Quantcha Ideas: Turn a good idea about a stock into a great options trade

-

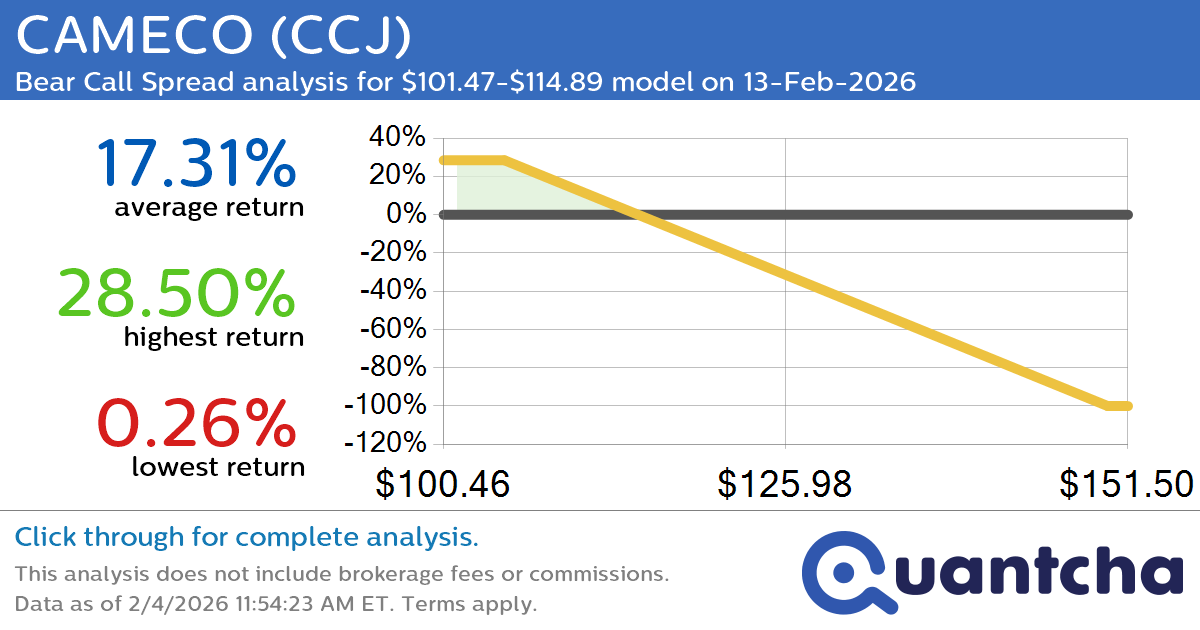

Big Loser Alert: Trading today’s -9.0% move in CAMECO $CCJ

Quantchabot has detected a new Bear Call Spread trade opportunity for CAMECO (CCJ) for the 13-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CCJ was recently trading at $114.77 and has an implied volatility of 76.12% for this period. Based on an analysis of the options…

-

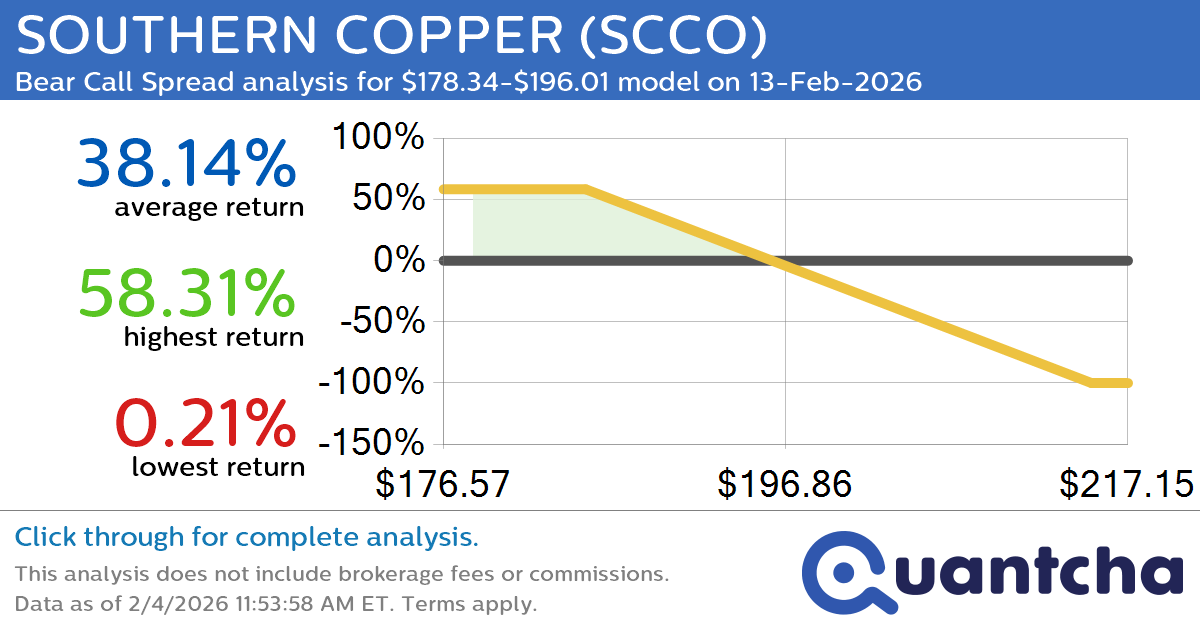

Big Loser Alert: Trading today’s -8.6% move in SOUTHERN COPPER $SCCO

Quantchabot has detected a new Bear Call Spread trade opportunity for SOUTHERN COPPER (SCCO) for the 13-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SCCO was recently trading at $196.81 and has an implied volatility of 57.90% for this period. Based on an analysis of the…

-

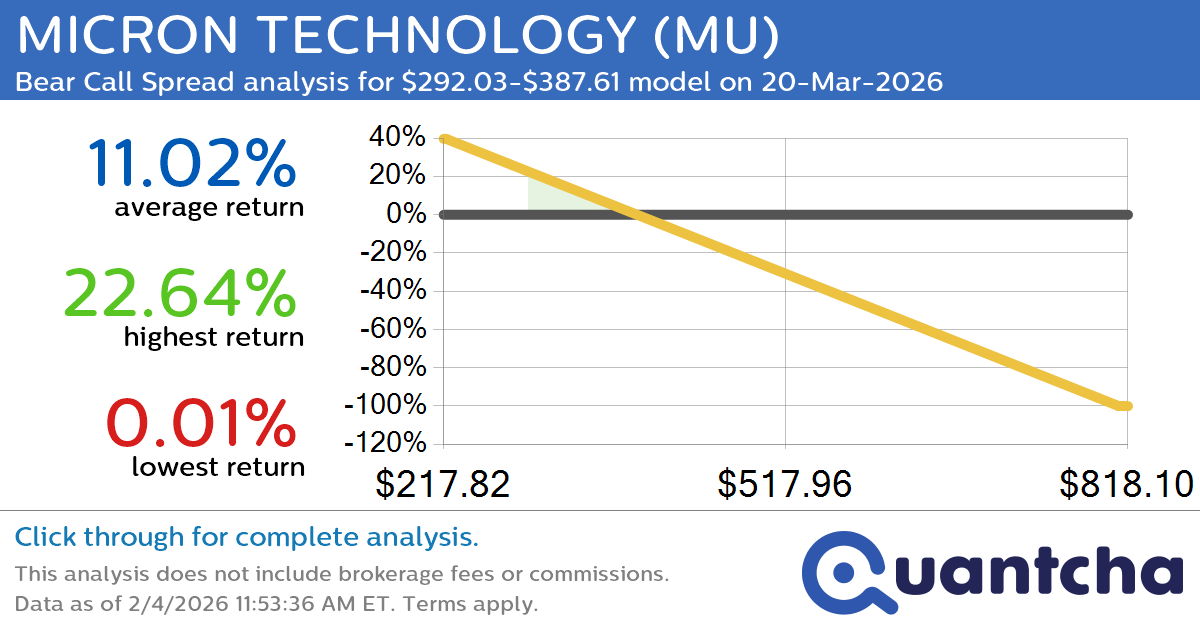

Big Loser Alert: Trading today’s -8.0% move in MICRON TECHNOLOGY $MU

Quantchabot has detected a new Bear Call Spread trade opportunity for MICRON TECHNOLOGY (MU) for the 20-Mar-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. MU was recently trading at $385.81 and has an implied volatility of 80.89% for this period. Based on an analysis of the…

-

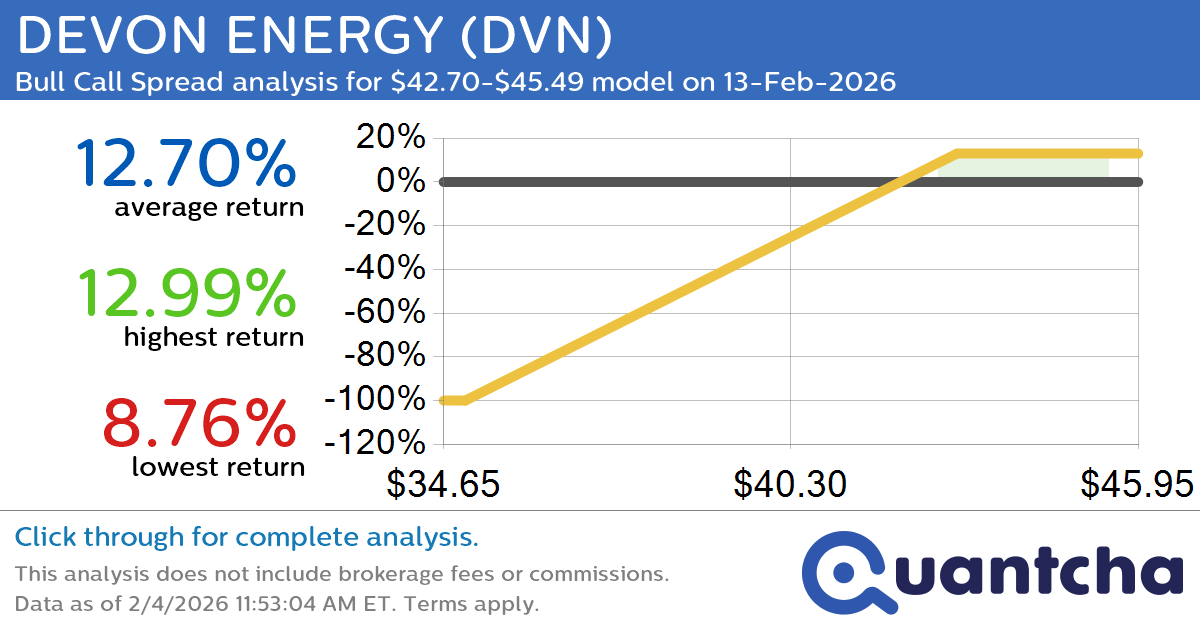

52-Week High Alert: Trading today’s movement in DEVON ENERGY $DVN

Quantchabot has detected a new Bull Call Spread trade opportunity for DEVON ENERGY (DVN) for the 13-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. DVN was recently trading at $42.66 and has an implied volatility of 38.72% for this period. Based on an analysis of the…

-

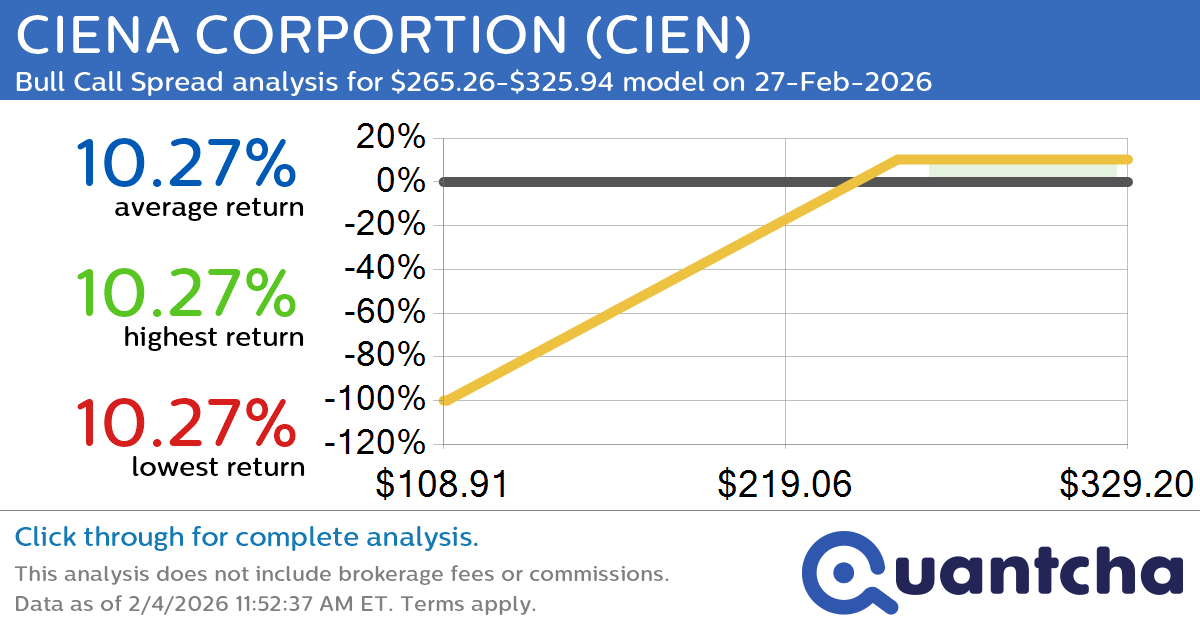

52-Week High Alert: Trading today’s movement in CIENA CORPORTION $CIEN

Quantchabot has detected a new Bull Call Spread trade opportunity for CIENA CORPORTION (CIEN) for the 27-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CIEN was recently trading at $264.61 and has an implied volatility of 80.81% for this period. Based on an analysis of the…

-

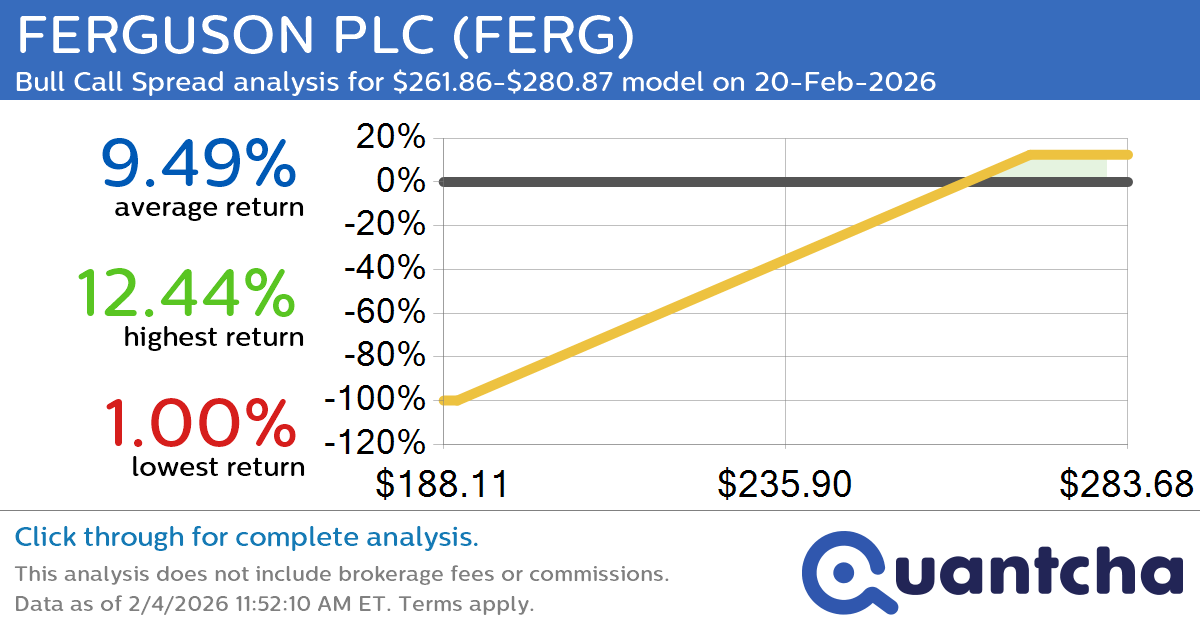

52-Week High Alert: Trading today’s movement in FERGUSON PLC $FERG

Quantchabot has detected a new Bull Call Spread trade opportunity for FERGUSON PLC (FERG) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. FERG was recently trading at $261.41 and has an implied volatility of 32.74% for this period. Based on an analysis of the…

-

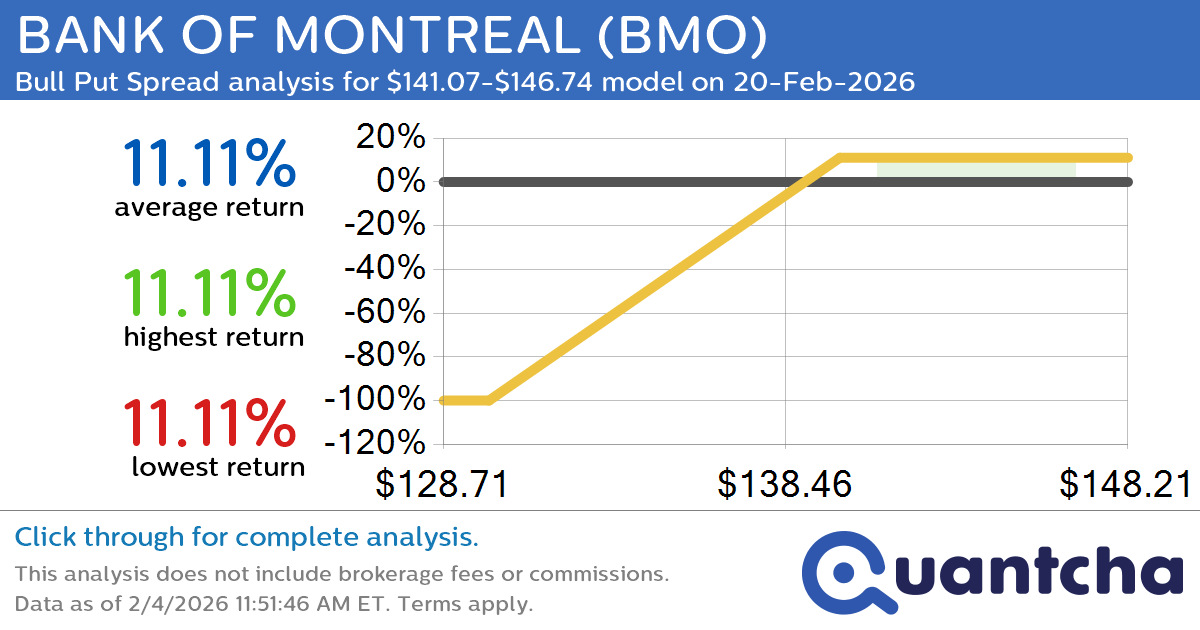

52-Week High Alert: Trading today’s movement in BANK OF MONTREAL $BMO

Quantchabot has detected a new Bull Put Spread trade opportunity for BANK OF MONTREAL (BMO) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. BMO was recently trading at $140.83 and has an implied volatility of 18.40% for this period. Based on an analysis of…

-

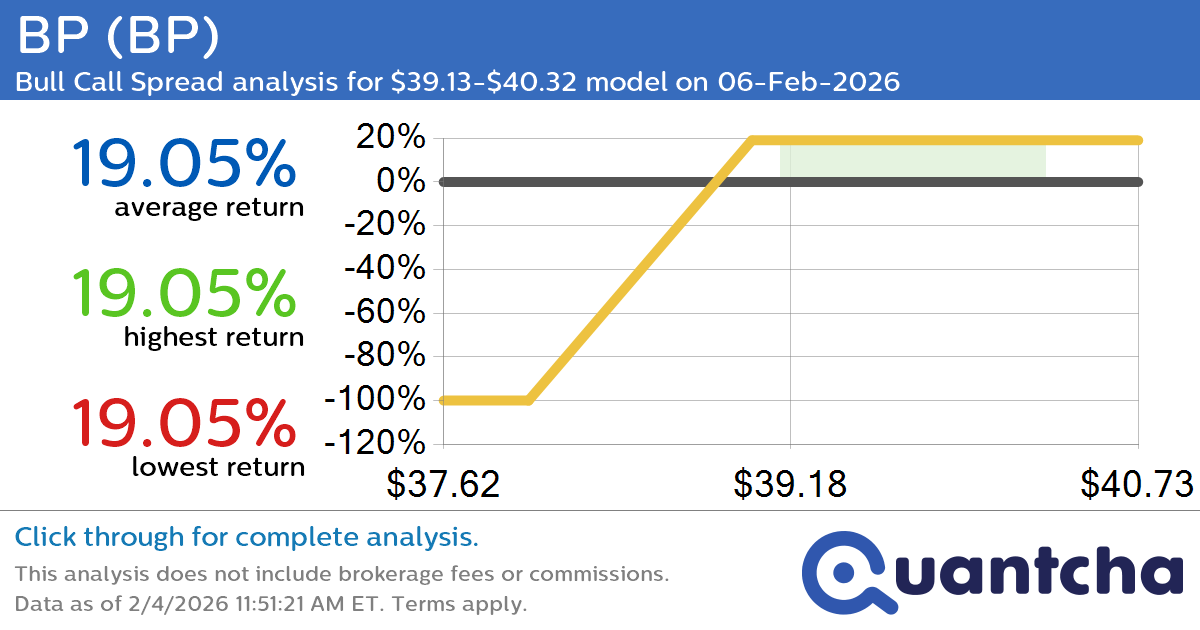

52-Week High Alert: Trading today’s movement in BP $BP

Quantchabot has detected a new Bull Call Spread trade opportunity for BP (BP) for the 6-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. BP was recently trading at $39.12 and has an implied volatility of 34.71% for this period. Based on an analysis of the options…

-

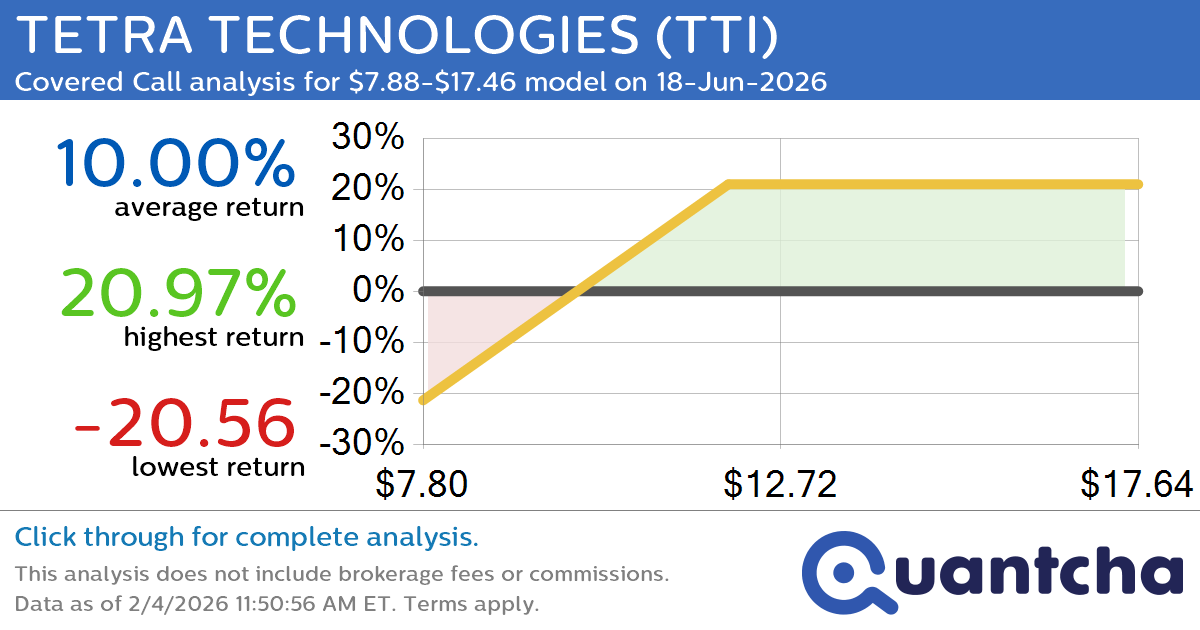

Covered Call Alert: TETRA TECHNOLOGIES $TTI returning up to 20.97% through 18-Jun-2026

Quantchabot has detected a new Covered Call trade opportunity for TETRA TECHNOLOGIES (TTI) for the 18-Jun-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TTI was recently trading at $11.57 and has an implied volatility of 65.41% for this period. Based on an analysis of the options…

-

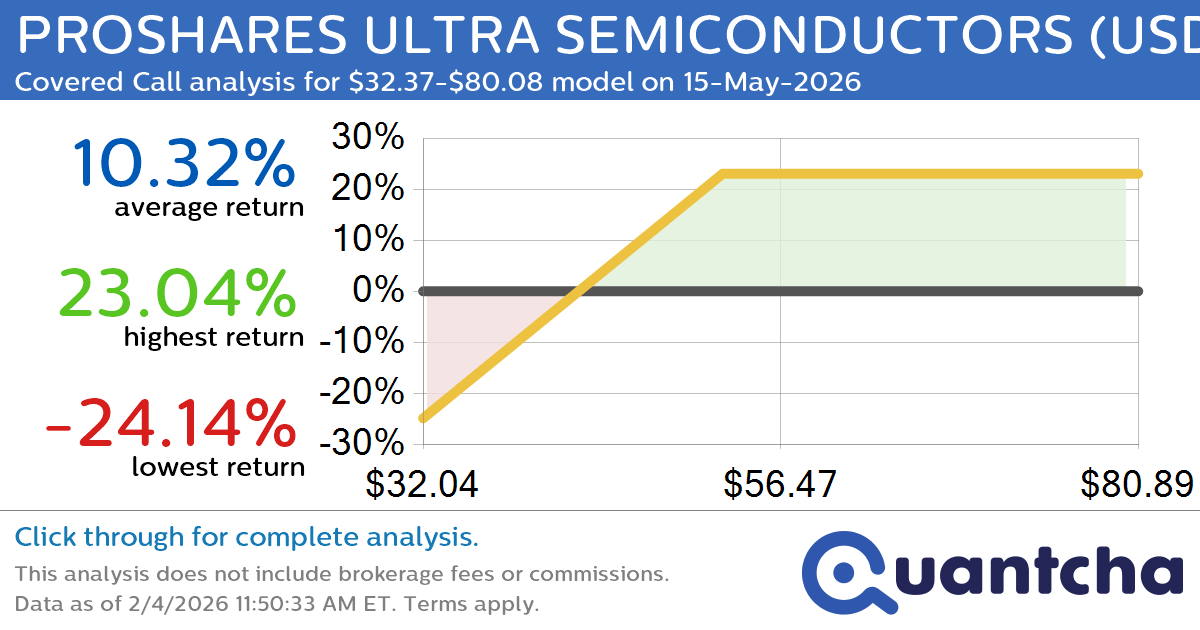

Covered Call Alert: PROSHARES ULTRA SEMICONDUCTORS $USD returning up to 23.04% through 15-May-2026

Quantchabot has detected a new Covered Call trade opportunity for PROSHARES ULTRA SEMICONDUCTORS (USD) for the 15-May-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. USD was recently trading at $50.39 and has an implied volatility of 86.21% for this period. Based on an analysis of the…