Quantcha Ideas: Turn a good idea about a stock into a great options trade

-

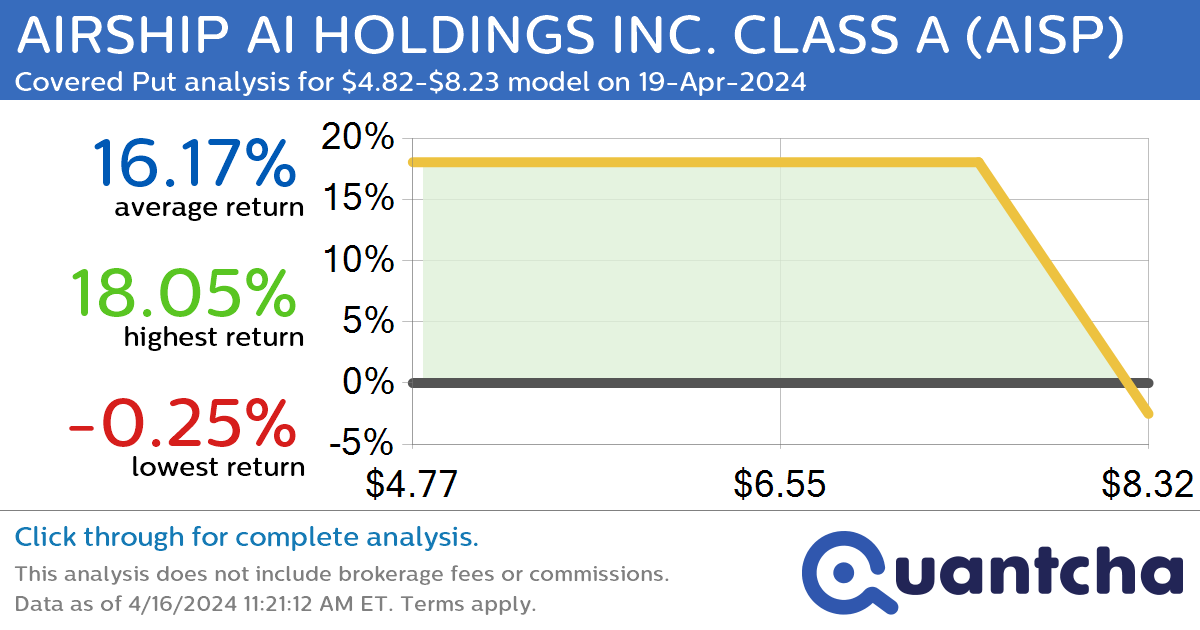

Big Loser Alert: Trading today’s -8.6% move in AIRSHIP AI HOLDINGS INC. CLASS A $AISP

Quantchabot has detected a new Covered Put trade opportunity for AIRSHIP AI HOLDINGS INC. CLASS A (AISP) for the 19-Apr-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. AISP was recently trading at $8.23 and has an implied volatility of 532.67% for this period. Based on an…

-

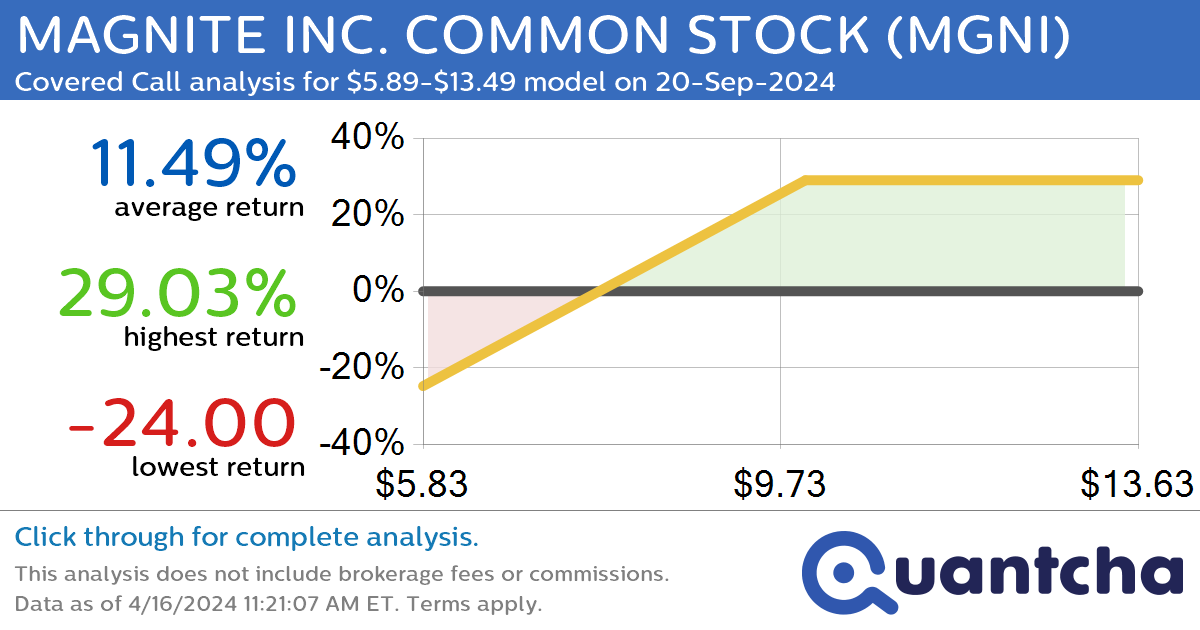

Covered Call Alert: MAGNITE INC. COMMON STOCK $MGNI returning up to 28.87% through 20-Sep-2024

Quantchabot has detected a new Covered Call trade opportunity for MAGNITE INC. COMMON STOCK (MGNI) for the 20-Sep-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. MGNI was recently trading at $8.70 and has an implied volatility of 63.10% for this period. Based on an analysis of…

-

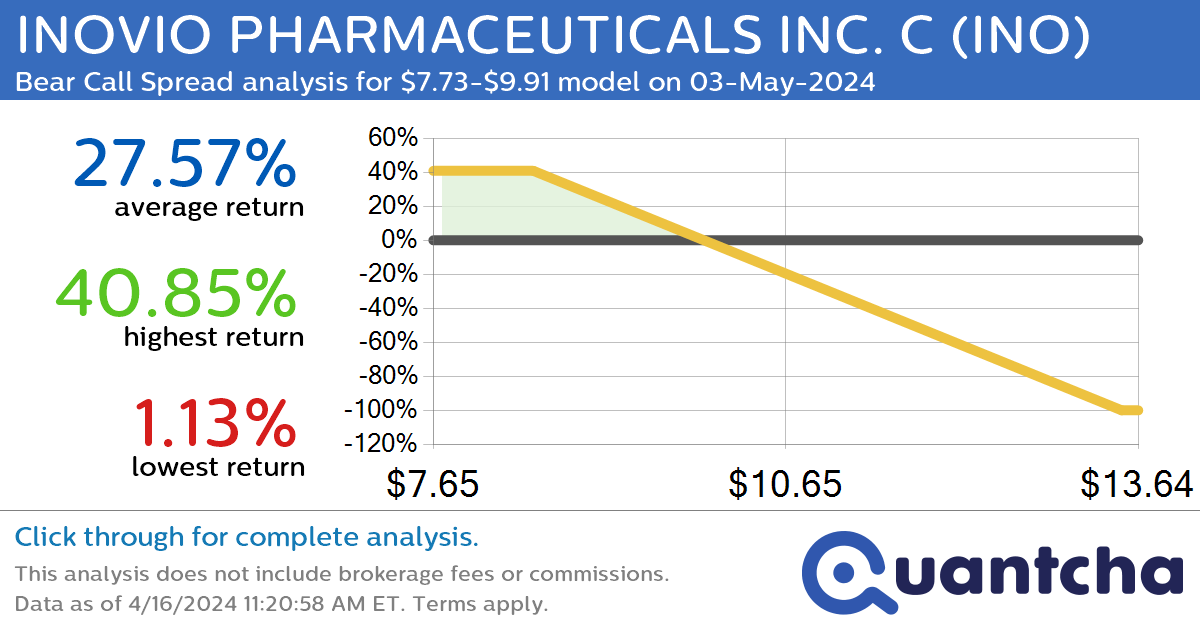

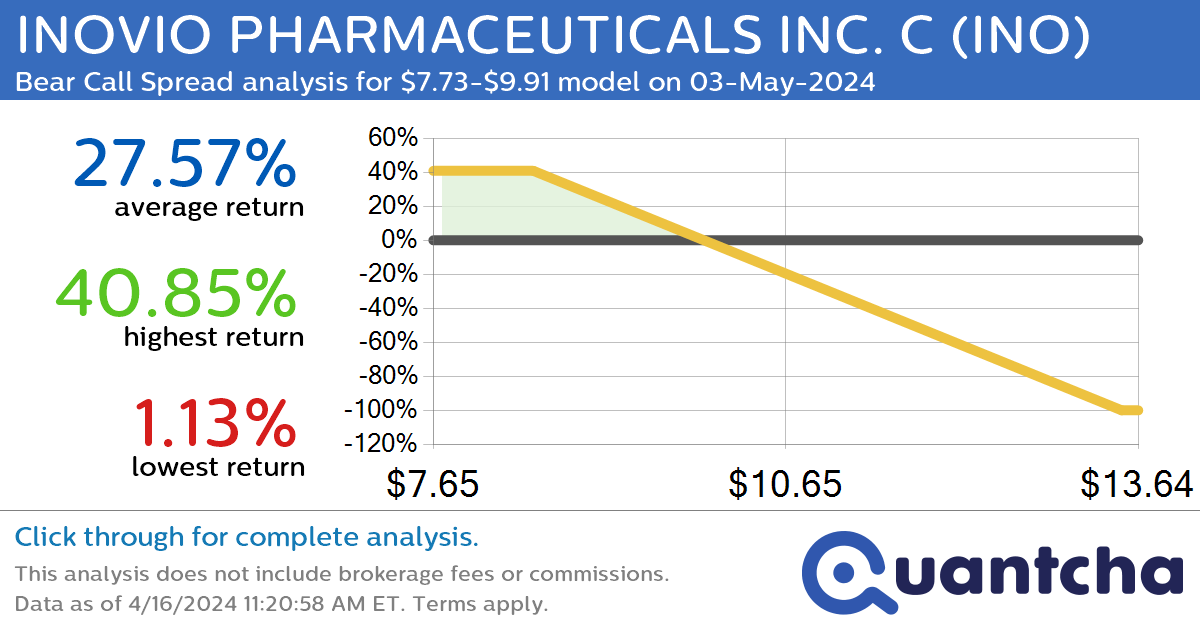

Big Loser Alert: Trading today’s -10.1% move in INOVIO PHARMACEUTICALS INC. C $INO

Quantchabot has detected a new Bear Call Spread trade opportunity for INOVIO PHARMACEUTICALS INC. C (INO) for the 3-May-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. INO was recently trading at $9.88 and has an implied volatility of 112.87% for this period. Based on an analysis…

-

52-Week Low Alert: Trading today’s movement in BOSTON BEER COMPANY $SAM

Quantchabot has detected a new Bear Call Spread trade opportunity for BOSTON BEER COMPANY (SAM) for the 19-Apr-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SAM was recently trading at $277.00 and has an implied volatility of 30.22% for this period. Based on an analysis of…

-

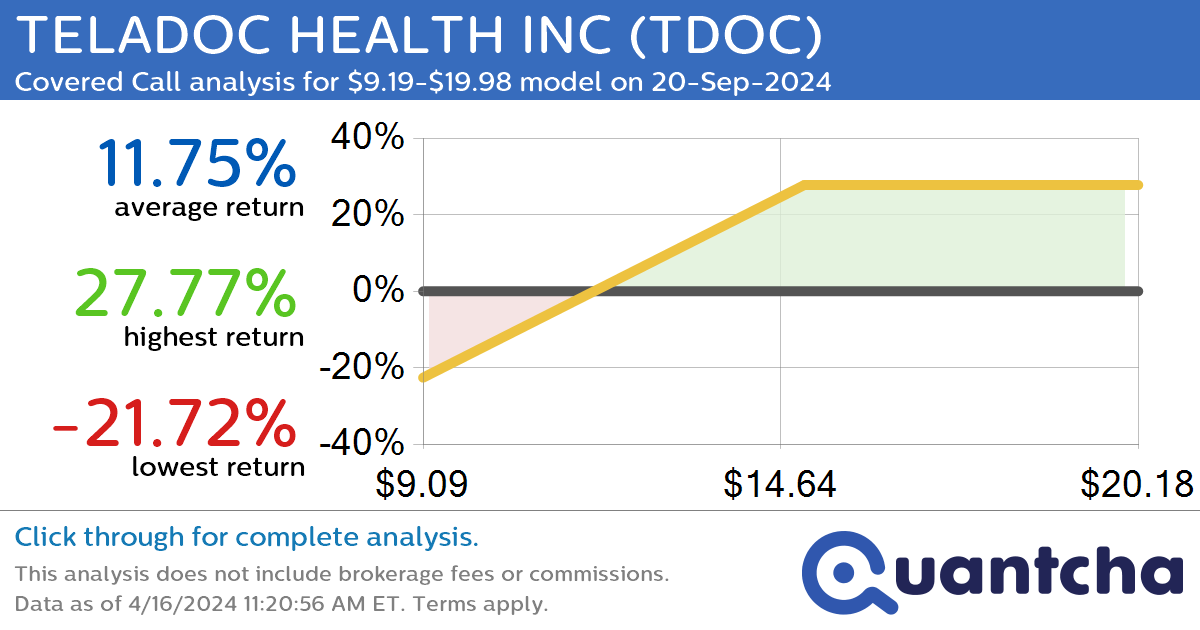

Covered Call Alert: TELADOC HEALTH INC $TDOC returning up to 27.44% through 20-Sep-2024

Quantchabot has detected a new Covered Call trade opportunity for TELADOC HEALTH INC (TDOC) for the 20-Sep-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TDOC was recently trading at $13.22 and has an implied volatility of 59.12% for this period. Based on an analysis of the…

-

52-Week Low Alert: Trading today’s movement in SOLAREDGE TECHNOLOGIES INC. C $SEDG

Quantchabot has detected a new Bear Call Spread trade opportunity for SOLAREDGE TECHNOLOGIES INC. C (SEDG) for the 26-Apr-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SEDG was recently trading at $59.14 and has an implied volatility of 91.71% for this period. Based on an analysis…

-

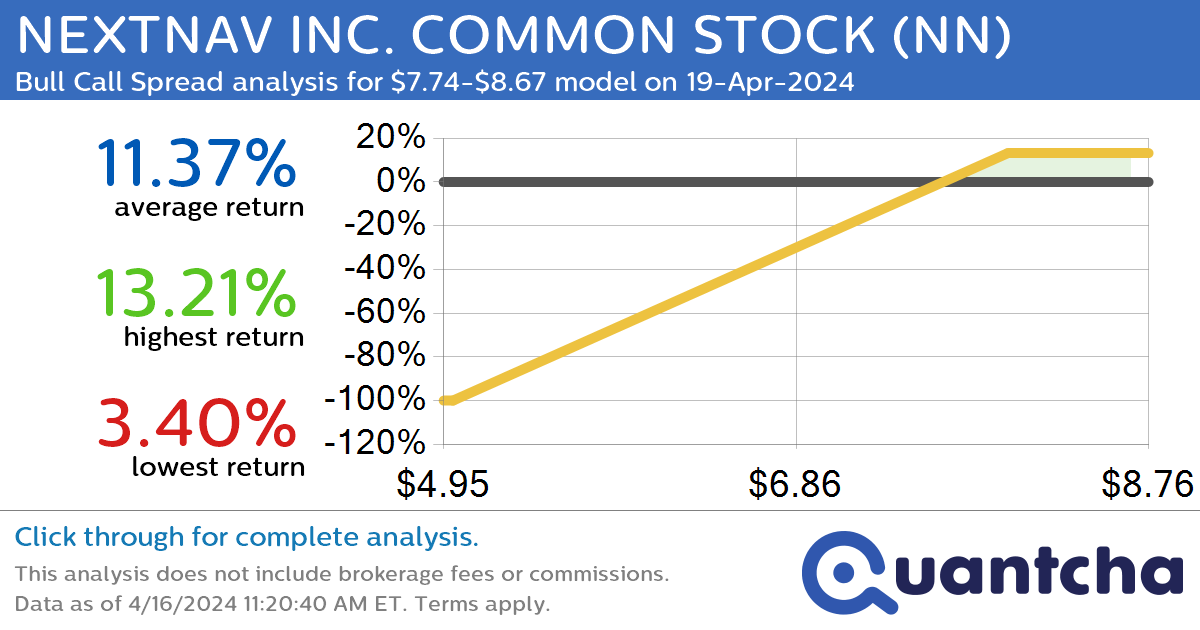

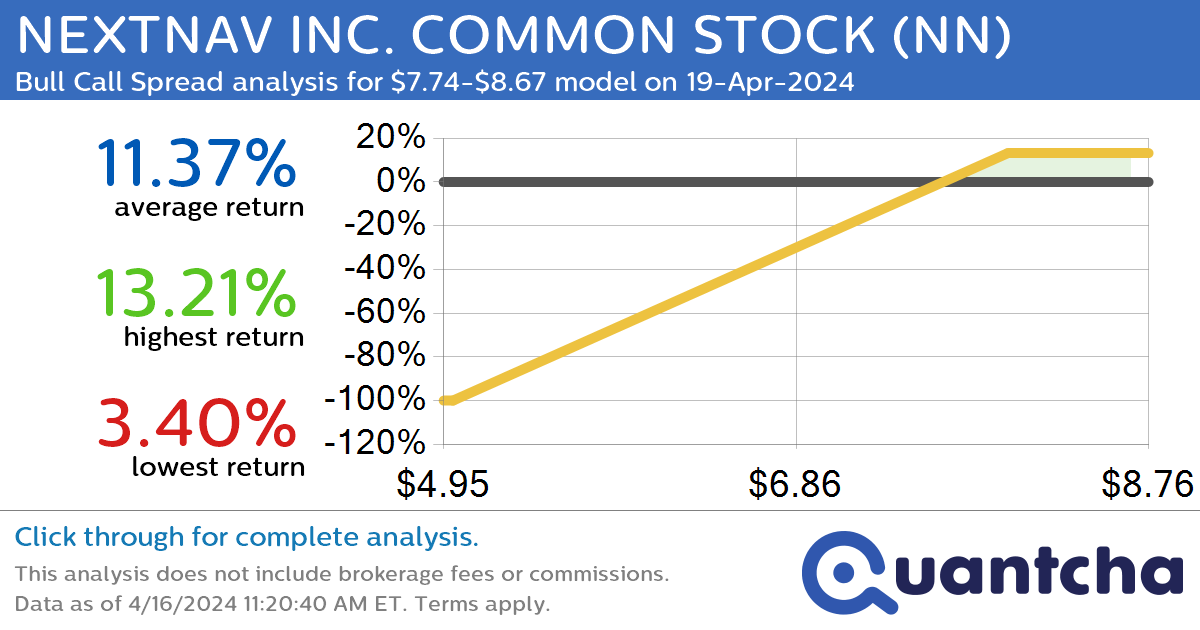

Big Gainer Alert: Trading today’s 9.6% move in NEXTNAV INC. COMMON STOCK $NN

Quantchabot has detected a new Bull Call Spread trade opportunity for NEXTNAV INC. COMMON STOCK (NN) for the 19-Apr-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. NN was recently trading at $7.74 and has an implied volatility of 113.27% for this period. Based on an analysis…

-

Synthetic Long Discount Alert: ICAHN ENTERPRISES $IEP trading at a 12.29% discount for the 16-Jan-2026 expiration

Quantchabot has detected a new Synthetic Long Stock trade opportunity for ICAHN ENTERPRISES (IEP) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. IEP was recently trading at $17.33 and has an implied volatility of 47.96% for this period. Based on an analysis of the…

-

Covered Call Alert: SEA LTD ADS $SE returning up to 34.15% through 20-Sep-2024

Quantchabot has detected a new Covered Call trade opportunity for SEA LTD ADS (SE) for the 20-Sep-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SE was recently trading at $57.20 and has an implied volatility of 60.50% for this period. Based on an analysis of the…

-

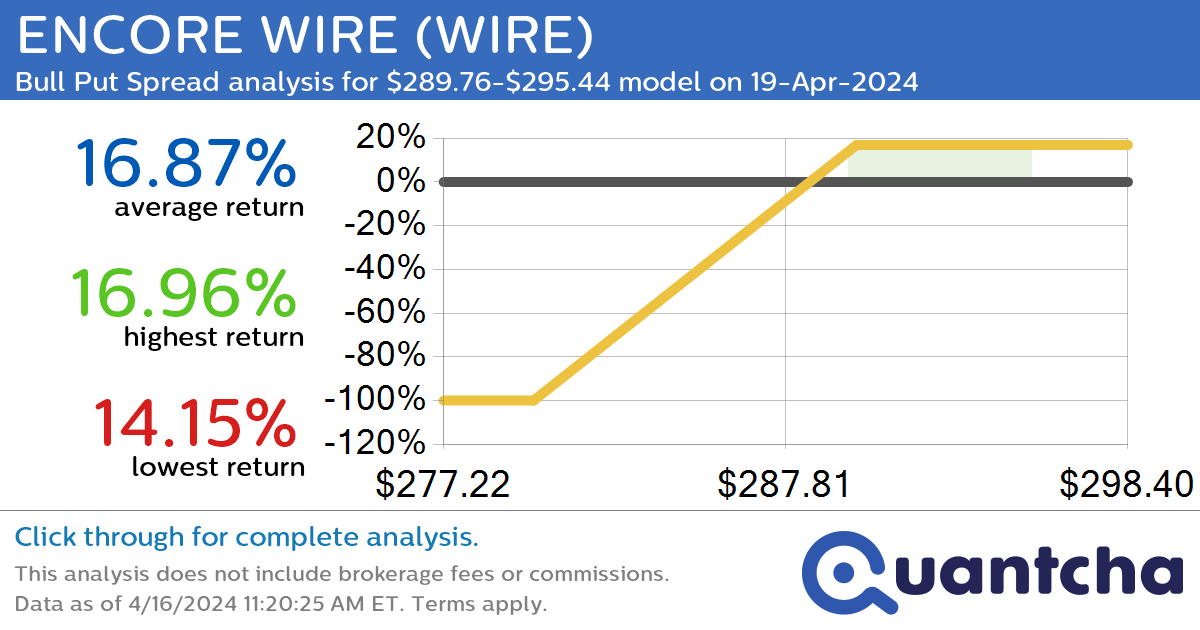

52-Week High Alert: Trading today’s movement in ENCORE WIRE $WIRE

Quantchabot has detected a new Bull Put Spread trade opportunity for ENCORE WIRE (WIRE) for the 19-Apr-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. WIRE was recently trading at $289.60 and has an implied volatility of 19.29% for this period. Based on an analysis of the…