Quantcha Ideas: Turn a good idea about a stock into a great options trade

-

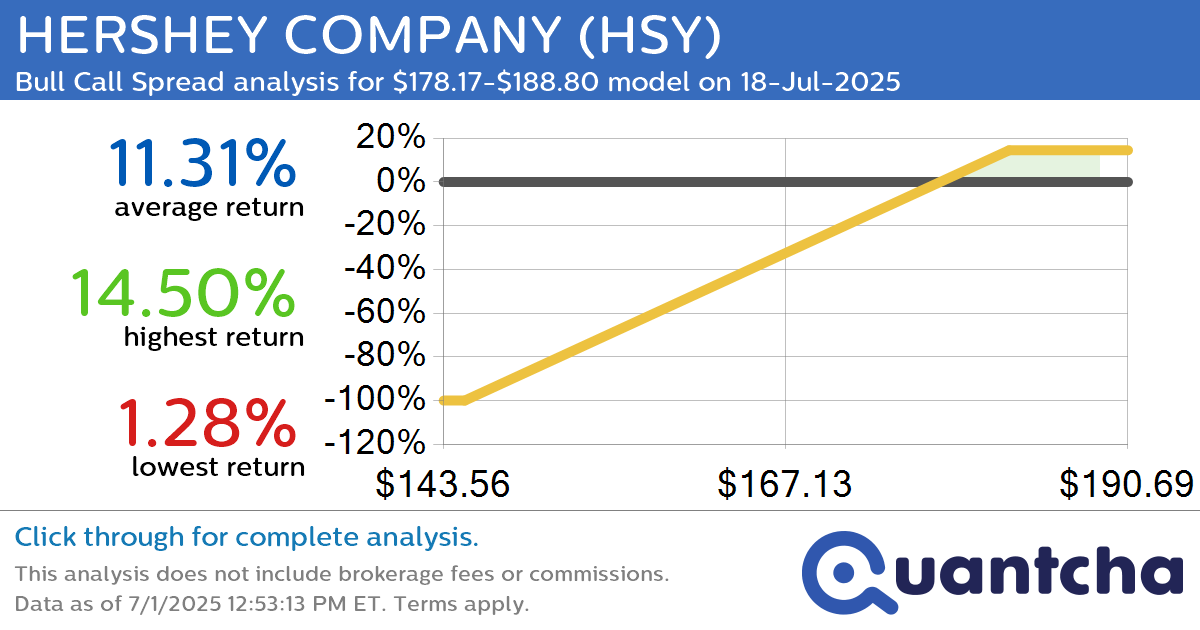

Big Gainer Alert: Trading today’s 7.1% move in HERSHEY COMPANY $HSY

Quantchabot has detected a new Bull Call Spread trade opportunity for HERSHEY COMPANY (HSY) for the 18-Jul-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. HSY was recently trading at $177.79 and has an implied volatility of 26.38% for this period. Based on an analysis of the…

-

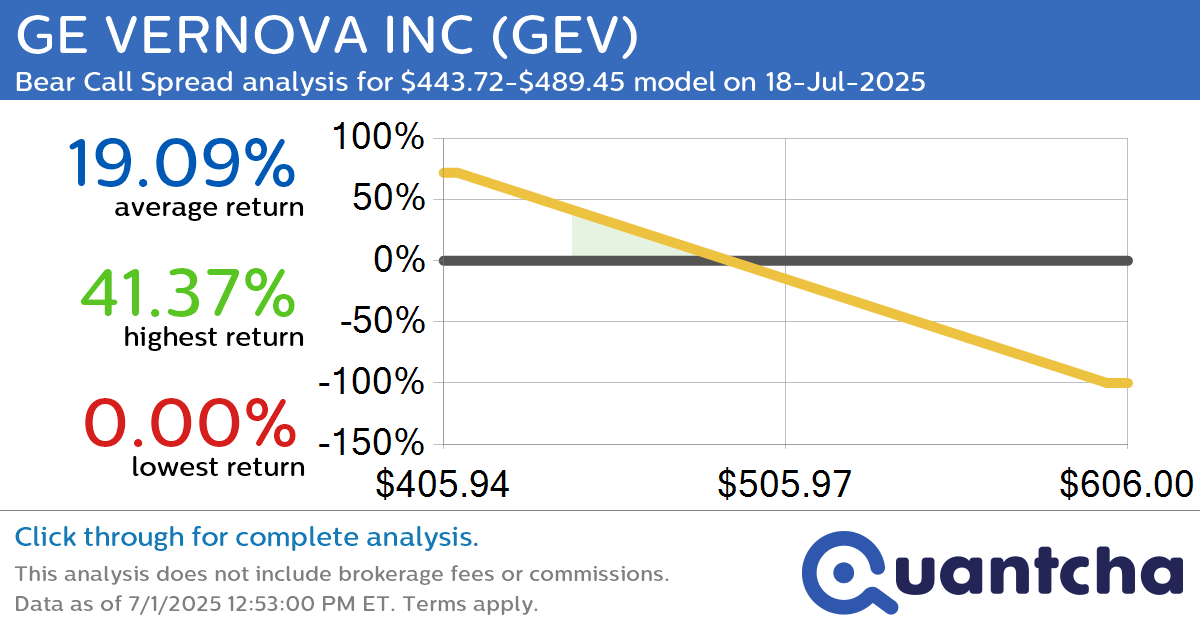

Big Loser Alert: Trading today’s -7.7% move in GE VERNOVA INC $GEV

Quantchabot has detected a new Bear Call Spread trade opportunity for GE VERNOVA INC (GEV) for the 18-Jul-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. GEV was recently trading at $488.42 and has an implied volatility of 44.63% for this period. Based on an analysis of…

-

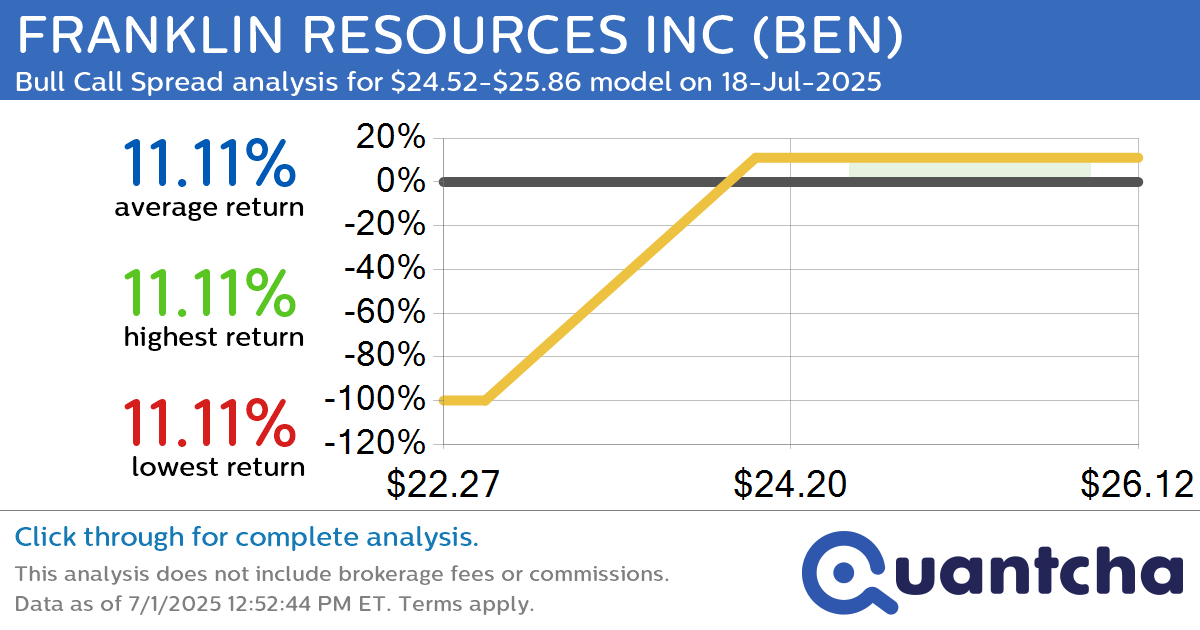

52-Week High Alert: Trading today’s movement in FRANKLIN RESOURCES INC $BEN

Quantchabot has detected a new Bull Call Spread trade opportunity for FRANKLIN RESOURCES INC (BEN) for the 18-Jul-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. BEN was recently trading at $24.46 and has an implied volatility of 24.35% for this period. Based on an analysis of…

-

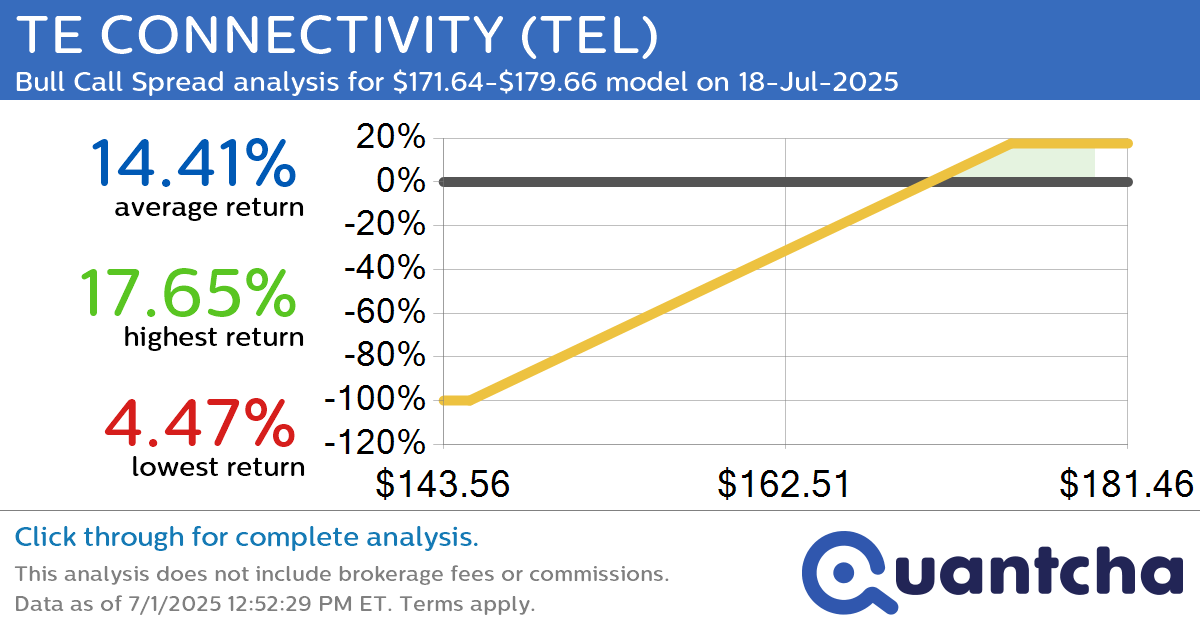

52-Week High Alert: Trading today’s movement in TE CONNECTIVITY $TEL

Quantchabot has detected a new Bull Call Spread trade opportunity for TE CONNECTIVITY (TEL) for the 18-Jul-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TEL was recently trading at $171.28 and has an implied volatility of 20.77% for this period. Based on an analysis of the…

-

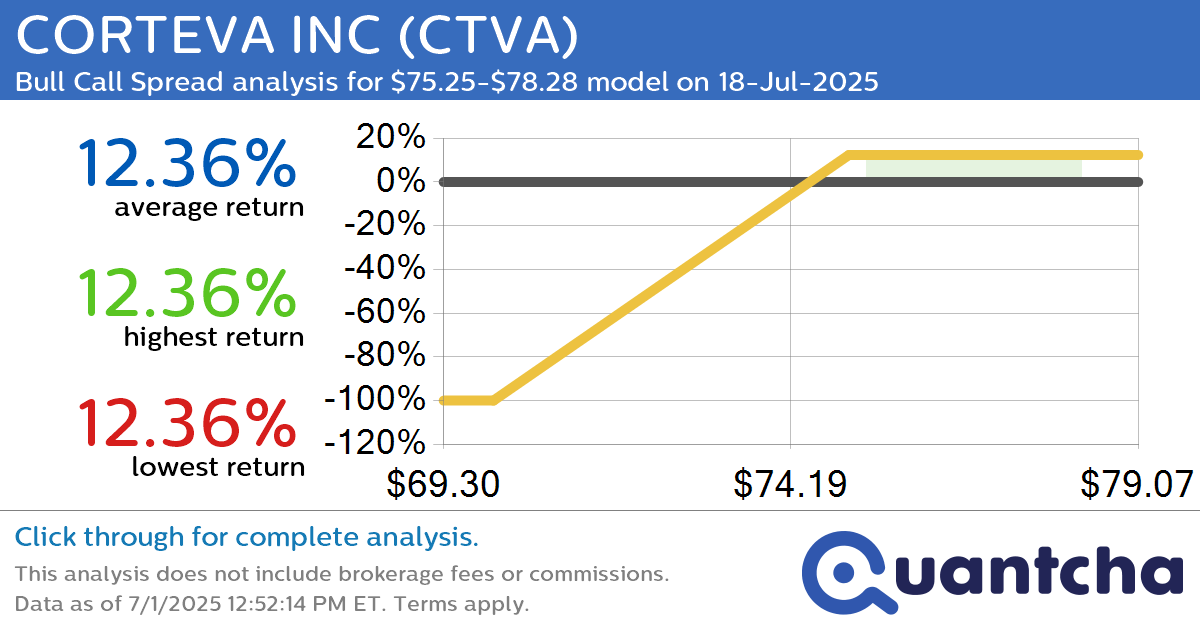

52-Week High Alert: Trading today’s movement in CORTEVA INC $CTVA

Quantchabot has detected a new Bull Call Spread trade opportunity for CORTEVA INC (CTVA) for the 18-Jul-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CTVA was recently trading at $75.09 and has an implied volatility of 17.96% for this period. Based on an analysis of the…

-

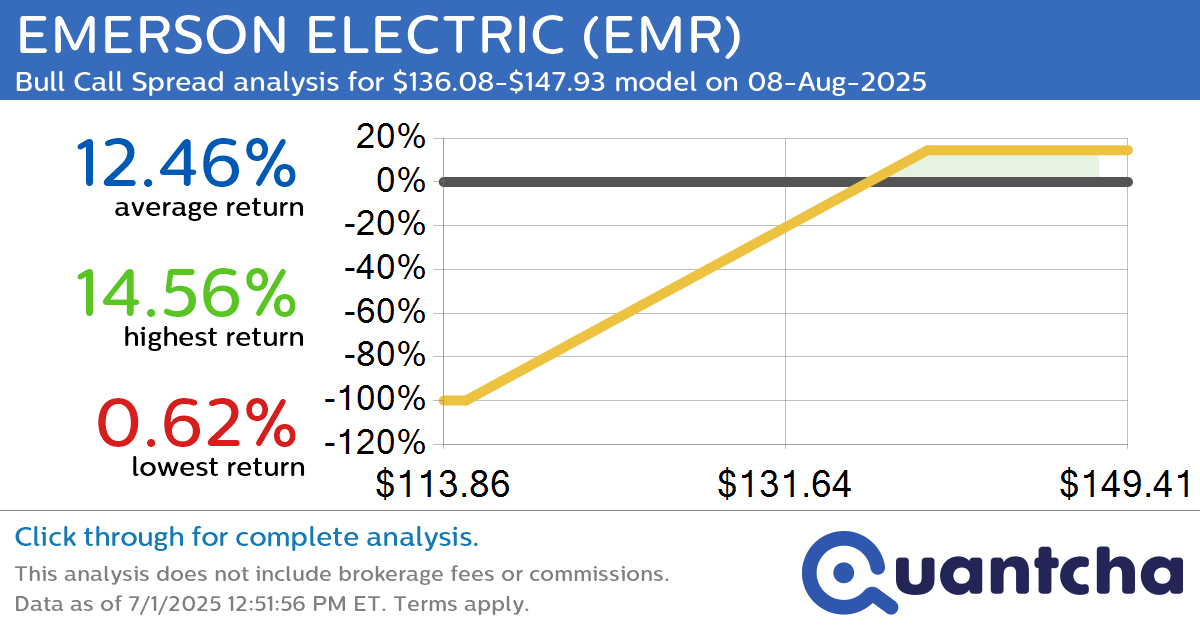

52-Week High Alert: Trading today’s movement in EMERSON ELECTRIC $EMR

Quantchabot has detected a new Bull Call Spread trade opportunity for EMERSON ELECTRIC (EMR) for the 8-Aug-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. EMR was recently trading at $135.45 and has an implied volatility of 25.67% for this period. Based on an analysis of the…

-

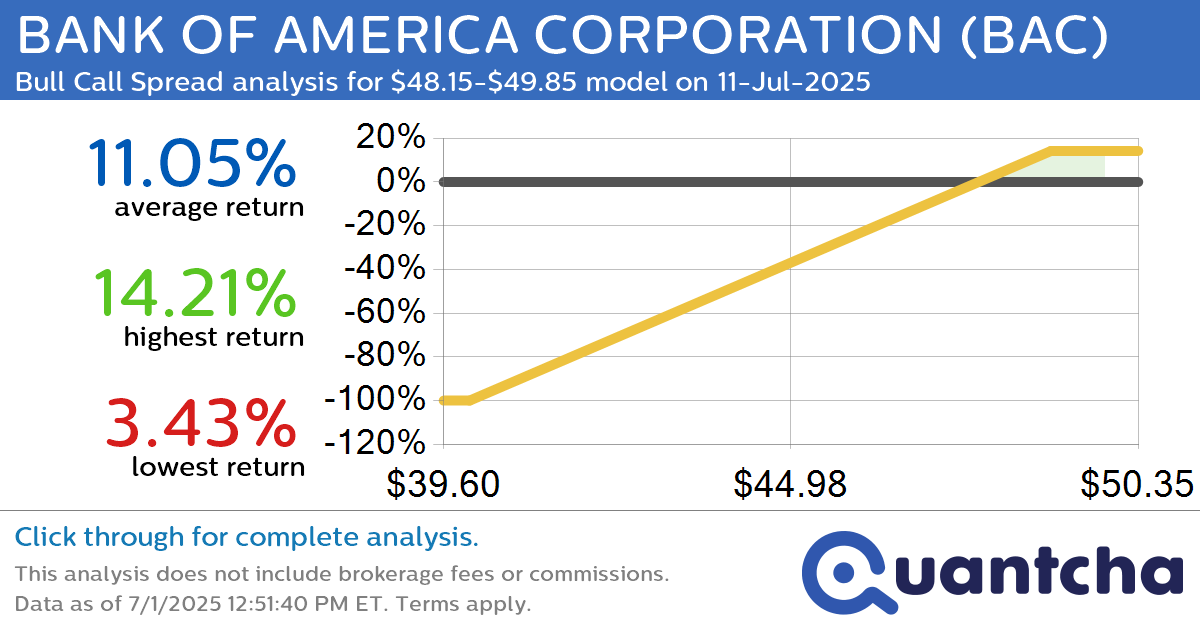

52-Week High Alert: Trading today’s movement in BANK OF AMERICA CORPORATION $BAC

Quantchabot has detected a new Bull Call Spread trade opportunity for BANK OF AMERICA CORPORATION (BAC) for the 11-Jul-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. BAC was recently trading at $48.09 and has an implied volatility of 20.30% for this period. Based on an analysis…

-

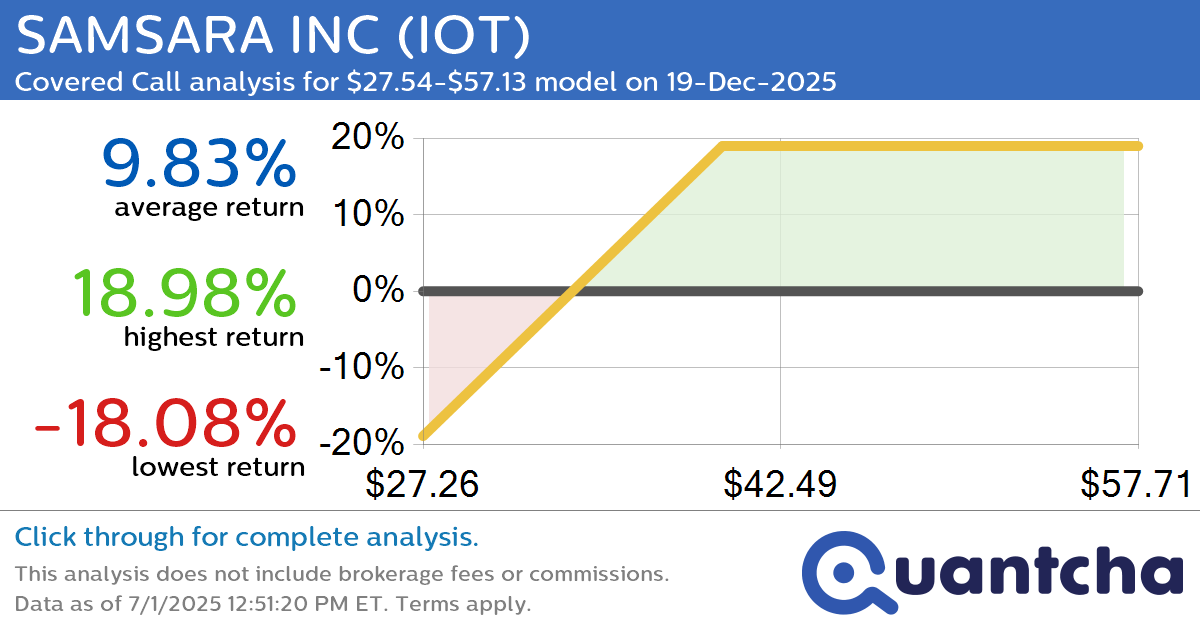

Covered Call Alert: SAMSARA INC $IOT returning up to 19.23% through 19-Dec-2025

Quantchabot has detected a new Covered Call trade opportunity for SAMSARA INC (IOT) for the 19-Dec-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. IOT was recently trading at $38.84 and has an implied volatility of 53.19% for this period. Based on an analysis of the options…

-

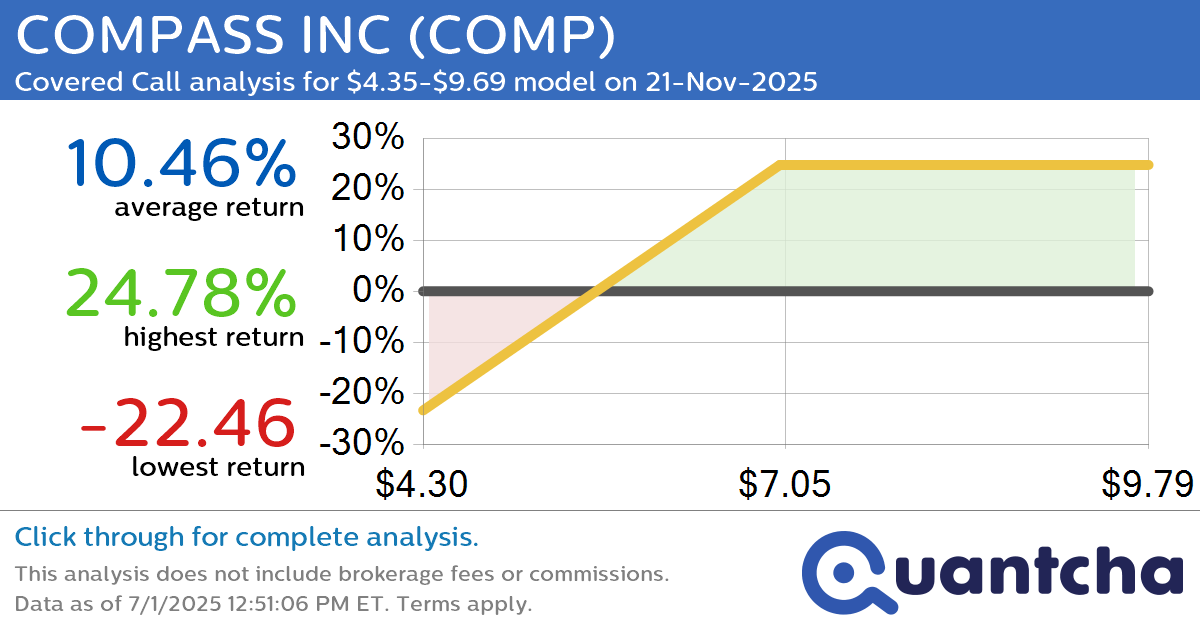

Covered Call Alert: COMPASS INC $COMP returning up to 24.33% through 21-Nov-2025

Quantchabot has detected a new Covered Call trade opportunity for COMPASS INC (COMP) for the 21-Nov-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. COMP was recently trading at $6.38 and has an implied volatility of 63.91% for this period. Based on an analysis of the options…

-

Covered Call Alert: SM ENERGY $SM returning up to 16.30% through 19-Dec-2025

Quantchabot has detected a new Covered Call trade opportunity for SM ENERGY (SM) for the 19-Dec-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SM was recently trading at $26.31 and has an implied volatility of 54.98% for this period. Based on an analysis of the options…