Quantcha Ideas: Turn a good idea about a stock into a great options trade

-

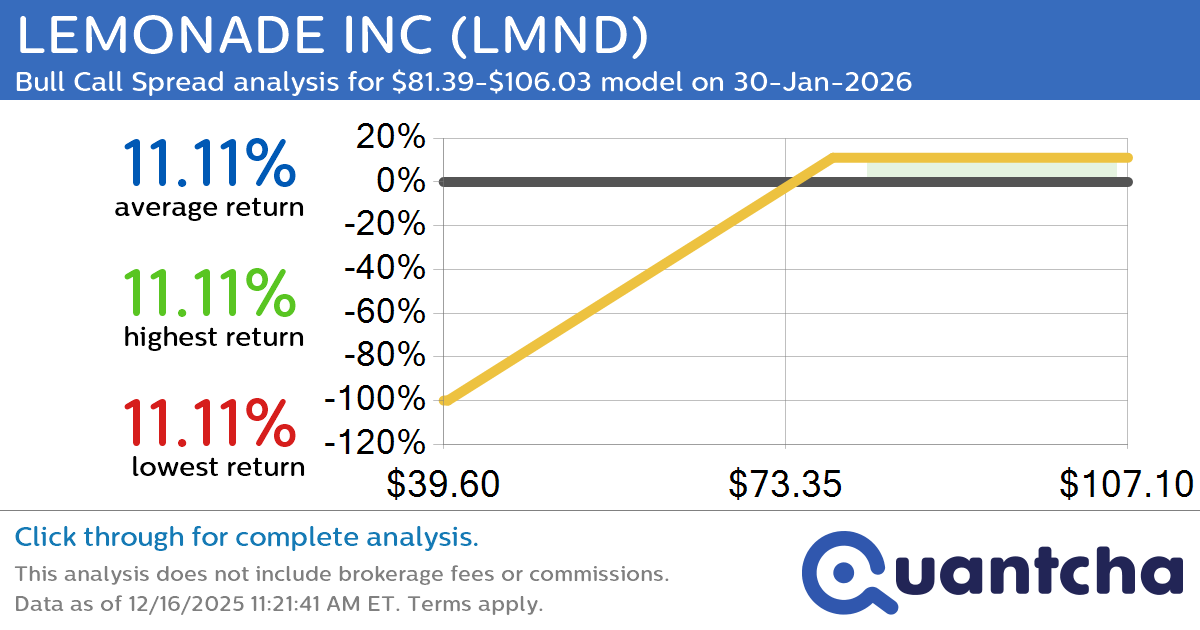

Big Gainer Alert: Trading today’s 7.9% move in LEMONADE INC $LMND

Quantchabot has detected a new Bull Call Spread trade opportunity for LEMONADE INC (LMND) for the 30-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. LMND was recently trading at $81.00 and has an implied volatility of 74.70% for this period. Based on an analysis of the…

-

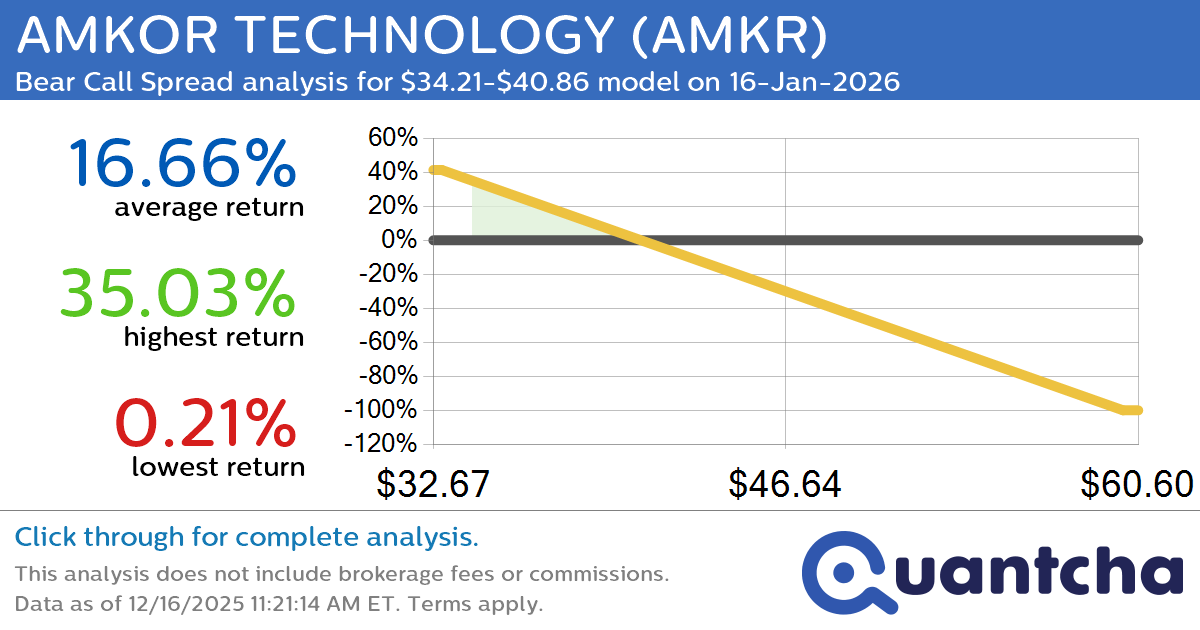

Big Loser Alert: Trading today’s -7.2% move in AMKOR TECHNOLOGY $AMKR

Quantchabot has detected a new Bear Call Spread trade opportunity for AMKOR TECHNOLOGY (AMKR) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. AMKR was recently trading at $40.73 and has an implied volatility of 60.31% for this period. Based on an analysis of the…

-

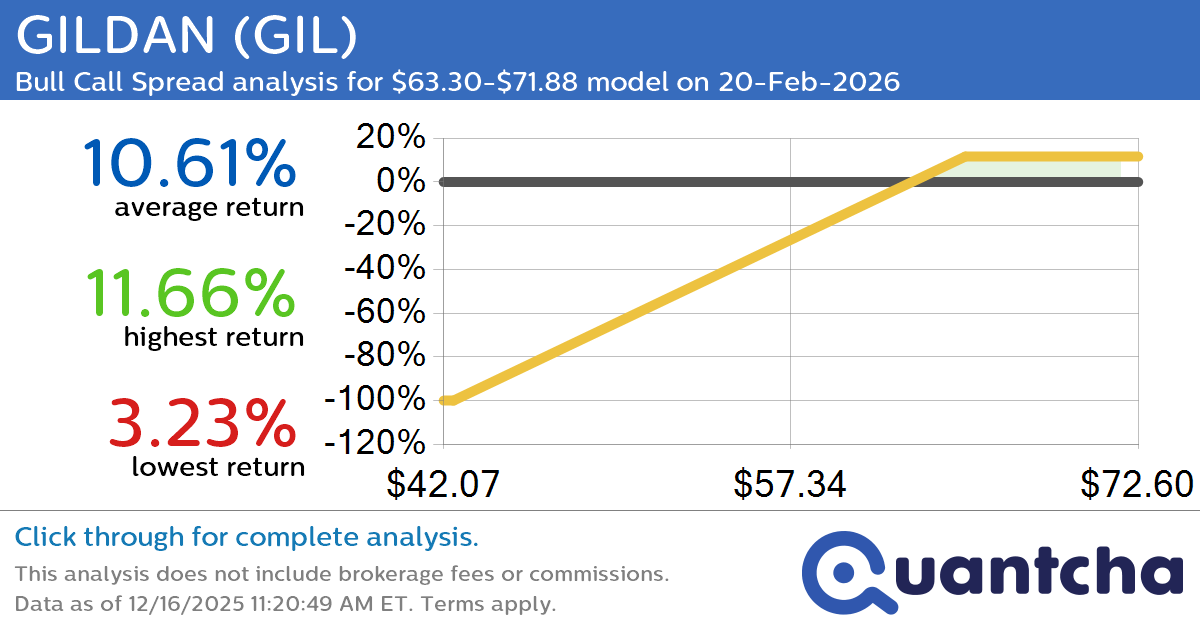

52-Week High Alert: Trading today’s movement in GILDAN $GIL

Quantchabot has detected a new Bull Call Spread trade opportunity for GILDAN (GIL) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. GIL was recently trading at $62.86 and has an implied volatility of 29.73% for this period. Based on an analysis of the options…

-

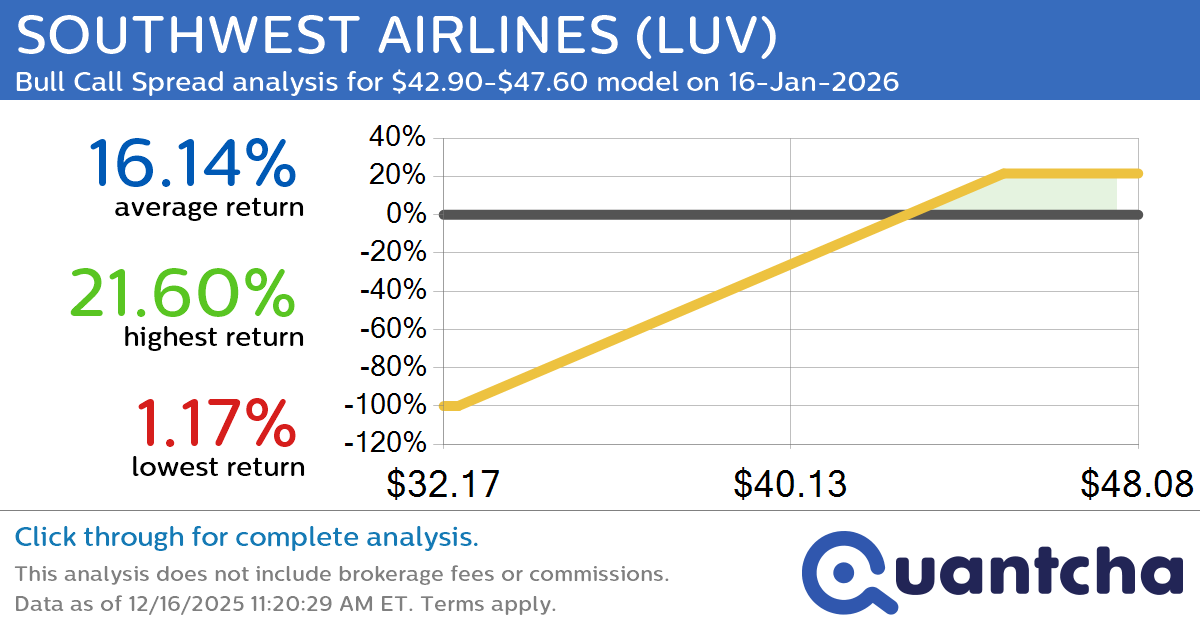

52-Week High Alert: Trading today’s movement in SOUTHWEST AIRLINES $LUV

Quantchabot has detected a new Bull Call Spread trade opportunity for SOUTHWEST AIRLINES (LUV) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. LUV was recently trading at $42.94 and has an implied volatility of 35.26% for this period. Based on an analysis of the…

-

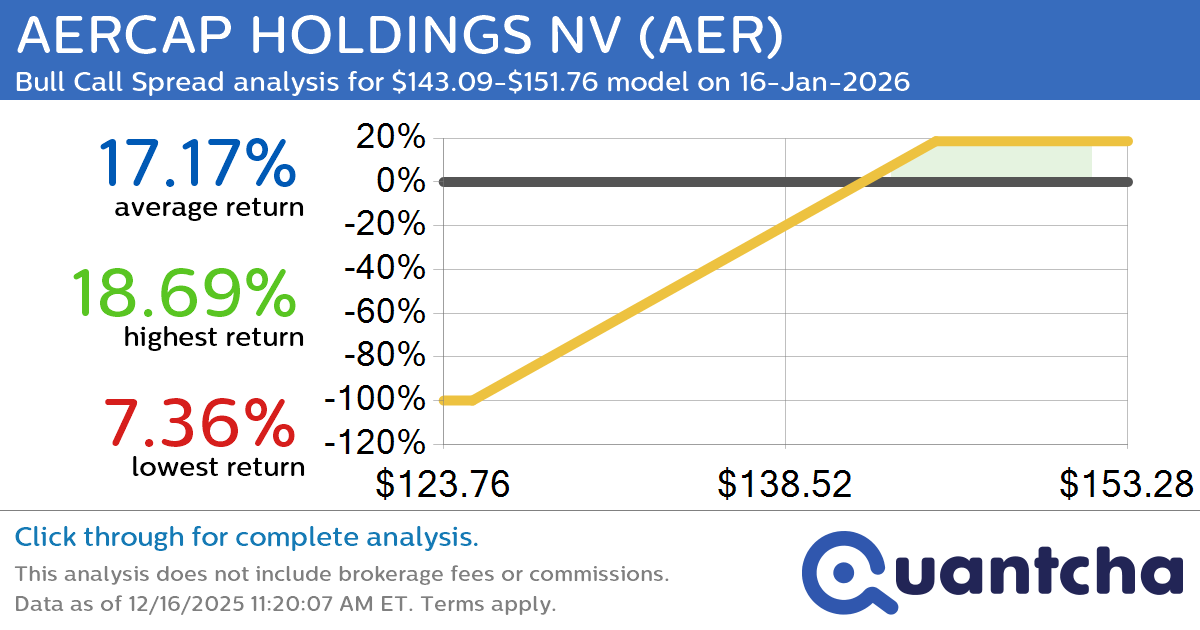

52-Week High Alert: Trading today’s movement in AERCAP HOLDINGS NV $AER

Quantchabot has detected a new Bull Call Spread trade opportunity for AERCAP HOLDINGS NV (AER) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. AER was recently trading at $142.62 and has an implied volatility of 19.95% for this period. Based on an analysis of…

-

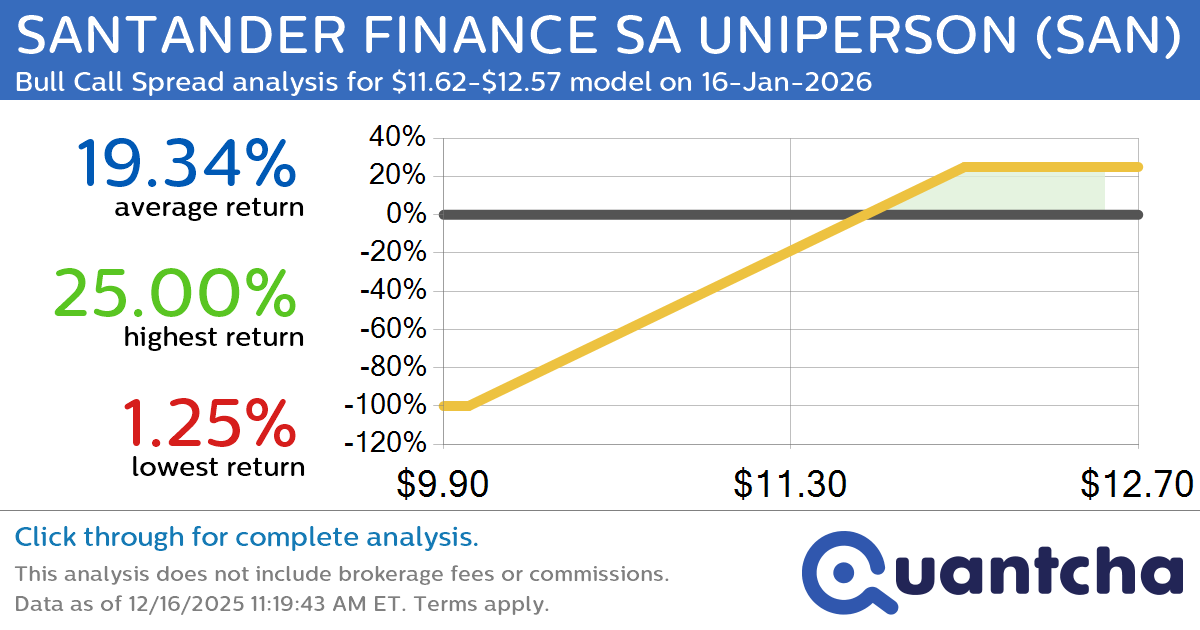

52-Week High Alert: Trading today’s movement in SANTANDER FINANCE SA UNIPERSON $SAN

Quantchabot has detected a new Bull Call Spread trade opportunity for SANTANDER FINANCE SA UNIPERSON (SAN) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SAN was recently trading at $11.59 and has an implied volatility of 26.44% for this period. Based on an analysis…

-

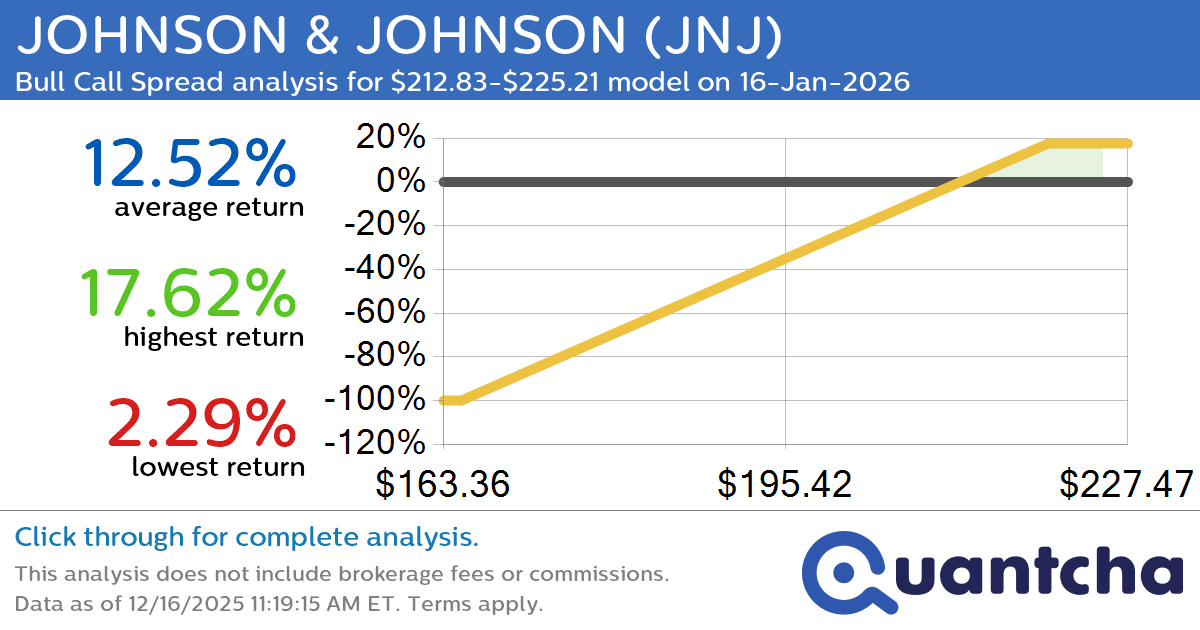

52-Week High Alert: Trading today’s movement in JOHNSON & JOHNSON $JNJ

Quantchabot has detected a new Bull Call Spread trade opportunity for JOHNSON & JOHNSON (JNJ) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. JNJ was recently trading at $212.12 and has an implied volatility of 19.18% for this period. Based on an analysis of…

-

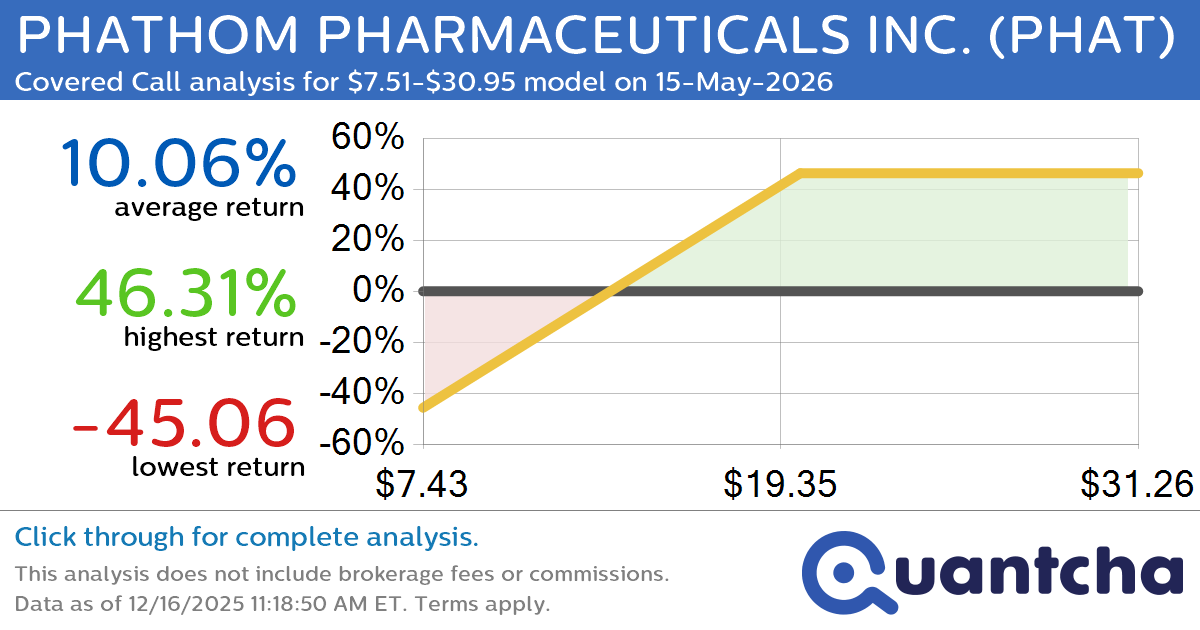

Covered Call Alert: PHATHOM PHARMACEUTICALS INC. $PHAT returning up to 46.31% through 15-May-2026

Quantchabot has detected a new Covered Call trade opportunity for PHATHOM PHARMACEUTICALS INC. (PHAT) for the 15-May-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. PHAT was recently trading at $15.01 and has an implied volatility of 110.23% for this period. Based on an analysis of the…

-

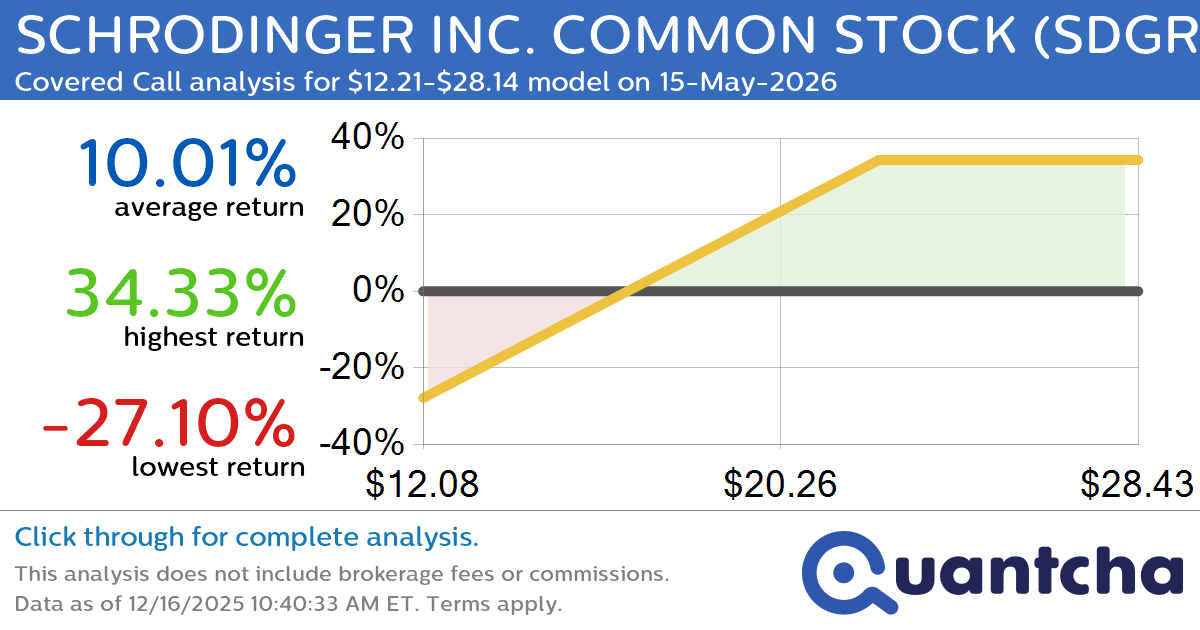

Covered Call Alert: SCHRODINGER INC. COMMON STOCK $SDGR returning up to 34.41% through 15-May-2026

Quantchabot has detected a new Covered Call trade opportunity for SCHRODINGER INC. COMMON STOCK (SDGR) for the 15-May-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SDGR was recently trading at $18.25 and has an implied volatility of 64.96% for this period. Based on an analysis of…

-

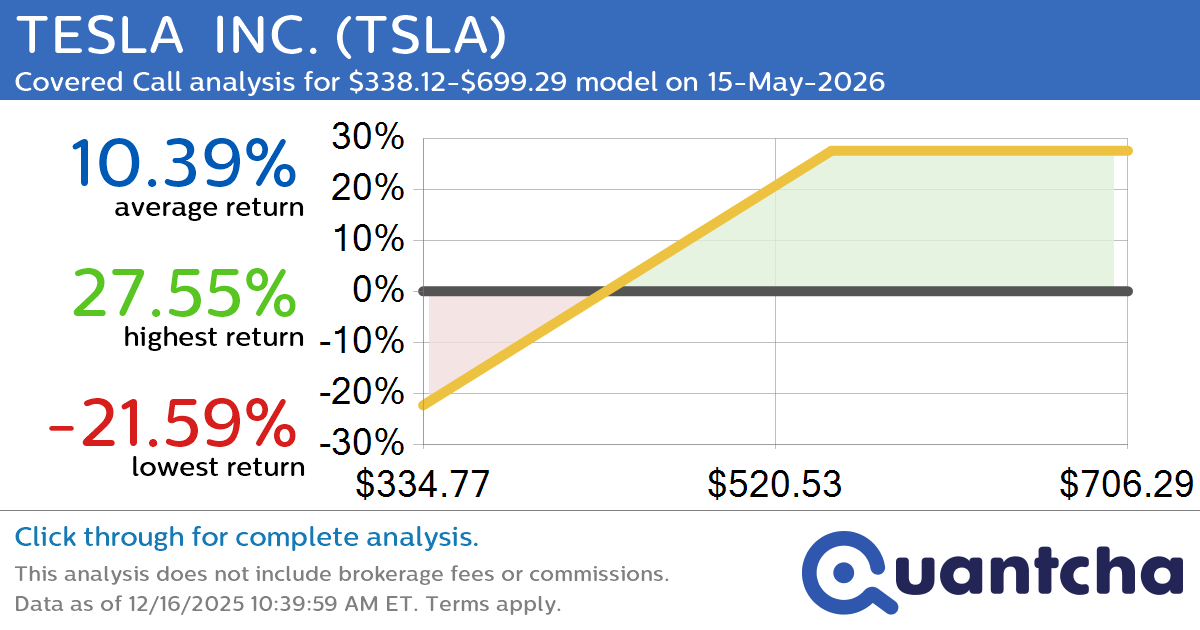

Covered Call Alert: TESLA INC. $TSLA returning up to 27.52% through 15-May-2026

Quantchabot has detected a new Covered Call trade opportunity for TESLA INC. (TSLA) for the 15-May-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TSLA was recently trading at $478.84 and has an implied volatility of 56.53% for this period. Based on an analysis of the options…