Quantcha Ideas: Turn a good idea about a stock into a great options trade

-

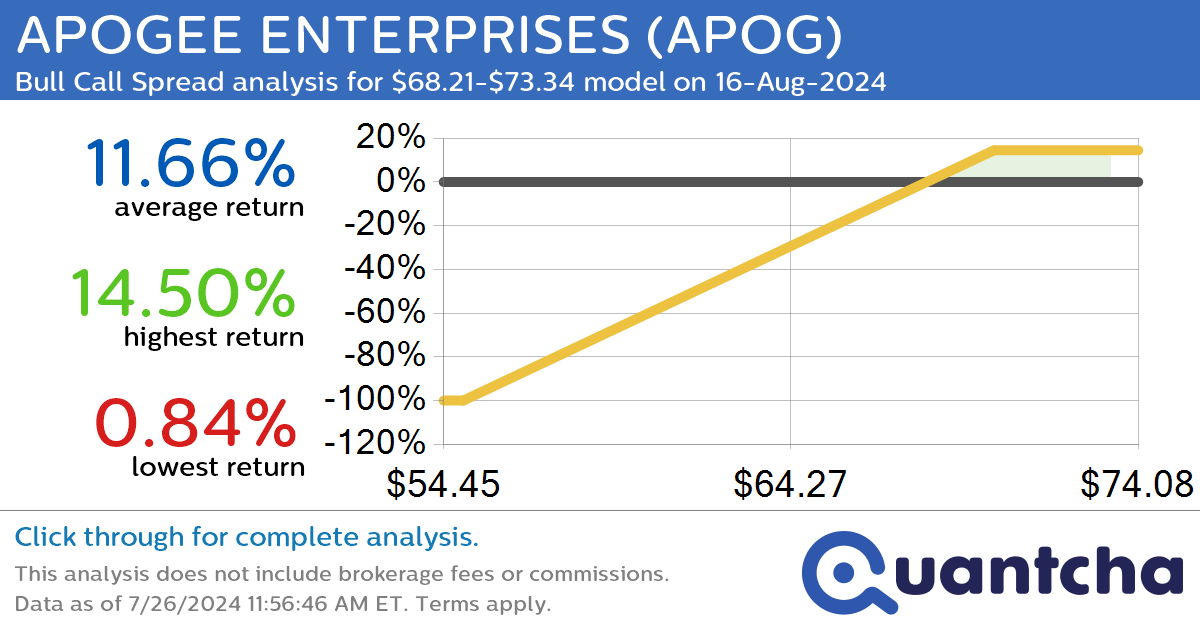

52-Week High Alert: Trading today’s movement in APOGEE ENTERPRISES $APOG

Quantchabot has detected a new Bull Call Spread trade opportunity for APOGEE ENTERPRISES (APOG) for the 16-Aug-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. APOG was recently trading at $67.98 and has an implied volatility of 29.75% for this period. Based on an analysis of the…

-

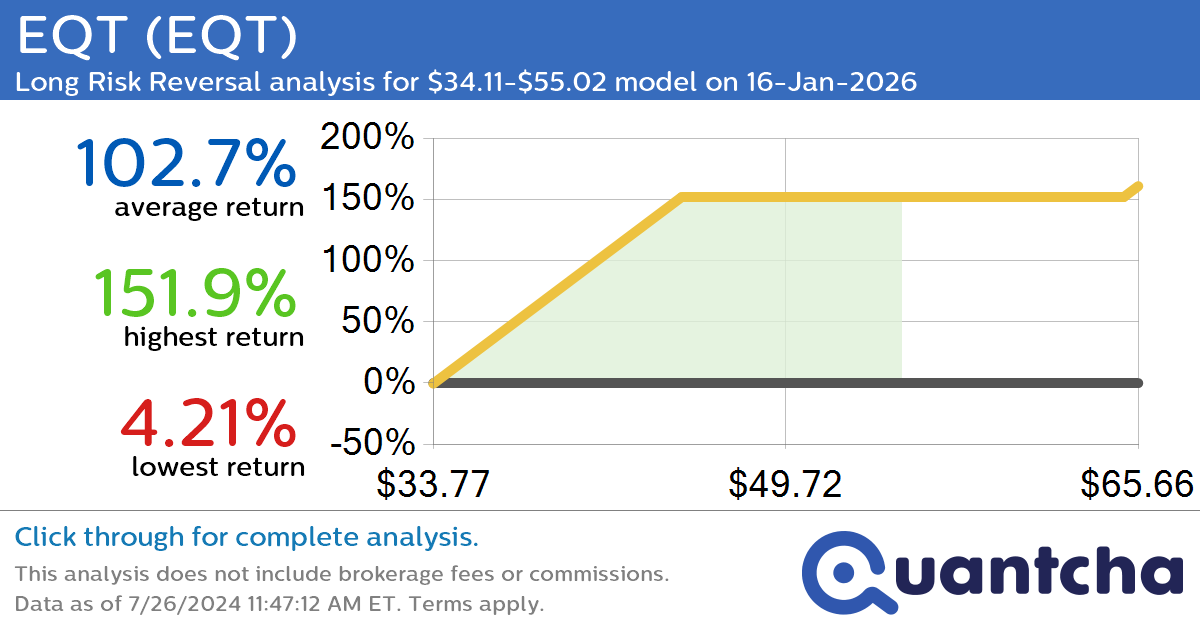

StockTwits Trending Alert: Trading recent interest in EQT $EQT

Quantchabot has detected a new Long Risk Reversal trade opportunity for EQT (EQT) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. EQT was recently trading at $34.11 and has an implied volatility of 35.65% for this period. Based on an analysis of the options…

-

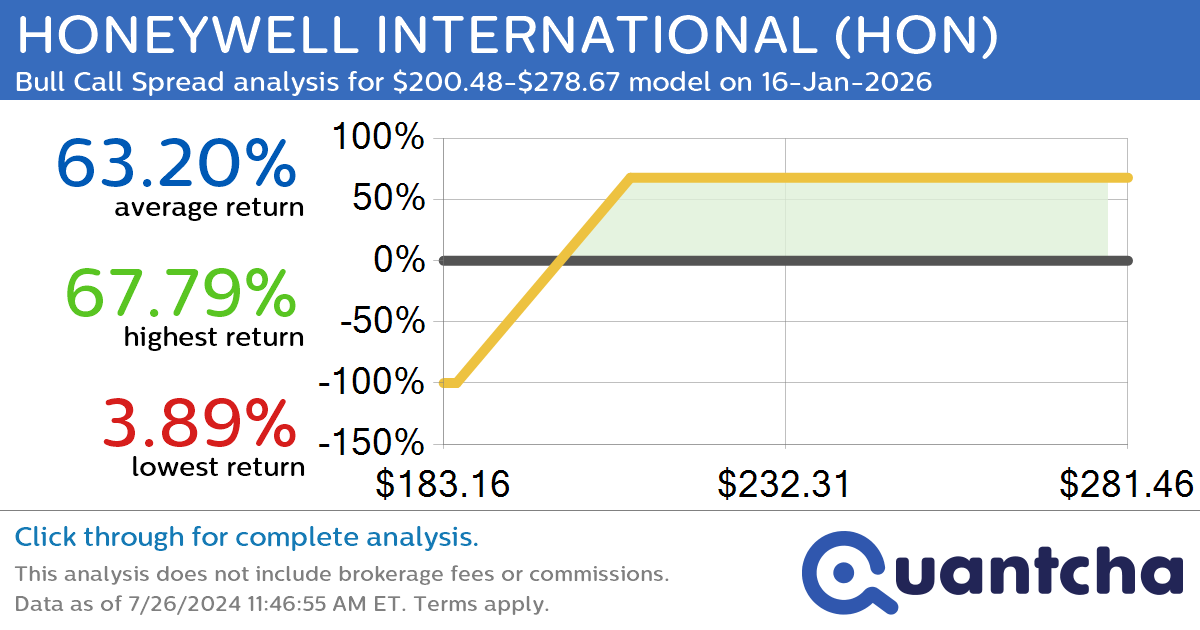

StockTwits Trending Alert: Trading recent interest in HONEYWELL INTERNATIONAL $HON

Quantchabot has detected a new Bull Call Spread trade opportunity for HONEYWELL INTERNATIONAL (HON) for the 16-Jan-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. HON was recently trading at $200.50 and has an implied volatility of 21.06% for this period. Based on an analysis of the…

-

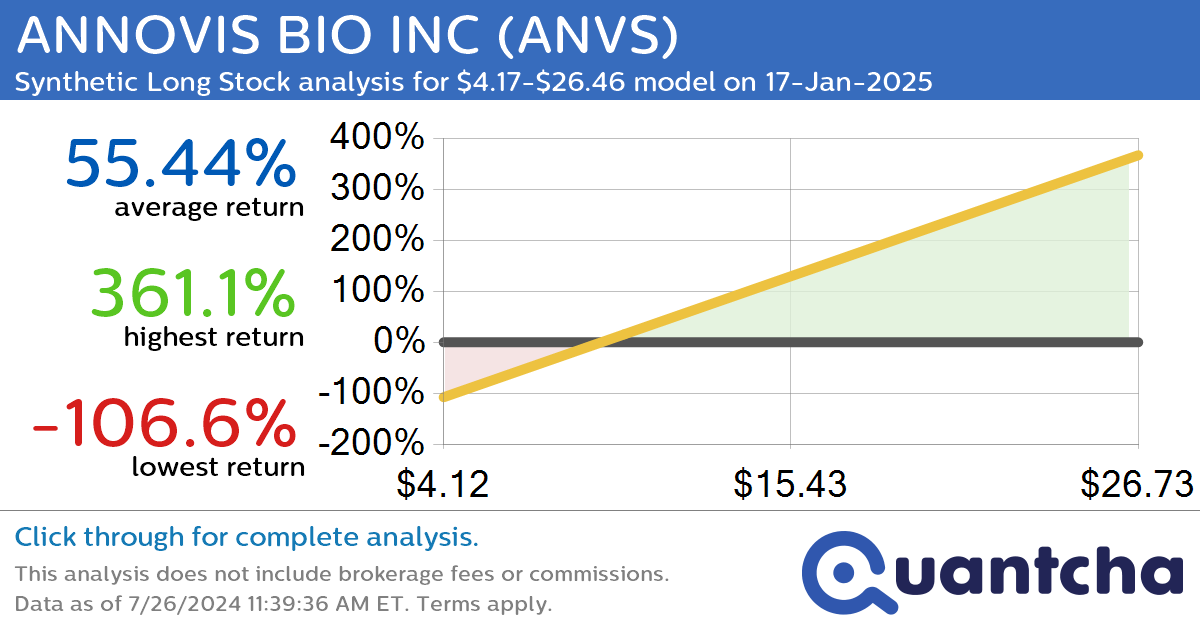

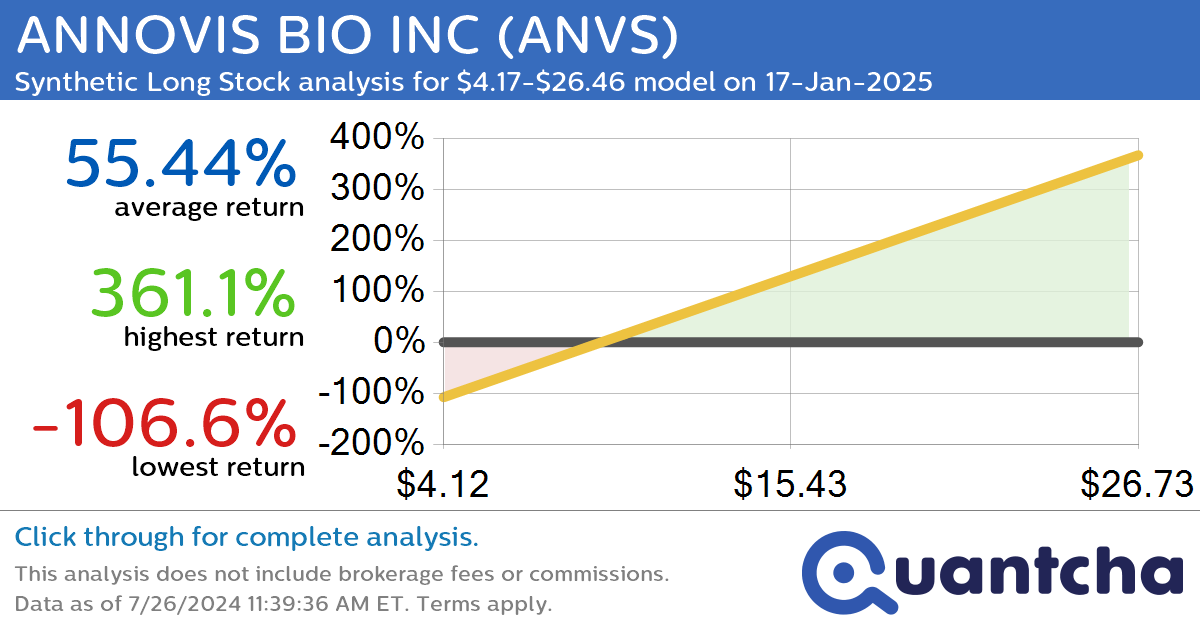

Synthetic Long Discount Alert: ANNOVIS BIO INC $ANVS trading at a 14.47% discount for the 17-Jan-2025 expiration

Quantchabot has detected a new Synthetic Long Stock trade opportunity for ANNOVIS BIO INC (ANVS) for the 17-Jan-2025 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ANVS was recently trading at $10.23 and has an implied volatility of 133.12% for this period. Based on an analysis of…

-

Big Gainer Alert: Trading today’s 7.1% move in WAYFAIR INC $W

Quantchabot has detected a new Bull Call Spread trade opportunity for WAYFAIR INC (W) for the 26-Jul-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. W was recently trading at $52.61 and has an implied volatility of 43.78% for this period. Based on an analysis of the…

-

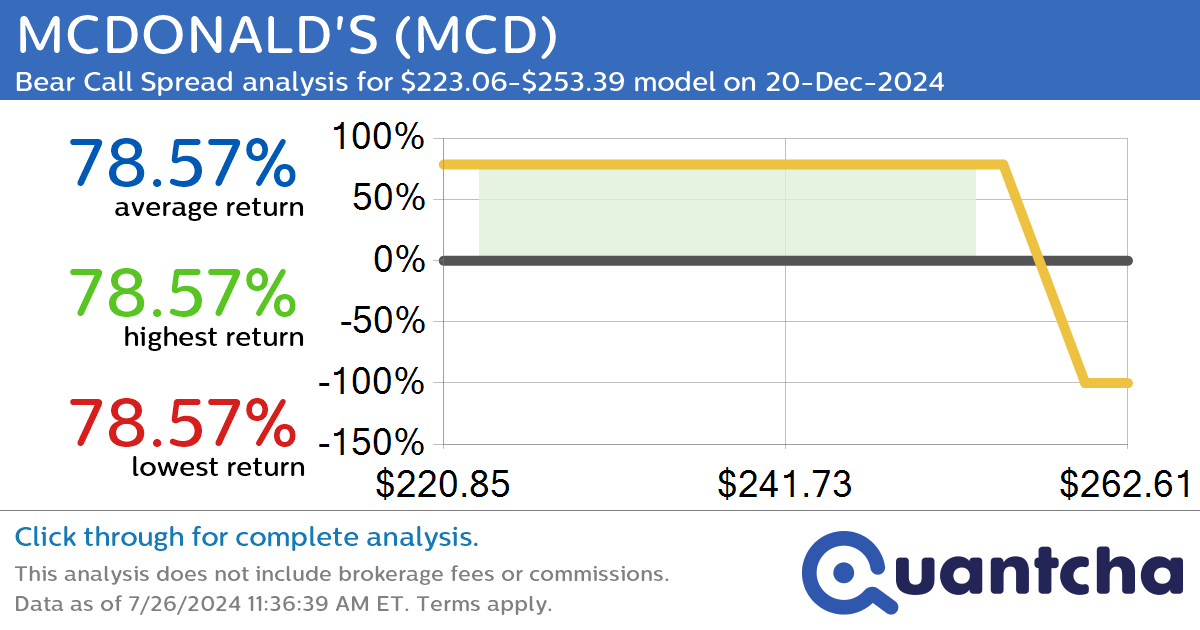

StockTwits Trending Alert: Trading recent interest in MCDONALD’S $MCD

Quantchabot has detected a new Bear Call Spread trade opportunity for MCDONALD’S (MCD) for the 20-Dec-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. MCD was recently trading at $253.40 and has an implied volatility of 21.48% for this period. Based on an analysis of the options…

-

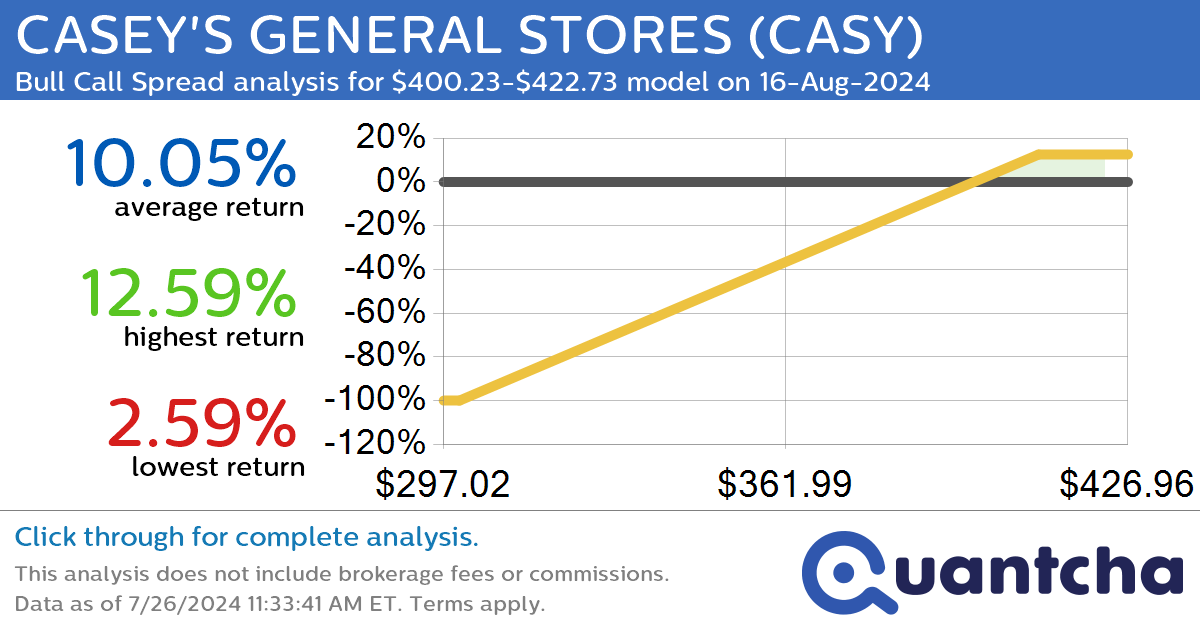

Big Gainer Alert: Trading today’s 7.1% move in CASEY’S GENERAL STORES $CASY

Quantchabot has detected a new Bull Call Spread trade opportunity for CASEY’S GENERAL STORES (CASY) for the 16-Aug-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CASY was recently trading at $399.39 and has an implied volatility of 22.44% for this period. Based on an analysis of…

-

Big Gainer Alert: Trading today’s 8.1% move in HUT 8 MINING CORP. COMMON SHARES $HUT

Quantchabot has detected a new Bull Call Spread trade opportunity for HUT 8 MINING CORP. COMMON SHARES (HUT) for the 9-Aug-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. HUT was recently trading at $15.99 and has an implied volatility of 109.02% for this period. Based on…

-

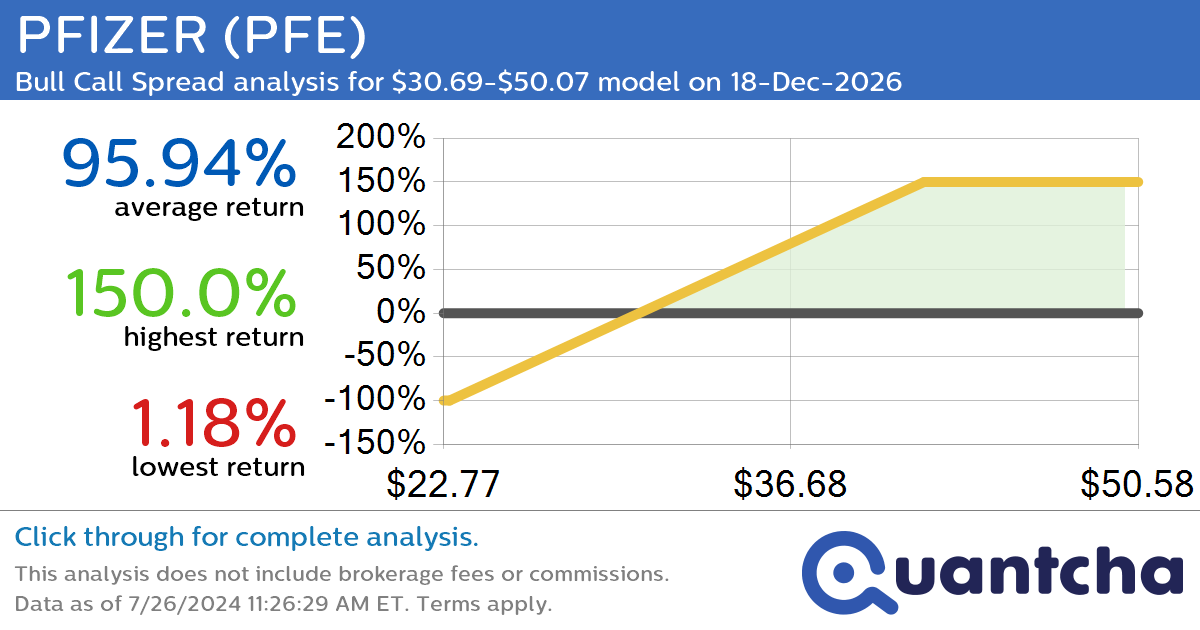

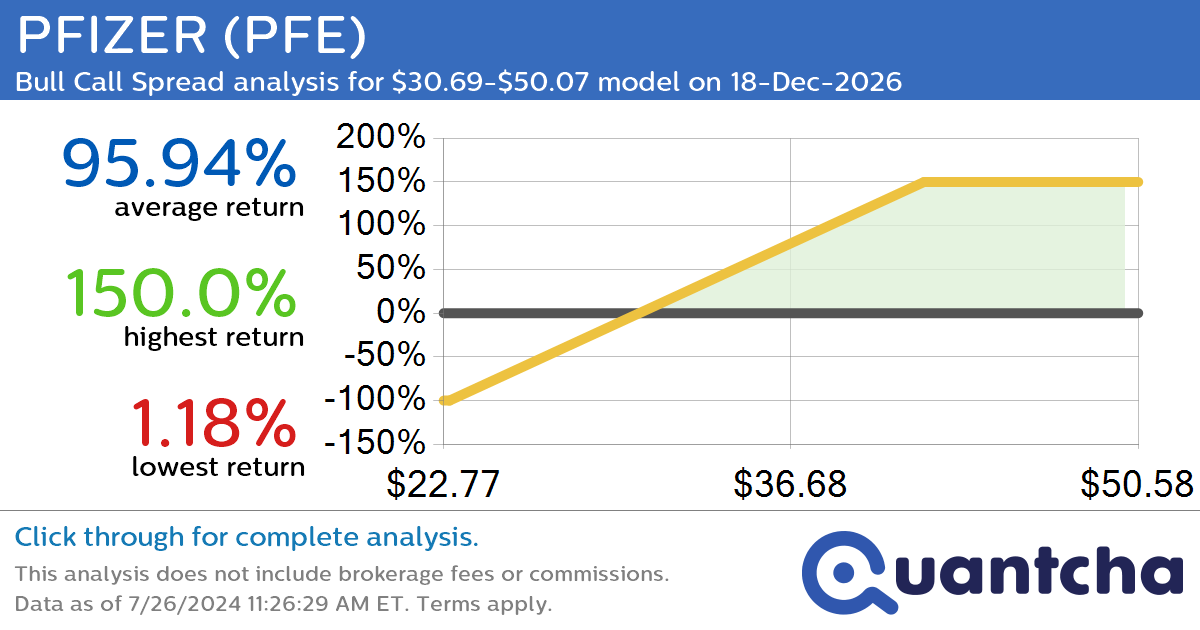

StockTwits Trending Alert: Trading recent interest in PFIZER $PFE

Quantchabot has detected a new Bull Call Spread trade opportunity for PFIZER (PFE) for the 18-Dec-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. PFE was recently trading at $30.69 and has an implied volatility of 32.42% for this period. Based on an analysis of the options…

-

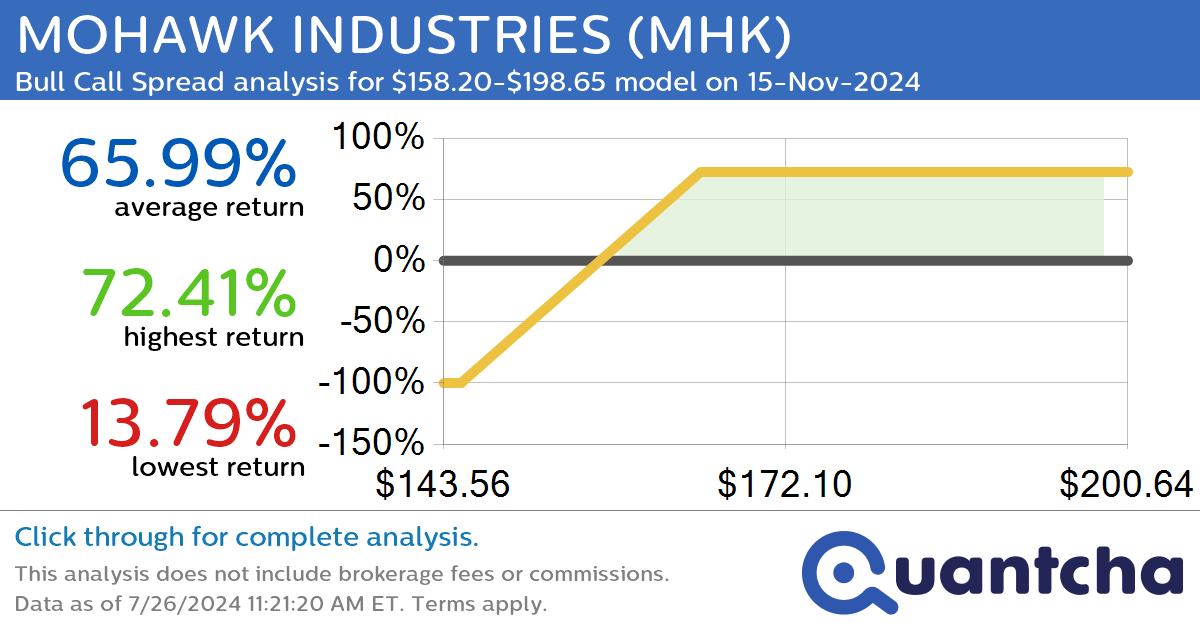

StockTwits Trending Alert: Trading recent interest in MOHAWK INDUSTRIES $MHK

Quantchabot has detected a new Bull Call Spread trade opportunity for MOHAWK INDUSTRIES (MHK) for the 15-Nov-2024 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. MHK was recently trading at $158.19 and has an implied volatility of 37.90% for this period. Based on an analysis of the…