Quantcha Ideas: Turn a good idea about a stock into a great options trade

-

Big Gainer Alert: Trading today’s 12.3% move in MICROSTRATEGY $MSTR

Quantchabot has detected a new Bull Call Spread trade opportunity for MICROSTRATEGY (MSTR) for the 26-Apr-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. MSTR was recently trading at $1,318.00 and has an implied volatility of 129.34% for this period. Based on an analysis of the options…

-

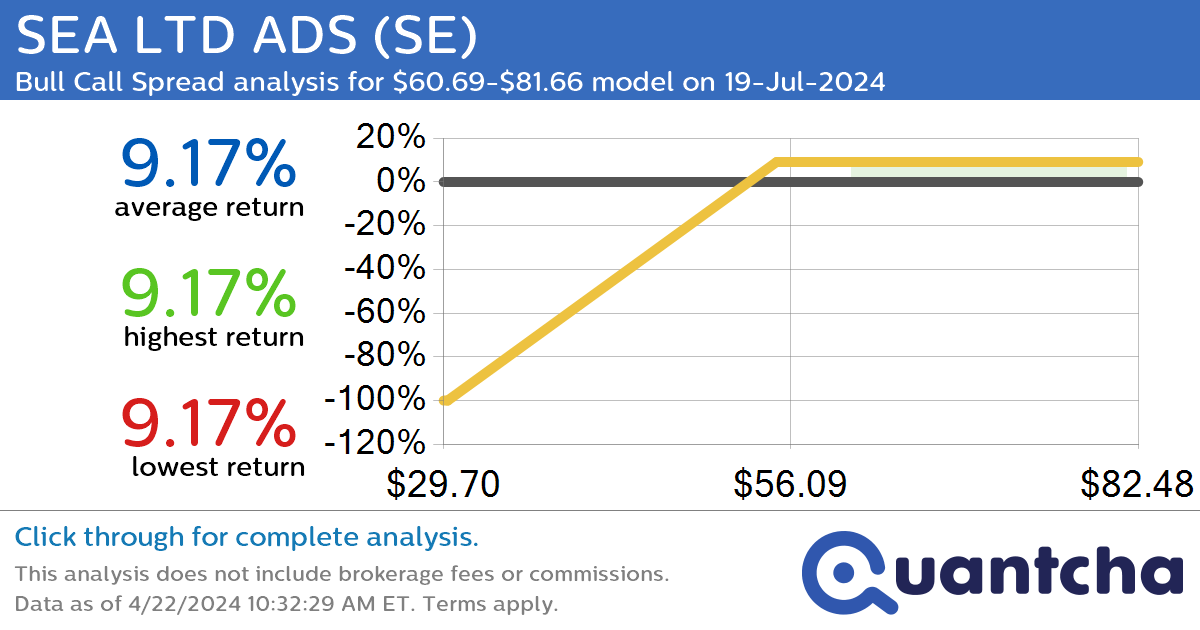

Big Gainer Alert: Trading today’s 8.7% move in SEA LTD ADS $SE

Quantchabot has detected a new Bull Call Spread trade opportunity for SEA LTD ADS (SE) for the 19-Jul-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SE was recently trading at $59.86 and has an implied volatility of 60.21% for this period. Based on an analysis of…

-

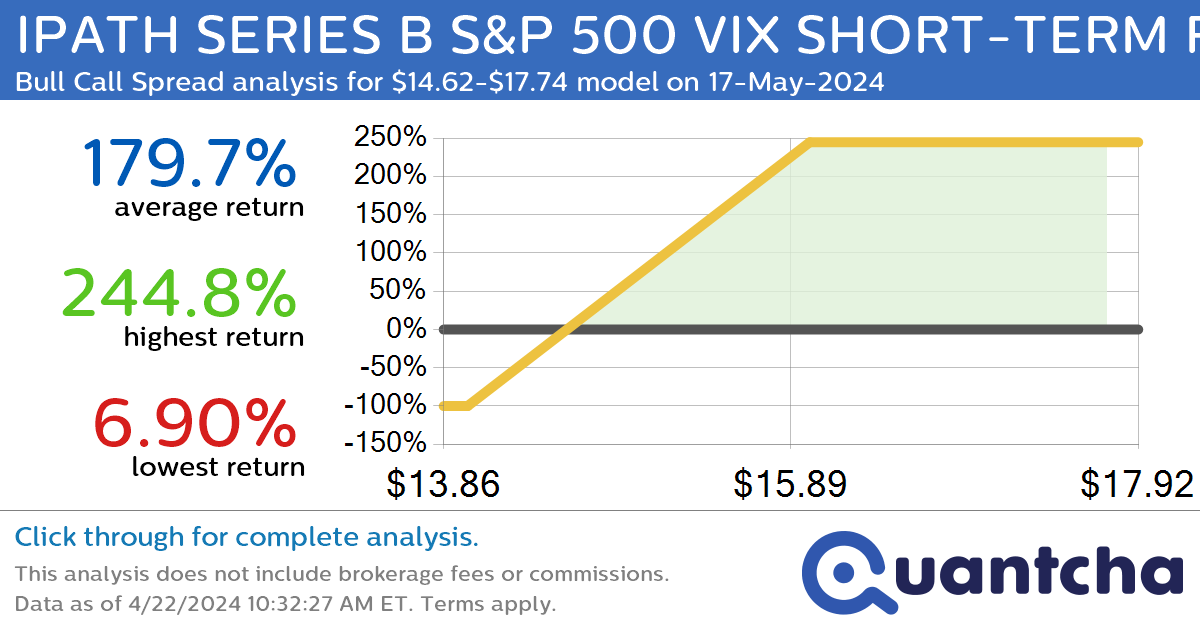

StockTwits Trending Alert: Trading recent interest in IPATH SERIES B S&P 500 VIX SHORT-TERM FUTURES ETN $VXX

Quantchabot has detected a new Bull Call Spread trade opportunity for IPATH SERIES B S&P 500 VIX SHORT-TERM FUTURES ETN (VXX) for the 17-May-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. VXX was recently trading at $14.62 and has an implied volatility of 71.48% for this…

-

Covered Call Alert: INSMED $INSM returning up to 63.31% through 19-Jul-2024

Quantchabot has detected a new Covered Call trade opportunity for INSMED (INSM) for the 19-Jul-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. INSM was recently trading at $24.09 and has an implied volatility of 181.21% for this period. Based on an analysis of the options available…

-

52-Week High Alert: Trading today’s movement in AMERICAN EXPRESS $AXP

Quantchabot has detected a new Bull Call Spread trade opportunity for AMERICAN EXPRESS (AXP) for the 19-Jul-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. AXP was recently trading at $229.16 and has an implied volatility of 24.31% for this period. Based on an analysis of the…

-

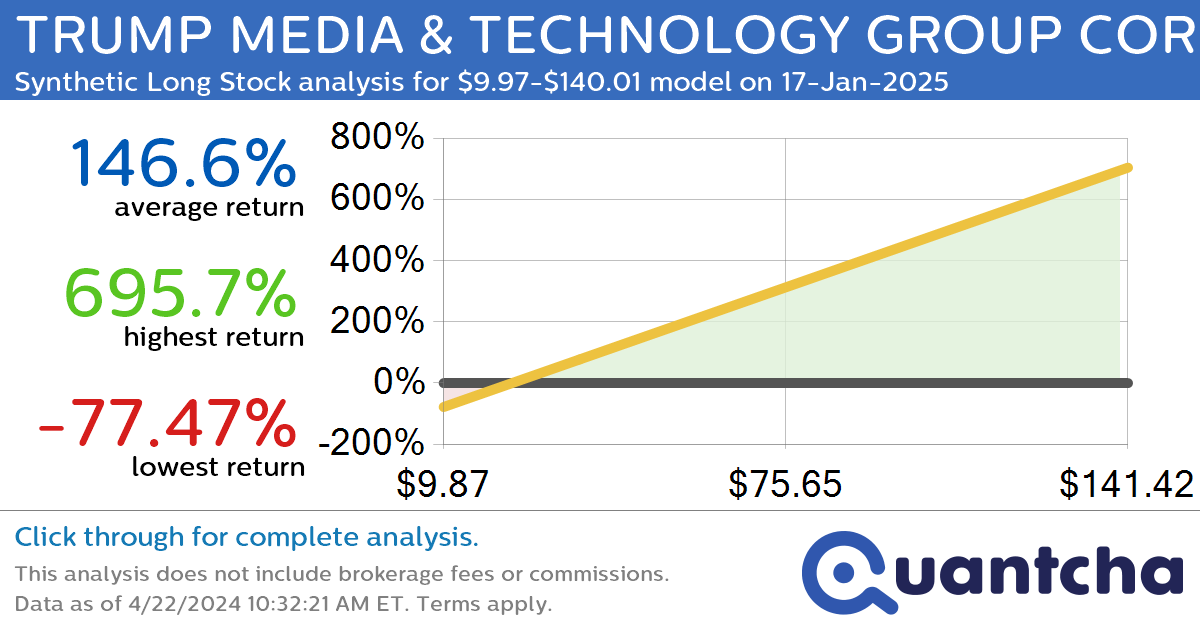

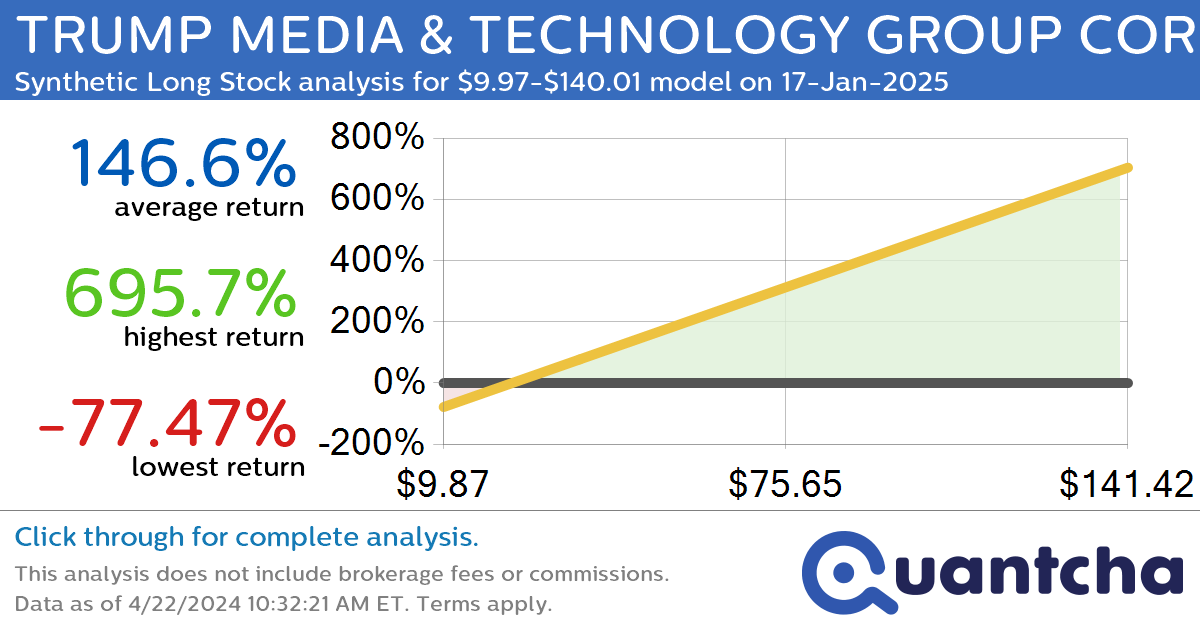

Synthetic Long Discount Alert: TRUMP MEDIA & TECHNOLOGY GROUP CORP. $DJT trading at a 38.77% discount for the 17-Jan-2025 expiration

Quantchabot has detected a new Synthetic Long Stock trade opportunity for TRUMP MEDIA & TECHNOLOGY GROUP CORP. (DJT) for the 17-Jan-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. DJT was recently trading at $35.85 and has an implied volatility of 153.42% for this period. Based on…

-

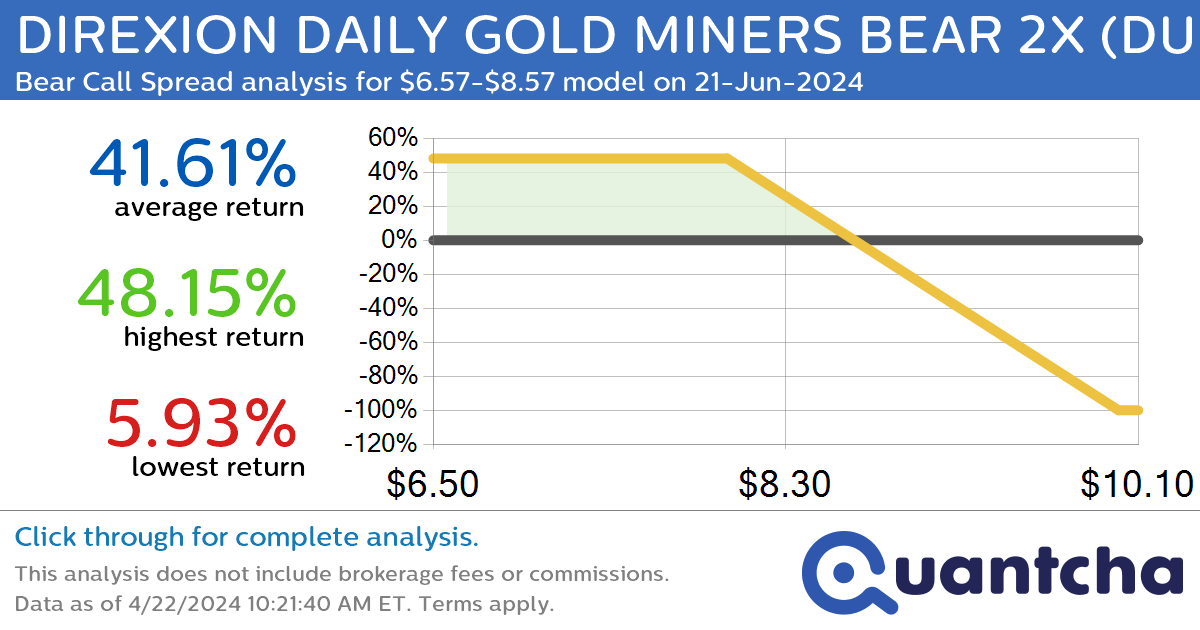

StockTwits Trending Alert: Trading recent interest in DIREXION DAILY GOLD MINERS BEAR 2X $DUST

Quantchabot has detected a new Bear Call Spread trade opportunity for DIREXION DAILY GOLD MINERS BEAR 2X (DUST) for the 21-Jun-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. DUST was recently trading at $8.56 and has an implied volatility of 67.16% for this period. Based on…

-

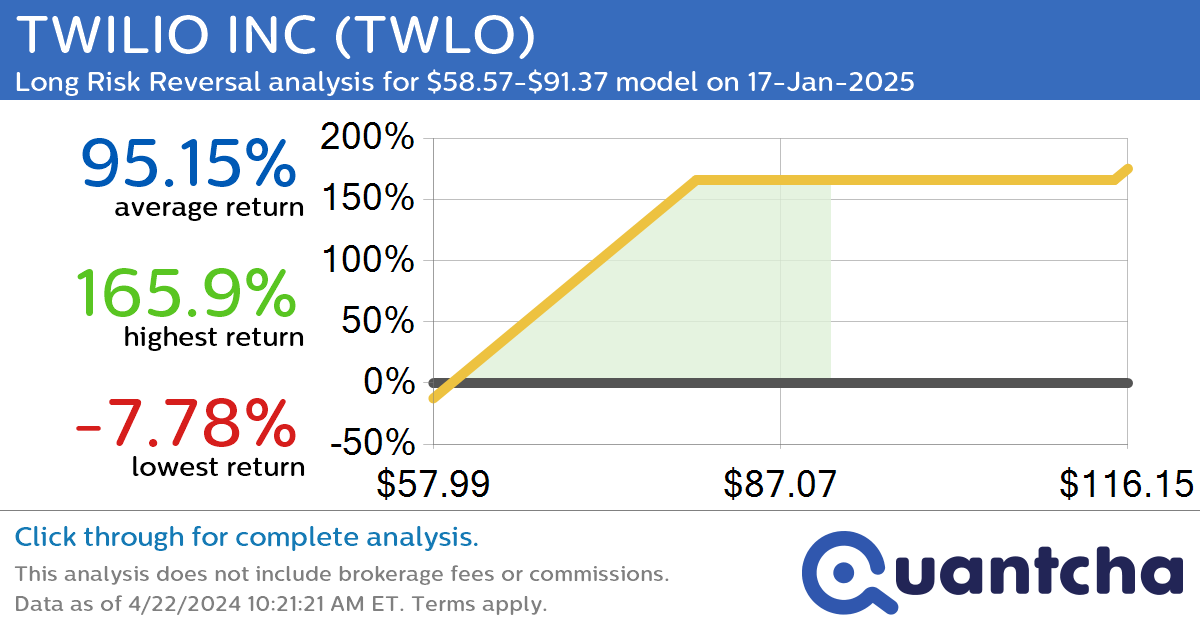

StockTwits Trending Alert: Trading recent interest in TWILIO INC $TWLO

Quantchabot has detected a new Long Risk Reversal trade opportunity for TWILIO INC (TWLO) for the 17-Jan-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TWLO was recently trading at $58.56 and has an implied volatility of 46.88% for this period. Based on an analysis of the…

-

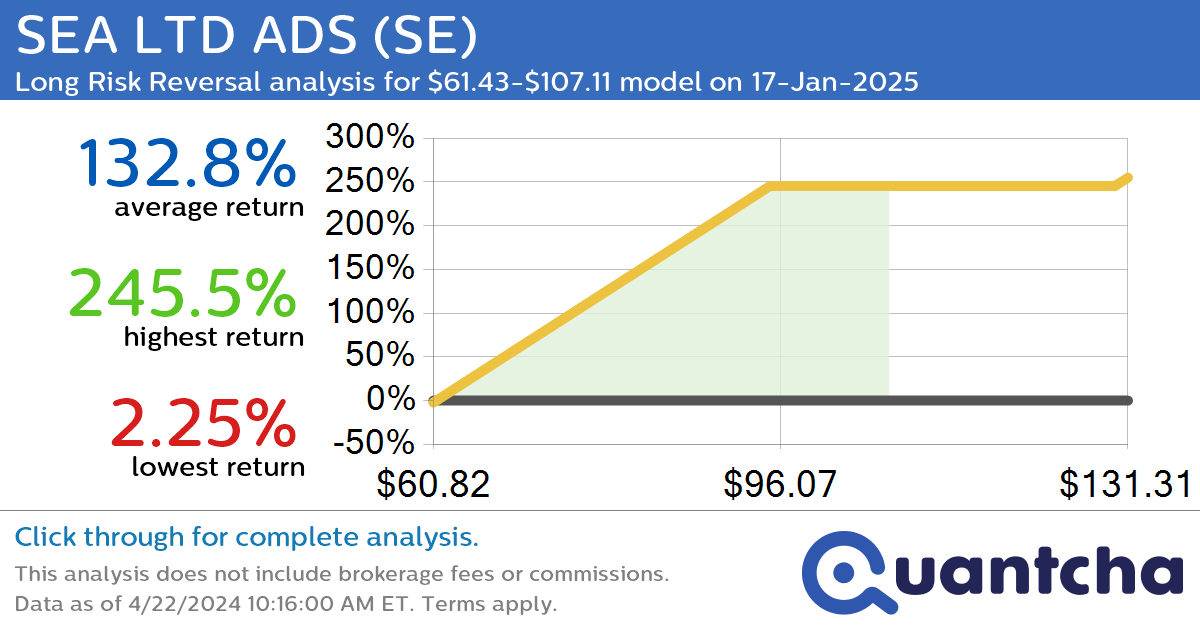

StockTwits Trending Alert: Trading recent interest in SEA LTD ADS $SE

Quantchabot has detected a new Long Risk Reversal trade opportunity for SEA LTD ADS (SE) for the 17-Jan-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SE was recently trading at $61.40 and has an implied volatility of 59.84% for this period. Based on an analysis of…

-

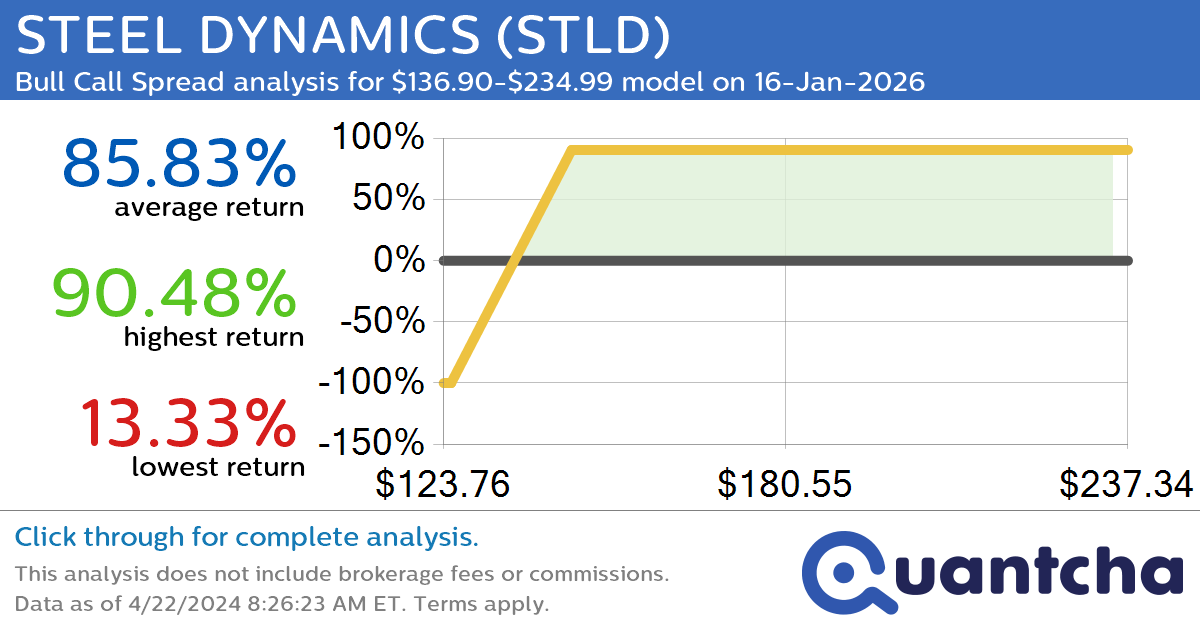

StockTwits Trending Alert: Trading recent interest in STEEL DYNAMICS $STLD

Quantchabot has detected a new Bull Call Spread trade opportunity for STEEL DYNAMICS (STLD) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. STLD was recently trading at $136.90 and has an implied volatility of 33.97% for this period. Based on an analysis of the…