Quantcha Ideas: Turn a good idea about a stock into a great options trade

-

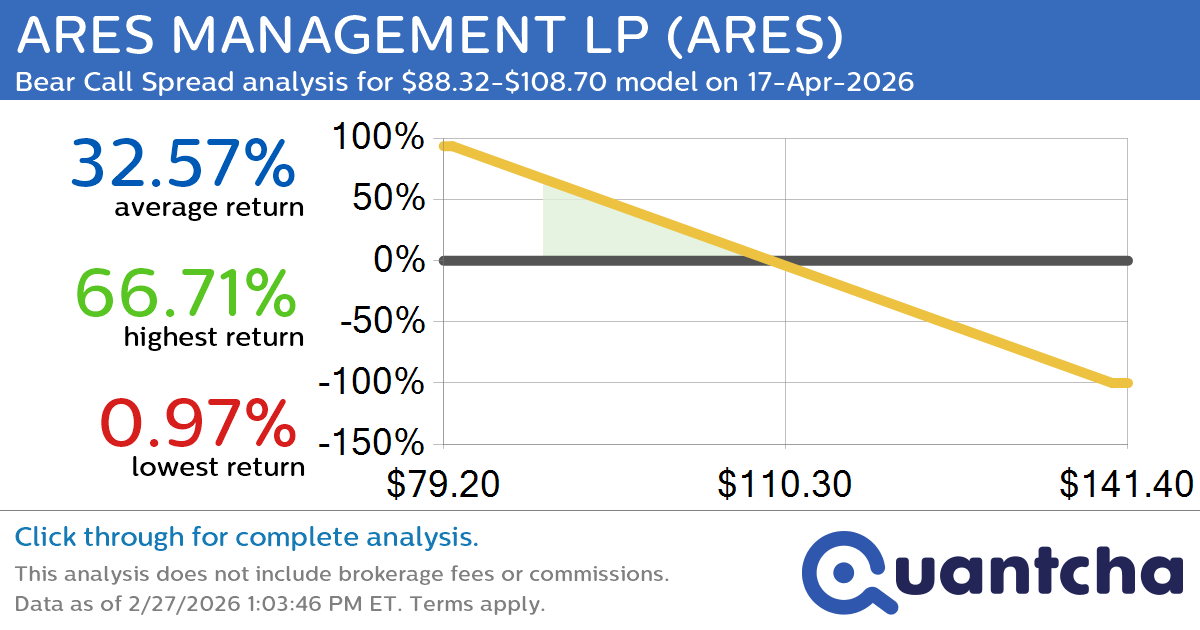

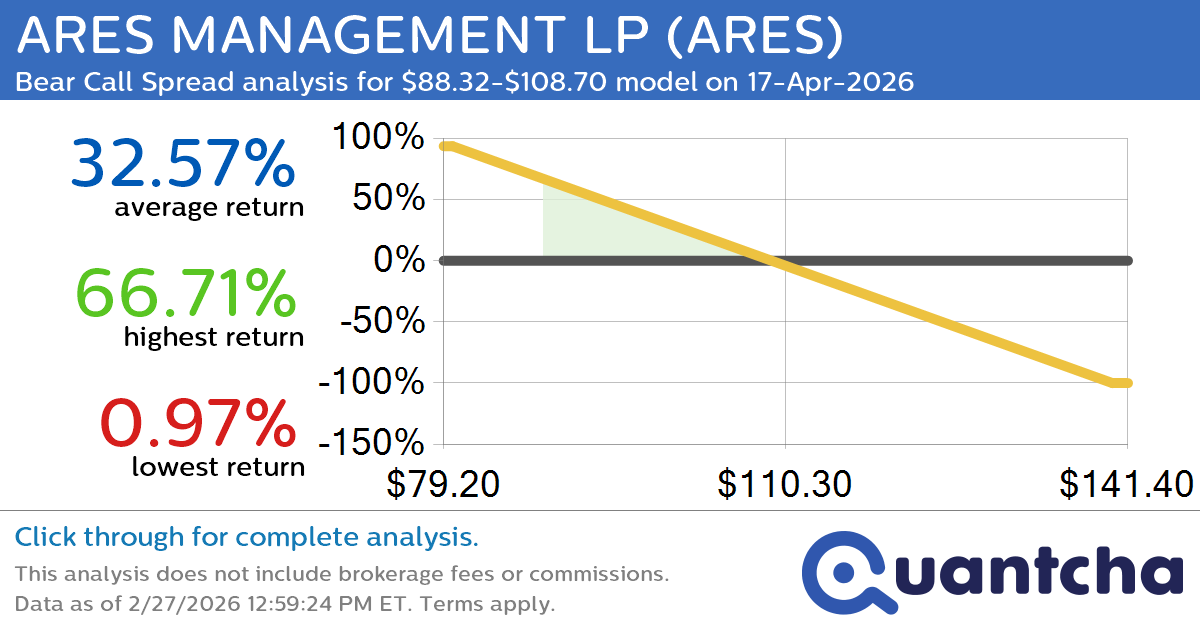

Big Loser Alert: Trading today’s -7.3% move in ARES MANAGEMENT LP $ARES

Quantchabot has detected a new Bear Call Spread trade opportunity for ARES MANAGEMENT LP (ARES) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ARES was recently trading at $109.49 and has an implied volatility of 56.30% for this period. Based on an analysis of…

-

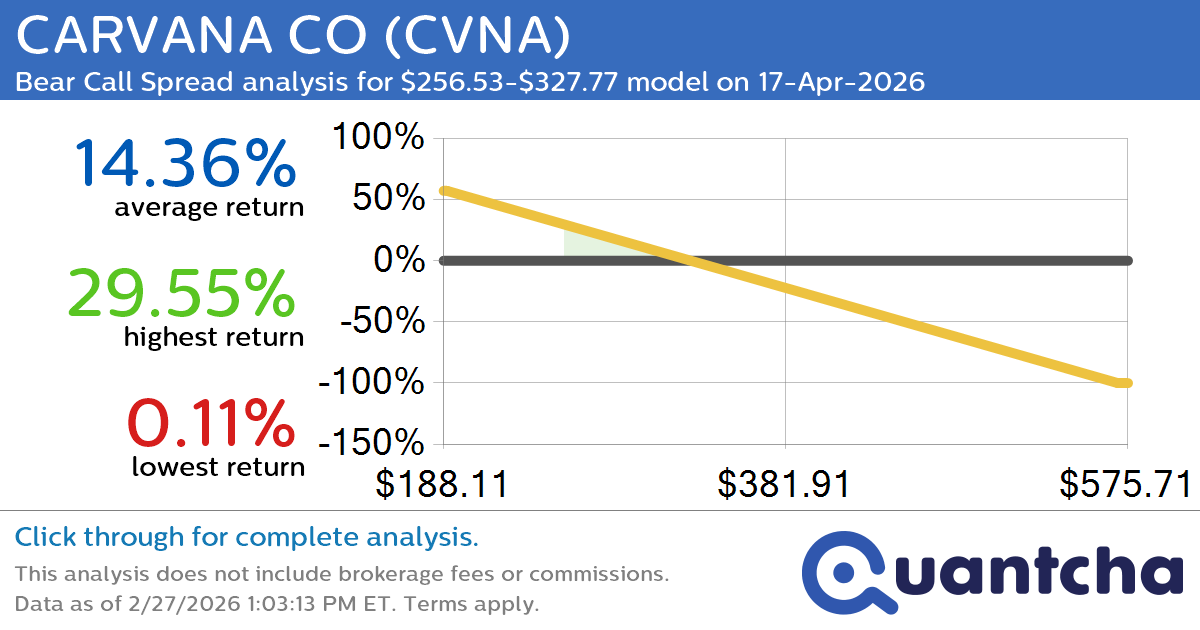

Big Loser Alert: Trading today’s -7.9% move in CARVANA CO $CVNA

Quantchabot has detected a new Bear Call Spread trade opportunity for CARVANA CO (CVNA) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. CVNA was recently trading at $326.07 and has an implied volatility of 66.43% for this period. Based on an analysis of the…

-

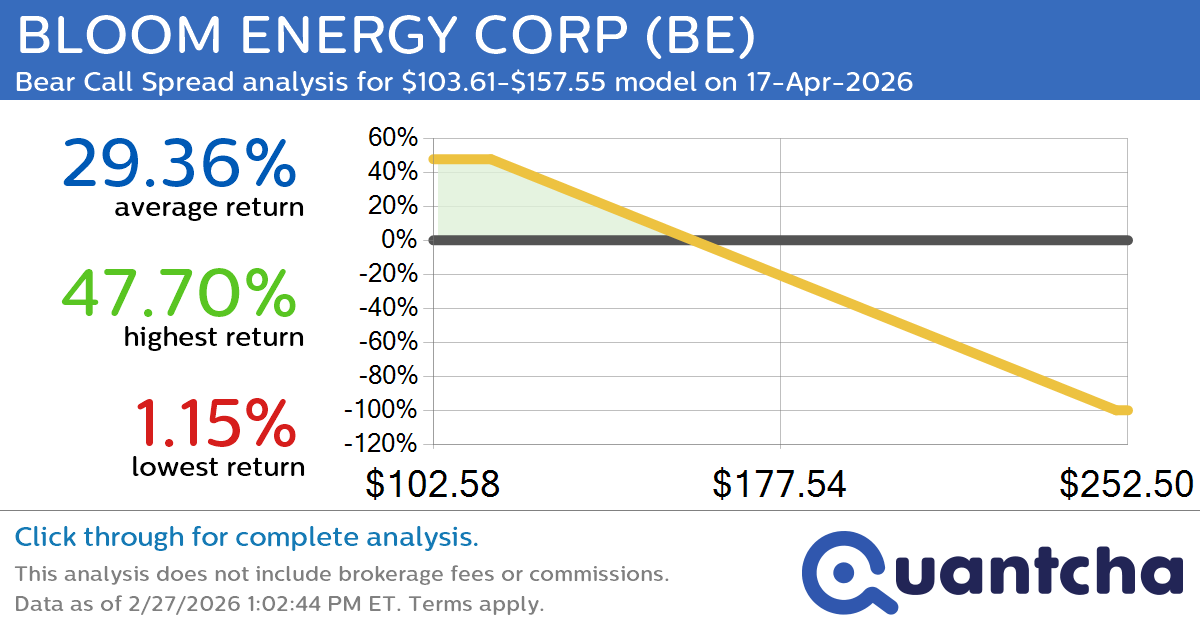

Big Loser Alert: Trading today’s -7.0% move in BLOOM ENERGY CORP $BE

Quantchabot has detected a new Bear Call Spread trade opportunity for BLOOM ENERGY CORP (BE) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. BE was recently trading at $156.74 and has an implied volatility of 113.63% for this period. Based on an analysis of…

-

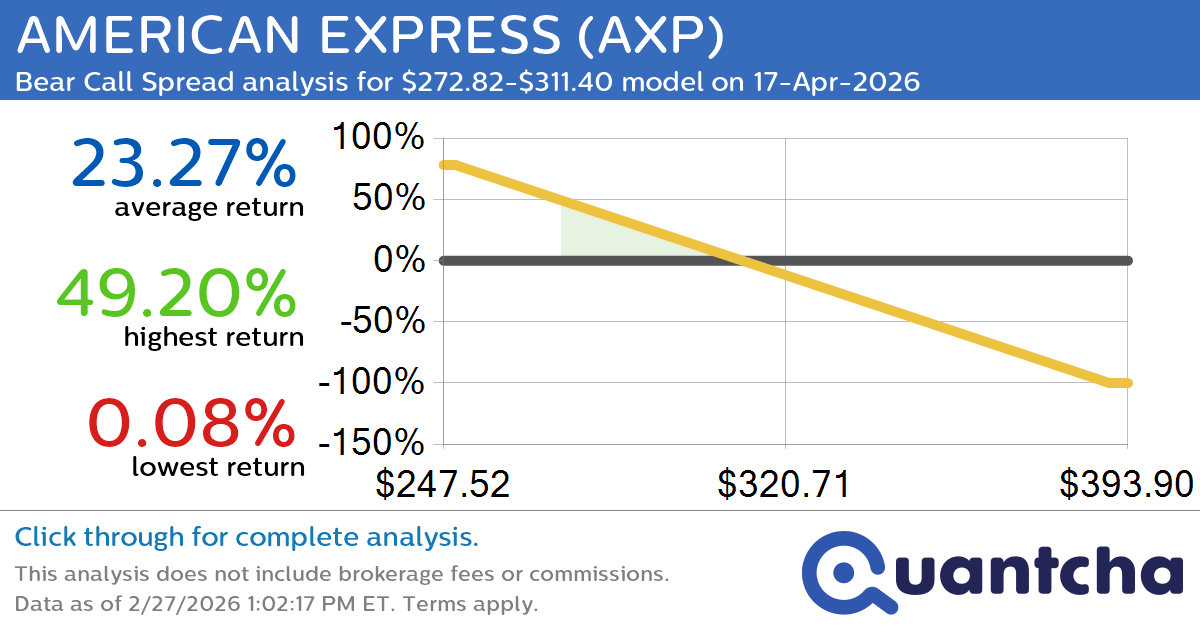

Big Loser Alert: Trading today’s -7.6% move in AMERICAN EXPRESS $AXP

Quantchabot has detected a new Bear Call Spread trade opportunity for AMERICAN EXPRESS (AXP) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. AXP was recently trading at $309.79 and has an implied volatility of 35.85% for this period. Based on an analysis of the…

-

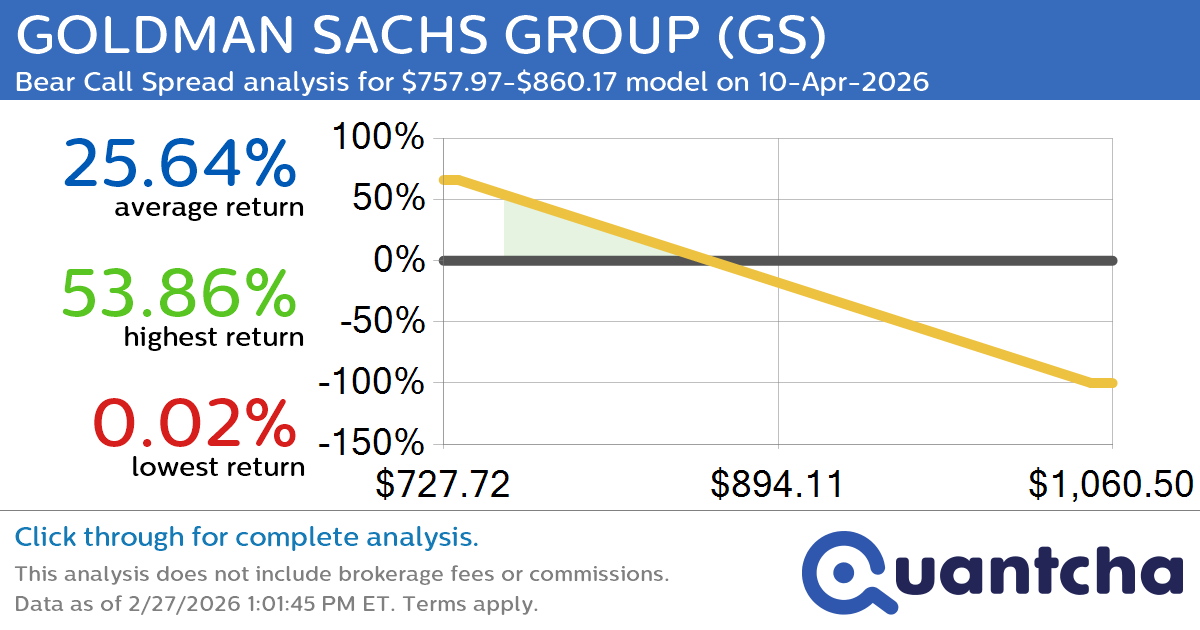

Big Loser Alert: Trading today’s -7.3% move in GOLDMAN SACHS GROUP $GS

Quantchabot has detected a new Bear Call Spread trade opportunity for GOLDMAN SACHS GROUP (GS) for the 10-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. GS was recently trading at $860.85 and has an implied volatility of 36.99% for this period. Based on an analysis of…

-

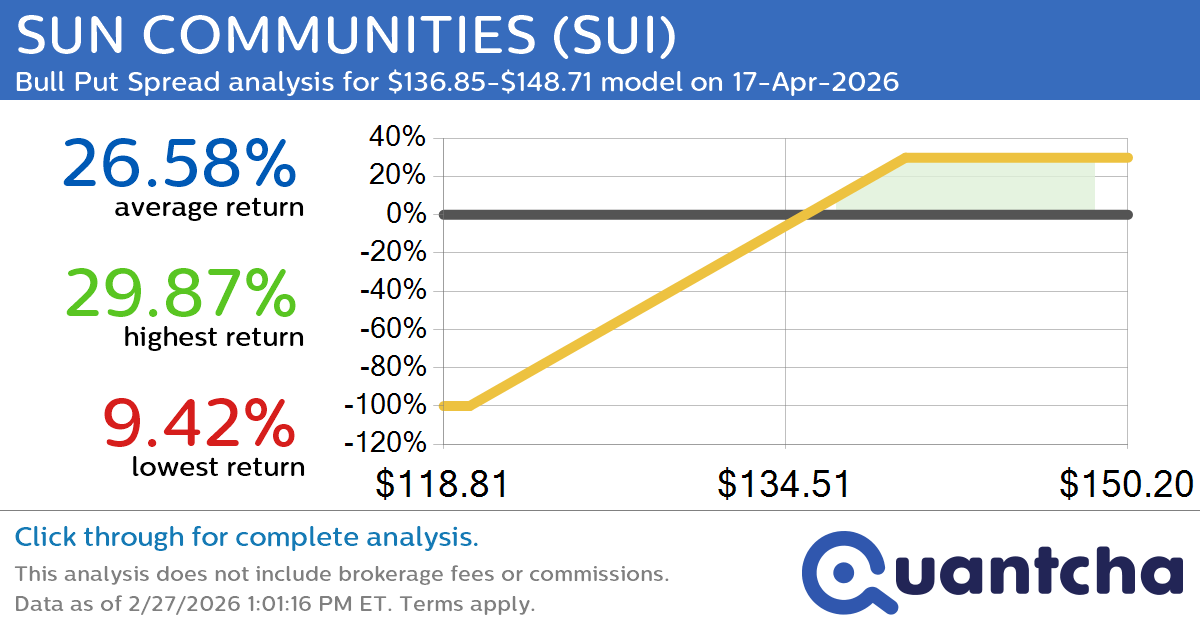

52-Week High Alert: Trading today’s movement in SUN COMMUNITIES $SUI

Quantchabot has detected a new Bull Put Spread trade opportunity for SUN COMMUNITIES (SUI) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. SUI was recently trading at $136.15 and has an implied volatility of 22.53% for this period. Based on an analysis of the…

-

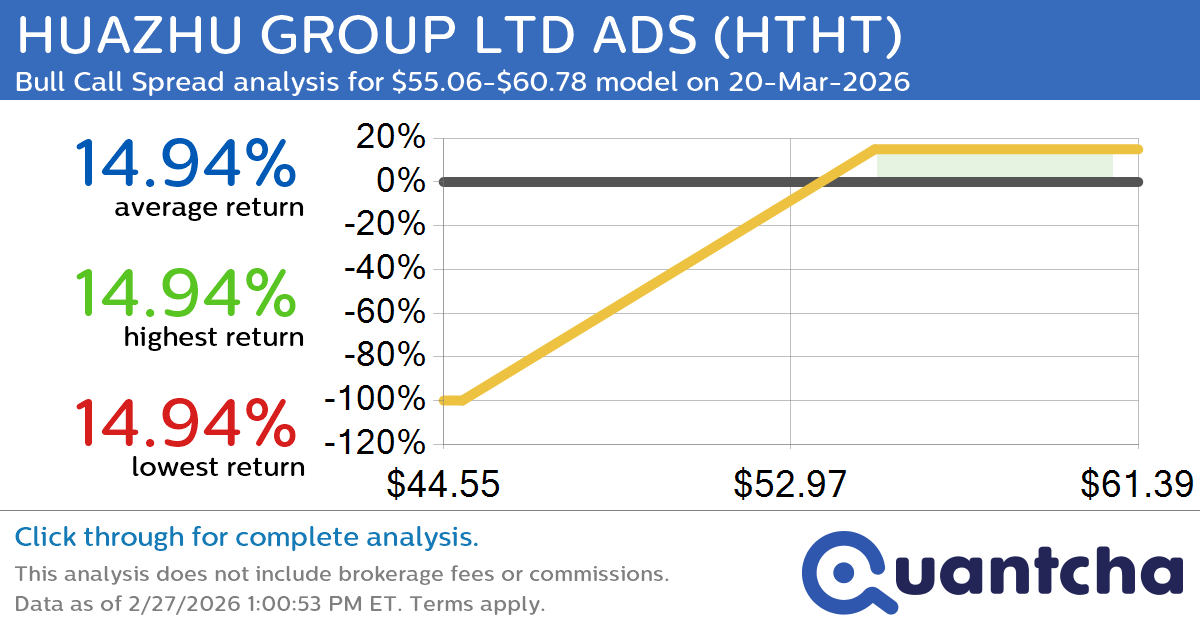

52-Week High Alert: Trading today’s movement in HUAZHU GROUP LTD ADS $HTHT

Quantchabot has detected a new Bull Call Spread trade opportunity for HUAZHU GROUP LTD ADS (HTHT) for the 20-Mar-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. HTHT was recently trading at $54.94 and has an implied volatility of 40.56% for this period. Based on an analysis…

-

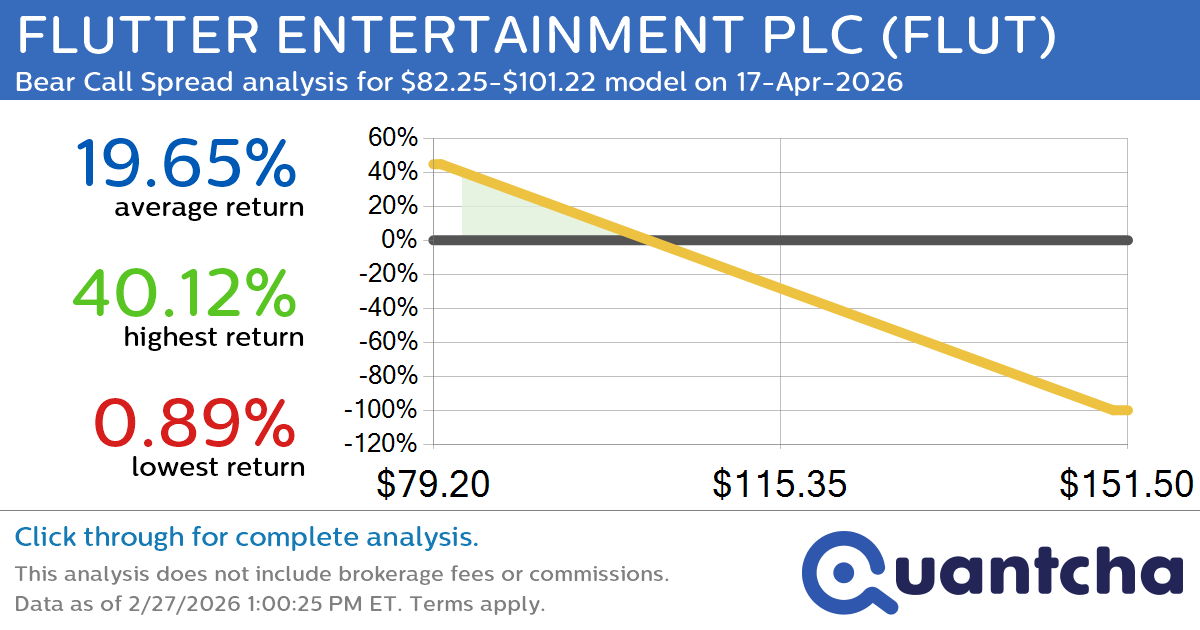

52-Week Low Alert: Trading today’s movement in FLUTTER ENTERTAINMENT PLC $FLUT

Quantchabot has detected a new Bear Call Spread trade opportunity for FLUTTER ENTERTAINMENT PLC (FLUT) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. FLUT was recently trading at $100.70 and has an implied volatility of 56.27% for this period. Based on an analysis of…

-

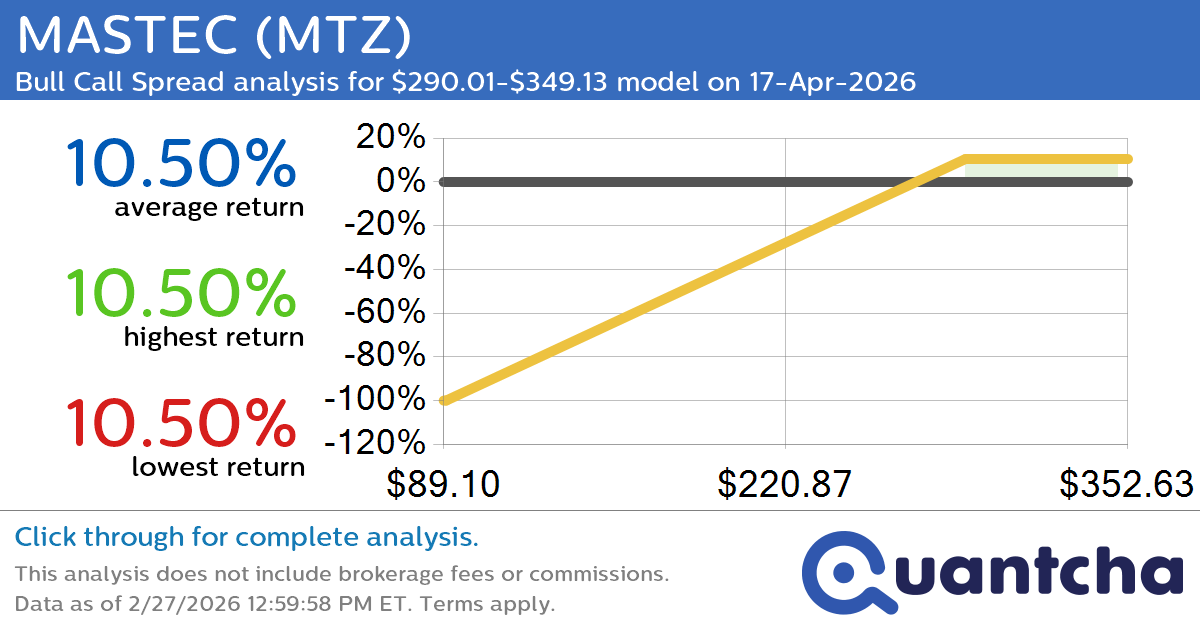

52-Week High Alert: Trading today’s movement in MASTEC $MTZ

Quantchabot has detected a new Bull Call Spread trade opportunity for MASTEC (MTZ) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. MTZ was recently trading at $288.51 and has an implied volatility of 50.30% for this period. Based on an analysis of the options…

-

52-Week Low Alert: Trading today’s movement in ARES MANAGEMENT LP $ARES

Quantchabot has detected a new Bear Call Spread trade opportunity for ARES MANAGEMENT LP (ARES) for the 17-Apr-2026 expiration period. You can analyze the opportunity in depth over at the Quantcha Options Search Engine. ARES was recently trading at $109.49 and has an implied volatility of 56.30% for this period. Based on an analysis of…