Quantcha Ideas: Turn a good idea about a stock into a great options trade

-

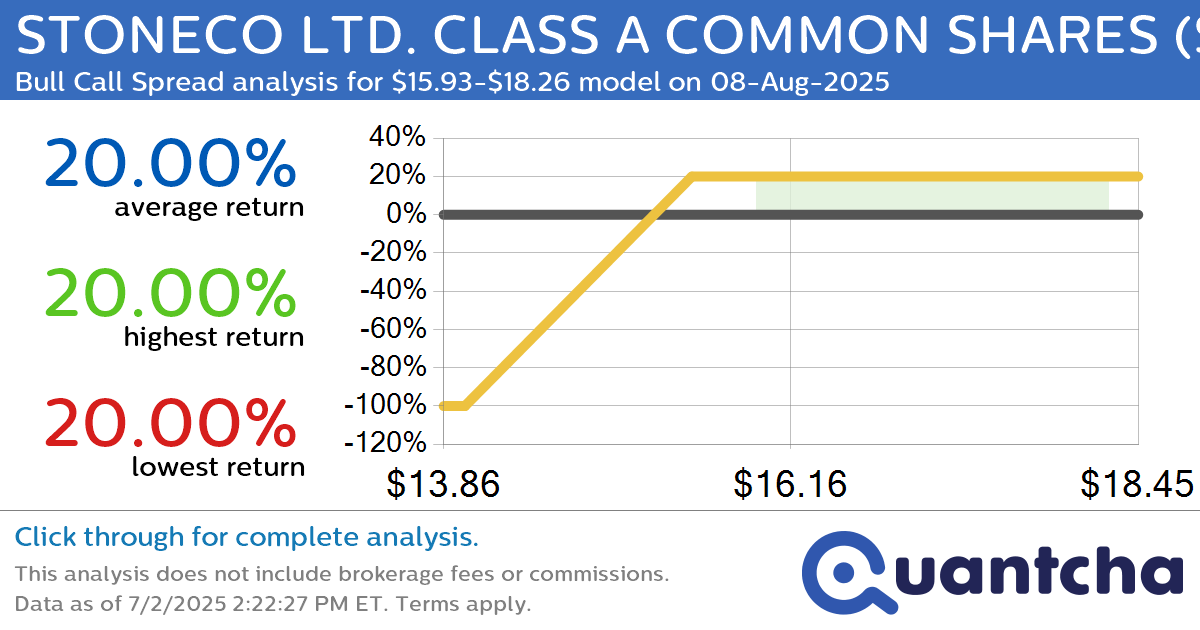

52-Week High Alert: Trading today’s movement in STONECO LTD. CLASS A COMMON SHARES $STNE

Quantchabot has detected a new Bull Call Spread trade opportunity for STONECO LTD. CLASS A COMMON SHARES (STNE) for the 8-Aug-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. STNE was recently trading at $15.86 and has an implied volatility of 42.67% for this period. Based on…

-

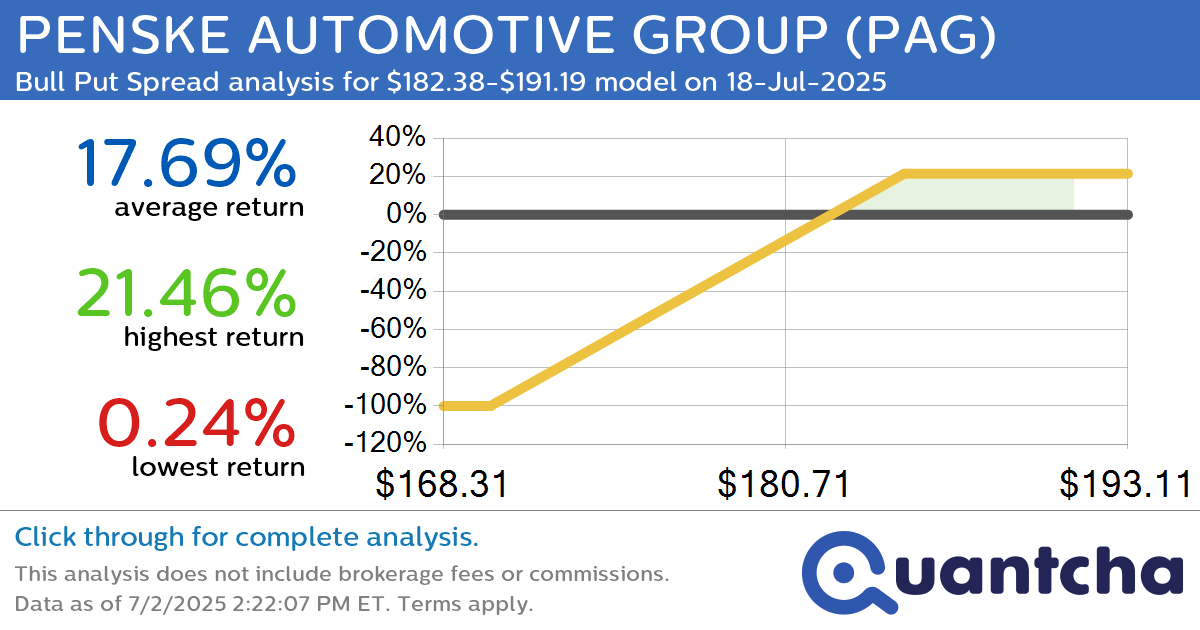

52-Week High Alert: Trading today’s movement in PENSKE AUTOMOTIVE GROUP $PAG

Quantchabot has detected a new Bull Put Spread trade opportunity for PENSKE AUTOMOTIVE GROUP (PAG) for the 18-Jul-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. PAG was recently trading at $182.01 and has an implied volatility of 22.16% for this period. Based on an analysis of…

-

Covered Call Alert: LGI HOMES INC. COMMON STOCK $LGIH returning up to 28.26% through 19-Dec-2025

Quantchabot has detected a new Covered Call trade opportunity for LGI HOMES INC. COMMON STOCK (LGIH) for the 19-Dec-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. LGIH was recently trading at $55.79 and has an implied volatility of 58.42% for this period. Based on an analysis…

-

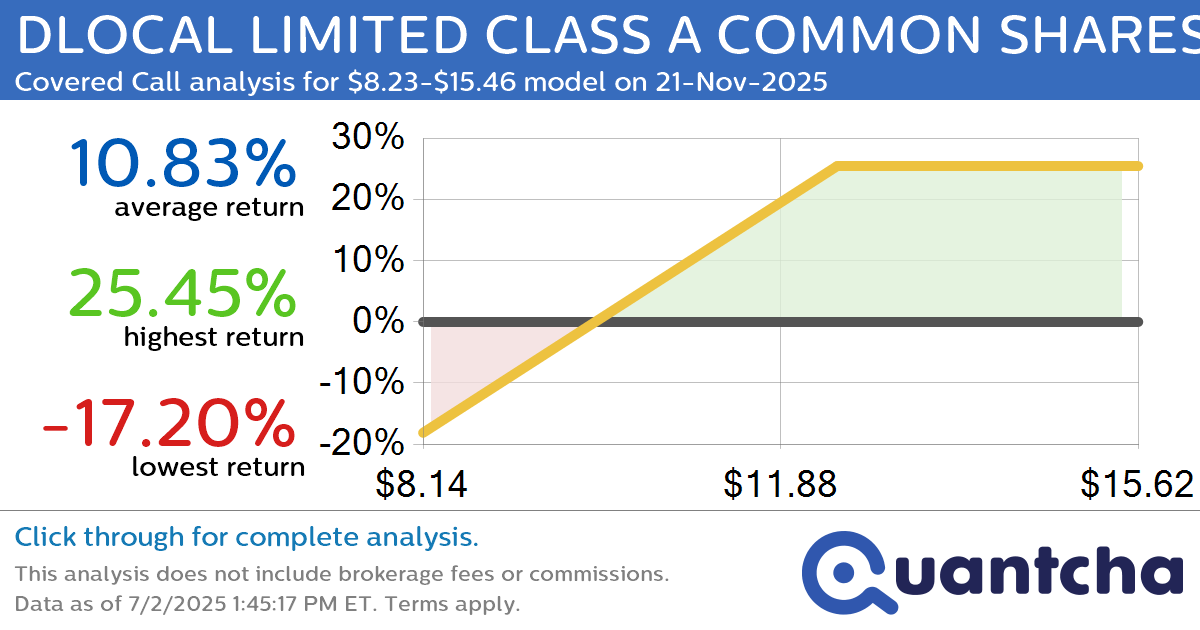

Covered Call Alert: DLOCAL LIMITED CLASS A COMMON SHARES $DLO returning up to 24.82% through 21-Nov-2025

Quantchabot has detected a new Covered Call trade opportunity for DLOCAL LIMITED CLASS A COMMON SHARES (DLO) for the 21-Nov-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. DLO was recently trading at $11.09 and has an implied volatility of 50.44% for this period. Based on an…

-

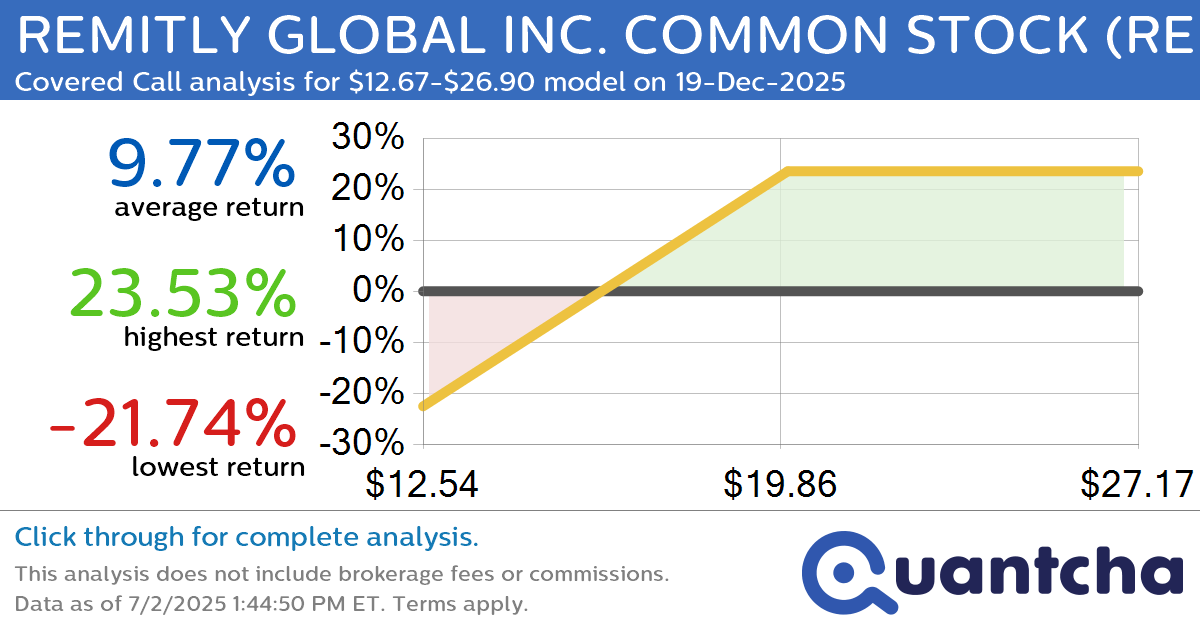

Covered Call Alert: REMITLY GLOBAL INC. COMMON STOCK $RELY returning up to 24.69% through 19-Dec-2025

Quantchabot has detected a new Covered Call trade opportunity for REMITLY GLOBAL INC. COMMON STOCK (RELY) for the 19-Dec-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. RELY was recently trading at $18.08 and has an implied volatility of 55.06% for this period. Based on an analysis…

-

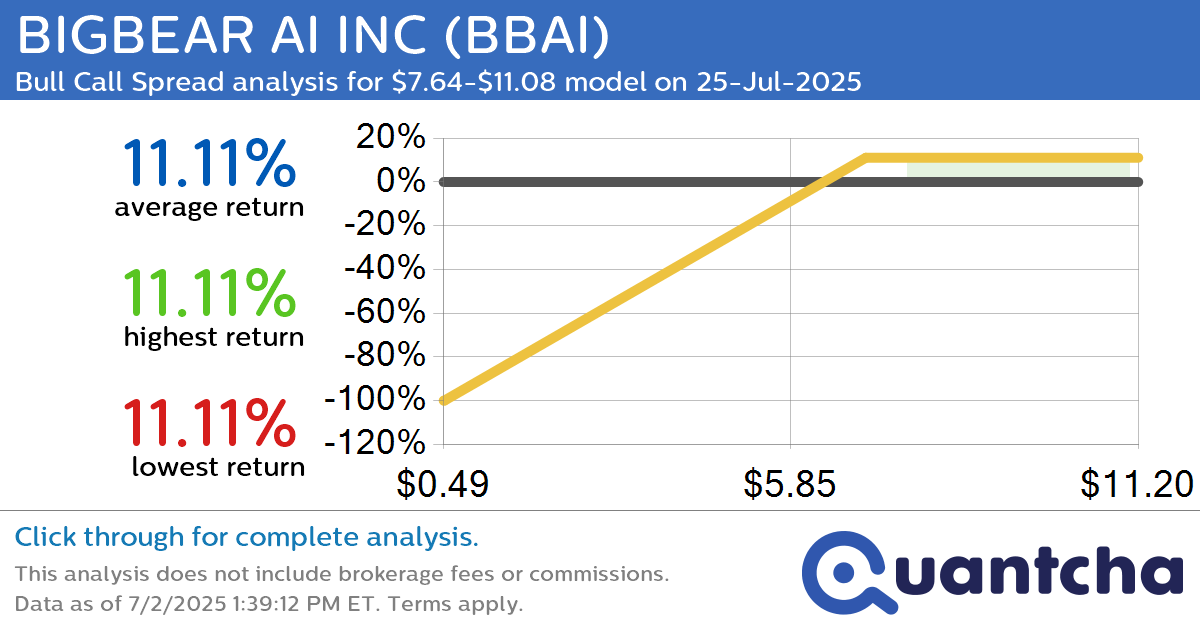

Big Gainer Alert: Trading today’s 14.6% move in BIGBEAR AI INC $BBAI

Quantchabot has detected a new Bull Call Spread trade opportunity for BIGBEAR AI INC (BBAI) for the 25-Jul-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. BBAI was recently trading at $7.62 and has an implied volatility of 146.04% for this period. Based on an analysis of…

-

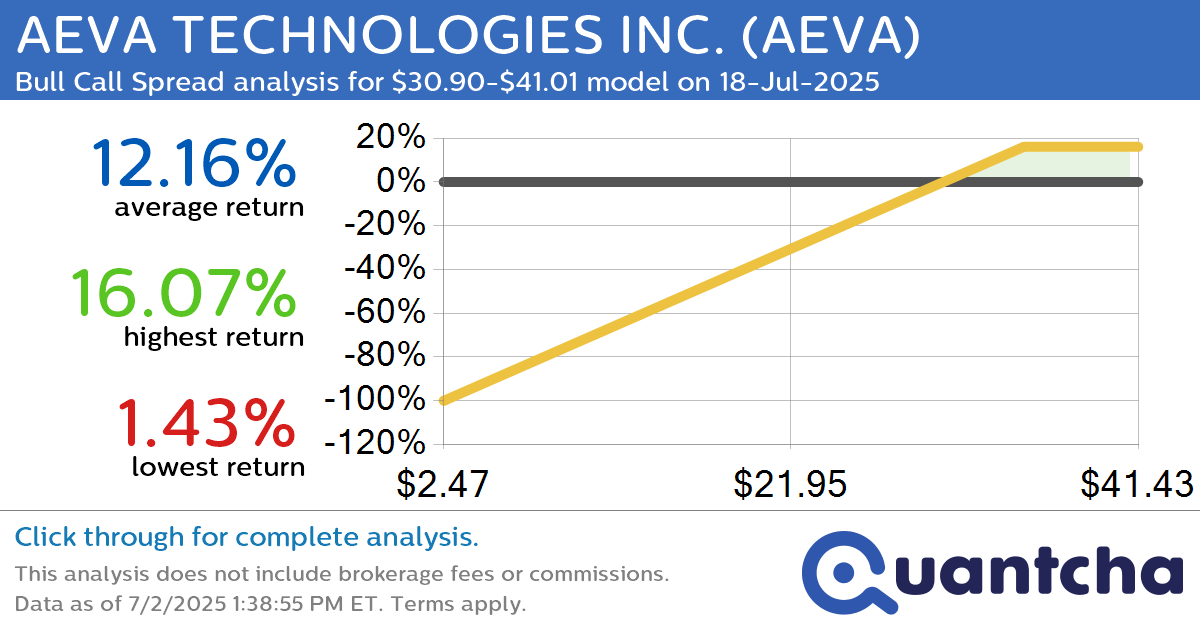

Big Gainer Alert: Trading today’s 7.6% move in AEVA TECHNOLOGIES INC. $AEVA

Quantchabot has detected a new Bull Call Spread trade opportunity for AEVA TECHNOLOGIES INC. (AEVA) for the 18-Jul-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. AEVA was recently trading at $30.84 and has an implied volatility of 132.75% for this period. Based on an analysis of…

-

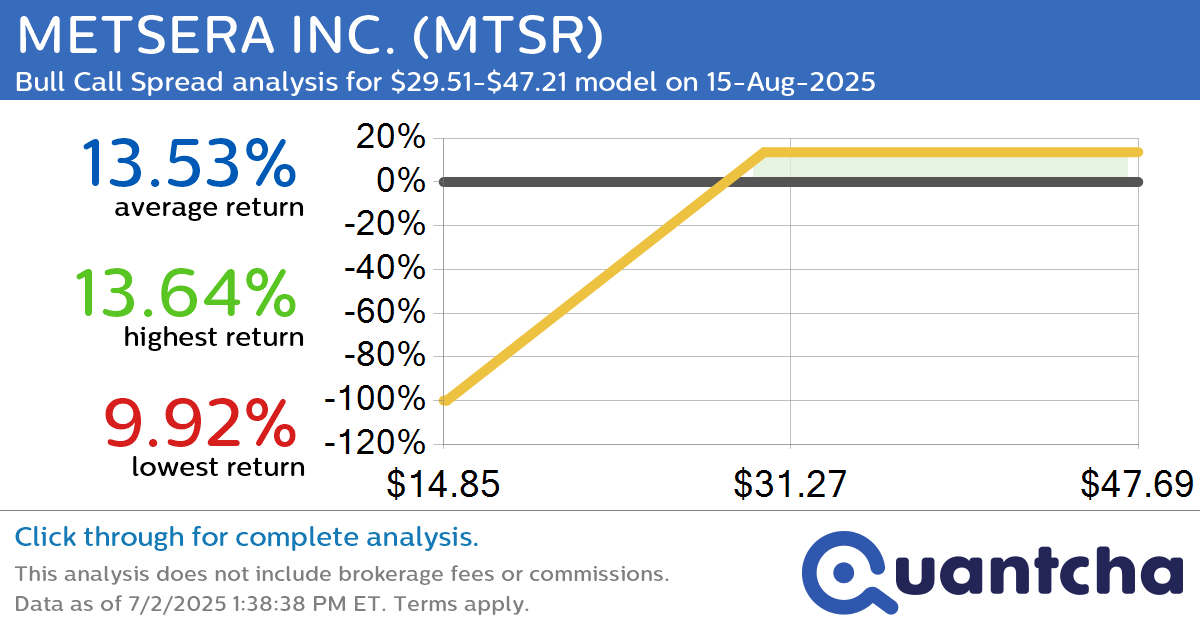

Big Gainer Alert: Trading today’s 9.2% move in METSERA INC. $MTSR

Quantchabot has detected a new Bull Call Spread trade opportunity for METSERA INC. (MTSR) for the 15-Aug-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. MTSR was recently trading at $29.35 and has an implied volatility of 134.42% for this period. Based on an analysis of the…

-

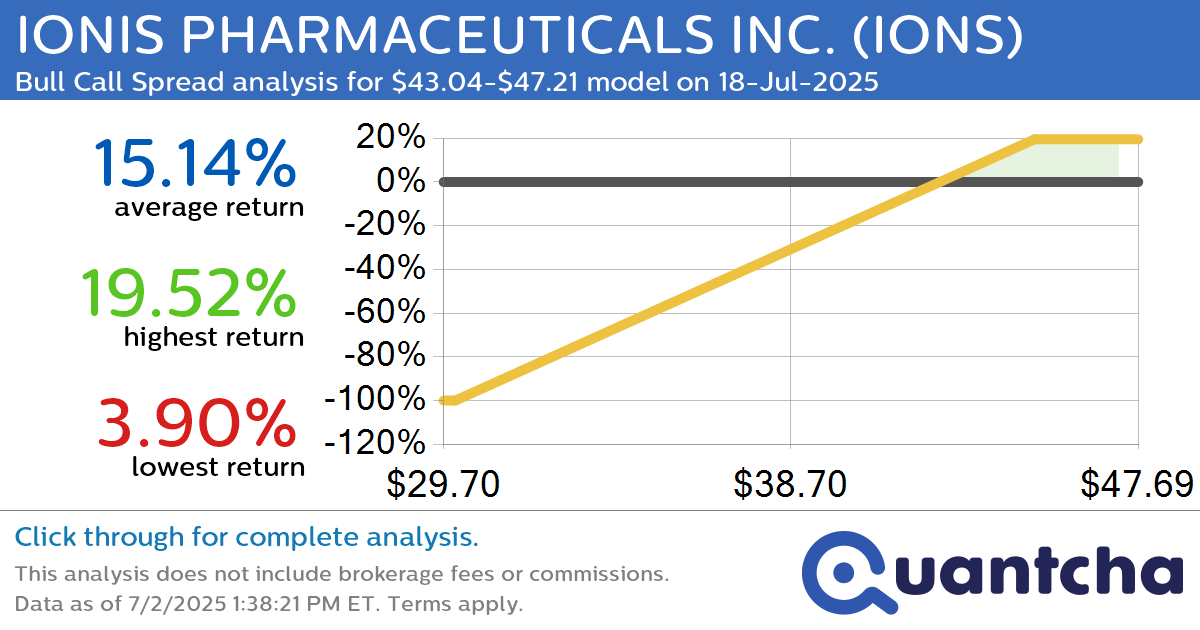

Big Gainer Alert: Trading today’s 7.5% move in IONIS PHARMACEUTICALS INC. $IONS

Quantchabot has detected a new Bull Call Spread trade opportunity for IONIS PHARMACEUTICALS INC. (IONS) for the 18-Jul-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. IONS was recently trading at $42.95 and has an implied volatility of 43.39% for this period. Based on an analysis of…

-

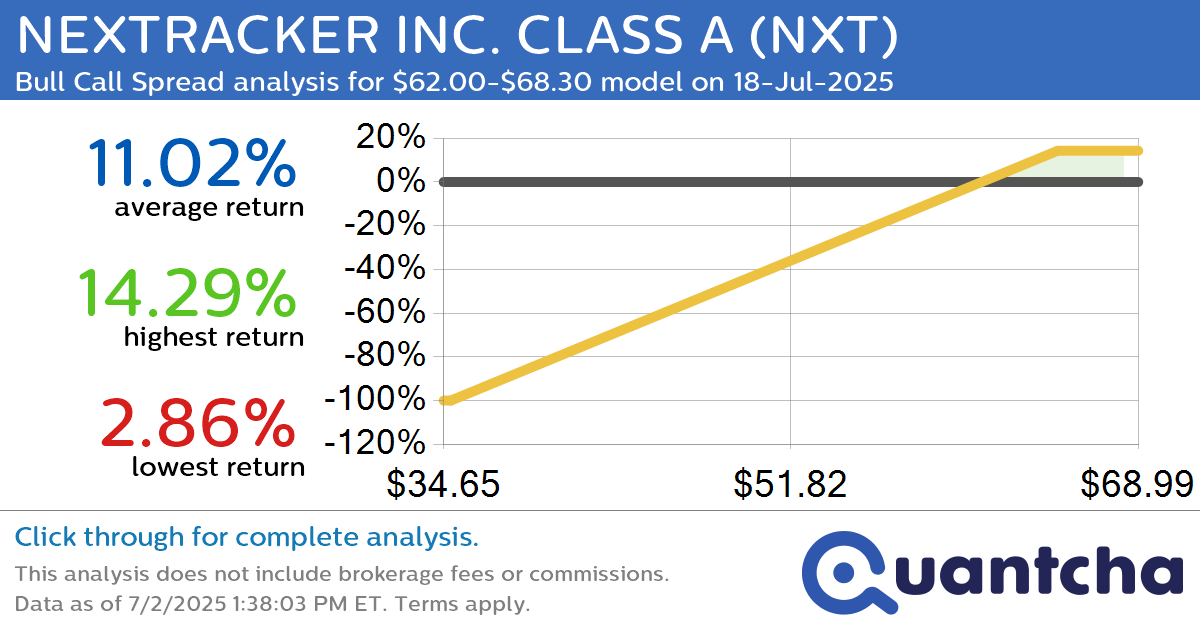

Big Gainer Alert: Trading today’s 7.6% move in NEXTRACKER INC. CLASS A $NXT

Quantchabot has detected a new Bull Call Spread trade opportunity for NEXTRACKER INC. CLASS A (NXT) for the 18-Jul-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. NXT was recently trading at $61.88 and has an implied volatility of 45.32% for this period. Based on an analysis…