Quantcha Ideas: Turn a good idea about a stock into a great options trade

-

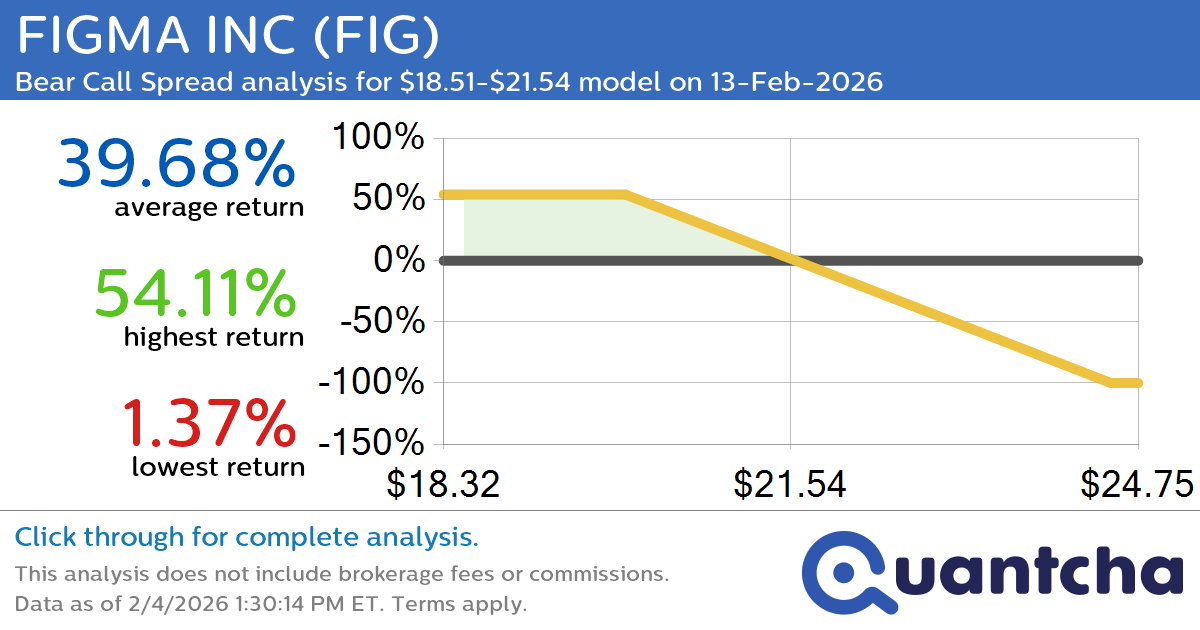

52-Week Low Alert: Trading today’s movement in FIGMA INC $FIG

Quantchabot has detected a new Bear Call Spread trade opportunity for FIGMA INC (FIG) for the 13-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. FIG was recently trading at $21.52 and has an implied volatility of 93.18% for this period. Based on an analysis of the…

-

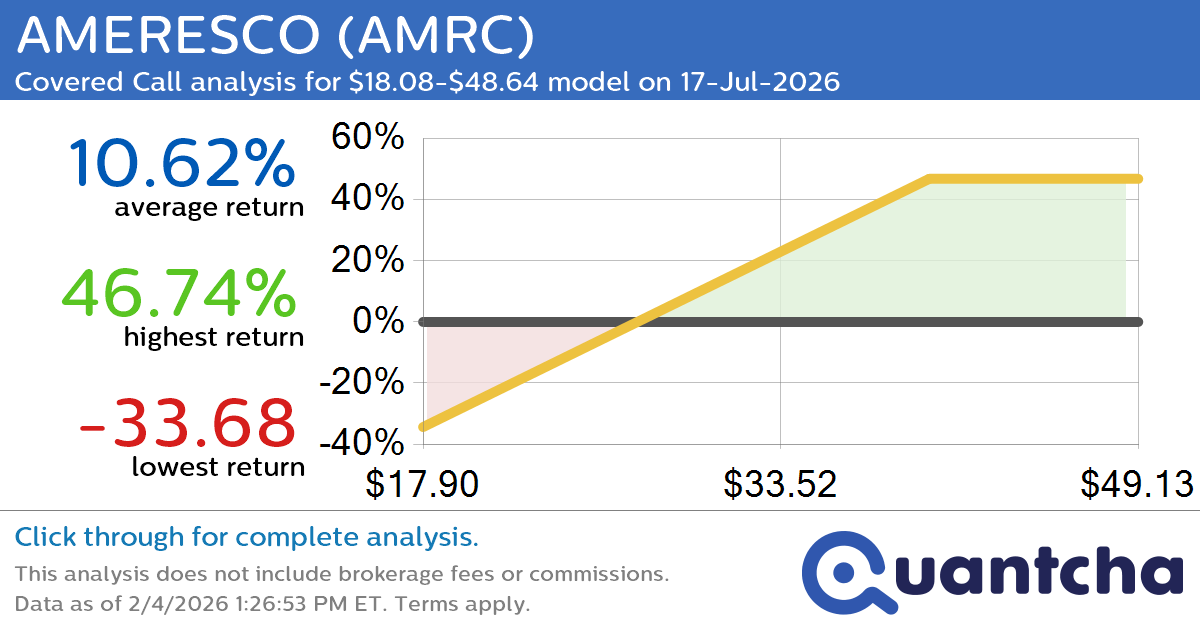

Covered Call Alert: AMERESCO $AMRC returning up to 47.06% through 17-Jul-2026

Quantchabot has detected a new Covered Call trade opportunity for AMERESCO (AMRC) for the 17-Jul-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. AMRC was recently trading at $29.16 and has an implied volatility of 73.89% for this period. Based on an analysis of the options available…

-

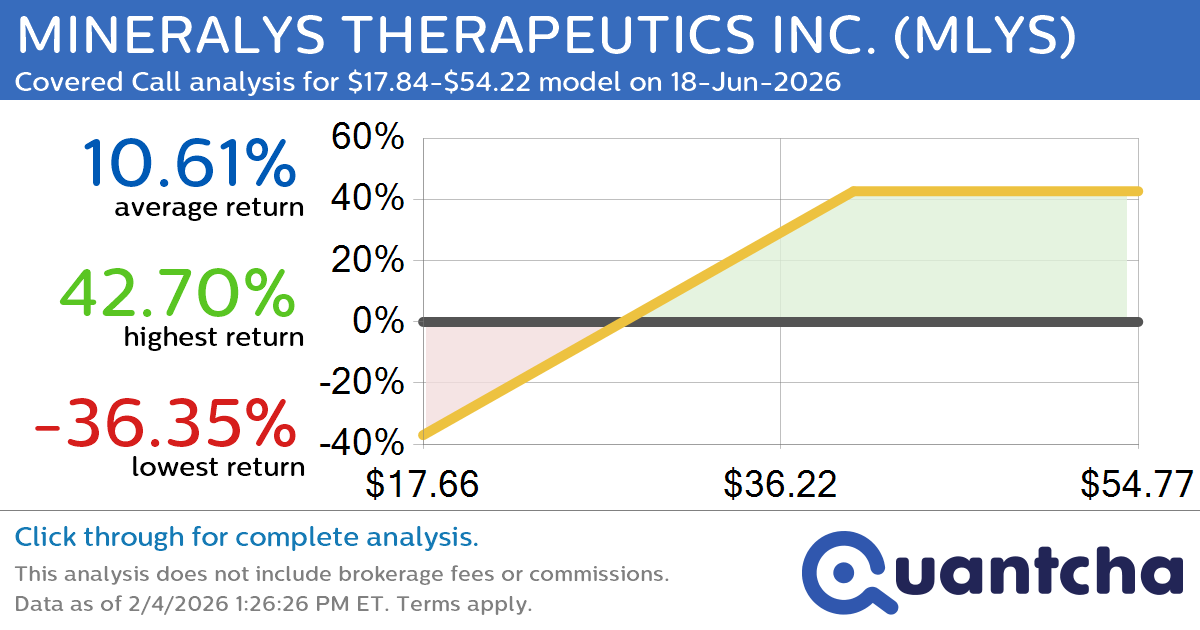

Covered Call Alert: MINERALYS THERAPEUTICS INC. $MLYS returning up to 42.96% through 18-Jun-2026

Quantchabot has detected a new Covered Call trade opportunity for MINERALYS THERAPEUTICS INC. (MLYS) for the 18-Jun-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. MLYS was recently trading at $30.67 and has an implied volatility of 91.53% for this period. Based on an analysis of the…

-

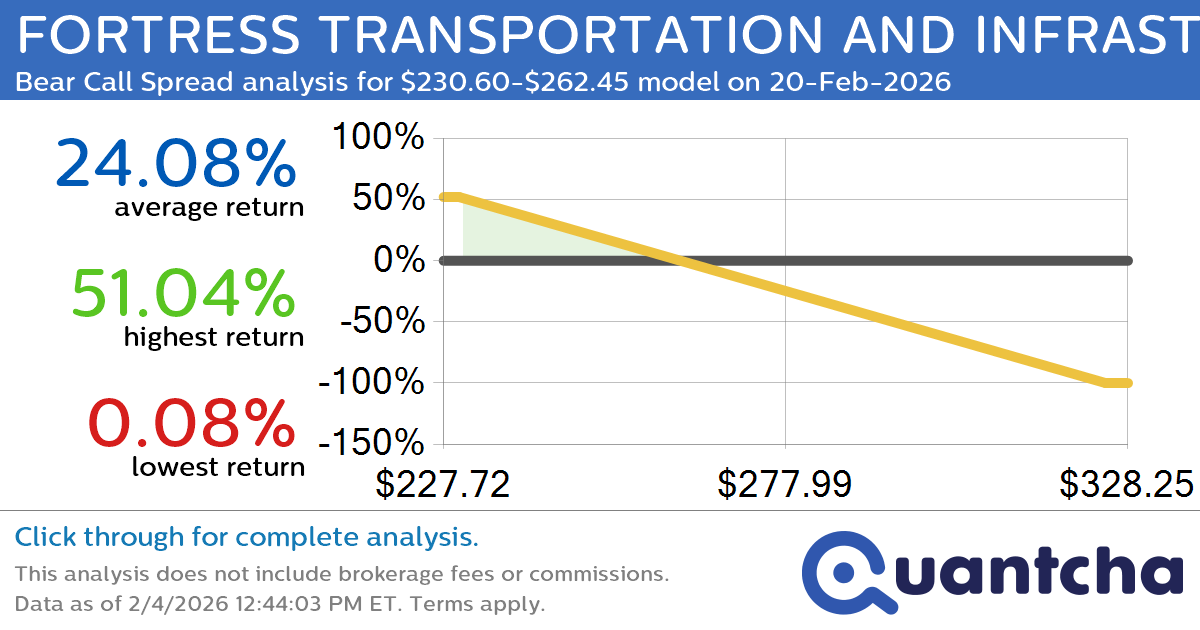

Big Loser Alert: Trading today’s -8.5% move in FORTRESS TRANSPORTATION AND INFRASTRUCTURE INVESTO $FTAI

Quantchabot has detected a new Bear Call Spread trade opportunity for FORTRESS TRANSPORTATION AND INFRASTRUCTURE INVESTO (FTAI) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. FTAI was recently trading at $262.00 and has an implied volatility of 60.53% for this period. Based on an…

-

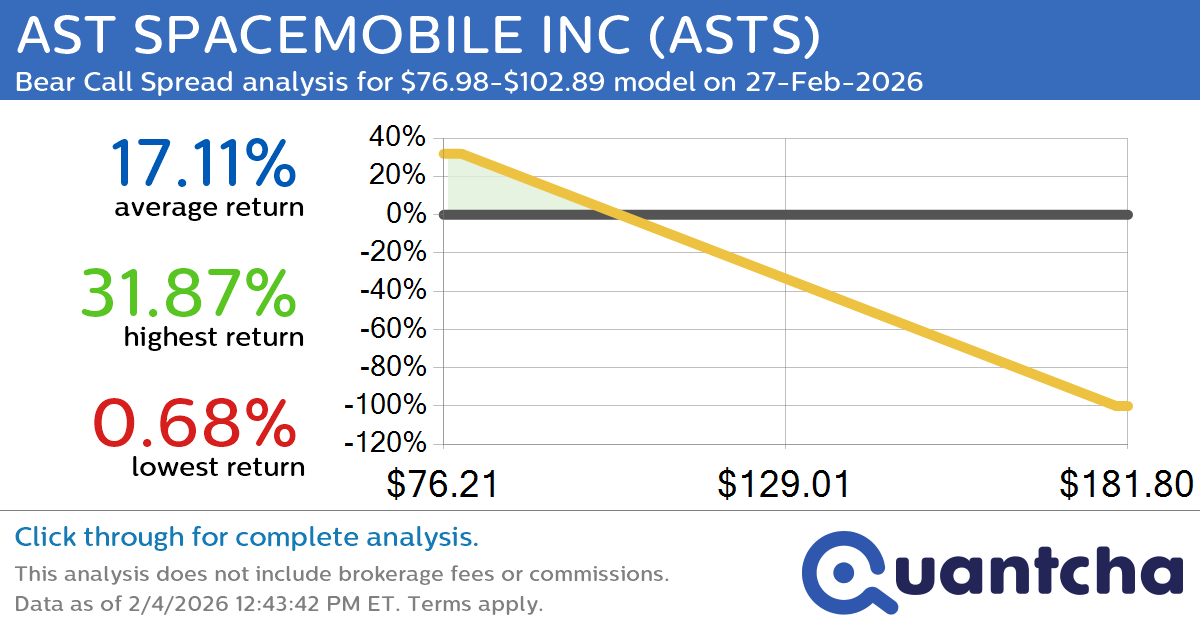

Big Loser Alert: Trading today’s -11.3% move in AST SPACEMOBILE INC $ASTS

Quantchabot has detected a new Bear Call Spread trade opportunity for AST SPACEMOBILE INC (ASTS) for the 27-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ASTS was recently trading at $102.64 and has an implied volatility of 113.86% for this period. Based on an analysis of…

-

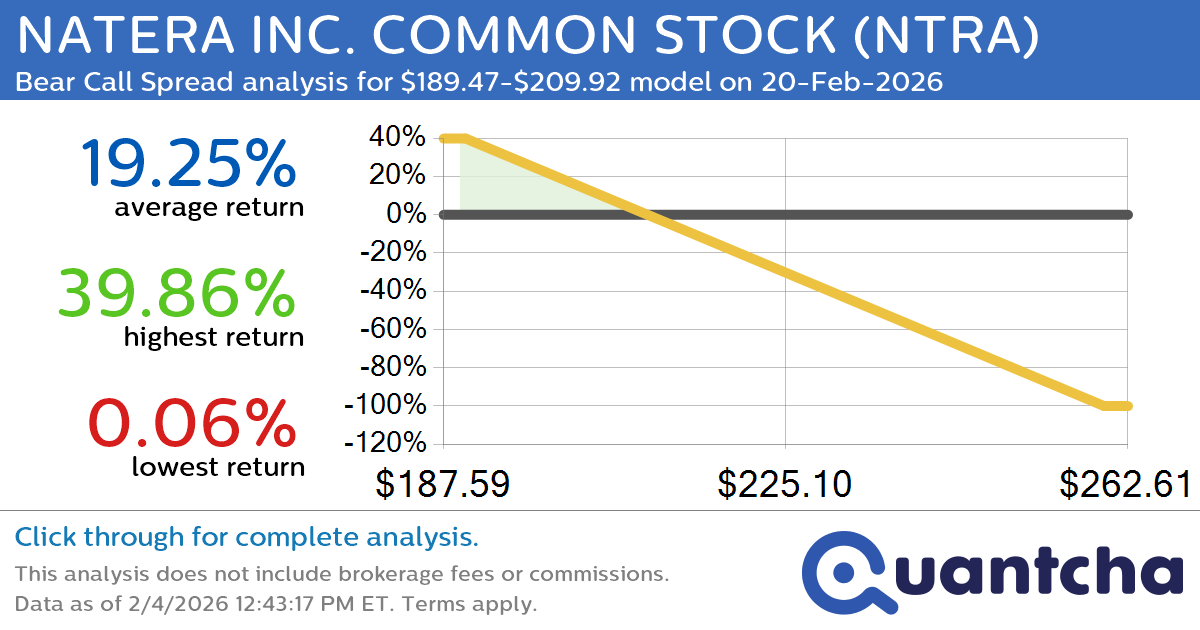

Big Loser Alert: Trading today’s -8.0% move in NATERA INC. COMMON STOCK $NTRA

Quantchabot has detected a new Bear Call Spread trade opportunity for NATERA INC. COMMON STOCK (NTRA) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. NTRA was recently trading at $209.56 and has an implied volatility of 47.94% for this period. Based on an analysis…

-

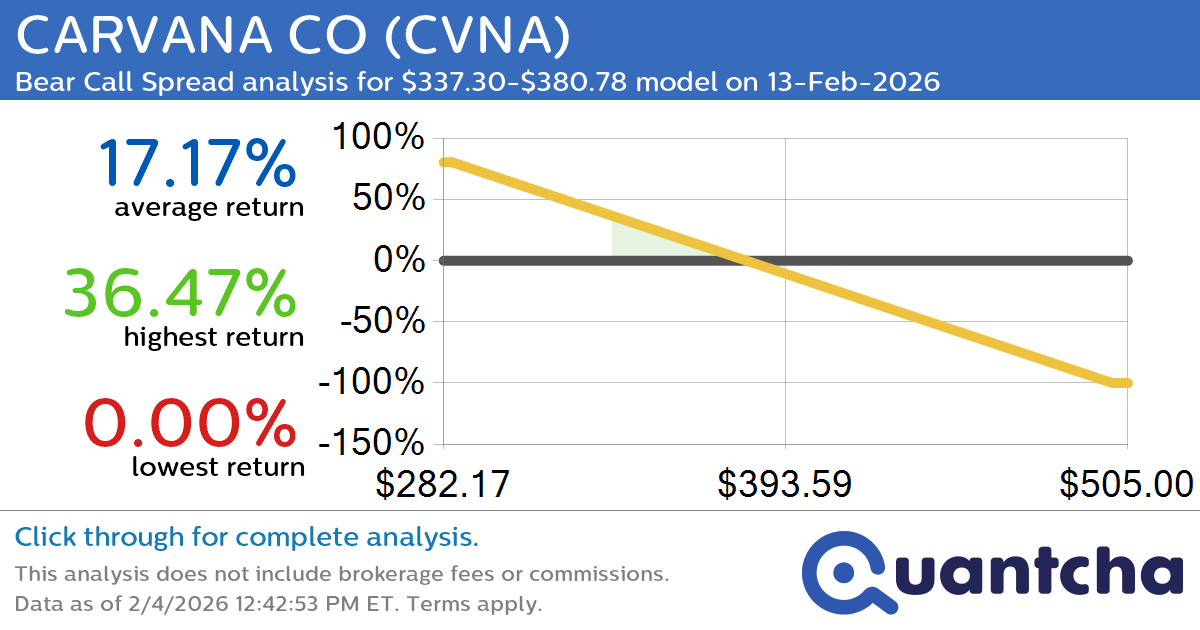

Big Loser Alert: Trading today’s -7.3% move in CARVANA CO $CVNA

Quantchabot has detected a new Bear Call Spread trade opportunity for CARVANA CO (CVNA) for the 13-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CVNA was recently trading at $380.40 and has an implied volatility of 74.44% for this period. Based on an analysis of the…

-

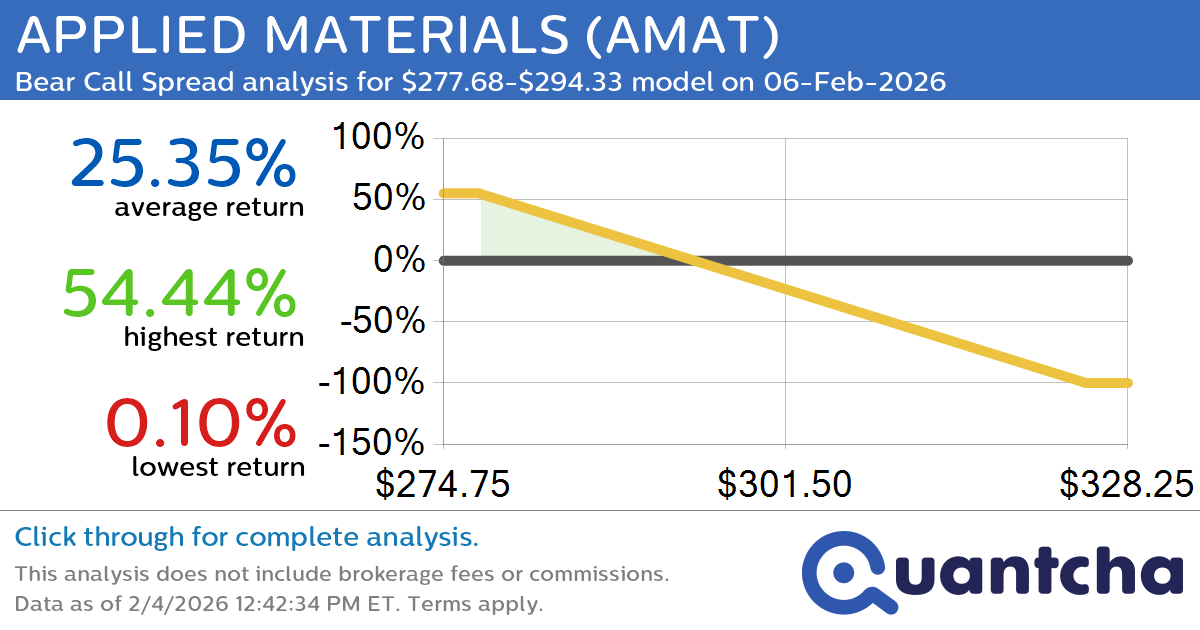

Big Loser Alert: Trading today’s -7.7% move in APPLIED MATERIALS $AMAT

Quantchabot has detected a new Bear Call Spread trade opportunity for APPLIED MATERIALS (AMAT) for the 6-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. AMAT was recently trading at $294.25 and has an implied volatility of 67.93% for this period. Based on an analysis of the…

-

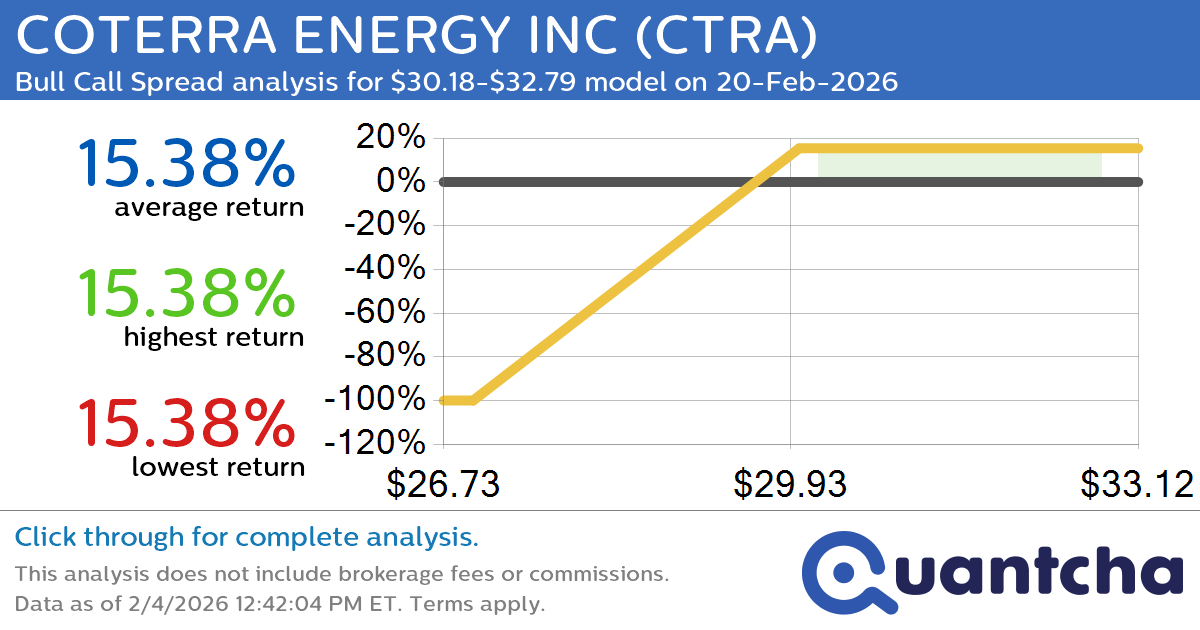

52-Week High Alert: Trading today’s movement in COTERRA ENERGY INC $CTRA

Quantchabot has detected a new Bull Call Spread trade opportunity for COTERRA ENERGY INC (CTRA) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CTRA was recently trading at $30.13 and has an implied volatility of 38.81% for this period. Based on an analysis of…

-

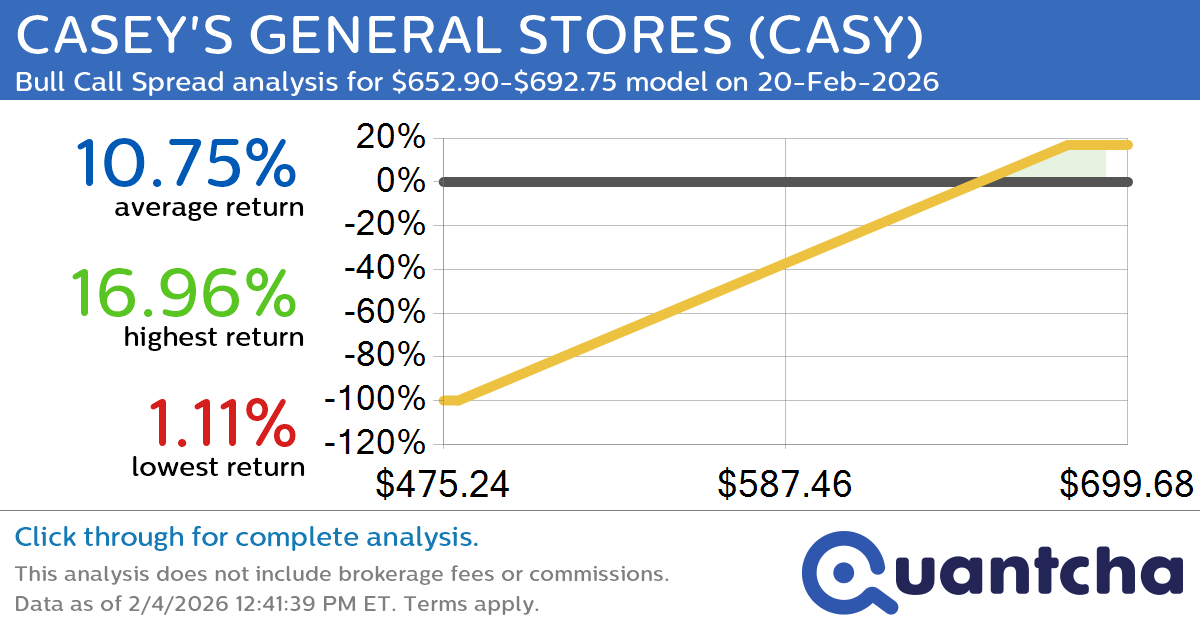

52-Week High Alert: Trading today’s movement in CASEY’S GENERAL STORES $CASY

Quantchabot has detected a new Bull Call Spread trade opportunity for CASEY’S GENERAL STORES (CASY) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CASY was recently trading at $651.77 and has an implied volatility of 27.71% for this period. Based on an analysis of…