Quantcha Ideas: Turn a good idea about a stock into a great options trade

-

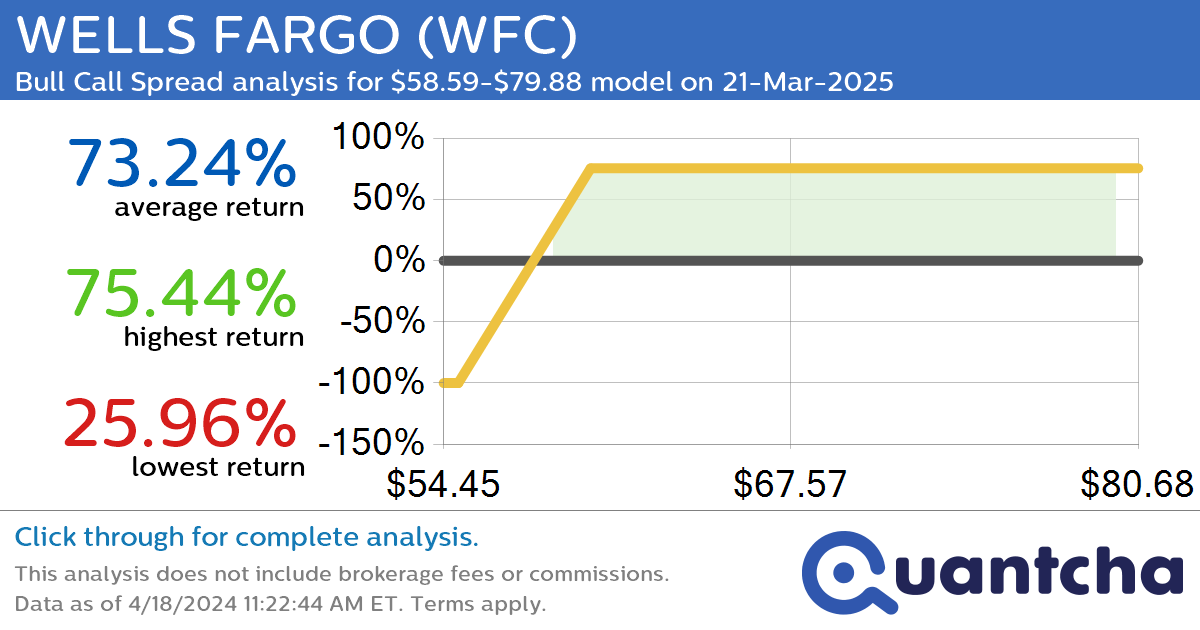

StockTwits Trending Alert: Trading recent interest in WELLS FARGO $WFC

Quantchabot has detected a new Bull Call Spread trade opportunity for WELLS FARGO (WFC) for the 21-Mar-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. WFC was recently trading at $58.59 and has an implied volatility of 26.91% for this period. Based on an analysis of the…

-

52-Week Low Alert: Trading today’s movement in LCI INDUSTRIES $LCII

Quantchabot has detected a new Bear Call Spread trade opportunity for LCI INDUSTRIES (LCII) for the 19-Jul-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. LCII was recently trading at $104.89 and has an implied volatility of 39.83% for this period. Based on an analysis of the…

-

Big Gainer Alert: Trading today’s 7.2% move in CIPHER MINING INC. COMMON STOCK $CIFR

Quantchabot has detected a new Bull Call Spread trade opportunity for CIPHER MINING INC. COMMON STOCK (CIFR) for the 3-May-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CIFR was recently trading at $3.67 and has an implied volatility of 115.96% for this period. Based on an…

-

Covered Call Alert: UNITED STATES NATURAL GAS $UNG returning up to 30.47% through 18-Oct-2024

Quantchabot has detected a new Covered Call trade opportunity for UNITED STATES NATURAL GAS (UNG) for the 18-Oct-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. UNG was recently trading at $14.47 and has an implied volatility of 53.52% for this period. Based on an analysis of…

-

52-Week Low Alert: Trading today’s movement in INSTRUCTURE HOLDINGS INC $INST

Quantchabot has detected a new Bear Call Spread trade opportunity for INSTRUCTURE HOLDINGS INC (INST) for the 19-Jul-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. INST was recently trading at $19.29 and has an implied volatility of 38.71% for this period. Based on an analysis of…

-

Covered Call Alert: SCHRODINGER INC. COMMON STOCK $SDGR returning up to 32.98% through 20-Sep-2024

Quantchabot has detected a new Covered Call trade opportunity for SCHRODINGER INC. COMMON STOCK (SDGR) for the 20-Sep-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SDGR was recently trading at $25.24 and has an implied volatility of 66.26% for this period. Based on an analysis of…

-

Big Gainer Alert: Trading today’s 10.6% move in GAOTU TECHEDU INC $GOTU

Quantchabot has detected a new Bull Call Spread trade opportunity for GAOTU TECHEDU INC (GOTU) for the 17-May-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. GOTU was recently trading at $6.50 and has an implied volatility of 92.97% for this period. Based on an analysis of…

-

Covered Call Alert: VIR BIOTECHNOLOGY INC. $VIR returning up to 35.87% through 18-Oct-2024

Quantchabot has detected a new Covered Call trade opportunity for VIR BIOTECHNOLOGY INC. (VIR) for the 18-Oct-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. VIR was recently trading at $8.15 and has an implied volatility of 63.45% for this period. Based on an analysis of the…

-

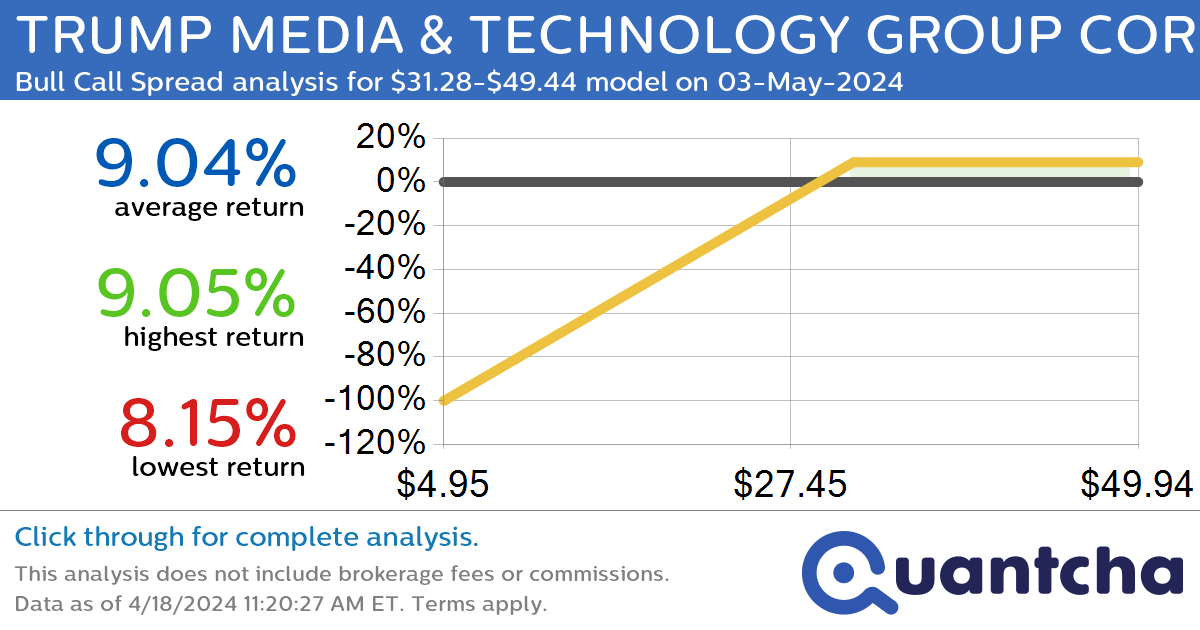

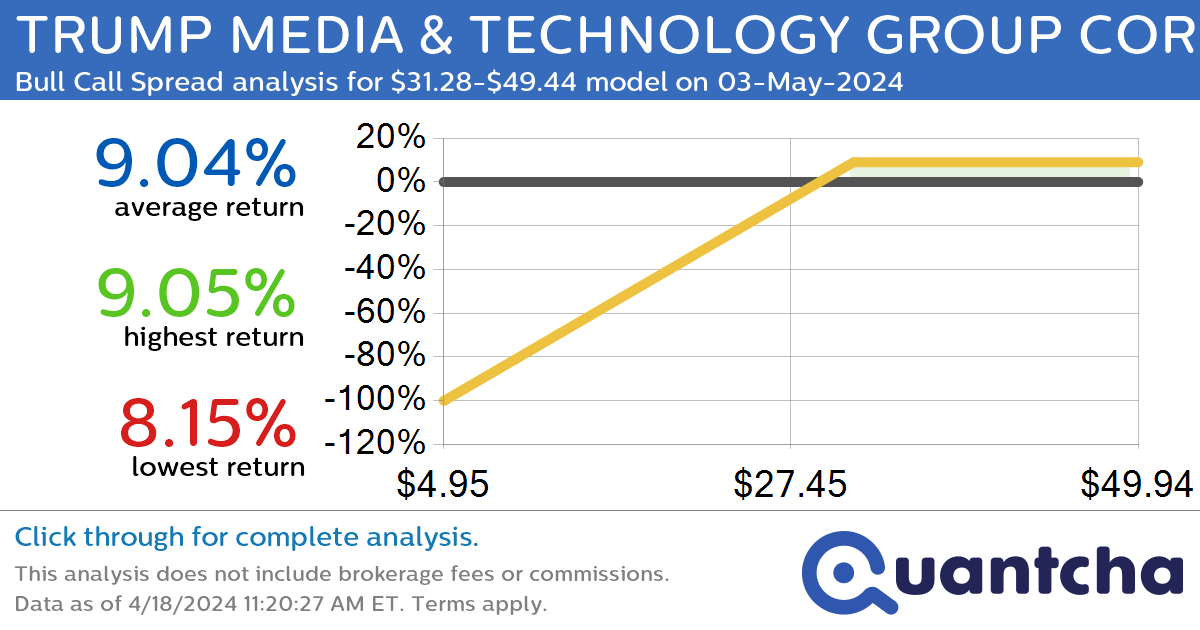

Big Gainer Alert: Trading today’s 18.2% move in TRUMP MEDIA & TECHNOLOGY GROUP CORP. $DJT

Quantchabot has detected a new Bull Call Spread trade opportunity for TRUMP MEDIA & TECHNOLOGY GROUP CORP. (DJT) for the 3-May-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. DJT was recently trading at $31.20 and has an implied volatility of 220.86% for this period. Based on…

-

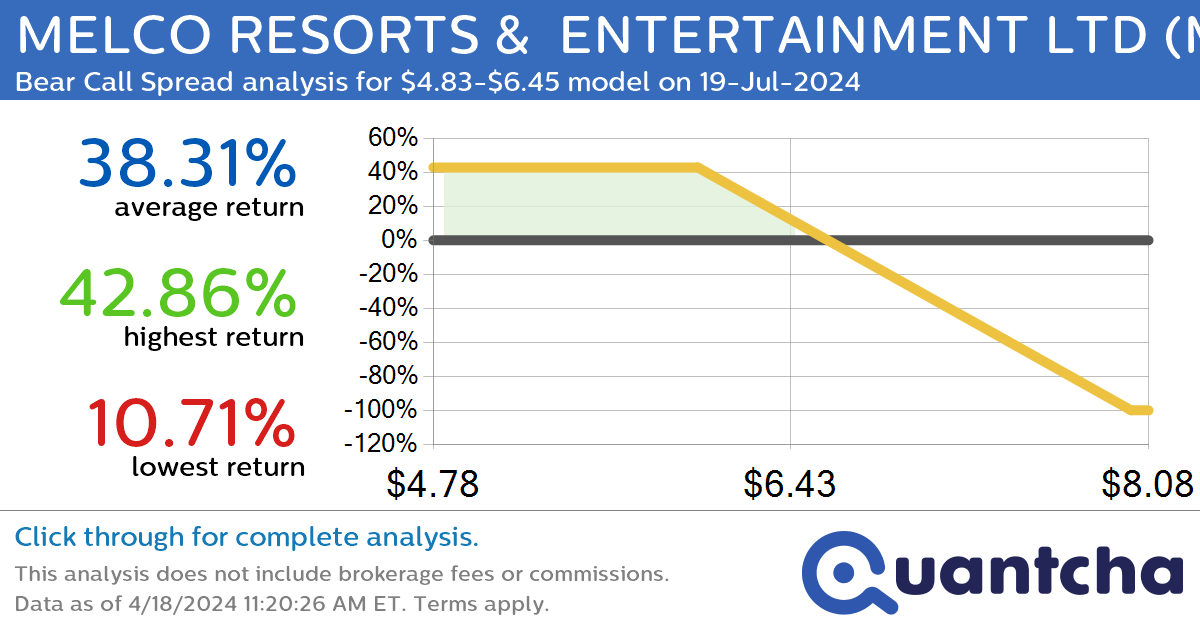

52-Week Low Alert: Trading today’s movement in MELCO RESORTS & ENTERTAINMENT LTD $MLCO

Quantchabot has detected a new Bear Call Spread trade opportunity for MELCO RESORTS & ENTERTAINMENT LTD (MLCO) for the 19-Jul-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. MLCO was recently trading at $6.36 and has an implied volatility of 57.33% for this period. Based on an…