Quantcha Ideas: Turn a good idea about a stock into a great options trade

-

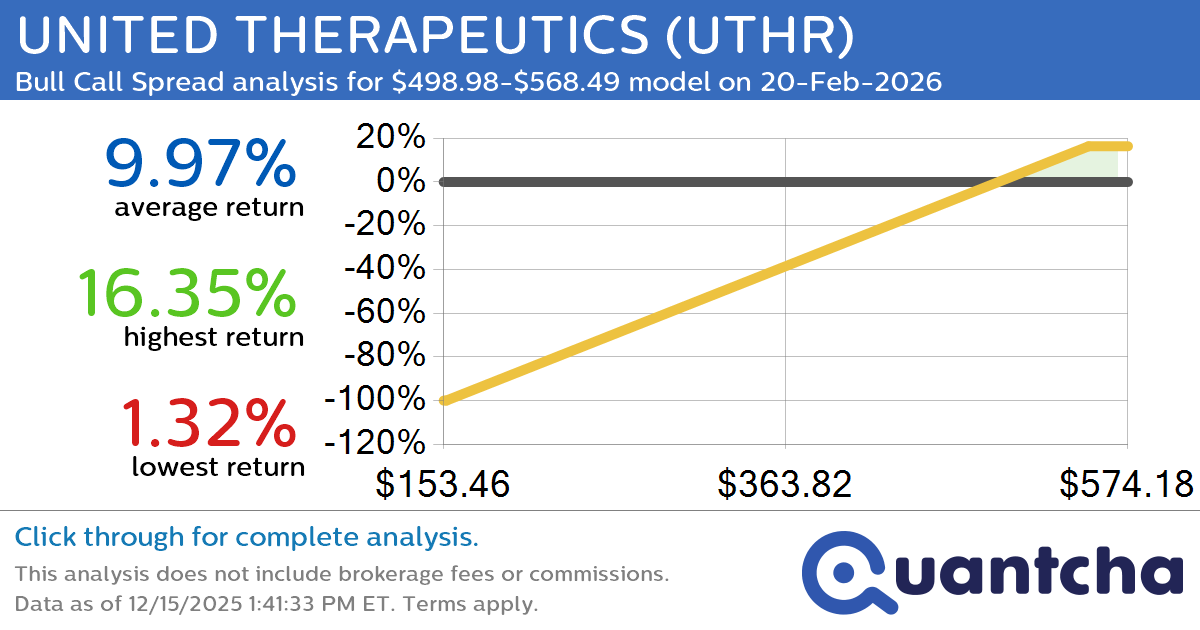

52-Week High Alert: Trading today’s movement in UNITED THERAPEUTICS $UTHR

Quantchabot has detected a new Bull Call Spread trade opportunity for UNITED THERAPEUTICS (UTHR) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. UTHR was recently trading at $495.45 and has an implied volatility of 30.29% for this period. Based on an analysis of the…

-

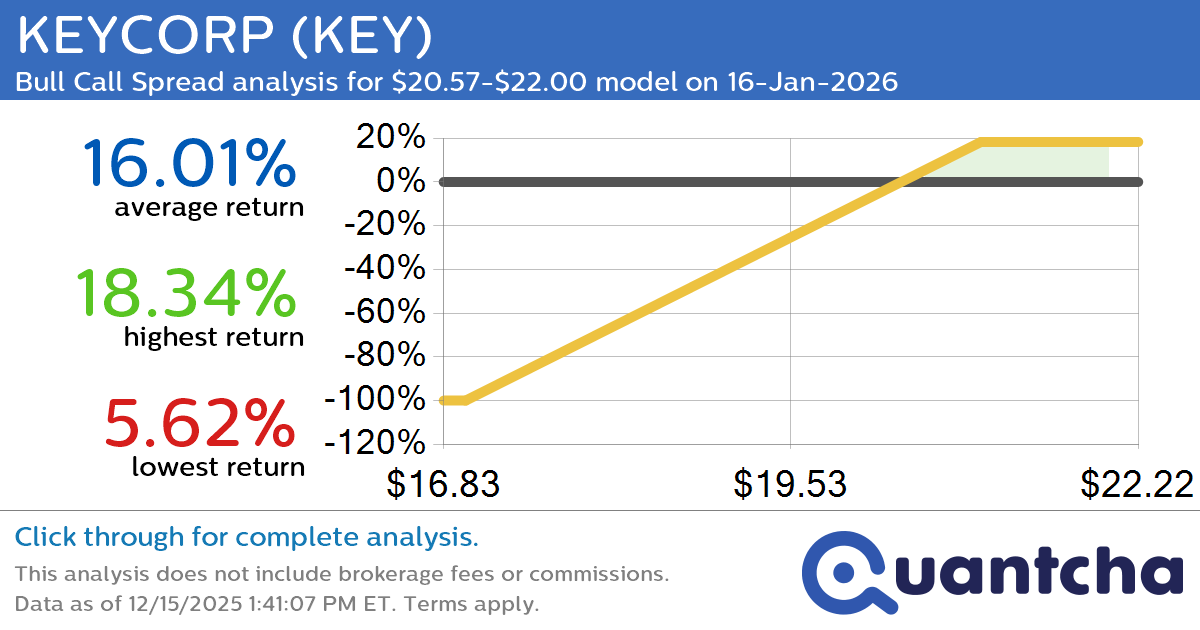

52-Week High Alert: Trading today’s movement in KEYCORP $KEY

Quantchabot has detected a new Bull Call Spread trade opportunity for KEYCORP (KEY) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. KEY was recently trading at $20.50 and has an implied volatility of 22.56% for this period. Based on an analysis of the options…

-

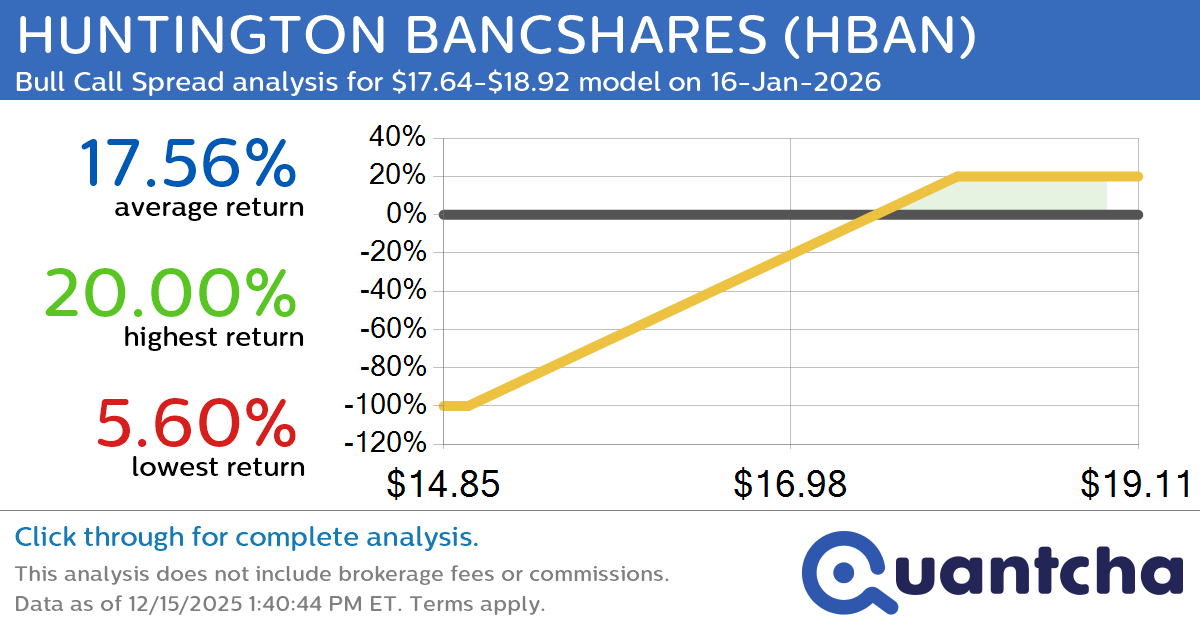

52-Week High Alert: Trading today’s movement in HUNTINGTON BANCSHARES $HBAN

Quantchabot has detected a new Bull Call Spread trade opportunity for HUNTINGTON BANCSHARES (HBAN) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. HBAN was recently trading at $17.73 and has an implied volatility of 23.55% for this period. Based on an analysis of the…

-

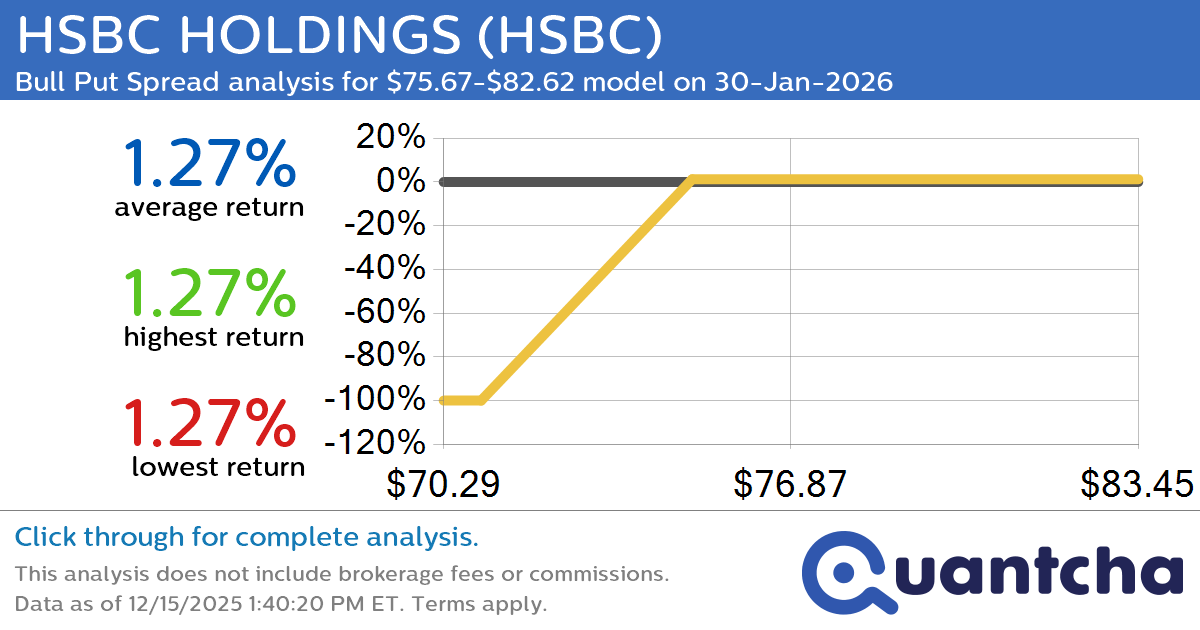

52-Week High Alert: Trading today’s movement in HSBC HOLDINGS $HSBC

Quantchabot has detected a new Bull Put Spread trade opportunity for HSBC HOLDINGS (HSBC) for the 30-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. HSBC was recently trading at $75.30 and has an implied volatility of 24.58% for this period. Based on an analysis of the…

-

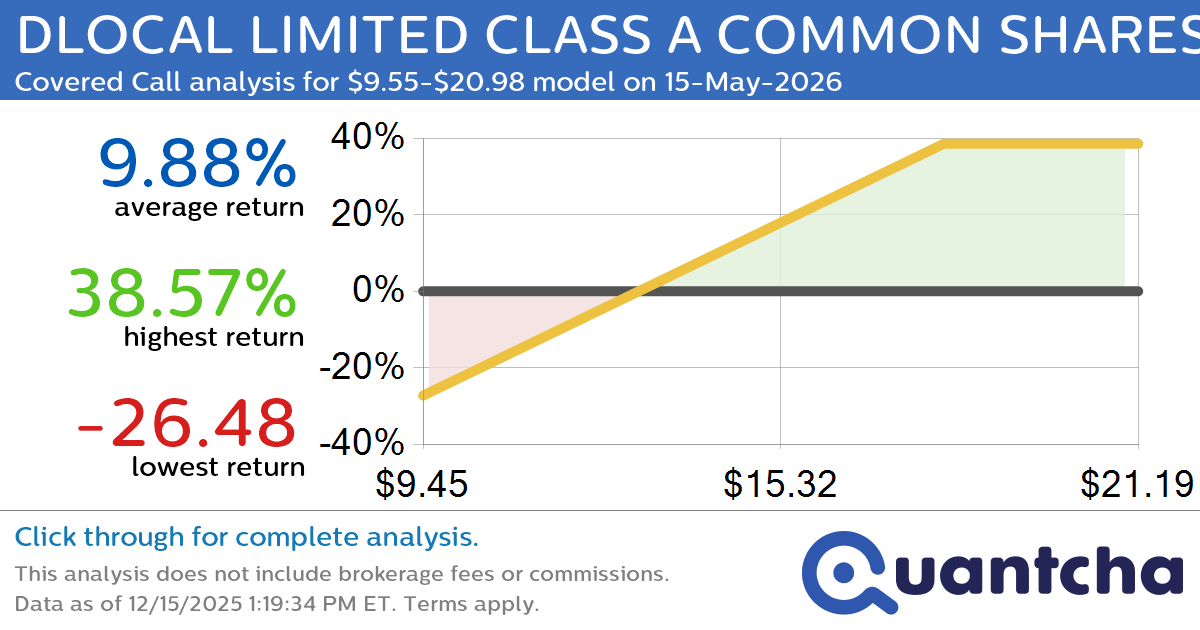

Covered Call Alert: DLOCAL LIMITED CLASS A COMMON SHARES $DLO returning up to 38.57% through 15-May-2026

Quantchabot has detected a new Covered Call trade opportunity for DLOCAL LIMITED CLASS A COMMON SHARES (DLO) for the 15-May-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. DLO was recently trading at $13.94 and has an implied volatility of 61.01% for this period. Based on an…

-

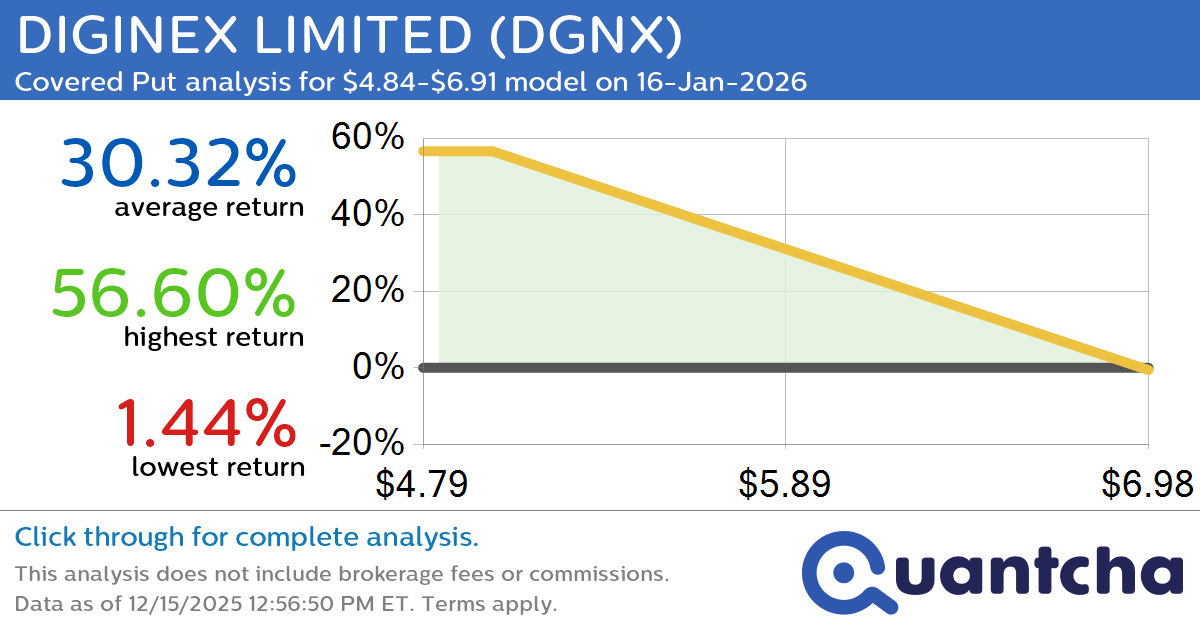

Big Loser Alert: Trading today’s -14.0% move in DIGINEX LIMITED $DGNX

Quantchabot has detected a new Covered Put trade opportunity for DIGINEX LIMITED (DGNX) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. DGNX was recently trading at $6.89 and has an implied volatility of 119.32% for this period. Based on an analysis of the options…

-

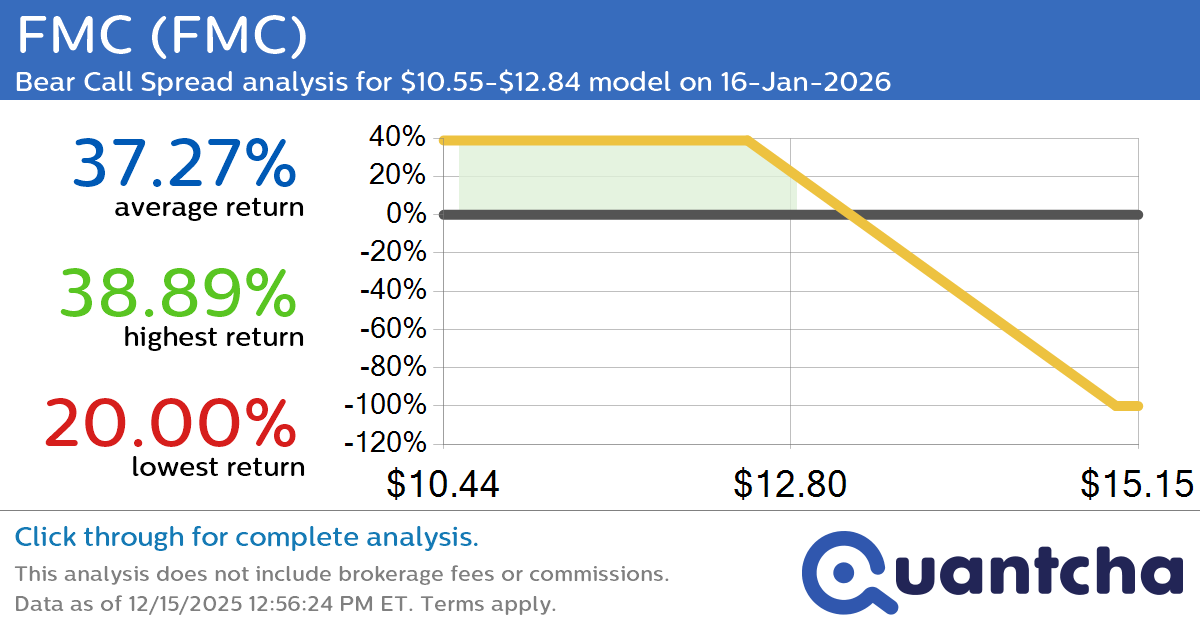

Big Loser Alert: Trading today’s -7.4% move in FMC $FMC

Quantchabot has detected a new Bear Call Spread trade opportunity for FMC (FMC) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. FMC was recently trading at $12.87 and has an implied volatility of 65.57% for this period. Based on an analysis of the options…

-

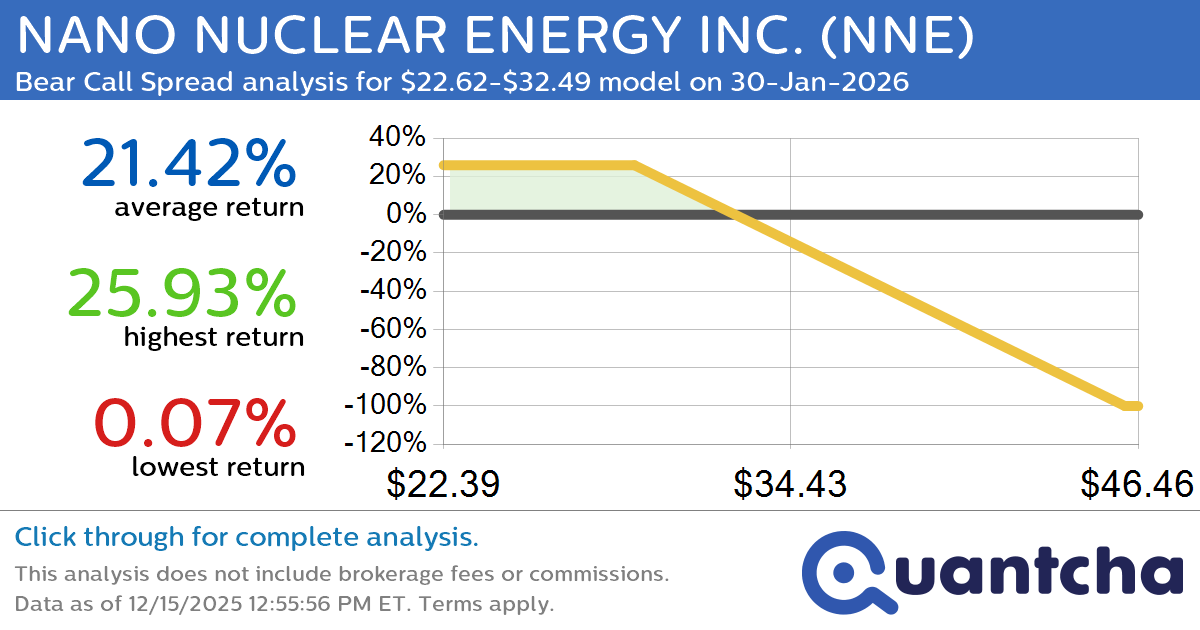

Big Loser Alert: Trading today’s -8.7% move in NANO NUCLEAR ENERGY INC. $NNE

Quantchabot has detected a new Bear Call Spread trade opportunity for NANO NUCLEAR ENERGY INC. (NNE) for the 30-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. NNE was recently trading at $32.33 and has an implied volatility of 101.20% for this period. Based on an analysis…

-

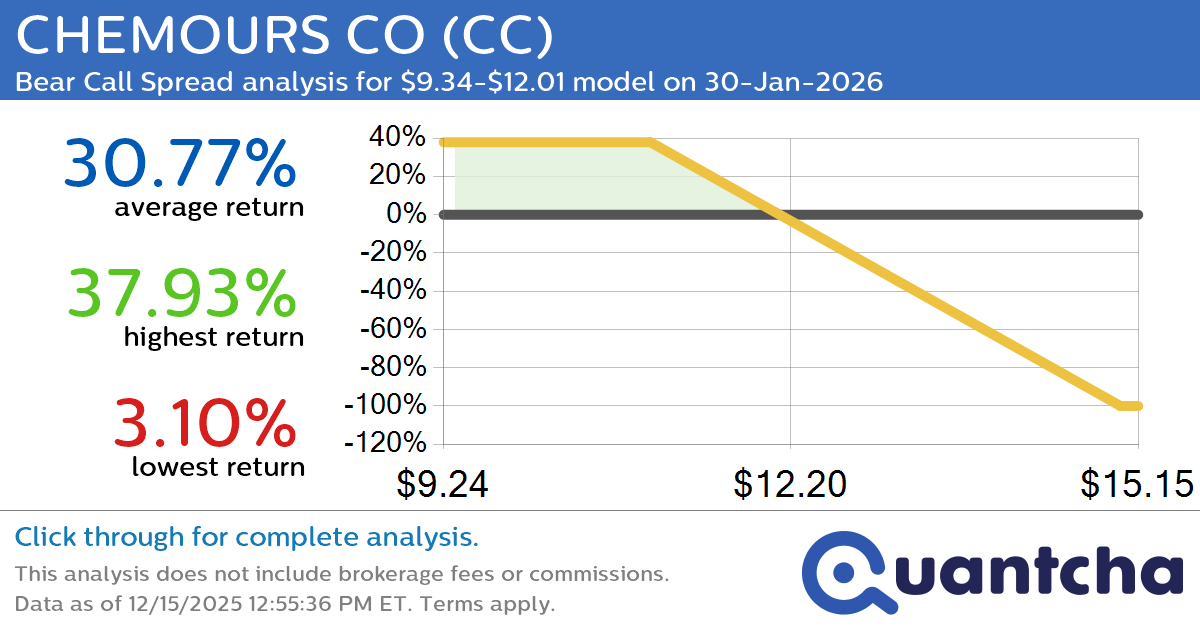

Big Loser Alert: Trading today’s -7.7% move in CHEMOURS CO $CC

Quantchabot has detected a new Bear Call Spread trade opportunity for CHEMOURS CO (CC) for the 30-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CC was recently trading at $11.96 and has an implied volatility of 70.39% for this period. Based on an analysis of the…

-

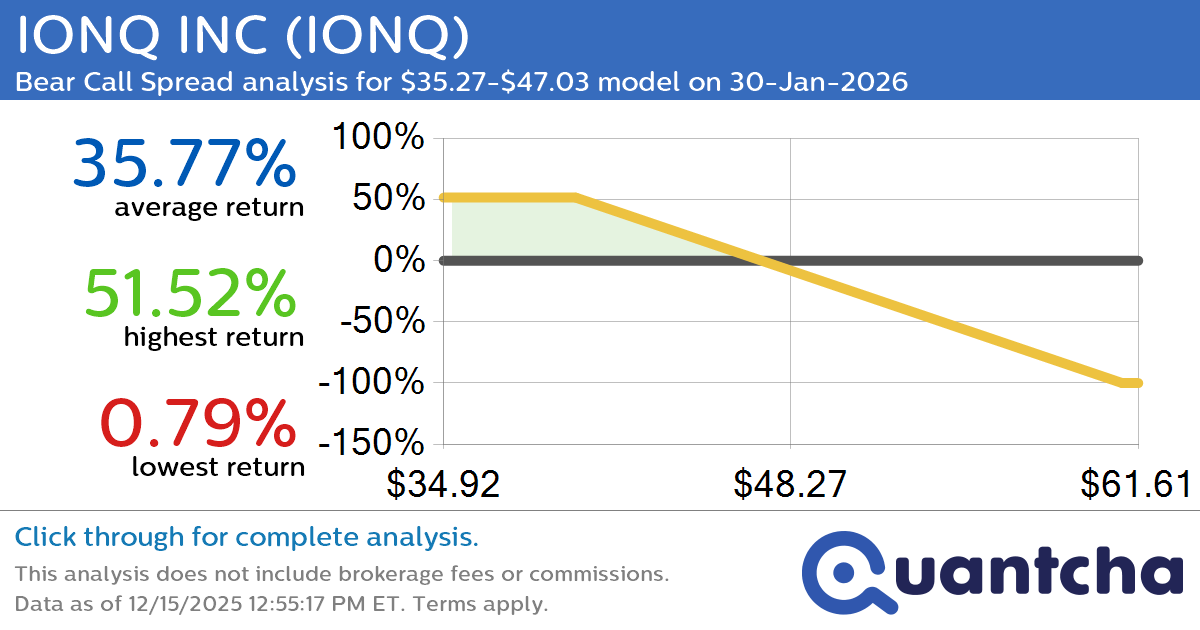

Big Loser Alert: Trading today’s -7.1% move in IONQ INC $IONQ

Quantchabot has detected a new Bear Call Spread trade opportunity for IONQ INC (IONQ) for the 30-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. IONQ was recently trading at $46.80 and has an implied volatility of 80.44% for this period. Based on an analysis of the…