Quantcha Ideas: Turn a good idea about a stock into a great options trade

-

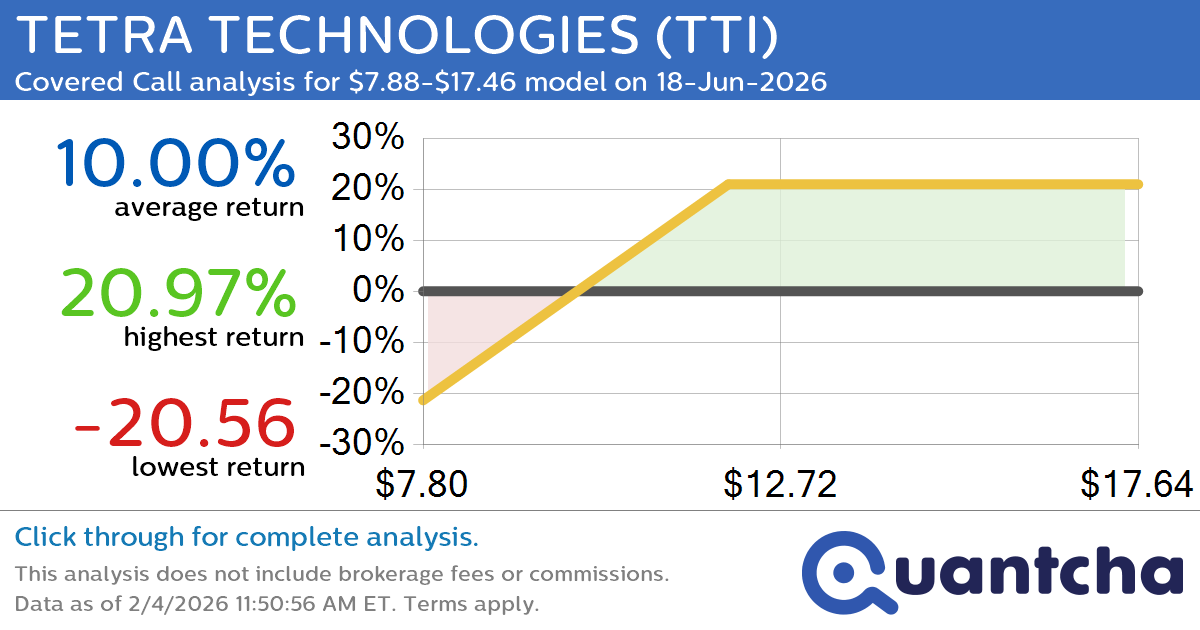

Covered Call Alert: TETRA TECHNOLOGIES $TTI returning up to 20.97% through 18-Jun-2026

Quantchabot has detected a new Covered Call trade opportunity for TETRA TECHNOLOGIES (TTI) for the 18-Jun-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TTI was recently trading at $11.57 and has an implied volatility of 65.41% for this period. Based on an analysis of the options…

-

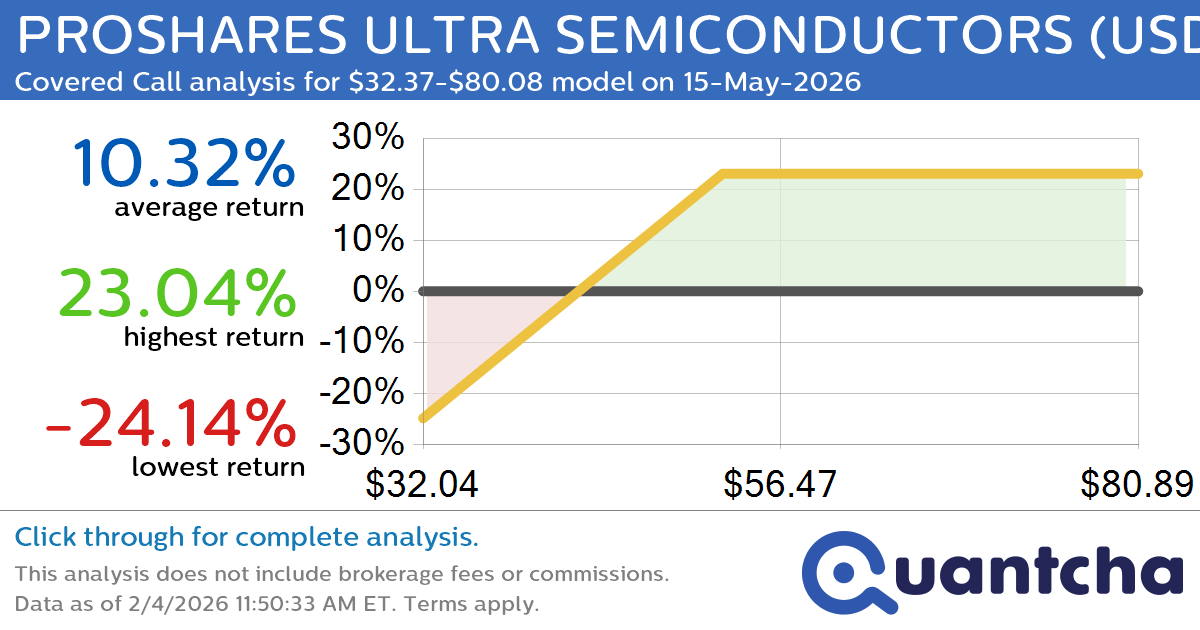

Covered Call Alert: PROSHARES ULTRA SEMICONDUCTORS $USD returning up to 23.04% through 15-May-2026

Quantchabot has detected a new Covered Call trade opportunity for PROSHARES ULTRA SEMICONDUCTORS (USD) for the 15-May-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. USD was recently trading at $50.39 and has an implied volatility of 86.21% for this period. Based on an analysis of the…

-

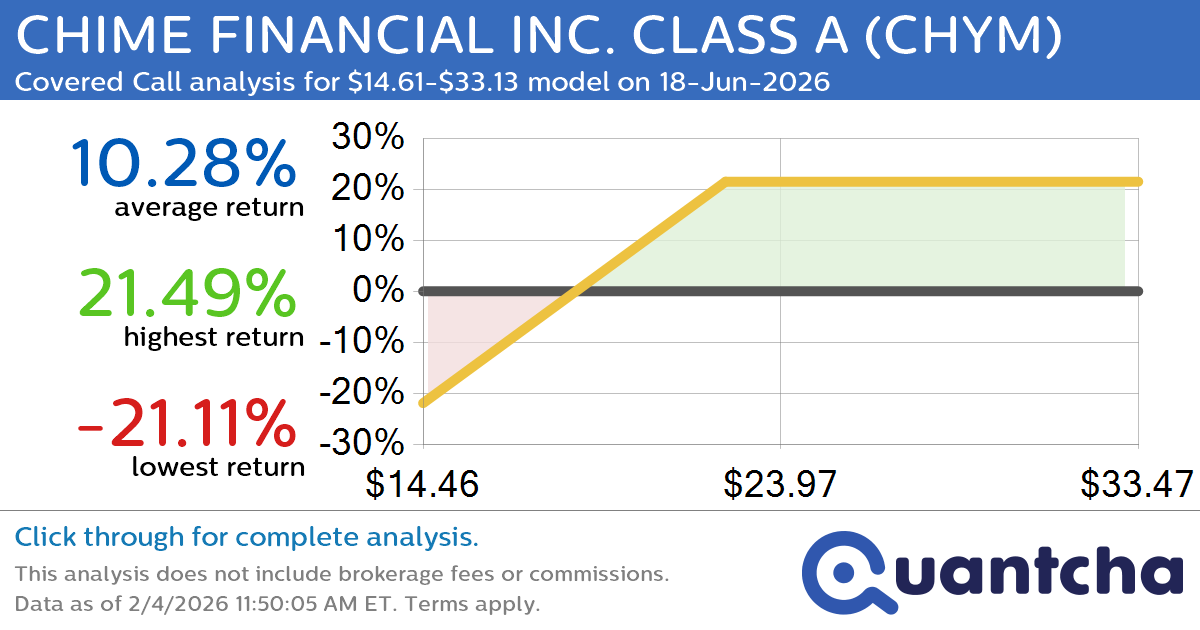

Covered Call Alert: CHIME FINANCIAL INC. CLASS A $CHYM returning up to 21.49% through 18-Jun-2026

Quantchabot has detected a new Covered Call trade opportunity for CHIME FINANCIAL INC. CLASS A (CHYM) for the 18-Jun-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CHYM was recently trading at $21.70 and has an implied volatility of 67.37% for this period. Based on an analysis…

-

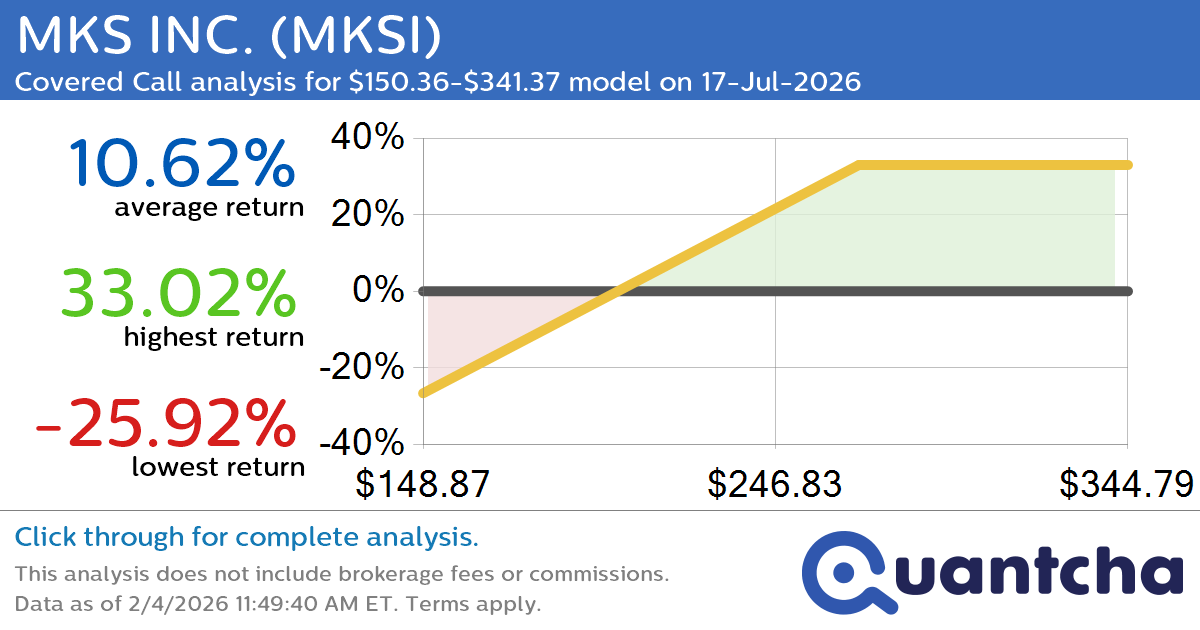

Covered Call Alert: MKS INC. $MKSI returning up to 32.96% through 17-Jul-2026

Quantchabot has detected a new Covered Call trade opportunity for MKS INC. (MKSI) for the 17-Jul-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. MKSI was recently trading at $222.77 and has an implied volatility of 61.21% for this period. Based on an analysis of the options…

-

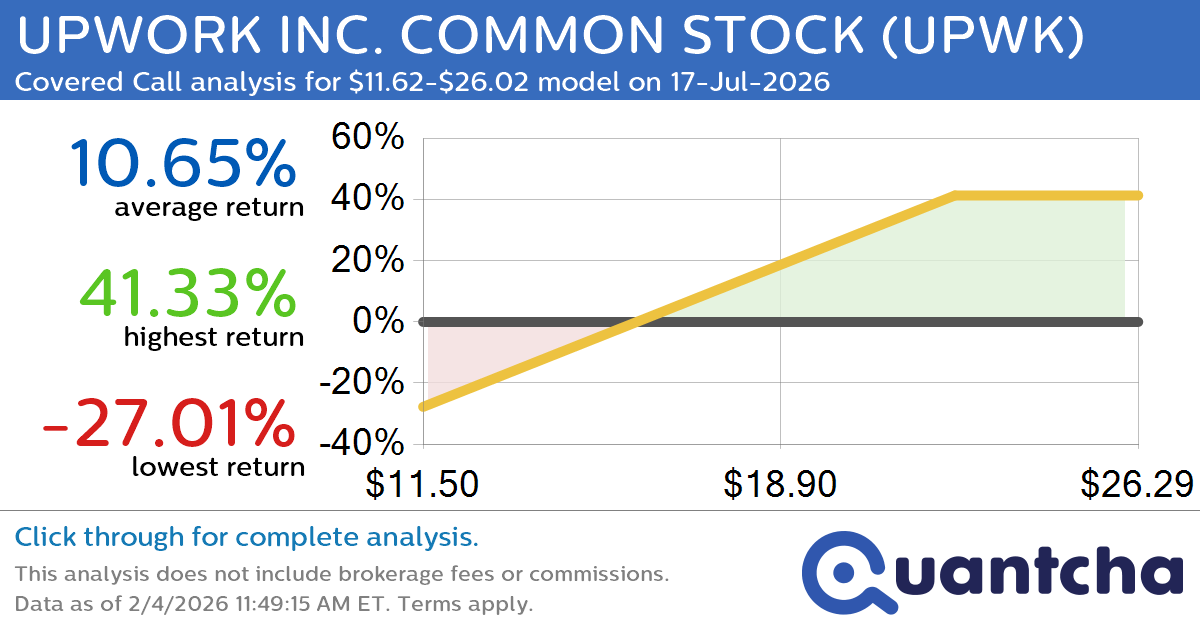

Covered Call Alert: UPWORK INC. COMMON STOCK $UPWK returning up to 41.33% through 17-Jul-2026

Quantchabot has detected a new Covered Call trade opportunity for UPWORK INC. COMMON STOCK (UPWK) for the 17-Jul-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. UPWK was recently trading at $17.10 and has an implied volatility of 60.16% for this period. Based on an analysis of…

-

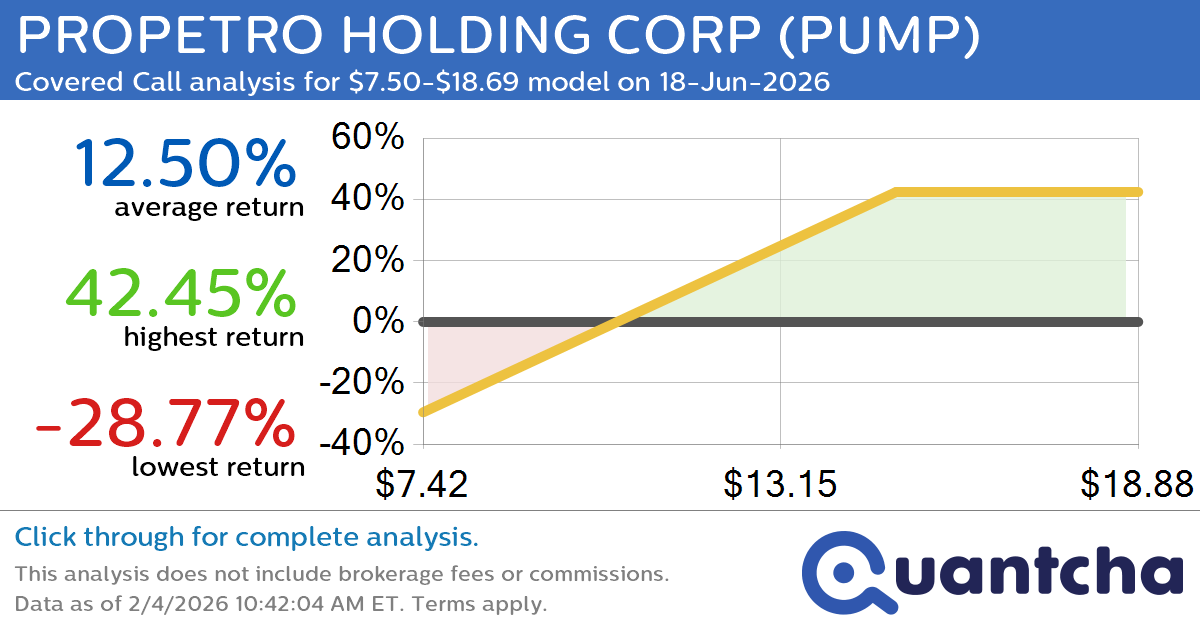

Covered Call Alert: PROPETRO HOLDING CORP $PUMP returning up to 40.85% through 18-Jun-2026

Quantchabot has detected a new Covered Call trade opportunity for PROPETRO HOLDING CORP (PUMP) for the 18-Jun-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. PUMP was recently trading at $11.68 and has an implied volatility of 75.08% for this period. Based on an analysis of the…

-

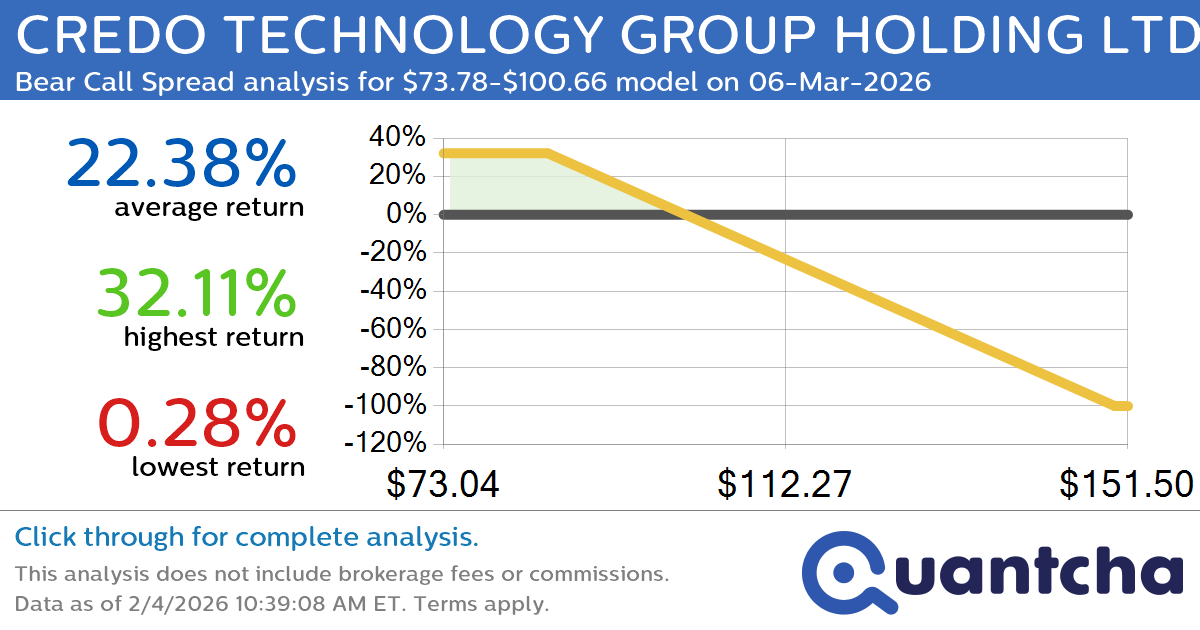

Big Loser Alert: Trading today’s -9.9% move in CREDO TECHNOLOGY GROUP HOLDING LTD $CRDO

Quantchabot has detected a new Bear Call Spread trade opportunity for CREDO TECHNOLOGY GROUP HOLDING LTD (CRDO) for the 6-Mar-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CRDO was recently trading at $100.33 and has an implied volatility of 106.99% for this period. Based on an…

-

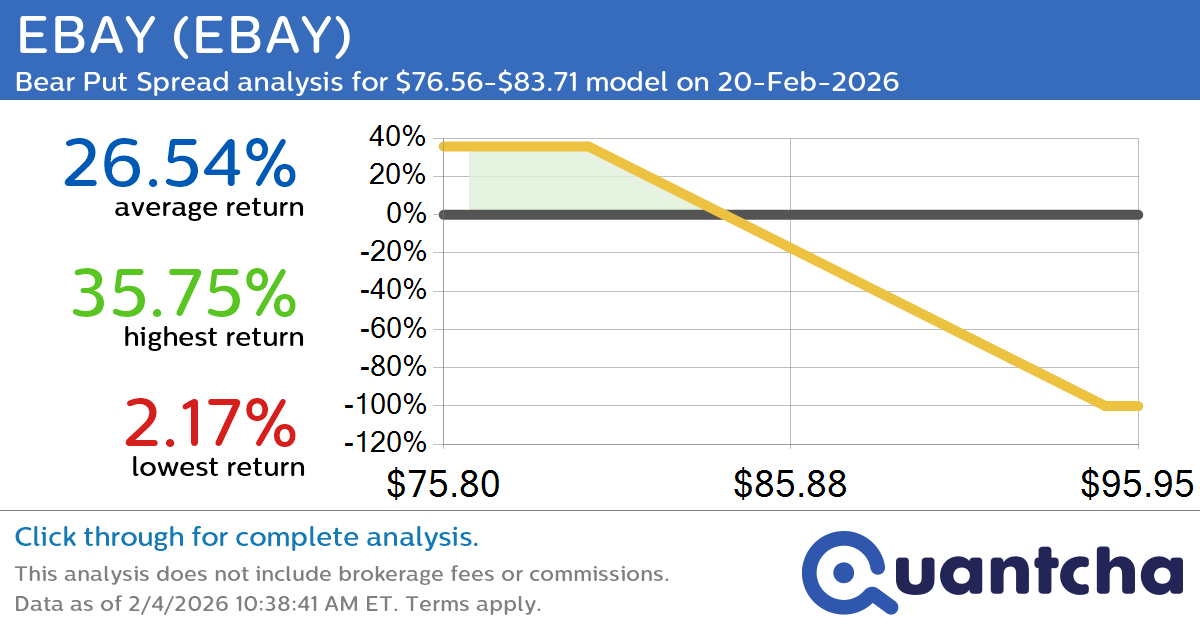

Big Loser Alert: Trading today’s -9.5% move in EBAY $EBAY

Quantchabot has detected a new Bear Put Spread trade opportunity for EBAY (EBAY) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. EBAY was recently trading at $83.56 and has an implied volatility of 41.66% for this period. Based on an analysis of the options…

-

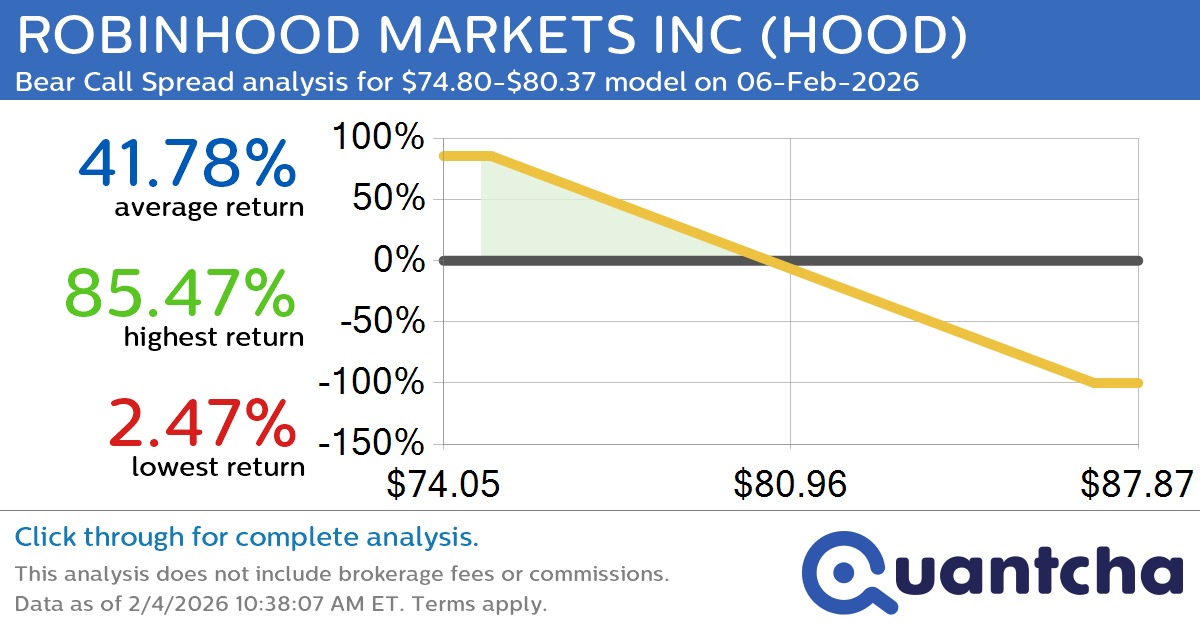

Big Loser Alert: Trading today’s -7.7% move in ROBINHOOD MARKETS INC $HOOD

Quantchabot has detected a new Bear Call Spread trade opportunity for ROBINHOOD MARKETS INC (HOOD) for the 6-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. HOOD was recently trading at $80.35 and has an implied volatility of 82.55% for this period. Based on an analysis of…

-

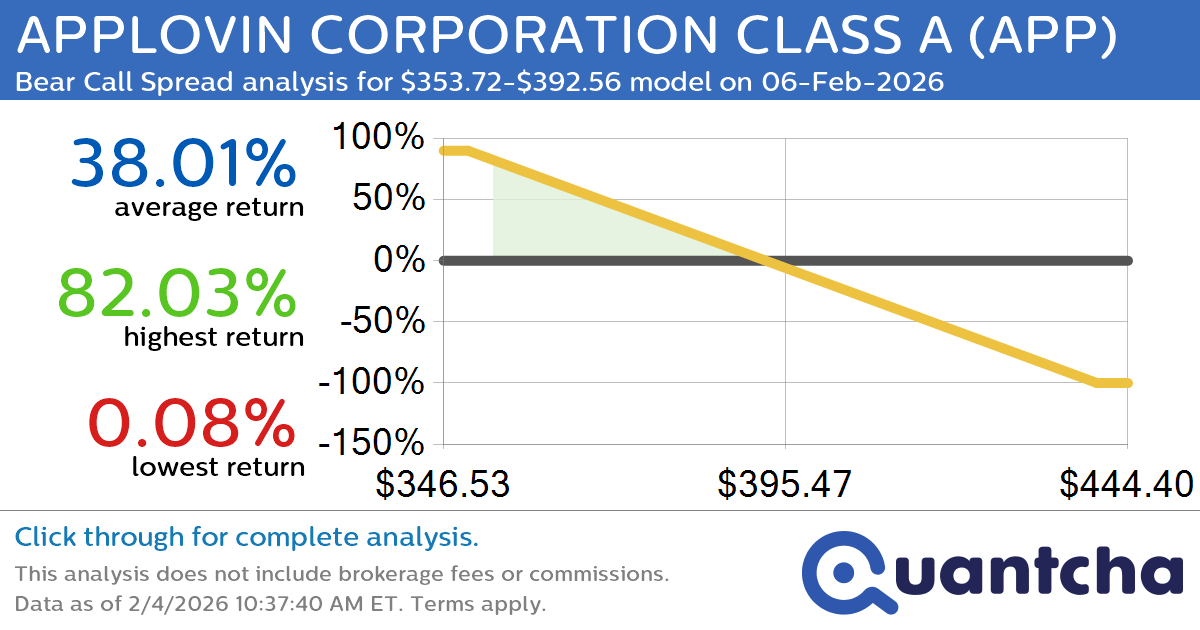

Big Loser Alert: Trading today’s -15.0% move in APPLOVIN CORPORATION CLASS A $APP

Quantchabot has detected a new Bear Call Spread trade opportunity for APPLOVIN CORPORATION CLASS A (APP) for the 6-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. APP was recently trading at $392.44 and has an implied volatility of 119.57% for this period. Based on an analysis…