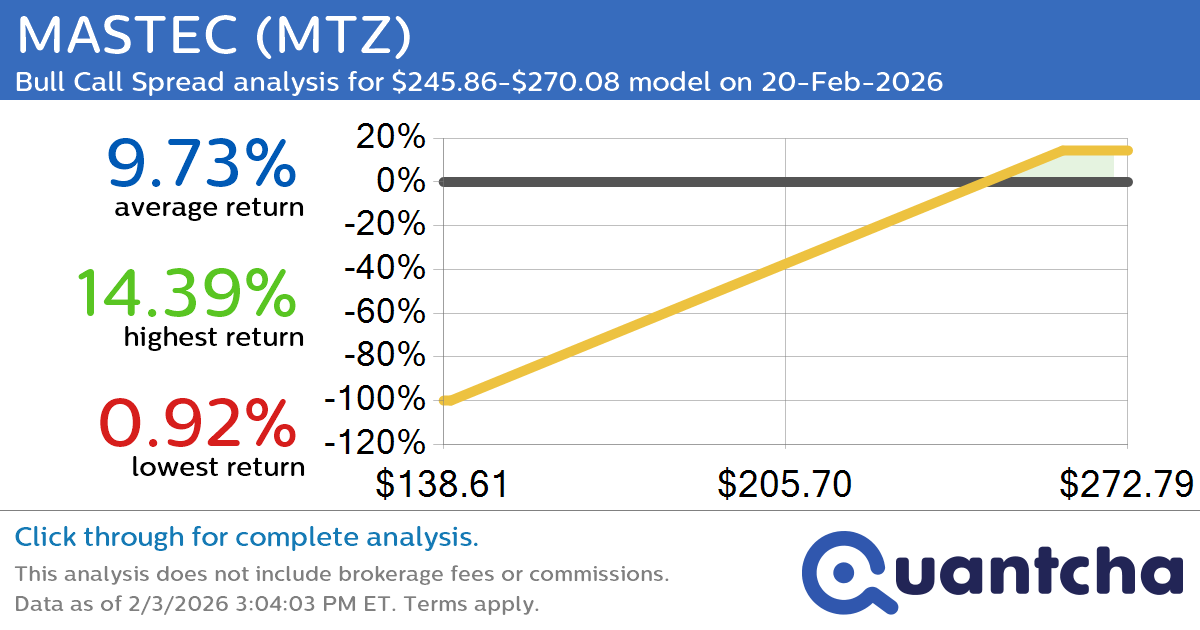

52-Week High Alert: Trading today’s movement in MASTEC $MTZ

Quantchabot has detected a new Bull Call Spread trade opportunity for MASTEC (MTZ) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. MTZ was recently trading at $245.41 and has an implied volatility of 42.81% for this period. Based on an analysis of the options…

-

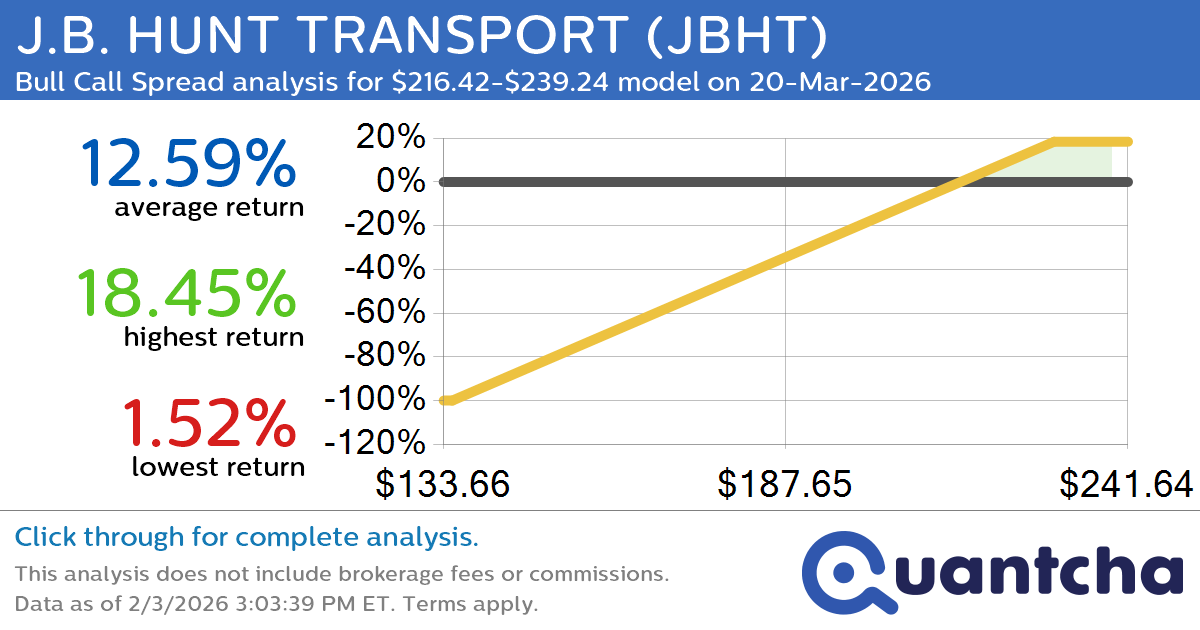

52-Week High Alert: Trading today’s movement in J.B. HUNT TRANSPORT $JBHT

Quantchabot has detected a new Bull Call Spread trade opportunity for J.B. HUNT TRANSPORT (JBHT) for the 20-Mar-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. JBHT was recently trading at $215.84 and has an implied volatility of 28.37% for this period. Based on an analysis of…