Quantcha Ideas: Turn a good idea about a stock into a great options trade

-

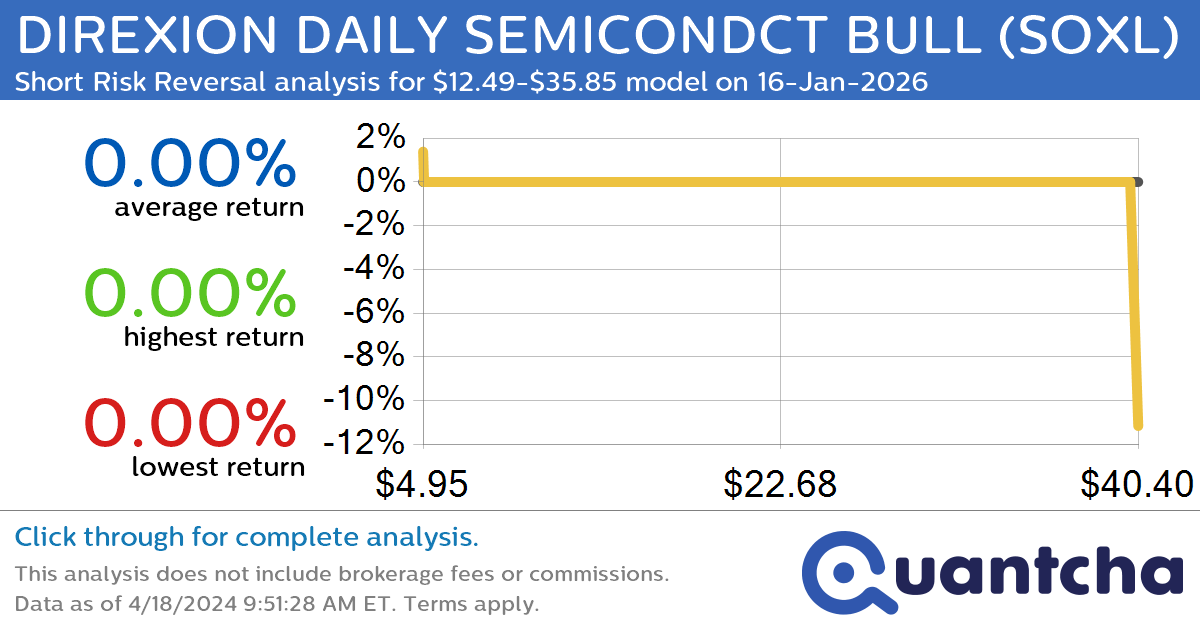

StockTwits Trending Alert: Trading recent interest in DIREXION DAILY SEMICONDCT BULL $SOXL

Quantchabot has detected a new Short Risk Reversal trade opportunity for DIREXION DAILY SEMICONDCT BULL (SOXL) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SOXL was recently trading at $35.85 and has an implied volatility of 86.74% for this period. Based on an analysis…

-

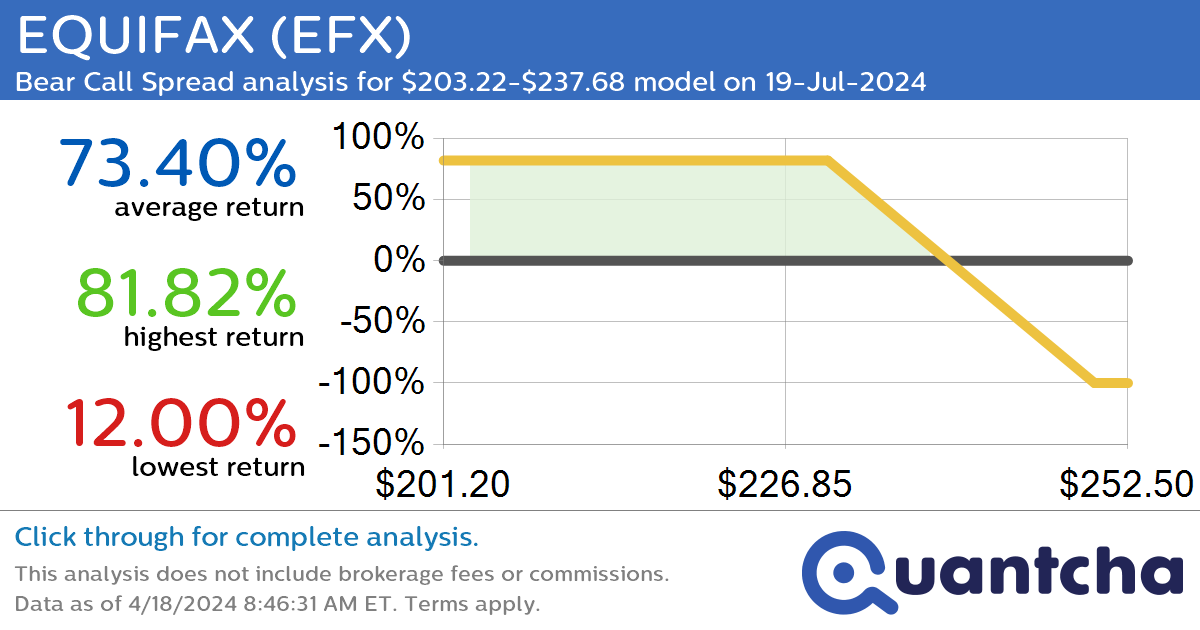

StockTwits Trending Alert: Trading recent interest in EQUIFAX $EFX

Quantchabot has detected a new Bear Call Spread trade opportunity for EQUIFAX (EFX) for the 19-Jul-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. EFX was recently trading at $237.68 and has an implied volatility of 33.88% for this period. Based on an analysis of the options…

-

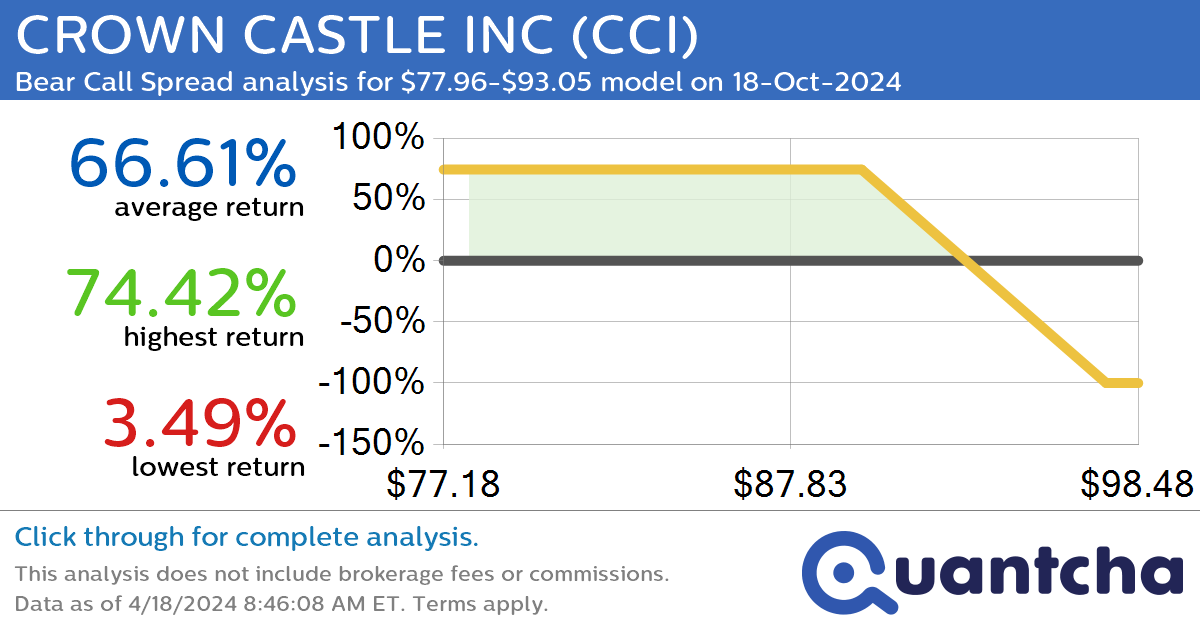

StockTwits Trending Alert: Trading recent interest in CROWN CASTLE INC $CCI

Quantchabot has detected a new Bear Call Spread trade opportunity for CROWN CASTLE INC (CCI) for the 18-Oct-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CCI was recently trading at $93.05 and has an implied volatility of 28.86% for this period. Based on an analysis of…

-

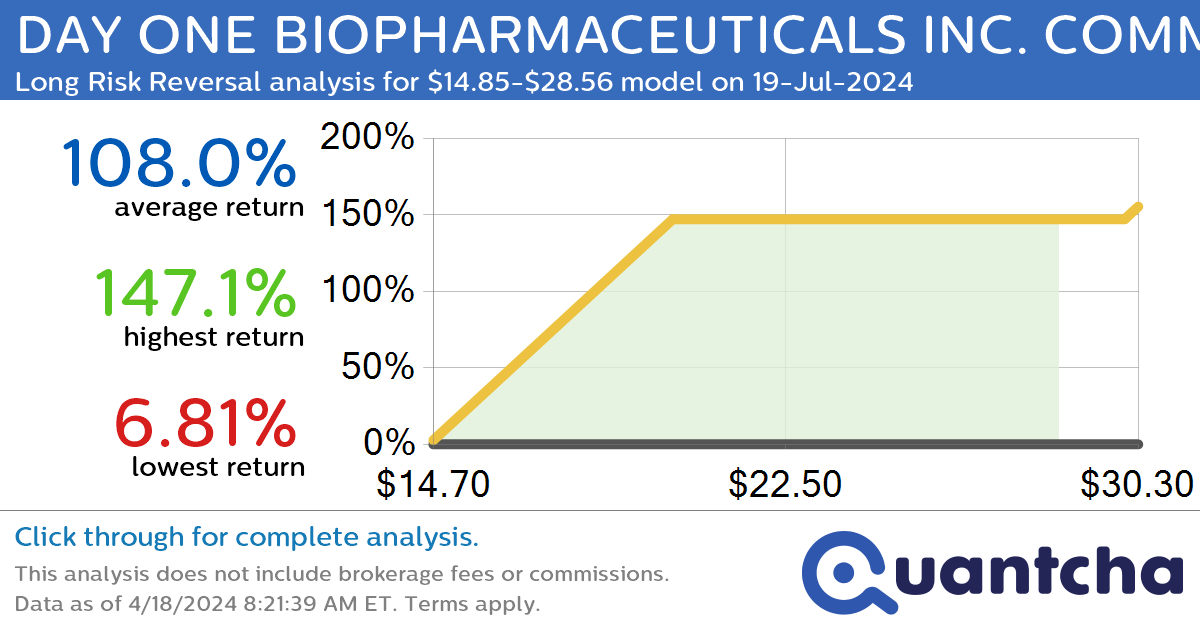

StockTwits Trending Alert: Trading recent interest in DAY ONE BIOPHARMACEUTICALS INC. COMMON $DAWN

Quantchabot has detected a new Long Risk Reversal trade opportunity for DAY ONE BIOPHARMACEUTICALS INC. COMMON (DAWN) for the 19-Jul-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. DAWN was recently trading at $14.85 and has an implied volatility of 126.90% for this period. Based on an…

-

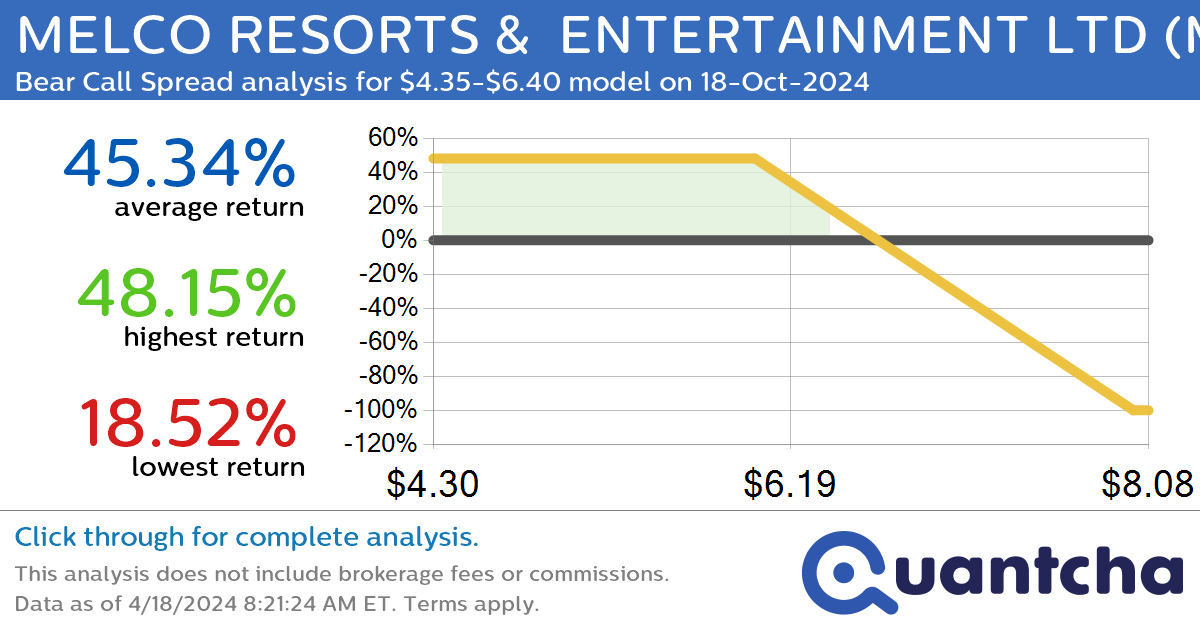

StockTwits Trending Alert: Trading recent interest in MELCO RESORTS & ENTERTAINMENT LTD $MLCO

Quantchabot has detected a new Bear Call Spread trade opportunity for MELCO RESORTS & ENTERTAINMENT LTD (MLCO) for the 18-Oct-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. MLCO was recently trading at $6.40 and has an implied volatility of 58.22% for this period. Based on an…

-

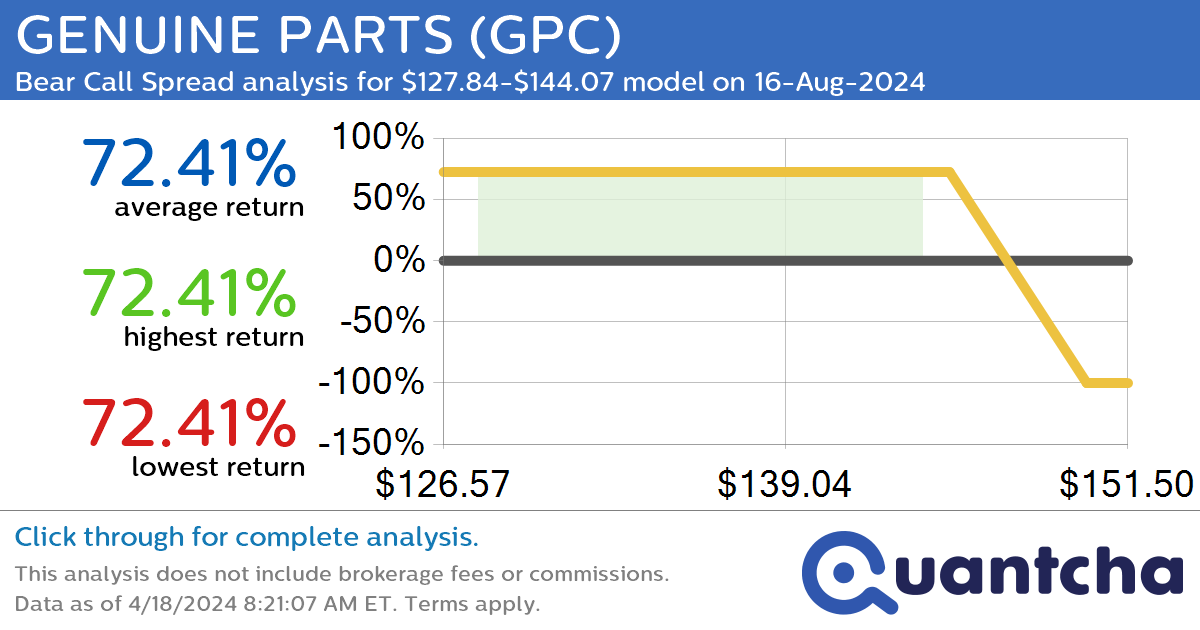

StockTwits Trending Alert: Trading recent interest in GENUINE PARTS $GPC

Quantchabot has detected a new Bear Call Spread trade opportunity for GENUINE PARTS (GPC) for the 16-Aug-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. GPC was recently trading at $144.07 and has an implied volatility of 23.99% for this period. Based on an analysis of the…

-

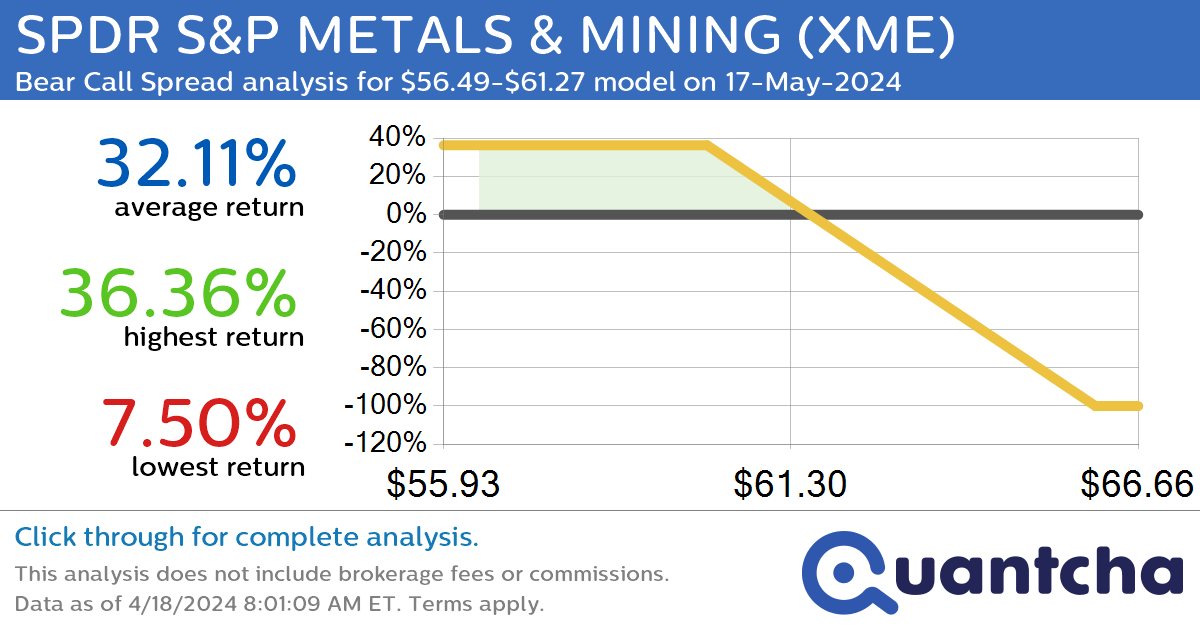

StockTwits Trending Alert: Trading recent interest in SPDR S&P METALS & MINING $XME

Quantchabot has detected a new Bear Call Spread trade opportunity for SPDR S&P METALS & MINING (XME) for the 17-May-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. XME was recently trading at $61.27 and has an implied volatility of 30.03% for this period. Based on an…

-

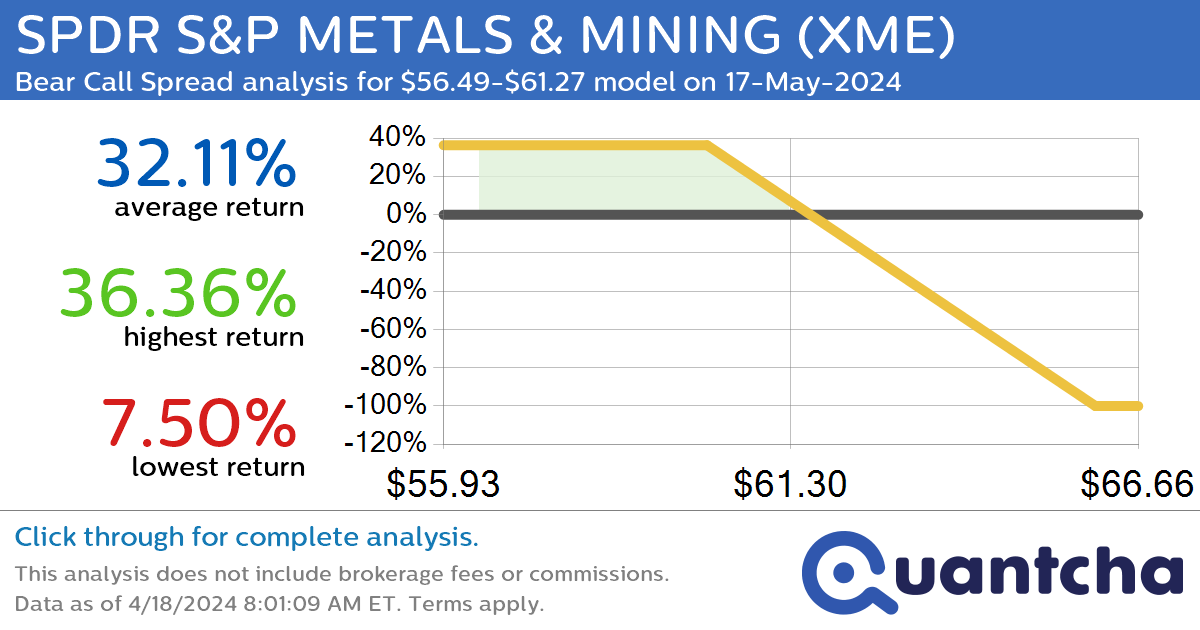

StockTwits Trending Alert: Trading recent interest in SPDR S&P METALS & MINING $XME

Quantchabot has detected a new Bear Call Spread trade opportunity for SPDR S&P METALS & MINING (XME) for the 17-May-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. XME was recently trading at $61.27 and has an implied volatility of 30.03% for this period. Based on an…

-

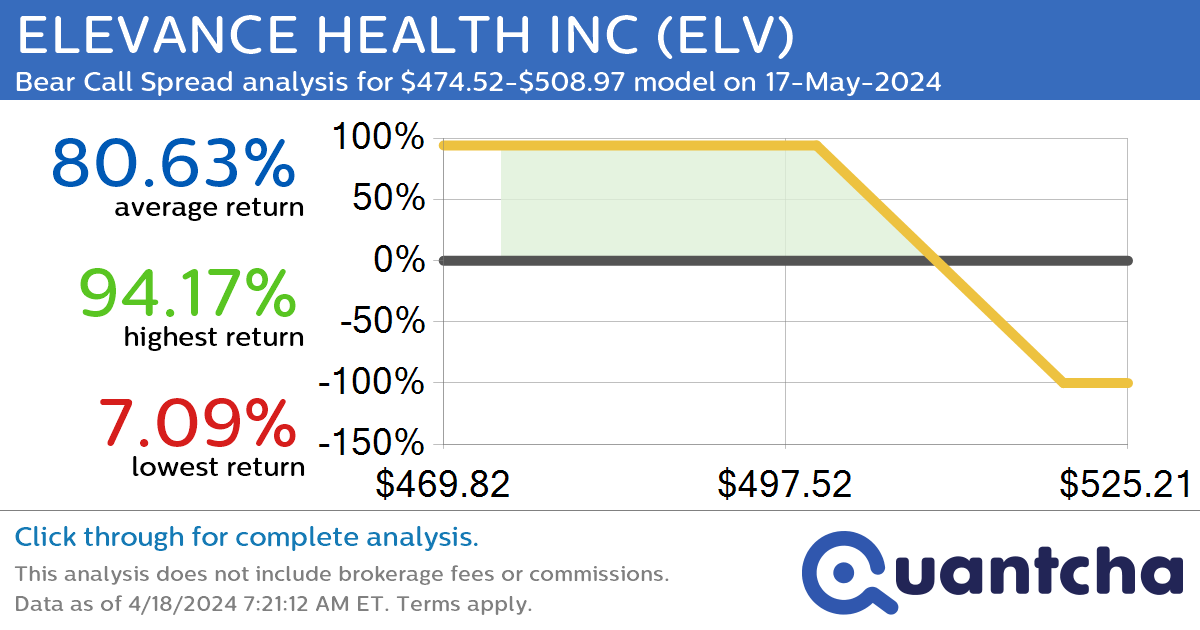

StockTwits Trending Alert: Trading recent interest in ELEVANCE HEALTH INC $ELV

Quantchabot has detected a new Bear Call Spread trade opportunity for ELEVANCE HEALTH INC (ELV) for the 17-May-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ELV was recently trading at $508.97 and has an implied volatility of 26.11% for this period. Based on an analysis of…

-

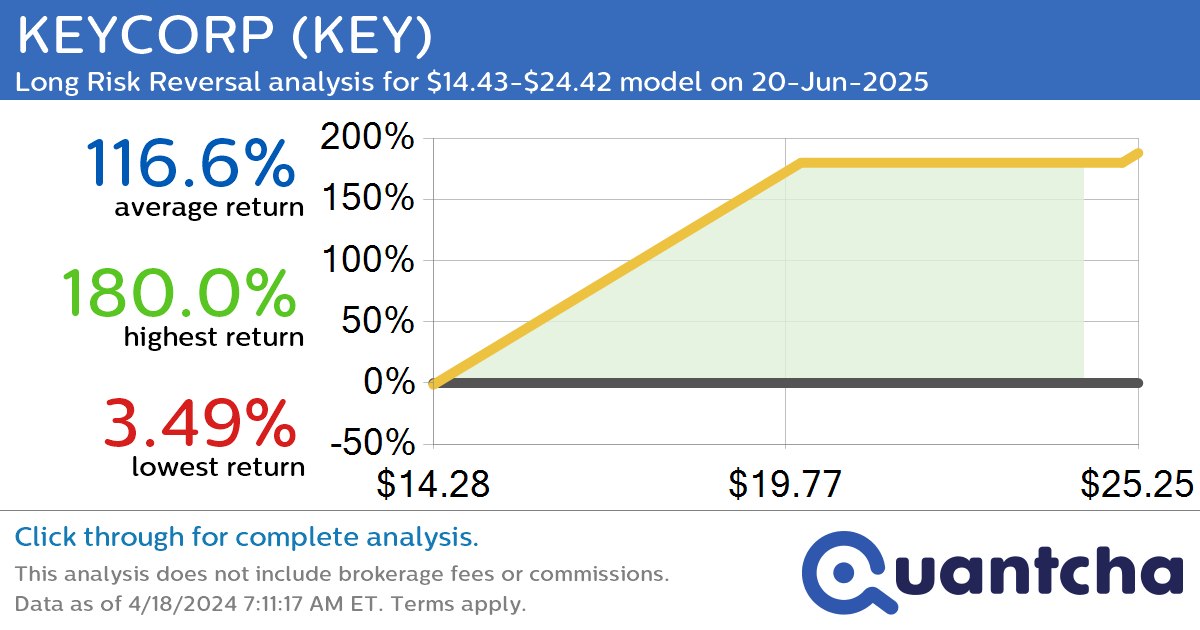

StockTwits Trending Alert: Trading recent interest in KEYCORP $KEY

Quantchabot has detected a new Long Risk Reversal trade opportunity for KEYCORP (KEY) for the 20-Jun-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. KEY was recently trading at $14.43 and has an implied volatility of 42.80% for this period. Based on an analysis of the options…