Quantcha Ideas: Turn a good idea about a stock into a great options trade

-

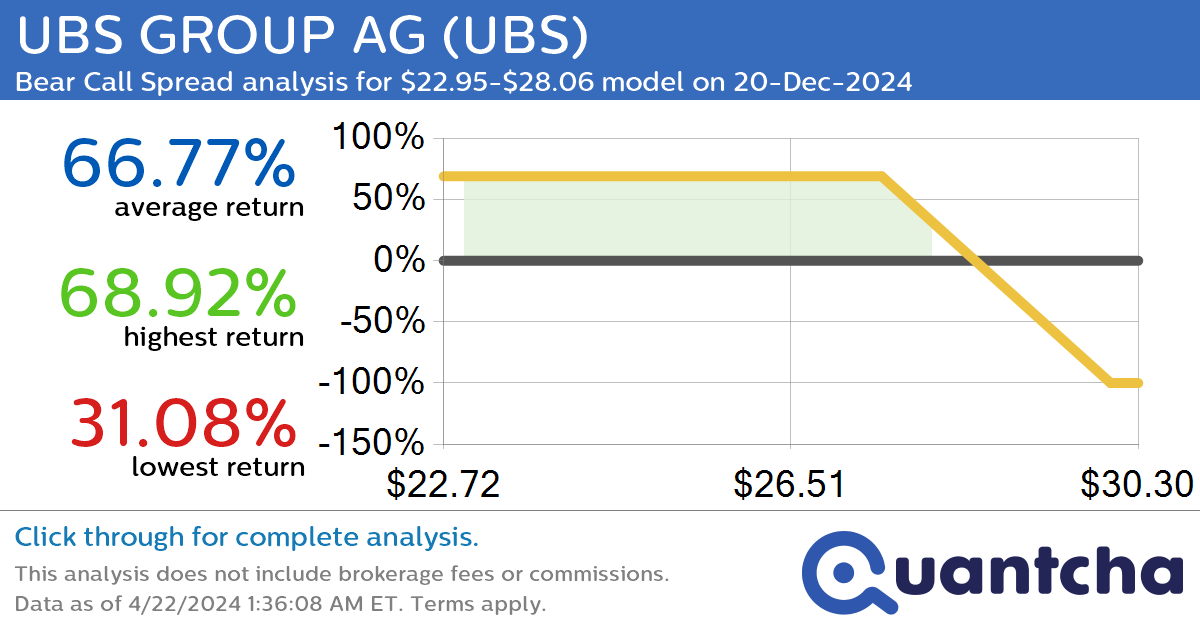

StockTwits Trending Alert: Trading recent interest in UBS GROUP AG $UBS

Quantchabot has detected a new Bear Call Spread trade opportunity for UBS GROUP AG (UBS) for the 20-Dec-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. UBS was recently trading at $28.06 and has an implied volatility of 28.14% for this period. Based on an analysis of…

-

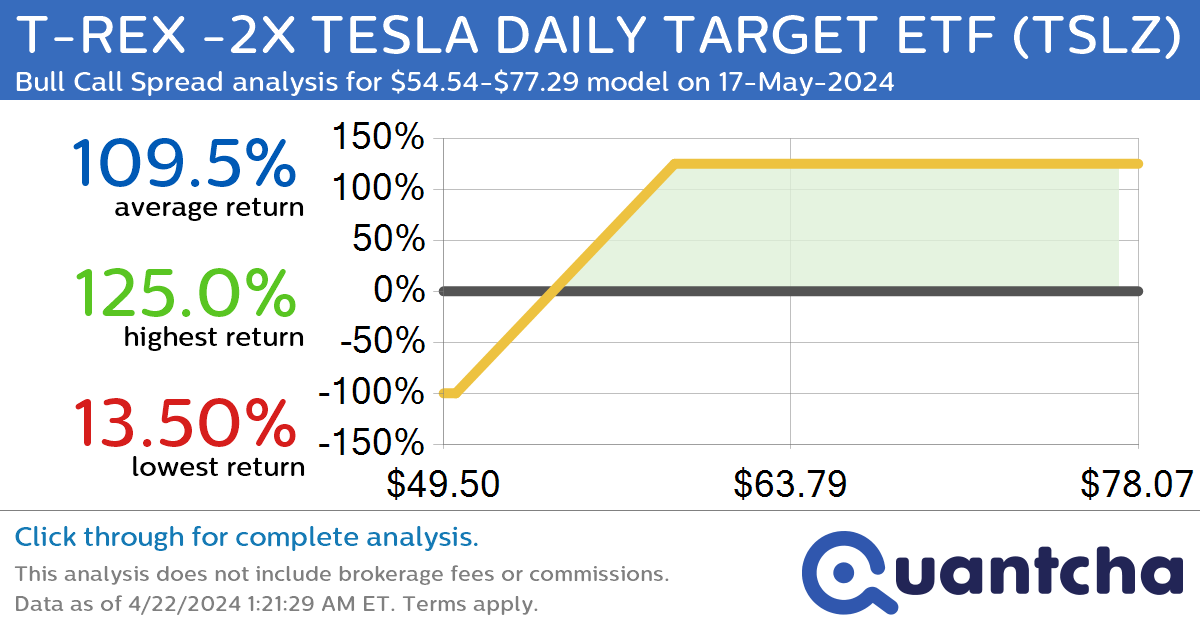

StockTwits Trending Alert: Trading recent interest in T-REX -2X TESLA DAILY TARGET ETF $TSLZ

Quantchabot has detected a new Bull Call Spread trade opportunity for T-REX -2X TESLA DAILY TARGET ETF (TSLZ) for the 17-May-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TSLZ was recently trading at $54.54 and has an implied volatility of 128.83% for this period. Based on…

-

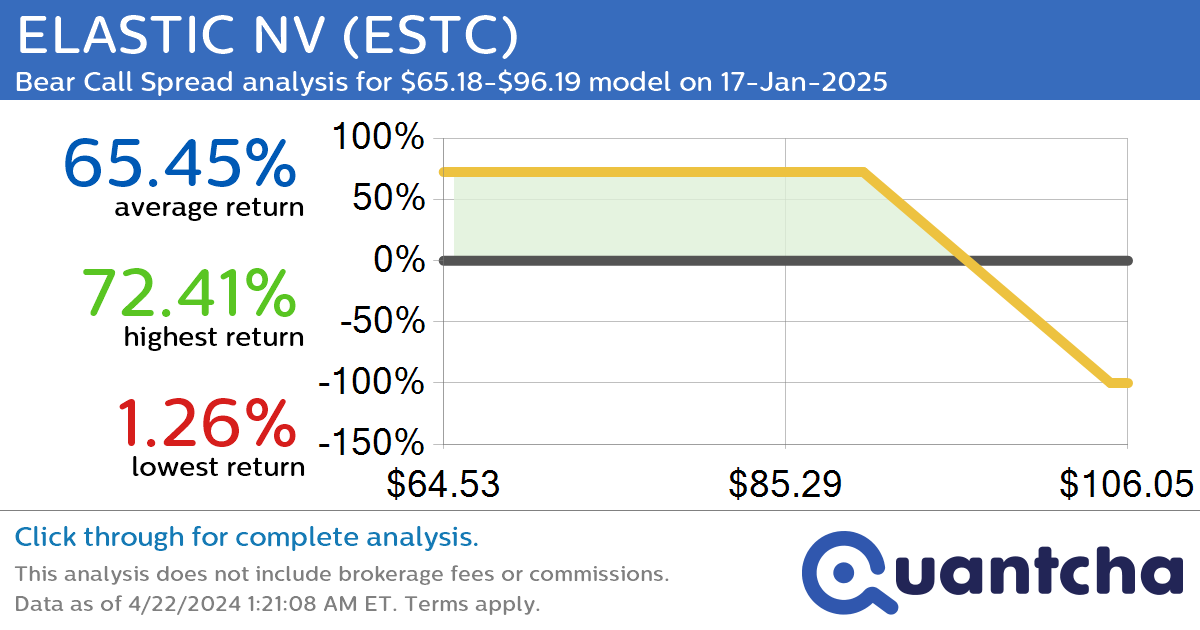

StockTwits Trending Alert: Trading recent interest in ELASTIC NV $ESTC

Quantchabot has detected a new Bear Call Spread trade opportunity for ELASTIC NV (ESTC) for the 17-Jan-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ESTC was recently trading at $96.19 and has an implied volatility of 49.93% for this period. Based on an analysis of the…

-

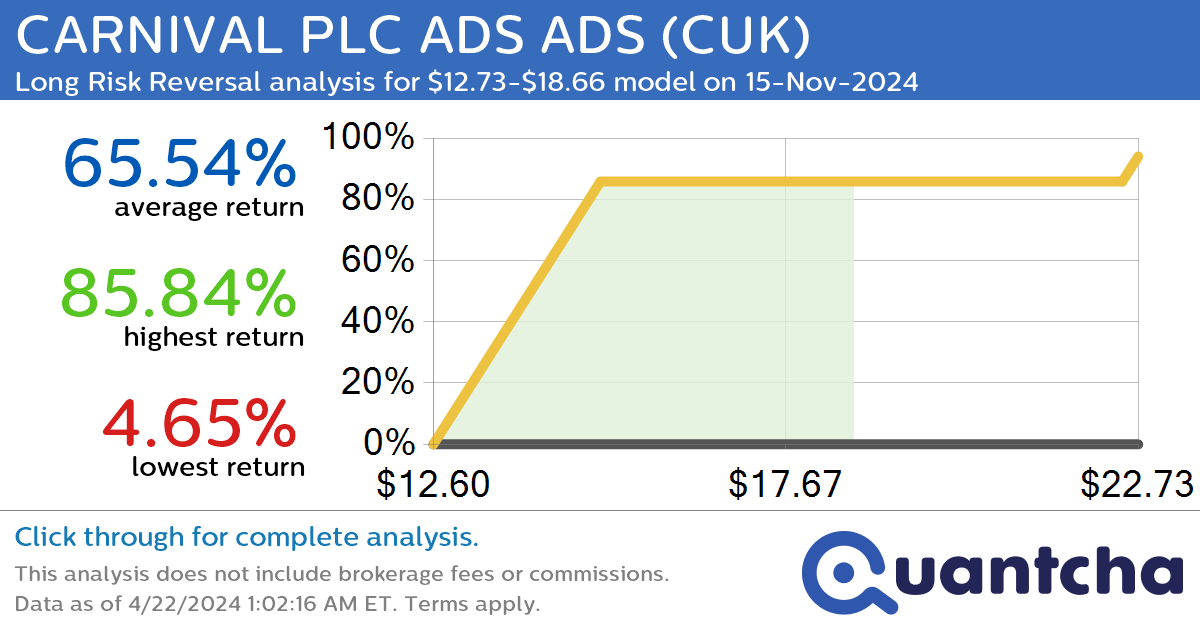

StockTwits Trending Alert: Trading recent interest in CARNIVAL PLC ADS ADS $CUK

Quantchabot has detected a new Long Risk Reversal trade opportunity for CARNIVAL PLC ADS ADS (CUK) for the 15-Nov-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CUK was recently trading at $12.73 and has an implied volatility of 46.47% for this period. Based on an analysis…

-

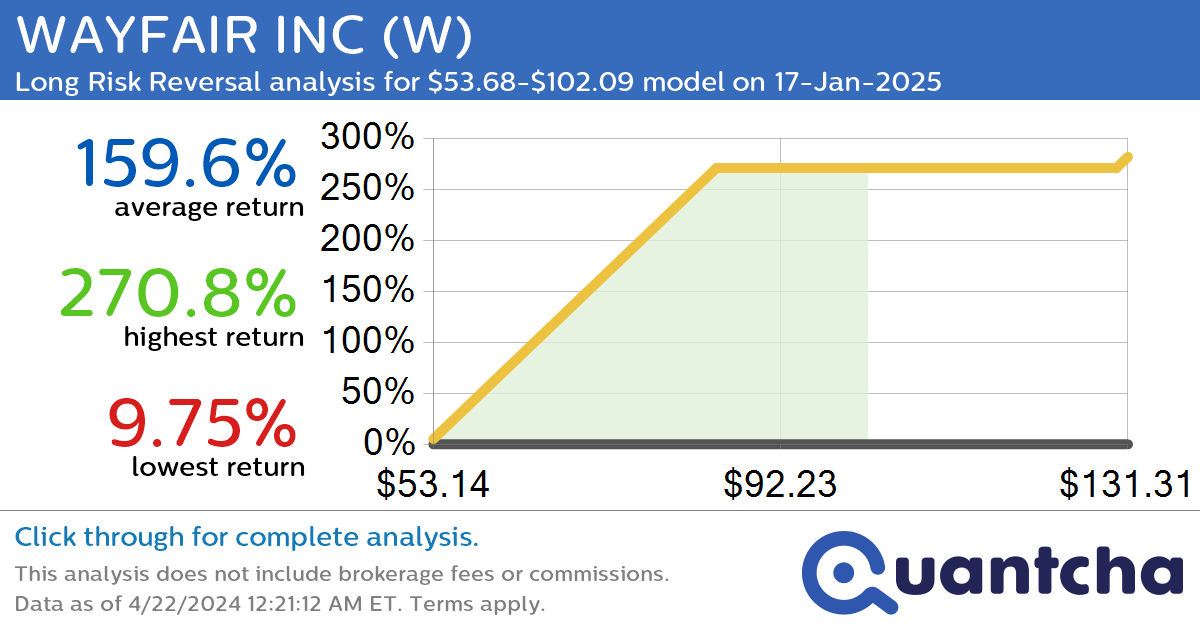

StockTwits Trending Alert: Trading recent interest in WAYFAIR INC $W

Quantchabot has detected a new Long Risk Reversal trade opportunity for WAYFAIR INC (W) for the 17-Jan-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. W was recently trading at $53.68 and has an implied volatility of 69.81% for this period. Based on an analysis of the…

-

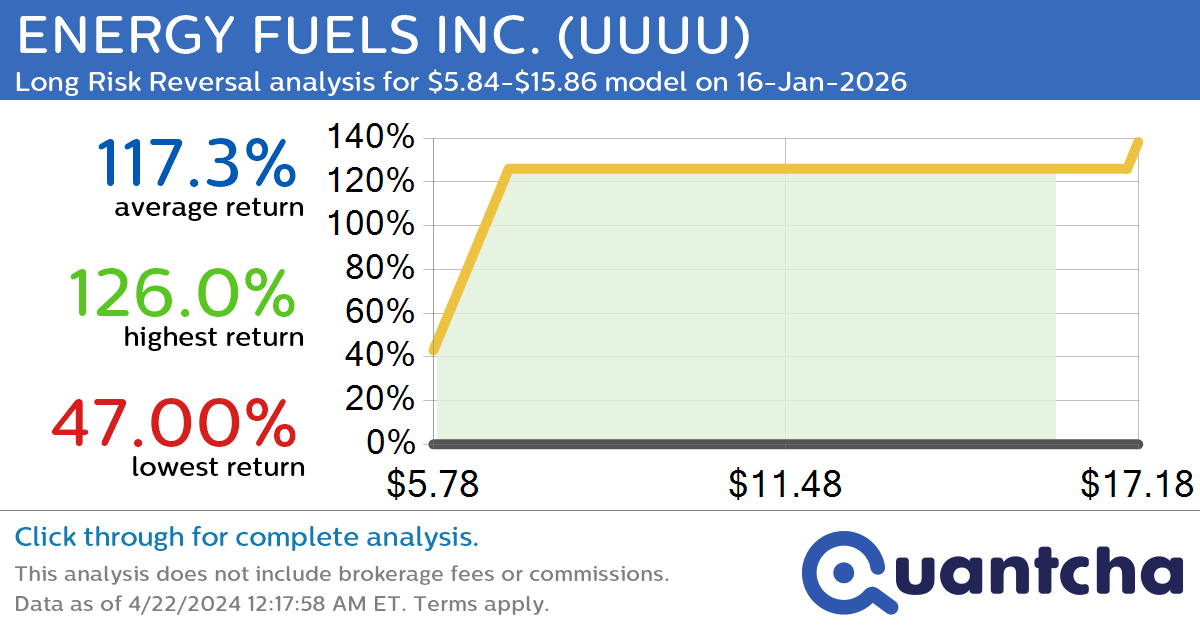

StockTwits Trending Alert: Trading recent interest in ENERGY FUELS INC. $UUUU

Quantchabot has detected a new Long Risk Reversal trade opportunity for ENERGY FUELS INC. (UUUU) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. UUUU was recently trading at $5.84 and has an implied volatility of 68.76% for this period. Based on an analysis of…

-

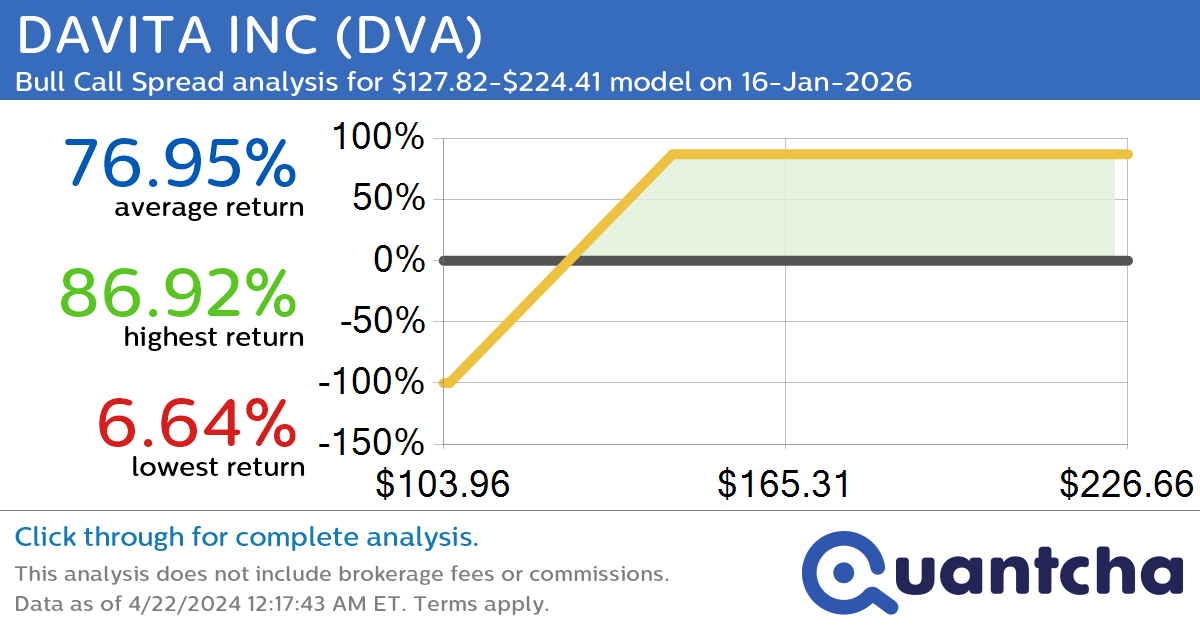

StockTwits Trending Alert: Trading recent interest in DAVITA INC $DVA

Quantchabot has detected a new Bull Call Spread trade opportunity for DAVITA INC (DVA) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. DVA was recently trading at $127.82 and has an implied volatility of 35.67% for this period. Based on an analysis of the…

-

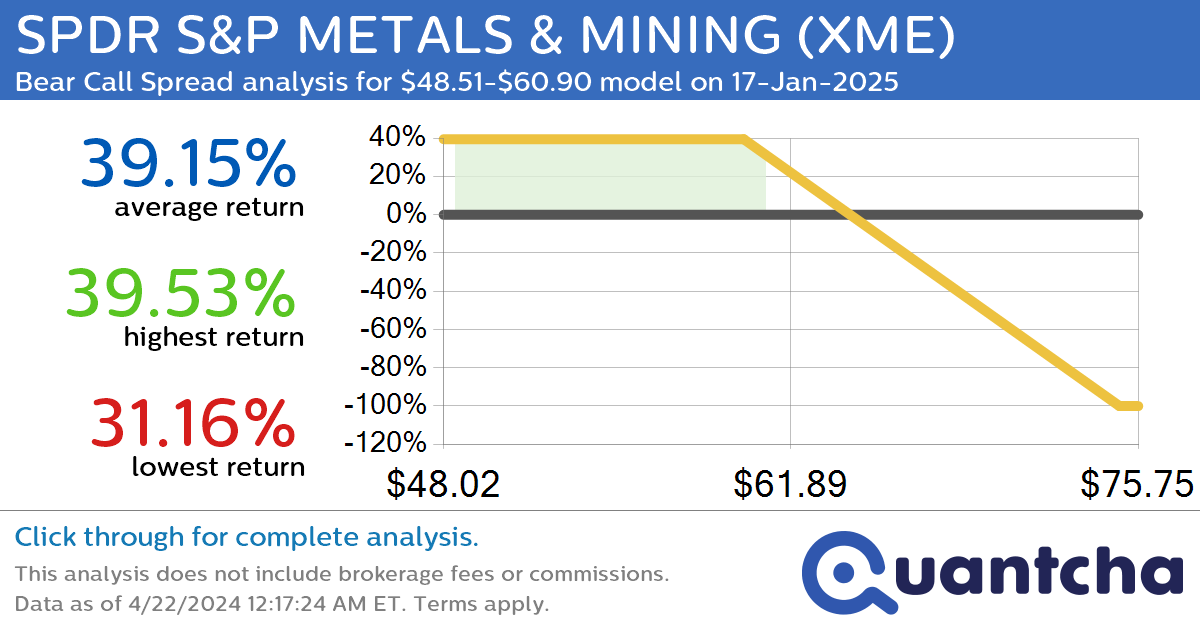

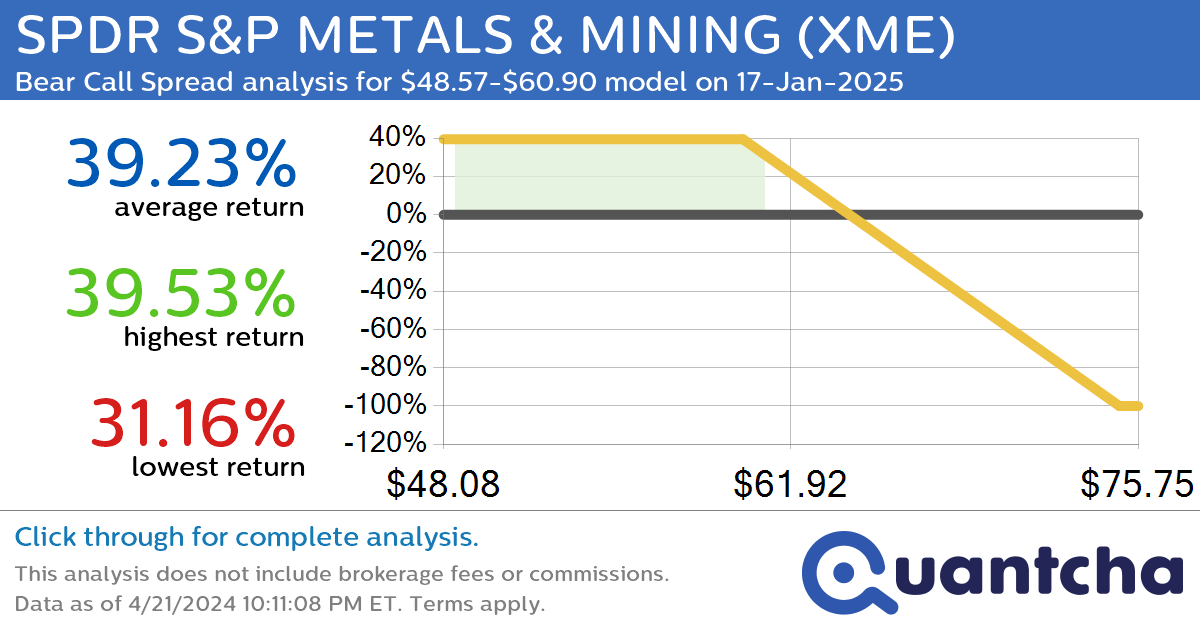

StockTwits Trending Alert: Trading recent interest in SPDR S&P METALS & MINING $XME

Quantchabot has detected a new Bear Call Spread trade opportunity for SPDR S&P METALS & MINING (XME) for the 17-Jan-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. XME was recently trading at $60.90 and has an implied volatility of 30.21% for this period. Based on an…

-

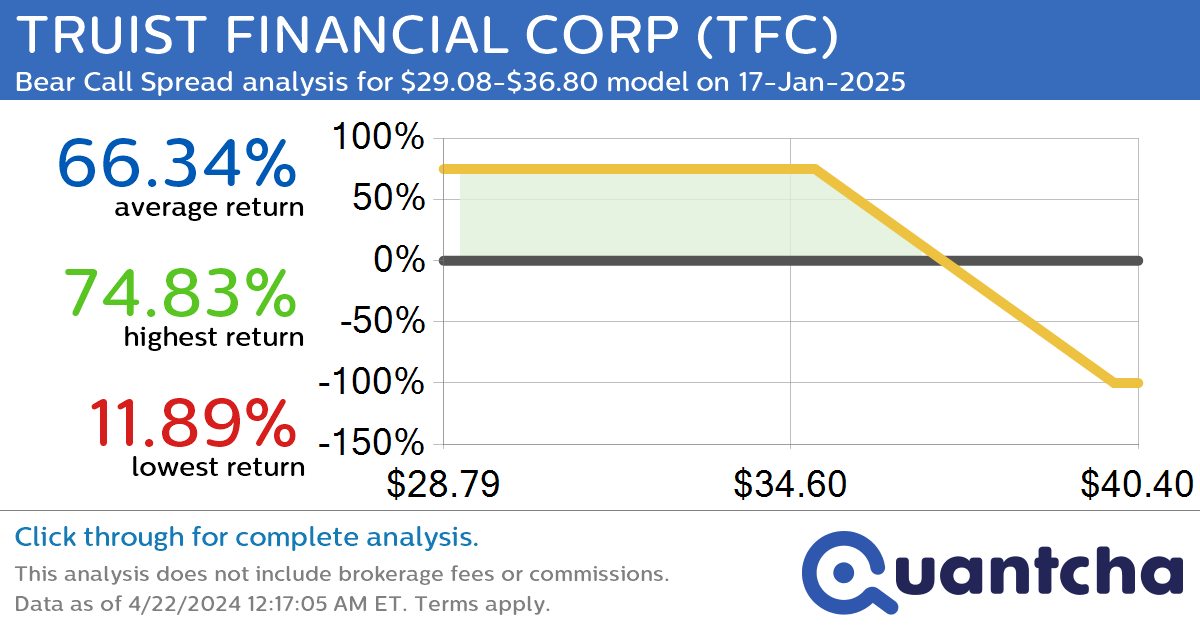

StockTwits Trending Alert: Trading recent interest in TRUIST FINANCIAL CORP $TFC

Quantchabot has detected a new Bear Call Spread trade opportunity for TRUIST FINANCIAL CORP (TFC) for the 17-Jan-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TFC was recently trading at $36.80 and has an implied volatility of 32.07% for this period. Based on an analysis of…

-

StockTwits Trending Alert: Trading recent interest in SPDR S&P METALS & MINING $XME

Quantchabot has detected a new Bear Call Spread trade opportunity for SPDR S&P METALS & MINING (XME) for the 17-Jan-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. XME was recently trading at $60.90 and has an implied volatility of 30.05% for this period. Based on an…