Quantcha Ideas: Turn a good idea about a stock into a great options trade

-

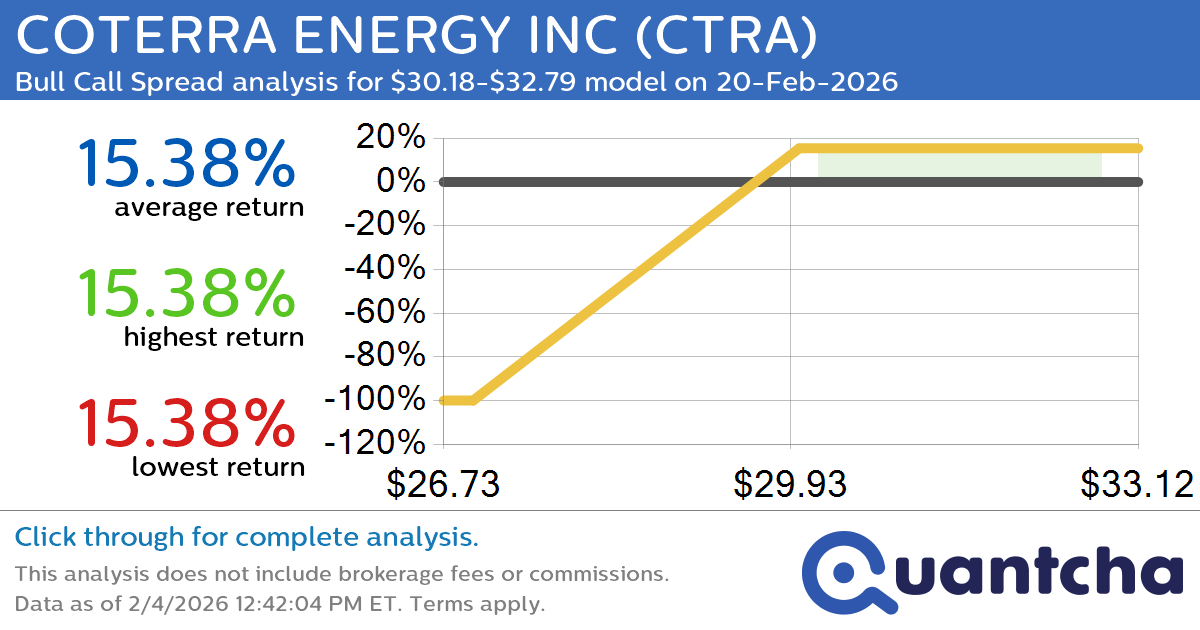

52-Week High Alert: Trading today’s movement in COTERRA ENERGY INC $CTRA

Quantchabot has detected a new Bull Call Spread trade opportunity for COTERRA ENERGY INC (CTRA) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CTRA was recently trading at $30.13 and has an implied volatility of 38.81% for this period. Based on an analysis of…

-

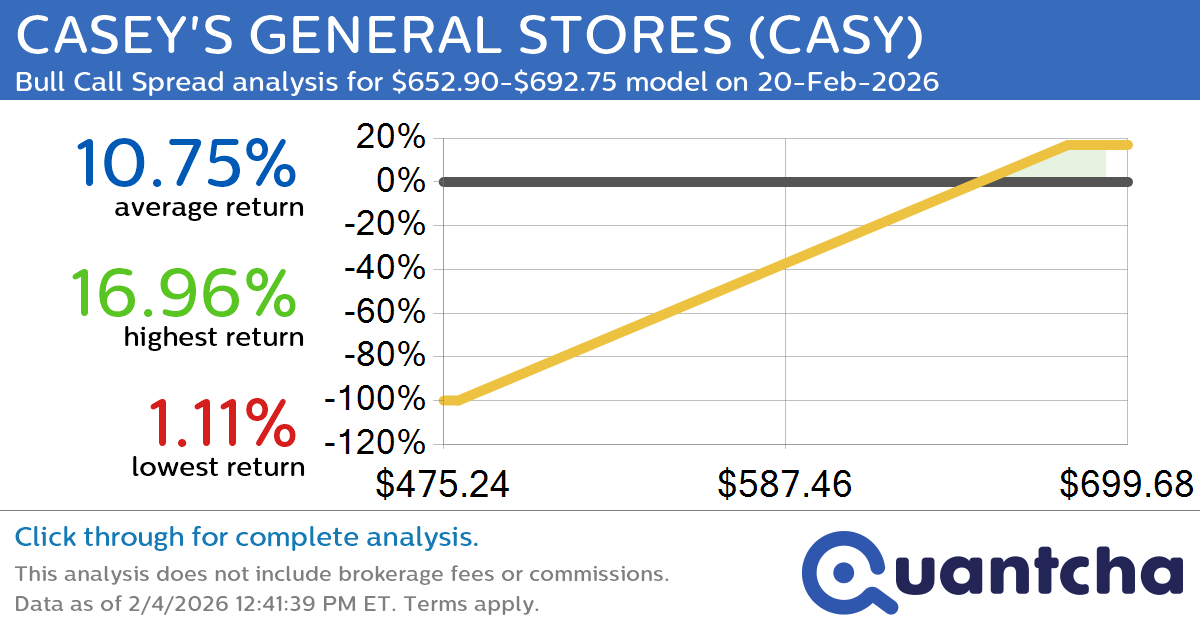

52-Week High Alert: Trading today’s movement in CASEY’S GENERAL STORES $CASY

Quantchabot has detected a new Bull Call Spread trade opportunity for CASEY’S GENERAL STORES (CASY) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CASY was recently trading at $651.77 and has an implied volatility of 27.71% for this period. Based on an analysis of…

-

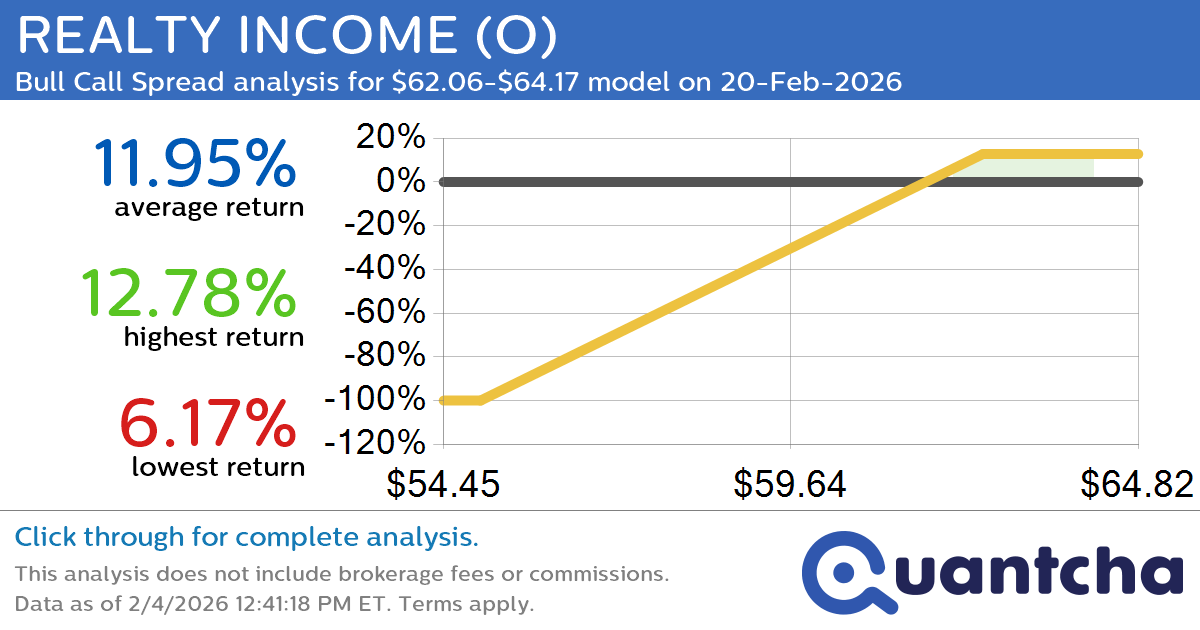

52-Week High Alert: Trading today’s movement in REALTY INCOME $O

Quantchabot has detected a new Bull Call Spread trade opportunity for REALTY INCOME (O) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. O was recently trading at $61.95 and has an implied volatility of 15.68% for this period. Based on an analysis of the…

-

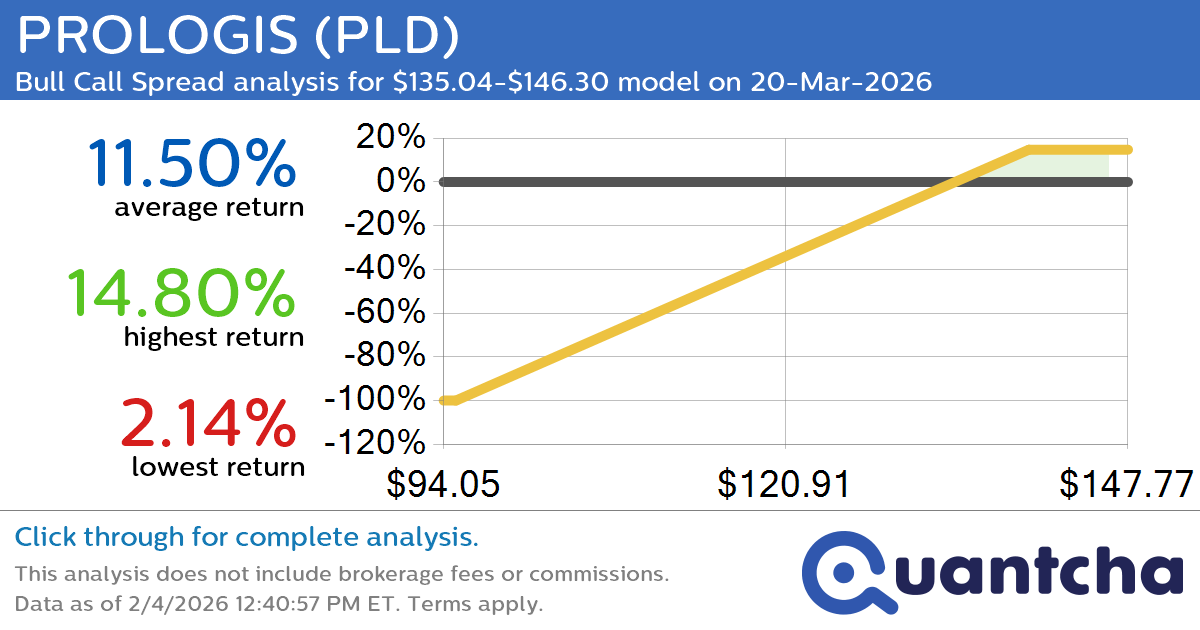

52-Week High Alert: Trading today’s movement in PROLOGIS $PLD

Quantchabot has detected a new Bull Call Spread trade opportunity for PROLOGIS (PLD) for the 20-Mar-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. PLD was recently trading at $134.41 and has an implied volatility of 22.90% for this period. Based on an analysis of the options…

-

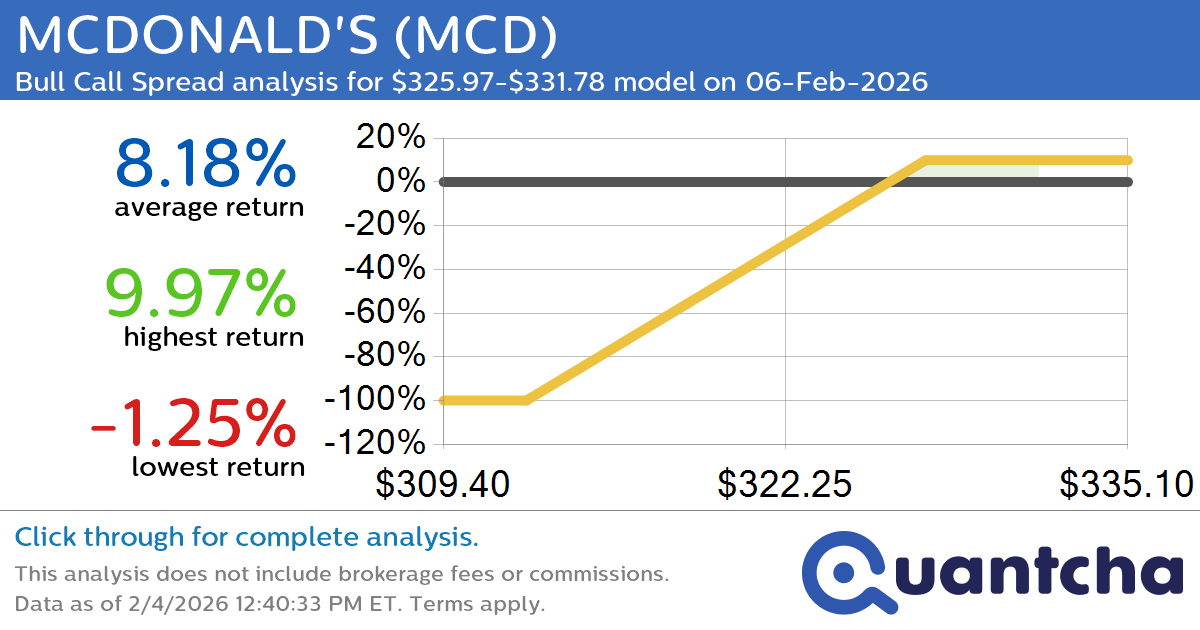

52-Week High Alert: Trading today’s movement in MCDONALD’S $MCD

Quantchabot has detected a new Bull Call Spread trade opportunity for MCDONALD’S (MCD) for the 6-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. MCD was recently trading at $325.88 and has an implied volatility of 20.59% for this period. Based on an analysis of the options…

-

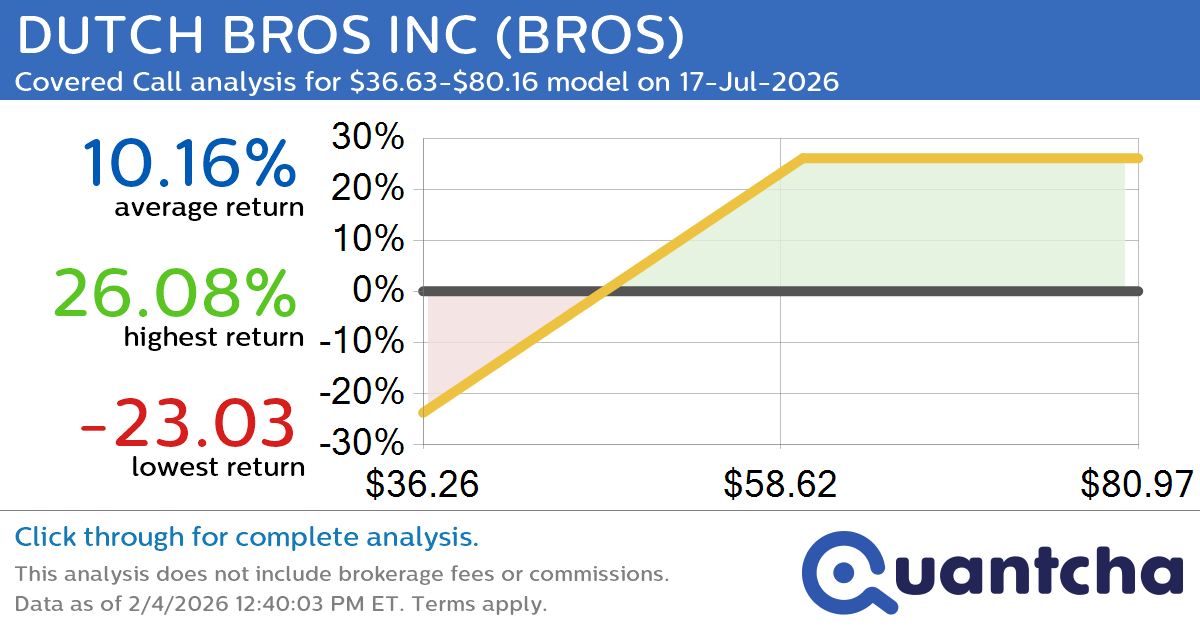

Covered Call Alert: DUTCH BROS INC $BROS returning up to 26.08% through 17-Jul-2026

Quantchabot has detected a new Covered Call trade opportunity for DUTCH BROS INC (BROS) for the 17-Jul-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. BROS was recently trading at $53.28 and has an implied volatility of 58.47% for this period. Based on an analysis of the…

-

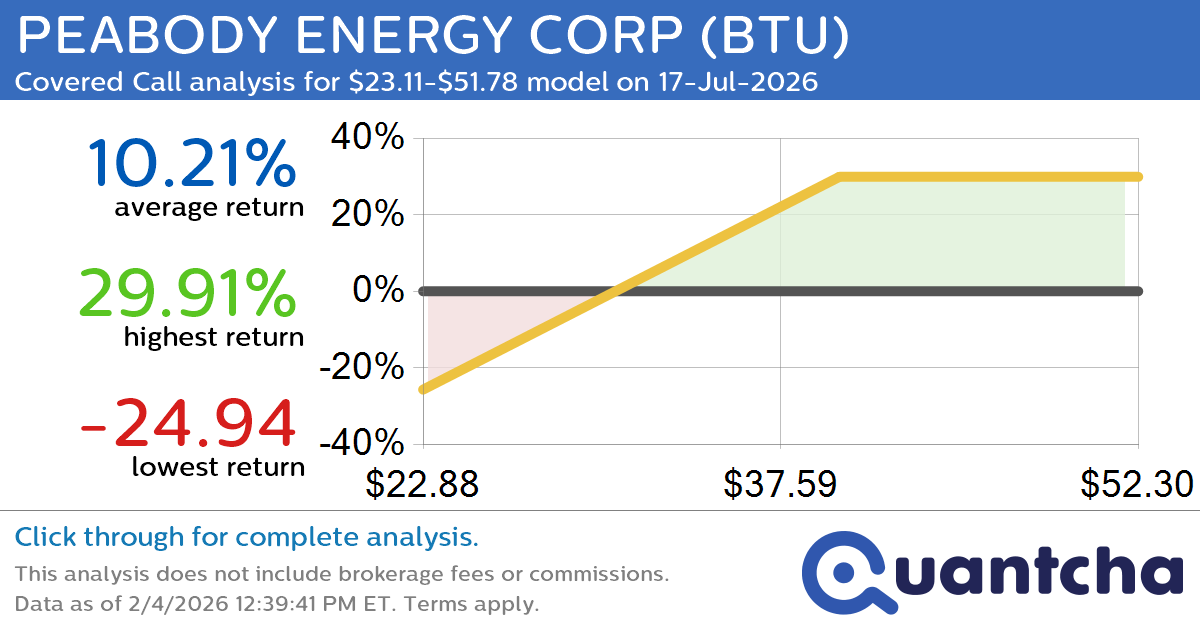

Covered Call Alert: PEABODY ENERGY CORP $BTU returning up to 29.70% through 17-Jul-2026

Quantchabot has detected a new Covered Call trade opportunity for PEABODY ENERGY CORP (BTU) for the 17-Jul-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. BTU was recently trading at $34.02 and has an implied volatility of 60.24% for this period. Based on an analysis of the…

-

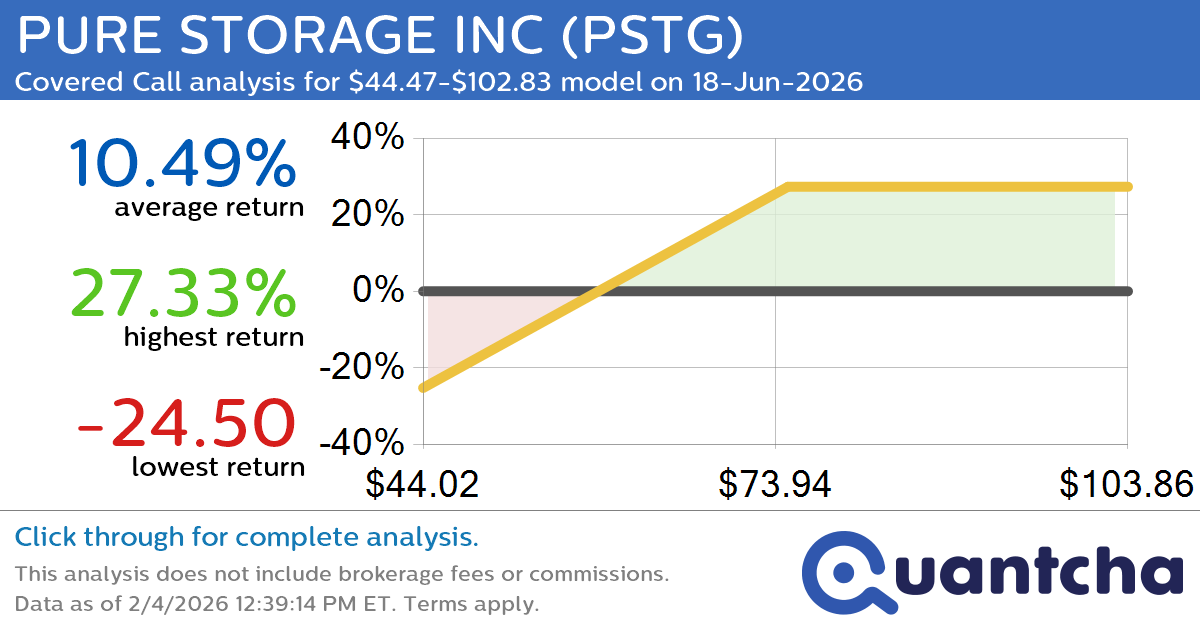

Covered Call Alert: PURE STORAGE INC $PSTG returning up to 27.33% through 18-Jun-2026

Quantchabot has detected a new Covered Call trade opportunity for PURE STORAGE INC (PSTG) for the 18-Jun-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. PSTG was recently trading at $66.69 and has an implied volatility of 68.99% for this period. Based on an analysis of the…

-

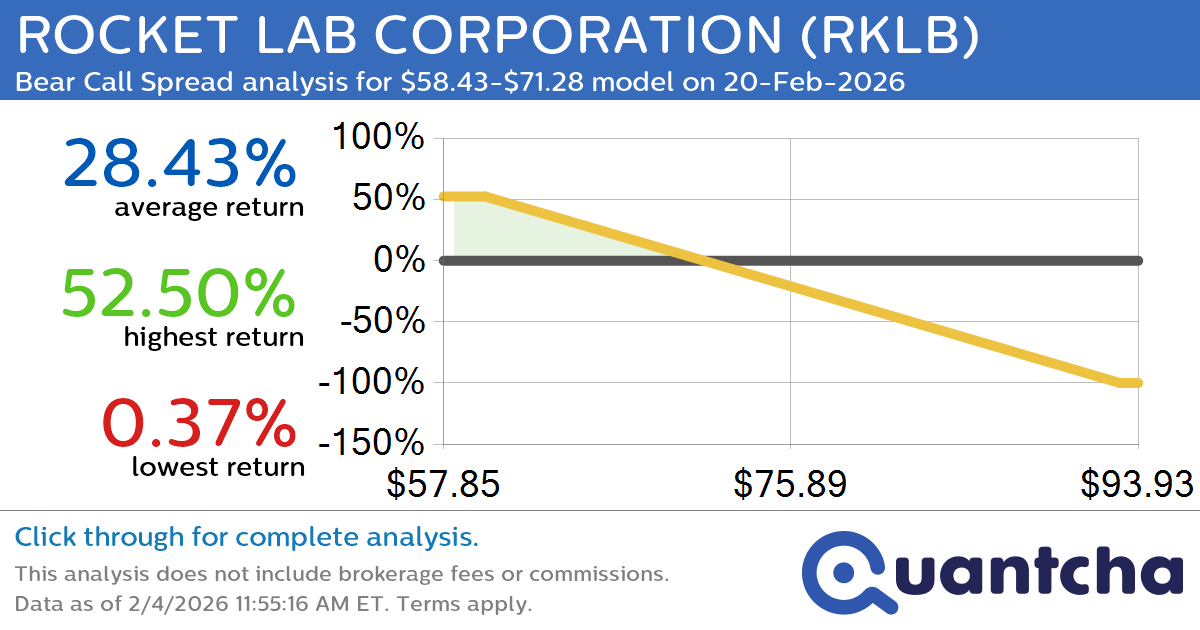

Big Loser Alert: Trading today’s -12.4% move in ROCKET LAB CORPORATION $RKLB

Quantchabot has detected a new Bear Call Spread trade opportunity for ROCKET LAB CORPORATION (RKLB) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. RKLB was recently trading at $71.16 and has an implied volatility of 92.93% for this period. Based on an analysis of…

-

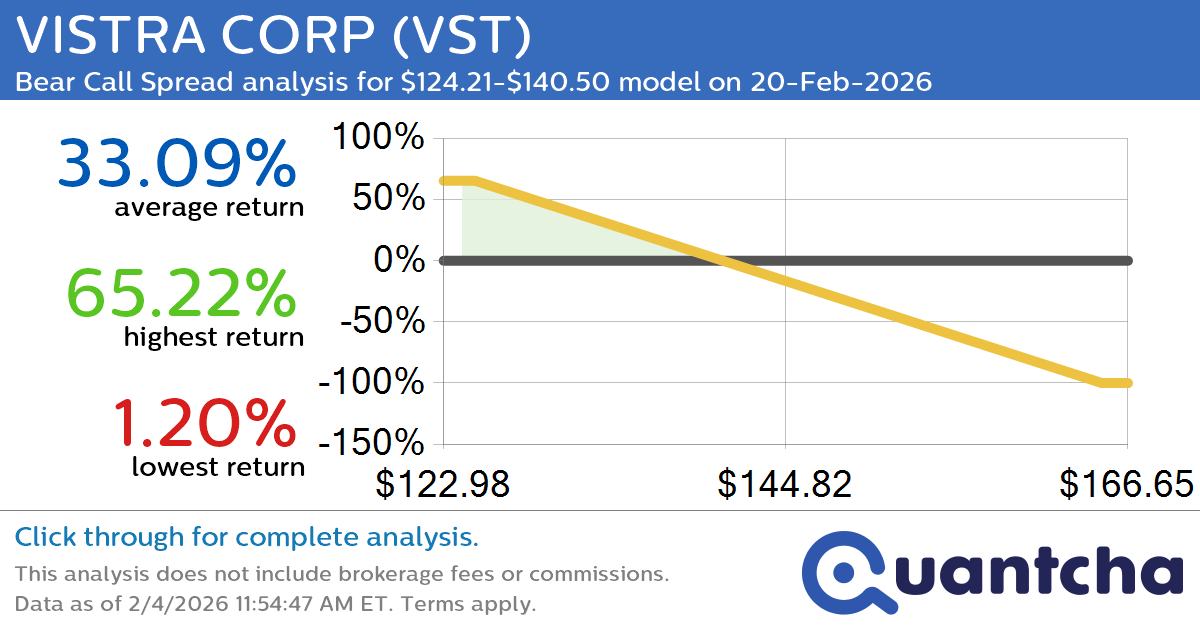

Big Loser Alert: Trading today’s -8.3% move in VISTRA CORP $VST

Quantchabot has detected a new Bear Call Spread trade opportunity for VISTRA CORP (VST) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. VST was recently trading at $140.26 and has an implied volatility of 57.60% for this period. Based on an analysis of the…