Quantcha Ideas: Turn a good idea about a stock into a great options trade

-

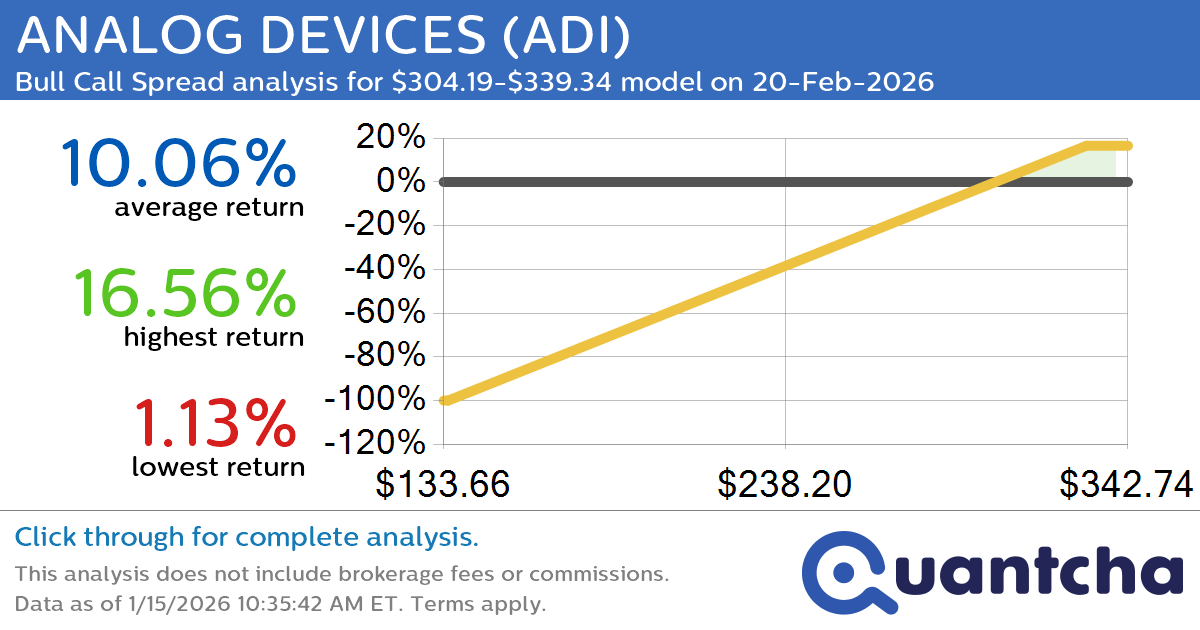

52-Week High Alert: Trading today’s movement in ANALOG DEVICES $ADI

Quantchabot has detected a new Bull Call Spread trade opportunity for ANALOG DEVICES (ADI) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ADI was recently trading at $303.03 and has an implied volatility of 34.46% for this period. Based on an analysis of the…

-

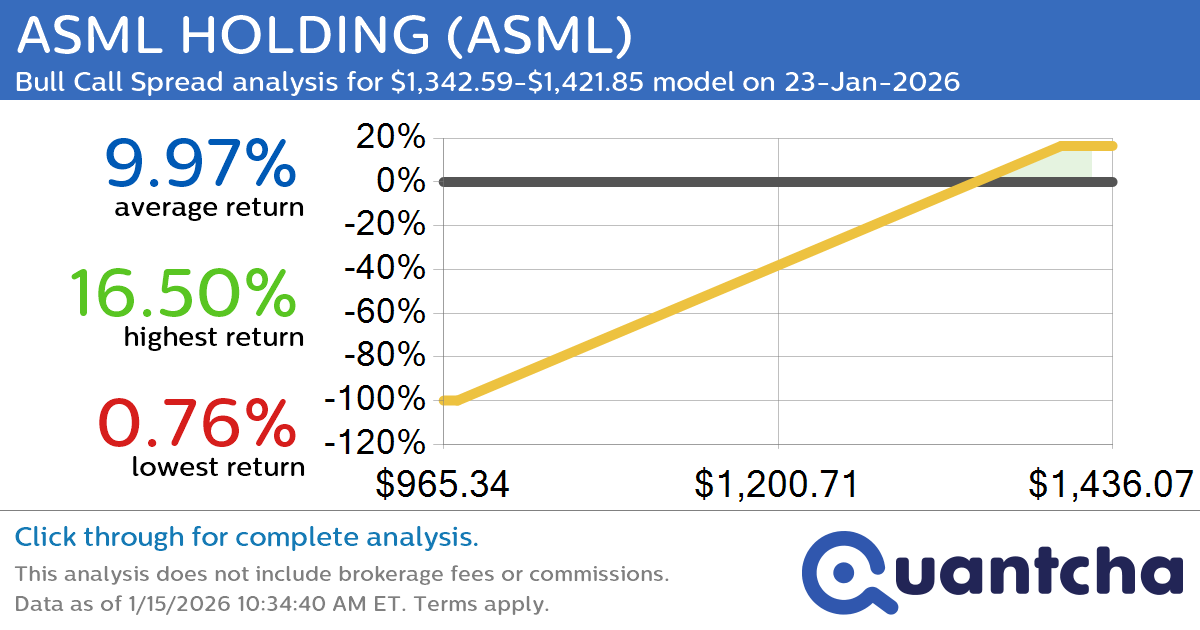

52-Week High Alert: Trading today’s movement in ASML HOLDING $ASML

Quantchabot has detected a new Bull Call Spread trade opportunity for ASML HOLDING (ASML) for the 23-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ASML was recently trading at $1,341.37 and has an implied volatility of 37.00% for this period. Based on an analysis of the…

-

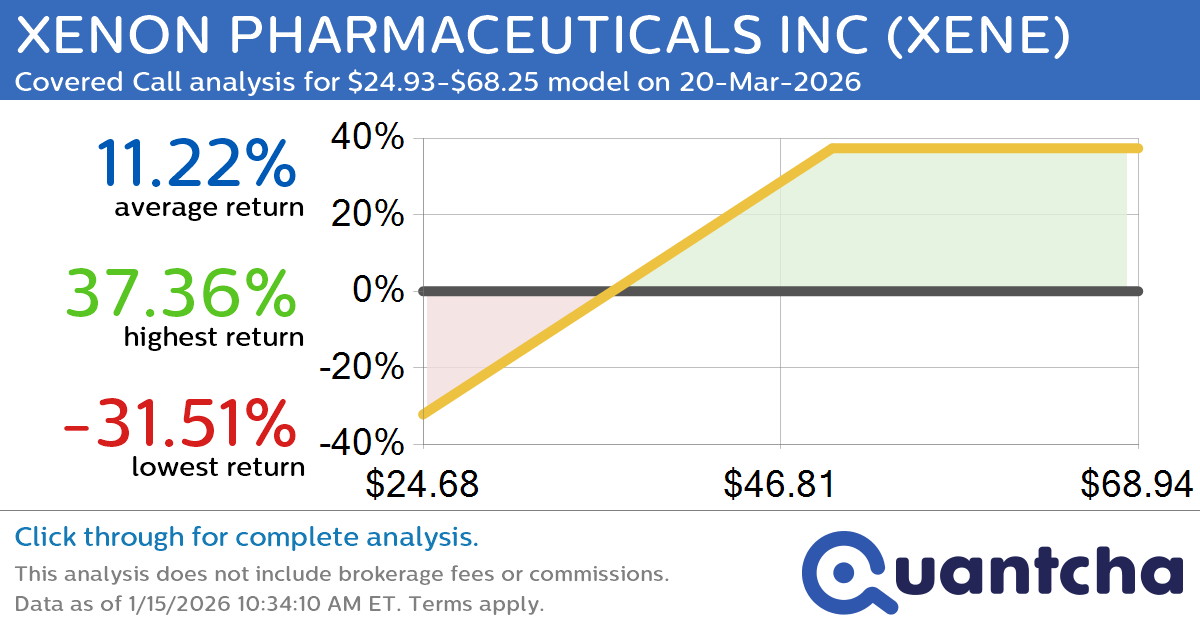

Covered Call Alert: XENON PHARMACEUTICALS INC $XENE returning up to 36.87% through 20-Mar-2026

Quantchabot has detected a new Covered Call trade opportunity for XENON PHARMACEUTICALS INC (XENE) for the 20-Mar-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. XENE was recently trading at $40.98 and has an implied volatility of 119.52% for this period. Based on an analysis of the…

-

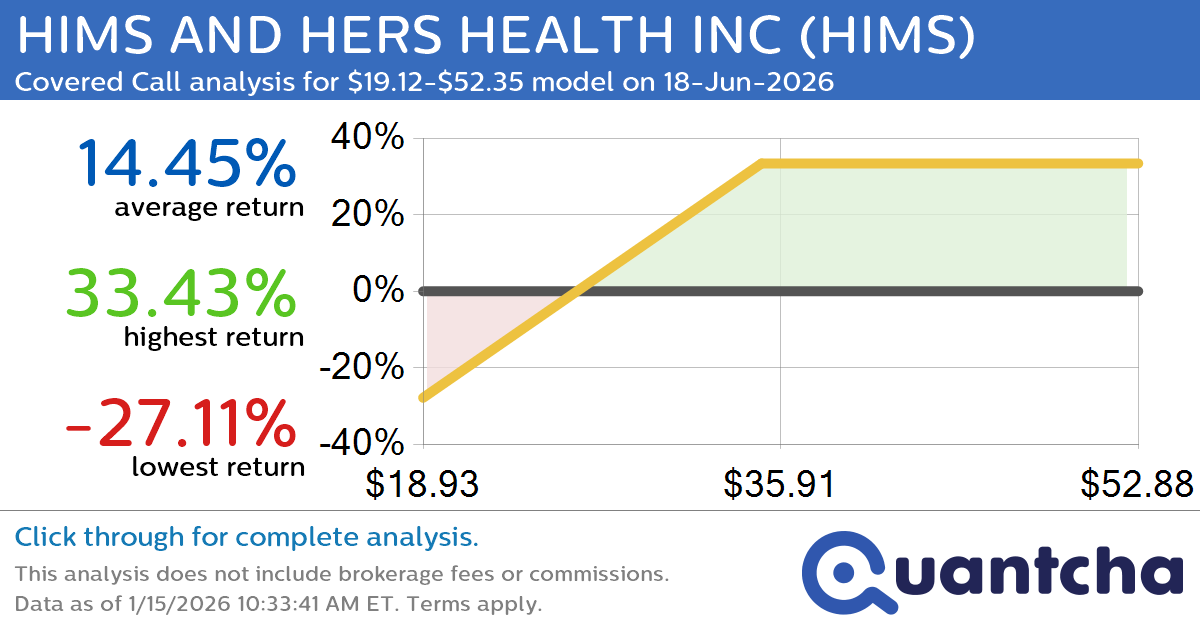

Covered Call Alert: HIMS AND HERS HEALTH INC $HIMS returning up to 34.62% through 18-Jun-2026

Quantchabot has detected a new Covered Call trade opportunity for HIMS AND HERS HEALTH INC (HIMS) for the 18-Jun-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. HIMS was recently trading at $31.14 and has an implied volatility of 77.35% for this period. Based on an analysis…

-

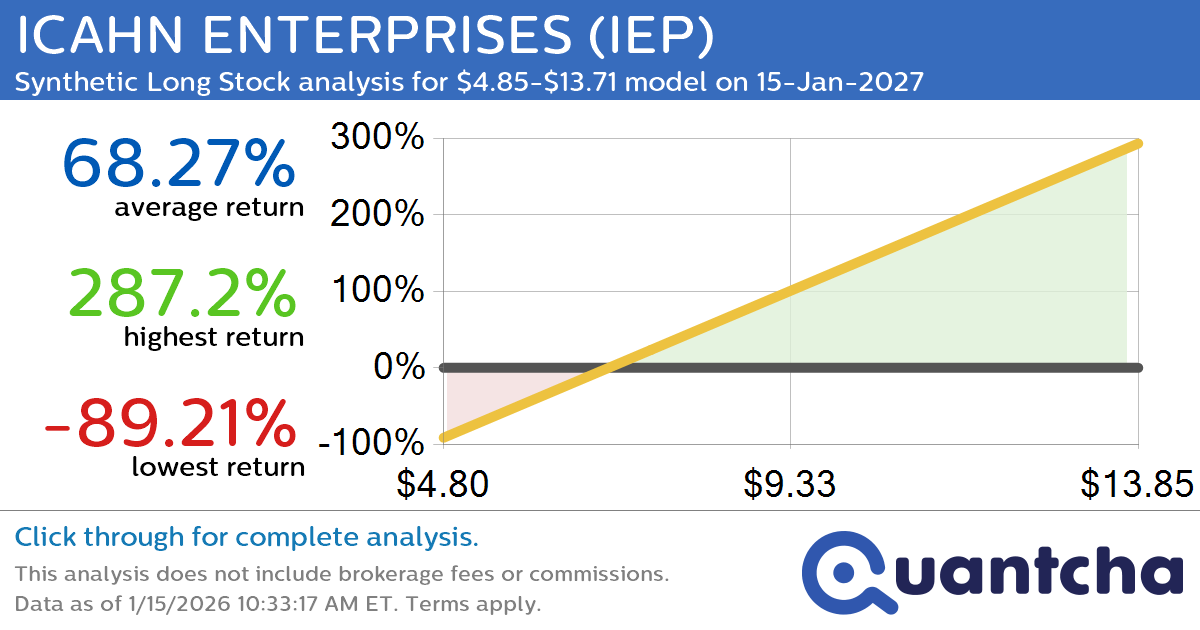

Synthetic Long Discount Alert: ICAHN ENTERPRISES $IEP trading at a 11.69% discount for the 15-Jan-2027 expiration

Quantchabot has detected a new Synthetic Long Stock trade opportunity for ICAHN ENTERPRISES (IEP) for the 15-Jan-2027 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. IEP was recently trading at $7.87 and has an implied volatility of 51.92% for this period. Based on an analysis of the…

-

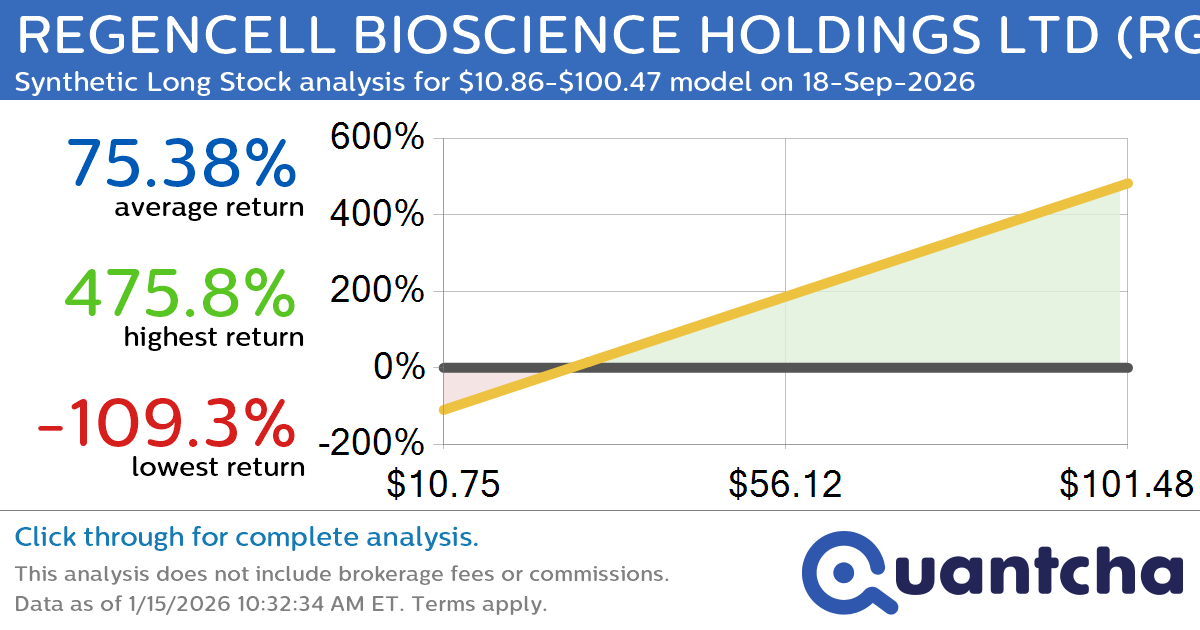

Synthetic Long Discount Alert: REGENCELL BIOSCIENCE HOLDINGS LTD $RGC trading at a 14.36% discount for the 18-Sep-2026 expiration

Quantchabot has detected a new Synthetic Long Stock trade opportunity for REGENCELL BIOSCIENCE HOLDINGS LTD (RGC) for the 18-Sep-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. RGC was recently trading at $32.23 and has an implied volatility of 135.29% for this period. Based on an analysis…

-

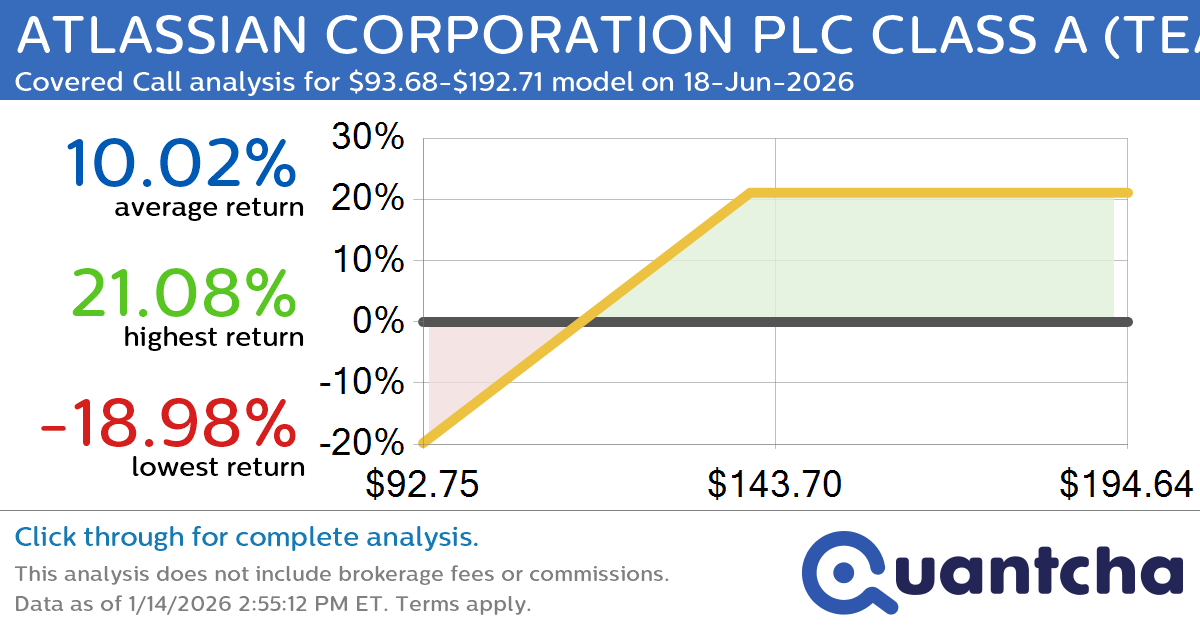

Covered Call Alert: ATLASSIAN CORPORATION PLC CLASS A $TEAM returning up to 21.08% through 18-Jun-2026

Quantchabot has detected a new Covered Call trade opportunity for ATLASSIAN CORPORATION PLC CLASS A (TEAM) for the 18-Jun-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TEAM was recently trading at $132.24 and has an implied volatility of 55.24% for this period. Based on an analysis…

-

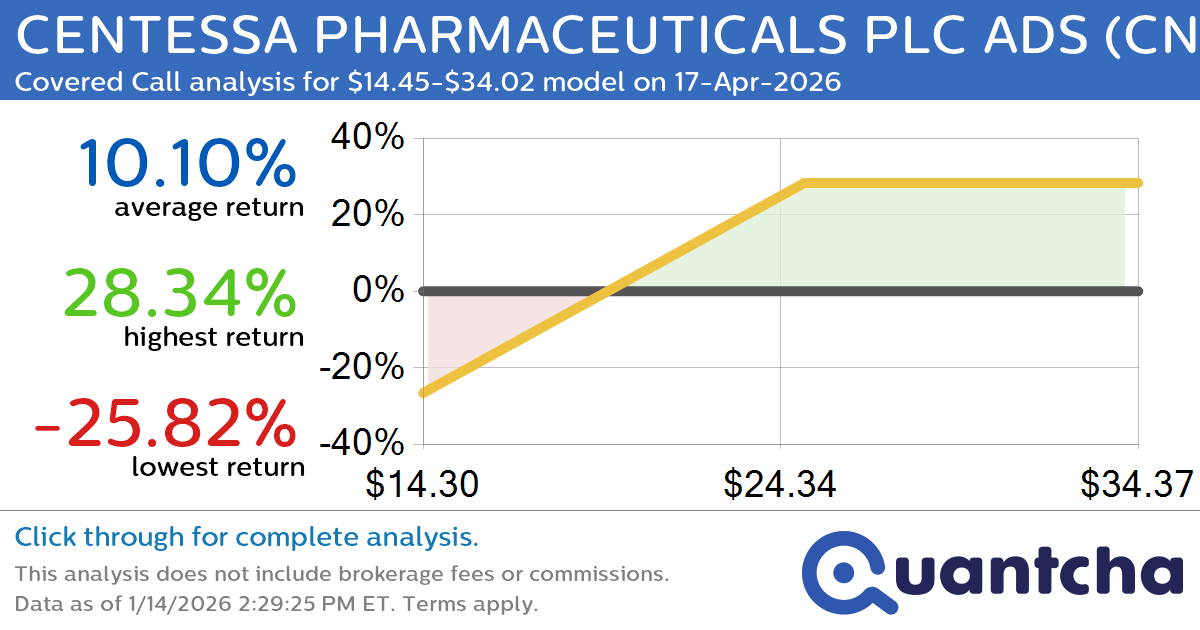

Covered Call Alert: CENTESSA PHARMACEUTICALS PLC ADS $CNTA returning up to 28.34% through 17-Apr-2026

Quantchabot has detected a new Covered Call trade opportunity for CENTESSA PHARMACEUTICALS PLC ADS (CNTA) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CNTA was recently trading at $21.96 and has an implied volatility of 84.56% for this period. Based on an analysis of…

-

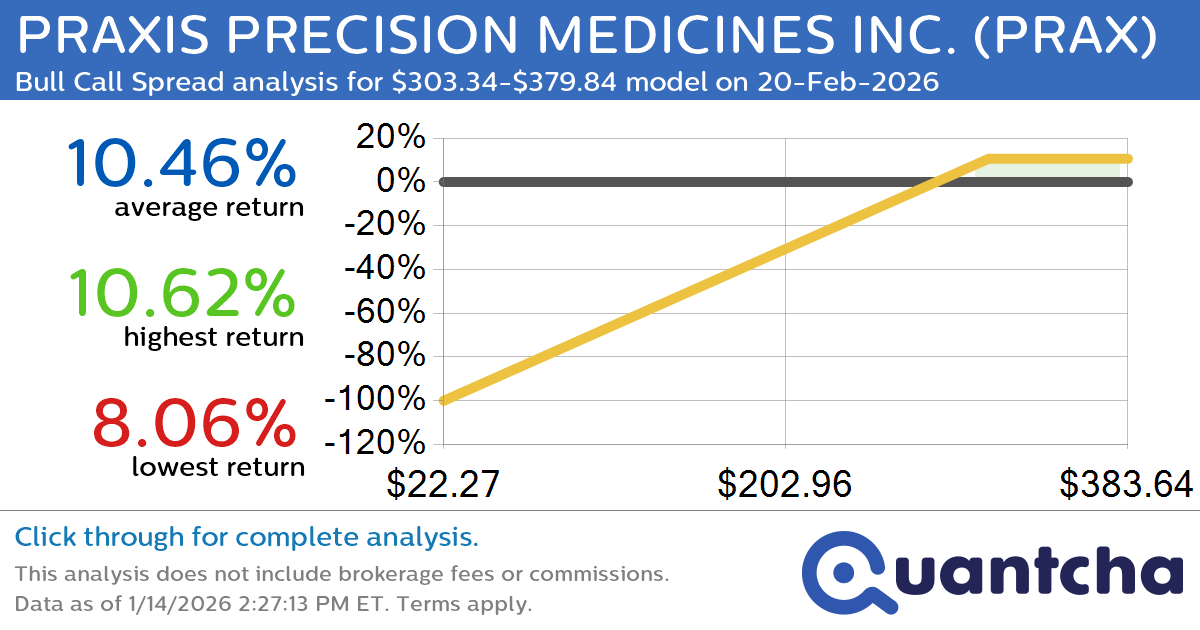

Big Gainer Alert: Trading today’s 7.6% move in PRAXIS PRECISION MEDICINES INC. $PRAX

Quantchabot has detected a new Bull Call Spread trade opportunity for PRAXIS PRECISION MEDICINES INC. (PRAX) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. PRAX was recently trading at $302.16 and has an implied volatility of 70.06% for this period. Based on an analysis…

-

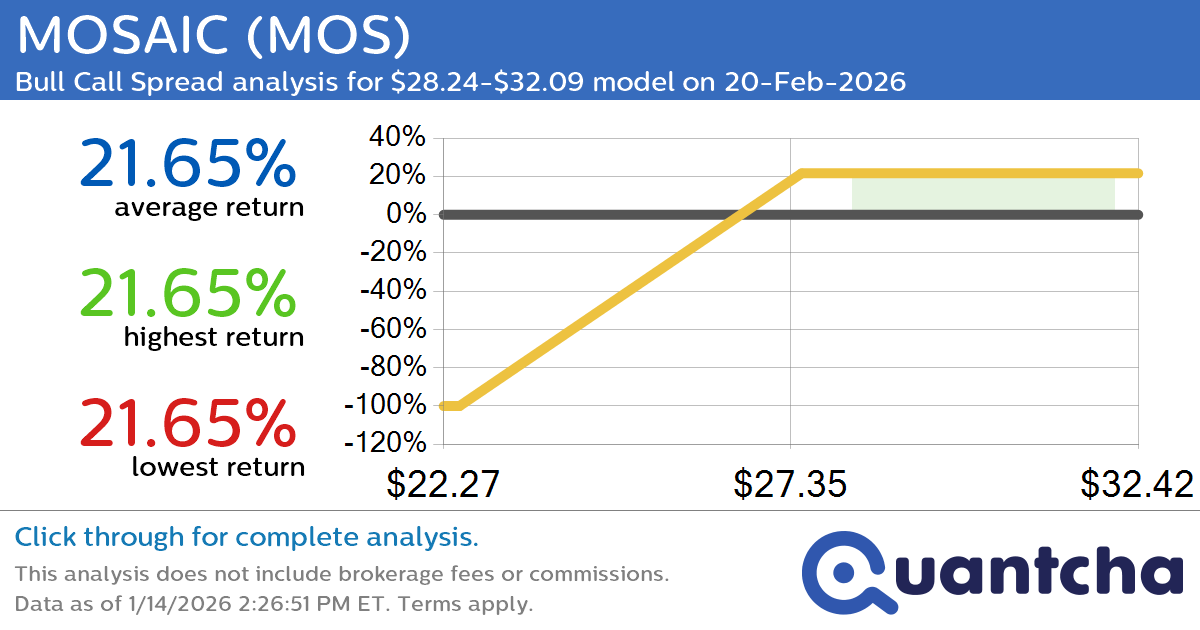

Big Gainer Alert: Trading today’s 7.3% move in MOSAIC $MOS

Quantchabot has detected a new Bull Call Spread trade opportunity for MOSAIC (MOS) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. MOS was recently trading at $28.13 and has an implied volatility of 39.80% for this period. Based on an analysis of the options…