Quantcha Ideas: Turn a good idea about a stock into a great options trade

-

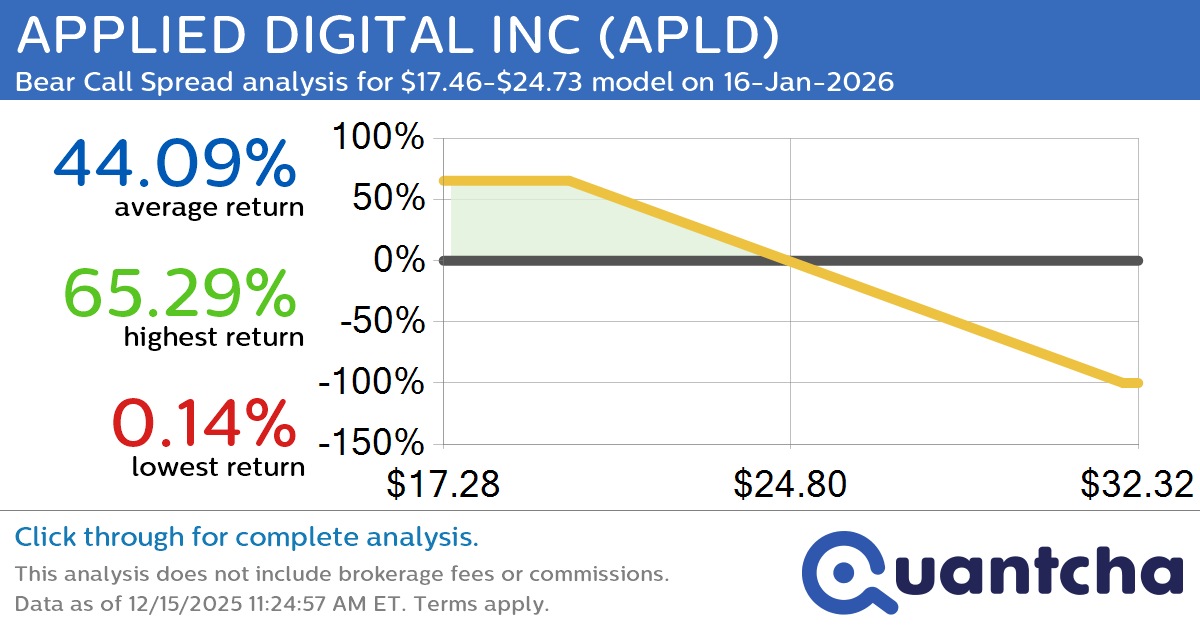

Big Loser Alert: Trading today’s -11.6% move in APPLIED DIGITAL INC $APLD

Quantchabot has detected a new Bear Call Spread trade opportunity for APPLIED DIGITAL INC (APLD) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. APLD was recently trading at $24.64 and has an implied volatility of 116.18% for this period. Based on an analysis of…

-

Big Loser Alert: Trading today’s -7.1% move in LYFT INC. CLASS A COMMON STOCK $LYFT

Quantchabot has detected a new Bear Call Spread trade opportunity for LYFT INC. CLASS A COMMON STOCK (LYFT) for the 30-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. LYFT was recently trading at $18.91 and has an implied volatility of 54.19% for this period. Based on…

-

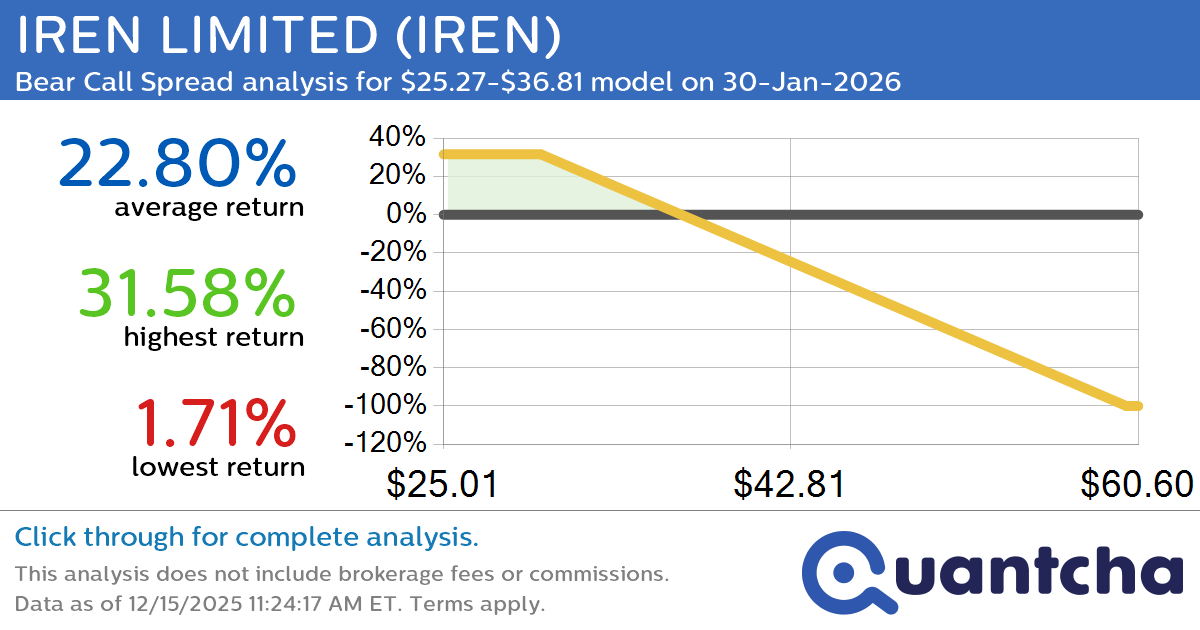

Big Loser Alert: Trading today’s -8.7% move in IREN LIMITED $IREN

Quantchabot has detected a new Bear Call Spread trade opportunity for IREN LIMITED (IREN) for the 30-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. IREN was recently trading at $36.63 and has an implied volatility of 105.09% for this period. Based on an analysis of the…

-

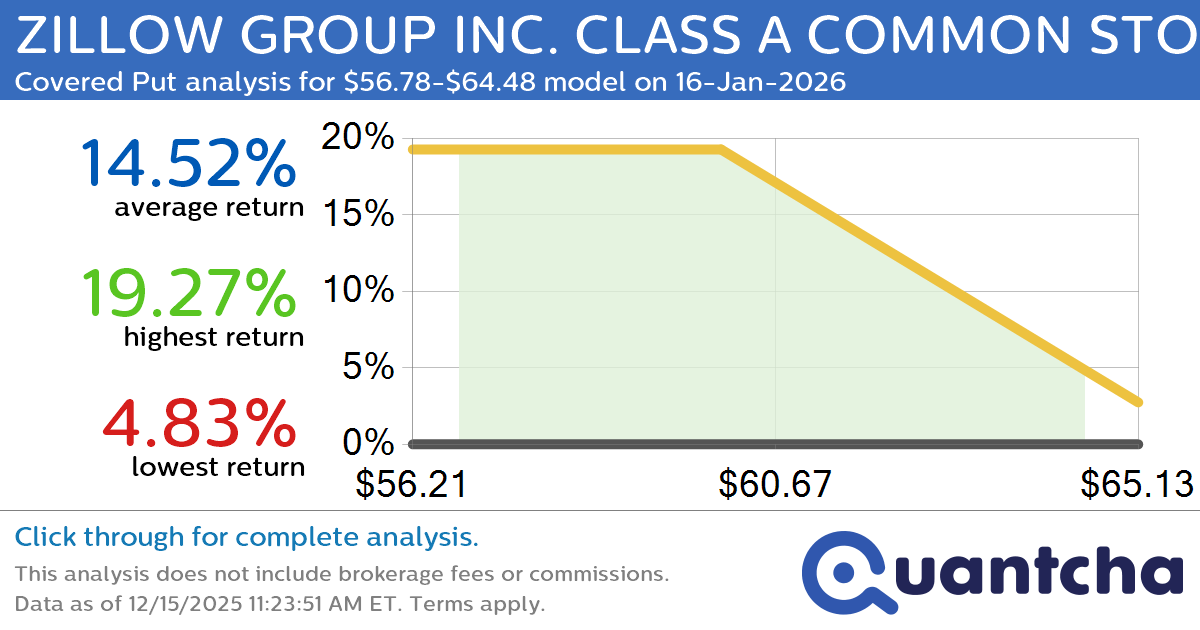

Big Loser Alert: Trading today’s -11.2% move in ZILLOW GROUP INC. CLASS A COMMON STOCK $ZG

Quantchabot has detected a new Covered Put trade opportunity for ZILLOW GROUP INC. CLASS A COMMON STOCK (ZG) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ZG was recently trading at $64.26 and has an implied volatility of 42.47% for this period. Based on…

-

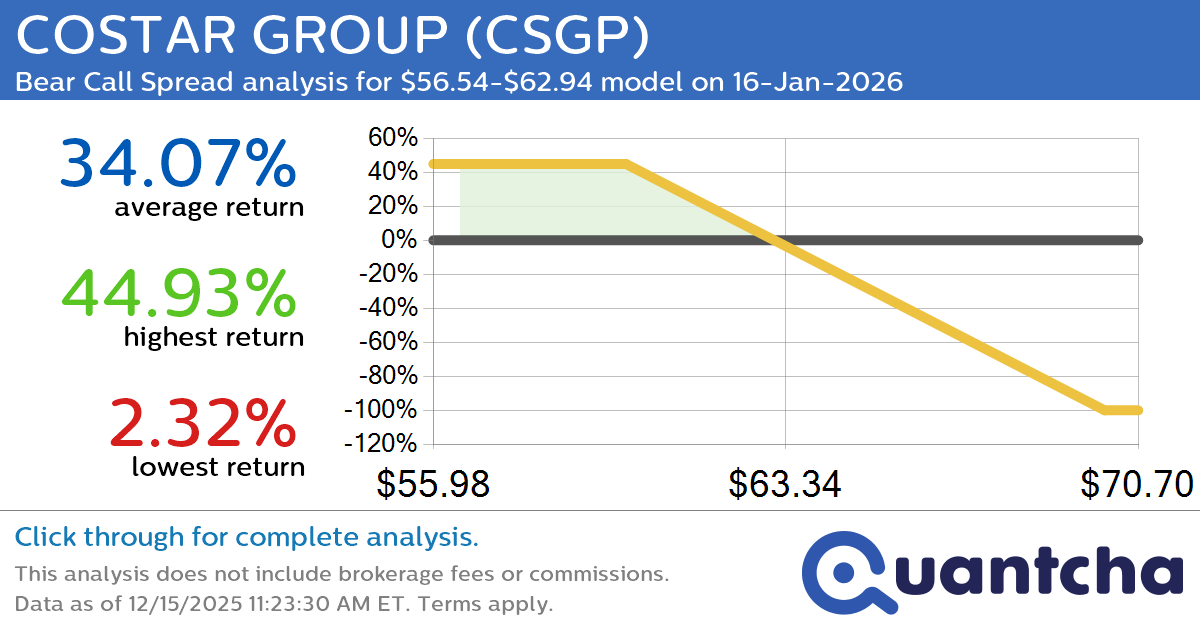

Big Loser Alert: Trading today’s -8.1% move in COSTAR GROUP $CSGP

Quantchabot has detected a new Bear Call Spread trade opportunity for COSTAR GROUP (CSGP) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CSGP was recently trading at $62.72 and has an implied volatility of 35.77% for this period. Based on an analysis of the…

-

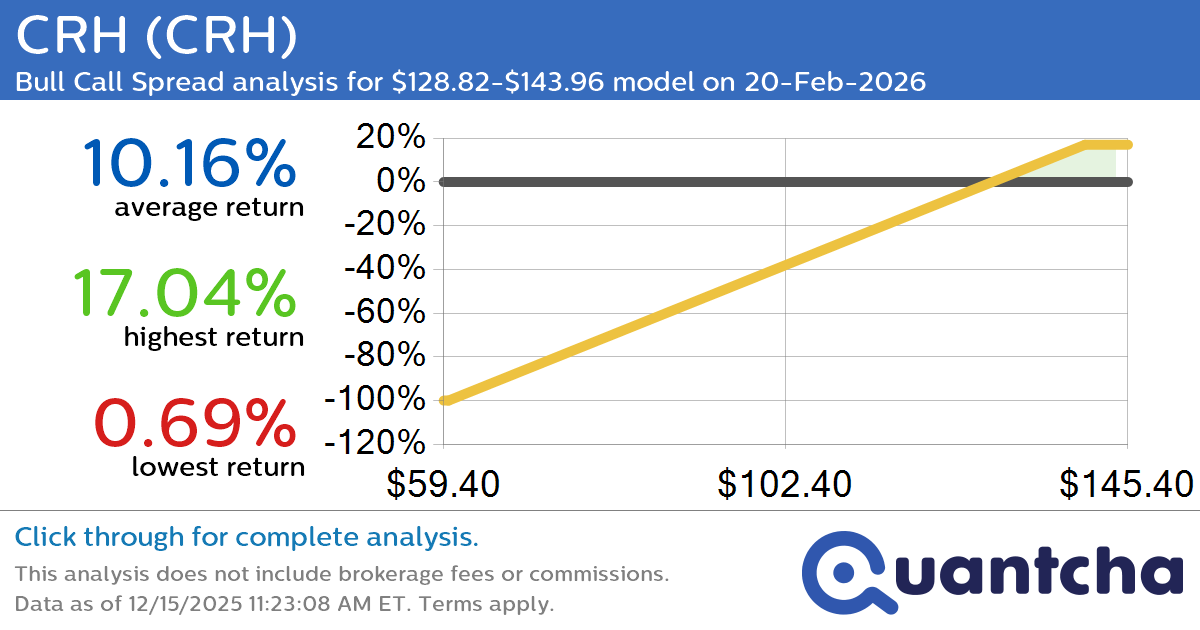

52-Week High Alert: Trading today’s movement in CRH $CRH

Quantchabot has detected a new Bull Call Spread trade opportunity for CRH (CRH) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CRH was recently trading at $127.91 and has an implied volatility of 25.81% for this period. Based on an analysis of the options…

-

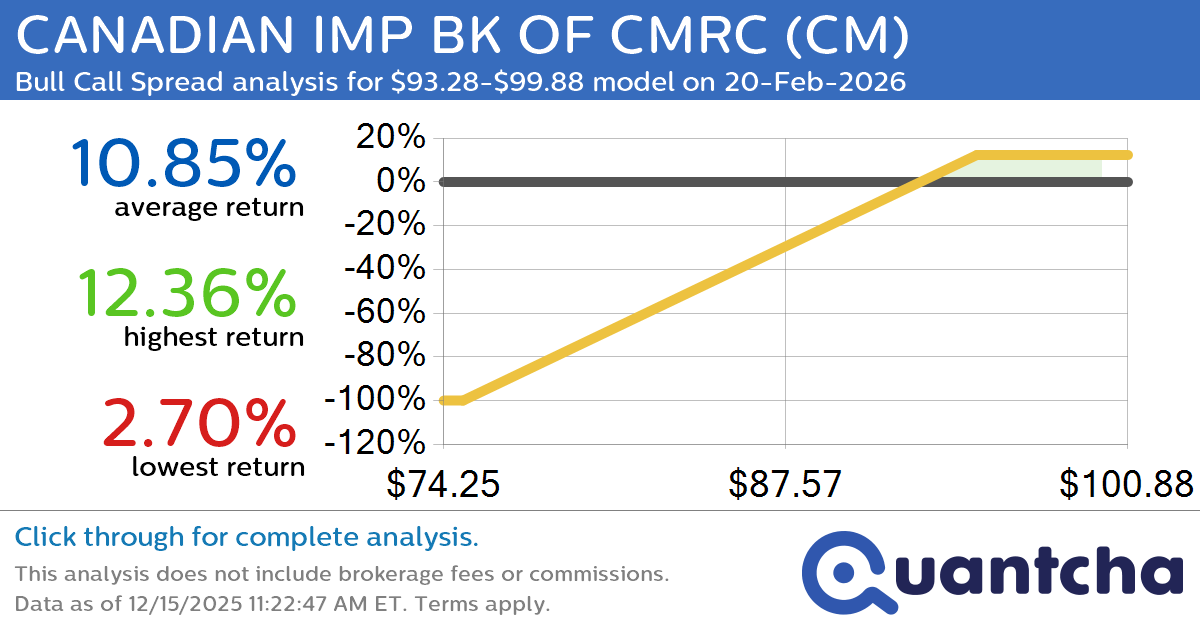

52-Week High Alert: Trading today’s movement in CANADIAN IMP BK OF CMRC $CM

Quantchabot has detected a new Bull Call Spread trade opportunity for CANADIAN IMP BK OF CMRC (CM) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CM was recently trading at $93.39 and has an implied volatility of 15.86% for this period. Based on an…

-

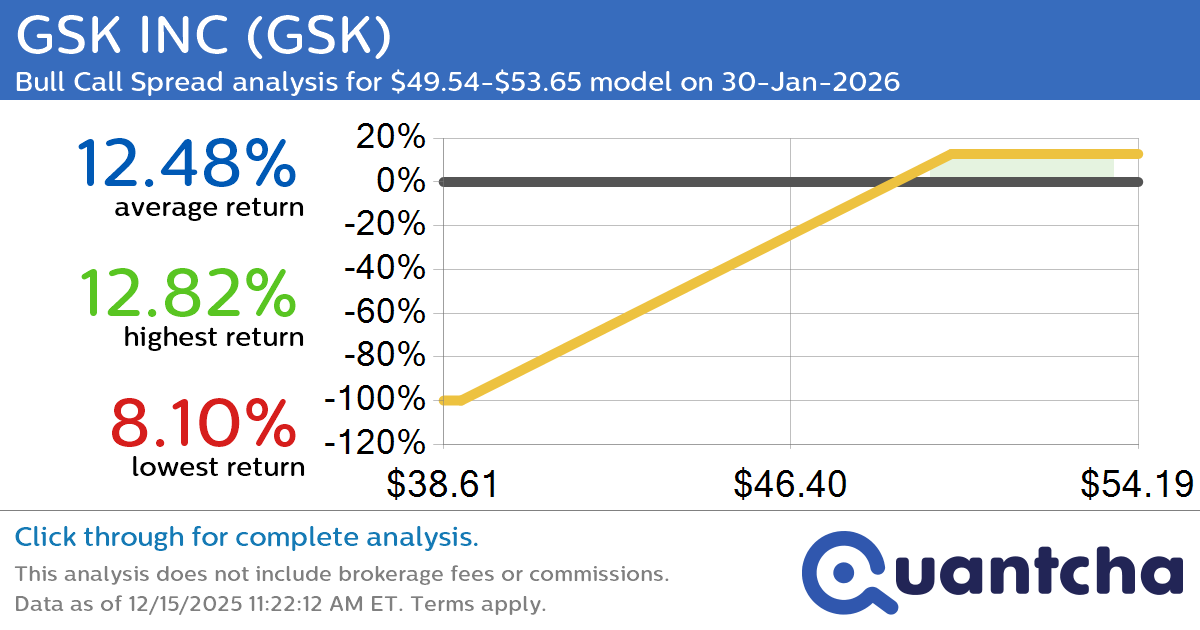

52-Week High Alert: Trading today’s movement in GSK INC $GSK

Quantchabot has detected a new Bull Call Spread trade opportunity for GSK INC (GSK) for the 30-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. GSK was recently trading at $49.30 and has an implied volatility of 22.25% for this period. Based on an analysis of the…

-

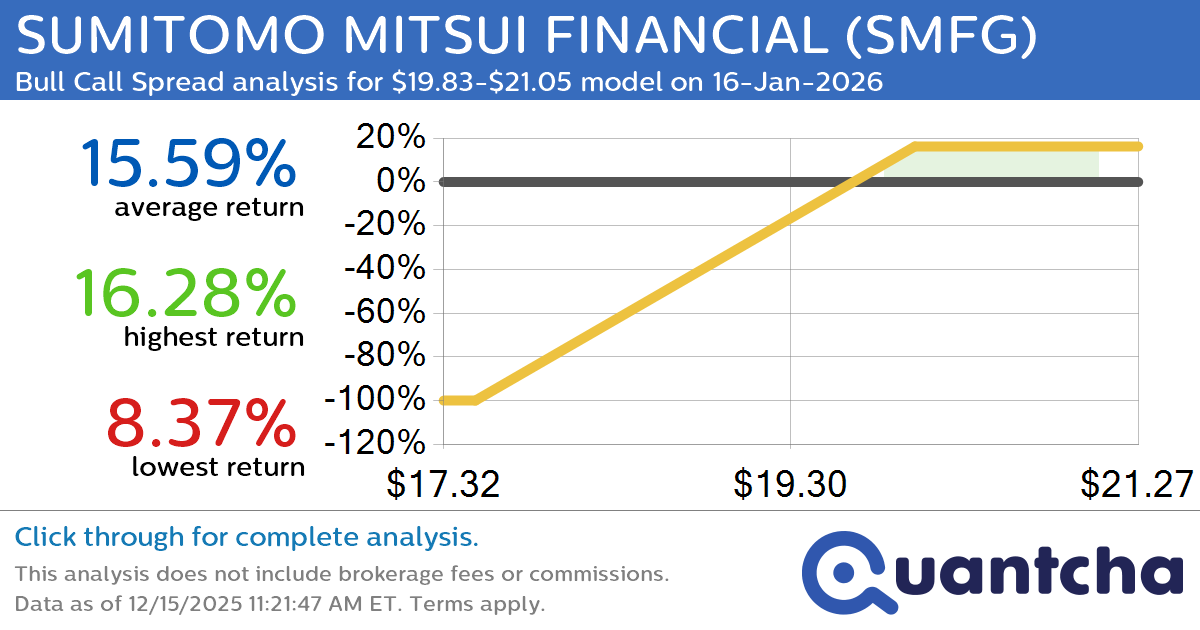

52-Week High Alert: Trading today’s movement in SUMITOMO MITSUI FINANCIAL $SMFG

Quantchabot has detected a new Bull Call Spread trade opportunity for SUMITOMO MITSUI FINANCIAL (SMFG) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SMFG was recently trading at $19.76 and has an implied volatility of 19.95% for this period. Based on an analysis of…

-

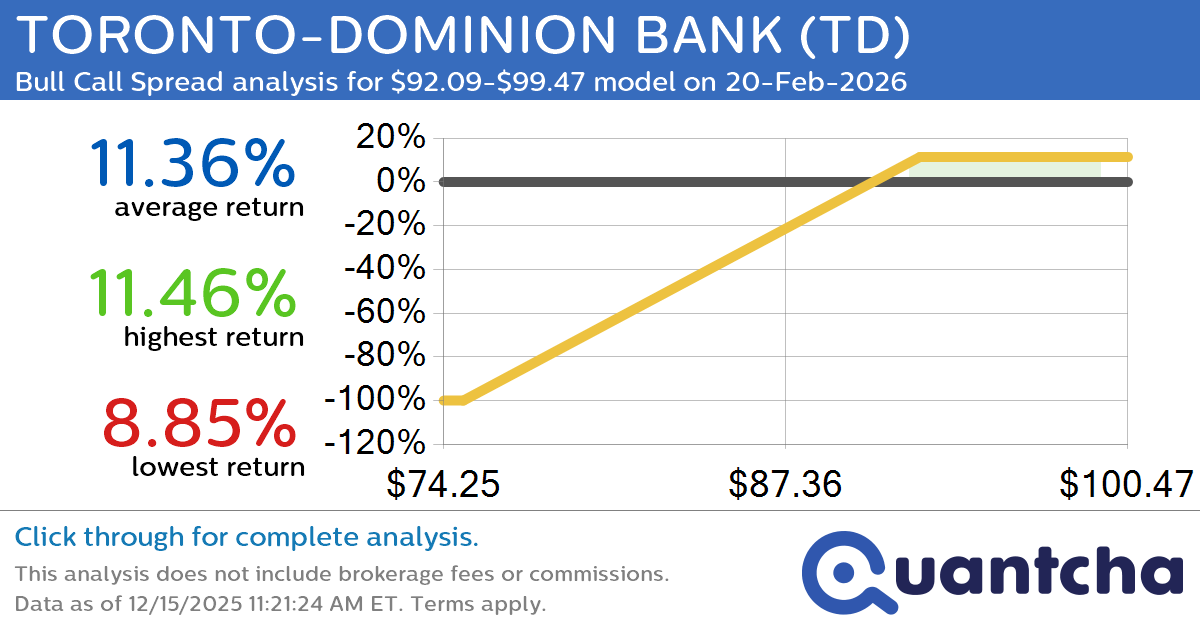

52-Week High Alert: Trading today’s movement in TORONTO-DOMINION BANK $TD

Quantchabot has detected a new Bull Call Spread trade opportunity for TORONTO-DOMINION BANK (TD) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TD was recently trading at $92.21 and has an implied volatility of 17.88% for this period. Based on an analysis of the…