Author: Quantcha Trade Ideas

-

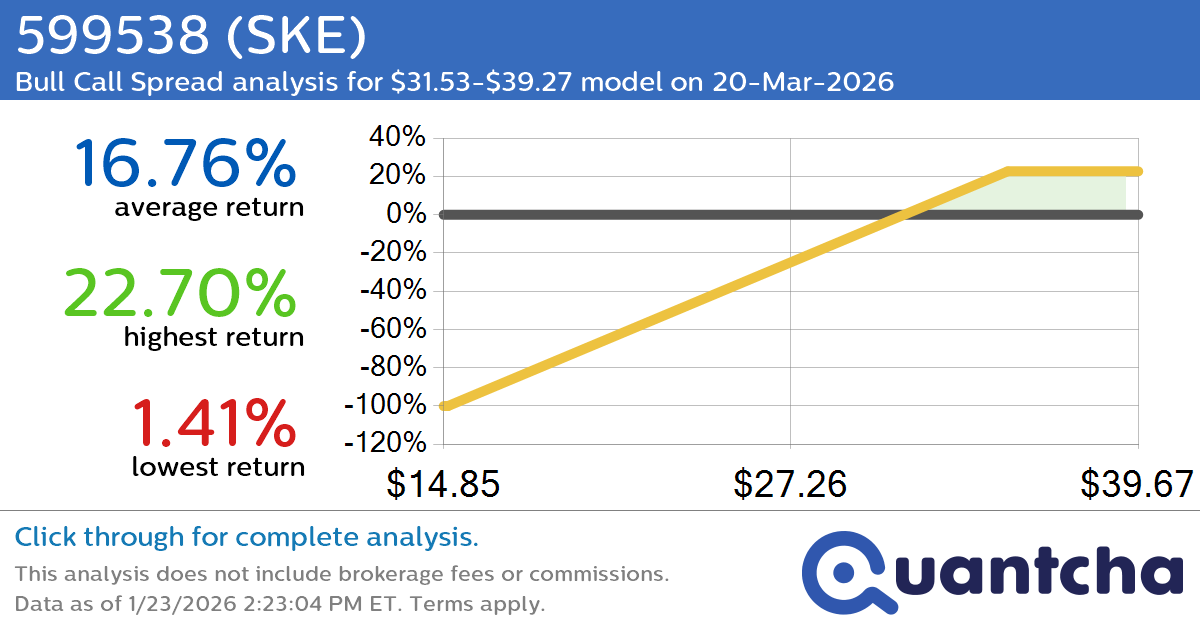

52-Week High Alert: Trading today’s movement in 599538 $SKE

Quantchabot has detected a new Bull Call Spread trade opportunity for 599538 (SKE) for the 20-Mar-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SKE was recently trading at $31.34 and has an implied volatility of 55.77% for this period. Based on an analysis of the options…

-

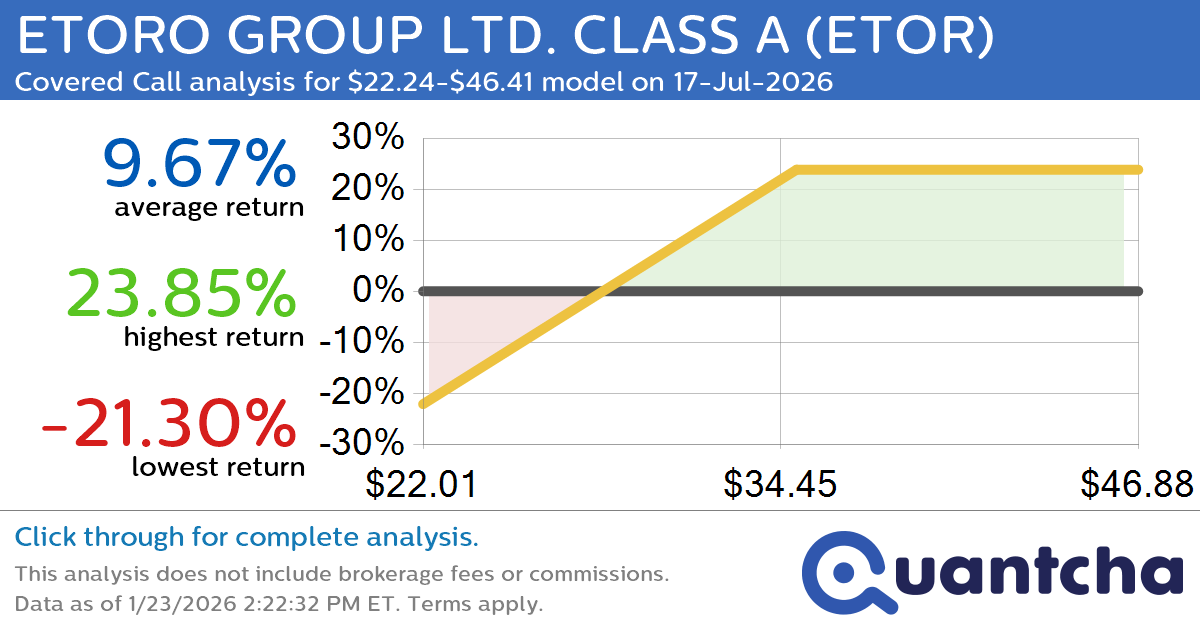

Covered Call Alert: ETORO GROUP LTD. CLASS A $ETOR returning up to 24.29% through 17-Jul-2026

Quantchabot has detected a new Covered Call trade opportunity for ETORO GROUP LTD. CLASS A (ETOR) for the 17-Jul-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ETOR was recently trading at $31.55 and has an implied volatility of 53.01% for this period. Based on an analysis…

-

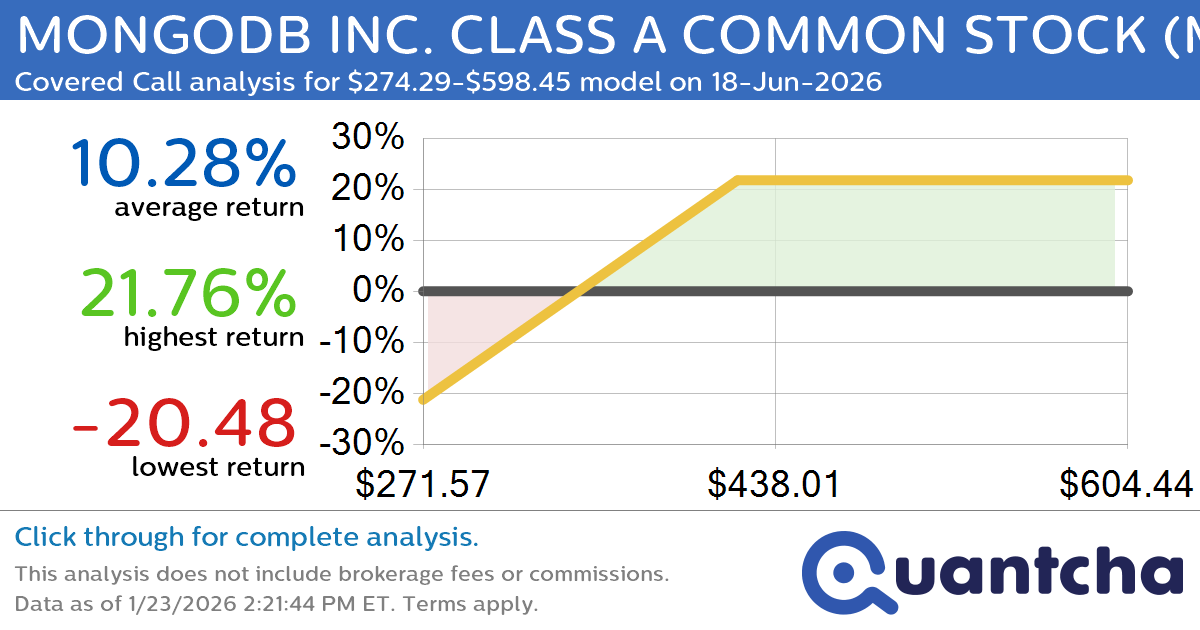

Covered Call Alert: MONGODB INC. CLASS A COMMON STOCK $MDB returning up to 21.76% through 18-Jun-2026

Quantchabot has detected a new Covered Call trade opportunity for MONGODB INC. CLASS A COMMON STOCK (MDB) for the 18-Jun-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. MDB was recently trading at $399.05 and has an implied volatility of 61.55% for this period. Based on an…

-

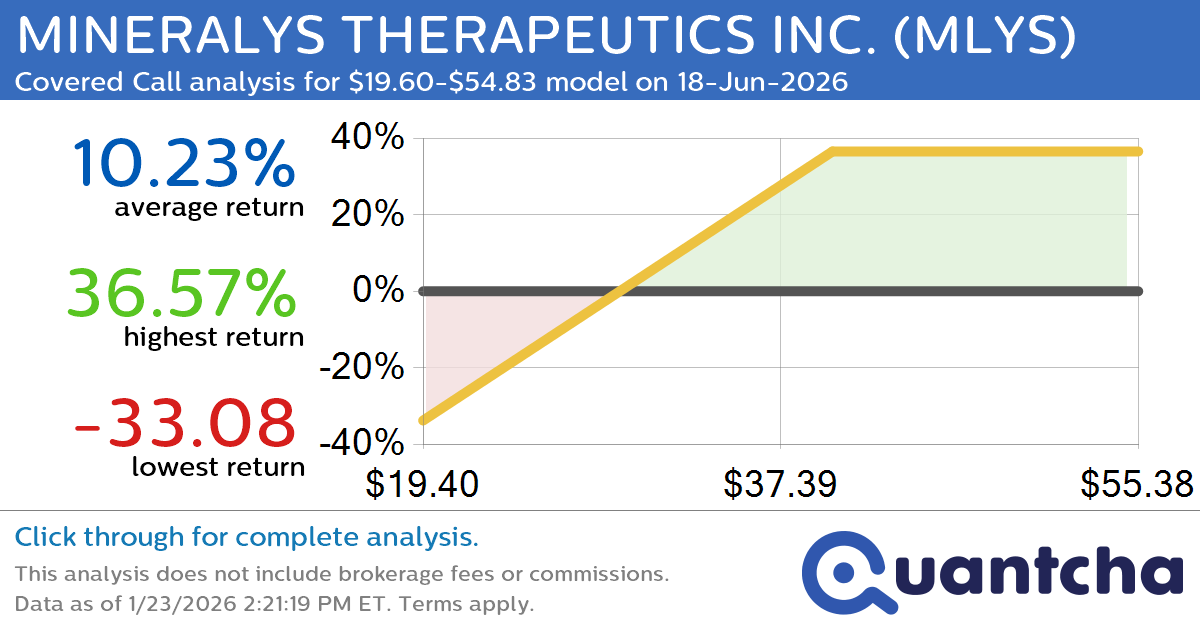

Covered Call Alert: MINERALYS THERAPEUTICS INC. $MLYS returning up to 36.57% through 18-Jun-2026

Quantchabot has detected a new Covered Call trade opportunity for MINERALYS THERAPEUTICS INC. (MLYS) for the 18-Jun-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. MLYS was recently trading at $32.29 and has an implied volatility of 81.15% for this period. Based on an analysis of the…

-

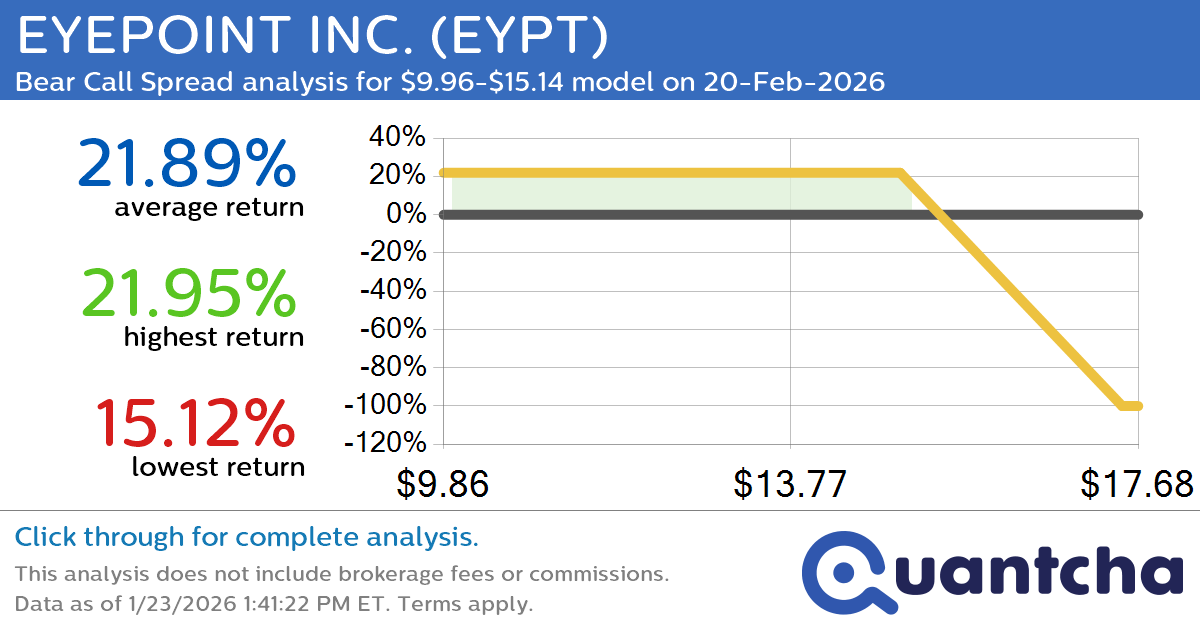

Big Loser Alert: Trading today’s -7.6% move in EYEPOINT INC. $EYPT

Quantchabot has detected a new Bear Call Spread trade opportunity for EYEPOINT INC. (EYPT) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. EYPT was recently trading at $15.09 and has an implied volatility of 149.64% for this period. Based on an analysis of the…

-

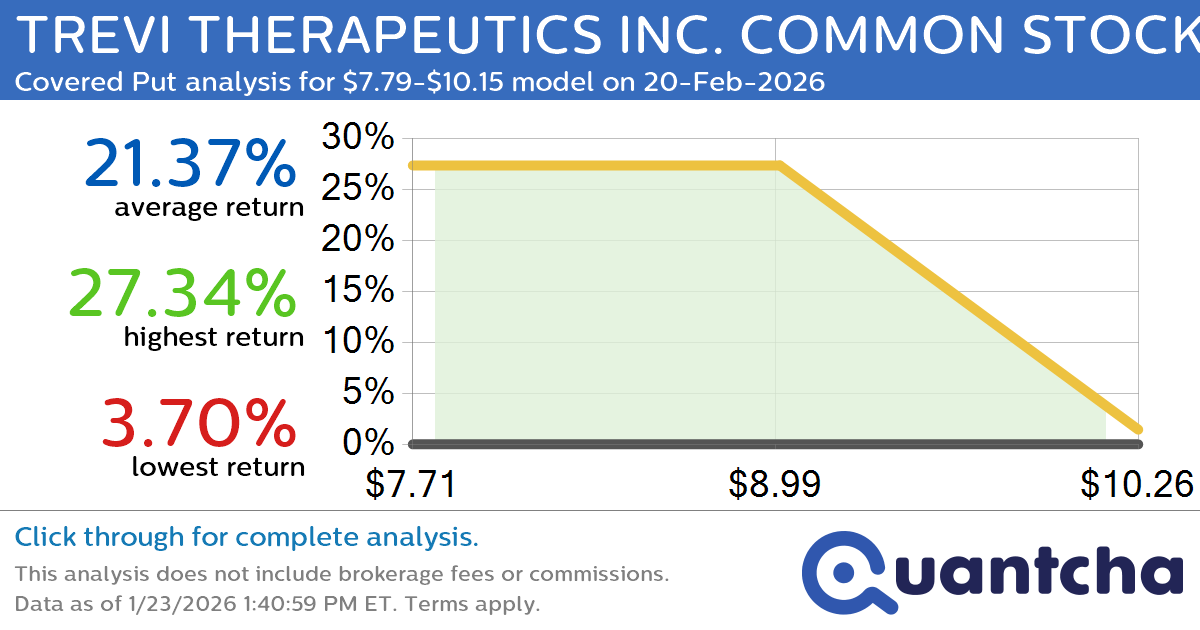

Big Loser Alert: Trading today’s -7.5% move in TREVI THERAPEUTICS INC. COMMON STOCK $TRVI

Quantchabot has detected a new Covered Put trade opportunity for TREVI THERAPEUTICS INC. COMMON STOCK (TRVI) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TRVI was recently trading at $10.12 and has an implied volatility of 94.61% for this period. Based on an analysis…

-

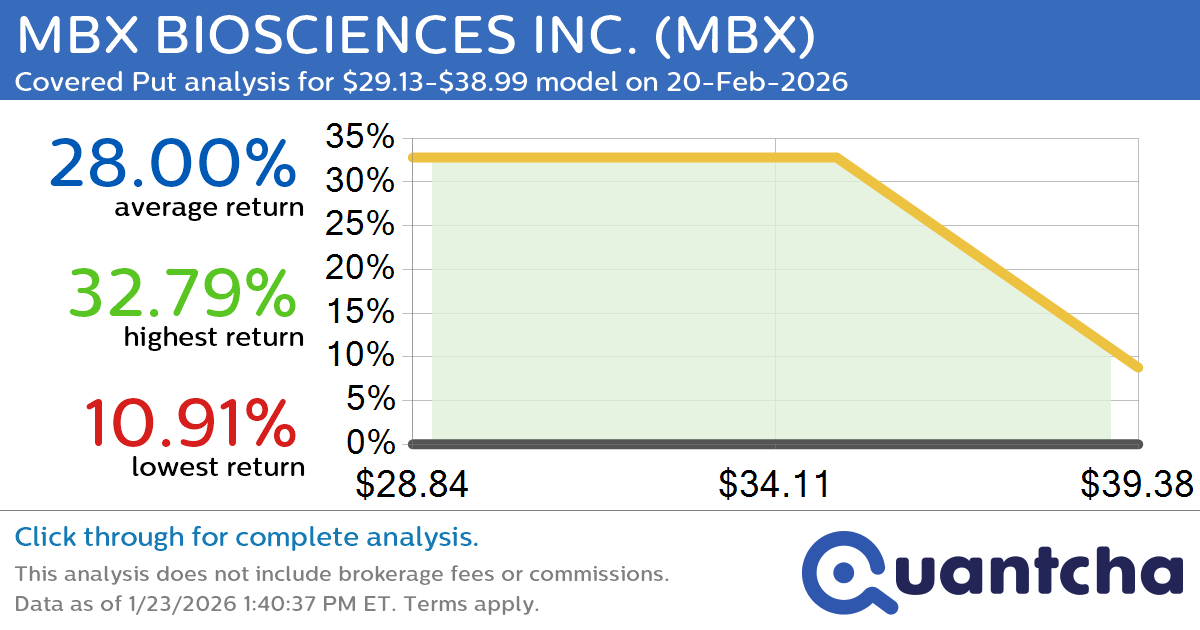

Big Loser Alert: Trading today’s -8.3% move in MBX BIOSCIENCES INC. $MBX

Quantchabot has detected a new Covered Put trade opportunity for MBX BIOSCIENCES INC. (MBX) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. MBX was recently trading at $38.87 and has an implied volatility of 104.07% for this period. Based on an analysis of the…

-

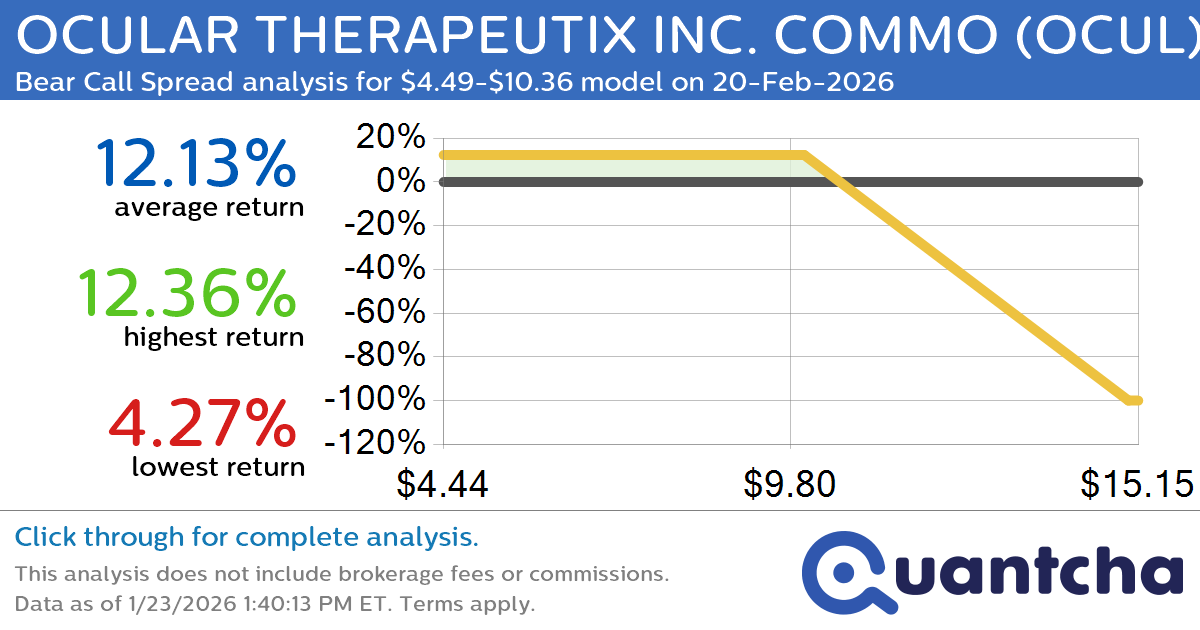

Big Loser Alert: Trading today’s -7.1% move in OCULAR THERAPEUTIX INC. COMMO $OCUL

Quantchabot has detected a new Bear Call Spread trade opportunity for OCULAR THERAPEUTIX INC. COMMO (OCUL) for the 20-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. OCUL was recently trading at $10.33 and has an implied volatility of 298.22% for this period. Based on an analysis…

-

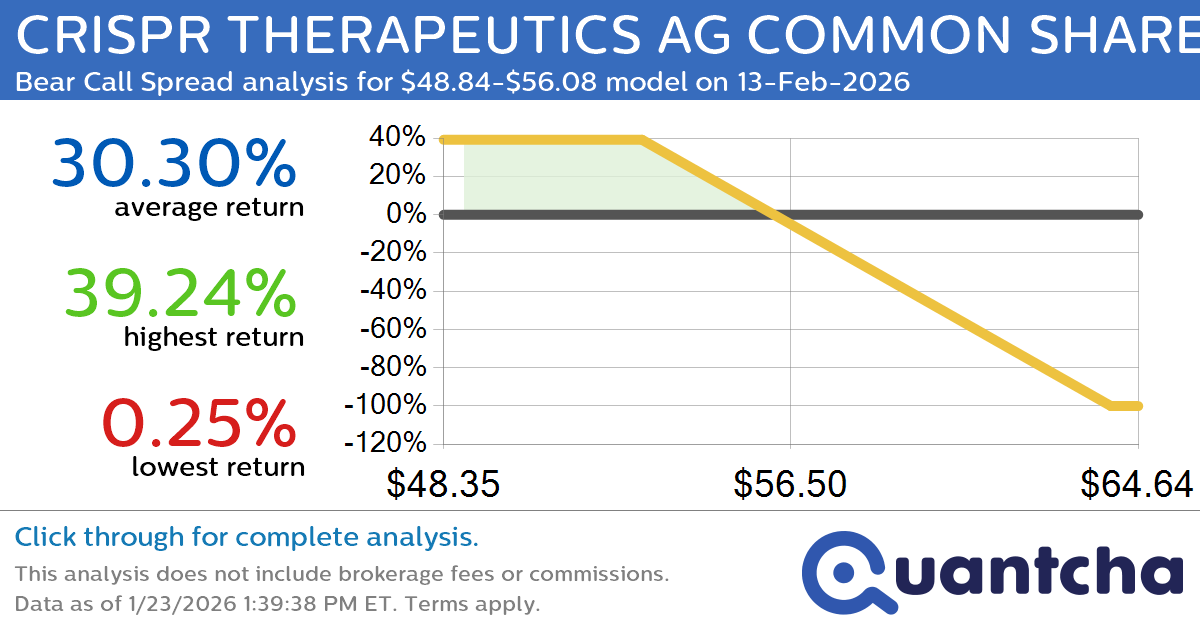

Big Loser Alert: Trading today’s -8.0% move in CRISPR THERAPEUTICS AG COMMON SHARES $CRSP

Quantchabot has detected a new Bear Call Spread trade opportunity for CRISPR THERAPEUTICS AG COMMON SHARES (CRSP) for the 13-Feb-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CRSP was recently trading at $55.95 and has an implied volatility of 56.79% for this period. Based on an…

-

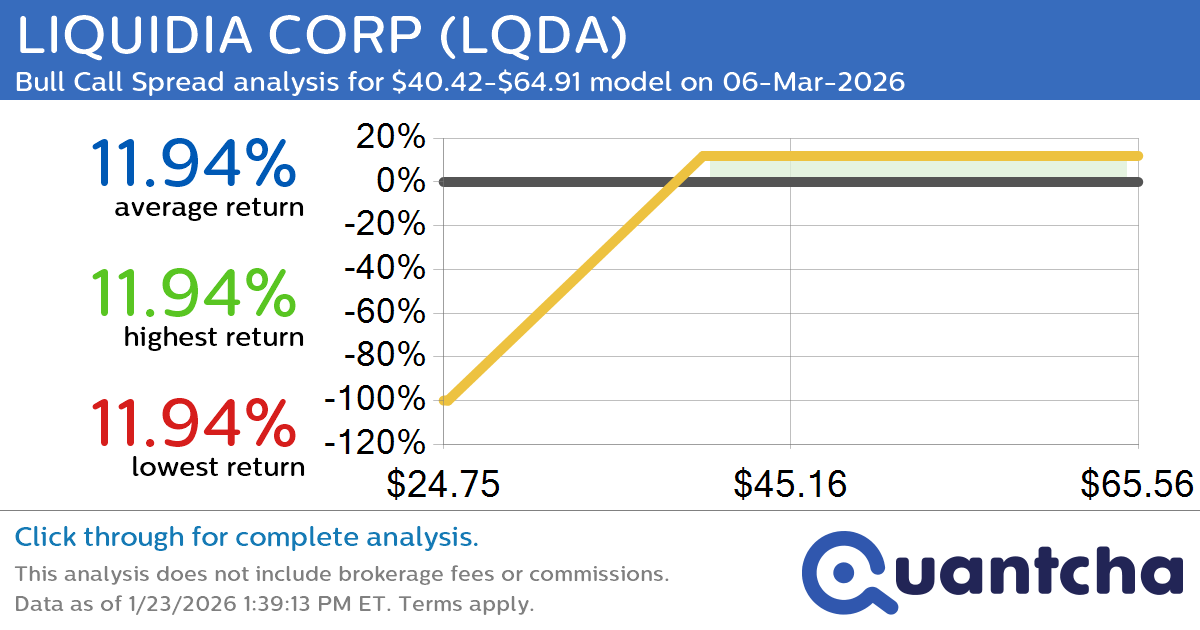

52-Week High Alert: Trading today’s movement in LIQUIDIA CORP $LQDA

Quantchabot has detected a new Bull Call Spread trade opportunity for LIQUIDIA CORP (LQDA) for the 6-Mar-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. LQDA was recently trading at $40.23 and has an implied volatility of 138.59% for this period. Based on an analysis of the…