Quantcha Ideas: Turn a good idea about a stock into a great options trade

-

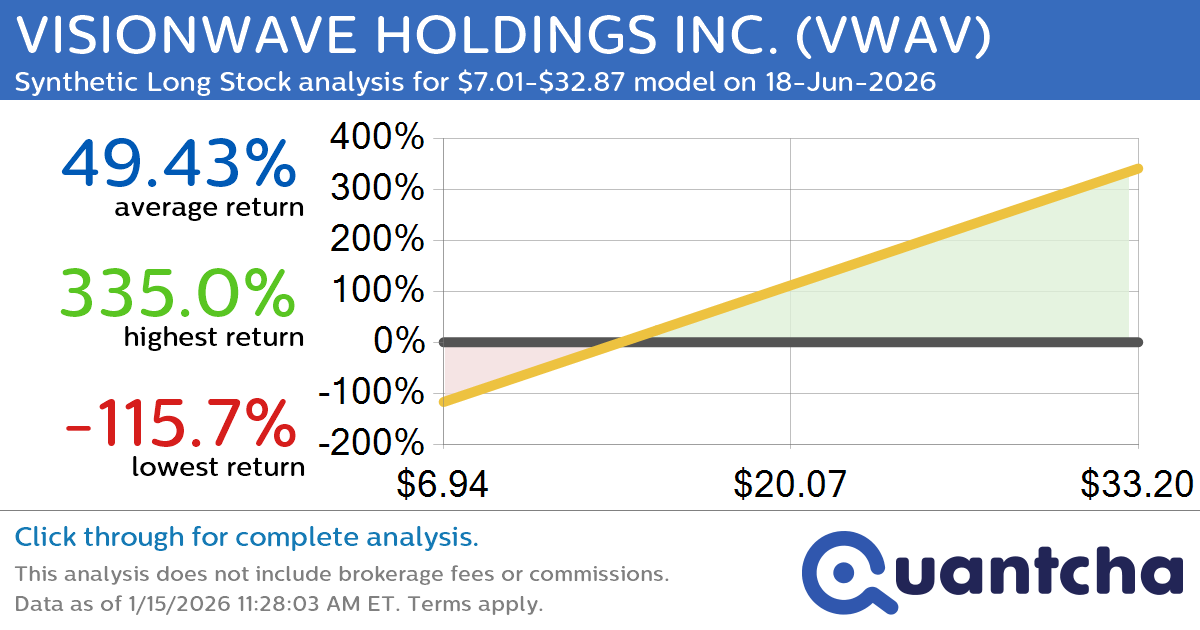

Synthetic Long Discount Alert: VISIONWAVE HOLDINGS INC. $VWAV trading at a 19.34% discount for the 18-Jun-2026 expiration

Quantchabot has detected a new Synthetic Long Stock trade opportunity for VISIONWAVE HOLDINGS INC. (VWAV) for the 18-Jun-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. VWAV was recently trading at $14.94 and has an implied volatility of 118.65% for this period. Based on an analysis of…

-

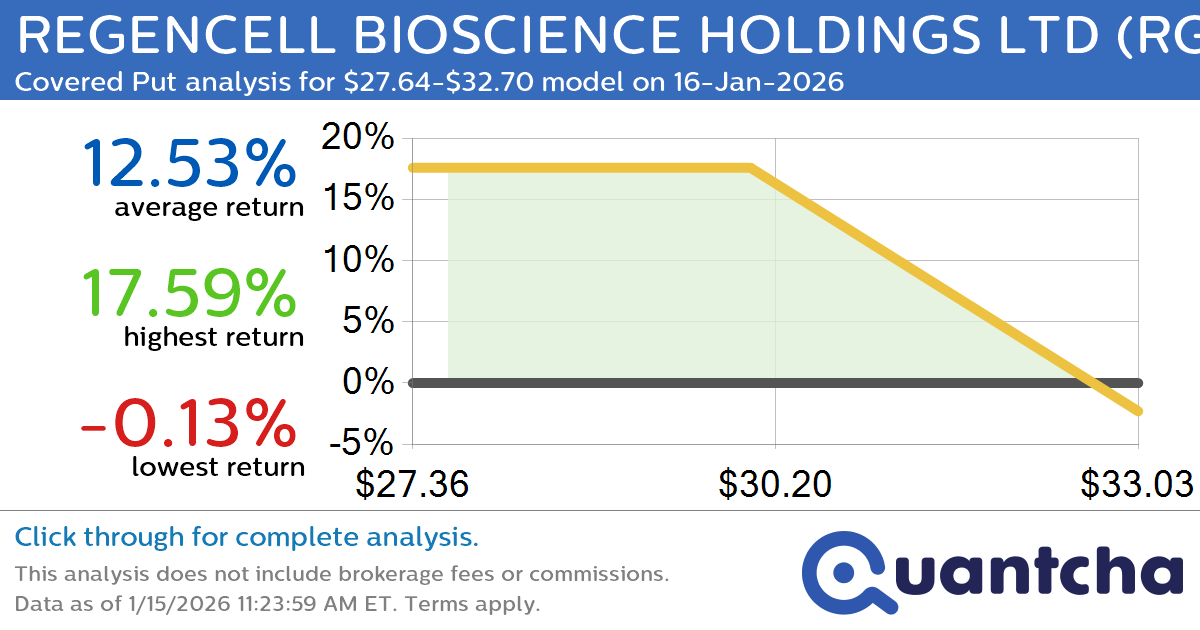

Big Loser Alert: Trading today’s -7.1% move in REGENCELL BIOSCIENCE HOLDINGS LTD $RGC

Quantchabot has detected a new Covered Put trade opportunity for REGENCELL BIOSCIENCE HOLDINGS LTD (RGC) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. RGC was recently trading at $32.69 and has an implied volatility of 243.59% for this period. Based on an analysis of…

-

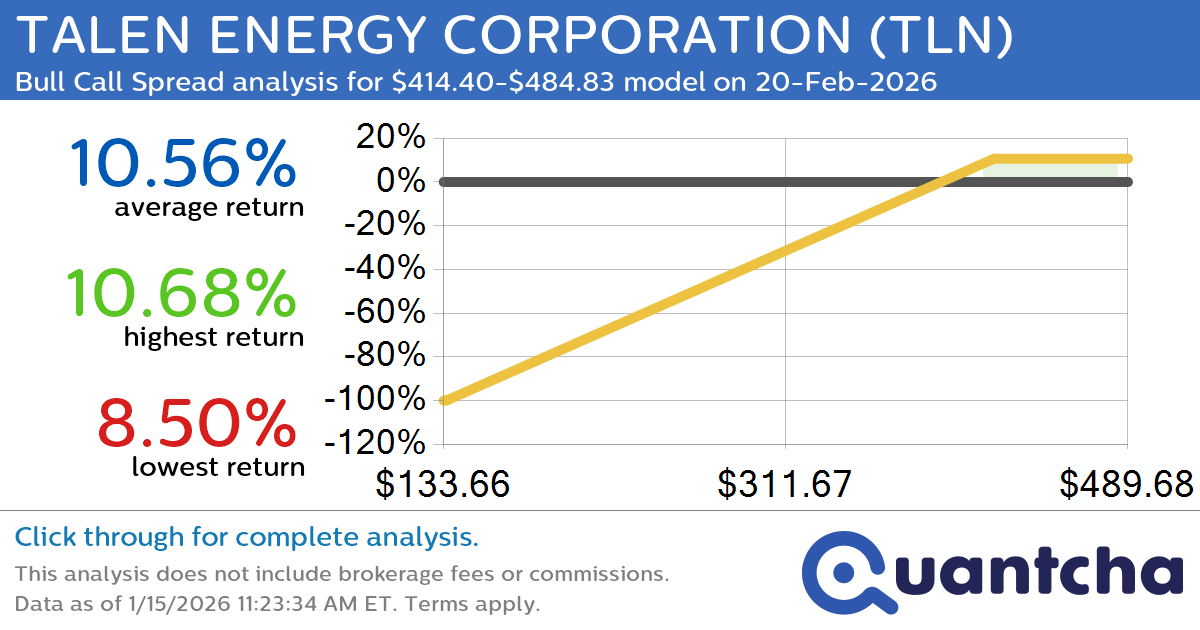

Big Gainer Alert: Trading today’s 10.1% move in TALEN ENERGY CORPORATION $TLN

Quantchabot has detected a new Bull Call Spread trade opportunity for TALEN ENERGY CORPORATION (TLN) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TLN was recently trading at $412.82 and has an implied volatility of 49.48% for this period. Based on an analysis of…

-

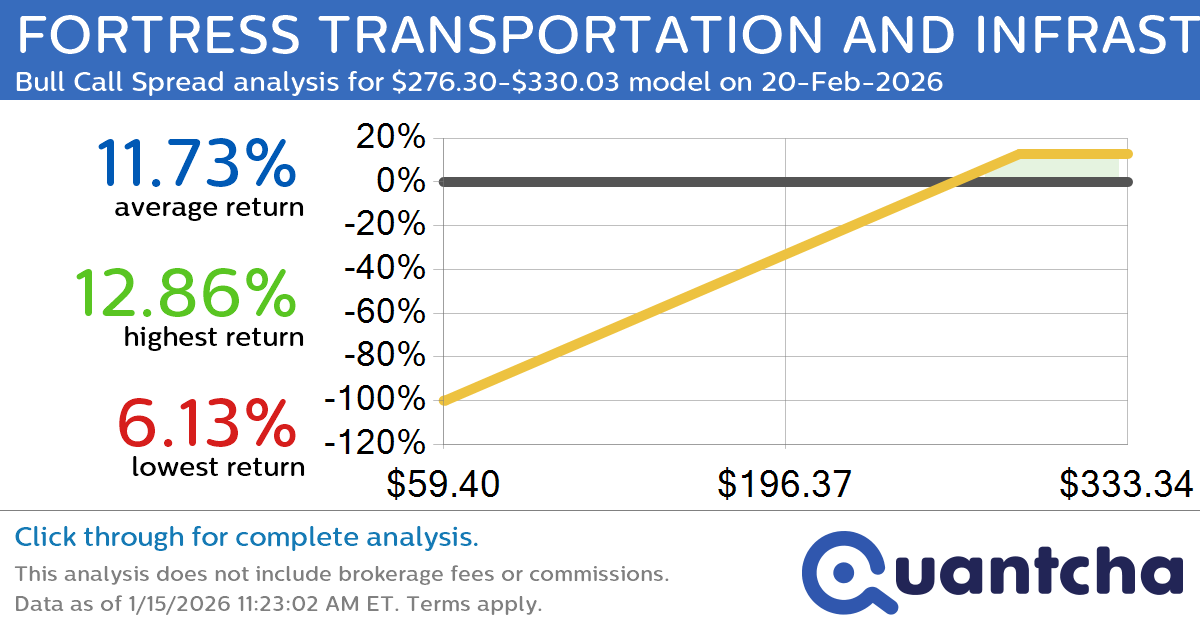

Big Gainer Alert: Trading today’s 9.2% move in FORTRESS TRANSPORTATION AND INFRASTRUCTURE INVESTO $FTAI

Quantchabot has detected a new Bull Call Spread trade opportunity for FORTRESS TRANSPORTATION AND INFRASTRUCTURE INVESTO (FTAI) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. FTAI was recently trading at $275.25 and has an implied volatility of 56.01% for this period. Based on an…

-

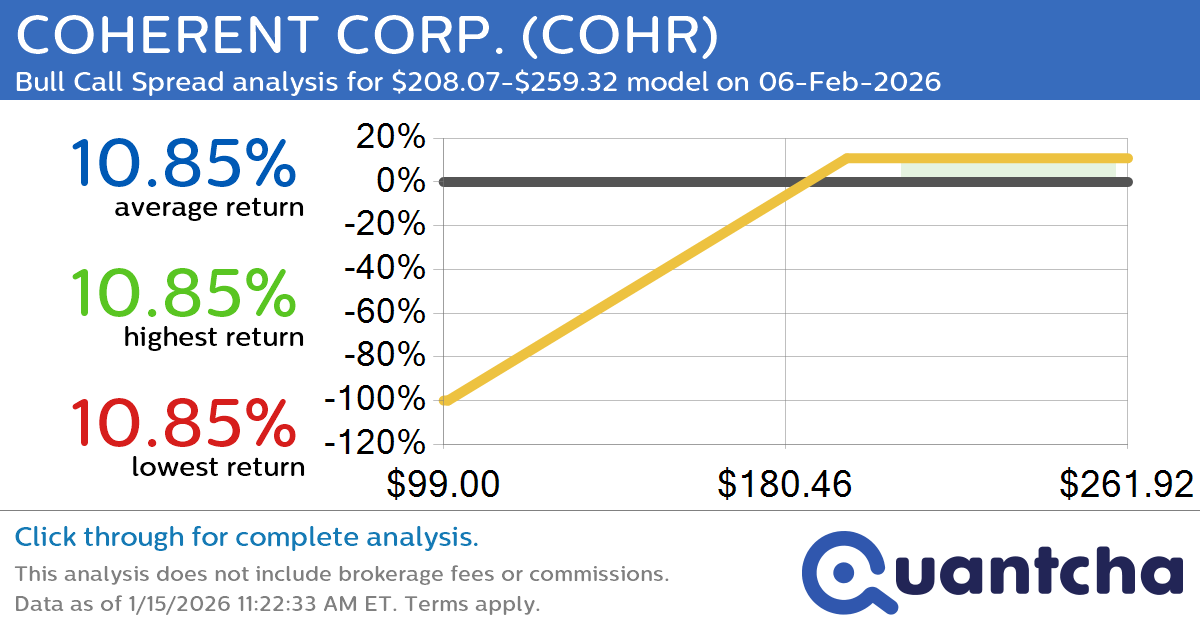

Big Gainer Alert: Trading today’s 12.7% move in COHERENT CORP. $COHR

Quantchabot has detected a new Bull Call Spread trade opportunity for COHERENT CORP. (COHR) for the 6-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. COHR was recently trading at $207.58 and has an implied volatility of 88.22% for this period. Based on an analysis of the…

-

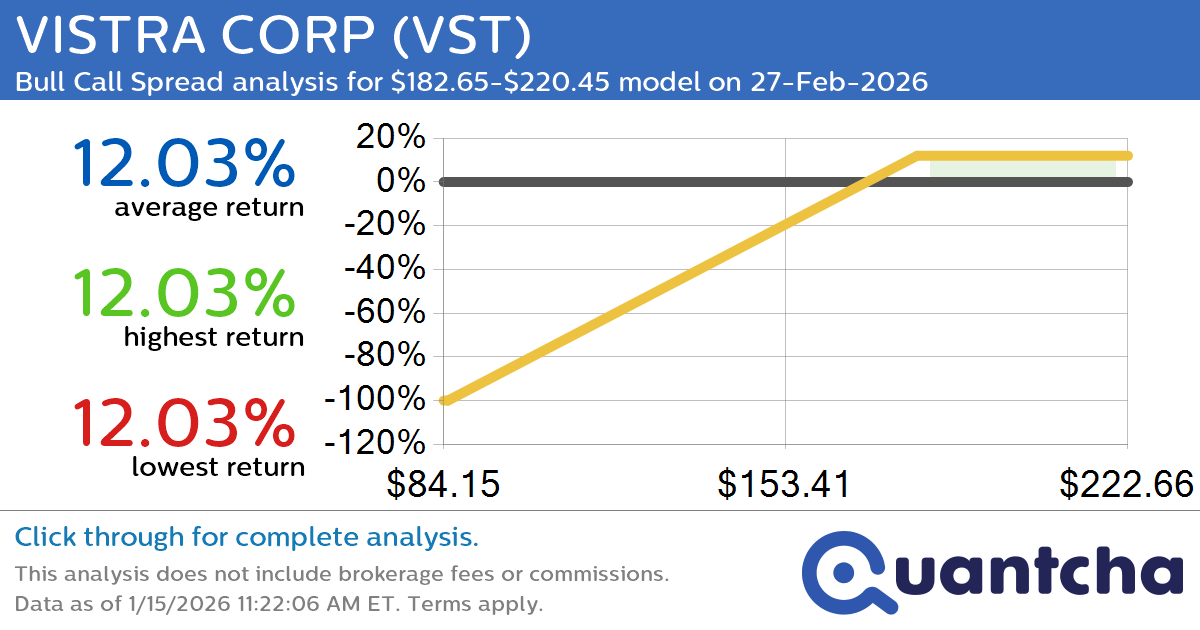

Big Gainer Alert: Trading today’s 7.6% move in VISTRA CORP $VST

Quantchabot has detected a new Bull Call Spread trade opportunity for VISTRA CORP (VST) for the 27-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. VST was recently trading at $181.82 and has an implied volatility of 54.35% for this period. Based on an analysis of the…

-

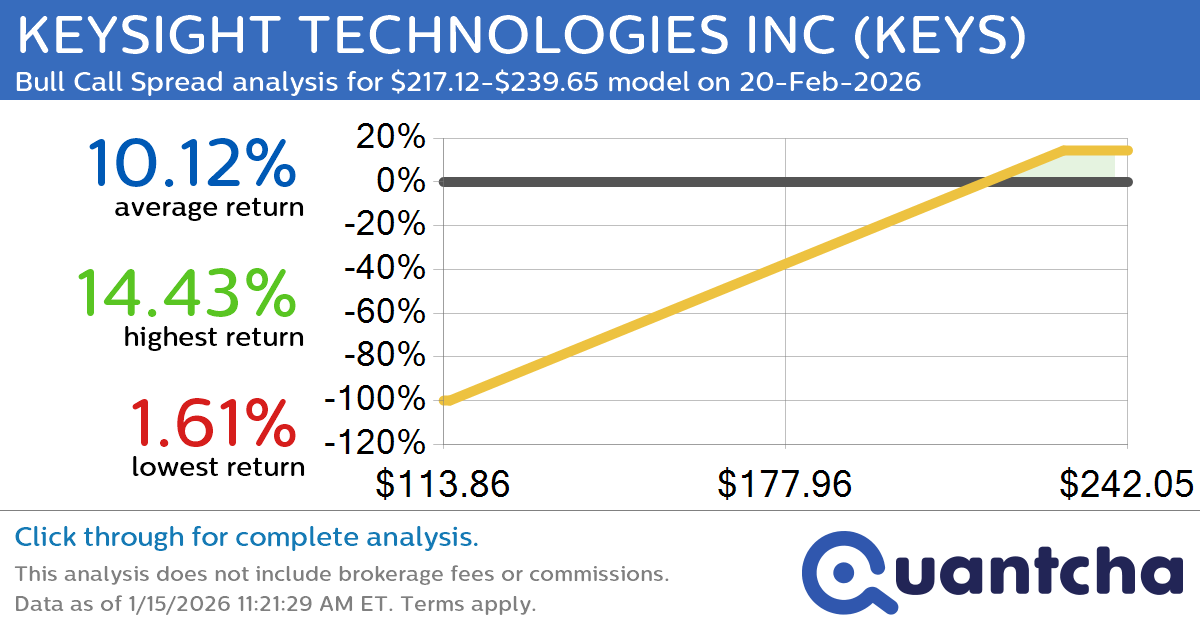

52-Week High Alert: Trading today’s movement in KEYSIGHT TECHNOLOGIES INC $KEYS

Quantchabot has detected a new Bull Call Spread trade opportunity for KEYSIGHT TECHNOLOGIES INC (KEYS) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. KEYS was recently trading at $216.29 and has an implied volatility of 31.13% for this period. Based on an analysis of…

-

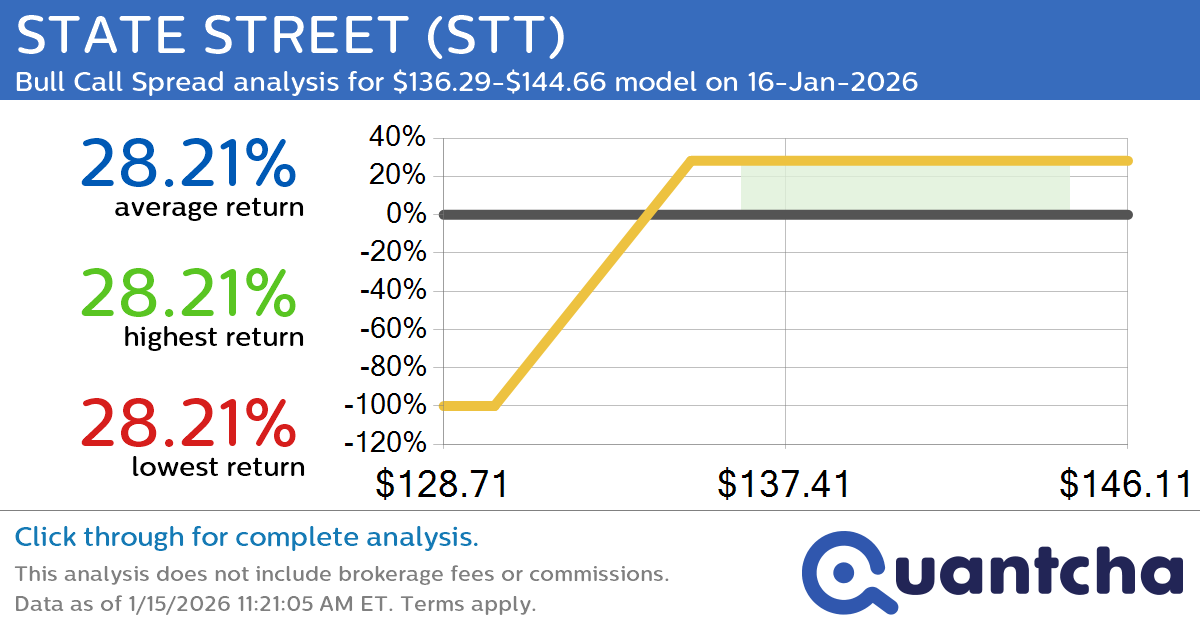

52-Week High Alert: Trading today’s movement in STATE STREET $STT

Quantchabot has detected a new Bull Call Spread trade opportunity for STATE STREET (STT) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. STT was recently trading at $136.27 and has an implied volatility of 86.36% for this period. Based on an analysis of the…

-

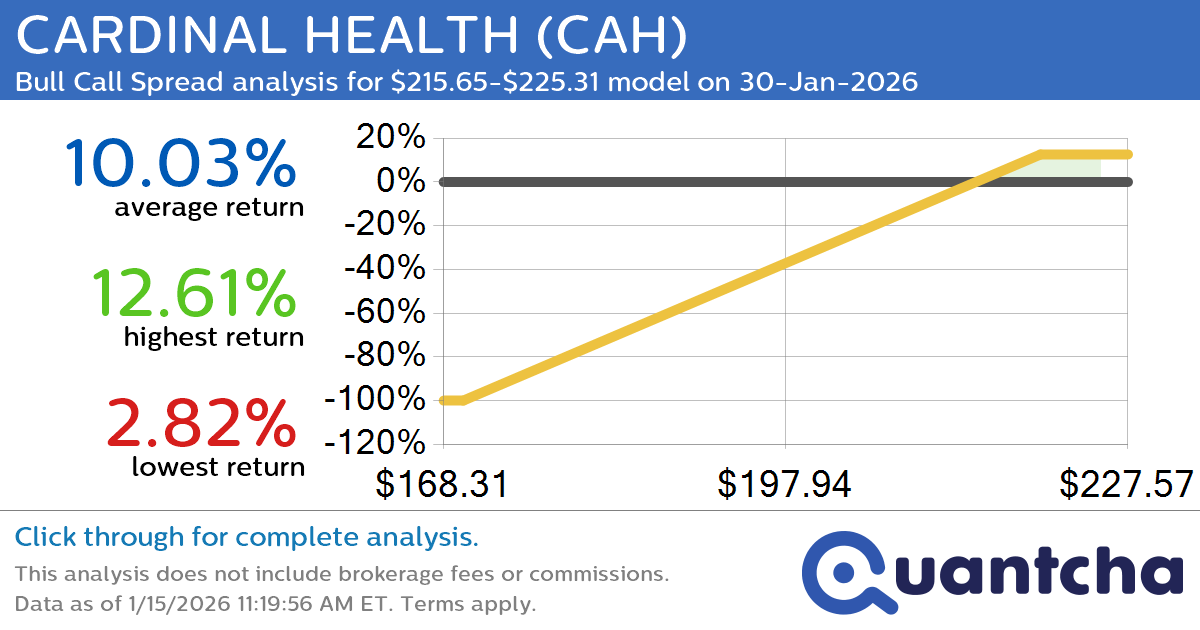

52-Week High Alert: Trading today’s movement in CARDINAL HEALTH $CAH

Quantchabot has detected a new Bull Call Spread trade opportunity for CARDINAL HEALTH (CAH) for the 30-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CAH was recently trading at $215.30 and has an implied volatility of 21.10% for this period. Based on an analysis of the…

-

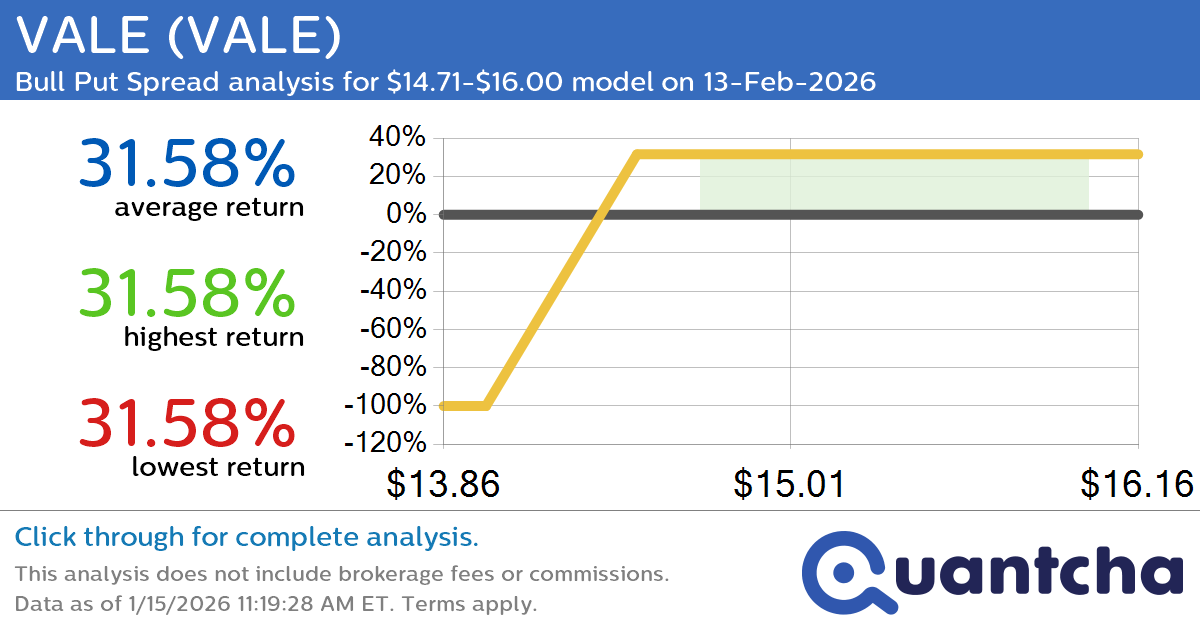

52-Week High Alert: Trading today’s movement in VALE $VALE

Quantchabot has detected a new Bull Put Spread trade opportunity for VALE (VALE) for the 13-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. VALE was recently trading at $14.66 and has an implied volatility of 29.46% for this period. Based on an analysis of the options…