Quantcha Ideas: Turn a good idea about a stock into a great options trade

-

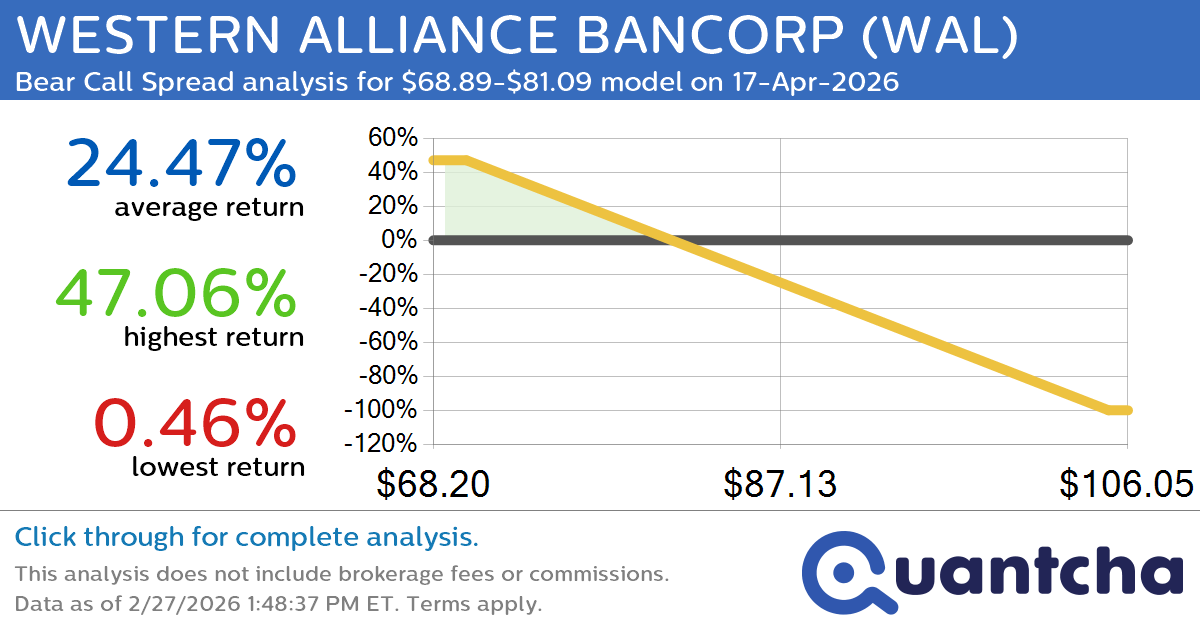

Big Loser Alert: Trading today’s -10.4% move in WESTERN ALLIANCE BANCORP $WAL

Quantchabot has detected a new Bear Call Spread trade opportunity for WESTERN ALLIANCE BANCORP (WAL) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. WAL was recently trading at $80.67 and has an implied volatility of 44.22% for this period. Based on an analysis of…

-

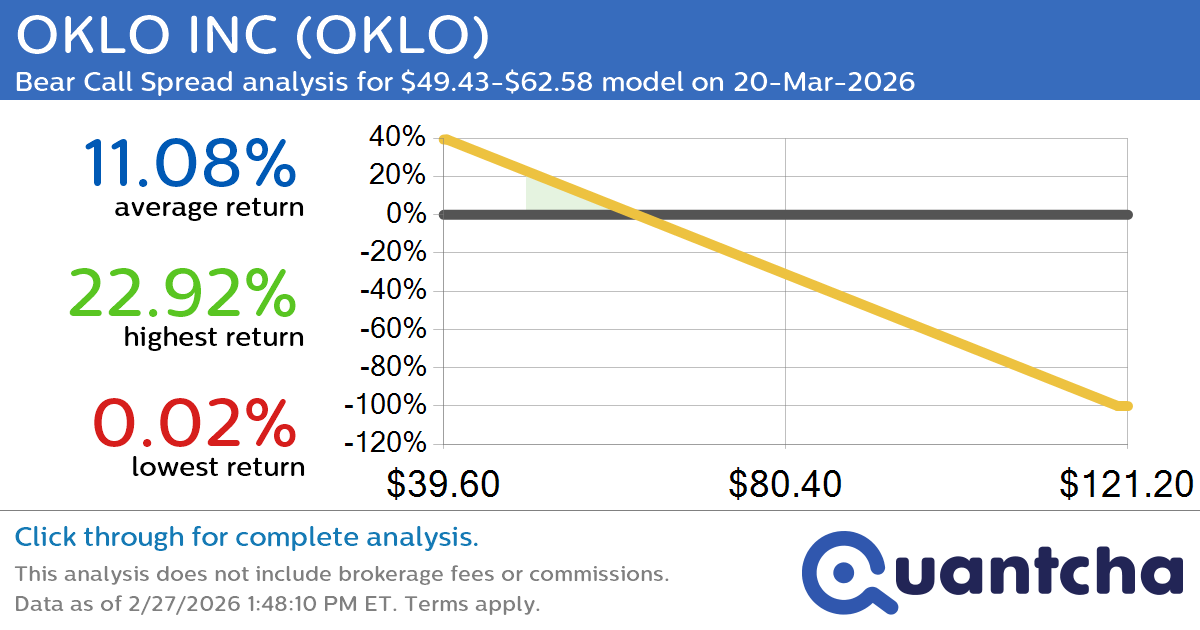

Big Loser Alert: Trading today’s -9.6% move in OKLO INC $OKLO

Quantchabot has detected a new Bear Call Spread trade opportunity for OKLO INC (OKLO) for the 20-Mar-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. OKLO was recently trading at $62.44 and has an implied volatility of 96.91% for this period. Based on an analysis of the…

-

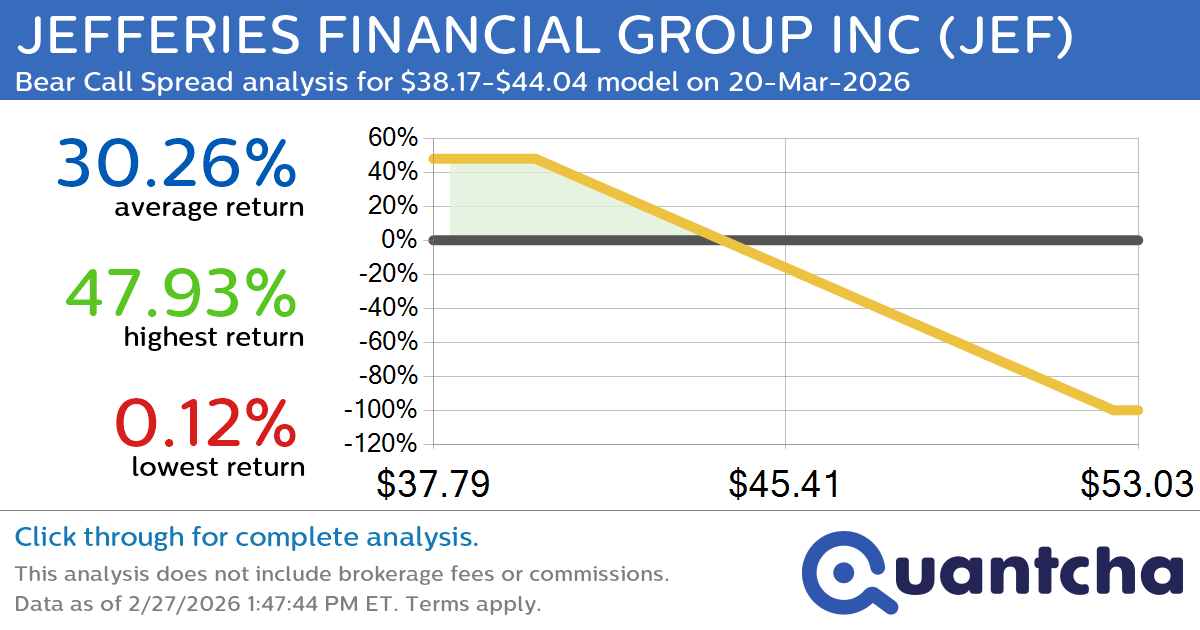

Big Loser Alert: Trading today’s -10.3% move in JEFFERIES FINANCIAL GROUP INC $JEF

Quantchabot has detected a new Bear Call Spread trade opportunity for JEFFERIES FINANCIAL GROUP INC (JEF) for the 20-Mar-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. JEF was recently trading at $43.94 and has an implied volatility of 58.77% for this period. Based on an analysis…

-

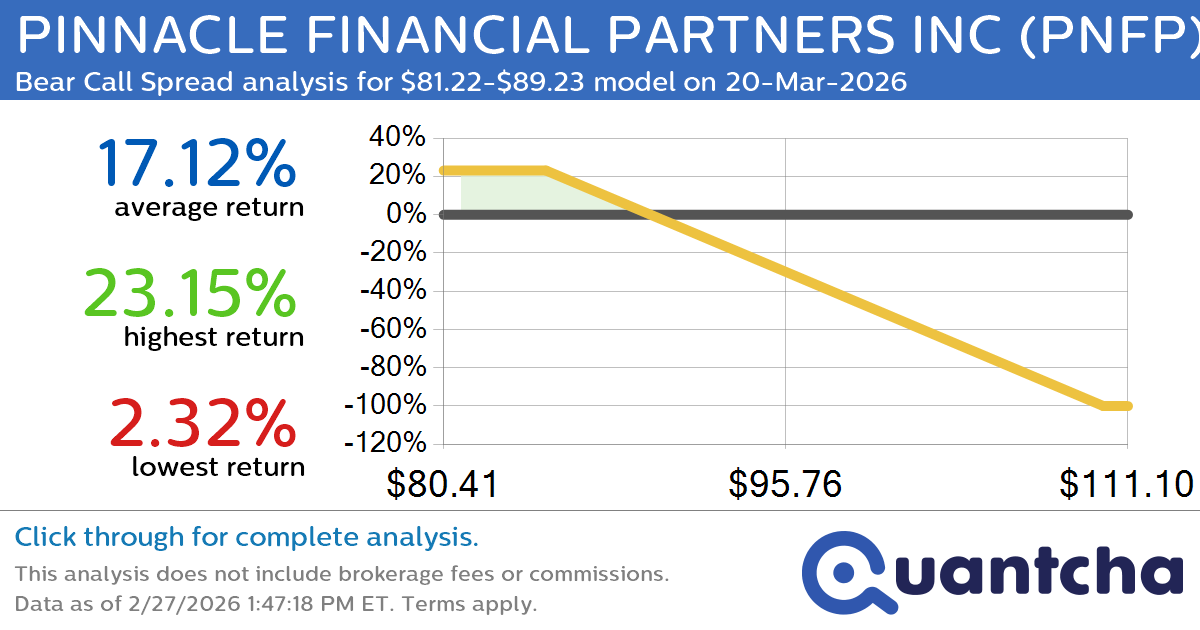

Big Loser Alert: Trading today’s -7.4% move in PINNACLE FINANCIAL PARTNERS INC $PNFP

Quantchabot has detected a new Bear Call Spread trade opportunity for PINNACLE FINANCIAL PARTNERS INC (PNFP) for the 20-Mar-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. PNFP was recently trading at $89.03 and has an implied volatility of 38.64% for this period. Based on an analysis…

-

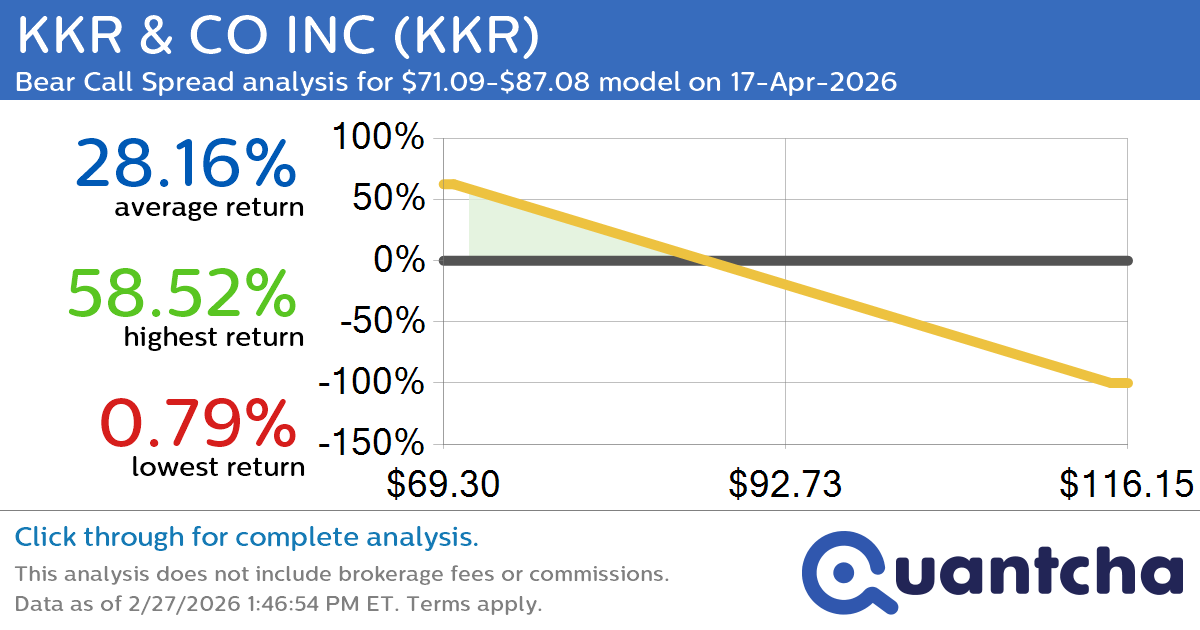

Big Loser Alert: Trading today’s -7.5% move in KKR & CO INC $KKR

Quantchabot has detected a new Bear Call Spread trade opportunity for KKR & CO INC (KKR) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. KKR was recently trading at $86.63 and has an implied volatility of 55.03% for this period. Based on an analysis…

-

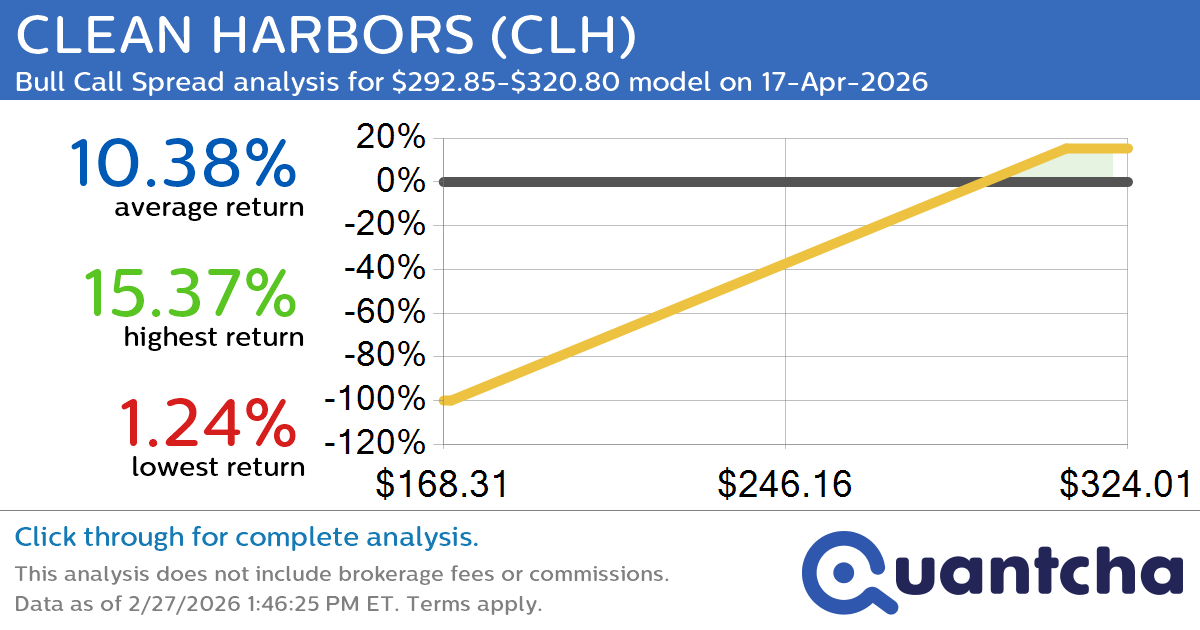

52-Week High Alert: Trading today’s movement in CLEAN HARBORS $CLH

Quantchabot has detected a new Bull Call Spread trade opportunity for CLEAN HARBORS (CLH) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CLH was recently trading at $291.34 and has an implied volatility of 24.71% for this period. Based on an analysis of the…

-

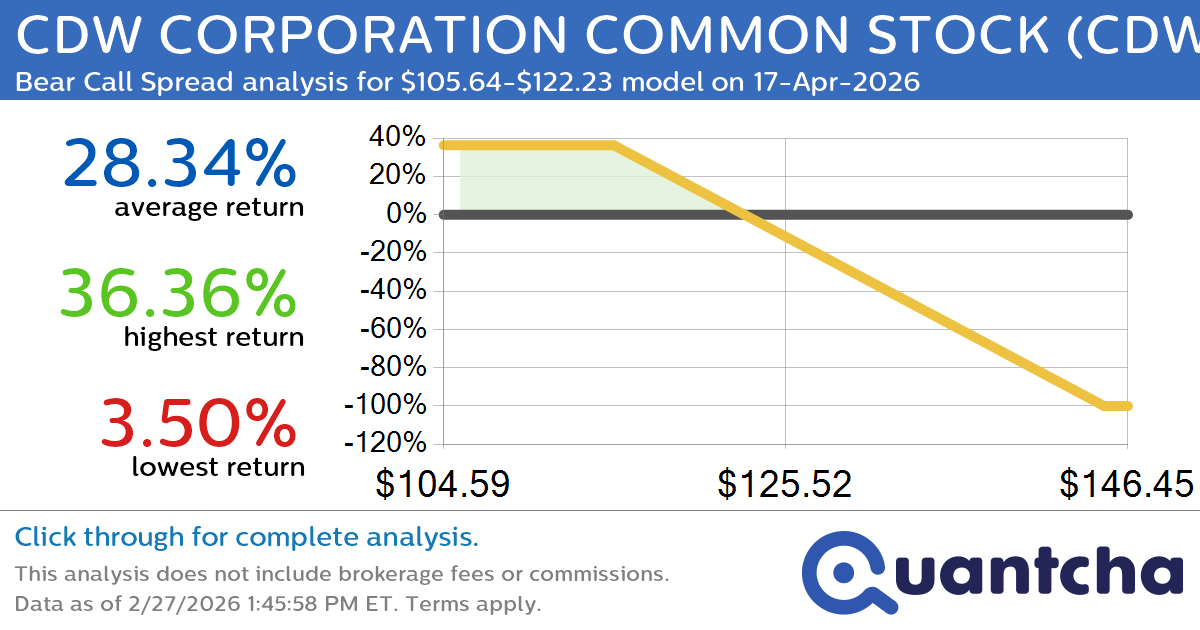

52-Week Low Alert: Trading today’s movement in CDW CORPORATION COMMON STOCK $CDW

Quantchabot has detected a new Bear Call Spread trade opportunity for CDW CORPORATION COMMON STOCK (CDW) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CDW was recently trading at $121.59 and has an implied volatility of 39.56% for this period. Based on an analysis…

-

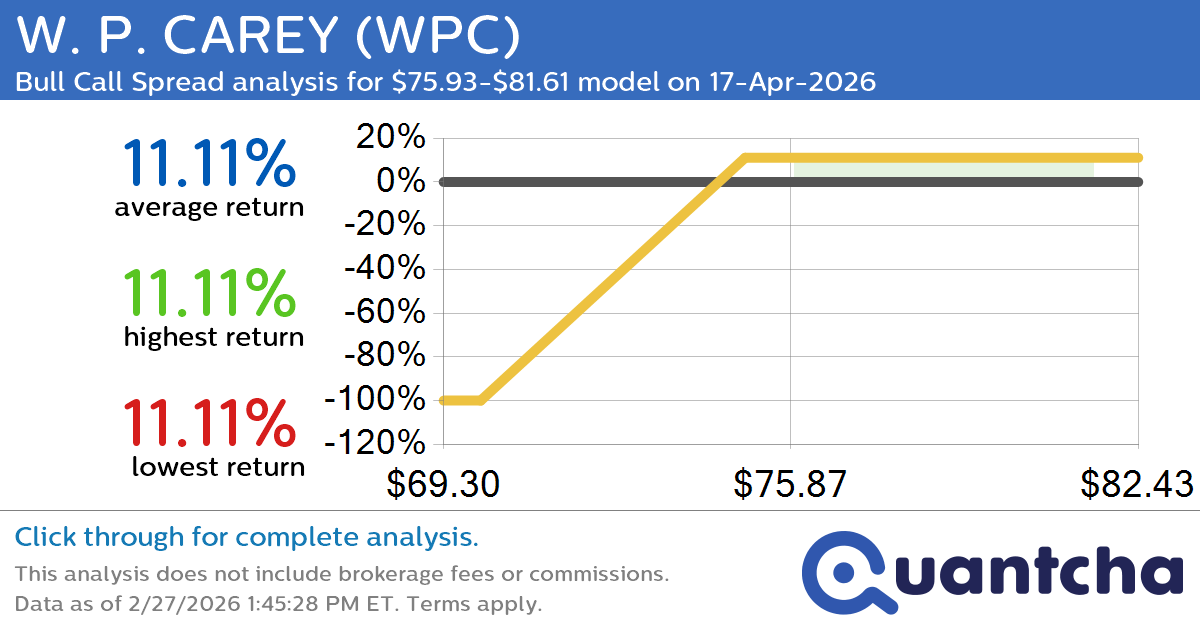

52-Week High Alert: Trading today’s movement in W. P. CAREY $WPC

Quantchabot has detected a new Bull Call Spread trade opportunity for W. P. CAREY (WPC) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. WPC was recently trading at $75.54 and has an implied volatility of 19.55% for this period. Based on an analysis of…

-

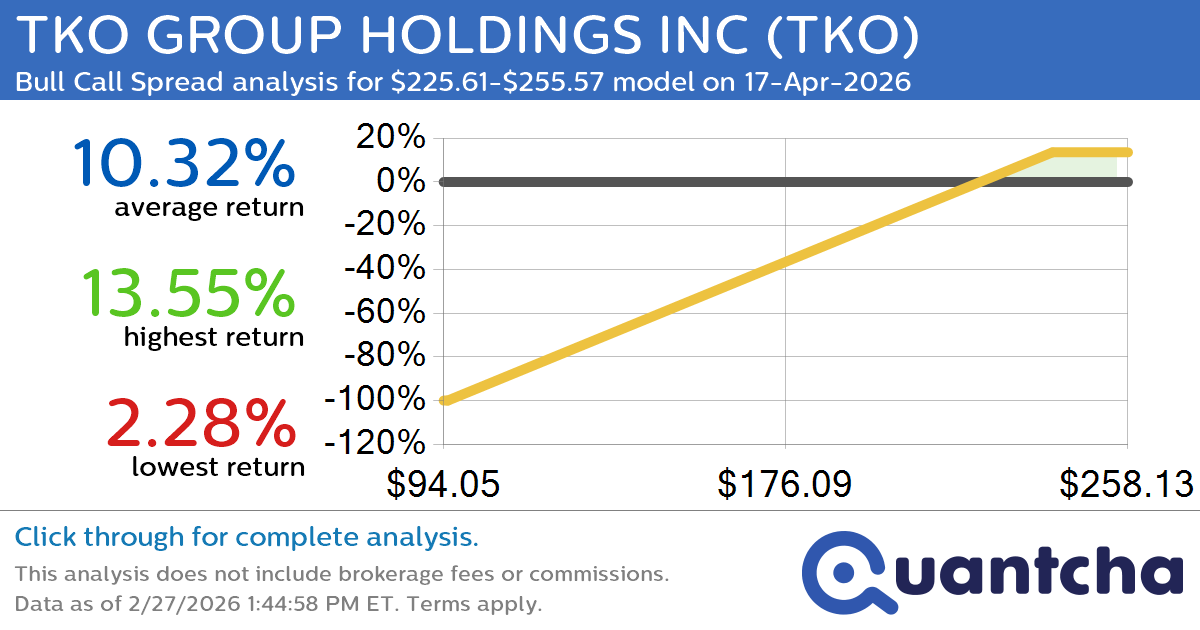

52-Week High Alert: Trading today’s movement in TKO GROUP HOLDINGS INC $TKO

Quantchabot has detected a new Bull Call Spread trade opportunity for TKO GROUP HOLDINGS INC (TKO) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. TKO was recently trading at $224.45 and has an implied volatility of 33.81% for this period. Based on an analysis…

-

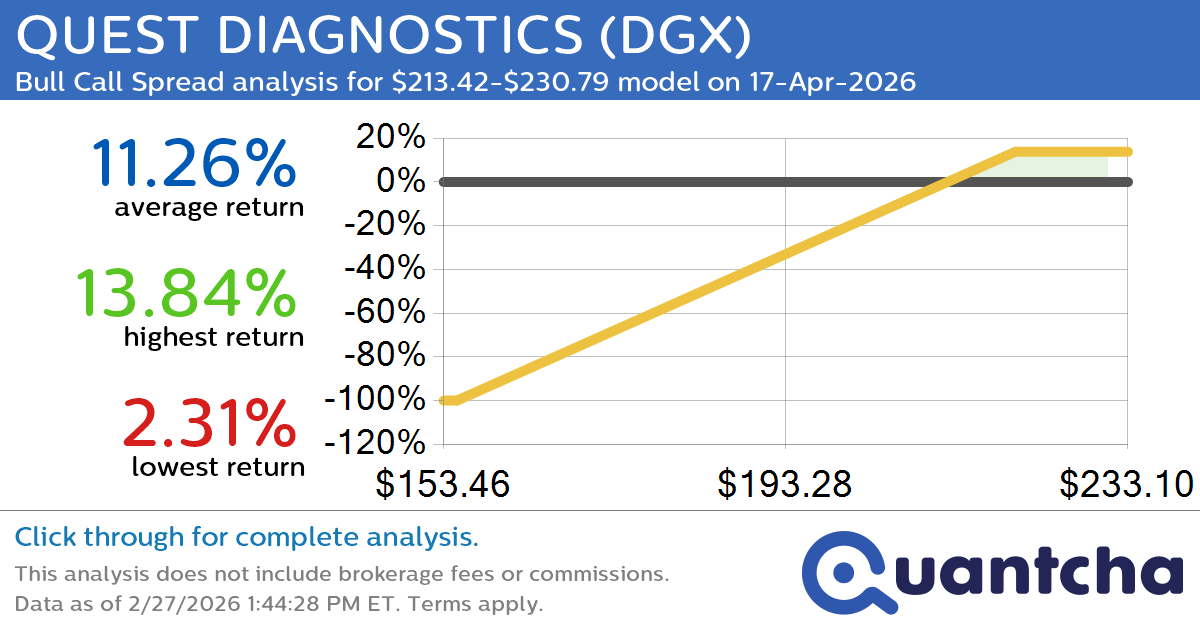

52-Week High Alert: Trading today’s movement in QUEST DIAGNOSTICS $DGX

Quantchabot has detected a new Bull Call Spread trade opportunity for QUEST DIAGNOSTICS (DGX) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. DGX was recently trading at $213.18 and has an implied volatility of 21.22% for this period. Based on an analysis of the…